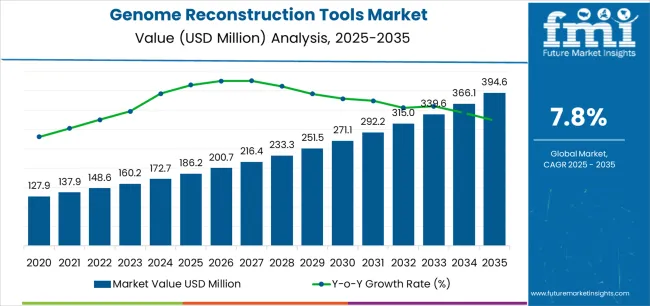

The global genome reconstruction tools market is valued at USD 182.6 million in 2025 and is slated to reach USD 387 million by 2035, recording an absolute increase of USD 204.4 million over the forecast period. This translates into a total growth of 111.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.8% between 2025 and 2035. The overall market size is expected to grow by approximately 2.12X during the same period, supported by increasing demand for advanced genomic analysis solutions, growing adoption of cloud-based bioinformatics platforms across biotechnology and pharmaceutical sectors, and rising preference for precision genomics tools in research applications.

The genome reconstruction tools market represents a specialized segment of the global bioinformatics industry, characterized by technological innovation and robust demand across biotech companies, contract research organizations, and academic research channels. Market dynamics are influenced by evolving genomic research paradigms toward high-throughput sequencing, growing interest in personalized medicine technologies, and expanding partnerships between bioinformatics providers and research institutions in developed and emerging economies. Traditional genomic analysis systems continue evolving as researchers seek proven reconstruction alternatives that offer enhanced analytical capabilities and reliable genomic interpretation characteristics.

Research behavior in the genome reconstruction tools market reflects broader biotechnology trends toward precision medicine systems that provide both analytical effectiveness benefits and extended research capability improvements. The market benefits from the growing popularity of cloud/SaaS subscription applications, which are recognized for their superior scalability and research compatibility across microorganism analysis and pharmaceutical development applications. Additionally, the versatility of genome reconstruction tools as both standalone analytical solutions and integrated research platforms supports demand across multiple biotechnology applications and genomic segments.

Regional adoption patterns vary significantly, with North American markets showing strong preference for biotechnology company implementations, while European markets demonstrate increasing adoption of academic research applications alongside conventional pharmaceutical systems. The genomics landscape continues to evolve with sophisticated and feature-rich analytical products gaining traction in mainstream operations, reflecting researcher willingness to invest in proven bioinformatics technology improvements and precision-oriented features.

The competitive environment features established genomics companies alongside specialized bioinformatics manufacturers that focus on unique analytical capabilities and advanced reconstruction methods. Research efficiency and technology development optimization remain critical factors for market participants, particularly as data complexity and analytical standards continue to evolve. Distribution strategies increasingly emphasize multi-channel approaches that combine traditional biotechnology supply chains with direct research partnerships through technology licensing agreements and custom analysis contracts.

Market consolidation trends indicate that larger biotechnology companies are acquiring specialty bioinformatics developers to diversify their analytical portfolios and access specialized reconstruction segments. Advanced genomic integration has gained momentum as pharmaceutical companies seek to differentiate their offerings while maintaining competitive research standards. The emergence of specialized reconstruction variants, including enhanced cloud formulations and microorganism-specific platforms, reflects changing research priorities and creates new market opportunities for innovative analytical system developers.

Genome Reconstruction Tools Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 182.6 million |

| Forecast Value (2035F) | USD 387 million |

| Forecast CAGR (2025 to 2035) | 7.80% |

Between 2025 and 2030, the genome reconstruction tools market is projected to expand from USD 182.6 million to USD 272.9 million, resulting in a value increase of USD 90.3 million, which represents 44.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of cloud/SaaS systems, rising demand for microorganism analysis solutions, and growing emphasis on biotechnology integration features with advanced analytical characteristics. Research facilities are expanding their genomic capabilities to address the growing demand for specialized reconstruction implementations, advanced analytical options, and application-specific offerings across biotechnology segments.

A more detailed breakdown of KPIs relevant to the market is outlined in the table below:

| KPI | Description |

|---|---|

| Installed Base by Equipment Type | Estimated number of genome reconstruction tools (e.g., software, hardware) in use across research labs, hospitals, and biotechnology companies |

| Automation Level | Percentage of genome reconstruction processes that are automated vs. manual (e.g., sequencing, data analysis) |

| Certification Volume | Number of certifications or standards related to genomic tools (e.g., ISO 13485 for medical devices, GLP for research labs) |

| Testing Frequency | Frequency of quality checks, validation, and calibration for genome reconstruction tools and sequencing equipment |

| Service/Calibration Market Size | Estimated annual spending (USD million) on servicing, software updates, and calibration of genome reconstruction tools |

| Adoption of Next- Gen Sequencing Technologies | Percentage of the market transitioning from traditional sequencing methods to next- gen sequencing tools in genome reconstruction |

| Data Processing Speed & Accuracy | Average time taken and accuracy rates in genome reconstructions, which can impact adoption in clinical and research applications |

| Market Segmentation by Application | Breakdown of market share across different applications like research, clinical diagnostics, agriculture, forensics, etc. |

Market expansion is being supported by the increasing global demand for advanced genomic analysis systems and the corresponding need for reconstruction technologies that can provide superior analytical benefits and research advantages while enabling enhanced pharmaceutical development and extended compatibility across various microorganism analysis and biotechnology applications. Modern biotechnology researchers and pharmaceutical specialists are increasingly focused on implementing proven analytical technologies that can deliver effective genomic interpretation, minimize traditional analysis limitations, and provide consistent performance throughout complex research configurations and diverse genomic conditions. Genome reconstruction tools proven ability to deliver exceptional analytical accuracy against traditional alternatives, enable advanced research integration, and support modern pharmaceutical protocols makes it an essential component for contemporary biotechnology and pharmaceutical operations.

The growing emphasis on precision medicine and genomic research optimization is driving demand for reconstruction systems that can support large-scale research requirements, improve pharmaceutical outcomes, and enable advanced biotechnology systems. Researcher preference for technologies that combine effective genomic analysis with proven scalability and research enhancement benefits is creating opportunities for innovative reconstruction implementations. The rising influence of personalized medicine trends and research efficiency awareness is also contributing to increased demand for genome reconstruction tools that can provide advanced features, seamless research integration, and reliable performance across extended development cycles.

The genome reconstruction tools market is poised for robust growth and technological advancement. As research facilities across North America, Europe, Asia-Pacific, and emerging markets seek technologies that deliver exceptional analytical characteristics, advanced cloud capabilities, and reliable research options, reconstruction solutions are gaining prominence not just as specialty analytical systems but as strategic enablers of genomic technologies and advanced research functionality.

Rising cloud/SaaS adoption in biotechnology applications and expanding pharmaceutical development initiatives globally amplify demand, while developers are leveraging innovations in analytical engineering, advanced cloud integration, and research optimization technologies.

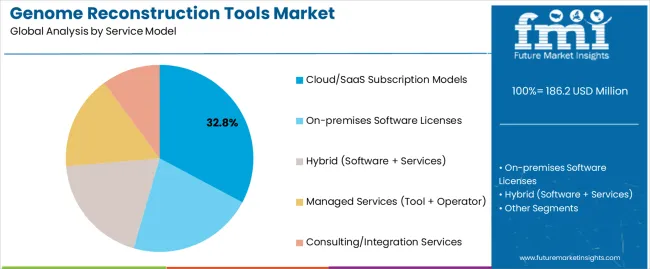

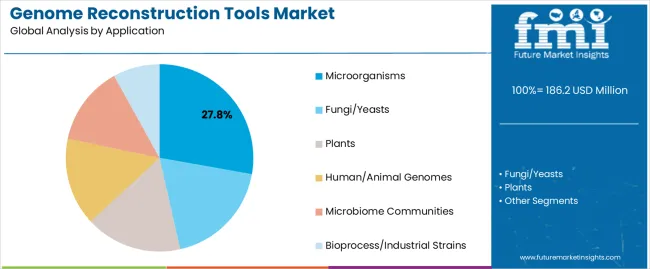

The market is segmented by service model, application, end user, and region. By service model, the market is divided into on-premises software licenses, cloud/SaaS subscription models, hybrid (software + services), managed services (tool + operator), and consulting/integration services categories. By application, it covers microorganisms, fungi/yeasts, plants, human/animal genomes, microbiome communities, and bioprocess/industrial strains segments. By end user, it encompasses biotech & pharma companies, CROs & CDMOs, clinical diagnostics labs, and academic & research institutes segments. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The cloud/SaaS subscription models segment is projected to account for 32.8% of the genome reconstruction tools market in 2025, reaffirming its position as the leading service model category. Research facilities and biotechnology integrators increasingly utilize cloud/SaaS implementations for their superior scalability characteristics when operating across diverse research platforms, excellent accessibility properties, and widespread acceptance in applications ranging from basic genomic analysis to premium pharmaceutical development operations. Cloud/SaaS technology's established deployment methods and proven performance capabilities directly address the facility requirements for dependable analytical solutions in complex research environments.

This service model segment forms the foundation of modern biotechnology adoption patterns, as it represents the implementation with the greatest market penetration and established researcher acceptance across multiple research categories and application segments. Facility investments in cloud/SaaS standardization and analytical consistency continue to strengthen adoption among biotechnology companies and pharmaceutical developers. With researchers prioritizing analytical flexibility and research scalability, cloud/SaaS implementations align with both functionality preferences and cost expectations, making them the central component of comprehensive genomic research strategies.

Microorganism applications are projected to represent 27.8% of genome reconstruction tools demand in 2025, underscoring their critical role as the primary application type for genomic analysis across microbiology research operations. Research facilities prefer reconstruction tools for microorganism analysis for their exceptional analytical characteristics, scalable processing options, and ability to enhance genomic interpretation while ensuring consistent analytical quality throughout diverse research platforms and microbiology operations. Positioned as essential analytical components for modern microbiology systems, reconstruction solutions offer both technological advantages and research efficiency benefits.

The segment is supported by continuous innovation in microbiology technologies and the growing availability of specialized implementations that enable diverse microorganism requirements with enhanced analytical uniformity and extended research capabilities. Additionally, research facilities are investing in advanced technologies to support large-scale analytical integration and product development. As microbiology research trends become more prevalent and genomic analysis awareness increases, microorganism applications will continue to represent a major implementation market while supporting advanced research utilization and technology integration strategies.

The biotech & pharma companies segment is expected to capture 41.9% of the genome reconstruction tools market in 2025, driven by increasing demand for advanced analytical systems that enhance drug discovery while maintaining research precision. Biotechnology and pharmaceutical manufacturers are increasingly adopting genome reconstruction tools for therapeutic target identification, biomarker discovery, and personalized medicine development due to their superior analytical capabilities and research compatibility. The segment benefits from growing pharmaceutical R&D investment and continuous innovation in reconstruction technologies tailored for pharmaceutical applications.

The genome reconstruction tools market is advancing steadily due to increasing demand for advanced genomic analysis technologies and growing adoption of reconstruction systems that provide superior analytical characteristics and research benefits while enabling enhanced pharmaceutical development across diverse microorganism analysis and biotechnology applications. The market faces challenges, including complex data management requirements, evolving computational standards, and the need for specialized analytical expertise and quality programs. Innovation in analytical methods and advanced cloud systems continues to influence product development and market expansion patterns.

Expansion of Precision Medicine Technologies and Research Integration

The growing adoption of advanced precision medicine, sophisticated analytical capabilities, and research efficiency awareness is enabling biotechnology developers to produce advanced reconstruction solutions with superior analytical positioning, enhanced cloud profiles, and seamless integration functionalities. Advanced precision medicine systems provide improved pharmaceutical outcomes while allowing more efficient research workflows and reliable performance across various biotechnology applications and research conditions. Developers are increasingly recognizing the competitive advantages of research integration capabilities for market differentiation and technology positioning.

Integration of Advanced Cloud Methods and Analytical Engineering

Modern reconstruction manufacturers are incorporating advanced cloud technology, analytical integration, and sophisticated research solutions to enhance product appeal, enable intelligent genomic features, and deliver value-added solutions to biotechnology customers. These technologies improve reconstruction performance while enabling new market opportunities, including multi-omics analytical systems, optimized cloud treatments, and enhanced computational characteristics. Advanced analytical integration also allows developers to support comprehensive biotechnology platforms and market expansion beyond traditional reconstruction approaches.

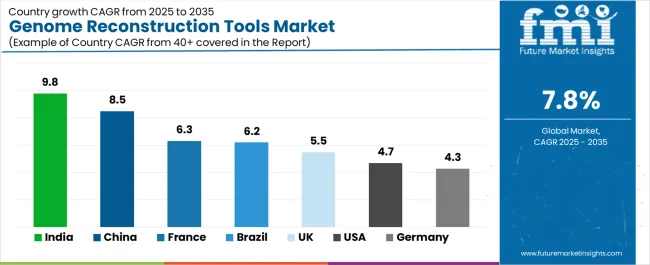

| Countries | CAGR (2025 to 2035) |

|---|---|

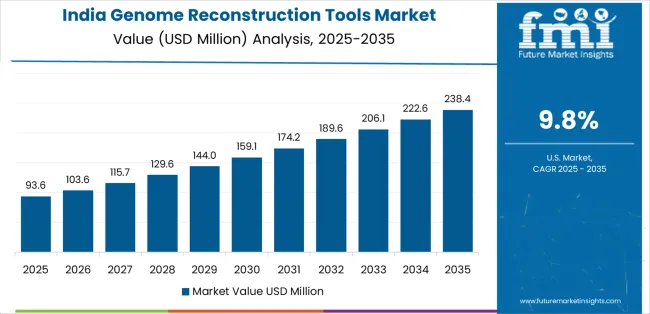

| India | 9.8% |

| China | 8.5% |

| France | 6.3% |

| Brazil | 6.2% |

| UK | 5.5% |

| USA | 4.7% |

| Germany | 4.3% |

The genome reconstruction tools market is experiencing varied growth globally, with India leading at a 9.8% CAGR through 2035, driven by expanding biotechnology infrastructure, growing genomics research programs, and significant investment in life sciences development. China follows at 8.5%, supported by increasing biotechnology modernization, growing research integration patterns, and expanding pharmaceutical infrastructure. France shows growth at 6.3%, emphasizing biotechnology innovation leadership and genomics development.

Brazil records 6.2%, focusing on expanding research capabilities and biotechnology modernization. The UK exhibits 5.5% growth, emphasizing research excellence and premium biotechnology development. The USA demonstrates 4.7% growth, prioritizing advanced biotechnology development and quality-focused research patterns. Germany shows 4.3% growth, supported by biotechnology excellence initiatives and quality-focused genomics patterns.

Revenue from genome reconstruction tools in India is projected to exhibit robust growth with a CAGR of 9.8% through 2035, driven by expanding biotechnology infrastructure capacity and rapidly growing genomics research supported by government initiatives promoting life sciences development. The country's improving research capabilities and increasing investment in biotechnology infrastructure are creating substantial demand for advanced reconstruction implementations. Major research facilities and biotechnology companies are establishing comprehensive analytical capabilities to serve both domestic pharmaceutical demand and expanding genomics markets.

Government support for biotechnology innovation initiatives and genomics development is driving demand for advanced reconstruction systems throughout major research regions and biotechnology centers across the country. Strong pharmaceutical growth and an expanding network of research-focused organizations are supporting the rapid adoption of genome reconstruction tools among facilities seeking advanced analytical capabilities and integrated biotechnology platforms.

Revenue from genome reconstruction tools in China is growing at a CAGR of 8.5%, driven by the country's expanding biotechnology sector, growing research capacity, and increasing adoption of advanced analytical technologies. The country's initiatives promoting biotechnology modernization and growing pharmaceutical development awareness are driving requirements for technology-integrated analytical systems. International reconstruction providers and domestic biotechnology companies are establishing extensive research and integration capabilities to address the growing demand for advanced analytical solutions.

Strong biotechnology expansion and expanding modern research operations are driving adoption of integrated analytical systems with superior reconstruction capabilities and advanced integration among large pharmaceutical producers and progressive biotechnology operations. Growing technology diversity and increasing biotechnology enhancement adoption are supporting market expansion for advanced reconstruction implementations with seamless integration profiles and modern analytical systems throughout the country's research regions. China's strategic biotechnology position and expanding research base make it an attractive destination for reconstruction development facilities serving both domestic and Asian markets.

Revenue from genome reconstruction tools in France is growing at a CAGR of 6.3%, driven by the country's expanding biotechnology sector, growing research development programs, and increasing investment in genomics technology development. France's large biotechnology market and commitment to research advancement are supporting demand for diverse reconstruction solutions across multiple biotechnology segments. Developers are establishing comprehensive integration capabilities to serve the growing domestic market and expanding research opportunities.

Strong biotechnology expansion and expanding modern research operations are driving adoption of integrated analytical systems with superior reconstruction capabilities and advanced integration among large pharmaceutical producers and progressive research operations. Growing technology diversity and increasing biotechnology enhancement adoption are supporting market expansion for advanced reconstruction implementations with seamless integration profiles and modern analytical systems throughout the country's biotechnology regions.

Revenue from genome reconstruction tools in Brazil is growing at a CAGR of 6.2%, driven by the country's expanding biotechnology sector, growing research development programs, and increasing investment in life sciences technology development. Brazil's large biotechnology market and commitment to research advancement are supporting demand for diverse reconstruction solutions across multiple biotechnology segments. Biotechnology providers are establishing comprehensive analytical capabilities to serve the growing domestic market and expanding research opportunities.

Strong biotechnology expansion and expanding modern research operations are driving adoption of integrated analytical systems with superior reconstruction capabilities and advanced integration among large pharmaceutical producers and progressive research operations. Growing research diversity and increasing biotechnology enhancement adoption are supporting market expansion for advanced reconstruction implementations with seamless integration profiles and modern analytical systems throughout the country's biotechnology regions.

Revenue from genome reconstruction tools in the UK is growing at a CAGR of 5.5%, driven by the country's focus on biotechnology advancement, emphasis on premium research innovation, and strong position in genomics development. The UK's established research excellence capabilities and commitment to technology diversification are supporting investment in specialized reconstruction technologies throughout major research regions. Industry leaders are establishing comprehensive technology integration systems to serve domestic premium biotechnology production and enhancement applications.

Innovations in analytical platforms and biotechnology integration capabilities are creating demand for advanced reconstruction implementations with exceptional analytical properties among progressive research facilities seeking enhanced technology differentiation and pharmaceutical appeal. Growing premium biotechnology adoption and increasing focus on research innovation are driving adoption of advanced reconstruction platforms with integrated analytical systems and biotechnology optimization across research enterprises throughout the country.

Revenue from genome reconstruction tools in the USA is growing at a CAGR of 4.7%, driven by the country's focus on biotechnology innovation advancement, emphasis on premium pharmaceutical innovation, and strong position in genomics development. The USA's established biotechnology excellence capabilities and commitment to technology diversification are supporting investment in specialized reconstruction technologies throughout major research regions. Research leaders are establishing comprehensive technology integration systems to serve domestic premium biotechnology production and enhancement applications.

Innovations in analytical platforms and biotechnology integration capabilities are creating demand for advanced reconstruction implementations with exceptional research properties among progressive biotechnology facilities seeking enhanced technology differentiation and pharmaceutical appeal. Growing premium research adoption and increasing focus on biotechnology innovation are driving adoption of advanced reconstruction platforms with integrated analytical systems and research optimization across biotechnology enterprises throughout the country.

Revenue from genome reconstruction tools in Germany is expanding at a CAGR of 4.3%, supported by the country's biotechnology excellence initiatives, growing quality technology sector, and strategic emphasis on advanced genomics development. Germany's advanced quality control capabilities and integrated biotechnology systems are driving demand for high-quality reconstruction platforms in premium applications, biotechnology development, and advanced research applications. Leading facilities are investing in specialized capabilities to serve the stringent requirements of technology-focused biotechnology and premium pharmaceutical producers.

Quality biotechnology advancement and technology-focused development are creating requirements for specialized reconstruction solutions with superior quality integration, exceptional analytical capabilities, and advanced research features among quality-conscious biotechnology operations and premium pharmaceutical producers. Strong position in biotechnology innovation is supporting adoption of advanced reconstruction systems with validated analytical characteristics and quality integration capabilities throughout the country's biotechnology sector.

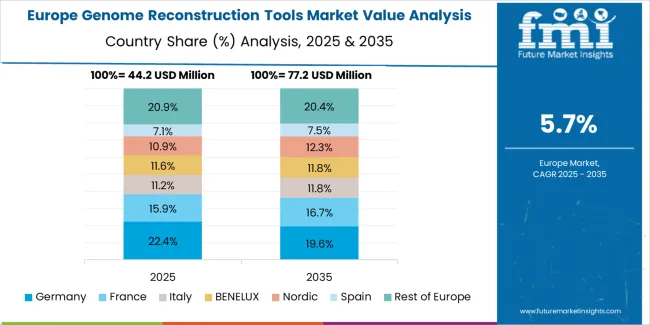

The genome reconstruction tools market in Europe is projected to grow from USD 46.7 million in 2025 to USD 79.5 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is expected to maintain its leadership position with a 27.6% market share in 2025, declining slightly to 24.6% by 2035, supported by its strong biotechnology excellence culture, sophisticated genomics research capabilities, and comprehensive life sciences sector serving diverse reconstruction applications across Europe.

France follows with a 14.8% share in 2025, projected to reach 16.1% by 2035, driven by robust demand for biotechnology technologies in research applications, advanced genomics development programs, and analytical enhancement markets, combined with established biotechnology infrastructure and technology integration expertise. Italy holds a 11.2% share in 2025, expected to reach 12.9% by 2035, supported by growing biotechnology research activities. Spain commands a 8.4% share in 2025, projected to reach 10.3% by 2035, while BENELUX accounts for 6.8% in 2025, expected to reach 6.7% by 2035. Nordic Countries maintain a 5.9% share in 2025, declining to 5.3% by 2035. The Rest of Western Europe region is anticipated to maintain momentum, with its collective share moving from 25.3% to 24.1% by 2035, attributed to increasing biotechnology modernization and growing technology penetration implementing advanced analytical programs.

The genome reconstruction tools market is characterized by competition among established biotechnology companies, specialized bioinformatics manufacturers, and integrated analytical solution providers. Companies are investing in analytical technology research, cloud optimization, advanced biotechnology system development, and comprehensive reconstruction portfolios to deliver consistent, high-quality, and application-specific analytical solutions. Innovation in advanced cloud integration, analytical enhancement, and research compatibility improvement is central to strengthening market position and competitive advantage.

Illumina leads the market with a 15.5% market share, offering comprehensive analytical solutions including quality sequencing platforms and advanced reconstruction systems with a focus on premium and biotechnology applications. QIAGEN Digital Insights provides specialized bioinformatics capabilities with an emphasis on advanced reconstruction implementations and innovative analytical solutions. DNAnexus delivers comprehensive cloud services with a focus on integrated platforms and large-scale research applications. Oxford Nanopore specializes in advanced sequencing technologies and specialized reconstruction implementations for premium applications. PacBio focuses on biotechnology-oriented analytical integration and innovative sequencing solutions.

The competitive landscape is further strengthened by companies like Dotmatics, which brings expertise in advanced research informatics and biotechnology solutions, while DNASTAR focuses on genomics software solutions for specialized applications. CosmosID emphasizes microbiome analysis platforms and research integration, and Igenbio specializes in comprehensive analytical services. These companies continue to invest in research and development, strategic partnerships, and cloud capacity expansion to maintain their market positions and capture emerging opportunities in the growing genome reconstruction tools sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 182.6 million |

| Service Model | On-premises Software Licenses; Cloud/SaaS Subscription Models; Hybrid (Software + Services); Managed Services (Tool + Operator); Consulting/Integration Services |

| Application | Microorganisms; Fungi/Yeasts; Plants; Human/Animal Genomes; Microbiome Communities; Bioprocess/Industrial Strains |

| End User | Biotech & Pharma Companies; CROs & CDMOs; Clinical Diagnostics Labs; Academic & Research Institutes |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | USA; Germany; France; UK; Japan; China; India; South Korea; Brazil; and 40+ additional countries |

| Key Companies Profiled | Illumina; QIAGEN Digital Insights; DNAnexus ; Oxford Nanopore ; PacBio ; Dotmatics |

| Additional Attributes | Dollar sales by service model and application category; regional demand trends; competitive landscape; technological advancements in analytical engineering; advanced cloud development; biotechnology innovation; research integration protocols |

The global genome reconstruction tools market is estimated to be valued at USD 186.2 million in 2025.

The market size for the genome reconstruction tools market is projected to reach USD 394.6 million by 2035.

The genome reconstruction tools market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in genome reconstruction tools market are cloud/saas subscription models, on-premises software licenses, hybrid (software + services), managed services (tool + operator) and consulting/integration services.

In terms of application, microorganisms segment to command 27.8% share in the genome reconstruction tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Genome Editing Market Insights – Trends & Forecast 2024-2034

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Whole Genome Amplification Market Size and Share Forecast Outlook 2025 to 2035

Global Optical Genome Mapping Market Analysis – Size, Share & Forecast 2024-2034

Personal Genome Testing Market Size and Share Forecast Outlook 2025 to 2035

3D Reconstruction Technology Market Analysis & Forecast by Component, Type, Enterprise Size, Deployment Model, Application, and Region Through 2035

Nose Reconstruction Market Growth & Demand 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Joint Reconstruction Devices Market Overview - Trends & Forecast 2024-2034

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Pelvic Reconstruction Market - Growth & Demand 2025 to 2035

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Scapula Reconstruction Market Analysis Size and Share Forecast Outlook 2025 to 2035

Mastectomy Reconstruction Implants Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

Content Disarm and Reconstruction Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA