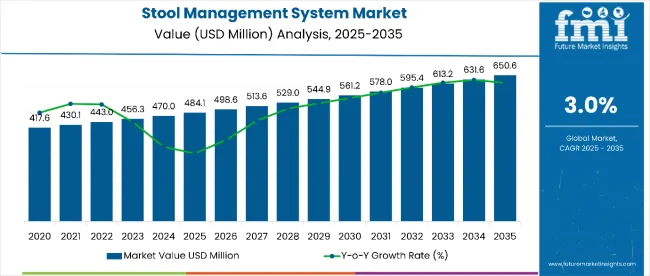

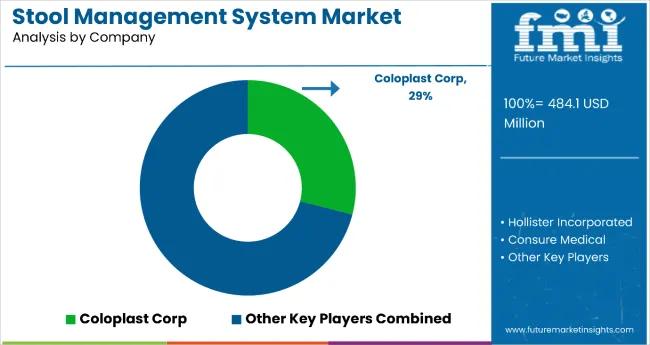

The global stool management system market is valued at USD 484.1 million in 2025 and is slated to be worth USD 650.6 million by 2035, recording an absolute increase of USD 166.5 million over the forecast period. This translates into a total growth of 34.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.34X during the same period, supported by rising prevalence of fecal incontinence, growing aging population, and increasing awareness of bowel hygiene and non-invasive treatment options.

Stool Management System Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 484.1 million |

| Forecast Value in (2035F) | USD 650.6 million |

| Forecast CAGR (2025 to 2035) | 3.0% |

Between 2020 and 2025, the stool management system market experienced steady expansion, driven by increasing prevalence of neurological disorders and growing awareness of bowel dysfunction management. The market developed as healthcare providers recognized the need for effective fecal incontinence solutions to improve patient outcomes and reduce healthcare costs. Clinical evidence and dermatologist recommendations began emphasizing the importance of proper stool management systems in preventing skin complications and improving quality of life for patients with bowel dysfunction.

Between 2025 and 2030, the stool management system market is projected to expand from USD 484.1 million to USD 562.4 million, resulting in a value increase of USD 78.3 million, which represents 47.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about bowel management benefits, increasing demand for advanced and user-friendly devices, and growing penetration of stool management products in emerging markets. Healthcare facilities are expanding their bowel management product portfolios to address the growing demand for effective fecal incontinence solutions.

From 2030 to 2035, the market is forecast to grow from USD 562.4 million to USD 650.6 million, adding another USD 88.2 million, which constitutes 53.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of home care settings, integration of smart monitoring systems in devices, and development of personalized bowel management solutions. The growing adoption of telehealth services and digital monitoring tools will drive demand for advanced stool management systems with enhanced patient compliance and safety profiles.

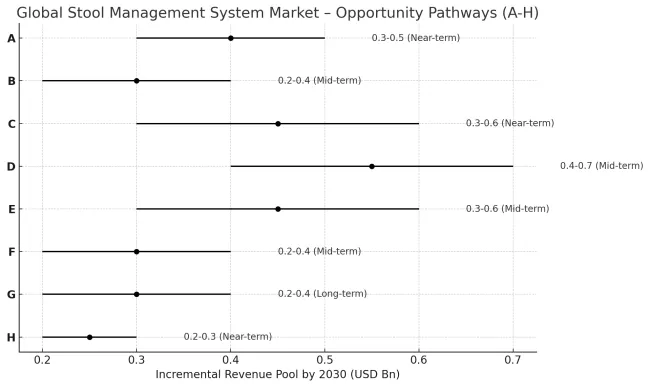

The stool management system market is set for gradual but essential expansion. With rising incidence of fecal incontinence (driven by neurological disorders, aging, chronic illnesses), there is growing demand for better, more dignified, safer, and more comfortable solutions. Hospitals and long-term care facilities are under pressure to reduce infection risks and improve patient outcomes; simultaneously, home care is gaining attention as healthcare shifts away from institutions wherever feasible.

Innovations that boost patient comfort (better materials, adhesives, odor control) and safety (closed systems, infection control) are likely to see early adoption. The integration of smart features (leak sensors, remote monitoring) will differentiate higher-end offerings. Cost pressures and reimbursement policies will shape adoption especially in emerging markets, while sustainability concerns will gradually influence product designs. Regulatory and educational efforts will be important to raise awareness (by patients, caregivers, healthcare systems) of both the clinical and quality-of-life benefits.

Market expansion is being supported by the rising prevalence of fecal incontinence, especially among patients with neurological disorders such as Parkinson's disease, multiple sclerosis, and spinal cord injuries. The global rise in the aging population, which is more vulnerable to bowel dysfunction, further propels demand for effective bowel management solutions. Modern healthcare providers are increasingly focused on non-invasive treatment options that can improve patient comfort, reduce nursing workload, and prevent skin complications.

The growing emphasis on infection control and hygiene protocols is driving demand for advanced stool management systems that provide better containment and reduced risk of healthcare-associated infections. Healthcare facilities' preference for clinical-grade devices that meet stringent safety standards and provide measurable improvements in patient outcomes is creating opportunities for innovative formulations. The rising influence of evidence-based medicine and clinical studies demonstrating cost savings and improved patient satisfaction is also contributing to increased product adoption across different healthcare settings and patient demographics.

The market is segmented by product, age group, end user, and region. By product, the market is divided into transanal irrigation systems and stoma bags. Based on age group, the market is categorized into pediatric and adults. In terms of end user, the market is segmented into hospitals, ambulatory surgical centers, home care settings, and long-term care centers. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

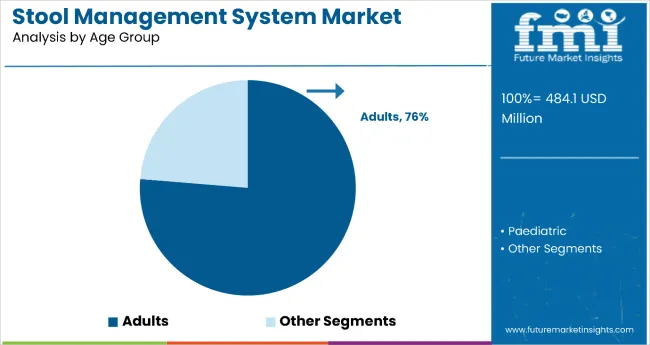

The adults segment is projected to account for 76% of the stool management system market in 2025, reaffirming its position as the category's dominant demographic. This leadership is driven by the aging population and the significantly higher prevalence of fecal incontinence among adults, particularly those aged 45 and above who are more susceptible to chronic conditions such as colorectal cancer, spinal cord injuries, and neurological disorders including Parkinson's disease and multiple sclerosis.

This segment forms the foundation of most market demand, as it represents the population most affected by bowel dysfunction and chronic health conditions. The adult segment benefits from greater awareness, accessibility to advanced medical devices, and wider insurance coverage for fecal management solutions. With increasing geriatric population globally and rising prevalence of conditions requiring bowel management, adults segment aligns with both treatment and preventive healthcare goals. Its broad clinical applications across demographics ensure sustained dominance, making it the central growth driver of stool management system demand.

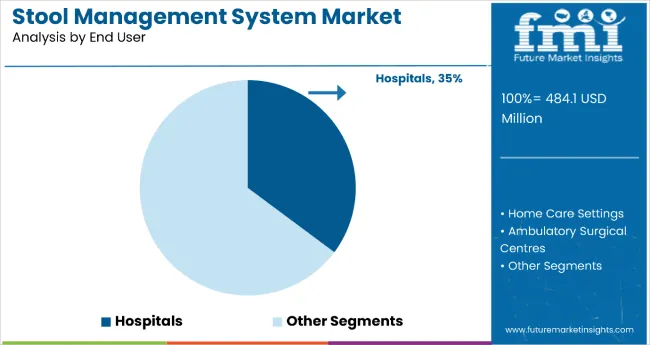

Hospitals are projected to represent 35% of stool management system demand in 2025, underscoring their role as the primary healthcare setting for advanced bowel management solutions. Healthcare providers gravitate toward hospitals for their comprehensive infrastructure, specialized medical staff, and ability to handle complex cases involving stoma care, transanal irrigation, and post-operative bowel dysfunction, maximizing the efficacy of stool management interventions.

The segment is supported by hospitals' enhanced infection control measures, availability of reimbursement frameworks, and preference for clinical-grade stool management systems that meet stringent healthcare standards. Additionally, centralized procurement processes and bulk purchasing agreements strengthen hospitals' position as the leading consumer segment. As healthcare facilities prioritize patient safety, hygiene protocols, and clinical outcomes, hospital-based stool management systems will continue to dominate demand, reinforcing their critical positioning within the bowel management healthcare market.

The stool management system market is advancing steadily due to increasing prevalence of fecal incontinence and growing demand for effective bowel management solutions. However, the market faces challenges including high costs of advanced devices, lack of awareness among healthcare professionals, and competition from alternative bowel management strategies. Innovation in smart monitoring systems and sustainable manufacturing practices continue to influence product development and market expansion patterns.

Clinical Breakthroughs in Stool Management Systems

Recent clinical evidence demonstrates significant improvements in patient outcomes and cost effectiveness of modern stool management systems. Evidence from recent studies underscores their role in improving outcomes for high-risk patients in critical care settings through measurable reductions in skin complications, nursing workload, and overall care costs. Advanced devices incorporating leak prevention technology and skin-friendly materials are showing superior performance in preventing incontinence-associated dermatitis.

Integration of Smart Monitoring Systems and Digital Technologies

Modern stool management system manufacturers are incorporating smart monitoring capabilities, digital tracking features, and telehealth integration to enhance patient compliance and clinical outcomes. These technologies improve device effectiveness while extending usage periods and providing better healthcare provider oversight. Advanced monitoring systems also enable remote patient management and data collection that support evidence-based treatment protocols and improved patient safety.

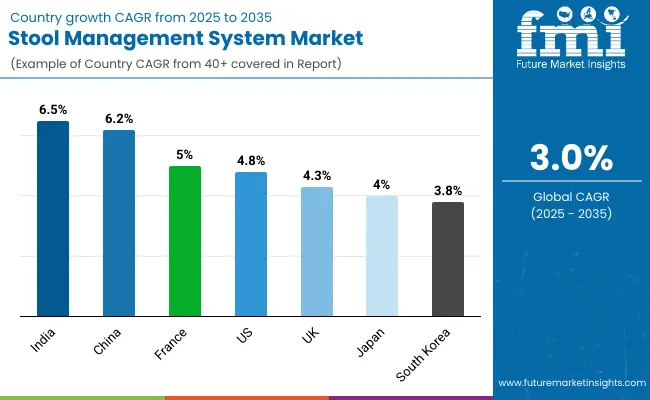

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.5% |

| China | 6.2% |

| France | 5.0% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 4.0% |

| South Korea | 3.8% |

The stool management system market is experiencing moderate growth globally, with India leading at a 6.5% CAGR through 2035, driven by rising prevalence of colorectal cancer, expanding healthcare infrastructure, and increasing awareness of bowel management solutions. China follows closely at 6.2%, supported by aging population demographics, government healthcare initiatives, and growing adoption of modern medical devices. France shows steady growth at 5.0%, focusing on innovative medical solutions and patient-centered care. The United States records 4.8% growth, emphasizing clinical effectiveness and advanced healthcare protocols. The United Kingdom shows growth at 4.3%, focusing on evidence-based healthcare practices and NHS-supported bowel management protocols. Japan demonstrates 4.0% growth, emphasizing advanced medical technology and aging population care. South Korea shows 3.8% growth, prioritizing healthcare innovation and medical device advancement.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from stool management systems in India is expanding at a CAGR of 6.5%, supported by increasing prevalence of colorectal cancer, growing healthcare infrastructure, and rising adoption of advanced medical devices. The country's expanding patient population requiring bowel management solutions and improving access to specialized healthcare are driving demand for effective stool management products. Healthcare facilities and government initiatives are establishing comprehensive care protocols to serve the growing demand for quality bowel management solutions.

Revenue from stool management systems in China is projected to exhibit strong growth with a CAGR of 6.2% through 2035, driven by rapidly aging population and increasing prevalence of conditions requiring bowel management solutions. The country's expanding healthcare system and growing awareness of advanced medical devices are creating significant demand for effective stool management products. Major healthcare facilities and medical device companies are establishing comprehensive distribution networks to serve the growing population requiring specialized bowel management care.

Revenue from stool management systems in France is projected to grow at a CAGR of 5.0% through 2035, driven by emphasis on innovative medical solutions and patient-centered care approaches. French healthcare facilities are implementing comprehensive stool management programs that address diverse patient needs across clinical settings. The country's focus on medical technology advancement and quality healthcare delivery is creating sustained demand for effective bowel management solutions.

Revenue from stool management systems in the US is projected to grow at a CAGR of 4.8%, supported by advanced clinical practices, high healthcare spending, and robust reimbursement frameworks. American healthcare providers are increasingly focused on evidence-based bowel management solutions and clinical outcomes. The market is characterized by strong demand for devices that demonstrate measurable improvements in patient safety and cost effectiveness.

Revenue from stool management systems in the UK is projected to grow at a CAGR of 4.3%, supported by robust healthcare infrastructure, NHS protocols, and evidence-based medical practices. British healthcare providers value clinical effectiveness, cost efficiency, and proven patient outcomes, positioning stool management systems as essential components of comprehensive bowel management protocols. The NHS framework provides structured reimbursement and clinical guidelines that support product adoption across healthcare settings.

Revenue from stool management systems in Japan is projected to grow at a CAGR of 4.0% through 2035, supported by the country's advanced medical technology capabilities and aging population demographics. Japanese healthcare providers prioritize innovative medical devices that deliver superior patient comfort and clinical outcomes. The market benefits from strong healthcare infrastructure and consumer acceptance of advanced medical technologies.

Revenue from stool management systems in South Korea is projected to grow at a CAGR of 3.8% through 2035, supported by the country's focus on healthcare innovation, medical technology advancement, and quality patient care standards. Korean healthcare providers emphasize evidence-based medical practices and advanced device technologies that improve patient outcomes and clinical efficiency.

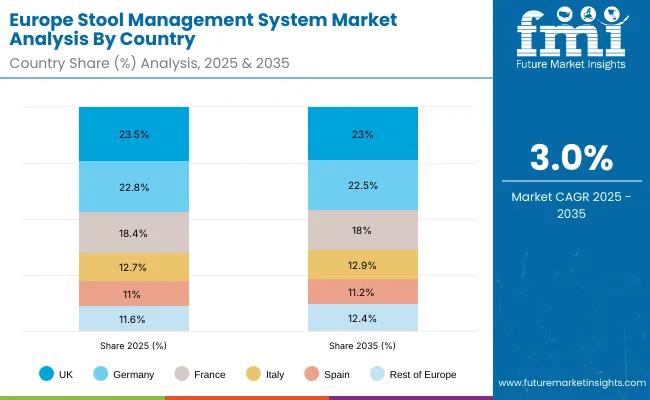

The stool management system market in Europe is projected to grow from USD 135.5 million in 2025 to USD 182.1 million by 2035, registering a CAGR of 3.0% over the forecast period. The United Kingdom is expected to lead the regional market with 23.5% share in 2025, easing slightly to 23.0% by 2035, supported by NHS-led bowel-management protocols, strong hospital adoption, and growing home-care uptake. Germany follows as the second-largest market, accounting for 22.8% in 2025 and dipping to 22.5% by 2035, driven by advanced hospital infrastructure and rapid clinical adoption of infection-control-focused stool-management devices.

France is projected to hold 18.4% in 2025, moderating to 18.0% by 2035, supported by innovation in medical device adoption and patient-centered care programs. Italy contributes 12.7% in 2025, rising slightly to 12.9% by 2035, reflecting expanding long-term care capacity and growing awareness of faecal-incontinence management. Spain accounts for 11.0% in 2025, edging to 11.2% by 2035, as specialized care and home-care services expand. The Rest of Europe (Nordic, BENELUX, Eastern Europe and smaller markets) represents 11.6% in 2025, strengthening to 12.4% by 2035, driven by improving healthcare access, increased procurement of clinical-grade devices, and rising focus on aging-population care.

The stool management system market is characterized by competition among established medical device companies, specialty healthcare manufacturers, and emerging technology-focused players. Companies are investing in advanced device technologies, clinical research, regulatory compliance, and healthcare provider education to deliver effective, safe, and accessible bowel management solutions. Product innovation, clinical evidence, and distribution network expansion are central to strengthening product portfolios and market presence.

Coloplast A/S leads the market with comprehensive stool management product portfolios focusing on patient comfort, clinical effectiveness, and healthcare provider satisfaction. Hollister Incorporated provides innovative bowel management solutions with emphasis on skin protection and device reliability. ConvaTec Group PLC delivers advanced stool management technologies with focus on infection control and patient safety. B. Braun Melsungen AG focuses on clinical-grade devices that meet stringent healthcare standards.

C.R. Bard Inc. and 3M Healthcare provide specialized stool management solutions with emphasis on clinical outcomes and cost effectiveness. Salts Healthcare Ltd. offers patient-centered devices with focus on comfort and ease of use. Marlen Manufacturing & Development Co. provides innovative bowel management technologies with emphasis on product reliability. Welland Medical Limited and Torbot Group Inc. focus on specialized applications and niche market segments with targeted solutions for specific patient populations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 484.1 Million |

| Product | Transanal Irrigation Systems, Stoma Bags |

| Age Group | Pediatric, Adults |

| End User | Hospitals, Ambulatory Surgical Centers, Home Care Settings, Long-Term Care Centers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, South Korea, Australia and 40+ countries |

| Key Companies Profiled | Coloplast A/S, Hollister Incorporated, ConvaTec Group PLC, B. Braun Melsungen AG, C.R. Bard Inc., 3M Healthcare, Salts Healthcare Ltd., Marlen Manufacturing & Development Co., Welland Medical Limited, and Torbot Group Inc. |

| Additional Attributes | Dollar sales by product type and age group, regional demand trends, competitive landscape, clinical evidence and safety protocols, integration with digital monitoring systems, healthcare reimbursement frameworks, and innovations in patient-centered design and infection control technologies |

The stool management system market is expected to be valued at USD 484.1 million in 2025.

The market is projected to reach USD 650.6 million by 2035.

The market is anticipated to grow at a CAGR of 3.0% during the forecast period.

The stoma bags segment is the largest in the stool management system market, accounting for a 63.76% market share in 2025, driven by rising adoption for non-invasive bowel management and ease of use in both clinical and home care settings.

Key manufacturers include Coloplast A/S, Hollister Incorporated, ConvaTec Group PLC, B. Braun Melsungen AG, Welland Medical Limited, Salts Healthcare Ltd., and 3M Company.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Potty Training and Step Stools Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Fleet Management Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA