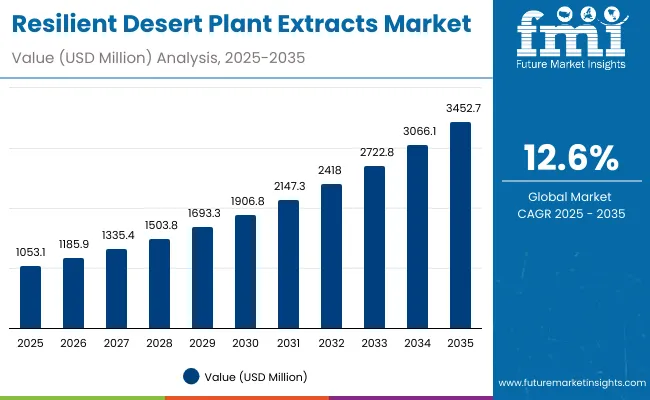

A valuation of USD 1,053.1 million has been projected for the Resilient Desert Plant Extracts Market in 2025, and the figure is anticipated to reach USD 3,452.7 million by 2035. This remarkable increase of USD 2,399.6 million represents a threefold expansion, equivalent to a CAGR of 12.6% during the period 2025-2035.

Resilient Desert Plant Extracts Market Key Takeaways

| Metric | Value |

|---|---|

| Resilient Desert Plant Extracts Market Estimated Value in (2025E) | USD 1,053.1 million |

| Resilient Desert Plant Extracts Market Forecast Value in (2035F) | USD 3,452.7 million |

| Forecast CAGR (2025 to 2035) | 12.60% |

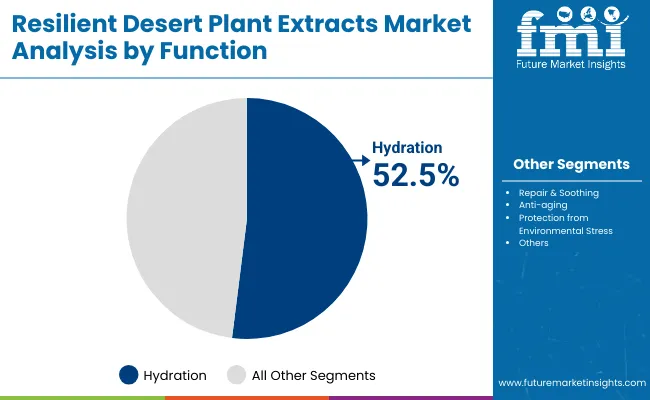

During the initial half of the decade, the market is expected to rise steadily from USD 1,053.1 million in 2025 to USD 1,906.8 million in 2030, generating an incremental value of USD 853.7 million. This phase is likely to account for 35.6% of the total forecast growth. Expansion during these years is anticipated to be shaped by consistent adoption of hydration-focused formulations, as desert-derived ingredients continue to resonate with demand for moisture-rich, functional, and natural solutions. Hydration is forecast to lead the functional segments with 52.5% share in 2025, highlighting its dominance in consumer preferences.

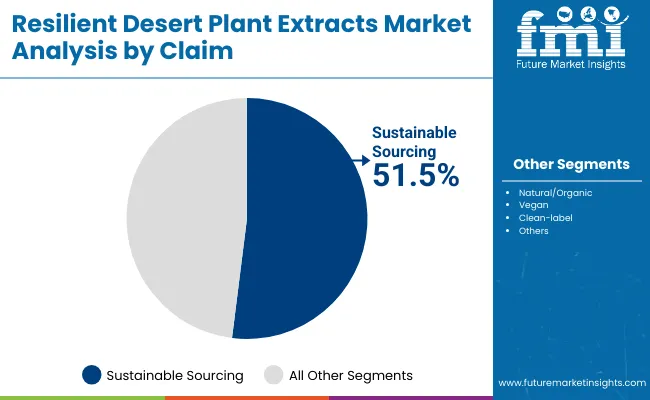

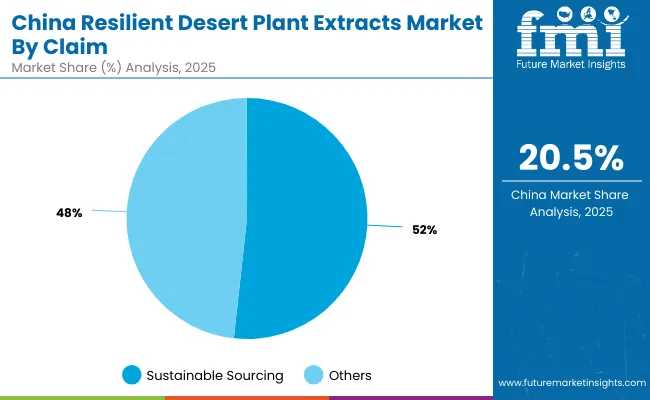

The second phase, spanning from 2030 to 2035, is projected to deliver accelerated growth, adding USD 1,545.9 million as the market advances from USD 1,906.8 million to USD 3,452.7 million. This represents 64.4% of the total decade expansion, underpinned by widespread demand for sustainable sourcing and eco-ethical claims. Sustainable sourcing is forecast to dominate the claim segment with 51.5% share in 2025, reinforcing its role as a decisive driver. Stronger adoption of resilient ingredients in personal care and wellness applications is expected to sustain momentum in the later years.

Between 2020 and 2024, the Resilient Desert Plant Extracts Market expanded steadily as demand for natural, eco-ethical, and multifunctional plant-based solutions gained traction across personal care and wellness applications. The competitive environment was largely defined by ingredient suppliers, who held significant influence through proprietary sourcing methods and resilient supply chains. By 2025, demand is expected to climb to USD 1,053.1 million, with hydration-led formulations capturing the highest value share.

The period 2025-2035 is projected to witness transformative momentum, as revenues are forecast to triple, reaching USD 3,452.7 million. Growth will be underpinned by consumer-driven emphasis on sustainable sourcing, which is set to dominate with 51.5% share in 2025. Competitive differentiation is anticipated to shift toward ecological certifications, innovation in bioactive efficacy, and strategic positioning in high-growth markets such as China and India. Established players are expected to diversify into advanced sustainability platforms, while regional firms may leverage cost-effective supply models. Competitive advantage is projected to evolve from basic extract provision to ecosystem-driven strategies built on traceability, clean-label alignment, and long-term environmental resilience.

Growth in the Resilient Desert Plant Extracts Market is being fueled by rising consumer preference for natural, sustainable, and multifunctional ingredients. Increased awareness of hydration, anti-aging, and protective benefits associated with desert-derived botanicals has been observed, and these properties are being valued for their resilience against extreme climates. Demand has been further strengthened by the global shift toward clean-label, vegan, and eco-ethical claims, with sustainable sourcing recognized as a decisive growth driver.

Expanding use of aloe vera, baobab, cactus, and prickly pear extracts is being reinforced by their proven efficacy in skincare and wellness applications. Rapid adoption in high-growth economies such as China and India is being supported by evolving consumer lifestyles and the expansion of premium personal care categories. Regulatory encouragement for eco-conscious formulations is also influencing industry direction. Competitive differentiation is projected to be built on transparency, traceability, and innovation in functional performance, sustaining momentum throughout the forecast period.

The Resilient Desert Plant Extracts Market has been segmented by function, claim, and product type to capture the key dynamics shaping demand. Each segment reflects evolving consumer priorities, where hydration-led performance, sustainable sourcing practices, and diverse product formulations are being emphasized as critical growth drivers. Functional segmentation highlights the dominance of hydration, supported by the intrinsic moisture-retention properties of desert-derived botanicals.

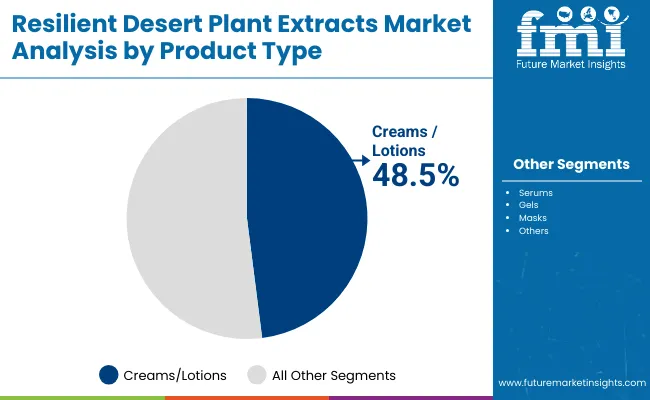

Claim-based segmentation underlines the growing preference for sustainable sourcing, reflecting the alignment of consumer behavior with ethical and eco-conscious standards. In terms of product type, creams and lotions continue to account for the largest share, reaffirming their role as core applications in skincare and wellness regimens. These segments together illustrate how resilience, sustainability, and everyday usability are converging to define the trajectory of this market through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| Hydration | 52.5% |

| Others | 47.5% |

Hydration is expected to emerge as the dominant functional segment in the Resilient Desert Plant Extracts Market, accounting for 52.5% of the share in 2025 with USD 551.5 million in sales. This dominance is being supported by the proven ability of desert-derived actives to retain moisture under extreme conditions, a property that resonates strongly with skincare and wellness consumers. The category is projected to expand further as awareness of natural hydration solutions continues to rise, reinforced by demand for products that provide both immediate and long-term moisture benefits. While repair, soothing, and anti-aging functions are expected to maintain relevance, the sustained consumer preference for hydration-led formulations is likely to ensure continued leadership in this segment throughout the forecast horizon.

| Segment | Market Value Share, 2025 |

|---|---|

| Sustainable sourcing | 51.5% |

| Others | 48.5% |

Sustainable sourcing is projected to dominate the claim segment with 51.5% share in 2025, generating USD 541.4 million in revenue. Growth in this category is being reinforced by rising consumer demand for eco-conscious and ethically produced formulations, as well as by regulatory initiatives promoting transparency and sustainability. The ability of desert plant extracts to thrive in arid climates with minimal resources has positioned them as symbols of ecological resilience, strengthening their role in sustainable supply chains. Consumer alignment with environmental responsibility is expected to intensify, pushing sustainable sourcing further into the mainstream. Other claims such as natural, organic, clean-label, and vegan will retain importance, but sustainable sourcing is forecast to remain the most influential growth driver in this segment.

| Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 48.5% |

| Others | 51.5% |

Creams and lotions are anticipated to lead the product type segment with 48.5% share in 2025, contributing USD 509.1 million in sales. This leadership is being supported by their everyday use and broad adoption across global skincare routines, ensuring consistent demand for desert-derived hydration and protective benefits. Growth in this segment is likely to be enhanced by product innovations offering improved textures, multifunctional benefits, and sensorial appeal. Other product types, representing 51.5% share and USD 542.5 million in 2025, are projected to expand steadily as consumer interest in diverse formulations such as gels and masks gains momentum. However, creams and lotions are expected to remain the backbone of market revenues due to their entrenched role in daily personal care regimens.

Despite promising growth, the Resilient Desert Plant Extracts Market is being shaped by complex sustainability requirements and shifting consumer priorities, even as opportunities in advanced bioactive innovation and ethical supply chains continue to reinforce expansion across personal care and wellness industries.

Ecological Resilience as a Value Proposition

Market momentum is being supported by the ecological resilience of desert plants, which thrive in harsh environments while utilizing minimal resources. This characteristic is being positioned as a strategic advantage in sustainability narratives, allowing brands to build differentiation beyond traditional functional claims. Extracts from aloe vera, baobab, cactus, and prickly pear are increasingly being recognized not only for hydration or repair but also for their symbolic alignment with climate adaptation. As climate stress becomes a mainstream concern, desert plant extracts are expected to be marketed as natural solutions embodying environmental survival, creating deeper resonance with eco-conscious consumers. This dynamic is anticipated to accelerate adoption by both established and emerging brands.

Supply Chain Fragility and Traceability Gaps

Constraints are being observed in ensuring transparent, traceable, and resilient supply chains for desert botanicals. Many cultivation zones remain concentrated in specific geographies, exposing producers to climate volatility, regional policy shifts, and logistical disruptions. Without strong traceability frameworks, ethical sourcing claims may face scrutiny, undermining consumer trust. Regulatory focus on proof of sustainability is intensifying, and the inability to verify origins could restrict scalability. Investment in digital traceability systems and fair-trade certifications is projected to become essential for industry credibility. This restraint, if unaddressed, could limit the pace at which the market expands globally.

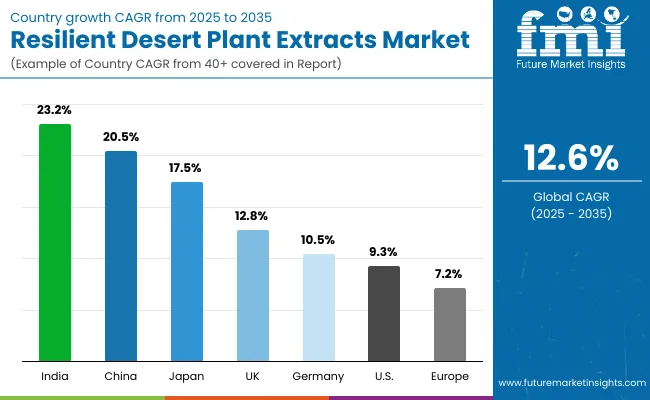

| Countries | CAGR |

|---|---|

| China | 20.5% |

| USA | 9.3% |

| India | 23.2% |

| UK | 12.8% |

| Germany | 10.5% |

| Japan | 17.5% |

Adoption of resilient desert plant extracts is being observed at varied speeds across leading global markets, reflecting differences in consumer priorities, regulatory frameworks, and industrial innovation. Asia is projected to demonstrate the fastest pace of expansion, with India expected to record a CAGR of 23.2% and China anticipated at 20.5% between 2025 and 2035. India’s growth is likely to be reinforced by rising demand for natural wellness and skincare solutions, while China is expected to benefit from large-scale commercialization supported by sustainability policies and advanced manufacturing ecosystems. Japan, at 17.5% CAGR, is forecast to sustain momentum through its strong alignment with premium personal care categories emphasizing natural efficacy.

In Europe, growth is projected at a comparatively modest 7.2%, with Germany at 10.5% and the UK at 12.8%. Market expansion in the region is anticipated to be driven by regulatory support for eco-labels, though saturation and compliance costs may temper acceleration. North America is expected to demonstrate moderate growth, with the USA forecast at 9.3% CAGR, reflecting its maturity in natural ingredients adoption but slower uptake relative to Asia. Collectively, these country-level variations highlight how sustainability narratives, regulatory influence, and consumer alignment with eco-conscious choices are shaping long-term opportunities.

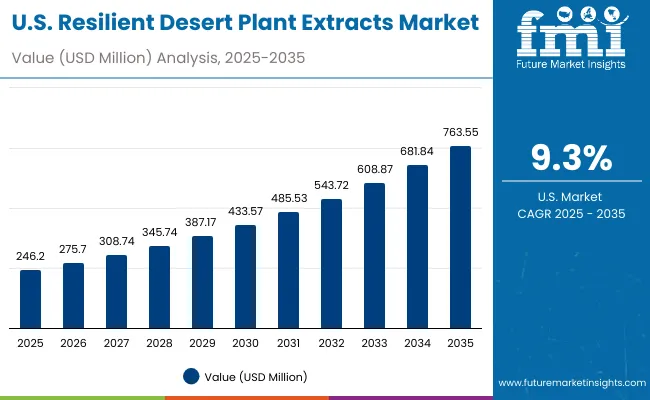

| Year | USA Resilient Desert Plant Extracts Market (USD Million) |

|---|---|

| 2025 | 246.20 |

| 2026 | 275.70 |

| 2027 | 308.74 |

| 2028 | 345.74 |

| 2029 | 387.17 |

| 2030 | 433.57 |

| 2031 | 485.53 |

| 2032 | 543.72 |

| 2033 | 608.87 |

| 2034 | 681.84 |

| 2035 | 763.55 |

The Resilient Desert Plant Extracts Market in the United States is projected to grow at a CAGR of 12% from 2025 to 2035, advancing from USD 246.2 million to USD 763.6 million. Expansion is expected to be reinforced by sustained demand for hydration-led formulations, supported by proven desert plant bioactive properties. Sustainable sourcing is anticipated to emerge as a differentiator, with eco-ethical claims likely to shape consumer loyalty and regulatory alignment.

Premium personal care and wellness applications are forecast to capture the majority of demand, with hydration and repair benefits aligning closely with USA consumer expectations. Partnerships between extract producers and formulators are projected to strengthen competitive positioning, while innovation in multifunctional ingredients is expected to diversify product portfolios.

A CAGR of 12.8% is projected for the UK Resilient Desert Plant Extracts Market through 2035. Expansion is expected to be shaped by retailer-led sustainability scorecards, stringent substantiation standards, and consumer preference for traceable naturals. Hydration-led efficacy will remain the anchor use case, while eco-labels will guide premium positioning. E-commerce and pharmacy chains are anticipated to serve as the primary scale channels, with own-label ranges integrating ethically sourced desert botanicals. Formulators are likely to prioritize lifecycle-assessed inputs and recyclable packaging, reinforcing brand trust. Partnerships with certified growers and third-party auditors are expected to de-risk supply continuity and claims verification.

A CAGR of 23.2% is projected for India, indicating the fastest trajectory among key markets. Growth is expected to be enabled by Ayurveda-aligned formulations, domestic cultivation capacity in arid zones, and cost-efficient processing ecosystems. Hydration and soothing benefits are likely to be embedded in mass-premium skincare, while clean-label and vegan cues enhance trust. Contract manufacturing clusters are anticipated to scale private-label launches for modern trade and D2C brands. Digital commerce will catalyze nationwide reach, and localized storytelling around water stewardship is expected to elevate brand equity. Harmonization with eco-label standards is projected to unlock export opportunities across Asia and the Middle East.

A CAGR of 20.5% is projected for China through 2035. Momentum is expected to be supported by clean-beauty regulation, rapid product cycle times, and data-driven merchandising on leading social-commerce platforms. Hydration leadership is likely to persist, with sustainable-sourcing claims gaining visibility through digital traceability pilots. Local extraction and blending capacity are anticipated to compress lead times, enabling frequent seasonal drops. Cross-border assortments will complement domestic lines where certified sourcing narratives are strongest. Collaboration between ingredient producers and C-beauty brands is expected to yield sensorial textures optimized for humid and dry climates alike.

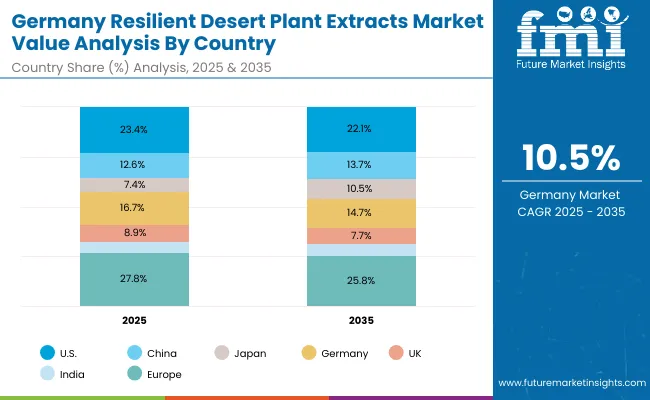

| Countries | 2025 |

|---|---|

| USA | 23.4% |

| China | 12.6% |

| Japan | 7.4% |

| Germany | 16.7% |

| UK | 8.9% |

| India | 5.6% |

| Countries | 2035 |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 10.5% |

| Germany | 14.7% |

| UK | 7.7% |

| India | 6.3% |

A CAGR of 10.5% is projected for Germany, reflecting disciplined expansion under rigorous safety and environmental norms. Market development is expected to be shaped by pharmacy-led counseling, strong interest in clinically substantiated naturals, and preference for recyclable packaging. Sustainable-sourcing claims are likely to be scrutinized, driving adoption of supplier audits and chain-of-custody documentation. Hydration and repair benefits are anticipated to feature in dermocosmetic ranges targeting sensitive-skin users. Specialty retail and e-pharmacies are expected to concentrate value, while private-label portfolios standardize eco-criteria across tiers. Supplier partnerships emphasizing LCA data and fair-trade frameworks are projected to secure durable placements.

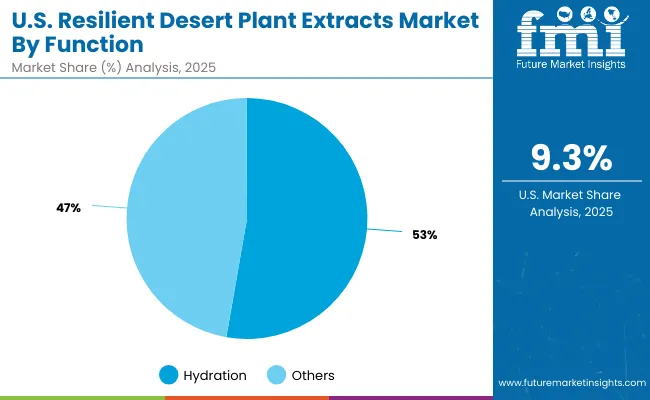

| Segment | Market Value Share, 2025 |

|---|---|

| Hydration | 52.5% |

| Others | 47.5% |

The USA Resilient Desert Plant Extracts Market is projected at USD 246.2 million in 2025. Hydration contributes 52.5%, while other functions hold 47.5%, reflecting balanced but hydration-led demand. This hydration leadership is being reinforced by the proven ability of desert-derived botanicals to retain moisture under extreme conditions, a property that aligns closely with consumer expectations in personal care. The functional advantage of hydration is anticipated to sustain long-term adoption, particularly as climate-induced dryness and environmental stress heighten consumer awareness of protective care.

Other functional categories, including repair, soothing, and anti-aging, are also expected to maintain a strong presence, supported by demand for multifunctional natural solutions. However, hydration’s dominance underscores its position as the cornerstone of functional claims in the USA market. Strategic innovation is likely to integrate hydration benefits with sustainability narratives, further strengthening competitive positioning.

| Segment | Market Value Share, 2025 |

|---|---|

| Sustainable sourcing | 51.5% |

| Others | 48.5% |

The Resilient Desert Plant Extracts Market in China is projected at USD 132.9 million in 2025. Sustainable sourcing contributes 51.5%, while other claims account for 48.5%, reflecting a near-equal split but clear leadership of sustainability-driven narratives. This emphasis on sustainable sourcing is being supported by regulatory encouragement for eco-friendly practices and consumer alignment with ethical choices. Rising sensitivity to traceability, environmental responsibility, and supply chain transparency is expected to reinforce the primacy of this claim throughout the decade.

Other claims, including natural, organic, clean-label, and vegan attributes, are anticipated to retain strong relevance as consumer awareness expands across skincare and wellness categories. However, sustainable sourcing’s dominance illustrates how environmental narratives are being integrated into purchasing behavior, particularly among younger demographics. Brand differentiation in China is likely to be shaped by the depth of sustainability integration, combined with the performance efficacy of desert-derived actives.

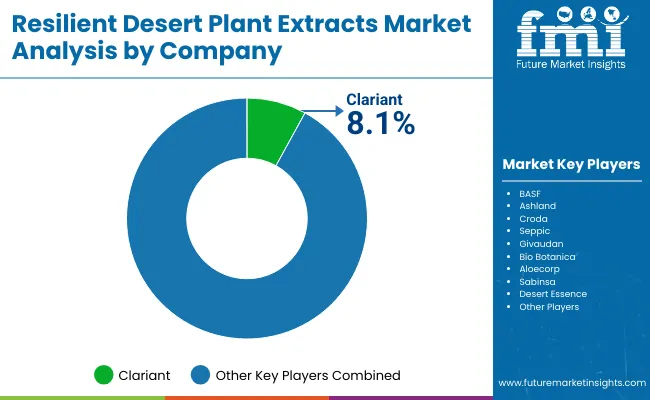

The Resilient Desert Plant Extracts Market is moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across diverse applications. Global ingredient leaders such as Clariant, BASF, Ashland, Croda, Seppic, and Givaudan are recognized as key players in this market, reflecting their deep expertise in specialty chemicals and botanical actives. These companies are strengthening portfolios with desert-derived extracts positioned for hydration, anti-aging, and eco-ethical claims. Their strategies are being aligned toward sustainability certifications, supply chain traceability, and partnerships with personal care brands to secure long-term relevance.

Mid-sized innovators such as Bio Botanica, Aloecorp, Sabinsa, and Desert Essence are addressing demand for niche and regionally specialized formulations. Their strength lies in vertical integration of sourcing, strong alignment with natural wellness narratives, and adaptability to regional preferences. These firms are expected to grow by catering to D2C brands and natural personal care labels prioritizing authenticity and transparency.

Niche-focused specialists are emphasizing application-specific solutions, including organic certification, vegan-compatible offerings, and clean-label positioning. Their competitive advantage is being driven by agility, regional adaptability, and close consumer alignment.

Competitive differentiation is expected to shift from traditional extract supply toward ecosystem leadership built on sustainability, multifunctional efficacy, and traceable sourcing platforms.

Key Developments in Resilient Desert Plant Extracts Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,053.1 million (2025E) - USD 3,452.7 million (2035F) |

| Function | Hydration (52.5%, USD 551.5 million in 2025), Others (47.5%, USD 499.9 million in 2025) |

| Claim | Sustainable sourcing (51.5%, USD 541.4 million in 2025), Others (48.5%, USD 510.6 million in 2025) |

| Product Type | Creams/lotions (48.5%, USD 509.1 million in 2025), Others (51.5%, USD 542.5 million in 2025) |

| Channel | E-commerce, Pharmacies, Specialty retail, Mass retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clariant, BASF, Ashland, Croda, Seppic, Givaudan, Bio Botanica, Aloecorp, Sabinsa, Desert Essence |

| Additional Attributes | Dollar sales by function, claim, and product type; adoption trends in hydration and eco-ethical claims; rising demand for vegan, clean-label, and organic botanicals; sustainable sourcing and traceability initiatives; sector-specific growth in skincare, nutraceuticals, and wellness; regional variations driven by regulatory standards and consumer behavior; innovations in eco-friendly cultivation and extraction technologies. |

The global Resilient Desert Plant Extracts Market is estimated to be valued at USD 1,053.1 million in 2025.

The market size for the Resilient Desert Plant Extracts Market is projected to reach USD 3,452.7 million by 2035.

The Resilient Desert Plant Extracts Market is expected to grow at a CAGR of 12.6% between 2025 and 2035.

The key product types in the Resilient Desert Plant Extracts Market are creams/lotions and other formats such as gels, masks, and serums.

In terms of function, hydration is expected to command 52.5% share in the Resilient Desert Plant Extracts Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Climate resilient Coffee Beans Market Size and Share Forecast Outlook 2025 to 2035

Adhesive for Resilient Floor Market Growth – Trends & Forecast 2024-2034

Desert Air Cooler Market Growth - Size & Forecast 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Desert Island Tourism Market Growth – Forecast 2024-2034

Extracts and Distillates Market

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Anti-Aging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bamboo Extracts for Skin Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Jujube Extracts Market Analysis by Type, End-Use, Distribution Channel, Region And Other Forms Through 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Ginseng Extracts Market Analysis by Product Type, Form and Application Through 2035

Glycerol Extracts Market

Pine Bark Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chamomile Extracts for Soothing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chlorella Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA