The UK preclinical medical device testing services market is expected to reach USD 76.5 million in 2025. The market is projected to grow at a CAGR of 3.1% during the forecast period and reach a total value of USD 103.4 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 76.5 million |

| Projected Value 2035 | USD 103.4 million |

| Value-based CAGR from 2025 to 2035 | 3.1% |

Several factors attribute to the growing demand of UK preclinical medical device testing services market. Few of these are growing healthcare infrastructure in the country which has provided opportunities for market players to continuously innovate in the medical devices and their manufacturing.

Moreover, the growing stringent policies of European Medicines Agency and the Medicines and Healthcare products Regulatory Agency for launch of new product to the market significantly contribute to the growth of preclinical medical device testing service market.

Moreover, the growing emphasis of manufacturers towards increasing the scope of application of cardiology, orthopedic and neurology devices, further anticipates the market growth. This growing application encourage UK government and manufacturers to invests heavily in advanced technologies which reduce the time consumed by the testing procedure.

Besides this, the growing adoption of sustainable best practices, increase in a patient-centric approach, and the country's well-established ecosystem for clinical trials make for significant market growth drivers, driving innovation while assuring regulatory compliance.

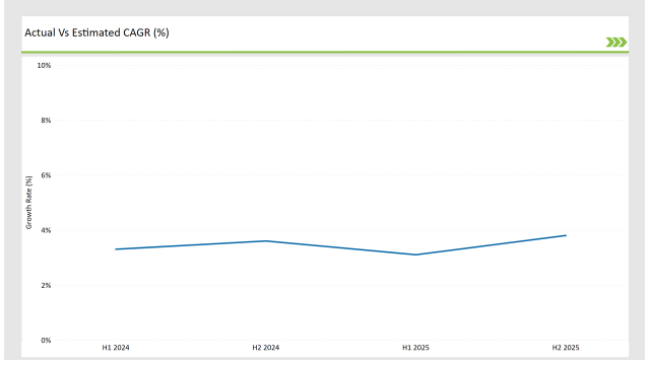

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK preclinical medical device testing services market.

This semi-annual analysis highlights crucial shifts in market dynamics and provide with a more precise understanding of the growth trajectory within the year. The H1, which is the first half of the year shows the January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Preclinical medical device testing services is projected to grow at a CAGR of 3.3% during H1 2024 and further surge to an increment of 3.6% in the latter half of 2024. In 2024, the rate is projected to slightly lower down to 3.1% in H1 and increase up to 3.8% in H2.

The market also witnessed decline of 20 basis points from the first half of 2024 to the first half of 2025 and an increase of 23 basis points in the second half of 2025 over the second half of 2024. The foregoing figures describe the dynamics or changing nature in the UK preclinical medical device testing services market impacted by factors, such as altered regulatory changes or innovations in several services provided by the service providers.

This semi-annual breakdown is critical for businesses planning and strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Presence of Advanced Research Institutions: Presence of established research and development institutions in country such as America® Holdings, NAMSA among others propels growth of the market |

| 2024 | Growing Investment in MedTech Startups: Funding provided by angel investors and capital investment companies such as Porsolt, Gradient LLC and Goupe Icare surges growth of the market |

| 2024 | Emerging Focus on Bioelectronic: Emphasis of Eurofins Scientific towards development of bioelectronics surges demand of the market. |

Growing Focus of Manufacturers towards Development of Bioelectronics anticipates the Growth of Market in the UK

Bioelectronics, as a field of research using electrical signals to remedy chronic pain, neuromodulation, and other neurological disorders. These technologies interact with complex neural systems of the human body. These technologies can be used as specific preclinical testing methods for the assessment of safety, efficacy, and risks.

Conventional test methodologies may be inadequate for such advanced devices; thus, tailored, state-of-the-art testing approaches have become necessary. This, in turn, creates the demand for very specialized preclinical testing services that can evaluate the functionality, biocompatibility, and long-term effects of bioelectronic devices, hence fast-tracking their development and ensuring only those meeting rigorous regulatory standards enter clinical trials.

Increase in Availability of Advanced Testing Facilities Anticipates its Market Growth in UK

Government support for R&D in the UK also plays an important role in increasing the preclinical medical device testing services market. The government provides grants for inducing more innovative research in medical devices like personalized medicine, robotics, and digital health technologies started by the UK government. This support for devices financially fast-tracks the creation of new devices that must undergo extensive preclinical testing to ensure safety, efficiency, and adherence to regulations.

This is why manufacturers are using specialized preclinical testing services-to meet the strict standards and bring these new devices to the market. Government-sponsored R&D programs are most likely to facilitate collaborations between universities, research institutions, and medical device companies developing state-of-the-art technologies, thus driving demand for higher-quality testing services.

The Critical Factor of Ensuring the Safety and Efficiency in Medical Device Aid Testing Services to dominate the Market

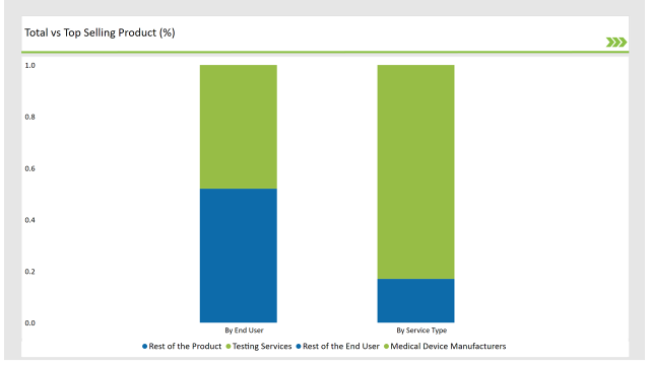

In the UK, testing services dominate the preclinical medical device testing services market, as it aid in ensuring that medical devices are safe, effective, and meet stringent regulatory requirements. These developments are normally highly complicated devices, which need special testing of functionality, biocompatibility, and long-term effects.

Furthermore, the regulatory environment in the UK is such that agencies like Medicines and Healthcare products Regulatory Agency, coupled with European Medicines Agency require a wide amount of pre-clinical tests for meeting standards of compliance. With medical devices becoming increasingly complex, the demand for accurate and efficient testing services has grown greater, with testing well on its way to dominating this market.

Comprehensive Testing Required by Medical Device aid them to hold Dominant Position

The preclinical medical device testing services market in the UK is dominated by medical device manufacturers, considering the strong medical device industry and regulatory landscape of the country.. The preclinical test helps pinpoint design flaws, risks, and issues of compliance at an early stage of the process with minimal costly revisions.

In addition, close collaboration between the manufacturing industries and testing service providers assures the appropriateness of testing methodologies for a specific device to shorten the time to market. Also, compliance will be made to adhere to UK and EU requirements. In conclusion, it has remained the demand drivers in UK in need of preclinical testing services by the medical device manufacturing.

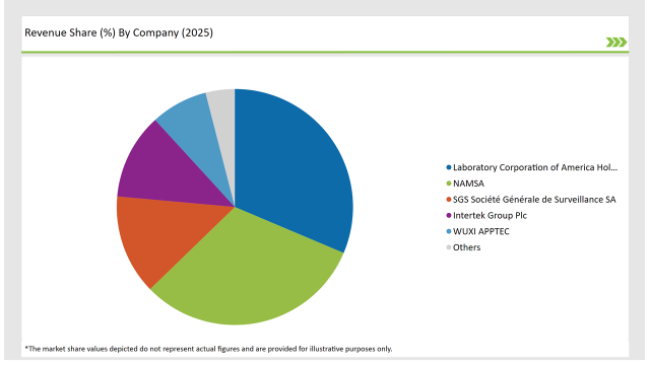

The UK preclinical medical device testing services market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment. Companies like Laboratory Corporation of America Holdings, Charles River Laboratories, WUXI APPTEC and Sotera Health dominate the market by leveraging advanced technologies for streamlining their production process.

The competitive landscape of the UK preclinical medical device testing services market features a blend of major multinational corporations and innovative regional companies.

2025 Market share of UK Preclinical Medical Device Testing Services

Note: above chart is indicative in nature

The industry includes Testing Services (Biocompatibility Testing, Microbiological & Sterility Testing, Analytical chemistry {Material Characterization, Extractables and leachables, Storage and stability testing and Polymer Investigation}, Toxicology Testing { Cytotoxicity, Genotoxicity and Other Toxicology Testing}, Functional Testing, Electromagnetic Compatibility (EMC) Testing, Implantation Studies, Biological Safety Evaluation, Package Validation, Reusability Testing, Pyrogen Testing and Others, and Consulting Services (Device Designing/Engineering and Regulatory affairs Consulting).

In terms of device category, the industry is divided into Orthopedics, Cardiovascular, Respiratory, Diabetes, Dental, Neurology, Oncology, Ocular, Bariatrics, Wound Healing, General Health (Wearables), In Vitro Diagnostics, General Surgery, Drug Device Combination and Other Device Category.

The industry is divided into Class I, Class II and Class III.

The industry is classified by end user as medical device manufacturers, pharmaceutical and biotech companies, device design and engineering firms and academic and research institutions

By 2035, the UK preclinical medical device testing services market is expected to grow at a CAGR of 3.1%.

By 2035, the sales value of the UK preclinical medical device testing services industry is expected to reach USD 103.4 million.

Key factors that are attributing to the growth of the UK preclinical medical device testing services market include presence of established research and development institutions in the country.

Prominent players in the UK preclinical medical device testing services manufacturing include Laboratory Corporation of America® Holdings, NAMSA, SGS Société Générale de Surveillance SA., Intertek Group Plc, WUXI APPTEC, TÜV SÜD, Sotera Health, Eurofins Scientific, iuvo BioScience, llc, RQM+, Pace Analytical Services LLC, Pharmaron, Bioneeds India Pvt. Ltd., Porsolt, Gradient LLC and Goupe Icare.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Preclinical Medical Device Testing Services Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Market Leaders & Share in the Preclinical Medical Device Testing Services Industry

China Preclinical Medical Device Testing Services Market Insights – Trends, Demand & Growth 2025-2035

India Preclinical Medical Device Testing Services Market Report – Trends & Innovations 2025-2035

Germany Preclinical Medical Device Testing Services Industry Analysis from 2025 to 2035

United States Preclinical Medical Device Testing Services Market Trends – Growth, Demand & Analysis 2025-2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Medical Device Analytical Testing Outsourcing Market Trends – Growth & Forecast 2024-2034

UK Medical Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Packaging Market Size, Share & Forecast 2025 to 2035

Medical Device & Equipment Tags Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Understanding Market Share Trends in Medical Device Packaging

Medical Home Services Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA