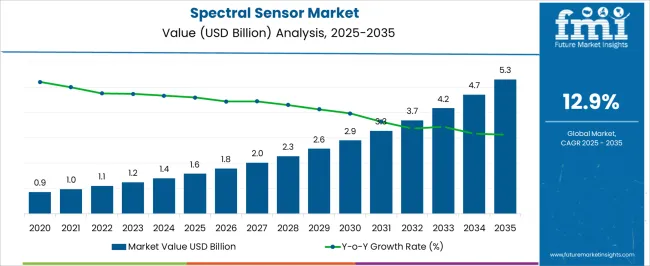

The spectral sensor market is projected to grow from USD 1.6 billion in 2025 to USD 5.3 billion by 2035, representing a CAGR of 12.9%. This growth corresponds to an absolute dollar opportunity of USD 3.7 billion over the decade. The increasing adoption of spectral sensors across agriculture, industrial, and research applications is driving demand. Companies can capitalize on this rapid growth by expanding production, strengthening distribution channels, and enhancing after-sales support.

Over the next ten years, the USD 3.7 billion opportunity highlights a robust growth trajectory for the spectral sensor market. By 2035, revenue will be driven by both new installations and upgrades in existing applications across multiple sectors. The CAGR of 12.9% indicates a high-growth environment, allowing firms to scale operations efficiently and expand regional presence.

Companies can focus on aligning sales, service, and supply chain strategies with market demand to maximize returns. The absolute growth potential provides strong incentives for stakeholders to optimize operational efficiency while capturing incremental revenue throughout the forecast period.

| Metric | Value |

|---|---|

| Spectral Sensor Market Estimated Value in (2025 E) | USD 1.6 billion |

| Spectral Sensor Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 12.9% |

In the early growth phase of the spectral sensor market, revenue expands steadily from USD 1.6 billion in 2025, reflecting a CAGR of 12.9%. Growth during this period is primarily driven by initial adoption in agriculture, industrial monitoring, and research applications. Companies focus on establishing supply chains, building distribution networks, and cultivating customer relationships to ensure consistent demand. The absolute dollar opportunity in this phase is moderate, allowing firms to test strategies, optimize operations, and respond to market feedback.

In the late growth phase, approaching 2035 and a market size of USD 5.3 billion, the spectral sensor market experiences accelerated revenue capture due to widespread adoption and upgrades of existing systems. Market strategies shift toward scaling production, expanding regional reach, and leveraging established client networks. The absolute dollar opportunity in this stage is significant, representing most of the USD 3.7 billion growth over the decade.

Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 12.9% CAGR translates into profitable, sustained growth. Late growth reflects a mature stage where market share optimization and service reliability are critical for long-term success.

The spectral sensor market is witnessing robust growth due to the expanding applications across precision agriculture, medical diagnostics, and remote sensing. Increasing demand for high-resolution imaging and real-time data acquisition in industrial and scientific settings is boosting the adoption of advanced spectral sensing technologies.

Government support for agricultural modernization and environmental monitoring, coupled with technological improvements in sensor miniaturization and spectral range, is further accelerating market uptake. As industries shift toward automation and data-driven processes, spectral sensors are becoming essential tools in quality control, material identification, and health monitoring systems.

Advancements in AI-powered spectral analysis are also enhancing the utility and scalability of spectral sensors across new and emerging use cases.

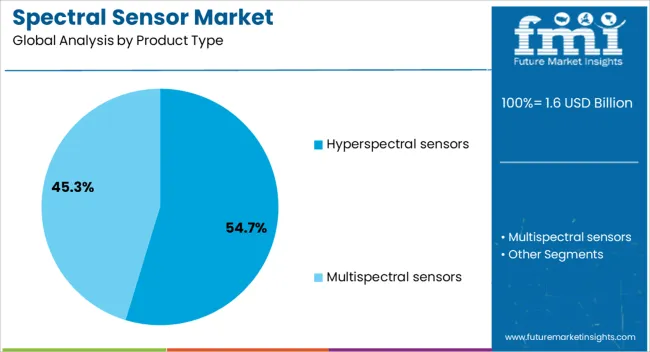

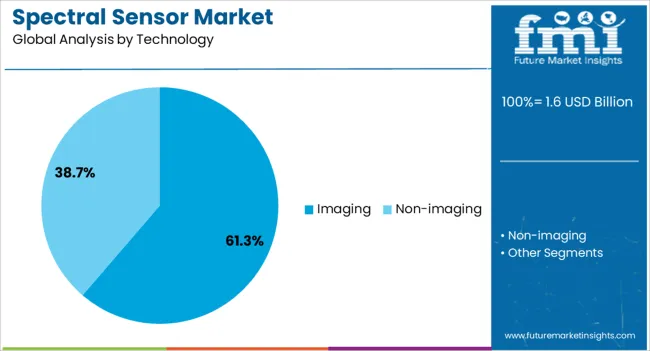

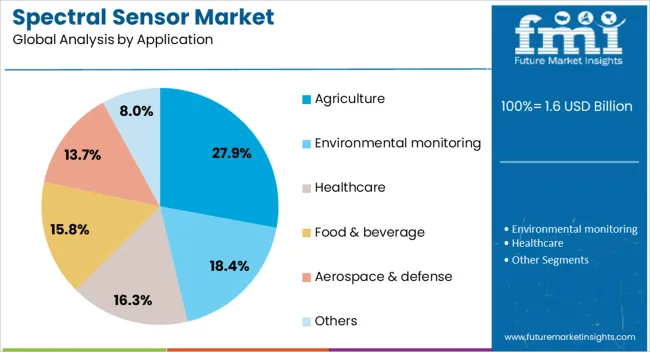

The spectral sensor market is segmented by product type, technology, application, and geographic regions. By product type, spectral sensor market is divided into Hyperspectral sensors and Multispectral sensors. In terms of technology, spectral sensor market is classified into Imaging and Non-imaging. Based on application, spectral sensor market is segmented into Agriculture, Environmental monitoring, Healthcare, Food & beverage, Aerospace & defense, and Others.

Regionally, the spectral sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hyperspectral sensors are projected to dominate the product landscape in 2025, capturing a 54.7% share of the spectral sensor market. These sensors provide detailed spectral information across hundreds of contiguous bands, making them ideal for applications requiring high-resolution material identification.

Their ability to distinguish subtle differences in surface composition and chemical properties positions them as essential tools in scientific research, environmental studies, and precision manufacturing. Rapid developments in compact, UAV-compatible hyperspectral systems have further expanded their adoption in field applications.

As industries increasingly rely on data-rich imaging systems for automation and analysis, hyperspectral sensors are expected to maintain a technological and commercial edge in the market.

Imaging technology is forecast to lead the market with a 61.3% share in 2025, driven by its widespread use in remote sensing, agriculture, medical diagnostics, and industrial inspection. Imaging-based spectral sensors offer enhanced visualization and spatial context, allowing users to detect anomalies, assess health conditions, and monitor processes in real time.

The growth of drone-based and satellite imaging platforms has broadened access to spectral imaging across both commercial and government sectors. Continuous improvements in image processing, edge computing, and storage capabilities are enhancing the precision and efficiency of imaging systems.

This momentum is further fueled by the rising integration of spectral imaging in automated quality control systems and smart manufacturing environments.

Agriculture is anticipated to emerge as the leading application segment, holding 27.9% of the spectral sensor market share by 2025. The adoption of spectral sensors in agriculture is being propelled by the demand for precision farming, where real-time crop monitoring, soil analysis, and yield estimation are critical for improving productivity and sustainability.

Spectral sensors enable non-invasive, data-driven decisions that enhance resource efficiency, reduce chemical usage, and improve crop health assessments. As governments and agri-tech firms increasingly invest in smart farming solutions, spectral sensors are becoming indispensable tools for addressing food security, climate adaptation, and supply chain optimization.

Their integration into UAVs and ground equipment is accelerating widespread adoption in both developed and emerging agricultural economies.

The spectral sensor market is expanding as industries increasingly adopt precision sensing technologies for applications in agriculture, food processing, pharmaceuticals, environmental monitoring, and industrial quality control. Spectral sensors analyze light absorption, reflection, and transmission across multiple wavelengths to detect chemical composition, moisture levels, or color quality in real time.

Rising demand for automated monitoring, IoT-enabled smart systems, and data-driven decision-making is driving adoption. Manufacturers offering compact, high-accuracy, and multi-spectral sensing solutions with seamless integration into production lines, drones, and handheld devices are well-positioned to capture market growth. Applications in precision agriculture, laboratory analysis, and industrial process monitoring highlight the versatility and critical role of spectral sensors in improving efficiency, quality, and compliance.

Market growth is constrained by the high costs of spectral sensors and the technical expertise required for calibration, deployment, and data interpretation. Multi-spectral and hyperspectral sensors often require advanced optics, precise detectors, and signal processing components, increasing manufacturing expenses. End-users must have trained personnel to analyze spectral data accurately, limiting adoption among smaller enterprises or cost-sensitive industries.

Integration with existing monitoring or automation systems may require additional hardware or software, further increasing complexity. Manufacturers are addressing these challenges by developing modular, easy-to-calibrate sensors, providing analytics software, and offering training or technical support. Reducing costs while maintaining precision is critical to expand adoption in agriculture, industrial, and environmental monitoring applications globally.

The market is shaped by IoT integration, drone-mounted sensors, and precision analytics trends. Spectral sensors are increasingly incorporated into smart agriculture systems to monitor crop health, soil conditions, and water quality in real time. Drone-based deployment enables large-area scanning with high spatial resolution, while industrial applications use sensors on production lines for quality assurance and process control. Advanced analytics and cloud connectivity allow data-driven decision-making and predictive modeling. These trends demonstrate the market shift toward automation, real-time monitoring, and smart sensing technologies, enhancing efficiency, reducing waste, and improving output quality across agriculture, manufacturing, and environmental monitoring sectors globally.

Opportunities in the spectral sensor market arise from precision agriculture, industrial automation, and environmental monitoring initiatives. Agricultural operators use spectral sensors to detect nutrient deficiencies, monitor crop growth, and optimize irrigation, reducing resource usage and improving yield. Industrial facilities utilize sensors for quality control, chemical composition monitoring, and process optimization. Environmental agencies and laboratories employ spectral sensors to measure water quality, pollution levels, and atmospheric conditions.

Emerging markets with increased automation adoption, sustainability initiatives, and smart farming programs present additional growth potential. Manufacturers offering accurate, versatile, and IoT-compatible spectral sensors with software integration are well-positioned to capitalize on these expanding applications worldwide.

Market growth is restrained by the high costs of optical components, calibration requirements, and intense competition from alternative sensing technologies. Multi-spectral and hyperspectral sensors require precision optics, detectors, and electronics, increasing manufacturing and maintenance expenses. Accurate operation depends on careful calibration and environmental compensation, which may limit adoption among smaller operators.

Competition from lower-cost sensors, colorimeters, and traditional optical devices can reduce market share for premium solutions. Additionally, integrating spectral sensors with existing systems and software platforms may present technical challenges. Until costs decrease, calibration becomes simpler, and differentiation through precision, versatility, and analytics integration is emphasized, adoption may remain focused on industrial, agricultural, and research-intensive applications.

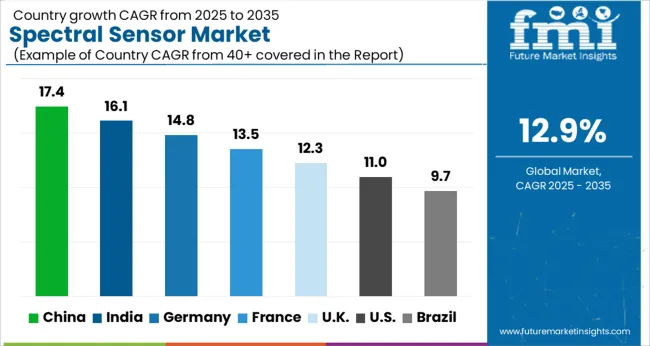

| Country | CAGR |

|---|---|

| China | 17.4% |

| India | 16.1% |

| Germany | 14.8% |

| France | 13.5% |

| UK | 12.3% |

| USA | 11.0% |

| Brazil | 9.7% |

The global spectral sensor market is projected to grow at a CAGR of 12.9% through 2035, driven by demand across agriculture, industrial automation, and environmental monitoring applications. Among BRICS nations, China has been recorded with 17.4% growth, where production and deployment of spectral sensors for precision agriculture, quality inspection, and industrial process monitoring have been extensively carried out by manufacturers such as Hamamatsu Photonics, Avantes, and Ocean Insight. India has been observed at 16.1%, supported by rising adoption in crop monitoring, soil analysis, and industrial sensing solutions. In the OECD region, Germany has been measured at 14.8%, where production for industrial quality control, chemical analysis, and environmental monitoring has been steadily maintained. The United Kingdom has been noted at 12.3%, reflecting growing use in research and laboratory applications, while the USA has been recorded at 11.0%, with deployment in agriculture technology, industrial automation, and environmental monitoring being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for spectral sensors in China is expanding at a CAGR of 17.4%, driven by industrial automation, agriculture technology, and environmental monitoring applications. Manufacturers are supplying spectral sensors for precision agriculture, food quality assessment, chemical analysis, and industrial process monitoring. Government programs supporting smart agriculture, industrial digitization, and environmental monitoring encourage adoption. Pilot implementations in agricultural fields, industrial plants, and research laboratories demonstrate operational benefits including accurate spectral data collection, improved process control, and real-time quality monitoring. Collaborations between sensor manufacturers, agricultural technology companies, and research institutes are enhancing spectral resolution, sensor accuracy, and durability. Growing demand for data-driven agricultural practices and automated industrial systems continues to drive the Chinese spectral sensor market.

The market for spectral sensors in India is projected to grow at a CAGR of 16.1%, supported by expanding agriculture technology, food safety monitoring, and pharmaceutical quality control. Local and global firms are offering compact spectral sensors for crop assessment, soil monitoring, and industrial inspection. Programs promoting digital agriculture and manufacturing modernization are fostering integration. Demonstrations in farms and production units reveal benefits such as precise crop health data, faster defect detection, and improved product quality. Partnerships with agricultural universities and industrial automation companies are improving sensor miniaturization and calibration accuracy.

The market for spectral sensors in Germany is recording a CAGR of 14.8%, driven by industrial automation, chemical analysis, and research applications. Manufacturers provide high-precision spectral sensors for laboratories, industrial facilities, and agricultural research. Government initiatives supporting industrial digitization, research, and environmental monitoring foster adoption. Pilot projects in research laboratories, industrial plants, and agricultural fields demonstrate operational benefits including accurate spectral data acquisition, improved process efficiency, and better quality monitoring. Collaborations between manufacturers, research institutes, and technology providers enhance spectral resolution, sensor stability, and system integration. Germany’s focus on advanced manufacturing, research, and precision agriculture supports continuous growth in the spectral sensor market.

The market for spectral sensors in the United Kingdom is growing at a CAGR of 12.3%, supported by industrial monitoring, agricultural technology, and environmental applications. Manufacturers supply spectral sensors for food quality testing, chemical analysis, industrial automation, and research. Government initiatives promoting smart agriculture, industrial innovation, and environmental monitoring foster adoption. Pilot deployments in industrial plants, research facilities, and agricultural farms demonstrate benefits including improved spectral measurement accuracy, process optimization, and enhanced data-driven decision-making. Partnerships between manufacturers, research institutions, and agritech companies enhance sensor performance, calibration, and durability. Rising adoption of precision agriculture and automated monitoring systems continues to drive growth in the United Kingdom spectral sensor market.

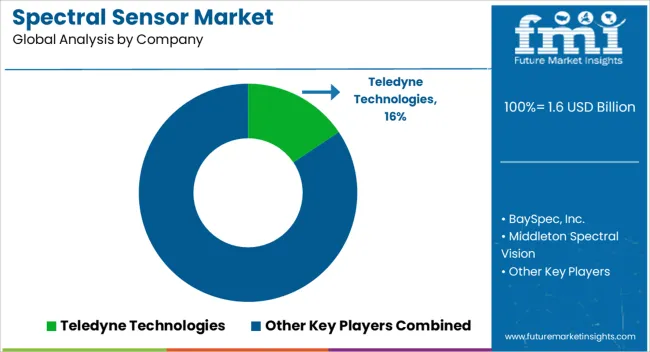

The spectral sensor market shows a competitive and technology-intensive landscape, driven by demand across agriculture, food quality inspection, environmental monitoring, industrial process control, and medical diagnostics. Competition is influenced by sensor sensitivity, spectral range, miniaturization, integration with analytics software, and cost efficiency. Leading companies such as Headwall Photonics, Ocean Insight, Hamamatsu Photonics, Spectral Engines, Corning, and BaySpec compete on high spectral resolution and broad product portfolios. Semiconductor and optoelectronics firms such as Broadcom, Texas Instruments, and ams-OSRAM are active in supplying core components that enable miniaturization and mass production.

Competition also depends on the ability to provide complete solutions, including calibration services, software integration, and field deployment support. Niche players target specific segments such as hyperspectral imaging systems, UAV-based sensors, or compact multispectral modules for precision agriculture. North America leads in research and systems development, Europe focuses on industrial and pharmaceutical use cases, while Asia-Pacific shows rapid expansion due to manufacturing and agri-tech applications. Industry trends include partnerships and acquisitions, a focus on sensor-plus-software offerings, and competition from adjacent compact spectrometry technologies. Companies that can deliver validated performance at competitive cost while supporting integration into end-user workflows are gaining stronger market positions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Hyperspectral sensors and Multispectral sensors |

| Technology | Imaging and Non-imaging |

| Application | Agriculture, Environmental monitoring, Healthcare, Food & beverage, Aerospace & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Teledyne Technologies, BaySpec, Inc., Middleton Spectral Vision, FLIR Systems, Hamamatsu Photonics K.K., Sensors Unlimited (UTC), Hyperspectral Imaging Systems LLC, Raytheon Technologies, BAE Systems, Lockheed Martin, L3Harris Technologies, SRI International, Axiom Semiconductor, Corning Incorporated, and Pepperl+Fuchs, Inc. |

| Additional Attributes | Dollar sales by type including multispectral, hyperspectral, and RGB sensors, application across agriculture, environmental monitoring, industrial inspection, and healthcare, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for precise data collection, advancements in sensor technology, and rising adoption in smart and automated applications. |

The global spectral sensor market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the spectral sensor market is projected to reach USD 5.3 billion by 2035.

The spectral sensor market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in spectral sensor market are hyperspectral sensors and multispectral sensors.

In terms of technology, imaging segment to command 61.3% share in the spectral sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spectral Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Spectral Cell Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Hyperspectral Imaging Market Forecast and Outlook 2025 to 2035

Hyperspectral Imaging Camera Market Size and Share Forecast Outlook 2025 to 2035

Hyperspectral Imaging for Seal Integrity Market Analysis Size and Share Forecast Outlook 2025 to 2035

Medical Hyperspectral Imaging Market - Growth, Demand & Forecast 2024 to 2034

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA