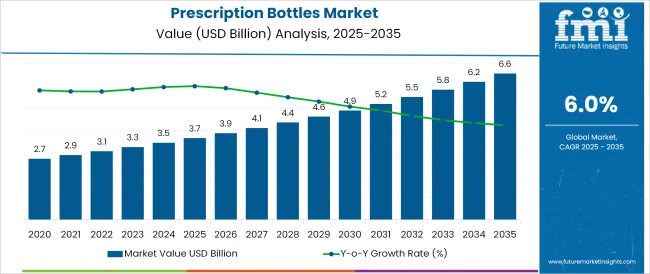

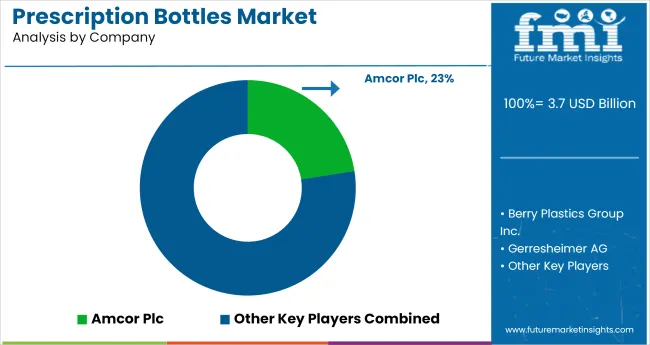

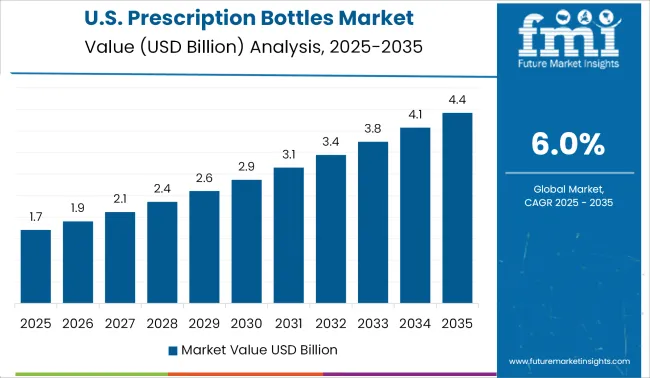

The Prescription Bottles Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The prescription bottles market is experiencing stable growth, supported by rising pharmaceutical production volumes and increasing demand for secure, compliant medication packaging. Industry publications and pharmaceutical supply chain updates have emphasized the importance of tamper evident packaging and child resistant closures in improving medication safety and regulatory compliance.

Manufacturers have expanded product portfolios with various material options and design formats to meet the evolving needs of pharmacies, hospitals, and mail order drug services. Additionally, the growing incidence of chronic illnesses has driven a steady rise in long term prescription volumes, requiring durable and safe storage solutions for medications.

Sustainability initiatives within the healthcare packaging sector have begun to influence material choices, with companies exploring recyclable plastics and bio based polymers. The market outlook remains positive, driven by rising outpatient prescriptions, automation in pharmacy dispensing systems, and the continued focus on patient adherence and drug safety.

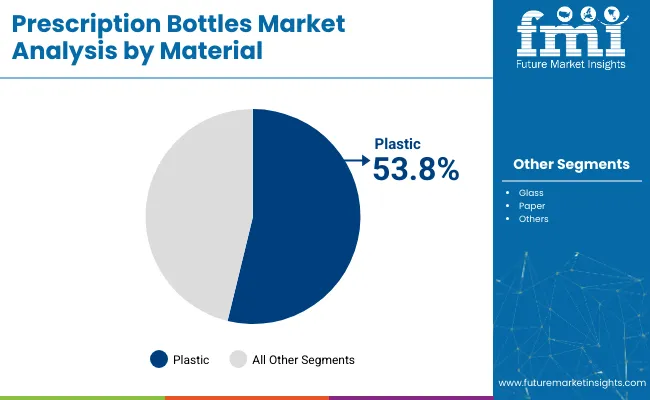

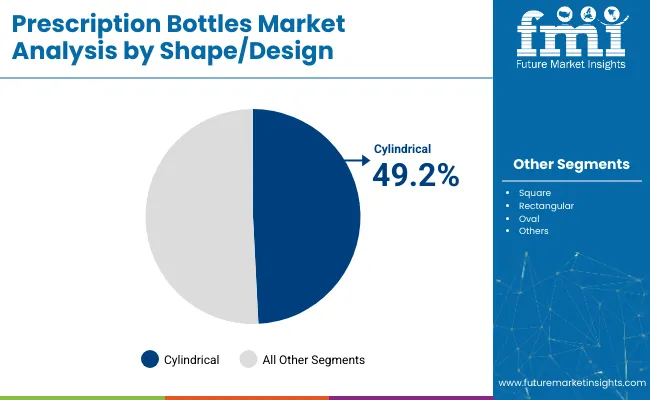

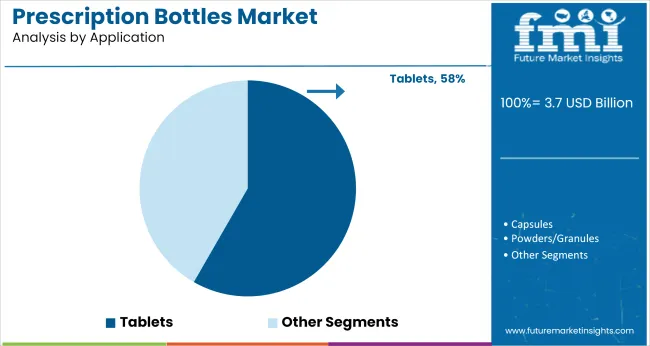

Segmental growth is being led by Plastic as the primary material type, Cylindrical as the preferred shape, and Tablets as the key application area, reflecting practical design choices and volume driven demand patterns.

The market is segmented by Material, Shape/design, and Application and region. By Material, the market is divided into Plastic, Glass, and Paper. In terms of Shape/design, the market is classified into Cylindrical, Square, Rectangular, and Oval.

Based on Application, the market is segmented into Tablets, Capsules, Powders/Granules, and Others (Semi-solid medications, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Plastic segment is projected to contribute 53.8% of the prescription bottles market revenue in 2025, maintaining its leadership among material types. Growth in this segment has been driven by the widespread use of high density polyethylene (HDPE) and polypropylene (PP) plastics, known for their durability, chemical resistance, and cost effectiveness.

Pharmaceutical packaging companies have preferred plastic for its lightweight properties, ease of molding into various shapes, and ability to incorporate child resistant and tamper evident features. Additionally, advancements in recyclable and biodegradable plastics have aligned with sustainability goals, further supporting the segment’s adoption.

Plastic prescription bottles have also facilitated automation in pharmacy dispensing operations, improving efficiency in filling and labeling processes. As the demand for safe, compliant, and cost efficient packaging solutions grows across retail pharmacies and mail order prescription services, the Plastic segment is expected to sustain its market dominance.

The Cylindrical segment is projected to account for 49.2% of the prescription bottles market revenue in 2025, retaining its leading position among shape and design formats. This preference has been driven by the ergonomic benefits and storage efficiency of cylindrical bottles, which have been widely adopted in retail and hospital pharmacies.

Cylindrical designs have simplified labeling, stacking, and handling processes, making them suitable for automated dispensing systems and pharmacy storage shelves. Packaging companies have continued to develop cylindrical bottles with user friendly features such as wide mouth openings, secure screw caps, and embossed dosage instructions.

The uniformity of the cylindrical shape has facilitated standardized production processes and cost efficiencies in packaging lines. As pharmacies continue to prioritize operational efficiency and patient convenience, the Cylindrical segment is expected to remain the preferred design choice in prescription bottle manufacturing.

The Tablets segment is projected to hold 58.3% of the prescription bottles market revenue in 2025, establishing itself as the dominant application area. Growth in this segment has been driven by the high volume of tablet based medications prescribed for chronic and acute conditions globally.

Pharmaceutical manufacturers and healthcare providers have relied on bottles for storing tablets due to their ability to protect contents from moisture, light, and contamination. Tablets have represented the most frequently dispensed dosage form in both outpatient and mail order pharmacy channels, driving continuous demand for packaging solutions.

Additionally, product labeling and dosage tracking features integrated into tablet bottles have supported medication adherence initiatives. With the prevalence of chronic diseases such as hypertension, diabetes, and cardiovascular disorders increasing worldwide, the Tablets segment is expected to sustain its leadership in the prescription bottles market, driven by consistent prescription volume and product stability requirements.

Prescription bottles are containers, especially made up of plastic and glass, cylindrical in shape which is prescribed by doctors, physicians, and pharmacists. The prescription bottles are available in different shapes, square, rectangular, oval, and cylindrical or round.

The prescription bottles are usually coloured to provide maximum protection towards the medicines from the changing weather conditions like high exposure to sunlight, etc. The prescription bottles are usually red, dark green, green, aqua, and cobalt blue in colour.

The majority of the prescription bottles are usually amber to orange in colour as they provide maximum protection to the pills and have low production costs. The prescription bottles have detailed information of the medicine to be taken along with timings, frequency, etc.

The prescription bottles are available in different colours and different shapes for the better handling of the medicines as compared to the medicine strip and the bottles are usually dark in colour to provide maximum protection against the photochemical reaction.

The prescription bottles with colour usually provide maximum protection to the tablets as compared to the transparent bottles. Also, the prescription bottles with attached lids and attached writable notepaper allows easy removal of the tablets from the bottle as compared to the non-lid attached pharmacy bottles.

The writable notepaper on the prescription bottle allows the patient to note the timings or frequency of taking the medicines which can be easily noticeable.

The prescription bottles have already attached information on the bottle in terms of the nature of the medicine, frequency of the medicine, time of the day for the intake of medicine, etc. by which a patient can easily refer while taking the medicine.

Also, there is no attached prescription note on the medicine or tablet strips as compared to the prescription bottles in which the patient has to refer to the prescription paper several times, and thereby it is less preferred as compared to the prescription bottles. The prescription bottles provide ease & convenience in the taking of the medicines are compared to the medicine strips.

The prescription bottles made of glass have high chances of breaking and require secondary packaging with the help of protective packaging for transportation and storage. The plastic prescription bottles are not resistant to long-distance transportation as the crushing rate is high which may cause medication or liquid leakage, microbial contamination of the medicine, etc.

The following global key players such as

Key Asian players manufacturing prescription bottles are National Bottle House, Keepet Containers, Raja Tradelinks Private Ltd., Hindustan Products, Ningbo Suncity, Whea-Stone Co., Ltd., and Neutroplast.

The manufacturers involved in the manufacturing of prescription bottles are involved in developing and launching the new technology in prescription bottles. The manufacturers are also focusing on the new, sustainable packaging formats to be used in the manufacturing of prescription bottles.

The majority of the manufacturers have shifted their aim towards the sustainable manufacturing of the product.

Therefore, the enhanced use of the paper while manufacturing the prescription bottles can be practiced by the manufacturers which can be easily decomposed with no risk of creating pollution of toxic waste as it eliminates the use of plastic and toxic chemicals and dyes during the manufacturing process for the paper prescription bottles.

The majority of the key players manufacturing prescription bottles have their presence in the USA which is a market driving factor for the USA.

Also, the use of advanced technology in the growing healthcare & pharmaceutical industry while conducting research and development of the new products is also uplifting the market share for prescription bottles in the USA Furthermore, the increasing research & development activities in the pharmaceutical companies are also expected to boost the market for the prescription bottles in the USA.

The global prescription bottles market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the prescription bottles market is projected to reach USD 6.6 billion by 2035.

The prescription bottles market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in prescription bottles market are plastic, glass and paper.

In terms of shape/design, cylindrical segment to command 49.2% share in the prescription bottles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Prescription Bottles Suppliers

Prescription Pharmacy Bags Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Prescription Lens Industry

Industry Share & Competitive Positioning in Prescription Pharmacy Bags Market

Prescription Delivery Service Market Insights – Trends, Growth & Forecast 2024 to 2034

Omega 3 Prescription Drugs Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Bottles Market Analysis - Growth & Forecast 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Beer Bottles Providers

MDPE Bottles Market

Glass Bottles Market Forecast and Outlook 2025 to 2035

Smart Bottles Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles And Containers Market Size and Share Forecast Outlook 2025 to 2035

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Paper Bottles Market Growth - Demand & Forecast 2025 to 2035

Competitive Overview of Glass Bottles Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA