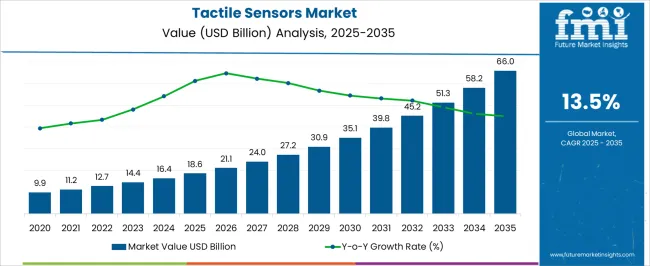

The Tactile Sensors Market is estimated to be valued at USD 18.6 billion in 2025 and is projected to reach USD 66.0 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period. The growth contribution index analysis highlights how this expansion is spread throughout the decade and identifies the key phases where the market’s value contribution accelerates or stabilizes. In the early years, moderate growth is seen as the market transitions from USD 18.6 billion towards USD 29-30 billion by around 2029-2030. During this period, growth contribution is steady, indicating foundational adoption and integration of tactile sensor technologies across key applications. As technological advancements and broader industrial integration gain traction, the market experiences a more pronounced uplift in growth contribution from 2030 onwards.

The latter phase of the forecast period, spanning approximately 2031 to 2035, is marked by higher annual increments in market value, moving towards USD 66.0 billion. This surge in growth contribution is driven by increasing demand in sectors such as robotics, healthcare devices, and automotive systems. The index analysis suggests that the Tactile Sensors Market benefits from compounded growth factors, including innovation and rising industrial automation. The growth contribution index reveals a market trajectory that shifts from steady development into accelerated expansion, making it a strategically important sector for long-term investments focused on emerging sensor technologies.

| Metric | Value |

|---|---|

| Tactile Sensors Market Estimated Value in (2025 E) | USD 18.6 billion |

| Tactile Sensors Market Forecast Value in (2035 F) | USD 66.0 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The tactile sensors market is evolving rapidly with demand driven by robotics, healthcare devices, consumer electronics, and industrial automation. Advancements in soft robotics, prosthetics, and intelligent HMI (human-machine interface) systems are encouraging the adoption of sensitive, scalable tactile sensing solutions.

Integration of AI and real-time signal processing into sensor systems is improving touch sensitivity and interpretability across complex surfaces and applications. Growing miniaturization and energy efficiency of components are allowing for seamless integration into compact devices, including wearables and robotic arms.

Government support for advanced robotics and smart manufacturing, along with continued R&D investments by global sensor manufacturers, is expected to accelerate innovation and cost-efficiency. Future growth will be supported by demand for artificial skin, pressure-sensitive navigation, and multi-modal sensing capabilities in high-precision environments.

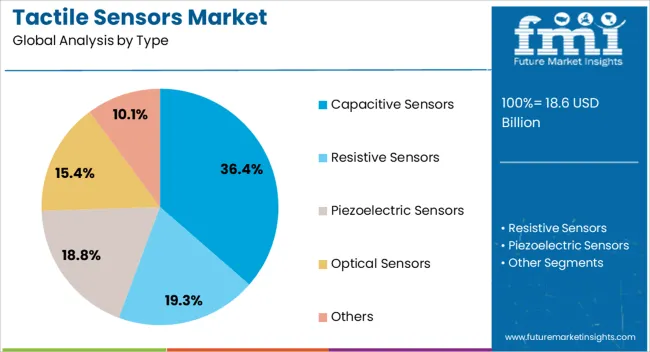

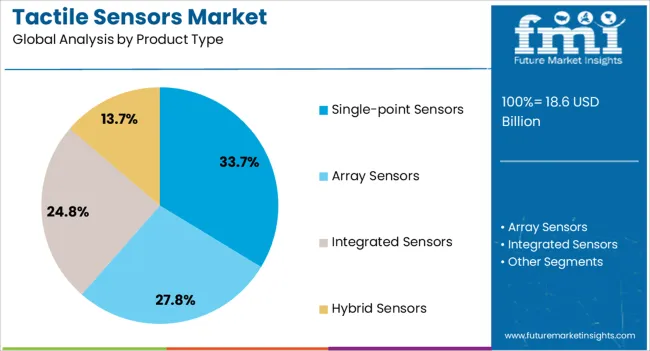

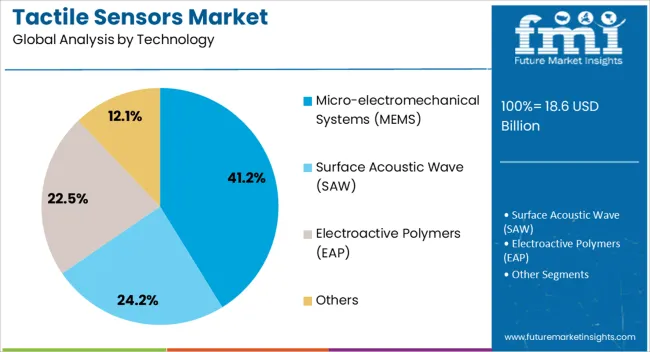

The tactile sensors market is segmented by type, product type, technology, application, and geographic regions. By type, the tactile sensors market is divided into Capacitive Sensors, Resistive Sensors, Piezoelectric Sensors, Optical Sensors, and Others. The tactile sensors market is classified by product type into Single-point Sensors, Array Sensors, Integrated Sensors, and Hybrid Sensors. The tactile sensors market is segmented based on technology into Micro-electromechanical Systems (MEMS), Surface Acoustic Wave (SAW), Electroactive Polymers (EAP), and Others.

The tactile sensors market is segmented into Consumer Electronics, Automotive, Healthcare & Medical Devices, Industrial & Robotics, Industrial automation, Aerospace & Defense, and Others. Regionally, the tactile sensors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Capacitive sensors are projected to account for 36.40% of total market revenue in 2025, positioning them as the dominant type segment in the tactile sensors market. This dominance is being supported by their high sensitivity, low power consumption, and compatibility with flexible substrates, which makes them ideal for next-generation robotic and wearable applications.

The ability to detect fine touch, pressure, and proximity through non-contact methods has enhanced their role in cleanroom and medical-grade devices. As capacitive technology continues to evolve with better noise immunity and multi-touch capabilities, its use in embedded systems, including advanced driver-assistance systems (ADAS) and smart textiles, is expected to rise.

Manufacturing scalability and integration with AI-driven edge processors further reinforce its lead within the tactile sensor domain.

Single-point sensors are expected to contribute 33.70% of the overall revenue in 2025, making them the leading product type in the tactile sensors market. Their prominence stems from widespread usage in precision applications requiring localized pressure detection, such as in robotics grippers, surgical instruments, and touch-enabled surfaces.

Their relatively simple structure enables cost-effective deployment in high-volume use cases without compromising performance. These sensors offer rapid response time, stability, and the ability to function in a variety of material interfaces.

The rise of compact robotics, haptic interfaces, and digital healthcare tools continues to support the demand for single-point tactile input where spatial resolution is not a primary concern, but accuracy and reliability are. Continued improvements in packaging and surface sensitivity are expected to sustain this segment’s growth trajectory.

Micro-electromechanical systems (MEMS) are projected to hold 41.20% of the tactile sensors market share in 2025, emerging as the dominant technology segment. MEMS-based tactile sensors are being adopted for their compactness, reliability, and ability to integrate complex functionalities into micro-scale platforms.

Their inherent advantages in power efficiency, batch manufacturability, and multi-axis force detection make them highly suitable for mobile, biomedical, and robotic applications. As demand grows for intelligent systems with high spatial and temporal resolution, MEMS technologies provide the ideal foundation for scalable, networked tactile sensing.

The technology’s adaptability to various form factors, including flexible and wearable formats, enhances its role in both consumer and industrial domains. Advances in silicon micromachining and packaging processes continue to improve the affordability and ruggedness of MEMS tactile systems, solidifying their leadership in precision sensing.

The market has been experiencing robust growth as advancements in robotics, healthcare, consumer electronics, and automotive sectors drive demand for enhanced touch-sensitive technologies. Tactile sensors enable devices to detect pressure, texture, and force, facilitating precise human-machine interactions and automation processes. Innovations in flexible materials, miniaturization, and multi-axis sensing have expanded application possibilities. Growing adoption in prosthetics, wearable devices, and industrial robots has further fueled market expansion. Despite challenges such as high production costs and integration complexities, ongoing research and development efforts aim to improve sensor sensitivity, durability, and affordability, supporting broader commercialization and diversified use cases.

The rise of industrial automation and collaborative robots (cobots) has significantly increased the need for sophisticated tactile sensing capabilities. These sensors enable robots to perform delicate tasks involving object manipulation, assembly, and quality inspection by providing real-time feedback on contact forces and surface textures. Enhanced tactile perception improves safety in human-robot interaction by allowing robots to adjust force application and avoid damage. In manufacturing, tactile sensors contribute to process optimization and defect detection. The growing reliance on automation in sectors such as electronics, automotive, and logistics is driving investment in advanced tactile sensor technologies, boosting market growth.

Technological progress in flexible electronics and sensor miniaturization has expanded the usability of tactile sensors across diverse devices. Flexible, stretchable sensors made from novel materials like conductive polymers and nanomaterials can conform to complex surfaces, enabling integration into wearable health monitors, prosthetics, and electronic skins. Miniaturized sensor arrays provide high-resolution tactile feedback crucial for precise control in surgical robots and consumer electronics. Improved fabrication techniques reduce production costs and enhance durability. The convergence of flexible design and enhanced sensing performance is broadening the scope of tactile sensors, facilitating adoption in emerging applications that demand lightweight and adaptable solutions.

The healthcare industry is a major adopter of tactile sensor technology, particularly in areas such as prosthetics, rehabilitation devices, and minimally invasive surgical tools. Tactile sensors enable prosthetic limbs to provide sensory feedback, enhancing user control and comfort. In rehabilitation, sensors monitor patient movements and pressure distribution to optimize therapy outcomes. Surgical robots equipped with tactile sensors allow surgeons to sense tissue properties and perform delicate procedures with greater precision. The increasing prevalence of chronic diseases and aging populations has intensified demand for advanced healthcare devices, making tactile sensors integral to next-generation medical technologies and improving patient care quality.

Despite promising applications, the tactile sensors market faces obstacles related to integration complexity, high manufacturing costs, and durability concerns. Embedding tactile sensors into existing systems requires compatibility with hardware and software platforms, which can be technically challenging and resource-intensive. The use of advanced materials and sophisticated fabrication methods contributes to higher product prices, limiting accessibility for cost-sensitive sectors. Sensor degradation over time due to mechanical stress or environmental factors affects reliability and necessitates regular maintenance or replacement. To overcome these barriers, manufacturers are focusing on developing standardized interfaces, cost-effective materials, and robust designs. Increasing economies of scale and ongoing research are expected to alleviate these challenges and promote wider adoption.

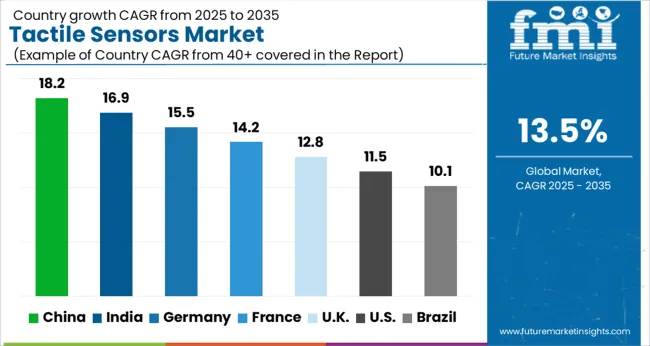

The market is projected to grow at a CAGR of 13.5% from 2025 to 2035, driven by rising demand in robotics, healthcare, and consumer electronics sectors. China leads with an 18.2% CAGR, supported by extensive research investments and rapid adoption in automation. India follows at 16.9%, fueled by growing manufacturing capabilities and increased use in medical devices. Germany, growing at 15.5%, benefits from advanced sensor technologies and strong industrial applications. The UK, at 12.8%, experiences steady growth driven by robotics and AI integration. The USA, with an 11.5% CAGR, reflects innovation in wearable devices and smart systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 18.2% in the tactile sensors market between 2025 and 2035. The demand is driven by rapid integration of tactile sensor technologies in consumer electronics, robotics, and industrial automation. Leading manufacturers such as Huawei and DJI are investing heavily in advanced sensor development to improve haptic feedback and precision control in smart devices. Collaborations with universities and research institutions have accelerated innovation in flexible and wearable tactile sensors. Growth is also propelled by expanding applications in healthcare devices and automotive safety systems. Government incentives for technology adoption in smart manufacturing further strengthen market prospects.

India is anticipated to grow at a CAGR of 16.9%, supported by rising automation in manufacturing and healthcare sectors. Domestic companies like Tata Elxsi and L&T Technology Services focus on designing cost-effective tactile solutions tailored for local industries. The rising adoption of robotics in automotive assembly lines and growing use in prosthetic devices accelerate demand. Government initiatives promoting Make in India and digital health technologies have encouraged investment in sensor development. Increasing startup activity in the IoT and wearable devices segment also contributes significantly to market expansion.

The tactile sensors market in Germany is projected to advance at a CAGR of 15.5% owing to strong industrial automation and automotive sectors. Companies such as Bosch and Siemens are leading innovation in high-precision tactile sensor technologies for manufacturing robots and vehicle safety systems. Demand for sensors in smart factories and quality control applications is rising steadily. Emphasis on Industry 4.0 integration and sensor miniaturization supports market development. Strategic partnerships between manufacturers and research centers further enhance technology readiness and application diversity.

The United Kingdom market is expected to expand at a CAGR of 12.8%, driven by investments in healthcare robotics and consumer electronics. Innovation hubs in the UK are developing tactile sensor applications for surgical robots and wearable haptic devices. Growing demand for enhanced user interfaces in gaming and virtual reality is supporting market growth. Collaborations between academic institutions and industry players are accelerating sensor technology advancements. Government support for digital health and manufacturing innovation encourages adoption across sectors.

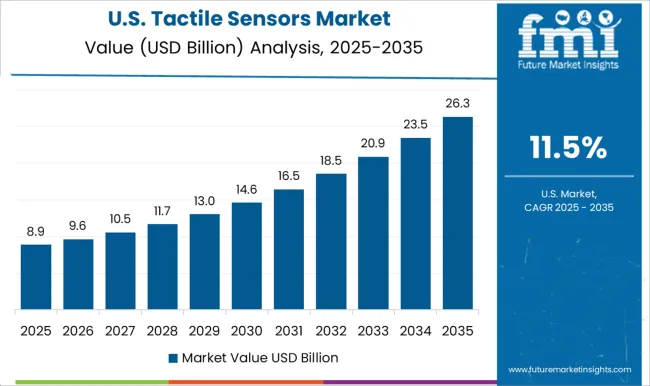

The tactile sensors industry in the United States is forecast to grow at a CAGR of 11.5%, with demand fueled by expanding applications in autonomous vehicles, medical devices, and consumer electronics. Companies such as Texas Instruments and Honeywell are investing in tactile sensor innovations for precision control and safety systems. The rise in wearable technology adoption and advanced robotics research contribute to market expansion. Government initiatives promoting advanced manufacturing and smart technologies have increased investments and accelerated technology commercialization.

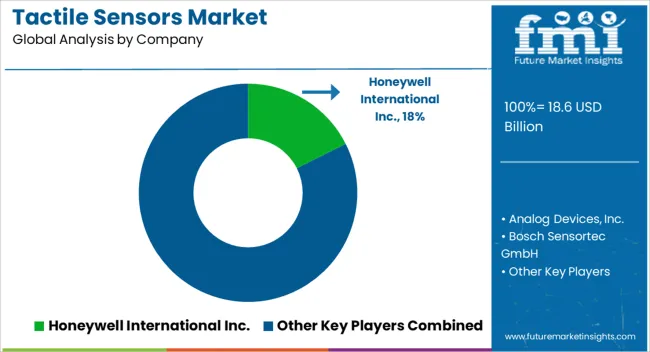

The market is dominated by key technology companies that develop advanced sensing solutions designed for applications in robotics, consumer electronics, healthcare, and automotive sectors. Honeywell International Inc. offers robust tactile sensor technologies known for precision and reliability, supporting industrial automation and safety systems. Analog Devices, Inc. specializes in high-performance sensor interfaces that enable accurate force and pressure detection, facilitating enhanced human-machine interaction. Bosch Sensortec GmbH focuses on miniaturized tactile sensors optimized for mobile devices and wearable technologies, combining compact design with high sensitivity. STMicroelectronics delivers integrated tactile sensing solutions that support diverse applications ranging from touchscreens to advanced robotics, emphasizing low power consumption and high durability. Texas Instruments Incorporated complements the market with analog and mixed-signal processing components that enhance tactile sensor performance and integration capabilities. Market growth is driven by increasing demand for responsive and intuitive interfaces in consumer and industrial devices. Barriers to entry include the need for sophisticated research and development, high manufacturing precision, and compatibility with complex electronic systems. Leading providers maintain competitive advantage through continuous innovation, strategic collaborations, and comprehensive product portfolios.

Companies are working on biocompatible and sensitive tactile feedback systems that offer enhanced sensory input to prosthetic limbs, improving overall user experience and functionality.

Companies in the tactile sensors market, such as Synaptics, Microchip Technology, and Sensonor, are forming strategic partnerships and making acquisitions to expand their product portfolios and gain access to new technological innovations. Collaborations are enabling companies to integrate tactile sensor technologies into a broader range of consumer devices and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.6 Billion |

| Type | Capacitive Sensors, Resistive Sensors, Piezoelectric Sensors, Optical Sensors, and Others |

| Product Type | Single-point Sensors, Array Sensors, Integrated Sensors, and Hybrid Sensors |

| Technology | Micro-electromechanical Systems (MEMS), Surface Acoustic Wave (SAW), Electroactive Polymers (EAP), and Others |

| Application | Consumer Electronics, Automotive, Healthcare & Medical Devices, Industrial & Robotics, Industrial automation, Aerospace & Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., Analog Devices, Inc., Bosch Sensortec GmbH, STMicroelectronics, and Texas Instruments Incorporated |

| Additional Attributes | Dollar sales by sensor type and application area, demand dynamics across robotics, healthcare devices, consumer electronics, and automotive systems, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in flexible materials, multi-modal sensing capabilities, and AI-enabled signal processing, environmental impact of manufacturing waste, material recyclability, and energy consumption, and emerging use cases in prosthetics, human-machine interfaces, and wearable health monitoring. |

The global tactile sensors market is estimated to be valued at USD 18.6 billion in 2025.

The market size for the tactile sensors market is projected to reach USD 66.0 billion by 2035.

The tactile sensors market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in tactile sensors market are capacitive sensors, resistive sensors, piezoelectric sensors, optical sensors and others.

In terms of product type, single-point sensors segment to command 33.7% share in the tactile sensors market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA