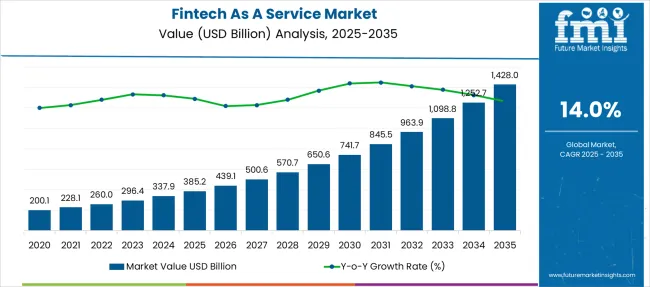

The Fintech As A Service Market is estimated to be valued at USD 385.2 billion in 2025 and is projected to reach USD 1428.0 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

This growth trajectory is supported by a compound acceleration pattern, where early-phase adoption focuses on digital banking and payments, while the late phase sees exponential expansion in API-driven integrations and AI-powered decision engines. Between 2025 and 2030, the market adds USD 356.5 billion, contributing 40% of decade growth, primarily driven by banking and remittance services in emerging economies. The next five years, 2030 to 2035, add over USD 686.3 billion, showing an intensified shift toward blockchain-enabled platforms, embedded finance, and cloud-native architectures for compliance and scalability.

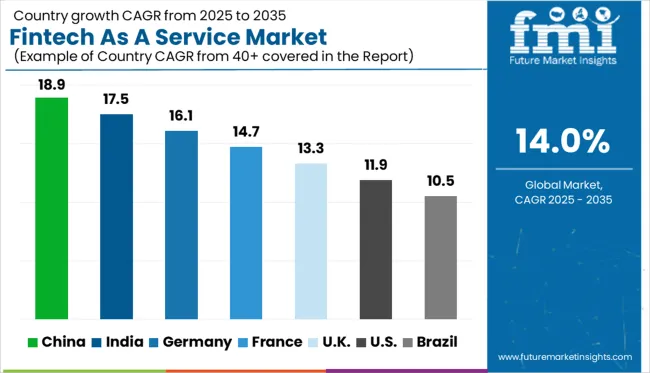

The global growth curve exhibits a consistent YoY rise, but the shape reflects an elongated S-curve, signaling room for innovation-led disruption rather than saturation. China and India lead the regional imbalance, posting CAGRs of 18.9% and 17.5%, fueled by policy reforms and open banking ecosystems, while mature markets like the USA and Brazil remain under 12%, relying heavily on service innovation. These variations indicate that future profit pools will be concentrated in APAC, where platform orchestration and digital infrastructure investments create structural advantage.

| Metric | Value |

|---|---|

| Fintech As A Service Market Estimated Value in (2025 E) | USD 385.2 billion |

| Fintech As A Service Market Forecast Value in (2035 F) | USD 1428.0 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The Fintech as a Service market demonstrates minimal seasonality but a clear cyclical growth pattern shaped by regulatory and innovation triggers rather than calendar-based events. YoY analysis from the chart shows a slowdown in growth momentum between 2025 and 2028, where the market expands from USD 385.2 billion to USD 570.7 billion, yet annual growth rates taper from high initial levels toward the 12% range. This period reflects an integration cycle where early adopters focus on system stability and regulatory alignment before scaling further.

The late phase, beginning around 2029, displays renewed acceleration as the market surges from USD 570.7 billion in 2028 to USD 1,098.8 billion by 2033, adding more than USD 528 billion within five years. This renewed momentum coincides with large-scale implementation of open banking mandates, API standardization, and digital currency frameworks across Asia-Pacific. These policy-driven waves create structural cyclicality, contrasting with the relative stability of North American markets where growth remains steady but less volatile.

Minor seasonal effects are visible in payments and remittances during festive quarters in Japan and South Korea, driven by year-end bonuses and cultural spending peaks. However, these shifts remain marginal compared to the dominant macro-driven investment and adoption cycles that define the industry’s trajectory.

The fintech as a service market is rapidly evolving as financial institutions and non-banking enterprises increasingly adopt digital platforms to streamline operations, enhance customer experience, and introduce agile, scalable financial solutions. The rise of embedded finance, open banking, and regulatory technology has created a fertile environment for FaaS providers, enabling businesses to integrate financial capabilities without building infrastructure from scratch.

Technological advancements, particularly in artificial intelligence, blockchain, and API architecture, are allowing fintech platforms to deliver real-time insights, automation, and secure transactions at scale. The future growth of this market is expected to be shaped by continued digital transformation across banking, insurance, e-commerce, and retail sectors.

Regulatory support in key regions and a strong demand for mobile-first financial services are reinforcing long-term adoption. As customer expectations shift toward frictionless and personalized digital experiences, fintech as a service is positioned to play a central role in modernizing global financial ecosystems.

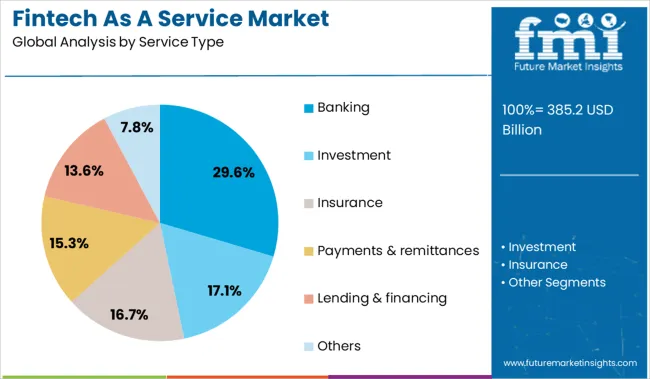

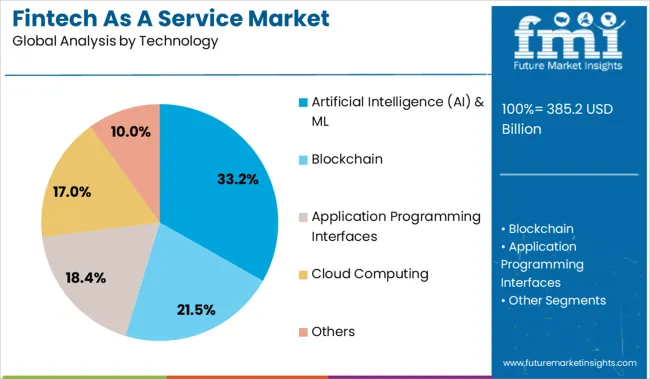

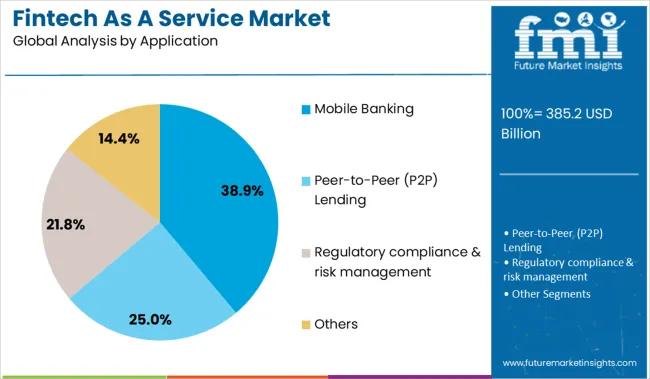

The market is segmented by service type, technology, application, end use, and region. By service type, it includes banking, investment, insurance, payments and remittances, lending and financing, and others, addressing core financial and auxiliary services. In terms of technology, the segmentation comprises artificial intelligence (AI) and machine learning, blockchain, application programming interfaces, cloud computing, and other emerging solutions enabling digital transformation. Based on application, it covers mobile banking, peer-to-peer (P2P) lending, regulatory compliance and risk management, and other financial technology-driven solutions. By end use, the market is divided into financial institutions and non-financial institutions, reflecting adoption across traditional and alternative service providers. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The banking segment holds a leading 29.6% share within the service type category, driven by the accelerated shift of traditional banking services to digital platforms. As banks face pressure to innovate while maintaining compliance and operational efficiency, many are leveraging fintech-as-a-service models to modernize core services such as payments, lending, account management, and fraud detection.

The ability to outsource key components of the banking stack enables institutions to reduce development costs, shorten go-to-market cycles, and remain competitive against neobanks and digital-native players. This segment is gaining momentum as financial service providers increasingly partner with fintech firms to deploy white-labeled or API-based banking solutions.

The demand for agility, enhanced customer engagement, and regulatory-ready platforms is expected to keep the banking segment at the forefront of FaaS adoption.

Artificial intelligence and machine learning dominate the technology category with a 33.2% share, underscoring their critical role in enhancing the intelligence and responsiveness of fintech solutions. These technologies are widely used for automating decision-making, fraud detection, credit scoring, customer onboarding, and personalized financial services.

The ability of AI and ML algorithms to learn from vast datasets and provide predictive analytics has become essential in delivering smarter, faster, and more secure financial services. Fintech companies are leveraging these tools to offer enhanced user experiences through chatbots, real-time analytics, and risk assessment engines.

As data privacy regulations evolve, AI and ML frameworks are being designed to operate within compliant and transparent boundaries, boosting their adoption across regulated sectors. Continued investment in AI infrastructure and algorithm optimization is expected to expand this segment’s capabilities and reinforce its leadership in the market.

The mobile banking segment commands a substantial 38.9% market share within the application category, highlighting the ongoing transition of financial services toward mobile-first platforms. Consumer expectations for 24/7, on-the-go financial access have driven financial institutions and fintech companies alike to prioritize mobile banking interfaces powered by robust backend services.

Fintech-as-a-service solutions are enabling faster deployment of mobile apps with embedded features such as peer-to-peer transfers, digital wallets, investment tools, and instant loan approvals. The rise in smartphone penetration and digital payment ecosystems, particularly in emerging economies, continues to amplify demand in this segment.

Enhanced security features, biometric authentication, and real-time notifications have further strengthened user confidence in mobile platforms. As financial habits become increasingly digital and mobile-reliant, the mobile banking segment is poised to retain its dominance, supported by continuous innovation and rising user engagement.

The Fintech-as-a-Service market is seeing major growth opportunities through embedded finance integrations. From 2024 to 2025, non-financial platforms adopted banking, payment, and lending features using pre-built APIs, enabling seamless financial transactions within retail, travel, and gig-economy ecosystems. This shift positions FaaS providers as key enablers of revenue diversification and customer engagement for digital platforms.

The rapid expansion of digital-only banking and embedded financial services has emerged as the central driver in the Fintech-as-a-Service (FaaS) market. In 2024, significant adoption of API-powered payment systems and mobile-first banking tools was recorded as consumers increasingly favored convenience and real-time transactions. By 2025, traditional banks and non-bank players were observed accelerating integration of modular FaaS platforms to deliver instant payments, account management, and compliance services without heavy in-house development. These developments suggest that demand for scalable, plug-and-play financial infrastructure is transforming FaaS into a critical enabler for next-generation banking ecosystems, rather than a supplementary digital option.

In 2024, non-financial brands were observed to embed banking and payment capabilities directly into e-commerce platforms and mobile apps, enabling checkout financing, user wallets, and loyalty-linked transactions without redirecting to third-party banks. By early 2025, accounts and payment initiation services were being offered via “banking-as-a-service” modules within ride-hailing, travel, and gig-economy platforms.

These integrations demonstrate that fintech-as-a-service can transform digital interfaces into financial touchpoints, turning retail platforms into financial conduits. Providers offering pre-built banking, compliance, and payment APIs are thus being positioned to capture value by enabling seamless consumer journeys and monetizing through embedded revenue sharing.

| Countries | CAGR |

|---|---|

| China | 18.9% |

| India | 17.5% |

| Germany | 16.1% |

| France | 14.7% |

| UK | 13.3% |

| USA | 11.9% |

| Brazil | 10.5% |

The global Fintech as a Service (FaaS) market is projected to grow at a CAGR of 14% from 2025 to 2035. China leads at 18.9%, followed by India at 17.5% and Germany at 16.1%. France records 14.7%, while the United Kingdom posts 13.3%. China and India dominate due to digital payments penetration, AI-based lending models, and API-driven financial ecosystems.

Germany’s growth is propelled by strong regulatory compliance frameworks and enterprise-grade embedded finance solutions. France accelerates through open banking initiatives and BaaS models, while the UK focuses on wealth tech integration, cross-border payment systems, and regulatory sandboxes for innovation.

China is expected to grow its Fintech as a Service market at 18.9% CAGR, driven by mobile-first banking ecosystems, super apps, and API-enabled embedded finance. Big tech firms and regional banks leverage FaaS platforms to launch lending, wealth management, and BNPL services at scale. Government regulations support secure digital payments and cloud-native financial architectures, boosting platform partnerships. AI-powered risk analytics and real-time transaction monitoring further enhance adoption across sectors.

India is forecast to grow its FaaS market at a 17.5% CAGR, fueled by UPI-driven payments, regulatory sandboxes, and digital lending expansion. Banks and NBFCs are adopting plug-and-play FaaS solutions for credit scoring, KYC automation, and micro-loan disbursements. Startups leverage API-driven models for rural inclusion and last-mile financial connectivity. Open banking protocols and data-sharing frameworks strengthen partnerships across fintech and traditional banking.

Germany is projected to grow its FaaS market at 16.1% CAGR, supported by strict compliance requirements and demand for modular, enterprise-grade fintech systems. Banks and insurers are deploying FaaS to deliver PSD2-compliant payment solutions, AML screening, and identity verification. Embedded finance solutions for SMEs and e-commerce platforms are gaining prominence. Strategic partnerships between local banks and cloud providers ensure scalability and data sovereignty.

France is forecast to grow its FaaS market at a 14.7% CAGR, led by the uptake of open banking APIs and banking-as-a-service offerings. Neobanks and traditional lenders leverage FaaS for instant credit decisions, wealth management, and digital onboarding. French fintech vendors are introducing white-label digital wallet solutions for retailers and marketplaces. Government-backed initiatives encourage API standardization for better interoperability.

The UK market is expected to grow at 13.3%, driven by adoption in wealth management, payments, and cross-border transactions. Challenger banks and investment platforms use FaaS for automated portfolio management and personalized advisory. API-driven B2B payment solutions are being integrated into SME platforms for real-time reconciliation. Regulatory sandboxes support rapid testing of blockchain and crypto-enabled payment systems.

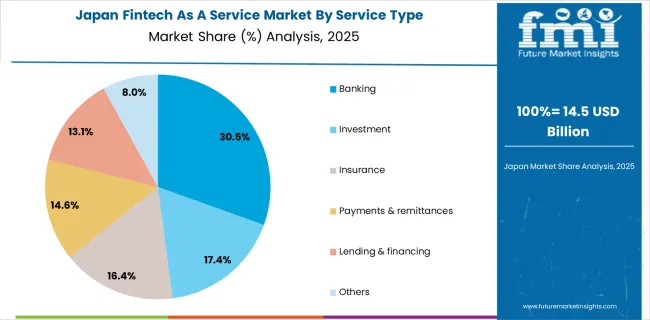

Japan’s FaaS market is valued at USD 14.5 billion in 2025, with banking dominating at 30.5%. This dominance reflects Japan’s conservative financial ecosystem, where incumbents drive partnerships to digitize traditional banking while adhering to strict compliance. Investments and insurance account for 17.4% and 16.4%, signaling a mature but evolving portfolio, as wealth management platforms and InsurTech gain traction among aging demographics. Payments and remittances hold 14.6%, influenced by consumer preference for cash alternatives and QR-based payments rather than crypto-heavy ecosystems seen in APAC peers.

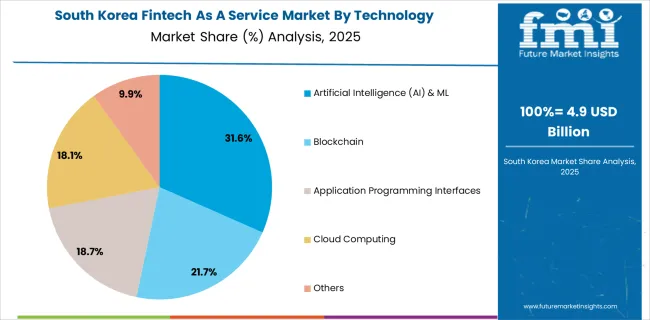

Demand in South Korea records a valuation of USD 4.9 billion in 2025, where AI & ML lead with 31.6%, underscoring the nation’s tech-first approach in automating credit scoring and fraud detection. Blockchain contributes 21.7%, propelled by cryptocurrency trading platforms and DeFi integrations aligned with high mobile penetration. API-based architecture accounts for 18.7%, crucial for interoperability between neobanks and traditional players. Cloud computing at 18.1% reflects ongoing migration to SaaS-driven compliance frameworks.

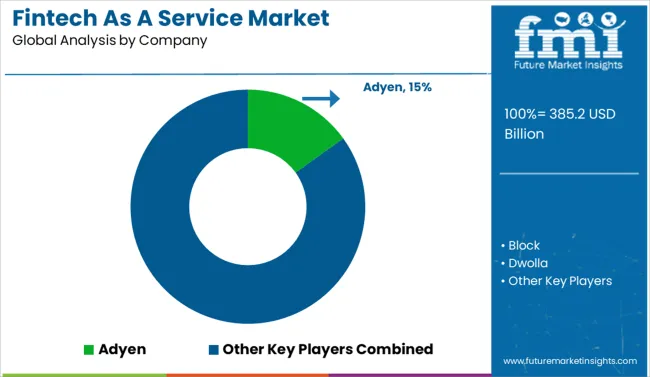

The fintech-as-a-service market is moderately consolidated, led by Adyen. The company holds a dominant position through its fully integrated payment infrastructure, global acquiring network, and strong merchant-centric solutions across multiple digital channels. Dominant player status is held exclusively by Adyen. Key players include Block, Dwolla, Envestnet, Finastra, FIS, Fiserv, Mastercard, OpenPayd, and PayPal - each offering modular fintech services such as payment processing, open banking APIs, and compliance-driven banking-as-a-service platforms for enterprises and digital-first businesses.

Emerging players are limited in this segment due to stringent regulatory frameworks, technology investment needs, and the entrenched position of established financial technology providers. Market demand is driven by rapid adoption of embedded finance, the rise of API-driven digital ecosystems, and the need for scalable, secure, and cost-efficient financial service integration across industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 385.2 Billion |

| Service Type | Banking, Investment, Insurance, Payments & remittances, Lending & financing, and Others |

| Technology | Artificial Intelligence (AI) & ML, Blockchain, Application Programming Interfaces, Cloud Computing, and Others |

| Application | Mobile Banking, Peer-to-Peer (P2P) Lending, Regulatory compliance & risk management, and Others |

| End Use | Financial Institutions and Non-Financial Institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adyen, Block, Dwolla, Envestnet, Finastra, FIS, Fiserv, Mastercard, OpenPayd, and Paypal |

| Additional Attributes | Dollar sales by service type (payments, lending, compliance), regional demand trends (North America largest, Asia-Pacific fastest), competitive landscape, buyer preference for cloud APIs, integration with open banking, innovations in AI-driven risk assessment and blockchain-based transaction security. |

The global fintech as a service market is estimated to be valued at USD 385.2 billion in 2025.

The market size for the fintech as a service market is projected to reach USD 1,428.0 billion by 2035.

The fintech as a service market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in fintech as a service market are banking, investment, insurance, payments & remittances, lending & financing and others.

In terms of technology, artificial intelligence (ai) & ml segment to command 33.2% share in the fintech as a service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fintech as a Service Market Analysis – Growth & Trends 2024-2034

Fintech-as-a-Service Platform Market

AI in Fintech Market – Trends & Forecast through 2034

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Aspirating System Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Aspirin Drug Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA