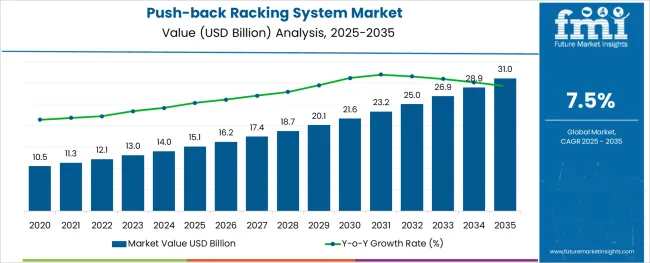

The Push-back Racking System Market is estimated to be valued at USD 15.1 billion in 2025 and is projected to reach USD 31.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The push-back racking system market is gaining momentum as industries seek compact, high-density storage solutions that optimize floor space while enabling rapid inventory retrieval. This growth is being influenced by rising warehouse automation, shifting SKU profiles, and the surge in omnichannel logistics. Companies across food, beverage, pharmaceuticals, and third-party logistics are investing in push-back systems to reduce aisle requirements and enhance storage throughput.

These systems allow multiple pallets to be stored in depth while offering better accessibility than traditional drive-in racks. Manufacturers are responding with modular designs compatible with forklift operations and adaptable to various load requirements.

As just-in-time inventory models gain prominence, demand for faster restocking and retrieval cycles is reshaping warehouse configurations. Future opportunities are expected in cold storage, perishable goods handling, and e-commerce fulfillment, where high-density, easily accessible storage is critical for operational efficiency and cost control.

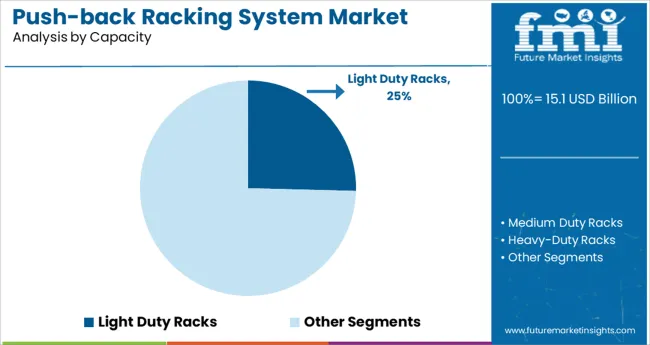

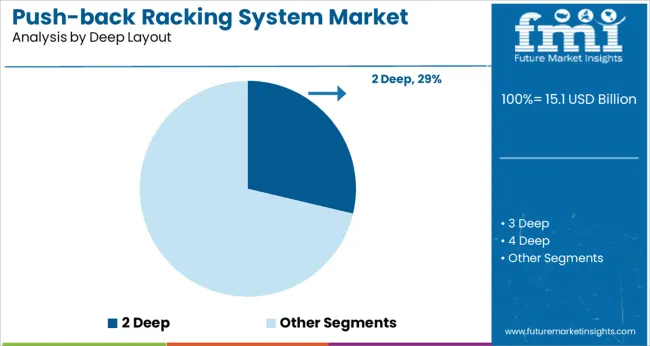

The market is segmented by Capacity, Deep Layout, and End Use and region. By Capacity, the market is divided into Light Duty Racks, Medium Duty Racks, and Heavy-Duty Racks. In terms of Deep Layout, the market is classified into 2 Deep, 3 Deep, 4 Deep, 5 Deep, and 6 Deep. Based on End Use, the market is segmented into Food & Beverage, Pharmaceutical, Automotive, Electrical & Electronics, Shipping & Logistics, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The light duty racks category is projected to account for 25.40% of the total revenue share in 2025 within the capacity segment, positioning it as a key contributor to market growth. This prominence is being driven by increasing demand for compact and cost-effective storage solutions in small to mid-sized warehouses and distribution centers.

Light duty racks are particularly suitable for storing low-weight inventory items that require frequent access and rapid turnover. Their ease of installation, modular expandability, and compatibility with manual handling equipment have made them a practical choice for operations with limited floor space or lower throughput requirements.

Sectors such as retail, small-scale manufacturing, and aftermarket parts have embraced light duty racking systems to streamline internal logistics without incurring the costs associated with heavier industrial alternatives. As businesses increasingly seek scalable storage solutions that align with lean operations, the segment is expected to maintain stable growth.

The 2 deep layout is forecasted to capture 28.70% of revenue share in 2025 within the deep layout segment, making it the most widely adopted configuration. This segment’s leadership is attributed to its optimal balance between storage density and selectivity, enabling warehouses to maximize pallet positions without sacrificing access speed.

The 2 deep layout allows two pallets to be stored in depth per lane, reducing the number of aisles required while still permitting straightforward inventory retrieval. It has become particularly favorable in facilities managing fast-moving or seasonal goods, where accessibility and throughput are both critical.

The layout’s flexibility, coupled with reduced structural requirements compared to deeper configurations, has accelerated its adoption across industries with dynamic storage needs. As warehouse operators prioritize operational flexibility and ROI, the 2 deep layout continues to be a preferred standard in push-back racking design.

The food and beverage sector is expected to hold 24.60% of the overall market revenue in 2025 within the end-use segment, emerging as a primary driver of push-back racking system adoption. Growth in this segment has been supported by increasing demand for high-turnover storage of perishable goods, packaged foods, and beverages that require controlled environments and efficient stock rotation.

Push-back systems are particularly suited to first-in-last-out (FILO) operations, which align with the inventory flow of many food and beverage products. The sector's need for hygienic, corrosion-resistant, and temperature-compatible racking materials has driven customization and innovation in rack design.

Additionally, growing investment in cold chain infrastructure and the global expansion of food processing and distribution facilities have reinforced the need for high-density storage solutions. As consumer demand shifts toward convenience and freshness, food and beverage companies are expected to continue driving adoption of push-back racking systems to support rapid, efficient inventory handling.

Increasing challenges in today’s warehouse racking systems such as accumulating an ever-growing number of pallets with an ever-growing number of products in fixed storage space.

A push-back racking system surges the pallet sum while offering many advantages over traditional high-density storage systems like a drive-in. Such factors are expected to create a significant demand for the push-back racking system market during the forecast period.

The lack of modern warehouse space and the rise of the retail industry across the globe is expected to create a massive opportunity for advanced racking systems, increasing the sales of push-back racking systems. It is foreseen to propel the growth of the global push-back racking system market during the forecast period.

The global warehouse inventory, which is becoming increasingly obsolete, will likely benefit from technological advancement, which improves speed, storage density, efficiency, and visibility. This pushes the sales of the push-back racking systems.

Hence, it is likely to augment the demand for convenient industrial racking systems, which ultimately pushes the growth of the global push-back racking system market during the forecast period. Thus, the notable global growth in the demand for push-back racking systems also tends to increase during the forecast period.

Continuous expansion of E-commerce and other industries in the North American region is expected to create significant demand for push-back racking systems during the forecast period. In North America, the USA is likely to remain at the forefront in terms of market share, while Canada is expected to register a maximum demand for push-back systems during the forecast period.

The Europe region is a significant shareholder of the global push-back system market and is projected to expand with a notable growth rate push-back system market during the forecast period. Germany and the United Kingdom are expected to be the most attractive market in the European region, accounting for significant push-back racking system market share. South and East Asia continue to emerge as a lucrative region for the growth of the push-back racking systems market during the forecast period.

The presence of emerging economies and the remarkable growth rate of end-use industries in the South and East Asia region are key factors driving the growth of the push-back racking systems market during the forecast period. India in South Asia while China in East Asia is expected to remain highly attractive regarding market share & growth rate of the push-back racking system market in the coming years.

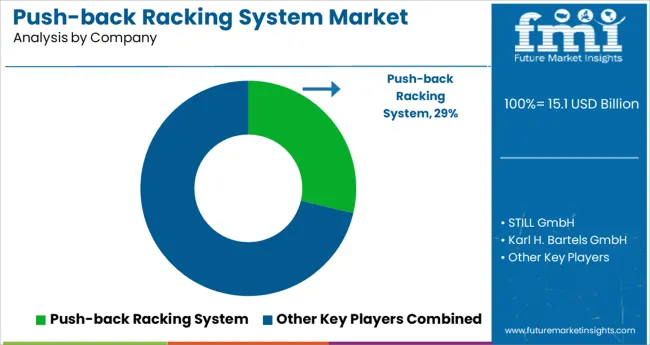

The key players of the push-back racking system market are focusing on enhancing durability, conciseness, and better pallet organization. This drives the sales of push-back racking systems.

Key players in the push-back racking system market include 3D Logistics Inc, STILL GmbH, Karl H. Bartels GmbH, Mecalux S.A., and Aceally (International) Co. Ltd

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.5% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Capacity, End Use, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | 3D Logistics Inc; STILL GmbH; Karl H. Bartels GmbH; Mecalux S.A.; Aceally (International) Co. Ltd |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global push-back racking system market is estimated to be valued at USD 15.1 billion in 2025.

It is projected to reach USD 31.0 billion by 2035.

The market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types are light duty racks, medium duty racks and heavy-duty racks.

2 deep segment is expected to dominate with a 28.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fracking Fluids And Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Eye Tracking Solutions Market

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Pallet Racking Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tumor Tracking Systems Market

Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Mobile Tracking Solution Market Size and Share Forecast Outlook 2025 to 2035

Stress Tracking Devices Market - Demand & Forecast 2025 to 2035

Facial Tracking Solution Market by Component, Technology Type, Industry & Region Forecast till 2035

Flight Tracking System Market Insights - Trends & Forecast 2025 to 2035

Ammonia Cracking Membrane Reactor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Envelope Tracking Chip Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Racking Market Growth - Trends & Forecast 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Tracking Solutions Market

Fertility Tracking Apps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA