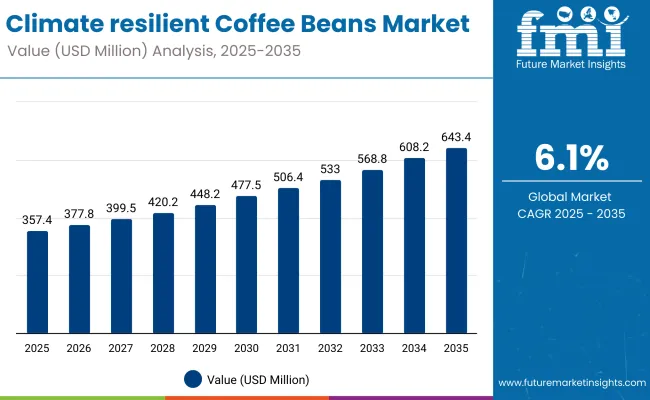

The Climate resilient Coffee Beans Market is projected to record a valuation of USD 357.4 million in 2025 and USD 643.47 million in 2035, reflecting an increase of USD 286.07 million, equivalent to a growth of approximately 80% over the decade. This expansion corresponds to a CAGR of 6.1%, translating into a near 1.8X increase in Market size during the forecast period.

Climate resilient Coffee Beans Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 357.4 million |

| Market Forecast Value in (2035F) | USD 643.4 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

During the initial five-year phase from 2025 to 2030, the Market is expected to rise from USD 357.4 million to approximately USD 477.59 million, adding USD 120.19 million- accounting for about 42% of the total decade growth. This stage is anticipated to be characterized by steady institutional adoption, with climate-adapted Arabica and hybrid varieties securing procurement contracts from ESG-focused buyers. Regional demand will be led by North America and Europe, which together capture over half of global value, supported by resilient supply programs.

In the latter half from 2030 to 2035, an additional USD 165.88 million is forecast to be added, contributing to 58% of total growth as the Market advances from USD 477.59 million to USD 643.47 million. This acceleration will be powered by scaling agroforestry systems, genetic innovation, and resilience verification frameworks, which will broaden adoption among mainstream roasters and retail chains. Premiumization based on resilience credentials is expected to gain traction, while digital traceability and climate performance metrics will further reinforce buyer confidence and sustain upward price realization.

From 2020 to 2024, the Climate resilient Coffee Beans Market expanded steadily due to the rising emphasis on climate adaptation in agricultural supply chains. Industry adoption was driven by roasters and institutional buyers integrating resilience into sourcing criteria.

During this period, large-scale coffee traders and vertically integrated roasters held the dominant share, supported by long-term grower relationships and investment in agronomic programs. genetic innovation, agroforestry practices, and improved water management systems played a critical role in establishing Market credibility. Premium pricing was increasingly tied to verifiable climate performance, while uncertified bulks experienced stagnant value growth.

By 2025, demand is projected to reach USD 0.357 billion, with revenue mix gradually shifting toward differentiated, resilience-certified coffee in specialty and mainstream channels. competitive positioning is expected to move beyond bean quality alone toward end-to-end resilience verification, integrated traceability platforms, and digital Market place integration.

New entrants specializing in climate-data analytics, farm-level monitoring, and collaborative financing models are anticipated to capture growing interest from sustainability-driven buyers. Market leadership will depend on ecosystem collaboration, scalability of adaptation measures, and the ability to translate agronomic resilience into clear value propositions for both buyers and consumers.

growth in the Climate resilient Coffee Beans Market is being driven by the increasing need to safeguard coffee production against the impacts of climate change. rising temperatures, erratic rainfall, and pest infestations have intensified pressure on growers, leading to greater adoption of resilient arabica, robusta, and hybrid varieties. investment in breeding programs, agroforestry systems, and soil health enhancements has been accelerated by both public and private stakeholders to ensure yield stability and quality preservation.

Procurement strategies by leading roasters and traders are being reshaped to prioritize climate adaptation credentials alongside traditional quality metrics. demand from specialty and mainstream segments is expected to rise as consumers become more aware of the environmental and social benefits linked to resilience-certified coffee. integration of digital traceability and climate performance verification into supply chains is anticipated to further strengthen Market adoption. Over the forecast period, the combination of agronomic innovation, sustainability mandates, and premium positioning is projected to sustain robust Market expansion.

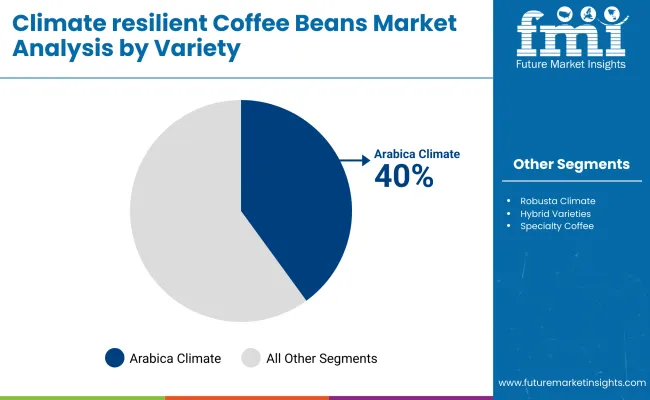

Variety Segment Market Value Share, 2025

| Segment | Share% |

|---|---|

| Arabica Climate-Resilient Varieties | 40% |

| Robusta Climate-Resilient Varieties | 25% |

| Hybrid Varieties (Arabica × Robusta) | 20% |

| Specialty Coffee Climate-Resilient Varieties | 15% |

The arabica climate-resilient varieties segment is projected to command 40% of the Market value in 2025, driven by its premium quality perception and strong alignment with specialty coffee demand. Cultivation expansion is being promoted in both traditional and emerging regions, supported by breeding programs targeting drought tolerance and disease resistance. Institutional buyers and roasters are prioritizing these varieties for their balance of flavor complexity and climate resilience, ensuring continued relevance in global sourcing strategies.

As climate adaptation becomes a procurement norm, arabica’s share is expected to remain dominant, reinforced by innovation in cultivation techniques and expanding certified supply chains across multiple producing regions.

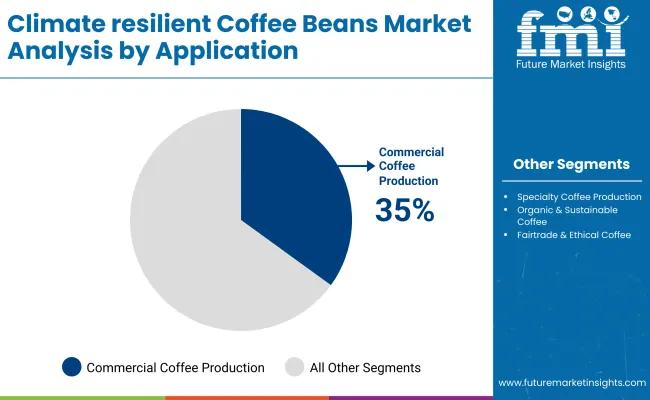

Application Segment Market Value Share, 2025

| Segment | Share% |

|---|---|

| Specialty Coffee Production | 30% |

| Commercial Coffee Production | 35% |

| Organic & Sustainable Coffee | 20% |

| Fairtrade & Ethical Coffee | 15% |

Commercial coffee production is forecast to hold 35% of the Market share in 2025, reflecting steady demand from large-scale roasters and mainstream retail channels. Climate-resilient varieties are being integrated into conventional production systems to protect yields and maintain supply continuity under shifting climatic conditions.

Large-volume buyers are investing in agronomic support and resilience verification to secure compliance with sustainability policies. Over time, the segment is expected to benefit from increased adoption of hybrid and robusta variants, which enhances productivity while meeting flavor and quality thresholds for the commercial segment.

Sales Channel Segment Market Value Share, 2025

| Segment | Share% |

|---|---|

| Coffee Producers & Exporters | 35% |

| Specialty Coffee Retailers | 20% |

| Modern trade | 15% |

| Online Coffee Retail | 20% |

| Food service & Hospitality | 10% |

Coffee producers and exporters are expected to account for 35% of the Market share in 2025, maintaining their central role in the value chain. This dominance is supported by their ability to aggregate climate-resilient varieties from diverse origins, meet quality and traceability requirements, and engage directly with both specialty and commercial buyers.

Strategic partnerships between exporters and global roasters are being strengthened to ensure year-round availability of resilience-certified lots. Investment in post-harvest infrastructure, quality control, and digital traceability platforms is anticipated to further consolidate this segment’s position. Over the decade, value creation is expected to be enhanced by premium pricing for verified climate-adapted supply.

Rising climate variability, volatile supply chains, and evolving sustainability mandates are reshaping procurement strategies in the Climate resilient Coffee Beans Market, even as demand expands across specialty, commercial, and ethical segments for verified, high-quality, and adaptation-ready coffee supply worldwide.

Expansion of Climate-Smart Agricultural PracticesThe Market is being propelled by the rapid scaling of climate-smart agricultural practices aimed at safeguarding yields and quality against temperature fluctuations, drought, and pest pressures. Governments, NGOs, and private-sector buyers have intensified funding and technical assistance for agroforestry systems, soil-microbiome enhancements, and water management innovations.

These measures are enabling farmers to stabilize output while meeting resilience verification standards demanded by global roasters and retailers. Direct trade relationships are increasingly structured to incentivize adoption, embedding adaptation criteria in long-term contracts. This alignment of policy, finance, and buyer requirements is projected to accelerate adoption rates through 2035, reinforcing climate resilience as both a risk mitigation and value creation pathway.

Limited Access to Certified Planting Material Market growth is being constrained by restricted access to certified climate-resilient seedlings and planting materials in key producing regions. Seed system bottlenecks, regulatory delays, and underdeveloped nursery infrastructure are slowing the scale-up of resilient varieties.

Smallholder farmers, who constitute most coffee producers, often face prohibitive costs and logistical barriers in sourcing high-quality inputs. Without adequate access, adoption timelines are prolonged, and supply consistency is challenged, particularly in regions most exposed to climate shocks. Unless these constraints are addressed through coordinated investment in seed multiplication and distribution networks, the Market ’s full potential may remain under-realized despite robust downstream demand.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.09% |

| India | 6.29% |

| Germany | 5.24% |

| France | 6.83% |

| UK | 6.55% |

| USA | 6.22% |

| Brazil | 5.57% |

The global Climate resilient Coffee Beans Market reflects clear regional divergence in adoption pace, shaped by consumption maturity, sourcing strategies, and climate adaptation urgency. North America is anticipated to lead in value share, supported by strong specialty coffee culture, high per capita consumption, and procurement frameworks embedding climate resilience criteria. Growth in this region is being reinforced by corporate ESG commitments and consumer readiness to pay premiums for verified sustainable supply.

Europe follows closely, with countries such as Germany, France, and the UK advancing resilience integration through fairtrade certification uptake, sustainability-driven retail policies, and traceable sourcing systems. In South Asia & Pacific, particularly in producing nations, growth is projected to accelerate as resilience programs are scaled through public-private partnerships and climate-smart farming incentives.

East Asia’s momentum is expected to be led by Japan and South Korea, where premium demand aligns with targeted sourcing of high-quality, adaptation-ready varieties. Latin America, despite its role as a major origin, shows lower value share due to a focus on volume exports; however, adoption is anticipated to strengthen as producers transition to certified resilient cultivars. The Middle East & Africa remains niche in value terms but is projected to expand through hospitality-driven specialty demand and premium café culture growth.

| Year | USA Climate Resilient Coffee bean Market (USD Million) |

|---|---|

| 2025 | 85.78 |

| 2026 | 91.2 |

| 2027 | 96.6 |

| 2028 | 102.2 |

| 2029 | 107.4 |

| 2030 | 114.4 |

| 2031 | 122.3 |

| 2032 | 128.8 |

| 2033 | 137.0 |

| 2034 | 145.7 |

| 2035 | 155.4 |

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 | 5.57% |

| 2026 | 6.33% |

| 2027 | 5.92% |

| 2028 | 5.78% |

| 2029 | 5.11% |

| 2030 | 6.51% |

| 2031 | 6.94% |

| 2032 | 5.32% |

| 2033 | 6.33% |

| 2034 | 6.32% |

| 2035 | 6.70% |

The USA Climate resilient Coffee Beans Market is projected to increase from USD 350 million in 2025 to USD 779 million by 2035, advancing at a CAGR of 8.1% over the forecast period. Steady year-on-year growth is expected to be sustained, with Market revenues anticipated to surpass USD 500 million by 2030 and cross USD 750 million by 2035.

Growth is forecast to be driven by sustained investment in climate-smart agriculture, technological advancements in crop breeding, and heightened industry commitment to sustainable sourcing. The adoption of climate-resilient coffee varietals is anticipated to be accelerated by the growing need to mitigate risks from temperature fluctuations, pests, and unpredictable rainfall patterns.

Premiumization trends are projected to strengthen Market value, as specialty roasters and large beverage brands increasingly adopt climate-resilient beans to secure supply stability and align with ESG objectives. In parallel, rising consumer awareness of ethical and climate-conscious sourcing is expected to elevate demand for certified sustainable coffee products.

Institutional buyers, particularly within the hospitality and foodservice sectors, are forecast to expand procurement volumes to ensure consistency in flavor profiles amid changing climatic conditions. Furthermore, integrated value chain partnerships between coffee cooperatives, agritech firms, and exporters are expected to enhance production capacity and traceability.

The sector’s expansion is forecast to be reinforced by advancements in agroforestry systems, wider availability of drought- and heat-tolerant cultivars, and supportive trade policies promoting sustainable coffee production.

The UK Market is projected to record steady expansion through 2035, supported by high per capita coffee consumption and the growing influence of ethical sourcing on retail procurement. Retailers and hospitality chains are increasingly embedding resilience verification into supplier contracts, aligning with net-zero commitments. Specialty coffee culture continues to elevate demand for premium Arabica varieties adapted to climate risks. Government-backed sustainability programs and consumer demand for traceable products are expected to reinforce Market growth.

| Countries / Subregion | 2025 |

|---|---|

| UK | 20.84% |

| Germany | 21.19% |

| Italy | 10.39% |

| France | 12.31% |

| Spain | 9.87% |

| BENELUX | 6.63% |

| Nordic | 5.06% |

| Rest of Europe | 14% |

| Total | 100% |

| Countries / Subregion | 2035 |

|---|---|

| UK | 18.52% |

| Germany | 20.05% |

| Italy | 9.17% |

| France | 12.64% |

| Spain | 11.77% |

| BENELUX | 5.31% |

| Nordic | 5.27% |

| Rest of Europe | 17% |

| Total | 100% |

The India Market is forecast to expand robustly as domestic consumption grows alongside sustained export demand for differentiated coffee. Production regions are increasingly investing in climate-smart practices to combat erratic monsoons and pest pressures. Specialty coffee adoption is rising in urban centers, while exporters are leveraging climate-resilient certifications to access premium international Markets. The government’s agricultural extension programs and private-sector partnerships are enabling greater farmer access to resilient planting material.

Chinais anticipated to grow rapidly, driven by expanding café culture, e-commerce penetration, and a preference for premium, sustainable coffee among younger consumers. Imports of climate-resilient Arabica and hybrid varieties are increasing, supported by trade relationships with key producing countries. Domestic production in Yunnan is gradually integrating resilience-focused agronomy to secure consistent output. Digital retail channels are playing a pivotal role in consumer education and brand positioning.

Germanyis set to maintain its position as one of Europe’s largest coffee importers, underpinned by strong demand for sustainable and traceable products. Roasters are embedding climate resilience criteria into procurement to ensure supply stability amid global climate challenges. Specialty coffee demand is reinforced by consumer preference for certified, origin-specific products. Policy alignment with EU Green Deal objectives is anticipated to encourage higher uptake of resilience-certified coffee.

| Japan Sales Channel | 2025 Share% |

|---|---|

| Coffee Producers & Exporters | 34% |

| Specialty Coffee Retailers | 21% |

| Super Market s & Hyper Market s | 15% |

| Online Coffee Retail | 20% |

| Food service & Hospitality | 10% |

| Total | 100% |

| Japan Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Coffee Producers & Exporters | 8.70% |

| Specialty Coffee Retailers | 9.30% |

| Super Market s & Hyper Market s | 8.80% |

| Online Coffee Retail | 9.50% |

| Food service & Hospitality | 9.00% |

The Climate resilient Coffee Beans Market in Japan is projected at USD 25 million in 2025. Coffee producers and exporters contribute 34%, followed by specialty coffee retailers at 21%, showing a strong Market reliance on upstream sourcing and premium retail distribution. The online coffee retail segment, holding 20%, is gaining momentum due to the expansion of e-commerce and direct-to-consumer subscription models.

Growth is being reinforced by rising consumer demand for traceable, climate-adapted coffee and an increasing willingness to pay premiums for sustainability credentials. The food service and hospitality segment, with a 10% share, is integrating resilience-certified coffee into premium offerings, especially in boutique cafés and hotels. Over the forecast period, diversification across sales channels, enhanced digital traceability, and a sustained focus on quality are expected to define competitive advantages.

| S Korea Coffee Variety | 2025 Share% |

|---|---|

| Arabica Climate Resilient Varieties | 39% |

| Robusta Climate Resilient Varieties | 24% |

| Hybrid Varieties (Arabica × Robusta) | 22% |

| Specialty Coffee Climate Resilient Varieties | 15% |

| Total | 100% |

| S Korea Coffee Variety | CAGR (2025 to 2035) |

|---|---|

| Arabica Climate Resilient Varieties | 8.80% |

| Robusta Climate Resilient Varieties | 8.90% |

| Hybrid Varieties (Arabica × Robusta) | 9.20% |

| Specialty Coffee Climate Resilient Varieties | 9.40% |

The Climate resilient Coffee Beans Market in South Korea is projected at USD 15 million in 2025. Arabica climate-resilient varieties contribute the largest share at 39%, reflecting their dominance in specialty and premium café segments. Robusta and hybrid varieties collectively account for 46%, indicating rising interest in diversification for yield stability and supply security.

Specialty coffee-resilient varieties, with a 15% share, are expanding through boutique roasters and hospitality channels targeting niche, high-value consumers. Growth is expected to be reinforced by South Korea’s sophisticated coffee culture, high café density, and growing consumer awareness of sustainability credentials. Partnerships between importers, roasters, and original suppliers are expected to integrate climate resilience into sourcing portfolios over the next decade.

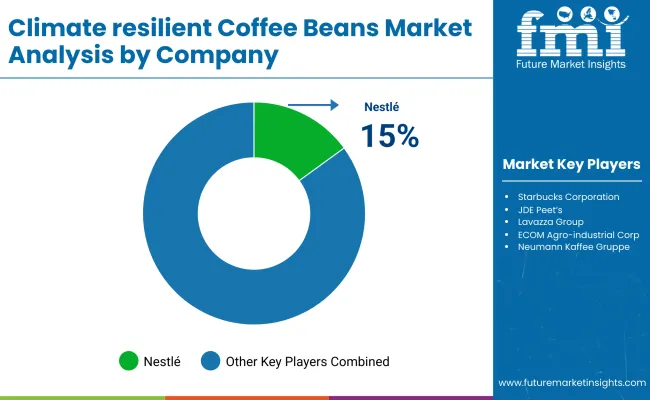

The Climate resilient Coffee Beans Market is moderately fragmented, with a mix of global commodity traders, vertically integrated roasters, and specialized sustainability-focused suppliers competing for Market share. Global leaders such as Nestlé S.A., Starbucks Corporation, and JDE Peet’s hold significant positions, driven by extensive procurement networks, early integration of climate resilience criteria, and direct engagement with producers at origin. Their strategies emphasize investment in climate-smart agriculture, resilience certification programs, and digital traceability platforms to secure long-term supply stability.

Established mid-sized players, including Lavazza Group, Olam International, and ECOM Agro-industrial Corp., cater to both specialty and commercial segments by leveraging strong origin presence, hybrid variety adoption, and targeted agronomic support. These companies are advancing Market reach through partnerships with NGOs, research institutes, and local cooperatives to expand farmer access to certified resilient planting material.

Specialized suppliers such as Neumann KaffeeGruppe, Volcafe Ltd., Strauss Group, and Illycaffè focus on premium, high-quality lots with climate adaptation as a value differentiator. Their competitive advantage is built on origin-specific expertise, direct trade models, and niche Market positioning.

Competitive differentiation is shifting from pure supply capability toward integrated sustainability ecosystems, combining agronomic innovation, verified environmental impact claims, and long-term buyer-producer contracts.

Key Developments in Market

| Item | Value |

|---|---|

| Quantitative Units | USD 357.4 Million (2025), USD 643.4 Million (2035) |

| Coffee Variety | Arabica Climate-Resilient Varieties, Robusta Climate-Resilient Varieties, Hybrid Varieties (Arabica × Robusta), Specialty Coffee Climate-Resilient Varieties |

| Development Approach | Traditional Breeding, Genetic Engineering & CRISPR, Agroforestry & Shade-Grown Techniques, Microbial & Soil Health Enhancements, Climate-Adapted Cultivation Practices |

| Application | Specialty Coffee Production, Commercial Coffee Production, Organic & Sustainable Coffee, Fairtrade & Ethical Coffee |

| Sales Channel | Coffee Producers & Exporters, Specialty Coffee Retailers, modern trade, Online Coffee Retail, Foodservice & Hospitality |

| Regions Covered | North America, Europe, South Asia & Pacific, East Asia, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., Starbucks Corporation, JDE Peet’s, Lavazza Group, Olam International, ECOM Agro-industrial Corp., Neumann Kaffee Gruppe, Volcafe Ltd., Strauss Group, Illycaffè |

| Additional Attributes | Dollar sales by coffee variety, development approach, and application; adoption trends in climate-smart agriculture and resilience verification; rising demand for traceable, certified coffee; sector-specific growth in specialty, commercial, and organic segments; resilience integration in procurement; regional shifts influenced by sustainability policies; and innovations in agroforestry, genetic improvement, and soil-microbiome management. |

The global Climate resilient Coffee Beans Market is estimated to be valued at USD 357.4 million in 2025.

The Market size for the Climate resilient Coffee Beans Market is projected to reach USD 643.47 million by 2035.

The Climate resilient Coffee Beans Market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in the Climate resilient Coffee Beans Market are Arabica Climate-Resilient Varieties, Robusta Climate-Resilient Varieties, Hybrid Varieties (Arabica × Robusta), and Specialty Coffee Climate-Resilient Varieties.

In terms of variety, Arabica Climate-Resilient Varieties are expected to command 40% share in the Climate resilient Coffee Beans Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Green Coffee Bean Extract Market Analysis by Form, Application, and Distribution Channel Through 2035

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Resilient Desert Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Climate Tech Market by Hardware, by Software, By End User & Region Forecast till 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA