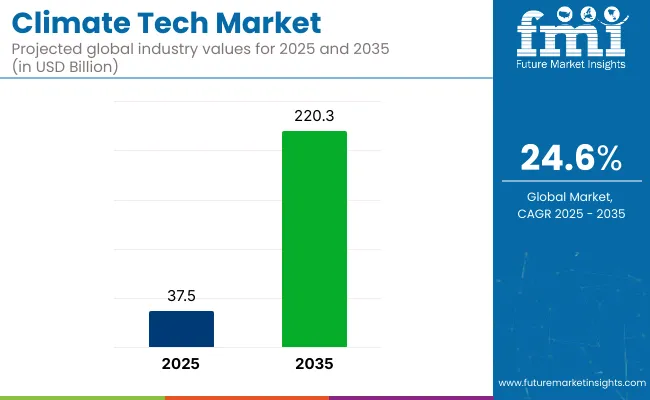

The global climate tech market is valued at USD 37.5 billion in 2025 and is poised to garner USD 220.3 billion by 2035 and it is reflecting a strong CAGR of 24.6%.

| Attributes | Description |

|---|---|

| Estimated Size, 2025 | USD 37.5 billion |

| Projected Size, 2035 | USD 220.3 billion |

| Value-based CAGR (2025 to 2035) | 24.6% |

The demand for climate-specific insurance solutions arises from the inherent risks associated with the adoption of Climate Tech hardware, ranging from renewable energy systems, smart grids to energy storage devices, as well as software-based platforms for carbon accounting, energy management, and climate models. Regulatory compliance is a big factor, as regulations such as the EU Green Deal and USA climate regulations require a higher bar when it comes to due diligence on technology vendors.

As businesses speed the transformation towards sustainability, they become more reliant on third-party providers for renewable energy infrastructure, smart grid technology and climate analytics platforms accelerating the demand for risk assessment tools.

The risks associated with cyber threats and operational vulnerabilities in Climate Tech solutions also contribute to the need for constantly monitoring and assessing risk in real-time, especially in the case of IoT-enabled smart grid networks and cloud-based sustainability platforms.

North America continues to dominate the market share owing to rigorous climate regulations and cybersecurity mandates, whilst regions such as India and Australia are on the rise, driven by decarbonization and further development of energy transition programs.

Organizations rolling out smart meters, grid monitoring sensors, and energy management platforms, for example, need to avoid having third-party solutions cause operational disruptions and compliance risks.

Sophisticated AI-powered risk mitigation technologies are emerging to analyze vendor efficacy, monitor compliance and respond to potential threats in the moment. As the Climate Tech market grows, companies are starting to prioritize transparency from suppliers, secure data exchange, and automated compliance management in order to create a robust, sustainable ecosystem.

The below table presents the expected CAGR for the global Climate Tech market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Climate Tech industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 23.6%, followed by a slightly higher growth rate of 23.9% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 23.6% |

| H2 (2024 to 2034) | 23.9% |

| H1 (2025 to 2035) | 24.6% |

| H2 (2025 to 2035) | 24.8% |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to decrease slightly to 24.6% in the first half and remain higher at 24.8% in the second half. In the first half H1 the market witnessed a decrease of 30 BPS while in the second half H2, the market witnessed an increase of 20 BPS.

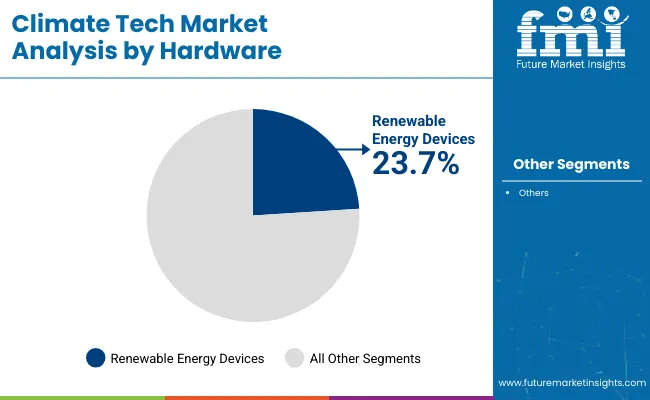

The market is segmented based on hardware, software, end user, and region. By hardware, the market includes renewable energy devices, energy storage systems, carbon capture and storage (CCS) technologies, building and construction technologies, waste management and recycling technologies, water and air treatment technologies, smart grid and energy management systems, climate monitoring and remote sensing, and other devices (bioplastics production equipment, EV charging infrastructure, sustainable agriculture systems, and environmental remediation tools).

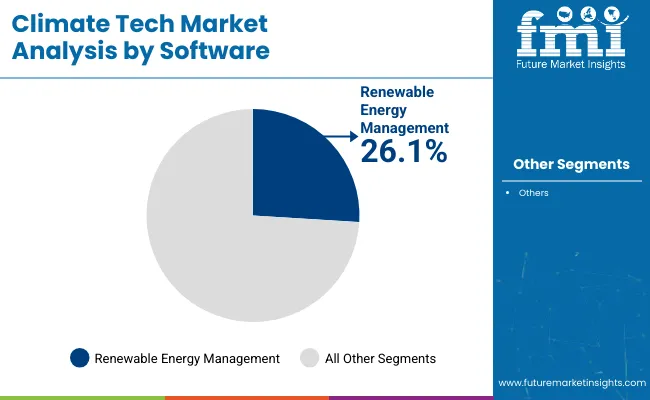

In terms of software, it is segmented into climate modeling and simulation, renewable energy management, smart grid and demand response, energy efficiency solutions, carbon accounting and emissions tracking, climate risk assessment, environmental monitoring, and others (sustainable supply chain management platforms, eco-friendly product lifecycle analysis tools, green building software, and circular economy optimization systems).

Based on end user, the market is categorized into utilities and energy providers, research institutions & labs, environment monitoring agencies, businesses/corporates, manufacturing industries, agricultural producers, transportation regulatory agencies, local government & municipalities, public health agencies, financial institutions and investors, international development organizations, and others (non-governmental organizations (NGOs), climate advocacy groups, educational institutions, disaster management agencies, insurance companies, and sustainability consulting firms).

Regionally, the market is classified into North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The renewable energy devices segment is anticipated to dominate the hardware category in the climate tech market, capturing a significant 23.7% market share in 2025. This includes solar panels, wind turbines, geothermal systems, and hydroelectric generators devices central to the clean energy transition.

| Hardware Segment | Market Share (2025) |

|---|---|

| Renewable Energy Devices | 23.7% |

As global net-zero targets intensify and energy security becomes a policy priority, governments and industries are accelerating the deployment of renewable energy infrastructure. China, currently the largest global manufacturer of solar and wind components, is playing a pivotal role in making renewable hardware cost-effective and accessible worldwide. The USA Inflation Reduction Act and similar policies in the EU and India are unlocking billions in funding to expand renewable capacity.

Meanwhile, decentralized energy systems such as rooftop solar, mini-grids, and peer-to-peer energy trading are driving adoption across residential and commercial applications. Renewable energy devices also benefit from parallel advances in storage technology, enabling more stable and scalable energy outputs.

Key players such as Vestas, First Solar, and Goldwind are leading innovations in efficiency, integration, and circularity. With global momentum behind clean energy and decarbonization, renewable energy devices will continue to anchor investment and growth in the climate tech ecosystem.

The renewable energy management segment is expected to lead the software category in the climate tech market, capturing a notable 26.1% market share in 2025. As renewable energy capacity expands globally, the need for intelligent software to optimize energy production, storage, and distribution has become critical. Renewable energy management platforms help utilities, businesses, and microgrid operators integrate diverse sources such as solar, wind, and hydro into a cohesive, efficient system.

| Software Segment | Market Share (2025) |

|---|---|

| Renewable Energy Management | 26.1% |

These platforms leverage AI, machine learning, and real-time analytics to forecast energy demand, balance supply loads, and reduce reliance on fossil fuel backup systems. The transition to decentralized power systems is further boosting demand for localized control and monitoring tools that these platforms provide.

Key players like Siemens, Schneider Electric, Enel X, and AutoGrid are developing solutions that enable predictive maintenance, fault detection, performance optimization, and emissions tracking. Additionally, integration with energy storage solutions and demand response programs enhances the value proposition of renewable energy management software.

With governments enforcing stricter emission regulations and renewable targets, enterprises and utilities alike are turning to software that ensures operational and regulatory compliance. As global renewable investments scale, this segment will remain central to climate tech adoption across energy and infrastructure sectors.

The utilities and energy providers segment is projected to grow at the highest CAGR of 29.5% from 2025 to 2035, emerging as a key catalyst in the climate tech market. This growth is fueled by a global shift from fossil fuels to renewables, backed by aggressive government incentives, private sector investment, and climate-driven mandates.

The USA Inflation Reduction Act allocated over USD 369 billion toward energy and climate programs, while countries like India and China are aggressively scaling solar, wind, and hydro infrastructure. Utilities are now central to this transformation, integrating renewable energy generation with smart grid solutions, energy storage, and carbon tracking systems.

Many have begun deploying AI-powered demand response platforms and decentralized grids to enhance resilience and grid performance. Additionally, the need for real-time emissions monitoring, grid transparency, and predictive energy forecasting is pushing utilities to adopt innovative climate tech software solutions.

With rising electrification across sectors and increasing pressure to meet decarbonization targets, utilities are expected to remain a high-growth market for climate technologies. Their evolving role from passive distributors to active energy innovators is creating massive opportunities for hardware and software providers in the climate tech ecosystem.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Utilities & Energy Providers | 29.5% |

Rising investments in clean energy and climate resilience projects

The climate change mobilization now has focused massive investments in clean energy and climate resilience efforts across the globe. In 2024, global investment in energy exceeded USD 3 trillion for the first time, including more than USD 2 trillion for clean energy^technologies and infrastructure.

This growth also demonstrates the global community's increasing focus on renewable energy sources and sustainable practices. For example, in 2024, Australia spent USD 9 billion on large-scale wind and solar farms, contributing 4.3 GW of new renewable capacity.

That also fits with the country’s target to produce 82% of its energy from renewables by 2030. In the same vein, the USA has made historic investments in clean energy, with the Department of Treasury stating that low-income communities benefited from USD 3.5 billion for solar installations, financing the creation of nearly 2 billion kilowatt-hours of clean electricity each year.

Growth of smart grid solutions for real-time energy optimization

Smart grid solutions are being deployed to facilitate better management of energy by allowing real-time identification and optimization of energy distribution. Technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) are integrated into smart grids to improve efficiency and reliability.

Examples include AI and machine learning algorithms that predict energy demand patterns to optimize distribution as well as continuous real-time monitoring of grid conditions with IoT devices and sensors. Decentralized energy management involves Blockchain technology enables secure, transparent energy transactions. Governments are also investing in grid infrastructure and trying to upgrade energy systems.

The USA Department of Energy announced a USD 3.5 billion investment in 58 projects in 44 states to upgrade the deteriorating power grid, with a focus on leveraging renewable energy sources and making it more resilient to severe weather events.

Adoption of blockchain for transparent carbon tracking and credit trading

The role of blockchain in environmental sustainability, carbon tracking & credit trading blockchain technology is a transformative instrument in environmental sustainability. It provides a transparent, secure, and efficient method of recording carbon emissions and transactions on a decentralized ledger. Blockchain technology promotes more effortless tracking and trading of carbon credits while preserving authenticity and requiring no double-counting by tokenizing carbon credits.

This builds trust between stakeholders, while also simplifying the carbon credit market. For example, blockchain can be used to log the creation and transfer process of Renewable Energy Certificates (RECs) which communicate the environmental characteristics of the production of renewable energy.

This increases the value of RECs and encourages more investment in renewable energy project. Blockchain-based solutions are being experimented by governments and organizations to enhance environmental compliance and reporting. The use of blockchain together with smart contracts and digital MRV systems facilitates the tracking of carbon credits across a digital ecosystem.

Large-scale deployment of carbon capture systems faces space and integration constraints

The carbon capture facial systems require a lot of space for installation, which makes large-scale deployment difficult in population-dense areas, as well as industries and sectors with limited geographic areas.

These systems also require integration with existing industrial processes, which can be complicated by differences in infrastructure, energy sources, and emissions levels. Adding carbon capture technology to older power plants and factories requires extensive retrofitting, raising costs and technical challenges.

Further logistical hurdles involve transportation and storage of captured carbon dioxide (CO₂), as new pipelines or underground storage sites have to be constructed, a process with strict regulatory pathways and extensive geological appraisals that could run into the cost thousands of times what it could to release CO₂ right back into the atmosphere.

The Tier 1 vendors dominate the global climate tech market, accounting for around 50% to 55% of the total market share. This includes large multinationals, and technology leaders focused on renewable energy, storing electricity, carbon capture, and smart grid Αθήνα.

Large-scale adoption is instigated by companies such as Tesla, Siemens, Schneider Electric, Vestas, and General Electric with high research and development investments and global supply chains. They are buoyed by government contracts, big corporate partnerships, and entrenched infrastructure.

Tier 2 vendors are responsible for about 15% to 20% of the market share, and have a mid-sized orientation along with niche specializations over carbon or climate modeling, smart-energy management and industrial emissions reduction.

These companies tend to operate on a regional basis or in niche sectors (for example, advanced energy efficiency solutions or grid modernization technologies). This segment includes companies such as Enphase Energy, Fluence and Carbon Clean that are using these solutions to add market share. But they struggle to scale globally versus Tier 1 competitors.

The remaining 20% to 25% market share is held by Tier 3 vendors, including start-ups and newer entrants. They are all mutual funds that invest in innovative solutions in climate tech, including AI-powered sustainability software, decentralized energy systems, and next-generation carbon capture technologies. Because of funding limitations as well as competition from more established competitors they are often not able to penetrate the market.

The section highlights the CAGRs of countries experiencing growth in the Climate Tech market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 29.9% |

| China | 30.9% |

| Germany | 22.1% |

| Japan | 28.4% |

| United States | 21.3% |

India's soaring electricity needs and demand for grid optimization is leading to rapid modernization of energy infrastructure with smart grid and AI-based energy management solutions.

Under the Revamped Distribution Sector Scheme (RDSS), the Indian government authorized USD 6.5 billion, or over 50% of the investment, to modernize the power distribution network with smart meters and artificial intelligence (AI) driven grid automation.

India to add 250 million smart meters by 2025 that will enable real-time energy monitoring, cutting power theft. Moreover, India's National Smart Grid Mission (NSGM) is advocating for the integration of AI to better optimize energy distribution and grid resilience.

Powered by AI driven grid management, this allows to reduce transmission losses by 15%. As we move towards greater reliance on renewable energy, AI-based forecasting tools are being used to more accurately predict electricity generation patterns and better balance supply and demand. India is anticipated to see substantial growth at a CAGR 29.9% from 2025 to 2035 in the Climate Tech market.

In the United States, corporate adoption of carbon accounting software and net-zero commitments are booming amid tighter climate regulations and pressure from shareholders. New rules proposed by the Securities and Exchange Commission (SEC) requiring public companies to disclose their carbon footprints have further accelerated demand for software that automates emissions tracking. More than 60 percent of Fortune 500 companies have committed to net-zero targets, and leading firms are investing in digital tools to track and report emissions.

The overarching USA government introduced USD 370 billion in climate-related incentives as part of the Inflation Reduction Act (IRA) last year, specifically to encourage businesses to embrace carbon management solutions. Microsoft and Google have among the tech giants that have built AI-infused carbon footprint tracking tools for companies, optimizing energy use, reducing emissions and serving customers.

In addition startups are focusing on blockchain to verify carbon credits, allowing companies to report sustainability efforts in a completely transparent manner. USA Climate Tech market is anticipated to grow at a CAGR 21.3% during this period.

China is at the forefront of global investment in carbon capture and green hydrogen, backed by strong government support and multi-billion-dollar funding. More than USD 10 billion have been directed by the government to carbon capture, utilization, and storage (CCUS) projects that target industrial emissions from steel, cement and power plants.

In 2023, China started working on its biggest CCUS facility in the world so far, with a capacity of 1 million tons CO₂ captured per year, which is a big milestone in China's goal for carbon neutrality by 2060. Furthermore, China’s 14th Five-Year Plan emphasizes the development of green hydrogen, with the intent to have 200,000 tons of green hydrogen production annually by 2025.

To speed adoption, the government is offering subsidies and tax incentives to companies investing in hydrogen infrastructure. In recent weeks China’s Ministry of Industry And Information Technology released a national hydrogen roadmap that aims for widespread transport use as well as heavy industrial sectors.

With the growing international cooperation, China is likely to hold the monopoly of the green hydrogen supply chain, reducing the cost of the world and increasing the scalability of the technology. China is anticipated to see substantial growth in the Climate Tech market significantly holds dominant share of 53.8% in 2025.

The Climate Tech market is a competitive one, spurred by breakthroughs in the fields of renewable energy, energy storage, and carbon capture technologies. How Companies Compete on Technology, Regulation and Sustainability There is strong startup participation in the market while established energy firms and tech giants invest in AI-powered climate solutions. These are compounded by the competitive landscape influenced by strategic partnerships, funding initiatives, and government-promoted projects.

Industry Update

In terms of hardware, the segment is divided into Renewable Energy Devices, Energy Storage Systems, Carbon Capture and Storage (CCS) Technologies, Building and Construction Technologies, Waste Management and Recycling Technologies, Water and Air Treatment Technologies, Smart Grid and Energy Management Systems, Climate Monitoring and Remote Sensing, Other devices.

In terms of software, the segment is segregated into Climate Modeling and Simulation, Renewable Energy Management, Smart Grid and Demand Response, Energy Efficiency Solutions, Carbon Accounting and Emissions Tracking, Climate Risk Assessment, Environmental Monitoring, Others.

In terms of end user, the segment is segregated into Utilities and Energy Providers, Research Institutions & Labs, Environment Monitoring Agencies, Businesses/Corporates, Manufacturing Industries, Agricultural Producers, Transportation Regulatory Agencies, Local Government & Municipalities, Public Health Agencies, Financial Institutions and Investors, International Development Organizations, Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The global market is expected to reach USD 220.3 billion by 2035, growing from USD 37.5 billion in 2025, at a strong CAGR of 24.6% during the forecast period.

Renewable energy devices are projected to lead the hardware segment, capturing a 23.7% market share in 2025. This includes solar panels, wind turbines, and hydroelectric systems central to the global energy transition.

Renewable energy management software is expected to dominate the software segment, accounting for 26.1% of the market in 2025, driven by the need to optimize distributed energy systems, forecast demand, and ensure regulatory compliance.

Utilities and energy providers are projected to grow at the highest CAGR of 29.5% from 2025 to 2035, supported by global decarbonization mandates, government incentives, and rapid smart grid integration.

Leading companies include Tesla, Siemens AG, Schneider Electric, Vestas Wind Systems, First Solar, Canon, General Electric (GE), Enphase Energy, Bloom Energy, Carbon Clean Solutions, and Johnson Controls.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Climate resilient Coffee Beans Market Size and Share Forecast Outlook 2025 to 2035

Climate Credit Analytics Market Insights - Growth & Forecast 2025 to 2035

Automotive Climate Control Market Size and Share Forecast Outlook 2025 to 2035

Tech Savvy Hotel Chains Market Size and Share Forecast Outlook 2025 to 2035

Technical Films Market Size and Share Forecast Outlook 2025 to 2035

Technical Insulation Market Size and Share Forecast Outlook 2025 to 2035

Technical Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Analyzing Technical Films Market Share & Industry Leaders

Technical Fluids Market

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Edtech Market Size and Share Forecast Outlook 2025 to 2035

Catecholamines Market Size and Share Forecast Outlook 2025 to 2035

Catechins Market Trends - Growth & Industry Forecast 2025 to 2035

Adtech Market Growth - Size, Trends & Forecast 2025 to 2035

Global Catecholamine Market Analysis – Size, Share & Forecast 2024-2034

HR Tech Market Forecast Outlook 2025 to 2035

EduTech Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Biotech QMS Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA