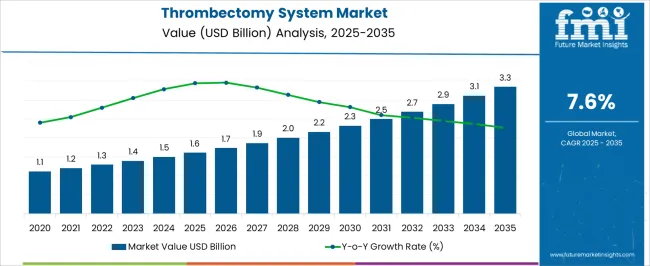

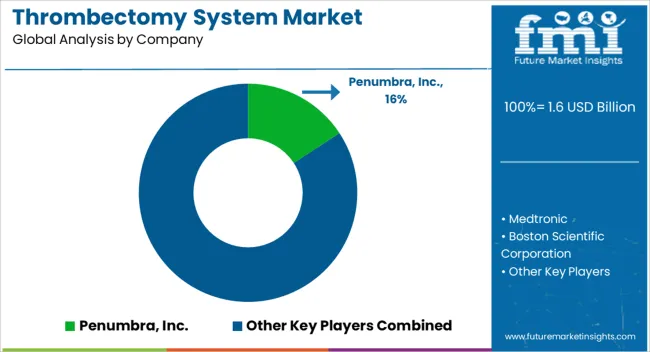

The Thrombectomy System Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Thrombectomy System Market Estimated Value in (2025 E) | USD 1.6 billion |

| Thrombectomy System Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The thrombectomy system market is experiencing significant growth, driven by the rising prevalence of stroke and other vascular blockages that require rapid intervention. Increasing awareness about acute ischemic stroke management and the critical need for timely treatment is expanding adoption of thrombectomy systems in both developed and emerging healthcare markets. Technological advancements in catheter design, imaging guidance, and clot retrieval mechanisms are improving procedural safety, efficiency, and patient outcomes.

Hospitals and specialized neurovascular centers are prioritizing minimally invasive intervention tools that reduce recovery times and improve survival rates. Additionally, growing healthcare infrastructure investments, favorable reimbursement policies, and the expansion of neurointerventional programs are contributing to increased market penetration. As the population ages and cardiovascular disorders become more prevalent, demand for advanced thrombectomy devices is expected to rise.

The market is also being shaped by ongoing research into novel clot retrieval technologies and integration with imaging systems, enabling real-time procedural adjustments and improved clinical effectiveness These factors collectively reinforce the long-term growth potential of the thrombectomy system market.

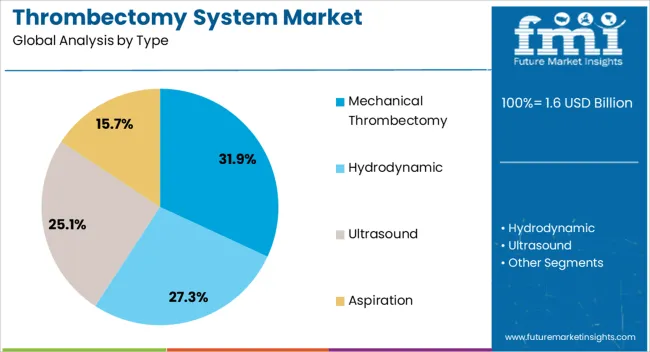

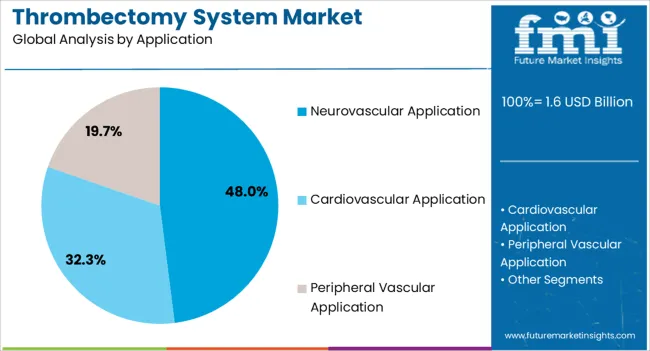

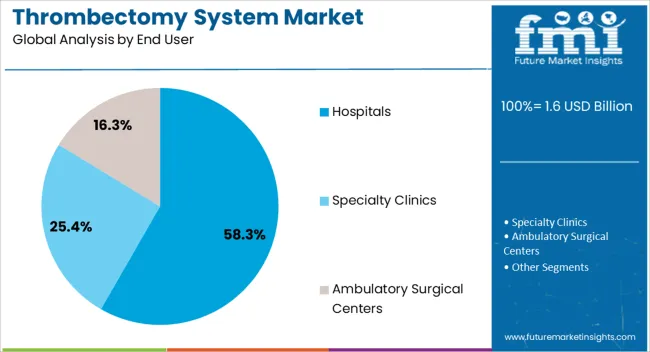

The thrombectomy system market is segmented by type, application, end user, and geographic regions. By type, thrombectomy system market is divided into Mechanical Thrombectomy, Hydrodynamic, Ultrasound, and Aspiration. In terms of application, thrombectomy system market is classified into Neurovascular Application, Cardiovascular Application, and Peripheral Vascular Application. Based on end user, thrombectomy system market is segmented into Hospitals, Specialty Clinics, and Ambulatory Surgical Centers. Regionally, the thrombectomy system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mechanical thrombectomy segment is projected to hold 31.9% of the thrombectomy system market revenue share in 2025, establishing it as the leading product type. Its prominence is being driven by the efficiency and precision of mechanical clot removal compared to other treatment options, providing immediate restoration of blood flow in acute ischemic stroke patients. This segment benefits from advanced device designs that allow navigation through complex vascular pathways while minimizing vessel trauma.

The widespread clinical adoption in neurovascular interventions has been facilitated by proven improvements in patient outcomes, including reduced neurological deficits and shorter hospital stays. Hospitals and neurovascular centers are increasingly prioritizing mechanical thrombectomy devices due to their reliability and compatibility with modern imaging systems.

Additionally, ongoing technological innovations, such as enhanced stent retriever and aspiration catheter systems, continue to improve procedural success rates The combination of high clinical efficacy, safety, and growing procedural volume is positioning the mechanical thrombectomy segment as the market leader among device types.

The neurovascular application segment is anticipated to account for 48.0% of the thrombectomy system market revenue share in 2025, making it the leading application area. Its dominance is being driven by the high prevalence of acute ischemic stroke, cerebral embolism, and other cerebrovascular disorders requiring rapid intervention. Thrombectomy systems enable minimally invasive clot retrieval, significantly improving patient survival rates and functional recovery compared to traditional therapies.

Adoption is being further reinforced by hospitals’ focus on reducing treatment delays and enhancing procedural precision with real-time imaging guidance. Technological advancements in catheter navigation, aspiration techniques, and device flexibility have expanded the range of treatable vascular conditions.

Regulatory approvals and clinical evidence demonstrating superior outcomes have also increased confidence among neurointerventional specialists As healthcare providers prioritize stroke management programs and early intervention protocols, the neurovascular segment is expected to maintain its leading position, supported by continuous innovation and rising procedural demand globally.

The hospitals end user segment is expected to hold 58.3% of the thrombectomy system market revenue share in 2025, securing its leadership position. Hospitals are being prioritized as primary points of adoption due to their capability to perform complex neurointerventional procedures and manage post-procedural care. The high patient volume, specialized staff availability, and advanced imaging infrastructure in hospital settings facilitate the effective deployment of thrombectomy systems.

Hospitals also benefit from reimbursement schemes that support the use of advanced medical devices for stroke and vascular emergencies. The segment is further reinforced by the integration of thrombectomy systems into hospital stroke centers and neurovascular programs, allowing standardized protocols and improved clinical outcomes.

Continuous training programs, combined with procedural success data, are encouraging hospitals to invest in high-performance devices As the global burden of cerebrovascular diseases increases and minimally invasive interventions gain preference, hospital adoption is expected to remain the primary driver of market growth, ensuring the segment’s continued dominance.

The thrombus is removed using a thrombectomy device, which is an intracoronary catheter with a central aspiration channel. Blood clots that form in capillaries, veins, and arteries are treated with it. An artery or vein with a blood clot that is obstructing blood flow can be treated with surgical thrombectomy.

Systems for thrombectomy are created to lessen blood loss and the number of blood vessels damaged during surgery. Deep vein thrombosis, pulmonary embolism, peripheral arterial disease, and neurovascular thrombosis disorders are all treated using these devices.

The market's primary growth drivers include the aging population's increased prevalence of cardiovascular diseases (CVDs), technological breakthroughs in blood clot-catching medical devices, and growing public awareness of the need for early disease detection. This market is mostly driven by aging people. In future years, there will be a demographic change in which the elderly will predominate. Since the number of aging people and the prevalence of chronic diseases is both expanding globally, this has a positive impact on market growth by driving up demand for thrombectomy system.

The need to introduce cutting-edge products to the market has been brought on by the rise in ischemic stroke incidence. The market is being driven by the development and introduction of new ischemic stroke-related suction devices, clot retrievers, and aspiration catheters.

Thrombectomy system demand is primarily rigorous in North America because of the region's high rate of aging population and rapid technological development. A growing number of clinical trials, the increased acceptance of technologically advanced thrombectomy products by surgeons, and the availability of medical reimbursements for thrombectomy procedures in the USA are some of the factors driving the expansion of the market for thrombectomy systems in North America.

Additionally, the Asian market for thrombectomy systems is anticipated to show rapid growth in the forecast period due to a huge patient population, an expansion of public insurance in developing nations, and a surge in the acceptance of new, inventive embolization and mechanical thrombectomy devices.

Some of the key manufacturers operating in the thrombectomy system market are Argon Medical Devices, Inc., BD Interventional, Boston Scientific Corporation, Control Medical Technology, LLC., NexGen Medical Systems Inc., Minnetronix Medical, Medtronic, Thrombolex, Inc., AngioDynamics., Koninklijke Philips N.V., Penumbra, Inc., and others.

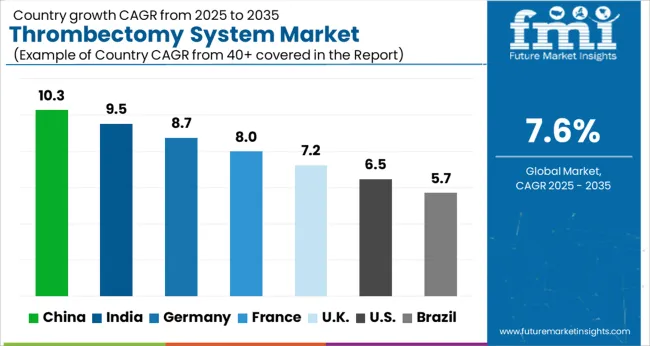

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The Thrombectomy System Market is expected to register a CAGR of 7.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.3%, followed by India at 9.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.7%, yet still underscores a broadly positive trajectory for the global Thrombectomy System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.7%. The USA Thrombectomy System Market is estimated to be valued at USD 581.3 million in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 6.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 74.9 million and USD 47.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type | Mechanical Thrombectomy, Hydrodynamic, Ultrasound, and Aspiration |

| Application | Neurovascular Application, Cardiovascular Application, and Peripheral Vascular Application |

| End User | Hospitals, Specialty Clinics, and Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Penumbra, Inc., Medtronic, Boston Scientific Corporation, BD Interventional, AngioDynamics., Koninklijke Philips N.V., Argon Medical Devices, Inc., Thrombolex, Inc., Control Medical Technology, LLC., NexGen Medical Systems Inc., and Minnetronix Medical |

The global thrombectomy system market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the thrombectomy system market is projected to reach USD 3.3 billion by 2035.

The thrombectomy system market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in thrombectomy system market are mechanical thrombectomy, hydrodynamic, ultrasound and aspiration.

In terms of application, neurovascular application segment to command 48.0% share in the thrombectomy system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA