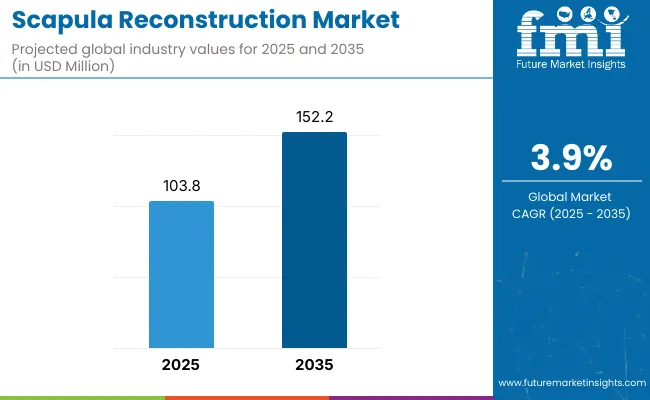

The global scapula reconstruction market is projected to grow from USD 103.8 million in 2025 to USD 152.2 million by 2035, representing an absolute value addition of USD 48.3 million. This indicates a total growth of approximately 50.4% over the decade and reflects a compound annual growth rate (CAGR) of 3.9% during the forecast period. The market is expected to expand by 1.5X between 2025 and 2035, supported by material advancements and precision surgical technologies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 103.8 million |

| Industry Size (2035F) | USD 152.2 million |

| CAGR (2025 to 2035) | 3.9% |

From 2025 to 2030, the market is projected to rise from USD 103.8 million to USD 128.2 million, adding approximately USD 24.4 million in value. Growth during this phase will be propelled by the wider adoption of 3D-printed scapular implants, rising incidences of bone tumors and traumatic injuries, and increased integration of patient-specific anatomical modelling into surgical planning.

During the 2030 to 2035 period, the market is forecast to expand further from USD 128.2 million to USD 152.2 million. This phase will benefit from improvements in bio-compatible polymers, expansion of orthopedic robotic-assisted surgeries, and a rise in reimbursement coverage for complex skeletal reconstructions across developed healthcare markets.

Between 2020 and 2025, the global scapula reconstruction market expanded from USD 93.1 million to USD 103.8 million, recording a total absolute increase of USD 10.7 million. This reflects a cumulative growth of 11.5% over five years, translating into a moderate CAGR of 2.2% during the period. The demand during this phase was largely shaped by rising awareness around limb-sparing surgeries and the increasing role of orthopedic oncology.

Medical centres specializing in musculoskeletal cancer began integrating modular scapula prosthetics into complex surgical workflows, especially in North America and Europe. Use of patient-specific implants saw early traction, particularly for tumors of the shoulder girdle requiring partial or total scapula resections. The adoption of 3D-printing technologies started gaining ground with initial FDA approvals and CE-marked devices supporting better anatomical matching and operative outcomes.

Growth was also supported by cross-disciplinary innovation involving orthopedic surgeons, biomechanical engineers, and radiologists. The use of CT-based modelling and additive manufacturing helped reduce surgery time and improved implant compatibility, laying the groundwork for broader adoption in the forecast period.

The global scapula reconstruction market is being driven by advancements in surgical oncology, precision implant development, and the integration of digital modelling in preoperative planning. As bone tumor resection rates increase and surgical outcomes become more data-driven, manufacturers are intensifying efforts to deliver scapular prosthetics that are lightweight, anatomically customized, and bio-compatible. The adoption of additive manufacturing and growing investments in personalized orthopaedics are reinforcing product-level differentiation across key markets.

An increase in diagnoses of chondrosarcoma, Ewing’s sarcoma, and metastatic shoulder girdle lesions is creating demand for reliable reconstructive options. Scapula resections, which were traditionally associated with poor functional outcomes, are now being addressed with advanced prosthetic systems. This is fueling clinical preference for modular or segmental scapular implants that can be tailored to the patient’s residual anatomy.

Preoperative imaging advancements such as CT/MRI fusion modelling and virtual surgical planning have enabled highly personalized designs in scapula reconstruction. The rising incorporation of 3D-printed implants-often developed using titanium and PEEK-has improved surgical alignment and post-operative range of motion. These developments are fostering better integration between surgical oncology and reconstructive orthopaedics.

A strong clinical shift toward limb-sparing surgeries over amputations is supporting the deployment of scapular endoprostheses, especially among pediatric and geriatric patients. Hospitals are increasingly seeking implant options that provide both structural restoration and functional mobility. This trend is particularly relevant in tertiary cancer centers across the USA, Germany, and Japan.

Collaborative efforts between surgeons, medical device designers, and biomechanical labs have reduced product development timelines and enabled more precise surgical tools. Regulatory bodies such as the FDA and EMA are increasingly evaluating patient-specific implants for orphan indications, allowing faster market entry and clinical experimentation, especially in rare skeletal reconstructions.

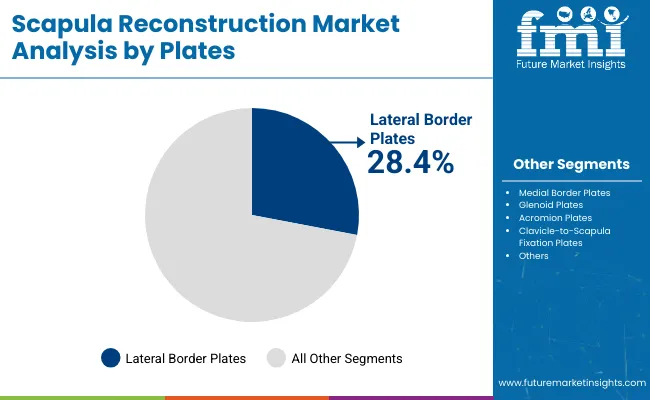

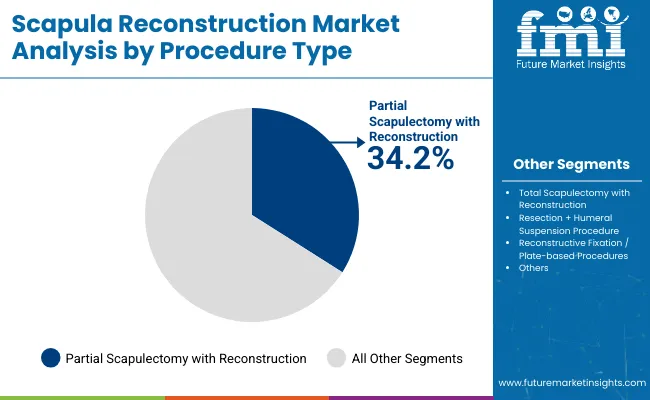

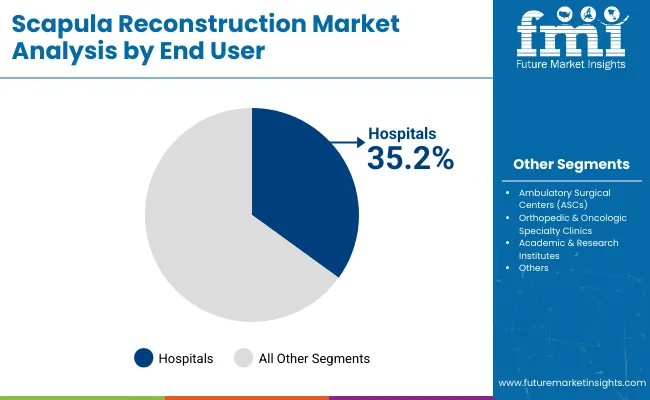

The scapula reconstruction market is segmented based on type of plates, procedure type, and end-user. Plate types include lateral border plates, medial border plates, glenoid plates, acromion plates, and clavicle-to-scapula fixation plates, reflecting the anatomical fixation needs across scapular regions. Procedures are categorized into partial scapulectomy with reconstruction, total scapulectomy with reconstruction, resection with humeral suspension, and reconstructive fixation using plate-based techniques. End-user segmentation comprises hospitals, ambulatory surgical centers (ASCs), orthopedic and oncologic specialty clinics, and academic or research institutes, covering the full range of clinical settings involved in scapular repair and reconstruction.

| By Type of Plates | 2025 |

|---|---|

| Lateral Border Plates | 28.4% |

| Medial Border Plates | 12.3% |

| Glenoid Plates | 20.1% |

| Acromion Plates | 21.8% |

| Clavicle-to-Scapula Fixation Plates | 17.4% |

Lateral border plates are estimated to hold the largest share of 28.4% in 2025, driven by their critical role in stabilizing the scapula’s outer edge during complex reconstructions. Their biomechanical advantage in fracture alignment and ease of contouring makes them suitable for a wide range of scapular injuries and oncologic resections. The growing number of trauma cases and advancements in pre-contoured implants are supporting their continued clinical preference.

| By Procedure type | 2025 |

|---|---|

| Partial Scapulectomy with Reconstruction | 34.2% |

| Total Scapulectomy with Reconstruction | 22.5% |

| Resection + Humeral Suspension Procedure | 10.8% |

| Reconstructive Fixation / Plate-based Procedures | 32.5% |

Partial scapulectomy with reconstruction is projected to account for 34.2% of procedures in 2025. This dominance is attributed to the increasing incidence of localized scapular tumors and segmental fractures that do not require complete resection. Surgeons prefer this method due to its relatively lower complexity, faster recovery timelines, and growing access to modular and 3D-printed implants designed for partial scapula replacement.

| By End User | 2025 |

|---|---|

| Hospitals | 35.2% |

| Ambulatory Surgical Centers (ASCs) | 28.5% |

| Orthopedic & Oncologic Specialty Clinics | 21.3% |

| Academic & Research Institutes | 14.9% |

Hospitals are expected to constitute 35.2% of the end-user base in 2025, reflecting their infrastructure capabilities for complex orthopedic and oncologic surgeries. The availability of multidisciplinary surgical teams, post-operative care, and imaging technologies such as 3D CT scans and MRIs reinforces the hospital segment’s role. Rising trauma admissions and bone tumor resections further support the hospital-based adoption of scapula reconstruction implants.

The scapula reconstruction market is advancing steadily due to the combined influence of surgical innovation, enhanced imaging techniques, and increasing acceptance of limb-salvage procedures. While adoption remains largely confined to specialized orthopedic and oncology centers, global interest in anatomical reconstruction solutions is growing. These drivers are shaping both product development and procurement behaviors across institutions.

Growing Adoption of Limb-Salvage Surgeries Over Amputation

The medical community is showing growing preference for limb-sparing techniques in managing shoulder girdle tumors and traumatic scapular injuries. As surgical oncology improves, clinicians are avoiding amputations and favoring partial or total scapular reconstructions. This has created consistent demand for prostheses that preserve joint mobility while ensuring oncological safety. Advancements in surgical margin control and resection planning are reinforcing this trend, especially in the USA, Japan, and Western Europe.

Integration of 3D-Printed Custom Implants

The availability of patient-specific 3D-printed scapula implants is driving the market’s growth. These implants, often produced using titanium or composite polymers, allow precise matching with the patient’s bone geometry. Hospitals and surgical centers are increasingly adopting virtual planning software and additive manufacturing platforms to pre-design implants that can be inserted with minimal intraoperative adjustment. This capability is becoming a differentiating factor among top suppliers.

Rise in Multi-Disciplinary Care Pathways

Reconstructive orthopedic surgeries involving the scapula now require coordinated planning across oncologists, radiologists, and orthopedic specialists. This shift has led to the development of hybrid care pathways that combine oncological tumor clearance with biomechanically optimized reconstruction. Vendors are responding by offering integrated solutions that include implants, planning tools, and post-operative rehabilitation kits.

Shift Toward Modular and Lightweight Prosthetic Designs

There is a growing trend toward modular implant systems that allow surgeons to reconstruct partial or total scapular sections with improved flexibility. These systems offer better handling during surgery and post-operative mobility. Additionally, manufacturers are focusing on lightweight materials to minimize shoulder fatigue and aid in muscle.

The scapula reconstruction market in Europe is projected to grow from USD 29.1 million in 2025 to USD 38.4 million by 2035, registering a CAGR of 2.8%. Germany will retain its dominant share due to its concentration of orthopedic trauma centers and clinical expertise in limb salvage surgeries. The UK and France are expected to maintain stable growth, driven by continued adoption of 3D-printed and patient-specific scapular implants. Countries like Italy and Spain show a slower pace of transition but benefit from expanding surgical robotics programs. Rest of Western Europe, including smaller economies and Nordic countries, will witness a gradual rise in share due to improved access and public healthcare investments targeting musculoskeletal rehabilitation services.

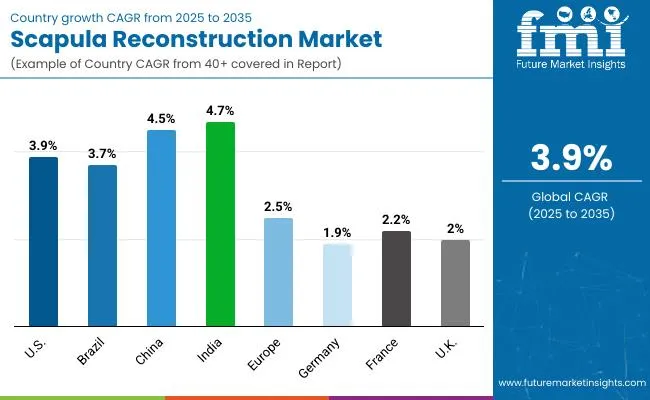

| Countries | CAGR |

|---|---|

| USA | 3.9% |

| Brazil | 3.7% |

| China | 4.5% |

| India | 4.7% |

| Europe | 2.5% |

| Germany | 1.9% |

| France | 2.2% |

| UK | 2.0% |

The Asia Pacific region is emerging as the fastest-growing market for scapula reconstruction, projected to expand at a CAGR of 4.7% in India and 4.5% in China between 2025 and 2035. In India, growth is driven by increasing investments in specialized orthopediccenters, rising trauma-related injuries, and adoption of advanced reconstructive implants in Tier 1 and Tier 2 cities. Meanwhile, China’s growth is supported by large-scale healthcare infrastructure upgrades under the Healthy China 2030 initiative, coupled with rising procedural volumes for oncology-driven reconstructions. The region benefits from government-backed reimbursement reforms and the rapid availability of custom 3D-printed implants.

Europe is expected to grow steadily at a CAGR of 2.5% through 2035. Germany with 1.9% CAGRleads in procedure volumes but sees slower growth due to market saturation and mature infrastructure. France is expected to grow at 2.2% CAGR and is benefiting from targeted funding for oncology surgeries under national health reforms, while the UK is driving adoption through NHS-led pilot programs focusing on bone cancer treatment and reconstructive procedures and holding a 2.0% CAGR.

North America remains a mature yet innovation-driven market, with the USA projected to grow at a CAGR of 3.9% through 2035. Growth is fueled by the adoption of patient-specific implants, integration of AI-driven preoperative planning, and availability of advanced biomaterials for complex scapular reconstructions. Federal funding for trauma care and cancer treatment programs is also boosting procedural adoption.

The United States is anticipated to grow at a CAGR of 3.9%, with strong demand for scapula reconstruction procedures in specialized orthopedic and trauma centers. The presence of highly trained reconstructive surgeons and robust referral networks ensures consistent procedure volumes. Personalized surgical planning, supported by advanced imaging, digital modeling, and the availability of custom implants, is further improving patient outcomes. Additionally, favorable reimbursement structures and broader insurance coverage are encouraging hospitals and patients to adopt advanced scapula reconstruction techniques. Growing patient awareness and a preference for limb-salvage surgery following trauma are also reinforcing market expansion.

India is set to lead global growth in the scapula reconstruction market with a CAGR of 4.7% between 2025 and 2035. Rising incidence of trauma-related scapular injuries due to urban traffic accidents and industrial mishaps is fostering demand. Alongside, private multi-specialty hospitals and medical tourism hubs are enhancing surgical volumes, particularly in metropolitan areas such as Delhi, Mumbai, and Bangalore. The country is also benefiting from the availability of specialized orthopedic trauma centers and the increasing presence of skilled reconstructive surgeons. In addition, government-backed health coverage for complex surgeries is improving accessibility for middle-income patients, ensuring broader treatment adoption.

The Scapula Reconstruction Market in the United Kingdom is projected to grow at a CAGR of 2.0% through 2035, supported by rising investments in oncology-driven reconstructive surgeries and trauma care advancements. NHS England’s elective recovery funding and targeted programs under the NHS Long-Term Plan are improving access to advanced orthopedic implants and personalized reconstruction solutions. Growing collaborations between hospitals and manufacturers are enhancing patient-specific 3D implant adoption, particularly for bone tumor resections and complex fractures. Demand is also being fueled by central procurement policies that focus on standardized, cost-efficient solutions to address rising surgical site complication risks.

| Europe Countries | 2025 |

|---|---|

| Germany | 24.4% |

| France | 14.5% |

| Italy | 11.0% |

| BENELUX | 7.0% |

| Nordic Countries | 5.4% |

| Spain | 9.3% |

| Rest of Western Europe | 28.4% |

| Germany | 24.4% |

| Europe Countries | 2035 |

|---|---|

| Germany | 21.4% |

| France | 14.3% |

| Italy | 11.9% |

| BENELUX | 8.2% |

| Nordic Countries | 6.4% |

| Spain | 9.7% |

| Rest of Western Europe | 28.0% |

| Germany | 21.4% |

The Scapula Reconstruction Market in Germany is forecast to grow at a CAGR of 1.9% through 2035, driven by high procedural volumes but tempered by market maturity. Federal investments under the Krankenhauszukunftsgesetz (Hospital Future Act) are improving oncology and trauma care infrastructure, enabling greater adoption of customized scapular reconstruction plates and implants. Germany’s well-established reimbursement framework ensures consistent procedural demand, yet growth is slower due to saturated hospital infrastructure and early-stage adoption of robotic-assisted reconstructive systems. Increasing collaborations between orthopedic centers and engineering firms are accelerating deployment of patient-specific 3D-printed implants for sarcoma resections and trauma-related reconstruction.

China is projected to grow at a CAGR of 4.5% through 2035, supported by increased investment in orthopedic trauma and reconstructive technologies. Leading hospitals are adopting advanced prosthetic solutions, integrating pre-surgical planning platforms that leverage AI and digital imaging. Domestic medical device players are also entering the space with cost-effective scapula implants and guided surgical tools, contributing to affordability and higher adoption rates. Furthermore, continuous upgrades in hospital infrastructure and expansion of trauma centers across provinces are improving access to specialized care. The national government’s emphasis on promoting indigenous medical devices is accelerating innovation and ensuring a stronger local supply chain.

The Scapula Reconstruction Market in Japan is projected to grow from USD 4.0 million in 2025, expanding at a CAGR of 3.0%. Demand is led by fixation plates, with lateral border plates projected to dominate at 27.6% share in 2025, driven by a high incidence of vehicular injuries and sports-related scapular fractures. Acromion plates, accounting for 21.2%, are increasingly adopted in surgeries focused on restoring shoulder elevation and mobility post-trauma. Clavicle-to-scapula fixation plates represent 19.9% share, reflecting the need for cross-bone stabilization in complex trauma cases. Glenoid plates (19.5%) are mainly applied in joint preservation procedures among elderly patients, while medial border plates (11.9%) remain limited to rare realignment cases.

The Scapula Reconstruction Market in South Korea is estimated at USD 2.9 million in 2025, growing at a CAGR of 5.1%. The market is driven by a preference for reconstructive fixation and plate-based procedures, which hold the highest share at 33.5% in 2025. Partial scapulectomy with reconstruction follows closely at 33.2%, reflecting a clinical emphasis on limb-sparing surgical approaches. Total scapulectomy with reconstruction accounts for 21.8%, usually applied in extensive cancer resections or severely comminuted fractures. Meanwhile, resection with humeral suspension, though niche, contributes 10.5%, primarily in palliative or non-reconstructable trauma cases.

The Scapula Reconstruction Market is moderately consolidated, with global orthopedic implant leaders, trauma-focused device manufacturers, and specialized reconstructive surgery firms competing across fixation plates, scapulectomy reconstruction systems, and plate-based stabilization solutions. DePuy Synthes holds the largest share, leveraging its extensive trauma and orthopedic implant portfolio, with strong distribution in both developed and emerging surgical markets. The company continues to emphasize advanced plate systems, surgeon training programs, and integration with digital surgical planning platforms.

Zimmer Biomet, Exactech, and LIMACORPORATE SPA maintain strong positions through diversified orthopedic portfolios that extend into oncology-driven reconstructions, trauma fixation, and joint-preservation solutions. Their strategies focus on procedural innovation, surgeon engagement, and expanding collaborations with cancer centers and sports medicine clinics. Zimmer Biomet, in particular, is advancing plate technologies designed for complex trauma and elderly fracture stabilization.

Acumed, TST Orthopedics, and Implantcast GmbH represent specialized players catering to complex scapular trauma and tumor-related reconstructions. Acumed is recognized for its trauma fixation expertise, while Implantcast leads in oncology-driven custom prosthetics and modular plate systems. LIMACORPORATE and Exactech are increasingly adopting 3D printing and custom reconstruction workflows, targeting limb-sparing surgeries.

Other regional players and contract manufacturers are entering the space with cost-effective plates and reconstruction kits tailored to local hospital needs. These companies often compete on affordability, rapid availability, and bundled offerings through hospital procurement networks.

As the market evolves, competitive differentiation is shifting from standard plate fixation toward customized 3D-printed implants, oncology-driven reconstructions, and integration with surgical navigation tools. Players that align innovation with surgeon trust, clinical outcomes, and regulatory compliance are expected to lead market growth through 2035.

Key Developments

| Item | Value |

|---|---|

| Market Value | USD 103.8 million |

| Types of Plate | Lateral Border Plates, Medial Border Plates, Glenoid Plates, Acromion Plates, Clavicle-to-Scapula Fixation Plates |

| Procedure type | Partial Scapulectomy with Reconstruction, Total Scapulectomy with Reconstruction, Resection + Humeral Suspension Procedure, Reconstructive Fixation / Plate-based Procedures |

| End User | Hospitals, Ambulatory Surgical Centers (ASCs), Orthopedic & Oncologic Specialty Clinics, Academic & Research Institutes |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Acumed, DePuy Synthes, Exactech, Zimmer Biomet, Implantcast GmbH, LIMACORPORATE SPA, TST Orthopedics, Others |

| Additional Attributes | Dollar sales by plate ty pe, procedure type, and regions, Adoption trends of plate-based scapula reconstruction systems, Rising demand in oncology-driven tumor resect ions and limb-sparing surgeries, Growing demand across trauma centers, orthopedic specialty clinics, and academic research hospitals |

The global Scapula Reconstruction Market is estimated to be valued at USD 103.8 million in 2025.

The market size for Scapula Reconstruction is projected to reach USD 152.2 million by 2035.

The Scapula Reconstruction Market is expected to grow at a CAGR of 3.9% during this period.

Key product types include Lateral Border Plates, Medial Border Plates, Glenoid Plates, Acromion Plates, and Clavicle-to-Scapula Fixation Plates.

Hospitals are projected to command 35.2% of the market in 2025, followed by Ambulatory Surgical Centers (ASCs) at 28.5%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Reconstruction Technology Market Analysis & Forecast by Component, Type, Enterprise Size, Deployment Model, Application, and Region Through 2035

Nose Reconstruction Market Growth & Demand 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Genome Reconstruction Tools Market Forecast and Outlook 2025 to 2035

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Pelvic Reconstruction Market - Growth & Demand 2025 to 2035

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Mastectomy Reconstruction Implants Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

Content Disarm and Reconstruction Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA