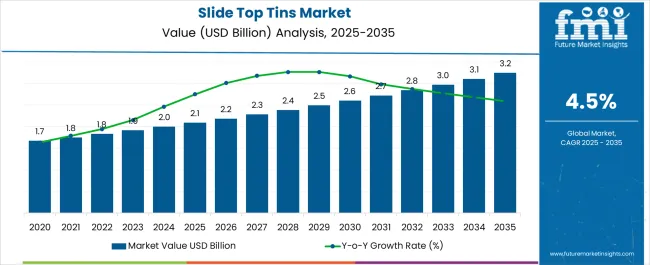

The Slide Top Tins Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Slide Top Tins Market Estimated Value in (2025 E) | USD 2.1 billion |

| Slide Top Tins Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Top Tins market is gaining momentum as consumer preferences shift toward convenient, durable, and visually appealing packaging solutions across industries such as confectionery, bakery, and specialty goods. Growing emphasis on product preservation, brand visibility, and eco-friendly materials has positioned tins as a premium packaging option. These containers provide strong resistance to moisture, light, and external damage, making them highly effective in extending product shelf life.

Manufacturers are focusing on lightweight but sturdy designs, ensuring ease of transport while maintaining durability. Increasing demand for recyclable and reusable packaging is further influencing market trends, as tins align well with sustainability initiatives adopted by global brands. Customizable printing and embossing technologies are also expanding their role in brand differentiation, allowing businesses to enhance consumer engagement through unique designs.

E-commerce expansion is accelerating demand for packaging that balances protection and aesthetics, positioning tins as a preferred choice for secure product delivery Rising adoption of premium and specialty goods packaging across developed and emerging markets is expected to sustain growth in the Top Tins market, with strong potential across consumer-centric industries.

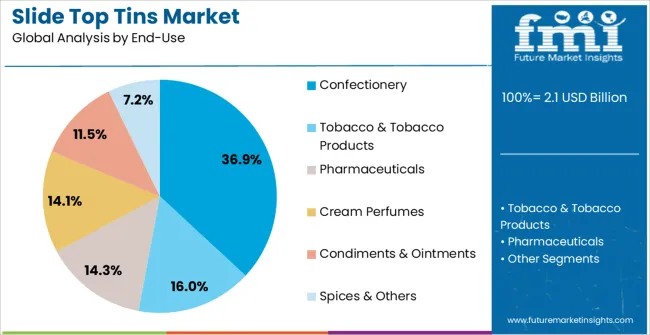

The slide top tins market is segmented by container weight (case of 500 pieces), end-use, and geographic regions. By container weight (case of 500 pieces), slide top tins market is divided into 14 To 20 Lb, 21 To 30 Lb, 31 To 40 Lb, and Above 40 Lb. In terms of end-use, slide top tins market is classified into Confectionery, Tobacco & Tobacco Products, Pharmaceuticals, Cream Perfumes, Condiments & Ointments, and Spices & Others. Regionally, the slide top tins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

.webp)

The 14 to 20 lb container weight segment is projected to hold 42.3% of the Top Tins market revenue in 2025, making it the leading weight category. This dominance is being driven by the segment’s balance of capacity, durability, and practicality in meeting bulk packaging requirements. These containers are widely used in food and confectionery distribution, where maintaining freshness and ensuring secure transportation are critical.

Their medium weight range offers flexibility for storing significant product volumes without compromising handling convenience. Manufacturers favor this segment due to its suitability for automated filling and sealing processes, which enhance operational efficiency. In addition, the segment supports cost-effective shipping and storage, reducing logistics expenses for suppliers.

Growing demand from wholesale and retail channels for reliable packaging that provides both strength and branding opportunities further supports its leadership As packaging standards evolve with rising emphasis on sustainability and consumer convenience, the 14 to 20 lb container weight segment is expected to remain dominant, backed by its proven adaptability and cost-performance balance.

The confectionery end-use segment is anticipated to account for 36.9% of the Top Tins market revenue in 2025, establishing it as the leading application area. Growth in this segment is driven by the increasing popularity of decorative and durable packaging solutions that enhance the appeal of chocolates, candies, and other sweets. Tins are widely used in confectionery due to their ability to preserve freshness, protect delicate items, and provide an attractive presentation that influences consumer purchasing decisions.

Their reusability adds value for consumers, contributing to brand loyalty and repeat purchases. Seasonal demand peaks, such as festive periods and gifting occasions, further reinforce the importance of tins in confectionery packaging strategies. Advances in customization, including embossing, vibrant printing, and windowed designs, are allowing confectionery brands to differentiate themselves in highly competitive markets.

With confectionery sales expanding globally, particularly in emerging economies with rising disposable incomes, the reliance on premium packaging is expected to strengthen As sustainability gains importance, recyclable tins are becoming more attractive, ensuring continued leadership of the confectionery segment in the market.

Slide top tins are also known as slide cover tins. These small tin boxes are manufactured with an inner lip, which securely holds the sliding top lid. This structure helps the user to easily open & close the container. Slide top tins also offer convenient storage solution for medium and smaller items.

Slide top tins market players are highly concentrated by small scale metal work or metal manufacturing companies located in Asia Pacific (APAC) especially in China & Japan. Tin is a lightweight material which offers very good printability.

Due to their attractiveness and lightweight features, slide top tins are gaining popularity to store special products such as tobacco, condiments & ointments, pins & cloth buttons, pharmaceutical drugs, confectionaries and other products.

These are also presented as gifts. Increasing disposable income levels, growing middle class population and changing lifestyle is significantly driving the global slide top tins market. Overall the global Slide top tins market is expected to grow at a lucrative compound annual growth rate (CAGR), during the forecast period.

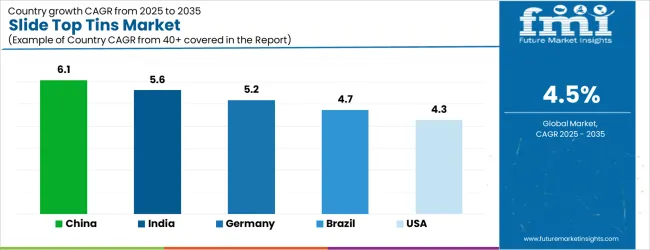

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

| USA | 4.3% |

| UK | 3.8% |

| Japan | 3.4% |

The Slide Top Tins Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Slide Top Tins Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%.

The USA Slide Top Tins Market is estimated to be valued at USD 788.6 million in 2025 and is anticipated to reach a valuation of USD 788.6 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 97.2 million and USD 68.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Container Weight (Case Of 500 Pieces) | 14 To 20 Lb, 21 To 30 Lb, 31 To 40 Lb, and Above 40 Lb |

| End-Use | Confectionery, Tobacco & Tobacco Products, Pharmaceuticals, Cream Perfumes, Condiments & Ointments, and Spices & Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

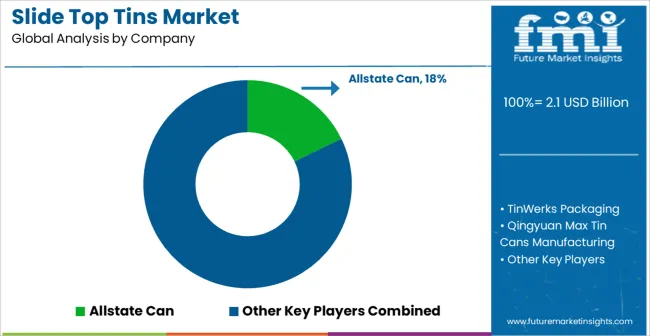

| Key Companies Profiled | Allstate Can, TinWerks Packaging, Qingyuan Max Tin Cans Manufacturing, Yum Tin, Dongguan Tinpak, Independent Can, Dongguan City Xin Yu Tin Can Manufactory, and Tin-Pac Promotional Packaging |

The global slide top tins market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the slide top tins market is projected to reach USD 3.2 billion by 2035.

The slide top tins market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in slide top tins market are 14 to 20 lb, 21 to 30 lb, 31 to 40 lb and above 40 lb.

In terms of end-use, confectionery segment to command 36.9% share in the slide top tins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slideway Oil Market Size and Share Forecast Outlook 2025 to 2035

Slider Pouches Market Size and Share Forecast Outlook 2025 to 2035

Slider Bags Market Size and Share Forecast Outlook 2025 to 2035

Slide tray box market Size, Share & Forecast 2025 to 2035

Market Share Insights for Slider Pouches Providers

Evaluating Slider Bags Market Share & Provider Insights

Linear Slide Units Market Size and Share Forecast Outlook 2025 to 2035

Linear Slides Market

Automotive Drawer Slides Market

Aircraft Evacuation Slide Market

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Top Coated Direct Thermal Printing Films Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

Competitive Breakdown of Top Coated Direct Thermal Printing Films Providers

Top Bottom Packaging Box Market from 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA