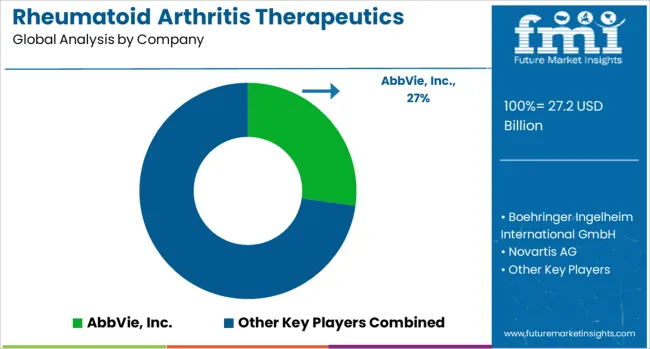

The rheumatoid arthritis therapeutics market is expected to increase from USD 27.2 billion in 2025 to USD 46.7 billion in 2035, at a compound annual growth rate (CAGR) of 6%. Market risks include patent expirations, pricing pressures, and regulatory changes impacting biologics and small-molecule drugs. Supply chain disruptions for active pharmaceutical ingredients may constrain production, while slower-than-expected adoption of new therapies could reduce incremental growth. Market sensitivity is high to reimbursement policies and healthcare access, with regions exhibiting variability in adoption. Careful planning, diversified portfolios, and strategic investments in emerging therapies are essential to sustain growth and mitigate operational and financial risks.

Quick Stats for Rheumatoid Arthritis Therapeutics Market

| Metric | Value |

| Estimated Value in (2025E) | USD 27.2 billion |

| Forecast Value in (2035F) | USD 46.7 billion |

| Forecast CAGR (2025 to 2035) | 6% |

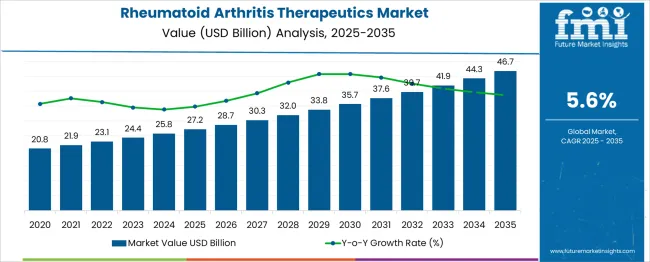

The rheumatoid arthritis therapeutics market shows steady expansion from USD 27.2 billion in 2025 to USD 46.7 billion in 2035 at a CAGR of 6%, but several risk and sensitivity factors could influence growth. Early-decade values from USD 20.8 billion in 2020 to USD 27.2 billion in 2025 reflect moderate adoption of biologics and conventional DMARDs. Patent expirations for key biologics in 2026–2028 could lead to increased competition from biosimilars, potentially impacting pricing and revenue. Supply chain challenges, particularly for active pharmaceutical ingredients and specialty excipients, could restrict production, while regulatory delays for novel therapies may affect launch timelines.

Sensitivity is further influenced by reimbursement policies and regional healthcare access. For instance, adoption in emerging markets may be constrained by affordability, while developed regions may see faster uptake of targeted therapies. Incremental market growth between USD 28.7 billion in 2026 and USD 32 billion in 2029 is highly dependent on new product launches and clinician acceptance. Late-decade expansion from USD 41.9 billion in 2034 to USD 46.7 billion in 2035 could be affected by pricing pressures, payer restrictions, or shifts in treatment guidelines. Strategic diversification of product portfolios and regional market focus are critical to mitigate risks and maintain consistent growth across the forecast period.

Market expansion is being supported by the increasing global prevalence of rheumatoid arthritis and growing demand for effective therapeutic solutions that provide sustained disease remission and improved patient outcomes. Modern rheumatoid arthritis treatments rely on advanced biologic therapies and targeted synthetic DMARDs that address underlying inflammatory pathways and immune system dysfunction. Even with appropriate treatment protocols, patients require continuous monitoring and therapy adjustments to maintain optimal disease control and prevent joint damage progression.

The growing complexity of rheumatoid arthritis treatment protocols and increasing focus on personalized medicine approaches are driving demand for specialized therapeutic solutions from pharmaceutical companies with proven clinical efficacy and safety profiles. Healthcare providers are increasingly adopting evidence-based treatment guidelines that emphasize early intervention and aggressive therapy approaches to prevent irreversible joint damage. Regulatory approvals and clinical research developments are establishing new therapeutic standards that require advanced biologic and synthetic therapeutic options.

The market is segmented by molecule outlook, sales channel outlook, and region. By molecule outlook, the market is divided into biopharmaceuticals, biologics, biosimilars, pharmaceuticals, NSAIDs, analgesics, DMARDs, and glucocorticoids. Based on sales channel outlook, the market is categorized into prescription and over-the-counter (OTC) distribution channels. Regionally, the market is divided into China, India, Germany, France, United Kingdom, United States, and Brazil.

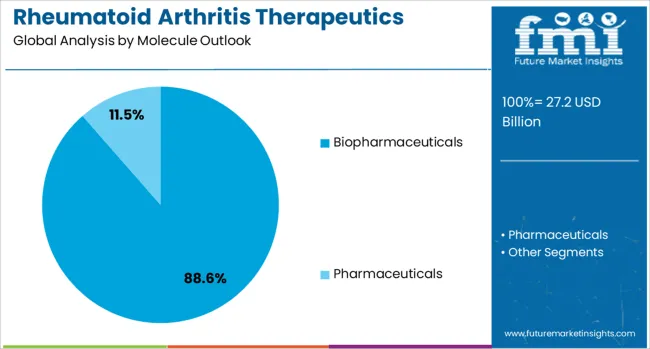

Biopharmaceuticals are projected to contribute 89% of the rheumatoid arthritis therapeutics market in 2025, maintaining dominance due to their precision and targeted therapeutic action. These biologic treatments specifically modulate inflammatory pathways and immune system components responsible for joint inflammation and tissue damage in rheumatoid arthritis. Increasing physician confidence, clinical validation, and continuous research into next-generation biologics strengthen market adoption. The segment’s efficacy, safety profile, and ability to reduce disease progression make it the preferred choice for both early- and late-stage rheumatoid arthritis management. Biopharmaceuticals remain the central growth driver of the market, supported by strong clinical evidence and sustained investment in innovation.

Prescription sales channels are expected to account for 90% of rheumatoid arthritis therapeutics distribution in 2025, reflecting the clinical oversight required for safe and effective treatment. These channels provide controlled access to biologic therapies, ensuring adherence to complex dosing schedules and monitoring for potential adverse effects. Rheumatologists and other healthcare providers play a critical role in patient education, dosage adjustment, and treatment optimization. The prescription model supports compliance, therapeutic efficacy, and patient safety, reinforcing its dominance. With increasing awareness of disease-modifying therapies and adherence importance, prescription channels continue to drive growth and establish the primary route for delivering high-value rheumatoid arthritis treatments.

The Rheumatoid Arthritis Therapeutics market is advancing steadily due to increasing disease prevalence and growing recognition of advanced therapy benefits for patient outcomes. The market faces challenges including high therapy costs, complex treatment protocols requiring specialized medical supervision, and varying patient responses to different therapeutic approaches across diverse patient populations. Regulatory approval processes and reimbursement policies continue to influence treatment accessibility and market development patterns.

The growing implementation of personalized medicine strategies is enabling tailored therapeutic selection based on patient-specific disease characteristics, genetic markers, and treatment response patterns. Healthcare providers are utilizing advanced diagnostic tools and biomarker testing to optimize therapy selection and minimize treatment failures. These approaches are particularly valuable for patients with complex disease presentations and those requiring combination therapy protocols for optimal disease management.

Modern pharmaceutical companies are developing biosimilar alternatives to established biologic therapies that provide cost-effective treatment options while maintaining therapeutic efficacy and safety profiles. Integration of biosimilar therapies into treatment protocols enables broader patient access to advanced biologic treatments and reduces healthcare system costs. Advanced manufacturing capabilities also support development of next-generation biologic therapies with improved efficacy and reduced adverse effect profiles.

| Country | CAGR (2025–2035) |

| China | 7.5% |

| India | 7% |

| Germany | 6.4% |

| France | 5.8% |

| United Kingdom | 5.3% |

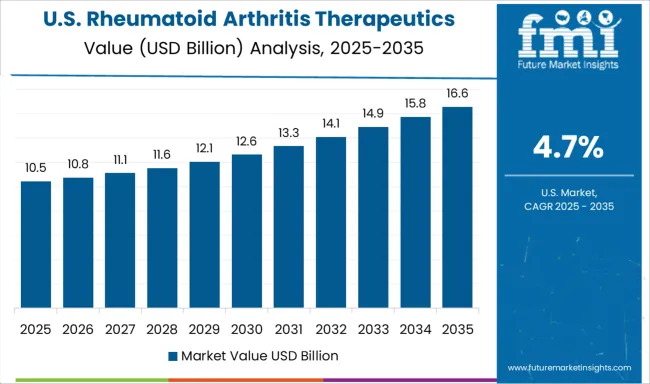

| United States | 4.7% |

| Brazil | 4.2% |

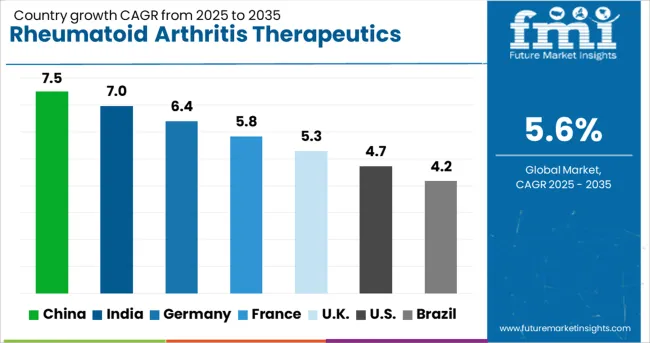

The rheumatoid arthritis therapeutics market shows varied growth across major economies, shaped by healthcare infrastructure, pharmaceutical innovation, and access to biologic therapies. China leads with a CAGR of 7.5%, driven by healthcare modernization, improved diagnosis, and rapid biologic adoption, supported by strong pharmaceutical distribution networks. India follows at 7%, benefitting from rising awareness, expanding rheumatology services, and robust pharmaceutical manufacturing capacity. Germany records 6.4% growth, emphasizing precision medicine, advanced biologics integration, and stringent safety standards. France grows at 5.8%, supported by universal healthcare coverage and regulatory-backed access to innovative treatments. The U.K. at 5.3% prioritizes evidence-based treatment protocols and biologics adoption through the NHS. The U.S. expands at 4.7%, with growth driven by therapeutic innovation and insurance coverage, but at a slower pace compared to Asia. Brazil trails at 4.1%, where healthcare development and biosimilar adoption are gradually improving access.

The report covers an in-depth analysis of 40+ countries top-performing OECD countries are highlighted below.

The market for rheumatoid arthritis therapeutics in China is expected to experience robust growth with a CAGR of 7.5% through 2035, driven by increasing diagnosis rates of rheumatoid arthritis, expanding access to biologic therapies, and improvements in healthcare delivery across urban and rural facilities. Rapid modernization of hospital networks and enhanced physician expertise in rheumatology are creating strong demand for specialized therapeutic solutions. Major pharmaceutical companies, both domestic and international, are building extensive distribution channels, patient support programs, and clinical service networks to meet the needs of diverse patient populations.

The market for rheumatoid arthritis therapeutics in India is projected to expand at a CAGR of 7% through 2035, driven by growing awareness of disease symptoms, increasing healthcare access, and adoption of modern treatment protocols. Expansion in pharmaceutical manufacturing, enhanced research and development capabilities, and rising international collaborations are fueling demand for advanced therapeutics across hospitals, specialty clinics, and emerging healthcare facilities.

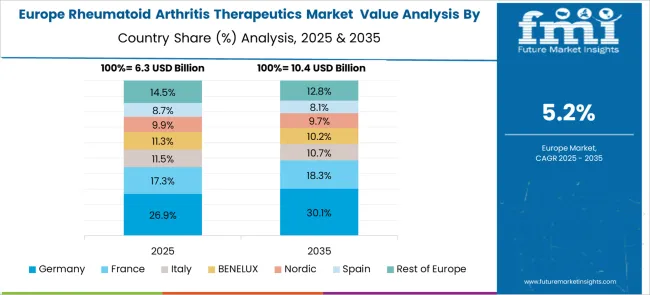

The market for rheumatoid arthritis therapeutics in Germany is expected to grow at a CAGR of 6.4% through 2035, supported by a well-established healthcare system, adoption of precision medicine, and comprehensive insurance coverage. German healthcare providers emphasize personalized treatment strategies that integrate biologic therapies with conventional disease-modifying agents to optimize patient outcomes. The market is defined by strong regulatory oversight, rigorous clinical guidelines, and patient-centered care across public and private healthcare networks.

The market for rheumatoid arthritis therapeutics in France is projected to grow at a CAGR of 5.8% through 2035, supported by comprehensive healthcare coverage, established rheumatology centers, and adoption of advanced biologic therapy protocols. French healthcare providers implement integrated treatment strategies combining pharmacologic interventions, patient education, and monitoring programs. Strong regulatory frameworks, insurance policies, and government-led health initiatives are supporting safe introduction of innovative therapies.

The market for rheumatoid arthritis therapeutics in the United Kingdom is expected to grow at a CAGR of 5.3% through 2035, driven by evidence-based clinical guidelines, NHS integration of biologic therapies, and adoption of personalized treatment models. Healthcare providers implement comprehensive treatment plans emphasizing early diagnosis, continuous monitoring, and patient education to optimize outcomes. The market focuses on cost-effective treatment solutions, accessibility, and consistent care delivery across public and private healthcare networks.

• Professional development initiatives are enhancing clinician expertise in advanced rheumatoid arthritis management, enabling precise treatment selection and effective long-term disease control.

• Patient education campaigns, digital health monitoring, and adherence programs are supporting adoption of biologic therapies and targeted treatment options, fueling market expansion.

The market for rheumatoid arthritis therapeutics in the United States is projected to grow at a CAGR of 4.7% through 2035, supported by pharmaceutical innovation, insurance coverage expansion, and advanced patient care networks. Healthcare providers are adopting integrated treatment centers combining specialized rheumatology care, patient education, therapy monitoring, and telemedicine support. Growth is fueled by research and development in biologics, biosimilars, and personalized medicine addressing diverse patient needs.

The market for rheumatoid arthritis therapeutics in Brazil is expected to grow at a CAGR of 4.2% through 2035, driven by expansion of healthcare infrastructure, increasing awareness of treatment options, and growing adoption of biosimilars. Improvements in pharmaceutical manufacturing and evidence-based treatment protocols are enabling broader access to advanced therapies. Healthcare providers are increasingly implementing chronic disease management programs, early diagnosis initiatives, and patient monitoring systems.

The rheumatoid arthritis therapeutics market is defined by competition among established pharmaceutical companies, biotechnology firms, and specialty therapeutic developers. Significant investments are being directed toward advanced biologic therapies, biosimilar development programs, personalized treatment strategies, and extensive clinical research initiatives. Regulatory approval pathways are being navigated, and global expansion efforts are being pursued to ensure effective, safe, and accessible treatment solutions. Strategic partnerships and collaborative research agreements are emphasized to strengthen therapeutic portfolios, enhance scientific innovation, and maintain competitive positioning across multiple healthcare markets.

AbbVie Inc., headquartered in the U.S., holds a leading position in the market, offering comprehensive rheumatoid arthritis therapies with particular focus on biologic treatment modalities and patient support programs. Boehringer Ingelheim International GmbH provides advanced pharmaceutical solutions, integrating extensive clinical research and global development capabilities to meet complex therapeutic needs. Switzerland-based Novartis AG delivers technologically advanced treatment solutions, emphasizing specialized protocols, clinical expertise, and regulatory compliance. Regeneron Pharmaceuticals Inc., U.S.-based, focuses on biologic innovation and targeted therapeutic approaches tailored to patient-specific requirements.

Global therapeutic coverage is maintained by Pfizer Inc., offering integrated solutions across worldwide healthcare delivery networks. Bristol-Myers Squibb Company provides advanced biologic therapies supported by clinical research programs. F. Hoffmann-La Roche Ltd., headquartered in Switzerland, emphasizes specialized pharmaceutical solutions with strong regulatory and compliance expertise. Additional market leaders including UCB S.A., Johnson & Johnson Services Inc., Amgen Inc., and Eli Lilly and Company deliver targeted therapeutic expertise, comprehensive treatment protocols, and clinical development capabilities across global and regional healthcare networks. Product brochures highlight biologic innovation, personalized therapy approaches, clinical efficacy, and regulatory compliance, collectively reinforcing competitive positioning and demonstrating commitment to advancing rheumatoid arthritis care.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.2 billion |

| Molecule Outlook | Biopharmaceuticals, biologics, biosimilars, pharmaceuticals, NSAIDs, analgesics, DMARDs, and glucocorticoids |

| Sales Channel Outlook | Prescription and over-the-counter (OTC) |

| Regions Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Countries Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Key Companies Profiled | AbbVie Inc., Boehringer Ingelheim International GmbH, Novartis AG, Regeneron Pharmaceuticals Inc., Pfizer Inc., Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., UCB S.A., Johnson & Johnson Services Inc., Amgen Inc., Lilly (Eli Lilly and Company) |

| Additional Attributes | Dollar sales by molecule outlook and sales channel outlook, regional demand trends across China, India, Germany, France, United Kingdom, United States, and Brazil, competitive landscape with established pharmaceutical companies and biotechnology firms, healthcare provider preferences for biologic versus traditional therapeutic approaches, integration with personalized medicine platforms and precision treatment protocols, innovations in biologic therapy development and biosimilar manufacturing capabilities, and adoption of comprehensive patient support programs with integrated monitoring systems and treatment adherence solutions for enhanced therapeutic outcomes. |

Molecule Outlook:

Sales Channel Outlook:

Region:

The global rheumatoid arthritis therapeutics market is estimated to be valued at USD 27.2 billion in 2025.

The market size for the rheumatoid arthritis therapeutics market is projected to reach USD 46.7 billion by 2035.

The rheumatoid arthritis therapeutics market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in rheumatoid arthritis therapeutics market are biopharmaceuticals, _biologics, _biosimilars, pharmaceuticals, _nsaids, _analgesics, _dmards and _glucocorticoids.

In terms of sales channel outlook, prescription segment to command 90.0% share in the rheumatoid arthritis therapeutics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rheumatoid Arthritis Treatment Market

Osteoarthritis Gene Therapy Market

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Reactive Arthritis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Psoriatic Arthritis (PsA) Treatment Market Insights – Growth & Forecast 2024-2034

Axial Spondyloarthritis Management Market Analysis by Types, End-User, Drug Class, and Region through 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Juvenile Idiopathic Arthritis Diagnostic Market Trends – Demand & Future Outlook 2024-2034

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA