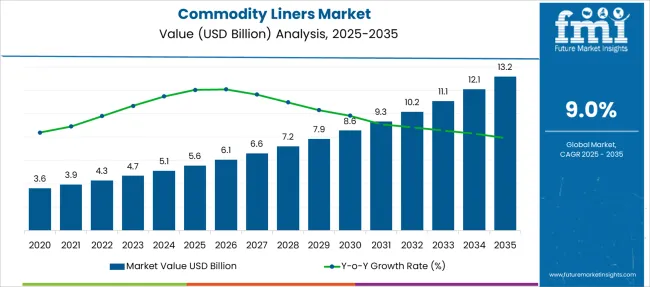

The Commodity Liners Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Commodity Liners Market Estimated Value in (2025 E) | USD 5.6 billion |

| Commodity Liners Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The commodity liners market is growing steadily as industries seek reliable packaging solutions to protect bulk materials during storage and transportation. Increasing demand for durable and cost-effective liners has been observed across sectors handling powders, granules, and fragile goods. The food and beverage industry in particular has driven growth by adopting liners that ensure product safety, hygiene, and compliance with regulatory standards.

Rising consumer awareness of food safety has pushed manufacturers to adopt high-quality packaging materials. Technological advancements in liner manufacturing have enhanced barrier properties and mechanical strength, supporting wider applications. The growth of e-commerce and logistics infrastructure has further increased the need for robust packaging.

Going forward, sustainability considerations and innovations in recyclable and biodegradable liners are expected to influence market dynamics. Segmental growth is expected to be led by polyethylene liners due to their versatility and cost efficiency, and the food and beverage sector as the largest end-use application.

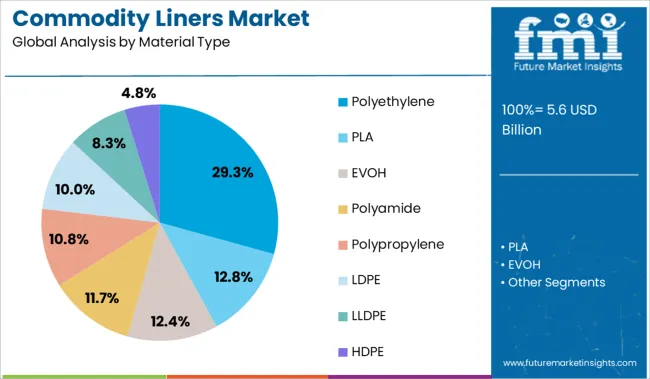

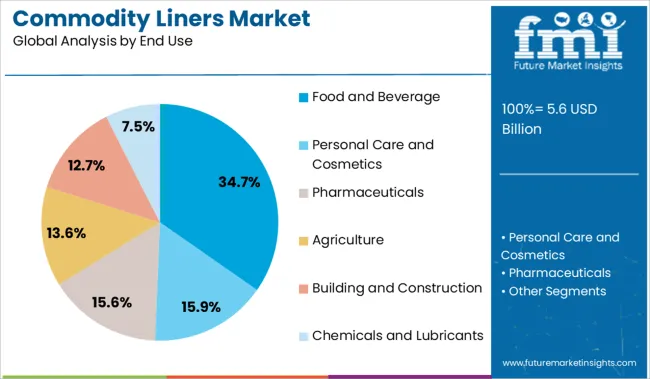

The market is segmented by Material Type and End Use and region. By Material Type, the market is divided into Polyethylene, PLA, EVOH, Polyamide, Polypropylene, LDPE, LLDPE, and HDPE. In terms of End Use, the market is classified into Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Agriculture, Building and Construction, and Chemicals and Lubricants. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment is projected to hold 29.3% of the commodity liners market revenue in 2025, maintaining its position as the leading material type. Polyethylene liners are favored for their excellent moisture resistance, chemical stability, and flexibility. These properties make them suitable for protecting a wide range of commodities from contamination and environmental factors.

The material’s cost-effectiveness has encouraged its use in bulk packaging across various industries. Manufacturing advancements have improved the durability and thickness options of polyethylene liners, enabling tailored solutions for different cargo requirements.

Additionally, polyethylene’s recyclability and compatibility with existing waste management systems have increased its acceptance in sustainability-focused markets. As industries continue to seek efficient packaging that balances performance and affordability, the polyethylene segment is expected to sustain strong growth.

The food and beverage segment is projected to account for 34.7% of the commodity liners market revenue in 2025, establishing itself as the dominant end-use category. Growth in this segment has been driven by stringent hygiene and safety standards in food processing and packaging. Liners are essential for maintaining the integrity of food products by preventing contamination, moisture ingress, and spoilage during transport and storage.

The expanding global food supply chain and increasing demand for processed and packaged foods have contributed to higher liner usage. Additionally, food manufacturers have been adopting liners that comply with food-grade regulations and support extended shelf life.

Consumer preference for fresh and safe food products has further bolstered the adoption of high-quality liners. The segment is expected to maintain its leadership as food safety regulations and supply chain complexities continue to intensify.

The demand for commodity liners is set to surge in the forthcoming years owing to the rapid transportation and storage activities associated with dry flowable products, such as plastic granules, fertilizers, and sand. The ability of these liners to withstand temperatures ranging from -20F to 180F is anticipated to propel the sales of commodity liners in the upcoming years.

Many manufacturers are expected to utilize superior-quality materials in these liners to protect goods from external elements. They are likely to come up with new liners equipped with multiple layers of high-barrier materials. Spurred by the aforementioned factors, the market is projected to grow at a fast pace.

The implementation of stringent packaging norms by governments of various countries across the globe may hinder the commodity liners' market growth in the assessment period. The USA Food and Drug Administration (FDA), for instance, is one of the regulatory bodies that have come up with strict packaging norms.

Many other countries are expected to set up new packaging rules so that numerous products are packed as per the commodity codes. The increasing number of rules controlling the usage of plastic in agricultural and food products, especially in emerging economies may also hamper the growth.

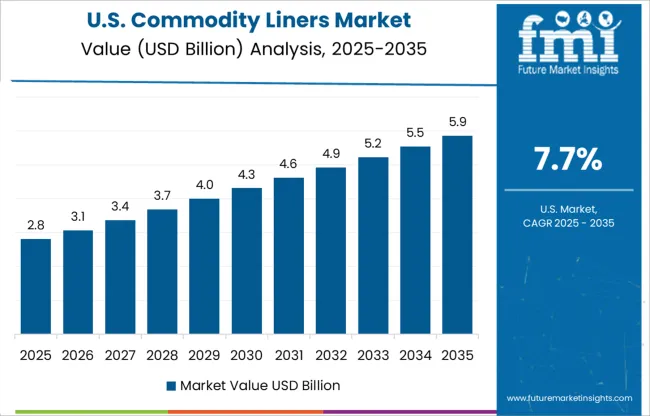

North American commodity liners' market share is likely to grow rapidly in the evaluation period. This growth is attributable to the increasing shift of consumers towards recyclable packaging in the USA and Canada. In March 2025, for instance, the USA Plastics Pact unveiled four targets to eliminate plastic waste at its source by 2025.

The emergence of such norms by regulatory bodies is estimated to help manufacturers in introducing eco-friendly materials for usage in commodity liners. The rising usage of these liners in developed countries to transport specific products that primarily do not require small packaging units is another major factor that is set to augur well for the North American market.

The entry of numerous international companies in India and China owing to the availability of more growth opportunities in these countries is set to accelerate the Asia Pacific commodity liners market size in the forecast period. The surging need for safe and secure packaging solutions is anticipated to propel the market in this region.

In March 2025, for instance, the Indian Institute of Packaging organized a one-day capacity training program at Aijal Club, Mizoram. It was aimed to educate the masses regarding suitable packaging for the export of handicraft, handloom, and agri-food products. Thus, the rising number of similar other educational programs by government institutions in India is expected to drive the Asia Pacific market.

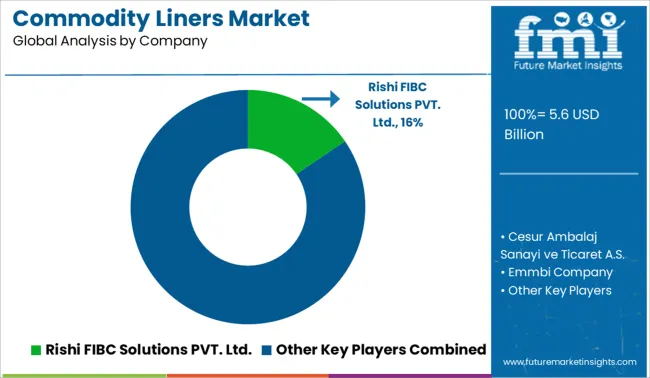

Some of the prominent manufacturers present in the global commodity liners market are Rishi FIBC Solutions PVT. Ltd., Cesur Ambalaj Sanayi ve Ticaret A.S., Emmbi Company, Berry Global, Inc., Powertex Inc., CorrPak Bulk Packaging Systems, Nier Systems Inc., AGRU Kunststofftechnik GmbH, Composite Containers LLC, Thrace Plastics Holding and Commercial S.A, Ozerden Plastik Sanayi ve Ticaret AS, Nier Systems Inc., United Bags, Parker Hannifin Corporation, Bulk Corp International, Solmax International Inc., Display Pack, Inc., Bemis Company, Inc., CDF Corporation, Greif Inc., and LC Packaging International B.V. among others.

Leading players in this market are increasingly focusing on the development of a wide range of products made of bio-based materials, as well as polymer materials. They are striving to improve the barrier and conductivity properties of films made with these materials by conducting exhaustive research and development activities. Meanwhile, a few other players are engaging in collaborations and acquisitions to co-develop new technologically advanced products to strengthen their positions.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material Type, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Easter Europe; Asia-Pacific excluding Japan; Japan; Middle East & Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Rishi FIBC Solutions PVT. Ltd.; Cesur Ambalaj Sanayi ve Ticaret A.S.; Emmbi Company; Berry Global, Inc.; Powertex Inc.; CorrPak Bulk Packaging Systems; Nier Systems Inc.; AGRU Kunststofftechnik GmbH; Composite Containers LLC; Thrace Plastics Holding and Commercial S.A.; Ozerden Plastik Sanayi ve Ticaret AS; Nier Systems Inc.; United Bags; Parker Hannifin Corporation; Bulk Corp International; Solmax International Inc.; Display Pack, Inc.; Bemis Company, Inc.; CDF Corporation; Greif Inc.; LC Packaging International B.V. |

| Customization | Available Upon Request |

The global commodity liners market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the commodity liners market is projected to reach USD 13.2 billion by 2035.

The commodity liners market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in commodity liners market are polyethylene, pla, evoh, polyamide, polypropylene, ldpe, lldpe and HDPE.

In terms of end use, food and beverage segment to command 34.7% share in the commodity liners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commodity Plastic Market Size and Share Forecast Outlook 2025 to 2035

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Box Liners Companies

Pan Liners Market

Pond Liners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tray Liners Market

Panty Liners Market

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Carton Liners Market Size and Share Forecast Outlook 2025 to 2035

Cheese Liners Market

Medical Liners Market Size and Share Forecast Outlook 2025 to 2035

Bladder Liners Market Growth – Trends & Forecast 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Foam Cap Liners

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Inner Bulk Liners Market Size and Share Forecast Outlook 2025 to 2035

Irrigation Liners Market

Anti-Static Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA