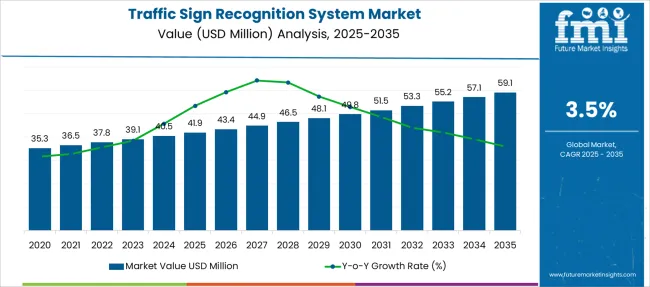

The Traffic Sign Recognition System Market is estimated to be valued at USD 41.9 million in 2025 and is projected to reach USD 59.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Traffic Sign Recognition System Market Estimated Value in (2025 E) | USD 41.9 million |

| Traffic Sign Recognition System Market Forecast Value in (2035 F) | USD 59.1 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

The traffic sign recognition system market is undergoing accelerated development as vehicle manufacturers integrate intelligent vision systems to support semi-autonomous and advanced driver assistance functionalities. The increasing implementation of traffic compliance technologies in vehicles has been strongly influenced by regulatory agencies aiming to reduce road fatalities and enhance traffic discipline.

OEMs are adopting machine learning algorithms and camera-based perception systems capable of detecting, classifying, and interpreting traffic signs under varied environmental conditions. The shift from static image databases to dynamic, real-time road interpretation has elevated the importance of adaptive software-defined modules within the in-vehicle architecture.

The ongoing evolution of automotive electronics, combined with the rollout of vehicle-to-infrastructure communication protocols, is expected to further enhance the reliability and accuracy of traffic sign recognition systems As consumer expectations grow for smarter and safer driving experiences, especially in premium and electric vehicle platforms, the adoption of such systems is anticipated to expand beyond developed markets into mid-range vehicles in emerging economies.

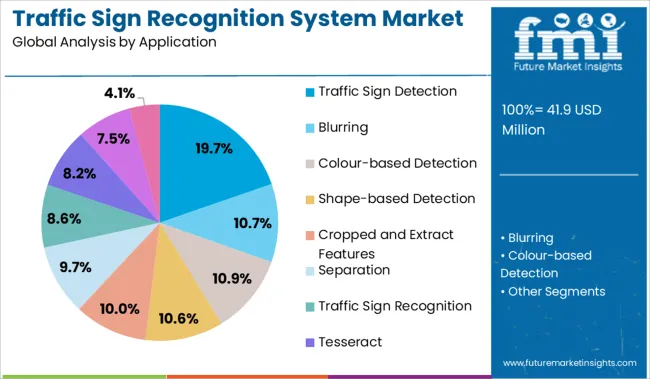

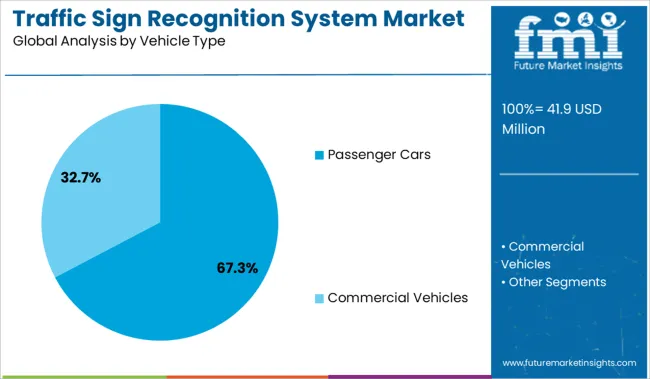

The market is segmented by Application and Vehicle Type and region. By Application, the market is divided into Traffic Sign Detection, Blurring, Colour-based Detection, Shape-based Detection, Cropped and Extract Features, Separation, Traffic Sign Recognition, Tesseract, Support Vector Machine (SVM), and Others (Template matching, SIFT, etc.). In terms of Vehicle Type, the market is classified into Passenger Cars and Commercial Vehicles. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The traffic sign detection application segment is projected to hold 19.7% of the revenue share in the traffic sign recognition system market in 2025. This segment has gained traction as automakers prioritize the implementation of real-time sign recognition systems to enhance vehicle safety and comply with evolving road safety regulations. The ability of traffic sign detection systems to interpret speed limits, warning signs, and prohibitory signals in real time has been instrumental in their integration within ADAS-enabled platforms.

The advancement of high dynamic range imaging and edge-based AI processors has supported reliable performance in adverse weather and lighting conditions. Additionally, the continuous training of vision models using localized traffic datasets has allowed manufacturers to optimize system accuracy for region-specific signage.

The deployment of these solutions has also been supported by their compatibility with existing camera infrastructure within vehicles, reducing additional hardware costs As legislation increasingly mandates traffic sign awareness features in new vehicles, this segment is expected to continue leading adoption across multiple automotive tiers.

Passenger cars are expected to account for 67.3% of the total revenue share in the traffic sign recognition system market in 2025, reflecting their dominant role in system deployment. The widespread integration of traffic sign recognition in passenger vehicles is being driven by rising consumer demand for safety features, growing awareness of assisted driving technologies, and increasing inclusion of ADAS functionalities in mid-range and compact car segments.

Automakers are leveraging camera-based perception systems to offer enhanced driver alerts and semi-autonomous driving capabilities as part of standard or optional safety packages. The affordability and scalability of vision-based solutions have facilitated their integration across both premium and mass-market passenger vehicles.

Furthermore, regulatory requirements in Europe, North America, and parts of Asia have accelerated the adoption of these systems, especially as compliance with General Safety Regulation and NCAP protocols becomes more stringent As connected vehicle ecosystems expand and real-time map integration becomes standard, passenger cars are expected to remain the primary platform for advanced traffic recognition solutions.

From the customer's perspective, safety is the main reason why the sales of traffic sign recognition systems are expected to rise. With nearly 40.5 million road deaths in 2024 and 50 million injuries caused because of road accidents, the time is now when people have started adopting safety practices while traveling on the road through vehicles.

The traffic sign recognition system does just that and would give impetus to people who aspire to have safe travel. Moreover, in many developed and developing countries, looking at the previous cases of road accidents, the governments have made it mandatory to install a traffic sign recognition system to avoid accidents. If someone is seen not having installed the traffic sign recognition system, they will be charged with a penalty. All this indicates towards higher demand for traffic sign recognition systems.

Developing countries like India, China, etc., are investing huge amounts of money in technology and road safety. If the benefits of traffic sign recognition system are effectively conveyed to the people residing in such countries, the sales of traffic sign recognition system would certainly increase, and more and more people will act proactively.

A very important point to note over here is that the traffic sign recognition system is mainly used in autonomous cars. Companies like Google, Tesla, Apple, etc., are investing heavily in the development of these autonomous cars. Moreover, based on a study conducted, autonomous cars can reduce the chances of an accident by nearly 95%, as these cars are trained to be extremely careful while plying on the road. Governments are also encouraging people to use these autonomous cars as they run on electric batteries, as a result of which they do not emit harmful gases. Moreover, as these cars make use of a traffic sign recognition system, the chances of road mishaps are drastically reduced. Because of this, the demand for traffic sign recognition system will take an uptick.

However, the only challenge associated with the traffic sign recognition system may be visual recognition. There are times when the signboards may not display the sign clearly because of the wear and tear caused due to extreme weather conditions. Because of that, the system may not be in a position to decide the right course of action and may end up doing something undesirable. This is something on which the manufacturers should ponder upon and come up with a suitable solution.

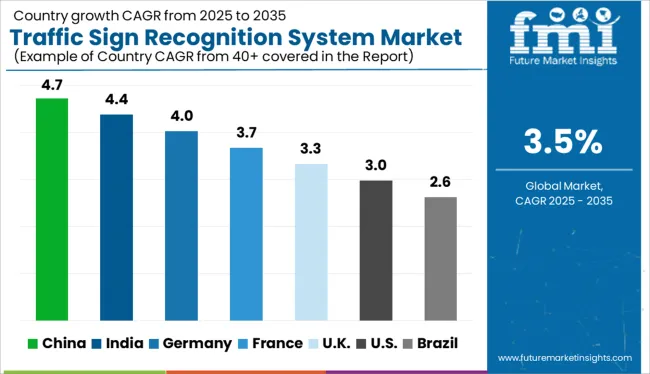

Based on the regional analysis, North America remains the biggest market for traffic sign detection systems followed by Europe. The reason is stringent laws framed by the public authorities to avoid accidents, and also more disposable income for people living in these regions. Thus, North America has the highest market share, followed by Europe.

However, Asia Pacific is showing exponential growth in terms of purchasing traffic sign recognition systems, and would certainly have a relatively higher market share in the future. The reason being major developing countries like India, China, etc., have started taking measures to reduce road mishaps, and to control these incidences, people are buying vehicles that are equipped with such systems.

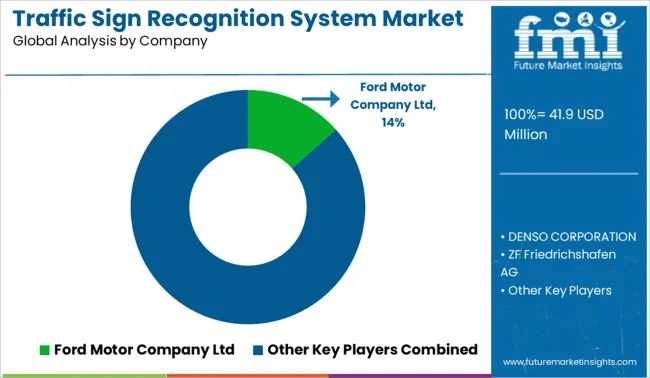

The traffic sign recognition system has a considerable market size. Some of the key players in the traffic sign recognition system market are Ford Motor Company Ltd, DENSO CORPORATION, ZF Friedrichshafen AG, Robert Bosch GmbH, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Daimler AG, HELLA Aglaia Mobile Vision GmbH, Continental AG, Skoda Auto a.s., dSPACE GmbH, Magna International Inc., ELBIT, Elektrobit, Mobileye Corporation, Volkswagen.

Recently, Continental announced that it is prepared for developing high-level Advanced Driver Assistance systems, and these would function mainly on the principle of full stack solution. The full stack includes three pillars - the system and the software; the ecosystem; and the component business.

Also, ZF Friedrichshafen AG is all set to hire 5000 engineers in India with an aim to increase its market presence and share in the autonomous technologies market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, Traffic, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Ford Motor Company Ltd; DENSO CORPORATION; ZF Friedrichshafen AG; Robert Bosch GmbH; TOSHIBA ELECTRONIC DEVICES & ; STORAGE CORPORATION; Daimler AG; HELLA Aglaia Mobile Vision GmbH; Continental AG,; Škoda Auto a.s.; dSPACE GmbH; Magna International Inc.; ELBIT; Elektrobit; Mobileye Corporation; Volkswagen. |

| Customization | Available Upon Request |

The global traffic sign recognition system market is estimated to be valued at USD 41.9 million in 2025.

The market size for the traffic sign recognition system market is projected to reach USD 59.1 million by 2035.

The traffic sign recognition system market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in traffic sign recognition system market are traffic sign detection, blurring, colour-based detection, shape-based detection, cropped and extract features, separation, traffic sign recognition, tesseract, support vector machine (svm) and others (template matching, sift, etc.).

In terms of vehicle type, passenger cars segment to command 67.3% share in the traffic sign recognition system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Traffic Road Marking Coatings Market Size and Share Forecast Outlook 2025 to 2035

Traffic Control Device Tape Market Size and Share Forecast Outlook 2025 to 2035

Traffic Sensors Market Growth – Trends & Forecast through 2034

Traffic Management System Market Analysis – Demand, Growth & Forecast 2025–2035

Traffic Signal Controller Market

Air Traffic Management Market Size and Share Forecast Outlook 2025 to 2035

Air Traffic Industry Analysis in the Kingdom of Saudi Arabia 2025 to 2035

Air Traffic Control Equipment Market

Vessel Traffic Management Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Traffic Management Market Trends – Growth & Forecast 2024 to 2034

Automotive Rear Cross Traffic Alert Market Size and Share Forecast Outlook 2025 to 2035

Signage Market Size and Share Forecast Outlook 2025 to 2035

Signal Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Signals Intelligence (SIGINT) Market Size and Share Forecast Outlook 2025 to 2035

Signal Generator Market Analysis by Product, Technology, Application, End-use, and Region through 2035

Market Leaders & Share in the Signage Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA