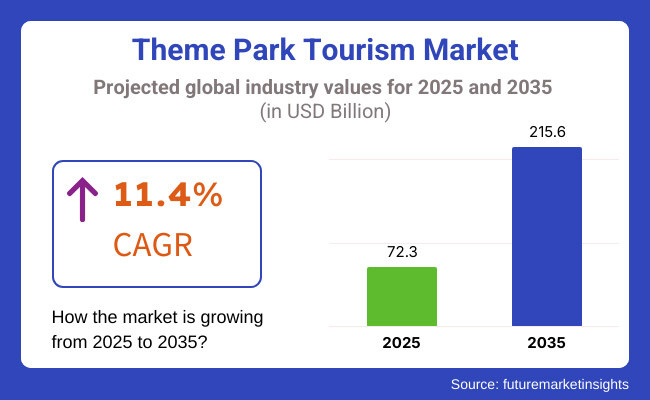

Market Overview The global theme park tourism industry is projected to grow from USD 72.3 billion in 2025 to USD 215.6 billion by 2035. With a CAGR of 11.4% between 2025 and 2035, the market is expanding due to rising disposable income, innovations in theme park attractions, and increasing consumer demand for immersive entertainment experiences.

Theme park operators continue to enhance visitor engagement by incorporating AI-driven attractions, virtual reality (VR) roller coasters, and interactive storytelling-based rides. Disney, Universal Studios, and Six Flags dominate the market with high-tech innovations, offering rides such as Star Wars: Rise of the Resistance, Super Nintendo World, and the record-breaking Kingda Ka coaster.

In China, Shanghai Disneyland's Zootopia-themed land and in the UAE, Ferrari World Abu Dhabi's Mission Ferrari ride exemplify the industry’s commitment to creating unparalleled attractions.

Technology is a dominant driving force behind the industry. AI-based personal park guides, AR-based scavenger hunts, and real-time ride queues in apps improve consumer experiences. Theme parks are also tapping into clean energy sources and AI-based crowd management systems for improving efficiency without compromising on environment.

Key Market Insights Between 2020 and 2024, theme park tourism grew at a 9.2% CAGR, driven by post-pandemic recovery and the return of large-scale tourism. With a projected CAGR of 11.4% from 2025 to 2035, the industry will benefit from increasing investment in smart theme parks, AR-based attractions, and eco-friendly amusement experiences.

| Water Parks (USD Billion) | Theme Park Industry (USD Billion) |

|---|---|

| 2020: 12.5 | 2020: 50.3 |

| 2024: 18.2 | 2024: 65.8 |

| 2025: 21.0 | 2025: 72.3 |

| 2035: 47.5 | 2035: 215.6 |

Water parks have gained popularity due to adventure-based slides, wave pools, and eco-friendly water recycling systems. Destinations such as Dubai's Atlantis Aquaventure, Orlando’s Volcano Bay, and Germany’s Therme Erding have fueled water park expansion, supporting the broader theme park sector.

| Country | Major Theme Park Attractions |

|---|---|

| United States | Disneyland, Universal Studios Orlando, Cedar Point’s record-breaking coasters |

| China | Shanghai Disneyland, Chimelong Ocean Kingdom, OCT Happy Valley |

| Japan | Tokyo Disneyland, Fuji-Q Highland, Ghibli Park |

| France | Disneyland Paris, Parc Asterix, Futuroscope |

| United Arab Emirates | Ferrari World Abu Dhabi, Warner Bros. World, IMG Worlds of Adventure |

| Germany | Europa-Park, Phantasialand, Legoland Deutschland |

| Brazil | Beto Carrero World, Hot Park, Beach Park Resort |

The footprint of the theme park industry is quite different between countries, with tourism policies, disposable income, and cultural choices playing a key role. The United States is the global market leader, hosting world-class theme park brands like Disney Parks and Universal Destinations. These parks welcome millions of tourists every year and generate huge amounts of domestic tourism revenue.

China is a close second, with the swift development of theme park facilities, such as Shanghai Disney Resort and Chimelong Ocean Kingdom. Government backing and a rising middle class drive theme park development in the region. Japan continues to be a strong leader in Asia, with Tokyo DisneySea and Universal Studios Japan providing world-class themed experiences specific to local markets.

In Europe, Germany's Europa-Park and France's Disneyland Paris are still going strong, drawing crowds from all over the continent. The Middle East has emerged as a new player, with Ferrari World Abu Dhabi and Motiongate Dubai introducing high-tech experiences and family entertainment to the region.

Southeast Asia, specifically Singapore and Malaysia, has seen increased investment in theme parks such as Universal Studios Singapore and Genting SkyWorlds. These destinations are regional entertainment complexes that attract tourists from other nearby countries. Latin America and Africa are also continuing to establish their theme park industry, with Brazil and South Africa advancing considerably in the inclusion of culture and eco-tourism into theme park attractions.

Amusement parks remain the benchmark for theme park tourism as they bring together high-speed thrills, immersive stories, and the latest technology. Operators of the parks are pouring money into record-breaking roller coasters, multi-sensory dark rides, and interactive experiences to attract visitors looking for the next level of entertainment.

Disney's Avengers Campus in California brings together real-time character experiences and augmented reality experiences to take visitors to the world of Marvel. Meanwhile, Universal Studios advances innovation with the Jurassic World VelociCoaster, boasting high-speed launches and gravity-defying inversions that reimagine the thrill-seeker experience.

In China, Chimelong Ocean Kingdom mesmerizes visitors with the world's largest aquarium and synchronized dolphin shows, combining conservation with entertainment. In the same vein, Ferrari World Abu Dhabi combines speed and engineering expertise with Formula Rossa, the fastest roller coaster in the world, simulating an F1 experience for visitors.

Theme parks such as Six Flags Magic Mountain and Cedar Point continuously feature coasters with record-breaking drops, inverted loops, and high-speed turns, attracting adrenaline seekers globally.

In addition to rides, amusement parks incorporate technology to enhance guest experiences. AI-driven queue management systems streamline wait times, and interactive wristbands at Disney's Magic Kingdom personalize ride choices and park exploration.

Parks like Efteling in the Netherlands lead the way in sustainability by using solar-powered attractions, showing a dedication to minimizing their environmental impact. Shanghai Disneyland's Zootopia-themed expansion also illustrates how cultural narrative intersects with contemporary entertainment, creating regionally relevant attractions that appeal to global audiences.

With changing visitor expectations, amusement parks continue to adopt innovation, sustainability, and personalization. The convergence of immersive storytelling, AI-based park improvements, and exhilarating rides ensures the amusement park industry remains the driving force behind theme park tourism development.

Families continue to be the prime movers of theme park travel, as they look for active, informative, and fun experiences that are designed for all ages. Theme park owners keep evolving to develop attractions that appeal to kids, parents, and multi-generational families.

Disney and Universal Studios lead in family-friendly attractions by offering interactive experiences that bring beloved stories to life. At Disneyland’s Fantasyland, young visitors board Peter Pan’s Flight, soaring over a reimagined London skyline, or meet their favorite Disney princesses in themed castle settings.

Universal Studios captivates families with The Wizarding World of Harry Potter, where guests sip Butterbeer, cast spells using interactive wands, and ride the Forbidden Journey, a motion-based dark ride that combines animatronics and 3D projections.

Beyond major entertainment brands, theme parks integrate education into their attractions. Legoland parks in California, Denmark, and Malaysia encourage children to explore engineering concepts through hands-on LEGO robotics and design challenges.

At EPCOT’s The Seas with Nemo & Friends, families observe real marine life while learning about ocean conservation. Similarly, Singapore’s Universal Studios features Puss in Boots’ Giant Journey, a coaster with a fairytale narrative designed for young thrill-seekers.

Technology enhances family experiences with personalized interactions. At Nickelodeon Universe in New Jersey, AI-powered systems allow children to talk to animated characters in real-time. In Dubai’s IMG Worlds of Adventure, projection mapping transforms static environments into dynamic storytelling experiences. Meanwhile, Disney’s MagicBand system helps families manage park entry, dining, and ride reservations seamlessly.

Understanding the families' needs, theme parks introduce kid-friendly areas, stroller availability, and food options which take into account allergy concerns. Through customized rides, technological advancement, and participative storytelling, theme parks maintain dominance as the go-to choice for family holidays across the globe.

United States leads the theme park tourism industry, attracting millions of visitors with world-class attractions, cutting-edge technology, and immersive storytelling. Orlando, the theme park capital of the world, welcomes over 75 million tourists annually, driven by Disney World, Universal Orlando, and SeaWorld.

Disney and Universal continue to push boundaries with record-breaking expansions. At Walt Disney World, TRON Lightcycle / Run delivers high-speed thrills with a futuristic aesthetic, while the Star Wars: Galactic Starcruiser hotel immerses guests in a two-night interactive space adventure.

Universal Orlando draws millions with The Wizarding World of Harry Potter, where visitors can experience Hagrid’s Magical Creatures Motorbike Adventure, a multi-launch coaster with animatronics and immersive scenery.

Regional parks also contribute to growth by offering unique attractions. Cedar Point in Ohio, known as the “Roller Coaster Capital of the World,” features record-breaking rides like Steel Vengeance, the world’s tallest and fastest hybrid coaster. In Tennessee, Dollywood blends Appalachian culture with family-friendly coasters, live bluegrass performances, and craft workshops.

Technology is changing the visitor experience. Disney MagicBands permit effortless entry into rides, dining, and hotel stays, and Universal's Virtual Line system streamlines ride waits. Parks also incorporate metaverse-inspired experiences, such as Disneyland's Avengers Campus, where Spider-Man does aerial stunts in an advanced robot figure.

Sustainability is another focus. Solar farms now power portions of Disney World, and SeaWorld Orlando uses AI-driven water filtration to support marine conservation. As theme parks expand, the USA continues to set industry standards by integrating innovation, entertainment, and sustainability to create next-level guest experiences.

China is quickly redeveloping its theme park sector, spending more than USD 50 billion by 2030 to compete with global entertainment destinations. Driven by an expanding middle class, increasing disposable income, and rising domestic tourism, China is set to become the biggest theme park market in terms of visitor arrivals. Global brands and domestic players are competing to increase their footprint with immersive experiences, high-speed roller coasters, and cutting-edge technology.

Shanghai Disneyland, one of China's theme park boom leaders, keeps growing. The park has just opened its Zootopia-themed area, complete with interactive AI-driven animal characters and motion-tracking technology that enables visitors to participate in real-time animated adventures.

The Tron Lightcycle Power Run, a Disney coaster that is among the fastest, combines high-speed excitement with neon-lit digital environments, making it one of the world's most technologically sophisticated rides.

Beijing Universal Resort, another crown jewel, has set a new standard for entertainment experience in China. The park's Jurassic World Adventure ride transports tourists into an incredibly realistic dinosaur world with animatronics and 360-degree projection mapping. Meanwhile, the Transformers Metrobase, the first Transformers-themed land globally, epitomizes China's effort to create unique attractions focused on local pop culture aspiration.

China's indigenous theme park brands are also causing ripples. Chimelong Ocean Kingdom boasts the world's largest aquarium, blending marine conservation with entertainment. The park's Penguin Parade and Dolphin Theatre Show draw millions of visitors every year. OCT Happy Valley, which runs several parks in China, continues to grow with state-of-the-art roller coasters such as Extreme Rusher, one of Asia's fastest launched coasters.

Technology is key to China's theme park growth. Parks increasingly incorporate facial recognition entry systems, crowd management with AI, and virtual queueing based on mobile apps to enhance visitor experiences. Sustainability is also emphasized, with parks investing in solar-powered attractions and water recycling facilities to match China's green agenda.

As China's urban population increases and tourism booms, its theme park sector will further develop, providing next-generation experiences that integrate cultural heritage, international franchises, and technological innovation.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Market Analysis | USD Billion (Value) |

| Key Regions | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Key Segments | Park Type, Visitor Category, Tourist Type, Booking Channel |

| Key Players | Disney, Universal Studios, Merlin Entertainments, Six Flags, Chimelong Group, Cedar Fair |

The global theme park tourism market is valued at USD 65.8 billion in 2024. It is expected to reach USD 72.3 billion by 2025 and expand to USD 215.6 billion by 2035, growing at a CAGR of 11.4%. Major investments in immersive attractions, AI-driven experiences, and themed entertainment fuel this expansion.

Innovative ride technology, increasing disposable income, and growing demand for experiential entertainment drive the market.

Disney, Universal Studios, Merlin Entertainments, Six Flags, Chimelong Group, and Cedar Fair dominate the global market.

Theme parks integrate AI, VR, and AR to create immersive experiences.

Domestic visitors drive attendance, especially in parks like Dollywood in Tennessee, Everland in South Korea, and Chimelong Ocean Kingdom in China.

Theme parks invest in solar-powered attractions, water conservation systems, and green building initiatives.

Visitors seek personalized, high-tech, and culturally immersive experiences.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Revenue Source, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Global Market Attractiveness by Revenue Source, 2023 to 2033

Figure 30: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 64: North America Market Attractiveness by Revenue Source, 2023 to 2033

Figure 65: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 66: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 67: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Revenue Source, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 102: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Revenue Source, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Revenue Source, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Revenue Source, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Revenue Source, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 242: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Revenue Source, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Revenue Source, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Revenue Source, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Revenue Source, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Revenue Source, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Theme Park Tourism Providers

Theme Park Tourism Market

Theme Park Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Animal Theme Parks Market Share

Animal Theme Parks Market Insights - Growth & Forecast 2025 to 2035

Parking Meter Apps Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Parking Finder Apps Market Size and Share Forecast Outlook 2025 to 2035

Parking Ticket Dispenser Market Growth, Trends & Forecast 2025 to 2035

Park Assist System Market Growth - Trends & Forecast 2025 to 2035

Parking Management Market - Smart Solutions & Urban Mobility

Parkinson’s Disease Therapeutic Market – Growth & Demand Forecast 2024-2034

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Spark Plug Market Growth – Trends & Forecast 2024 to 2034

Spark Plug Accessories Market

Water Parks Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Growth – Trends & Forecast through 2034

Iridium Spark Plug Market Size and Share Forecast Outlook 2025 to 2035

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Real Time Parking System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA