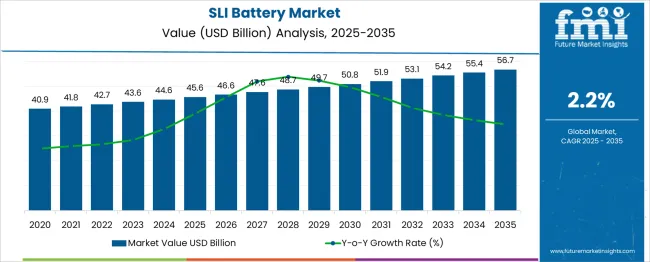

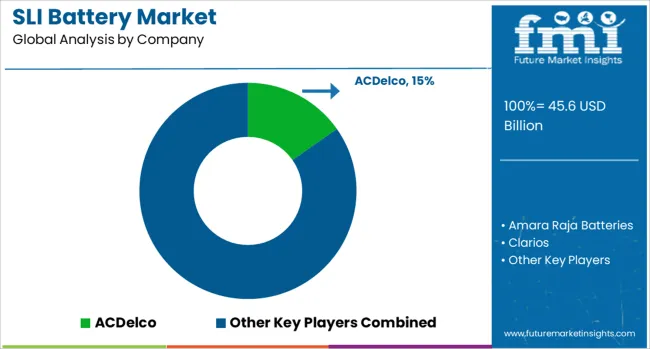

The SLI Battery Market is estimated to be valued at USD 45.6 billion in 2025 and is projected to reach USD 56.7 billion by 2035, registering a compound annual growth rate (CAGR) of 2.2% over the forecast period. From 2020 to 2024, the market is in the early adoption phase, growing from USD 40.9–44.6 billion. Growth during this period is restrained by traditional lead-acid dominance and the gradual uptake of advanced technologies. Conventional lead-acid SLI batteries dominate, while enhanced AGM (Absorbent Glass Mat) and EFB (Enhanced Flooded Battery) technologies, analogous to “Electric Hydraulic” and “EPS” innovations in voltage regulation, see limited niche adoption in premium automotive and fleet applications. From 2025–2030, the market enters the scaling phase, with revenues rising from USD 45.6–50.8 billion at a CAGR of 2.2%. During this stage, AGM and EFB technologies gain broader acceptance due to improved cycle life, performance under start-stop conditions, and environmental benefits. Conventional flooded lead-acid batteries continue to dominate the mainstream, especially in cost-sensitive vehicles. Between 2030 and 2035, the market moves into consolidation, with growth moderating to USD 56.7 billion as adoption saturates in mature markets. Advanced segments like AGM and EFB reach widespread deployment in passenger and commercial vehicles, while traditional flooded batteries stabilize in legacy applications. The overall market maturity curve is sigmoid-shaped, reflecting early experimentation, moderate expansion, and eventual stabilization, with technology segments mapped according to performance, cost, and adoption readiness.

| Metric | Value |

|---|---|

| SLI Battery Market Estimated Value in (2025 E) | USD 45.6 billion |

| SLI Battery Market Forecast Value in (2035 F) | USD 56.7 billion |

| Forecast CAGR (2025 to 2035) | 2.2% |

The SLI battery market is experiencing consistent growth influenced by the rising demand for reliable starting, lighting, and ignition solutions across automotive and industrial sectors. Flooded battery technology has remained a mainstay due to its cost-effectiveness, robust performance, and ease of maintenance, which continues to appeal to a broad range of end users. The growing focus on vehicle durability, extended service intervals, and affordability supports the sustained preference for flooded batteries in many markets.

Additionally, the expansion of original equipment manufacturer (OEM) sales channels is facilitating direct and timely distribution of batteries, ensuring alignment with vehicle manufacturing cycles and aftermarket support. The emphasis on integrating advanced battery management systems and improving electrolyte formulations is gradually enhancing the efficiency and life span of flooded batteries.

Market growth is also being supported by increasing automotive production and rising demand for commercial vehicles, especially in emerging economies. The future outlook anticipates steady adoption of flooded technology alongside evolving sales channel strategies that leverage OEM partnerships and service networks.

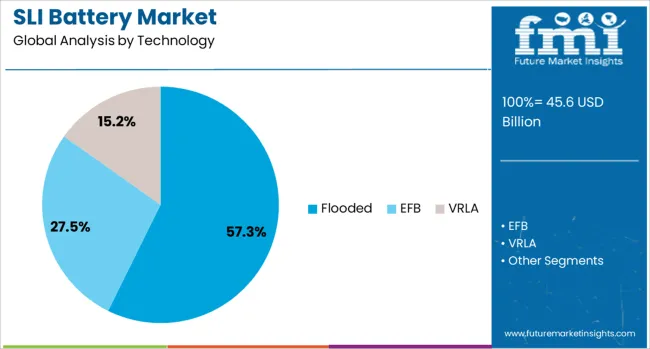

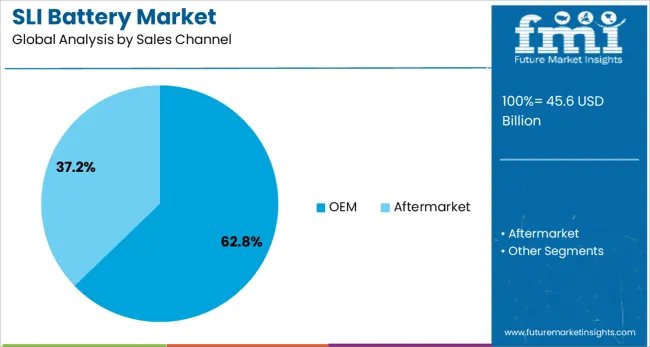

The SLI battery market is segmented by technology sales channel, and geographic regions. By technology, the SLI battery market is divided into Flooded and EFBVRLA. In terms of the sales channel, the SLI battery market is classified into OEM and market. Regionally, the SLI battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Flooded battery technology is expected to hold 57.3% of the total revenue share in the SLI battery market by 2025, reflecting its sustained dominance. This prominence is primarily attributed to the mature technology’s reliability, cost efficiency, and established manufacturing infrastructure.

Flooded batteries provide effective performance in a wide range of climatic and operational conditions, which has led to their continued preference in commercial and passenger vehicle applications. Their simpler design allows for easier maintenance and longer service life when properly managed, supporting cost-sensitive markets.

The segment’s growth is further reinforced by ongoing enhancements in battery design and electrolyte chemistry, improving charge retention and cycle durability. Additionally, widespread acceptance among original equipment manufacturers due to proven track records and compatibility with existing vehicle platforms underpins the segment’s leading position.

The original equipment manufacturer (OEM) sales channel is projected to command 62.8% of the SLI battery market revenue share in 2025, establishing it as the dominant distribution pathway. This is largely due to OEMs’ integral role in vehicle assembly processes, where batteries are sourced directly to ensure quality control and supply chain efficiency.

The OEM channel enables close alignment between battery specifications and vehicle requirements, facilitating integration with onboard electrical systems and battery management technologies. Furthermore, direct procurement through OEMs reduces the risk of counterfeit products and enhances warranty support, thereby increasing customer confidence.

The channel benefits from strategic partnerships and long-term contracts that provide steady revenue streams and support after-sales service. The prominence of OEM sales is also driven by expanding automotive production volumes globally and the preference of manufacturers to standardize battery sourcing within their supply chains.

The SLI (Starting, Lighting, and Ignition) battery market is growing steadily due to increasing demand for reliable automotive power solutions. These batteries provide critical support for vehicle starting, lighting, and ignition systems across passenger cars, commercial vehicles, and two-wheelers. Rising vehicle production, replacement demand, and focus on vehicle safety are driving market adoption. Asia-Pacific leads due to high automotive manufacturing and sales, while North America and Europe emphasize high-performance and maintenance-free SLI batteries. Technological improvements in durability and cold-start performance further enhance market growth.

SLI batteries are essential for ensuring smooth engine starts and consistent electrical supply to lighting and ignition systems. Increasing vehicle ownership and replacement needs are boosting demand, particularly in regions with extreme weather conditions, which require reliable cold-start performance. Commercial fleets, construction vehicles, and passenger cars depend on high-quality SLI batteries to minimize downtime and maintenance costs. OEMs are increasingly specifying maintenance-free and sealed designs to enhance convenience and safety. The growing focus on vehicle reliability and user safety continues to drive adoption of advanced SLI battery solutions across global automotive markets.

Manufacturers are developing SLI batteries with enhanced charge retention, longer service life, and superior cold-cranking ability. Innovations in lead-acid designs, advanced separators, and optimized electrolyte formulations improve performance under extreme conditions. Maintenance-free and valve-regulated lead-acid (VRLA) technologies are gaining popularity for their ease of use and safety. Enhanced durability reduces replacement frequency, lowering long-term costs for vehicle owners. Additionally, integration with start-stop vehicle technologies requires SLI batteries capable of handling frequent charge-discharge cycles. Continuous improvements in performance and reliability are a key factor in market growth.

Asia-Pacific dominates the SLI battery market due to high vehicle production volumes in China, India, Japan, and Southeast Asia. Replacement demand is also significant because of growing vehicle fleets and increasing road penetration. North America and Europe focus on premium and high-performance batteries to meet stringent automotive standards. Regional automotive trends, including fleet expansions and vehicle electrification, shape the types of SLI batteries in demand. Market growth is directly linked to the size of automotive manufacturing, replacement cycles, and regional climate conditions affecting battery performance.

Battery manufacturers are forming collaborations with automotive OEMs, distributors, and aftermarket suppliers to enhance reach and ensure supply reliability. Partnerships support co-development of high-performance batteries, faster market entry for new technologies, and access to replacement networks. Companies are also investing in R&D alliances to improve battery life, cold-start performance, and durability. Collaborative efforts enable adaptation to local regulatory requirements and regional performance expectations. These strategies strengthen brand trust, expand market share, and allow manufacturers to remain competitive in the rapidly evolving automotive power solutions landscape.

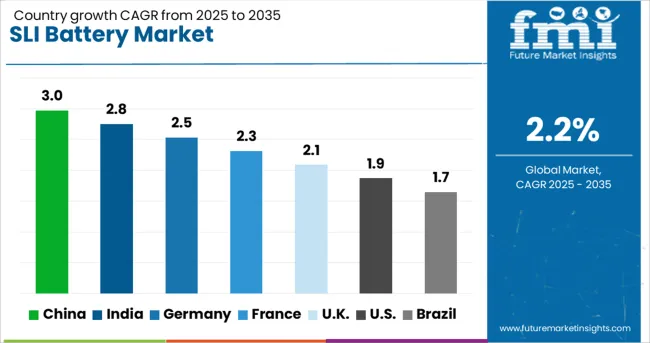

| Country | CAGR |

|---|---|

| China | 3.0% |

| India | 2.8% |

| Germany | 2.5% |

| France | 2.3% |

| UK | 2.1% |

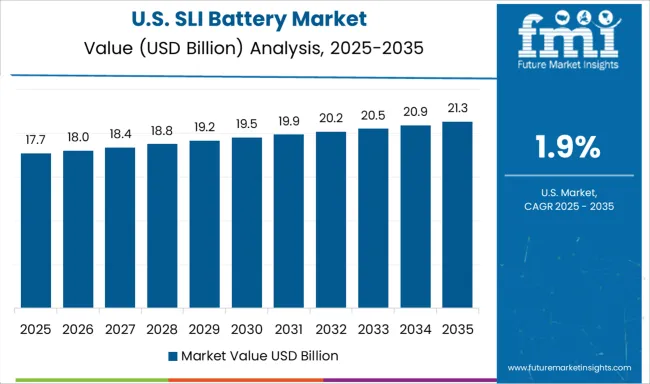

| USA | 1.9% |

| Brazil | 1.7% |

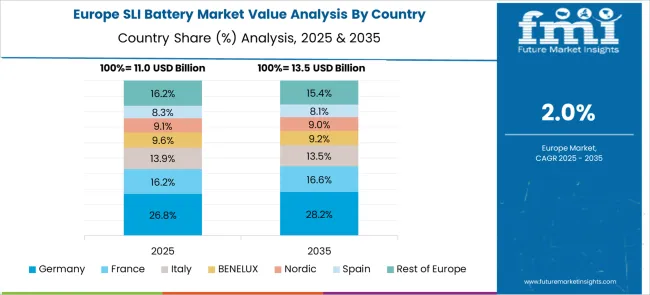

The SLI (Starting, Lighting, and Ignition) battery market is projected to grow at a modest CAGR of 2.2%, reflecting steady demand from automotive and commercial vehicle sectors. China leads with a growth rate of 3.0%, supported by its large-scale automotive production and increasing vehicle electrification. India follows at 2.8%, driven by expanding vehicle sales and a growing aftermarket for replacement batteries. Germany, growing at 2.5%, relies on high-quality manufacturing and technological expertise to serve European markets. The UK, with 2.1% growth, focuses on reliable automotive battery supply chains, while the USA, at 1.9%, maintains demand through replacement and commercial vehicle segments. This report includes insights on 40+ countries; the top countries are shown here for reference. The market reflects stable expansion, largely supported by automotive and industrial requirements.

China leads the SLI (Starting, Lighting, Ignition) battery market with a 3.0% growth rate. Market expansion is driven by increasing vehicle production, especially passenger cars and commercial vehicles, which rely heavily on reliable SLI batteries. Compared to India, China benefits from larger automotive manufacturing hubs and strong domestic supply chains. Government incentives supporting electric and hybrid vehicles further boost demand, as many SLI batteries are integrated into start-stop systems. Technological advancements in battery design improve efficiency, lifespan, and environmental compliance. Local manufacturers are expanding production capacities while incorporating high-quality materials to meet growing domestic and export requirements. Rising awareness among consumers about battery maintenance and replacement also contributes to steady growth. China remains a dominant market, benefiting from robust automotive infrastructure, strong supply networks, and a growing preference for reliable, high-performance SLI batteries.

India’s SLI battery market grows at 2.8%, driven by rising automotive production and increased vehicle electrification. Compared to Germany, India focuses on cost-effective battery solutions suitable for domestic passenger vehicles and commercial trucks. Growth in two-wheelers and small commercial vehicles also contributes to demand. Government initiatives to promote electric mobility and stricter emission norms indirectly increase reliance on high-quality batteries. Local manufacturers are investing in improving production efficiency, extending battery lifespan, and integrating better materials to meet consumer expectations. Awareness about battery maintenance and recycling is increasing, influencing market dynamics. The Indian market’s growth is further supported by the expanding automotive service sector, which demands reliable battery replacements and maintenance. As vehicle production and electrification increase, the SLI battery market in India is expected to experience steady growth, supported by domestic manufacturing expansion and rising consumer awareness.

Germany shows a 2.5% growth rate in the SLI battery market, fueled by stringent automotive standards and advanced vehicle technologies. Compared to the United Kingdom, Germany emphasizes high-performance and environmentally friendly batteries for premium cars and commercial fleets. The rise of start-stop vehicles and hybrid systems increases demand for long-lasting, reliable SLI batteries. Local manufacturers invest heavily in R&D to improve battery efficiency, durability, and recyclability. Germany’s strong automotive export market also supports consistent production and technological upgrades. Consumer preference for sustainable and high-quality products encourages adoption of advanced SLI batteries. Industrial and commercial vehicles further contribute to market demand. Overall, Germany maintains a steady SLI battery market growth, driven by technological advancements, automotive excellence, and a focus on sustainable energy solutions.

The United States experiences 1.9% growth in the SLI battery market, primarily driven by passenger cars and light commercial vehicles. Compared to China, the US emphasizes high-reliability batteries with advanced monitoring for fleet vehicles. Increasing start-stop and hybrid vehicle adoption supports consistent demand. Automotive service networks and aftermarket battery replacement services further contribute to market growth. Local manufacturers focus on improving lifespan, energy efficiency, and environmentally responsible production. Government regulations on automotive emissions and energy standards indirectly influence battery quality and adoption. Despite moderate growth, the US market continues to rely on innovation, fleet modernization, and consumer awareness to sustain demand for SLI batteries across commercial and passenger vehicles.

The United Kingdom’s SLI battery market grows at 2.1%, supported by commercial and passenger vehicle segments. Compared to the United States, the UK market emphasizes reliable, long-lasting batteries with better energy efficiency. Increasing adoption of start-stop vehicles and hybrid technologies encourages battery upgrades. Manufacturers focus on compact, high-performance designs to meet space and performance requirements. Growth in vehicle fleet management, logistics, and electric mobility also stimulates demand. Awareness about battery replacement cycles and recycling is driving consumer adoption. Technological advancements in battery chemistry and monitoring systems ensure improved performance and reliability. Despite modest growth compared to China or India, the UK SLI battery market maintains steady progress due to automotive standards, consumer focus on reliability, and increasing fleet modernization initiatives.

Key players, including Johnson Controls, GS Yuasa, Exide, EnerSys, Amara Raja, and East Penn, have adopted multi-pronged strategies to strengthen competitiveness. Heavy investments are being directed toward advanced manufacturing capabilities, with improvements in automation, grid alloys, and plate technology enhancing performance. The focus on AGM and EFB technologies has grown significantly to cater to vehicles with start-stop functionality, a segment where reliability and cycle life are critical. Sustainability has also emerged as a differentiator, with companies prioritizing lead recycling, closed-loop processes, and environmentally conscious sourcing. Another defining strategy involves the integration of digital diagnostics, enabling better monitoring of battery life and enhancing predictive maintenance. Strategic collaborations and geographic expansion remain core to growth, as highlighted by new hybrid-ready battery development partnerships, capacity expansions in Southeast Asia, and strengthened alliances with local automotive OEMs across South America and Africa. These strategies underscore a market defined by technological differentiation, regional expansion, and sustainability-driven practices, ensuring that both global leaders and regional players remain well-positioned to capture demand in an evolving automotive ecosystem. With the global rise in vehicle production, increasing demand for reliable automotive batteries, and expansion in commercial and industrial vehicle fleets, the SLI battery market has seen steady growth. ACDelco is a leading supplier known for high-performance automotive batteries that combine durability and reliability. Amara Raja Batteries is a prominent player in India and other emerging markets, offering advanced lead-acid batteries for diverse automotive applications. Clarios, formerly Johnson Controls Power Solutions, is a global leader providing technologically advanced batteries with enhanced lifespan and efficiency.

Exide Industries and EnerSys have strong market presence, supplying batteries for passenger vehicles, commercial transport, and industrial applications. GS Yuasa and East Penn Manufacturing are recognized for their innovation in battery chemistry, ensuring high energy density, long service life, and robust performance under extreme conditions. Other notable players include Banner Batteries, Camel Group, Chaowei Power, Continental Battery Systems, Discover Battery, Acumuladores Moura, FIAMM Energy Technology, Furukawa Battery, Erdil Battery, Fengfan, and First National Battery, which focus on regional dominance, product diversification, and technological advancements. The market is driven by increasing automotive production, growing demand for durable and maintenance-free batteries, and expansion in commercial vehicle fleets. Ongoing innovations, such as enhanced lead-acid technology and integration with start-stop systems, are further strengthening the position of these key players globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.6 Billion |

| Technology | Flooded, EFB, and VRLA |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ACDelco, Amara Raja Batteries, Clarios, Exide Industries, EnerSys, GS Yuasa, East Penn Manufacturing, Banner Batteries, Camel Group, Chaowei Power, Continental Battery Systems, Discover Battery, Acumuladores Moura, FIAMM Energy Technology, Furukawa Battery, Erdil Battery, Fengfan, and First National Battery |

| Additional Attributes | Dollar sales in the SLI Battery Market vary by type including lead-acid and absorbed glass mat batteries, application across passenger vehicles, commercial vehicles, and two-wheelers, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising vehicle production, demand for reliable starting, lighting, and ignition systems, and technological advancements in battery efficiency. |

The global SLI battery market is estimated to be valued at USD 45.6 billion in 2025.

The market size for the SLI battery market is projected to reach USD 56.7 billion by 2035.

The SLI battery market is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in SLI battery market are flooded, efb, vrla, _agm and _gel.

In terms of sales channel, oem segment to command 62.8% share in the SLI battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VRLA SLI Battery Market Size and Share Forecast Outlook 2025 to 2035

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Slip Lid Can Market Size and Share Forecast Outlook 2025 to 2035

Slide Top Tins Market Size and Share Forecast Outlook 2025 to 2035

Slip Cover Cans Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Slingshot/3 Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Sliding Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Slideway Oil Market Size and Share Forecast Outlook 2025 to 2035

Sliding Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Slider Pouches Market Size and Share Forecast Outlook 2025 to 2035

Slimming Tea Market Size and Share Forecast Outlook 2025 to 2035

Slider Bags Market Size and Share Forecast Outlook 2025 to 2035

Slip Tip Syringe Market Size and Share Forecast Outlook 2025 to 2035

Slipcases Market Size and Share Forecast Outlook 2025 to 2035

Slide tray box market Size, Share & Forecast 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Slippery Elm Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA