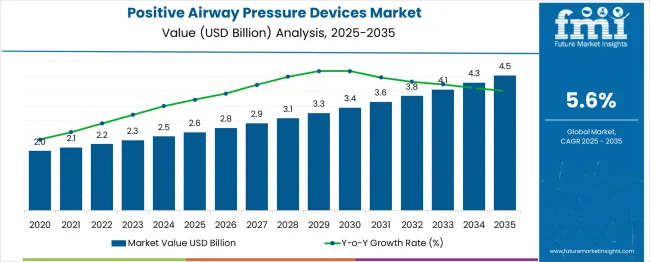

The positive airway pressure devices market is expected to grow from USD 2.6 billion in 2025 to USD 4.5 billion in 2035, achieving a compound annual growth rate (CAGR) of 6%. Year-on-year growth exhibits small but notable spikes, correlated with industry drivers such as adoption of advanced CPAP and BiPAP technologies, increased awareness of sleep apnea, and policy initiatives promoting home healthcare solutions. For example, values rise from USD 2.6 billion in 2025 to USD 2.9 billion in 2028, and from USD 3.3 billion in 2030 to USD 4.1 billion by 2034. These increments reflect technology integration, consumer preference shifts toward at-home therapy, and expanded reimbursement frameworks supporting sustained market adoption.

| Metric | Value |

| Estimated Value in (2025E) | USD 2.6 billion |

| Forecast Value in (2035F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The positive airway pressure devices market experiences occasional year-on-year dips influenced by supply-side and regulatory constraints. Minor slowdowns in growth are observed in 2021–2022 and 2026–2027, corresponding with raw material shortages, such as specialized polymers and electronic components, which temporarily limit device production. Economic downturns in certain regions also reduce healthcare expenditure, delaying purchases of CPAP and BiPAP devices. Regulatory changes, including stricter device approval protocols and compliance standards, may extend market entry timelines, creating temporary dips in annual increments.

These YoY constraints are generally short-term and do not alter the overall positive trajectory of the market. For instance, even during slower years, incremental growth remains positive, reflecting ongoing demand driven by rising awareness of sleep apnea, expanding home healthcare adoption, and policy support for reimbursement. Understanding the timing and causes of these dips allows manufacturers to manage inventory, diversify sourcing, and plan production cycles strategically. By anticipating supply, regulatory, and economic challenges, stakeholders can minimize disruptions and sustain long-term market growth across the forecast period.

Market expansion is being supported by the increasing prevalence of sleep apnea and respiratory disorders and the corresponding demand for effective treatment solutions that can improve sleep quality and reduce associated health risks. Modern healthcare systems are increasingly focused on preventive care and chronic disease management that can improve patient outcomes while reducing long-term healthcare costs. Positive airway pressure devices' proven effectiveness in treating sleep-disordered breathing and improving cardiovascular health makes them essential medical devices for respiratory therapy and sleep medicine.

The growing emphasis on home-based healthcare and patient comfort is driving demand for PAP devices that combine therapeutic effectiveness with user-friendly design and quiet operation. Patient preference for treatment solutions that enable comfortable sleep while maintaining therapy compliance is creating opportunities for innovative PAP device designs and features. The rising influence of aging population demographics and increasing awareness about sleep health is also contributing to expanded adoption of PAP therapy across diverse patient populations.

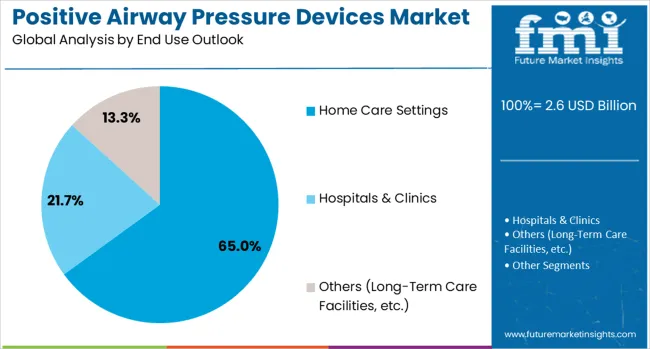

The market is segmented by product, application, end use, and region. By product, the market is divided into CPAP, APAP, and BiPAP. Based on application, the market is categorized into obstructive sleep apnea, respiratory failures, and COPD. In terms of end use, the market is segmented into home care settings, hospitals & clinics, and others (long-term care facilities, etc.). Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The CPAP (Continuous Positive Airway Pressure) segment is projected to account for 68% of the positive airway pressure devices market in 2025, retaining its position as the leading product category. Patients and healthcare providers increasingly rely on CPAP devices for their clinical efficacy in treating obstructive sleep apnea, offering consistent airway maintenance and improved sleep quality. The technology’s proven role in mitigating cardiovascular and metabolic risks reinforces its status as the gold standard therapy. Continuous innovation, including quieter operation, ergonomic designs, and enhanced compliance tracking, strengthens market adoption. CPAP devices remain central to therapy protocols, balancing clinical effectiveness with patient comfort across diverse age groups and care settings.

Obstructive sleep apnea (OSA) applications are expected to represent 46% of PAP device demand in 2025, highlighting the condition’s critical contribution to market growth. Healthcare providers favor PAP therapy for OSA management because it maintains airway patency during sleep, preventing apneic episodes and improving oxygenation. This application offers immediate symptom relief, enhanced daytime alertness, and long-term cardiovascular risk reduction. The segment benefits from rising diagnosis rates, increased patient awareness, and expanded screening programs. OSA-focused therapy continues to be the primary driver of PAP device adoption, supporting comprehensive management of sleep-disordered breathing and reinforcing the importance of devices designed to optimize adherence and clinical outcomes.

Home care settings are projected to account for 65% of the positive airway pressure devices market in 2025, reflecting the shift toward patient-centred, home-based sleep therapy. Patients prefer home-based PAP treatment for convenience, comfort, and integration into daily routines, while maintaining clinical efficacy. Providers recognize home therapy as cost-effective, scalable, and aligned with chronic disease management initiatives. The segment benefits from device portability, intuitive user interfaces, and tele monitoring capabilities that allow remote adherence tracking and real-time intervention. With reimbursement frameworks and evidence-based outcomes supporting at-home therapy, home care environments remain the primary setting for PAP device deployment, reinforcing patient empowerment and long-term treatment success.

The positive airway pressure devices market is being driven by the rising prevalence of sleep-related disorders, especially obstructive sleep apnea. Lifestyle changes, increasing obesity rates, and aging populations have led to a higher incidence of sleep apnea worldwide. PAP devices are considered the gold standard for treatment, as they maintain steady airflow to keep airways open during sleep. Greater awareness among patients and improved diagnosis rates are also boosting adoption. Healthcare providers emphasize early intervention to prevent complications such as cardiovascular disease, diabetes, and hypertension linked to untreated sleep apnea. This growing clinical recognition is ensuring consistent demand for PAP devices across hospitals, clinics, and homecare settings.

Another important dynamic in the market is the expanding use of PAP devices in home healthcare. Patients increasingly prefer home-based treatment options for sleep apnea because they offer greater comfort, convenience, and cost savings compared to prolonged hospital stays. Technological advancements in device portability, noise reduction, and mask comfort have further supported this trend. Healthcare systems also encourage home use to reduce pressure on hospital infrastructure while ensuring better long-term patient compliance. The homecare model has become particularly important in regions with growing elderly populations. The shift toward at-home care is strengthening the market and providing patients with accessible and user-friendly treatment solutions.

The PAP devices market is also growing due to stronger distribution networks and strategic partnerships. Medical device companies are collaborating with online retailers, specialty clinics, and healthcare providers to improve access to their products. Many firms are expanding into emerging markets by working with local distributors who understand regional regulations and patient needs. This approach ensures wider availability and increases patient adoption rates. Insurance providers and reimbursement programs also play a role by making devices more affordable for patients. As distribution channels become more diverse and accessible, manufacturers are able to capture larger market shares, fueling growth on a global scale.

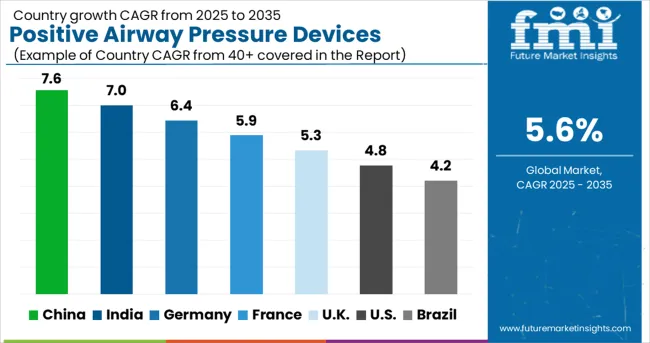

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

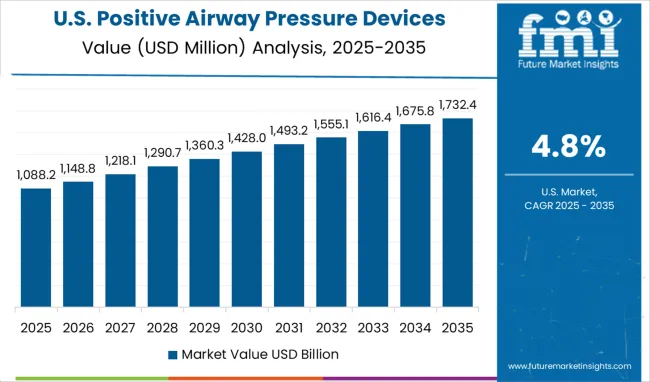

| U.S. | 4.8% |

| Brazil | 4.2% |

The positive airway pressure devices market is experiencing solid growth globally, with China leading at a 7.6% CAGR through 2035, driven by rapidly growing healthcare infrastructure, increasing awareness about sleep disorders, and an expanding middle-class population with rising healthcare spending. India follows closely at 7.0%, supported by growing healthcare access, increasing diagnosis rates, and the expanding private healthcare sector. Germany shows strong growth at 6.4%, emphasizing advanced sleep medicine and healthcare excellence. France records 5.9%, focusing on comprehensive healthcare and sleep disorder management. The UK shows 5.3% growth, prioritizing home healthcare and patient-centered treatment approaches.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is emerging as a dominant market for positive airway pressure devices, with projected growth at a compound annual growth rate of 7.6% through 2035. Market expansion is driven by rising awareness of sleep related disorders, increasing prevalence of lifestyle diseases, and rapid increase in hospital and specialty clinic capacities. Local and multinational device manufacturers are investing in distribution and service centers across urban and semi urban areas. The push for early diagnosis and home based therapy adoption has created demand for compact, user friendly positive airway pressure devices tailored to patients with obstructive sleep apnea and other chronic respiratory conditions.

India positive airway pressure devices market is expected to expand at a compound annual growth rate of 7.0% through 2035, propelled by growing awareness of obstructive sleep apnea and increasing access to specialized sleep clinics in urban centers. Rising disposable income and increasing private hospital presence have facilitated adoption of home based and clinic supported therapy. International manufacturers and domestic distributors are establishing service networks to meet demand for personalized therapy solutions. Public health campaigns highlighting the risks of untreated sleep disorders and the availability of effective therapy options have further contributed to market growth, making India a key focus for device innovation and market penetration.

Germany positive airway pressure devices market is forecasted to grow at a compound annual growth rate of 6.4% through 2035, fueled by an advanced healthcare ecosystem emphasizing diagnostic precision and chronic respiratory care. Hospitals, specialized sleep centers, and rehabilitation facilities are prioritizing devices that combine efficacy, comfort, and monitoring capabilities. Clinical guidelines strongly influence adoption, while reimbursement policies support therapy affordability. Manufacturers are innovating with devices featuring remote monitoring, intelligent pressure adjustment, and mobile connectivity. Germany market leadership in respiratory therapy ensures continuous investment in research and development and patient education, making it a benchmark for advanced positive airway pressure device implementation and clinical effectiveness.

France positive airway pressure devices market is projected to register a compound annual growth rate of 5.9% through 2035, supported by a structured healthcare system and strong regulatory oversight. Market demand is driven by public and private hospitals prioritizing patient compliance and therapeutic efficacy. Emerging trends include home based therapy models, cloud connected devices, and integration of positive airway pressure devices with comprehensive respiratory care programs. Collaborative initiatives between healthcare providers and manufacturers focus on patient education and remote therapy monitoring. High quality devices designed for comfort and effectiveness are increasingly preferred, reinforcing France as a market where clinical validation and patient centric design are central to adoption.

United Kingdom positive airway pressure devices market is expected to expand at a compound annual growth rate of 5.3% through 2035, driven by integration of home healthcare programs and National Health Service initiatives targeting chronic respiratory disease management. Patient focused therapy models and portable, easy to use devices are gaining preference. Distribution is increasingly supported by telemedicine and remote monitoring services, enabling efficient therapy management outside hospital settings. Demand is further strengthened by the growing aging population and increasing prevalence of sleep apnea. Manufacturers are focusing on compact, quiet, and energy efficient devices that can support long term home therapy, positioning United Kingdom as a key adopter of patient centered respiratory solutions.

United States positive airway pressure devices market is forecasted to grow at a compound annual growth rate of 4.8% through 2035, driven by the country leadership in sleep medicine, robust insurance coverage, and widespread availability of specialty sleep centers. Device adoption emphasizes clinical reliability, therapy personalization, and patient engagement. Smart positive airway pressure devices with cloud based tracking, automated pressure adjustment, and mobile app integration are increasingly used. Hospitals, outpatient clinics, and home care providers are investing in advanced devices to optimize adherence and treatment outcomes. Regulatory support, telehealth initiatives, and strong clinical validation continue to reinforce United States as a mature and highly specialized environment for positive airway pressure therapy.

Brazil positive airway pressure devices market is expected to achieve a compound annual growth rate of 4.2% through 2035, supported by expanding healthcare infrastructure, raising awareness about sleep disorders, and increasing adoption of advanced medical technologies in chronic disease management. Growth is driven by urban hospitals, private clinics, and emerging telehealth networks that provide access to home based therapy. International device manufacturers are expanding distribution networks to meet the increasing demand for effective, user friendly positive airway pressure devices. Public health initiatives focused on chronic respiratory disorders and patient education campaigns are facilitating adoption.

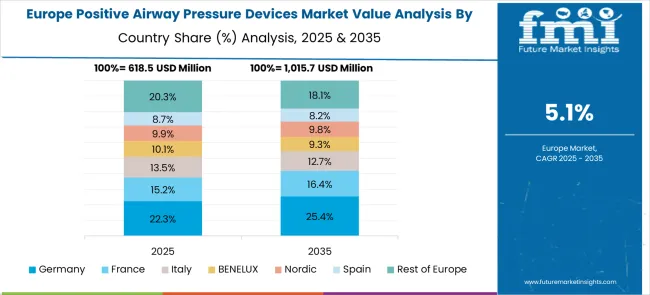

The positive airway pressure devices market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced healthcare system and emphasis on sleep medicine and respiratory therapy, supported by healthcare providers leveraging clinical expertise to implement comprehensive PAP therapy solutions that emphasize patient outcomes and treatment effectiveness across home care and clinical settings. France represents a significant market driven by its healthcare system excellence and sophisticated understanding of sleep disorder management, with healthcare providers focusing on advanced PAP therapy solutions that combine French medical expertise with patient-centered care approaches for enhanced sleep apnea treatment and respiratory therapy in home and clinical environments.

The UK exhibits considerable growth through its emphasis on home healthcare and patient-centered treatment approaches, with strong adoption of PAP devices across NHS facilities, private sleep clinics, and home care services. Germany and France are showing increasing interest in smart PAP device applications, particularly in connected healthcare and remote patient monitoring systems. BENELUX countries contribute through their focus on healthcare innovation and advanced medical device adoption. At the same time, Eastern Europe and the Nordic regions display growing potential driven by increasing healthcare investment and expanding awareness about sleep disorder treatment.

The positive airway pressure devices market is characterized by competition among established medical device manufacturers, specialized sleep medicine companies, and emerging connected health technology providers. Companies are investing in device innovation, patient comfort improvement, smart technology integration, and comprehensive patient support services to deliver effective, user-friendly, and clinically superior PAP therapy solutions. Product reliability, patient compliance enhancement, and clinical evidence are central to strengthening market position and healthcare provider confidence.

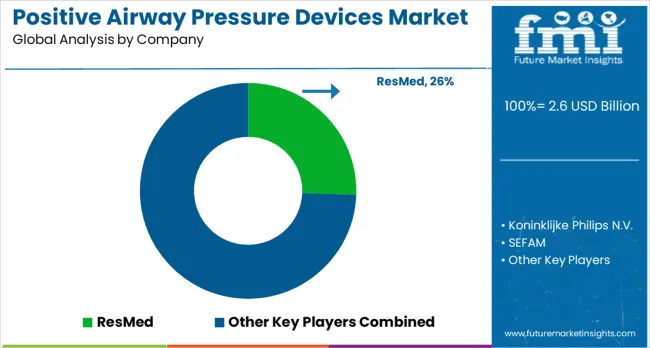

ResMed leads the market with significant market share, offering comprehensive PAP device solutions with a focus on sleep medicine innovation and connected health capabilities. Koninklijke Philips N.V. provides advanced medical technology, including PAP devices, with emphasis on patient-centered design and therapy effectiveness. SEFAM delivers specialized respiratory therapy solutions with a focus on European market expertise. Trudell Medical (Vyaire) focuses on respiratory care technologies, including PAP therapy solutions.

Löwenstein Medical UK Ltd provides comprehensive sleep and respiratory medicine solutions with emphasis on therapy effectiveness. Transcend Inc. (Somnetics International Inc.) offers portable PAP devices with a focus on travel-friendly solutions. Fisher & Paykel Healthcare Limited delivers innovative respiratory care technologies, including humidification and PAP therapy systems. Drive DeVilbiss Healthcare, React Health (3B Medical), BMC Medical, Armstrong Medical Inc., Wellell (Apex Medical), and Breas Medical provide specialized PAP devices and respiratory therapy solutions for diverse market segments and patient needs.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.6 Billion |

| Product | CPAP, APAP, BiPAP |

| Application | Obstructive Sleep Apnea, Respiratory Failures, COPD |

| End Use | Home Care Settings, Hospitals & Clinics, Others (Long-Term Care Facilities, etc.) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ResMed, Koninklijke Philips N.V., SEFAM, Trudell Medical (Vyaire), Löwenstein Medical UK Ltd, Transcend Inc. (Somnetics International Inc.), Fisher & Paykel Healthcare Limited, Drive DeVilbiss Healthcare, React Health (3B Medical), BMC Medical, Armstrong Medical Inc., Wellell (Apex Medical), and Breas Medical |

| Additional Attributes | Dollar sales by product type and end use category, regional demand trends, competitive landscape, buyer preferences for CPAP versus BiPAP technologies, integration with connected health platforms, innovations in patient comfort enhancement, smart technology advancement, and personalized therapy optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global positive airway pressure devices market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the positive airway pressure devices market is projected to reach USD 4.5 billion by 2035.

The positive airway pressure devices market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in positive airway pressure devices market are cpap, apap and bipap.

In terms of application outlook , obstructive sleep apnea segment to command 46.0% share in the positive airway pressure devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Continuous Positive Airway Pressure Devices Market Outlook – Share, Growth & Forecast 2025-2035

Positive Patient Identification Market Size and Share Forecast Outlook 2025 to 2035

Positive Displacement Blowers Market Size and Share Forecast Outlook 2025 to 2035

Positive Displacement Sanitary Pumps Market Size and Share Forecast Outlook 2025 to 2035

Positive Displacement Pumps Market Growth - Trends & Forecast 2025 to 2035

Positive Air Pressure Devices Market Size and Share Forecast Outlook 2025 to 2035

HER2 Positive Gastric Cancer Market Size and Share Forecast Outlook 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

OPEP Device Market Analysis – Growth & Forecast 2024-2034

BRCA Mutation-Positive Ovarian Cancer Market

UK Continuous Positive Airway Pressure (CPAP) Market Trends – Growth, Demand & Analysis 2025-2035

NTRK Fusion Gene Positive Advanced Solid Tumors Market Size and Share Forecast Outlook 2025 to 2035

India Continuous Positive Airway Pressure (CPAP) Market Trends – Size, Share & Growth 2025-2035

Germany Continuous Positive Airway Pressure (CPAP) Market Insights – Size, Trends & Forecast 2025-2035

United States Continuous Positive Airway Pressure (CPAP) Market Report – Trends, Demand & Forecast 2025-2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Airway Catheters Market Analysis - Growth & Industry Insights 2025 to 2035

Airway Clearance Devices Market Growth - Trends & Forecast 2025 to 2035

Airway Management Devices Market Growth – Demand & Industry Forecast 2025 to 2035

Fairway Mowers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA