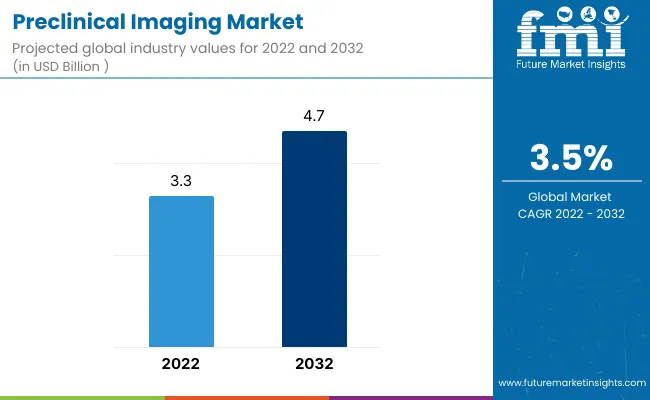

The global preclinical imaging market is expected to enjoy a valuation of US$ 3.3 Billion in 2022, and further expand at a CAGR of 3.5% to reach a valuation of US$ 4.7 Billion by the end of the year 2032. According to a recent study by Future Market Insights, MRI imaging is leading the market with a share of about 18.9% in the year 2021, within the global preclinical imaging market.

Market Outlook:

|

Data Points |

Market Insights |

|

Market Value 2021 |

US$ 3.2 Billion |

|

Market Value 2022 |

US$ 3.3 Billion |

|

Market Value 2032 |

US$ 4.7 Billion |

|

CAGR 2022 to 2032 |

3.5% |

|

Market Share of Top 5 Countries |

55.9% |

|

Key Market Players |

Bruker Corporation, Siemens A.G., General Electric (GE), TriFoil Imaging, PerkinElmer, Inc., VisualSonics Inc. (Fujifilm), Mediso Ltd., Agilent Technologies, MILabs B.V., MR Solutions, Molecules |

Over the past decade, preclinical imaging has developed into an important method for biological discoveries. High-frequency micro-ultrasound has developed gradually as a rapid and reasonably priced imaging tool for studying human disease models in small organisms in the post-genomic era.

According to a report published in the Radiology Journal by the University of Cincinnati Medical Center, in 2020, academic medical centers and universities rushed to suspend scientific research initiatives in order to maximize social distance and reduce the spread of infection to research employees and those with whom they might come into contact, in addition to clinical preparedness. Researchers in the field of radiology were debating these problems, which will continue to have an impact on current and upcoming imaging experiments.

The market value for the preclinical imaging market was approximately 11.4% of the overall US$ 28.2 Billion of the global medical imaging market in 2021.

The sales of the preclinical imaging market expanded at a 3.8% CAGR over the historic period of 2016 to 2021.

Preclinical imaging techniques completely follow the 3R (replacement, reduction, and refinement) tenets by lowering biological variability, gathering an extraordinary amount of unique information in multiple ways, and dramatically lowering the number of animals required for a given study.

The market for preclinical imaging is expected to be propelled due to increased investment in research and development for technological advancements in the fields of molecular imaging.

For Instance

To meet the growing need for antiviral research tools and to enable the testing of coronavirus vaccines and treatments, MILabs upgraded their preclinical diagnostic U-CT system for in vivo imaging of COVID-19 animal models in March 2020.

The multimodal imaging technique is gaining importance for the diagnosis of certain diseases. It also helps the physician to perform tests, and plan and guide the therapy.

Pre-symptomatic identification, targeted therapy, and personalized medicine will very soon comply with multimodal molecular imaging's rapid technological advancements.

Another driver that is expected to fuel the preclinical research market’s expansion is the growing number of clinical research organizations (CROs) and pharmaceutical organizations, which are quickly adapting to in-vivo imaging systems for pre-clinical research.

For instance

In July 2020, the USF Health Morsani College of Medicine installed their new 7T-3T MR/PET and PET-CT systems by MR solutions to create their first thorough preclinical imaging suite.

The market is set to present an opportunistic outlook, owing to an increasing number of preclinical imaging tests and new alternative methods of testing in the market such are in vitro assays, micro-dosing, computer-based models, virtual drug testing, and the creation of computerized databases for testing. Such strategies will provide the market an opportunity to expand, even in regions with low market penetration right now. New non-invasive imaging modalities are also entering the market to provide better options.

The growth will further be propelled by the increased initiative by public and private organizations for funding to accelerate preclinical research leading to the overall boost of the current market. Additionally, it is anticipated that significant investments made to promote the use of pre-clinical devices will fuel market expansion.

Although the preclinical imaging market has numerous end-users, there are certain obstacles that likely pose a challenge to market growth.

The stringent regulatory framework and the technical and procedural restrictions connected with autonomous systems are predicted to decline the market growth.

In addition, the evidence-based clinical trial and the various challenges posed by the animal rights activist while performing animal testing in the preclinical research will also restrain the growth of the market in the forecast period.

These propose an adverse consequence on the formative development of the preclinical imaging market.

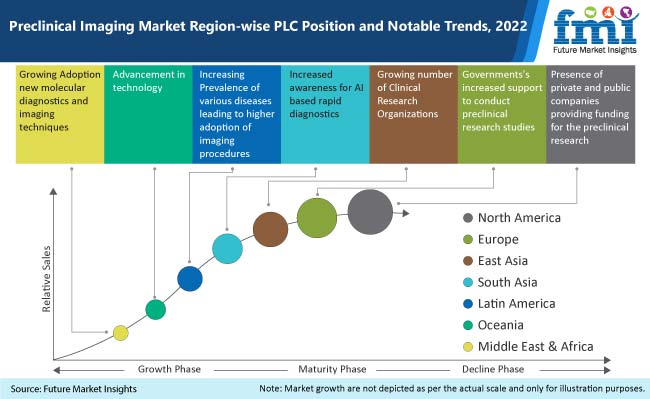

North America holds a revenue share of 32.3% and is the largest preclinical imaging market. This is attributed to the vast advancements in the research and development Research and Development sectors due to high investments, strong infrastructure, the presence of multiple private and public organizations, several preclinical initiatives underway, and greater acceptance rates for technologically advanced products.

A major player, namely NYU Langone’s Preclinical Imaging Laboratory, provides investigators with access to advanced imaging technologies and strategies to image live animals on the organ, tissue, cell, or molecular level. Moreover, the Accelerating Covid-19 Therapeutic Interventions and Vaccines (ACTIV) public-private partnership was announced by the National Institutes of Health (NIH) to establish a coordinated research strategy for prioritizing and speeding the development of the most promising treatments and vaccines.

To diversify their product portfolio, corporations are offering new products. For instance, a key market player announced the debut of the Ultima Investigator Plus in March 2022, which is the newest modular platform addition to the industry-leading Ultima range of multiphoton microscopes for deep tissue fluorescence imaging. These factors are expected to boost the global preclinical imaging market size.

Europe is the second leading market owing to the rising number of market players who are investing in government initiatives for encouraging clinical research and development projects in this region. Market players in Germany are offering versatile and highly specific contrast from a variety of tissue-intrinsic and extrinsic molecules, including hemoglobin, melanin, lipids, collagen, fluorophores, and nanoparticles. This allows for anatomical, functional, and molecular imaging within a single modality.

These key players are further showing unprecedented performance in terms of combining high resolution and sensitivity. Moreover, they provide new insights into a variety of diseases with the ability to visualize and quantify sub-organ structures at several centimeters of depth. These insights are estimated to contribute to the demand for preclinical imaging in Germany.

Bruker, a major German player, announced the first customer installation of its MPI Preclinical, which is a preclinical Magnetic Particle Imaging (MPI) scanner at the University Medical Center Hamburg-Eppendorf (UKE), Germany. Additionally, this marks the first time that MPI technology has been delivered in a commercial system, as preclinical MPI is an entirely new technology for in vivo imaging of small animals used in translational research.

United Kingdom witnesses the launch of new centers for translational cardiovascular imaging linking basic science

The increasing awareness amongst healthcare professionals and the rise in the number of in vivo molecular diagnostics are the reasons for the rising demand for preclinical imaging. For instance, Edinburgh Preclinical Imaging is a state-of-the-art facility that provides non-invasive, in vivo imaging of the structure and function of all organs and tissues of the body. Furthermore, the facility is within the campus at Little France, where it is ideally placed to provide cross-disciplinary work in cardiovascular biology, physiology, and neuroscience, which stabilizes the adoption of preclinical imaging in the United Kingdom

The British Heart Foundation awarded £ 1.9 Million to support the development of a new center for translational cardiovascular imaging that links basic science and preclinical and clinical cardiovascular research in Leeds and promotes rapid translation from molecular to clinical cardiovascular research. In addition, magnetic resonance imaging (MRI) is a versatile technology that provides sensitivity to a wide range of biologically relevant information.

The Asia Pacific is a growing lucrative preclinical imaging market, paying owing to factors such as low research costs, less-stringent regulatory guidelines, and increased government funding for the development of the research and development sector in the respective countries are making the region attractive for preclinical research studies.

Japan is experiencing a super-aging ;society both in rural and urban areas, as stated according to the Statistics Bureau of Japan. In addition, the healthcare industry in Japan has well adopted new innovations and advancements for diagnosis, which aids in the growth of the global preclinical imaging market size.

Hamamatsu Pharma Research Inc., a major Japanese market player, performs preclinical trials using rodent and nonhuman primate (NHP) models to judge the efficacy of pharmaceuticals. Furthermore, personalized medicine is emerging as a new goal in the diagnosis and treatment of diseases in Japan, which aims to establish differences between patients suffering from the same disease, which allows them to choose the most effective treatment.

In November 2021, an article titled Developing diagnostic reference levels in Japan was published in the Japanese Journal of Radiology, which indicated that the use of radiological tests in the nation has been increasing significantly in recent years. Similarly, an article published by the Public Relations Office of the Government of Japan in February 2021 stated that the percentage of people over the age of 65 years old in Japan is expected to reach 33.3% by the year 2036 and 38.4% by the year 2065. Hence, the preclinical imaging market share is likely to experience growth owing to these initiatives.

Diagnostic centers in South Korea usually consist of multiple inter-related research groups for the integration of experimental approaches from a diversity of disciplines such as Physics, Chemistry, and Engineering. Each sector assists in developing novel methods and materials for brain research.

10-year commitment funds have been made by the South Korean government to develop their biotechnology industry by building 15 Clinical Trial Centers (CTCs) at major teaching hospitals. These CTCs have avant-garde facilities to perform studies involving the confinement of study participants under highly controlled required for many early clinical research studies where the demand for preclinical imaging and its research is anticipated to develop.

Most healthcare professionals in South Korea are highly educated medical and scientific staff who are interested in early clinical research. Therefore, South Korean scientists are gaining rapid credibility among global clinical pharmacologists, as reflected by higher numbers of publications in leading medical research journals and presentations at leading scientific meetings for clinical pharmacologists.

With the vast advancements in the research and development sectors due to high investments, strong infrastructure, presence of multiple private and public organizations, several preclinical initiatives underway, and greater acceptance rates for technologically advanced products the USA holds a global market share of about 32.3% in 2021 and is expected to continue the same through the forecast period.

In April 2020, the National Institutes of Health (NIH) announced the Expediting COVID-19 Therapeutic Interventions and Vaccinations (ACTIV) public-private partnership to build a coordinated research approach for prioritizing and accelerating the development of the most effective drugs and vaccines. This will utilize all high-throughput screening techniques to screen the samples and enhance the efficiency of the scientists, which will inspire the use of such fast-track groups of prominent scientists from government, business, non-profit, charitable, and academic institutions.

The United Kingdom is expected to grow at a CAGR of 3.0% in the European market over the forecast period.

The market is anticipated to benefit from the rising number of market players who are investing, and government initiatives for encouraging clinical research and development projects in these regions.

Germany holds a global market share of 6.6% and is expected to grow with a CAGR of 3.8% during the forecasted period.

The reason for the rising demand and growth for the preclinical imaging market in the country is the increasing awareness among healthcare professionals, the rise in the number of in-vivo molecular diagnostics, and advanced multi-modal devices with increased sensitivity that are enhanced by digitalization.

MRI imaging held a market share of around 18.9% in the global market in 2021 and the segment is set to grow at a CAGR of 5.5% throughout the forecast period.

The rising prevalence of chronic diseases like cardiovascular, neurological, orthopedic, and cancer, is leading to the rising adoption of MRI imaging procedures across the globe. The introduction of technologically advanced equipment in the market as well as the use of AI-based devices for rapid diagnosis enhance the market growth.

The research and development sector has shown increased demand with a market share of 54.3% globally in 2021 and is expected to grow with a CAGR of 3.0% over the forecasted years.

With innovative technologies in the market, to draw conclusions for human medicine, researchers are thrilled to examine the structure of animal bodies. As a result, research into animal tissues, cells, molecular dynamics, and organs has accelerated recently.

Biotech companies hold the highest global market share value of 30.4% during the year 2021. Biotech companies are using this opportunity as an essential part of these research and development efforts to bridge molecular discoveries and clinical applications in diagnostics and/or therapies.

With several competitors in the production of compression therapy products, the overall market is highly fragmented. Key Players such as Bruker Corporation, and Siemens A.G. are adopting new strategies like collaborations, the launch of new high–tech products, and partnerships to promote their products.

These strategies are henceforth being followed by upcoming players to increase their business, and capture the untapped markets.

The following are examples of key development strategies used by industry players in the preclinical imaging market:

Similarly, recent developments related to companies manufacturing preclinical imaging products have been tracked by the team at Future Market Insights, which are available in the full report.

|

Attribute |

Details |

|

Forecast Period |

2022 to 2032 |

|

Historical Data Available for |

2016 to 2021 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa |

|

Key Countries Covered |

USA, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC Countries, Israel, Turkey, North Africa, and South Africa |

|

Key Market Segments Covered |

Product, Application, End User, and Region |

|

Key Companies Profiled |

|

|

Pricing |

Available upon Request |

The global preclinical imaging market is worth US$ 3.2 Billion in 2021 and is set to expand 1.4X over the next ten years.

The preclinical imaging market is expected to reach US$ 4.7 Billion by the end of 2032, with sales revenue expected to register a 3.5% CAGR.

The expanding research and development in preclinical imaging devices, increasing funds, rise in the number of in vitro and in vivo tests, and a large number of CROs are some of the key trends shaping the preclinical imaging market.

The USA, United Kingdom, Germany, China, and Japan are the top 5 countries and are expected to drive demand for the preclinical imaging industry.

North America is one of the key markets for preclinical imaging in the year 2021, with a market share accounting for 33.6%.

Demand for preclinical imaging in Europe is expected to register a growth of 3.6% CAGR over the next ten years.

The USA, Germany, and the United Kingdom are the key producers of the preclinical imaging market.

Demand for preclinical imaging in South Asia is expected to register a growth of 2.9% CAGR over the next ten years.

Demand for preclinical imaging in East Asia is expected to register a growth of 4.4% CAGR over the next ten years.

Bruker Corporation, Siemens A.G., General Electric (GE), TriFoil Imaging, PerkinElmer, Inc., VisualSonics Inc. (Fujifilm), Mediso Ltd., Agilent Technologies, MILabs B.V., MR Solutions, and Molecubes, are some of the key players in the preclinical imaging market.

1. Executive Summary | Preclinical Imaging Market

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Inclusions and Exclusions

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Development and Innovation Trends

4. Key Success Factors

4.1. Product Adoption/ Usage Analysis

4.2. Regulatory Scenario

4.3. Product Features/ USP’s Analysis

4.4. PESTLE Analysis

4.5. Porter’s Analysis

5. Market Background

5.1. Macro-Economic Factors

5.1.1. Global GDP Growth Outlook

5.1.2. Global Healthcare Industry Market Outlook

5.1.3. Global Clinical Imaging Market Overview

5.2. Forecast Factors - Relevance & Impact

5.2.1. Rising Demand for Advanced Molecular Diagnostics

5.2.2. Growing Global Burden of Disease

5.2.3. Growing Investments in Preclinical Research

5.2.4. Innovation and Development

5.2.5. Increased Mergers and Acquisitions

5.2.6. Adoption Rate of Preclinical Research

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunity Analysis

6. COVID-19 Crisis – Impact Assessment

6.1. COVID19 and Impact Analysis

6.1.1. Revenue By Product

6.1.2. Revenue By Application

6.1.3. Revenue By End User

6.1.4. Revenue By Region

6.2. 2021 Market Scenario

7. Global Market Volume (Units) Analysis 2016 to 2021 and Forecast, 2022 to 2032

7.1. Historical Market Volume (Units) Analysis, 2016 to 2021

7.2. Current and Future Market Volume (Units) Projections, 2022 to 2032

7.2.1. Y-o-Y Growth Trend Analysis

8. Global Market - Pricing Analysis

8.1. Regional Pricing Analysis By Product

8.2. Pricing Break-up

8.2.1. Manufacturer-Level Pricing

8.2.2. Distributor Level Pricing

8.3. Global Average Pricing Analysis Benchmark

8.4. Pricing Assumptions

9. Global Market Value (US$ Billion) Analysis 2016 to 2021 and Forecast, 2022 to 2032

9.1. Historical Market Value (US$ Billion) Analysis, 2015 to 2021

9.2. Current and Future Market Value (US$ Billion) Projections, 2022 to 2032

9.2.1. Y-o-Y Growth Trend Analysis

9.2.2. Absolute $ Opportunity Analysis

10. Global Market Analysis 2016 to 2021 and Forecast 2022 to 2032, By Product

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Billion) and Volume (Units), By Product, 2016 to 2021

10.3. Current and Future Market Size (US$ Billion) and Volume (Units) Analysis By Product, 2022 to 2032

10.3.1. CT Imaging

10.3.2. MRI Imaging

10.3.3. PET/SPECT Imaging

10.3.4. Multi-modal Imaging

10.3.5. Optical Imaging

10.3.6. Ultrasound Imaging

10.3.7. Photoacoustic Imaging

10.4. Market Attractiveness Analysis By Product

11. Global Market Analysis 2016 to 2021 and Forecast 2022 to 2032, By Application

11.1. Introduction / Key Findings

11.2. Current and Future Market Size (US$ Billion) and Volume (Units) Analysis and Forecast By Application, 2022 to 2032

11.2.1. Research and Development

11.2.2. Drug Discovery

11.3. Market Attractiveness Analysis By Application

12. Global Market Analysis 2016 to 2021 and Forecast 2022 to 2032, By End User

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Billion), By End User, 2016 to 2021

12.3. Current and Future Market Size (US$ Billion) and Forecast By End User, 2022 to 2032

12.3.1. Biotech Companies

12.3.2. Pharmaceutical companies

12.3.3. Research institutes

12.3.4. Contract Research Organizations

12.4. Market Attractiveness Analysis By End User

13. Global Market Analysis 2016 to 2021 and Forecast 2022 to 2032, by Region

13.1. Introduction

13.2. Historical Market Size (US$ Billion) and Volume (Units) Analysis By Region, 2016 to 2021

13.3. Current Market Size (US$ Billion) and Volume (Units) Analysis and Forecast By Region, 2022 to 2032

13.3.1. North America

13.3.2. Latin America

13.3.3. Europe

13.3.4. South Asia

13.3.5. East Asia

13.3.6. Oceania

13.3.7. Middle East and Africa (MEA)

13.4. Market Attractiveness Analysis By Region

14. North America Market Analysis 2016 to 2021 and Forecast 2022 to 2032

14.1. Introduction

14.2. Historical Market Size (US$ Billion) ) and Volume (Units) Analysis, By Market Taxonomy, 2016 to 2021

14.3. Current and Future Market Size (US$ Billion) ) and Volume (Units) Analysis, By Market Taxonomy 2022 to 2032

14.3.1. By Country

14.3.1.1. USA

14.3.1.2. Canada

14.3.2. By Product

14.3.3. By Application

14.3.4. By End User

14.4. Market Attractiveness Analysis

14.4.1. By Product

14.4.2. By Application

14.4.3. By End User

14.5. Key Market Participants - Intensity Mapping

14.6. Drivers and Restraints - Impact Analysis

14.7. Country-Level Analysis & Forecast

14.7.1. USA Market Analysis

14.7.1.1. .Introduction

14.7.1.2. Market Analysis and Forecast by Market Taxonomy

14.7.1.2.1. By Product

14.7.1.2.2. By Application

14.7.1.2.3. By End User

14.7.2. Canada Market Analysis

14.7.2.1. Introduction

14.7.2.2. Market Analysis and Forecast by Market Taxonomy

14.7.2.2.1. By Product

14.7.2.2.2. By Application

14.7.2.2.3. By End User

15. Latin America Market Analysis 2015 to 2021 and Forecast 2022 to 2032

15.1. Introduction

15.2. Historical Market Size (US$ Billion) and ) and Volume (Units) Analysis By Market Taxonomy, 2016 to 2021

15.3. Current and Future Market Size (US$ Billion) ) and Volume (Units) Analysis, By Market Taxonomy, 2022 to 2032

15.3.1. By Country

15.3.1.1. Mexico

15.3.1.2. Brazil

15.3.1.3. Argentina

15.3.1.4. Rest of Latin America

15.3.2. By Product

15.3.3. By Application

15.3.4. By End User

15.4. Market Attractiveness Analysis

15.4.1. By Product

15.4.2. By Application

15.4.3. By End User

15.5. Key Market Participants - Intensity Mapping

15.6. Drivers and Restraints - Impact Analysis

15.7. Country-Level Analysis & Forecast

15.7.1. Brazil Market Analysis

15.7.1.1. Introduction

15.7.1.2. Market Analysis and Forecast by Market Taxonomy

15.7.1.2.1. By Product

15.7.1.2.2. By Application

15.7.1.2.3. By End User

15.7.2. Mexico Market Analysis

15.7.2.1. Introduction

15.7.2.2. Market Analysis and Forecast by Market Taxonomy

15.7.2.2.1. By Product

15.7.2.2.2. By Application

15.7.2.2.3. By End User

15.7.3. Argentina Market Analysis

15.7.3.1. Introduction

15.7.3.2. Market Analysis and Forecast by Market Taxonomy

15.7.3.2.1. By Product

15.7.3.2.2. By Application

15.7.3.2.3. By End User

16. Europe Market Analysis 2016 to 2021 and Forecast 2022 to 2032

16.1. Introduction

16.2. Historical Market Size (US$ Billion) and Volume (Units) Analysis, By Market Taxonomy, 2016 to 2021

16.3. Current and Future Market Size (US$ Billion) ) and Volume (Units) Analysis, By Market Taxonomy, 2022 to 2032

16.3.1. By Country

16.3.1.1. United Kingdom

16.3.1.2. Germany

16.3.1.3. Italy

16.3.1.4. France

16.3.1.5. Spain

16.3.1.6. Russia

16.3.1.7. BENELUX

16.3.1.8. Rest of Europe

16.3.2. By Product

16.3.3. By Application

16.3.4. By End User

16.4. Market Attractiveness Analysis

16.4.1. By Product

16.4.2. By Application

16.4.3. By End User

16.5. Key Market Participants - Intensity Mapping

16.6. Drivers and Restraints - Impact Analysis

16.7. Country-Level Analysis & Forecast

16.7.1. United Kingdom Market Analysis

16.7.1.1. Introduction

16.7.1.2. Market Analysis and Forecast by Market Taxonomy

16.7.1.2.1. By Product

16.7.1.2.2. By Application

16.7.1.2.3. By End User

16.7.2. Germany Market Analysis

16.7.2.1. Introduction

16.7.2.2. Market Analysis and Forecast by Market Taxonomy

16.7.2.2.1. By Product

16.7.2.2.2. By Application

16.7.2.2.3. By End User

16.7.3. Italy Market Analysis

16.7.3.1. Introduction

16.7.3.2. Market Analysis and Forecast by Market Taxonomy

16.7.3.2.1. By Product

16.7.3.2.2. By Application

16.7.3.2.3. By End User

16.7.4. France Market Analysis

16.7.4.1. Introduction

16.7.4.2. Market Analysis and Forecast by Market Taxonomy

16.7.4.2.1. By Product

16.7.4.2.2. By Application

16.7.4.2.3. By End User

16.7.5. Spain Market Analysis

16.7.5.1. Introduction

16.7.5.2. Market Analysis and Forecast by Market Taxonomy

16.7.5.2.1. By Product

16.7.5.2.2. By Application

16.7.5.2.3. By End User

16.7.6. Russia Market Analysis

16.7.6.1. Introduction

16.7.6.2. Market Analysis and Forecast by Market Taxonomy

16.7.6.2.1. By Product

16.7.6.2.2. By Application

16.7.6.2.3. By End User

16.7.7. BENELUX Market Analysis

16.7.7.1. Introduction

16.7.7.2. Market Analysis and Forecast by Market Taxonomy

16.7.7.2.1. By Product

16.7.7.2.2. By Application

16.7.7.2.3. By End User

17. South Asia Market Analysis 2016 to 2021 and Forecast 2022 to 2032

17.1. Introduction

17.2. Historical Market Size (US$ Billion) and Volume (Units) Analysis By Market Taxonomy, 2016 to 2021

17.3. Current and Future Market Size (US$ Billion) and Volume (Units) Analysis, By Market Taxonomy, 2022 to 2032

17.3.1. By Country

17.3.1.1. India

17.3.1.2. Indonesia

17.3.1.3. Malaysia

17.3.1.4. Philippines

17.3.1.5. Thailand

17.3.1.6. Vietnam

17.3.1.7. Rest of South Asia

17.3.2. By Product

17.3.3. By Application

17.3.4. By End User

17.4. Market Attractiveness Analysis

17.4.1. By Product

17.4.2. By Application

17.4.3. By End User

17.5. Key Market Participants - Intensity Mapping

17.6. Drivers and Restraints - Impact Analysis

17.7. Country-Level Analysis & Forecast

17.7.1. India Market Analysis

17.7.1.1. Introduction

17.7.1.2. Market Analysis and Forecast by Market Taxonomy

17.7.1.2.1. By Product

17.7.1.2.2. By Application

17.7.1.2.3. By End User

17.7.2. Indonesia Market Analysis

17.7.2.1. Introduction

17.7.2.2. Market Analysis and Forecast by Market Taxonomy

17.7.2.2.1. By Product

17.7.2.2.2. By Application

17.7.2.2.3. By End User

17.7.3. Malaysia Market Analysis

17.7.3.1. Introduction

17.7.3.2. Market Analysis and Forecast by Market Taxonomy

17.7.3.2.1. By Product

17.7.3.2.2. By Application

17.7.3.2.3. By End User

17.7.4. Philippines Market Analysis

17.7.4.1. Introduction

17.7.4.2. Market Analysis and Forecast by Market Taxonomy

17.7.4.2.1. By Product

17.7.4.2.2. By Application

17.7.4.2.3. By End User

17.7.5. Thailand Market Analysis

17.7.5.1. Introduction

17.7.5.2. Market Analysis and Forecast by Market Taxonomy

17.7.5.2.1. By Product

17.7.5.2.2. By Application

17.7.5.2.3. By End User

17.7.6. Vietnam Market Analysis

17.7.6.1. Introduction

17.7.6.2. Market Analysis and Forecast by Market Taxonomy

17.7.6.2.1. By Product

17.7.6.2.2. By Application

17.7.6.2.3. By End User

18. East Asia Market Analysis 2016 to 2021 and Forecast 2022 to 2032

18.1. Introduction

18.2. Historical Market Size (US$ Billion) and Volume (Units) Analysis By Market Taxonomy, 2016 to 2021

18.3. Current and Future Market Size (US$ Billion) and Volume (Units) Analysis, By Market Taxonomy, 2022 to 2032

18.3.1. By Country

18.3.1.1. China

18.3.1.2. Japan

18.3.1.3. South Korea

18.3.2. By Product

18.3.3. By Application

18.3.4. By End User

18.4. Market Attractiveness Analysis

18.4.1. By Product

18.4.2. By Application

18.4.3. By End User

18.5. Key Market Participants - Intensity Mapping

18.6. Drivers and Restraints - Impact Analysis

18.7. Country-Level Analysis & Forecast

18.7.1. China Market Analysis

18.7.1.1. Introduction

18.7.1.2. Market Analysis and Forecast by Market Taxonomy

18.7.1.2.1. By Product

18.7.1.2.2. By Application

18.7.1.2.3. By End User

18.7.2. Japan Market Analysis

18.7.2.1. Introduction

18.7.2.2. Market Analysis and Forecast by Market Taxonomy

18.7.2.2.1. By Product

18.7.2.2.2. By Application

18.7.2.2.3. By End User

18.7.3. South Korea Market Analysis

18.7.3.1. Introduction

18.7.3.2. Market Analysis and Forecast by Market Taxonomy

18.7.3.2.1. By Product

18.7.3.2.2. By Application

18.7.3.2.3. By End User

19. Oceania Market 2016 to 2021 and Forecast 2022 to 2032

19.1. Introduction

19.2. Historical Market Size (US$ Billion) and Volume (Units) Analysis By Market Taxonomy, 2016 to 2021

19.3. Current and Future Market Size (US$ Billion) and Volume (Units) Analysis, By Market Taxonomy, 2022 to 2032

19.3.1. By Country

19.3.1.1. Australia

19.3.1.2. New Zealand

19.3.2. By Product

19.3.3. By Application

19.3.4. By End User

19.4. Market Attractiveness Analysis

19.4.1. By Product

19.4.2. By Application

19.4.3. By End User

19.4.4. Key Market Participants - Intensity Mapping

19.5. Drivers and Restraints - Impact Analysis

19.6. Country-Level Analysis & Forecast

19.6.1. Australia Market Analysis

19.6.1.1. Introduction

19.6.1.2. Market Analysis and Forecast by Market Taxonomy

19.6.1.2.1. By Product

19.6.1.2.2. By Application

19.6.1.2.3. By End User

19.6.2. New Zealand Market Analysis

19.6.2.1. Introduction

19.6.2.2. Market Analysis and Forecast by Market Taxonomy

19.6.2.2.1. By Product

19.6.2.2.2. By Application

19.6.2.2.3. By End User

20. Middle East and Africa (MEA) Market Analysis 2016 to 2021 and Forecast 2022 to 2032

20.1. Introduction

20.2. Historical Market Size (US$ Billion) and Volume (Units) Analysis By Market Taxonomy, 2016 to 2021

20.3. Current and Future Market Size (US$ Billion) and Volume (Units) Analysis, By Market Taxonomy, 2022 to 2032

20.3.1. By Country

20.3.1.1. GCC Countries

20.3.1.2. Israel

20.3.1.3. Turkey

20.3.1.4. South Africa

20.3.1.5. North Africa

20.3.1.6. Rest of Middle East and Africa

20.3.2. By Product

20.3.3. By Application

20.3.4. By End User

20.4. Market Attractiveness Analysis

20.4.1. By Product

20.4.2. By Application

20.4.3. By End User

20.5. Key Market Participants - Intensity Mapping

20.6. Drivers and Restraints - Impact Analysis

20.7. Country-Level Analysis & Forecast

20.7.1. GCC Countries Market Analysis

20.7.1.1. Introduction

20.7.1.2. Market Analysis and Forecast by Market Taxonomy

20.7.1.2.1. By Product

20.7.1.2.2. By Application

20.7.1.2.3. By End User

20.7.2. Israel Market Analysis

20.7.2.1. Introduction

20.7.2.2. Market Analysis and Forecast by Market Taxonomy

20.7.2.2.1. By Product

20.7.2.2.2. By Application

20.7.2.2.3. By End User

20.7.3. Turkey Market Analysis

20.7.3.1. Introduction

20.7.3.2. Market Analysis and Forecast by Market Taxonomy

20.7.3.2.1. By Product

20.7.3.2.2. By Application

20.7.3.2.3. By End User

20.7.4. South Africa Market Analysis

20.7.4.1. Introduction

20.7.4.2. Market Analysis and Forecast by Market Taxonomy

20.7.4.2.1. By Product

20.7.4.2.2. By Application

20.7.4.2.3. By End User

20.7.5. North Africa Market Analysis

20.7.5.1. Introduction

20.7.5.2. Market Analysis and Forecast by Market Taxonomy

20.7.5.2.1. By Product

20.7.5.2.2. By Application

20.7.5.2.3. By End User

21. Market Structure Analysis

21.1. Market Analysis by Tier of Companies

21.2. Market Share Analysis of Top Players

22. Competition Analysis

22.1. Competition Dashboard

22.2. Competition Benchmarking

22.3. Competition Deep Dive

22.3.1. Bruker Corporation

22.3.1.1. Overview

22.3.1.2. Product Portfolio

22.3.1.3. Sales Footprint

22.3.1.4. Key Financials

22.3.1.5. Strategy Overview

22.3.1.6. SWOT Analysis

22.3.2. Siemens A.G.

22.3.2.1. Overview

22.3.2.2. Product Portfolio

22.3.2.3. Sales Footprint

22.3.2.4. Key Financials

22.3.2.5. Strategy Overview

22.3.2.6. SWOT Analysis

22.3.3. General Electric (GE)

22.3.3.1. Overview

22.3.3.2. Product Portfolio

22.3.3.3. Sales Footprint

22.3.3.4. Key Financials

22.3.3.5. Strategy Overview

22.3.3.6. SWOT Analysis

22.3.4. TriFoil Imaging

22.3.4.1. Overview

22.3.4.2. Product Portfolio

22.3.4.3. Sales Footprint

22.3.4.4. Key Financials

22.3.4.5. Strategy Overview

22.3.4.6. SWOT Analysis

22.3.5. PerkinElmer, Inc.

22.3.5.1. Overview

22.3.5.2. Product Portfolio

22.3.5.3. Sales Footprint

22.3.5.4. Key Financials

22.3.5.5. Strategy Overview

22.3.5.6. SWOT Analysis

22.3.6. VisualSonics Inc. (Fujifilm)

22.3.6.1. Overview

22.3.6.2. Product Portfolio

22.3.6.3. Sales Footprint

22.3.6.4. Key Financials

22.3.6.5. Strategy Overview

22.3.6.6. SWOT Analysis

22.3.7. Mediso Ltd.

22.3.7.1. Overview

22.3.7.2. Product Portfolio

22.3.7.3. Sales Footprint

22.3.7.4. Key Financials

22.3.7.5. Strategy Overview

22.3.7.6. SWOT Analysis

22.3.8. Agilent Technologies

22.3.8.1. Overview

22.3.8.2. Product Portfolio

22.3.8.3. Sales Footprint

22.3.8.4. Key Financials

22.3.8.5. Strategy Overview

22.3.8.6. SWOT Analysis

22.3.9. MILabs B.V.

22.3.9.1. Overview

22.3.9.2. Product Portfolio

22.3.9.3. Sales Footprint

22.3.9.4. Key Financials

22.3.9.5. Strategy Overview

22.3.9.6. SWOT Analysis

22.3.10. MR Solutions

22.3.10.1. Overview

22.3.10.2. Product Portfolio

22.3.10.3. Sales Footprint

22.3.10.4. Key Financials

22.3.10.5. Strategy Overview

22.3.10.6. SWOT Analysis

22.3.11. Molecules

22.3.11.1. Overview

22.3.11.2. Product Portfolio

22.3.11.3. Sales Footprint

22.3.11.4. Key Financials

22.3.11.5. Strategy Overview

22.3.11.6. SWOT Analysis

23. Assumptions and Acronyms Used

24. Research Methodology

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Region

Table 06: North America Market Value (US$ Million) Analysis 2016t to 2021 and Forecast 2022 to 2032, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 11: Latin America Market Value (US$ Million) Analysis 2016 to 2021 and Forecast 2022 to 2032, by Country

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 16: Europe Market Value (US$ Million) Analysis 2016 to 2021 and Forecast 2022 to 2032, by Country

Table 17: Europe Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 18: Europe Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 21: South Asia Market Value (US$ Million) Analysis 2016 to 2021 and Forecast 2022 to 2032, by Country

Table 22: South Asia Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 24: South Asia Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 26: East Asia Market Value (US$ Million) Analysis 2016 to 2021 and Forecast 2022 to 2032, by Country

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 31: Oceania Market Value (US$ Million) Analysis 2016 to 2021 and Forecast 2022 to 2032, by Country

Table 32: Oceania Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 34: Oceania Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 35: Oceania Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Table 36: Middle East and Africa Market Value (US$ Million) Analysis 2016 to 2021 and Forecast 2022 to 2032, by Country

Table 37: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Product

Table 38: Middle East and Africa Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 39: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by Application

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2016 to 2032, by End User

Figure 01: Global Market Volume (Units), 2016 to 2021

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2022 to 2032

Figure 03: Global Market, Pricing Analysis per unit (US$), in 2022

Figure 04: Global Market, Pricing Forecast per unit (US$), in 2032

Figure 05: Global Market Value (US$ Million) Analysis, 2016 to2021

Figure 06: Global Market Forecast & Y-o-Y Growth, 2022 to 2032

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2021–2032

Figure 08: Global Market Value Share (%) Analysis 2022 and 2032, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, by Product

Figure 10: Global Market Attractiveness Analysis 2022 to 2032, by Product

Figure 11: Global Market Value Share (%) Analysis 2022 and 2032, by Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, by Application

Figure 13: Global Market Attractiveness Analysis 2022 to 2032, by Application

Figure 14: Global Market Value Share (%) Analysis 2022 and 2032, by End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, by End User

Figure 16: Global Market Attractiveness Analysis 2022 to 2032, by End User

Figure 17: Global Market Value Share (%) Analysis 2022 and 2032, by Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, by Region

Figure 19: Global Market Attractiveness Analysis 2022 to 2032, by Region

Figure 20: North America Market Value (US$ Million) Analysis, 2016–2021

Figure 21: North America Market Value (US$ Million) Forecast, 2022 to 2032

Figure 22: North America Market Value Share, by Product (2022 E)

Figure 23: North America Market Value Share, by Application (2022 E)

Figure 24: North America Market Value Share, by End User (2022 E)

Figure 25: North America Market Value Share, by Country (2022 E)

Figure 26: North America Market Attractiveness Analysis by Product, 2022 to 2032

Figure 27: North America Market Attractiveness Analysis by Application, 2022 to 2032

Figure 28: North America Market Attractiveness Analysis by End User, 2022 to 2032

Figure 29: North America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 30: USA Market Value Proportion Analysis, 2021

Figure 31: Global Vs USA Growth Comparison

Figure 32: USA Market Share Analysis (%) by Product, 2021 & 2032

Figure 33: USA Market Share Analysis (%) by Application, 2021 & 2032

Figure 34: USA Market Share Analysis (%) by End User, 2021 & 2032

Figure 35: Canada Market Value Proportion Analysis, 2021

Figure 36: Global Vs Canada. Growth Comparison

Figure 37: Canada Market Share Analysis (%) by Product, 2021 & 2032

Figure 38: Canada Market Share Analysis (%) by Application, 2021 & 2032

Figure 39: Canada Market Share Analysis (%) by End User, 2021 & 2032

Figure 40: Latin America Market Value (US$ Million) Analysis, 2016 to 2021

Figure 41: Latin America Market Value (US$ Million) Forecast, 2022 to 2032

Figure 42: Latin America Market Value Share, by Product (2022 E)

Figure 43: Latin America Market Value Share, by Application (2022 E)

Figure 44: Latin America Market Value Share, by End User (2022 E)

Figure 45: Latin America Market Value Share, by Country (2022 E)

Figure 46: Latin America Market Attractiveness Analysis by Product, 2022 to 2032

Figure 47: Latin America Market Attractiveness Analysis by Application, 2022 to 2032

Figure 48: Latin America Market Attractiveness Analysis by End User, 2022 to 2032

Figure 49: Latin America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 50: Mexico Market Value Proportion Analysis, 2021

Figure 51: Global Vs Mexico Growth Comparison

Figure 52: Mexico Market Share Analysis (%) by Product, 2021 & 2032

Figure 53: Mexico Market Share Analysis (%) by Application, 2021 & 2032

Figure 54: Mexico Market Share Analysis (%) by End User, 2021 & 2032

Figure 55: Brazil Market Value Proportion Analysis, 2021

Figure 56: Global Vs Brazil. Growth Comparison

Figure 57: Brazil Market Share Analysis (%) by Product, 2021 & 2032

Figure 58: Brazil Market Share Analysis (%) by Application, 2021 & 2032

Figure 59: Brazil Market Share Analysis (%) by End User, 2021 & 2032

Figure 60: Argentina Market Value Proportion Analysis, 2021

Figure 61: Global Vs Argentina Growth Comparison

Figure 62: Argentina Market Share Analysis (%) by Product, 2021 & 2032

Figure 63: Argentina Market Share Analysis (%) by Application, 2021 & 2032

Figure 64: Argentina Market Share Analysis (%) by End User, 2021 & 2032

Figure 65: Europe Market Value (US$ Million) Analysis, 2016 to 2021

Figure 66: Europe Market Value (US$ Million) Forecast, 2022 to 2032

Figure 67: Europe Market Value Share, by Product (2022 E)

Figure 68: Europe Market Value Share, by Application (2022 E)

Figure 69: Europe Market Value Share, by End User (2022 E)

Figure 70: Europe Market Value Share, by Country (2022 E)

Figure 71: Europe Market Attractiveness Analysis by Product, 2022 to 2032

Figure 72: Europe Market Attractiveness Analysis by Application, 2022 to 2032

Figure 73: Europe Market Attractiveness Analysis by End User, 2022 to 2032

Figure 74: Europe Market Attractiveness Analysis by Country, 2022 to 2032

Figure 75: United Kingdom Market Value Proportion Analysis, 2021

Figure 76: Global Vs. United Kingdom Growth Comparison

Figure 77: United Kingdom Market Share Analysis (%) by Product, 2021 & 2032

Figure 78: United Kingdom Market Share Analysis (%) by Application, 2021 & 2032

Figure 79: United Kingdom Market Share Analysis (%) by End User, 2021 & 2032

Figure 80: Germany Market Value Proportion Analysis, 2021

Figure 81: Global Vs. Germany Growth Comparison

Figure 82: Germany Market Share Analysis (%) by Product, 2021 & 2032

Figure 83: Germany Market Share Analysis (%) by Application, 2021 & 2032

Figure 84: Germany Market Share Analysis (%) by End User, 2021 & 2032

Figure 85: Italy Market Value Proportion Analysis, 2021

Figure 86: Global Vs. Italy Growth Comparison

Figure 87: Italy Market Share Analysis (%) by Product, 2021 & 2032

Figure 88: Italy Market Share Analysis (%) by Application, 2021 & 2032

Figure 89: Italy Market Share Analysis (%) by End User, 2021 & 2032

Figure 90: France Market Value Proportion Analysis, 2021

Figure 91: Global Vs France Growth Comparison

Figure 92: France Market Share Analysis (%) by Product, 2021 & 2032

Figure 93: France Market Share Analysis (%) by Application, 2021 & 2032

Figure 94: France Market Share Analysis (%) by End User, 2021 & 2032

Figure 95: Spain Market Value Proportion Analysis, 2021

Figure 96: Global Vs Spain Growth Comparison

Figure 97: Spain Market Share Analysis (%) by Product, 2021 & 2032

Figure 98: Spain Market Share Analysis (%) by Application, 2021 & 2032

Figure 99: Spain Market Share Analysis (%) by End User, 2021 & 2032

Figure 100: Russia Market Value Proportion Analysis, 2021

Figure 101: Global Vs Russia Growth Comparison

Figure 102: Russia Market Share Analysis (%) by Product, 2021 & 2032

Figure 103: Russia Market Share Analysis (%) by Application, 2021 & 2032

Figure 104: Russia Market Share Analysis (%) by End User, 2021 & 2032

Figure 105: BENELUX Market Value Proportion Analysis, 2021

Figure 106: Global Vs BENELUX Growth Comparison

Figure 107: BENELUX Market Share Analysis (%) by Product, 2021 & 2032

Figure 108: BENELUX Market Share Analysis (%) by Application, 2021 & 2032

Figure 109: BENELUX Market Share Analysis (%) by End User, 2021 & 2032

Figure 110: East Asia Market Value (US$ Million) Analysis, 2016 to 2021

Figure 111: East Asia Market Value (US$ Million) Forecast, 2022to 2032

Figure 112: East Asia Market Value Share, by Product (2022 E)

Figure 113: East Asia Market Value Share, by Application (2022 E)

Figure 114: East Asia Market Value Share, by End User (2022 E)

Figure 115: East Asia Market Value Share, by Country (2022 E)

Figure 116: East Asia Market Attractiveness Analysis by Product, 2022 to 2032

Figure 117: East Asia Market Attractiveness Analysis by Application, 2022 to 2032

Figure 118: East Asia Market Attractiveness Analysis by End User, 2022 to 2032

Figure 119: East Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 120: China Market Value Proportion Analysis, 2021

Figure 121: Global Vs. China Growth Comparison

Figure 122: China Market Share Analysis (%) by Product, 2021 & 2032

Figure 123: China Market Share Analysis (%) by Application, 2021 & 2032

Figure 124: China Market Share Analysis (%) by End User, 2021 & 2032

Figure 125: Japan Market Value Proportion Analysis, 2021

Figure 126: Global Vs Japan Growth Comparison

Figure 127: Japan Market Share Analysis (%) by Product, 2021 & 2032

Figure 128: Japan Market Share Analysis (%) by Application, 2021 & 2032

Figure 129: Japan Market Share Analysis (%) by End User, 2021 & 2032

Figure 130: South Korea Market Value Proportion Analysis, 2021

Figure 131: Global Vs South Korea Growth Comparison

Figure 132: South Korea Market Share Analysis (%) by Product, 2021 & 2032

Figure 133: South Korea Market Share Analysis (%) by Application, 2021 & 2032

Figure 134: South Korea Market Share Analysis (%) by End User, 2021 & 2032

Figure 135: South Asia Market Value (US$ Million) Analysis, 2016 to 2021

Figure 136: South Asia Market Value (US$ Million) Forecast, 2022 to 2032

Figure 137: South Asia Market Value Share, by Product (2022 E)

Figure 138: South Asia Market Value Share, by Application (2022 E)

Figure 139: South Asia Market Value Share, by End User (2022 E)

Figure 140: South Asia Market Value Share, by Country (2022 E)

Figure 141: South Asia Market Attractiveness Analysis by Product, 2022 to 2032

Figure 142: South Asia Market Attractiveness Analysis by Application, 2022 to 2032

Figure 143: South Asia Market Attractiveness Analysis by End User, 2022 to 2032

Figure 144: South Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 145: India Market Value Proportion Analysis, 2021

Figure 146: Global Vs India Growth Comparison

Figure 147: India Market Share Analysis (%) by Product, 2021 & 2032

Figure 148: India Market Share Analysis (%) by Application, 2021 & 2032

Figure 149: India Market Share Analysis (%) by End User, 2021 & 2032

Figure 150: Indonesia Market Value Proportion Analysis, 2021

Figure 151: Global Vs Indonesia Growth Comparison

Figure 152: Indonesia Market Share Analysis (%) by Product, 2021 & 2032

Figure 153: Indonesia Market Share Analysis (%) by Application, 2021 & 2032

Figure 154: Indonesia Market Share Analysis (%) by End User, 2021 & 2032

Figure 155: Malaysia Market Value Proportion Analysis, 2021

Figure 156: Global Vs Malaysia Growth Comparison

Figure 157: Malaysia Market Share Analysis (%) by Product, 2021 & 2032

Figure 158: Malaysia Market Share Analysis (%) by Application, 2021 & 2032

Figure 159: Malaysia Market Share Analysis (%) by End User, 2021 & 2032

Figure 160: Thailand Market Value Proportion Analysis, 2021

Figure 161: Global Vs Thailand Growth Comparison

Figure 162: Thailand Market Share Analysis (%) by Product, 2021 & 2032

Figure 163: Thailand Market Share Analysis (%) by Application, 2021 & 2032

Figure 164: Thailand Market Share Analysis (%) by End User, 2021 & 2032

Figure 165: Vietnam Market Value Proportion Analysis, 2021

Figure 166: Global Vs Vietnam Growth Comparison

Figure 167: Vietnam Market Share Analysis (%) by Product, 2021 & 2032

Figure 168: Vietnam Market Share Analysis (%) by Application, 2021 & 2032

Figure 169: Vietnam Market Share Analysis (%) by End User, 2021 & 2032

Figure 170: Philippines Market Value Proportion Analysis, 2021

Figure 171: Global Vs Philippines Growth Comparison

Figure 172: Philippines Market Share Analysis (%) by Product, 2021 & 2032

Figure 173: Philippines Market Share Analysis (%) by Application, 2021 & 2032

Figure 174: Philippines Market Share Analysis (%) by End User, 2021 & 2032

Figure 175: Oceania Market Value (US$ Million) Analysis, 2016 to 2021

Figure 176: Oceania Market Value (US$ Million) Forecast, 2022 to 2032

Figure 177: Oceania Market Value Share, by Product (2022 E)

Figure 178: Oceania Market Value Share, by Application (2022 E)

Figure 179: Oceania Market Value Share, by End User (2022 E)

Figure 180: Oceania Market Value Share, by Country (2022 E)

Figure 181: Oceania Market Attractiveness Analysis by Product, 2022 to 2032

Figure 182: Oceania Market Attractiveness Analysis by Application, 2022 to 2032

Figure 183: Oceania Market Attractiveness Analysis by End User, 2022 to 2032

Figure 184: Oceania Market Attractiveness Analysis by Country, 2022 to 2032

Figure 185: Australia Market Value Proportion Analysis, 2021

Figure 186: Global Vs Australia Growth Comparison

Figure 187: Australia Market Share Analysis (%) by Product, 2021 & 2032

Figure 188: Australia Market Share Analysis (%) by Application, 2021 & 2032

Figure 189: Australia Market Share Analysis (%) by End User, 2021 & 2032

Figure 190: New Zealand Market Value Proportion Analysis, 2021

Figure 191: Global Vs New Zealand Growth Comparison

Figure 192: New Zealand Market Share Analysis (%) by Product, 2021 & 2032

Figure 193: New Zealand Market Share Analysis (%) by Application, 2021 & 2032

Figure 194: New Zealand Market Share Analysis (%) by End User, 2021 & 2032

Figure 195: Middle East & Africa Market Value (US$ Million) Analysis, 2016 to 2021

Figure 196: Middle East & Africa Market Value (US$ Million) Forecast, 2022 to 2032

Figure 197: Middle East & Africa Market Value Share, by Product (2022 E)

Figure 198: Middle East & Africa Market Value Share, by Application (2022 E)

Figure 199: Middle East & Africa Market Value Share, by End User (2022 E)

Figure 200: Middle East & Africa Market Value Share, by Country (2022 E)

Figure 201: Middle East & Africa Market Attractiveness Analysis by Product, 2022 to 2032

Figure 202: Middle East & Africa Market Attractiveness Analysis by Application, 2022 to 2032

Figure 203: Middle East & Africa Market Attractiveness Analysis by End User, 2022 to 2032

Figure 204: Middle East & Africa Market Attractiveness Analysis by Country, 2022 to 2032

Figure 205: GCC Countries Market Value Proportion Analysis, 2021

Figure 206: Global Vs GCC Countries Growth Comparison

Figure 207: GCC Countries Market Share Analysis (%) by Product, 2021 & 2032

Figure 208: GCC Countries Market Share Analysis (%) by Application, 2021 & 2032

Figure 209: GCC Countries Market Share Analysis (%) by End User, 2021 & 2032

Figure 210: Turkey Market Value Proportion Analysis, 2021

Figure 211: Global Vs Turkey Growth Comparison

Figure 212: Turkey Market Share Analysis (%) by Product, 2021 & 2032

Figure 213: Turkey Market Share Analysis (%) by Application, 2021 & 2032

Figure 214: Turkey Market Share Analysis (%) by End User, 2021 & 2032

Figure 215: Israel Market Value Proportion Analysis, 2021

Figure 216: Global Vs Israel Growth Comparison

Figure 217: Israel Market Share Analysis (%) by Product, 2021 & 2032

Figure 218: Israel Market Share Analysis (%) by Application, 2021 & 2032

Figure 219: Israel Market Share Analysis (%) by End User, 2021 & 2032

Figure 220: South Africa Market Value Proportion Analysis, 2021

Figure 221: Global Vs South Africa Growth Comparison

Figure 222: South Africa Market Share Analysis (%) by Product, 2021 & 2032

Figure 223: South Africa Market Share Analysis (%) by Application, 2021 & 2032

Figure 224: South Africa Market Share Analysis (%) by End User, 2021 & 2032

Figure 225: North Africa Market Value Proportion Analysis, 2021

Figure 226: Global Vs North Africa Growth Comparison

Figure 217: North Africa Market Share Analysis (%) by Product, 2021 & 2032

Figure 218: North Africa Market Share Analysis (%) by Application, 2021 & 2032

Figure 219: North Africa Market Share Analysis (%) by End User, 2021 & 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Preclinical Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Preclinical MRI Equipment Market Size and Share Forecast Outlook 2025 to 2035

Preclinical CRO Market Size and Share Forecast Outlook 2025 to 2035

Preclinical Medical Device Testing Services Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Market Leaders & Share in the Preclinical Medical Device Testing Services Industry

UK Preclinical Medical Device Testing Services Market Outlook – Share, Growth & Forecast 2025-2035

China Preclinical Medical Device Testing Services Market Insights – Trends, Demand & Growth 2025-2035

India Preclinical Medical Device Testing Services Market Report – Trends & Innovations 2025-2035

Germany Preclinical Medical Device Testing Services Industry Analysis from 2025 to 2035

United States Preclinical Medical Device Testing Services Market Trends – Growth, Demand & Analysis 2025-2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA