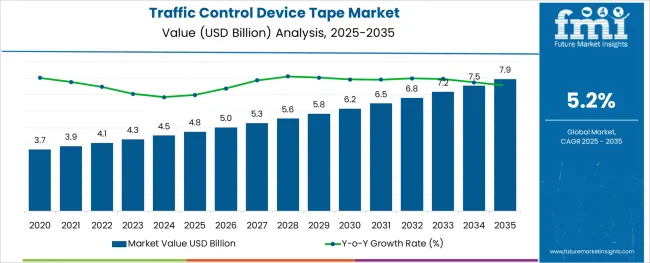

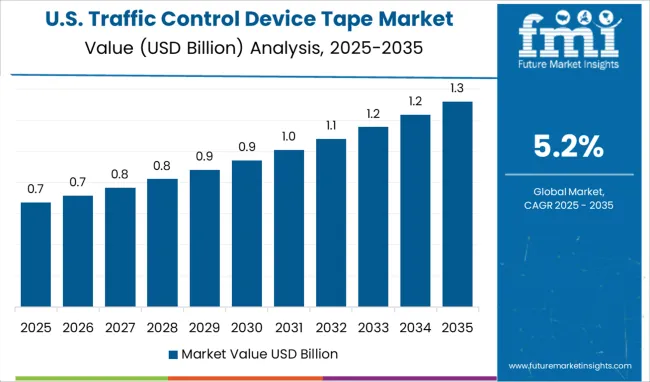

The Traffic Control Device Tape Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The traffic control device tape market is witnessing stable expansion, propelled by rising investments in transportation infrastructure, road safety awareness, and urban mobility projects. Governments and municipal agencies are increasing deployment of temporary and permanent traffic management systems, prompting higher consumption of reflective and high-adhesion tape products. Manufacturers are focusing on developing weather-resistant and UV-stable materials that maintain visibility and performance under diverse environmental conditions.

Technological advancements in pressure-sensitive adhesives and reflective pigmentation are further enhancing the functionality of these tapes for nighttime and low-light visibility. Integration with smart traffic systems and sensor-compatible road marking solutions is opening new growth opportunities.

As urbanization accelerates and road safety standards become more stringent, the need for cost-effective and quick-to-install marking alternatives like control device tapes is expected to grow steadily. Product innovation, regulatory compliance, and sustainable material sourcing are poised to influence long-term market dynamics across regions.

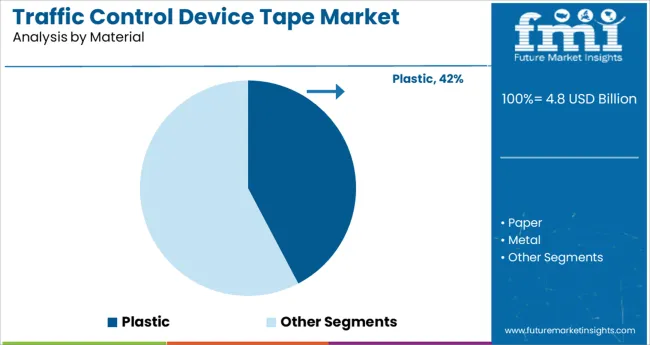

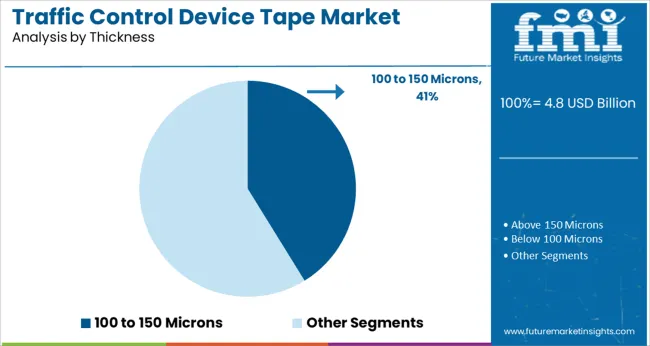

The market is segmented by Material, Product Type, and Thickness and region. By Material, the market is divided into Plastic, Paper, and Metal. In terms of Product Type, the market is classified into Adhesive Tape and Non-adhesive Tape. Based on Thickness, the market is segmented into 100 to 150 Microns, Above 150 Microns, and Below 100 Microns.

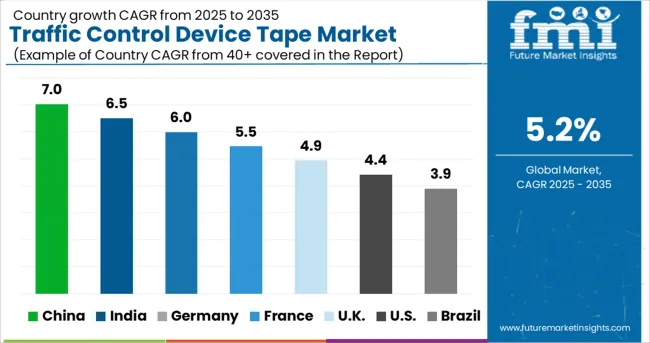

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material subsegment is expected to account for 42.3% of revenue within the material category in 2025, establishing it as the dominant material. This leadership has been driven by plastic’s lightweight characteristics, weather durability, and compatibility with both reflective and non-reflective formulations.

Its ability to retain structural integrity under fluctuating temperatures and moisture conditions has supported its use in high-traffic and temporary zone applications. Manufacturers have increasingly used engineered plastics to develop tapes that offer high tensile strength while remaining cost-efficient.

Additionally, the material’s recyclability and growing alignment with eco-conscious sourcing practices have made it preferable for agencies adopting green procurement policies. The versatility of plastic to support different coatings and printing processes has reinforced its sustained dominance across traffic marking and control applications.

Adhesive tape is projected to lead the product type category with a 64.7% revenue share in 2025, highlighting its strong market positioning. This dominance is attributed to its ease of installation, low maintenance, and adaptability to varied surfaces including asphalt, concrete, and metal.

The rise of pressure-sensitive adhesive technologies has improved adherence without the need for external activation, enabling faster deployment in critical zones such as road construction, lane demarcation, and pedestrian crossings. Adhesive tapes also allow for easy removal or repositioning, making them ideal for dynamic traffic environments.

Cost advantages and reduced downtime during installation have encouraged widespread municipal and contractor adoption. Continued innovation in adhesives that withstand abrasion, UV exposure, and oil residues has further solidified adhesive tape’s leadership in the traffic control device tape segment.

The 100 to 150 microns subsegment is expected to represent 41.2% of revenue within the thickness category in 2025, marking it as the leading specification. This range offers an optimal balance between flexibility, durability, and visibility, making it suitable for both short-term and semi-permanent applications.

Its compatibility with reflective coatings and non-slip surfaces has enhanced utility in diverse conditions including roadways, parking lots, and construction zones. Tapes in this thickness range provide sufficient strength to withstand foot and light vehicular traffic without cracking or peeling, thereby reducing replacement frequency.

Moreover, they offer ease of handling during installation while maintaining a profile that does not disrupt vehicular motion. As public and private sector infrastructure projects scale up, the preference for mid-range thickness tapes capable of withstanding moderate stress is expected to support continued growth in this segment.

Increasing traffic congestion in urban areas with the rising population is propelling the need for unique traffic management systems worldwide. The increasing usage of private vehicles by people in both developed and developing countries is another crucial factor that is anticipated to push the traffic control device tape market growth in future years.

Traffic control device tapes are mainly made by using tear-proof, resilient, and durable plastic materials, such as nylon, polypropylene, and polyethylene. Their high reusability capability is anticipated to augment the growth in this market. These are nearly 3 inches wide and 2 mm thick.

Rising fluctuations in the prices of raw materials may hamper the sales of traffic control device tapes in the upcoming years. As traffic management systems require vast amounts of data for analyzing real-time traffic information, the infrastructure needed should be highly developed.

Governments of various emerging countries are limiting their capabilities to spend more on road infrastructure development. This factor may also pose a major challenge in the global market over the forthcoming years.

The urgent need for barricade tapes in highly populated countries, such as India and China is likely to drive the Asia Pacific traffic control device tape market share in future years. Painting for warning or caution signs is a time consuming process and thus companies are preferring traffic control device tapes to avoid the inconvenience.

The presence of a large number of local manufacturers, especially in China would also create new growth opportunities in Asia Pacific. Besides, the country exports raw materials in other parts of the globe with the availability of low cost materials and labor. This factor would also enable manufacturers to generate more sales in the Asia Pacific market.

North America is estimated to remain in the second position, followed by Asia Pacific in the upcoming years. Increasing production and sales of vehicles in the USA and Canada is projected to bode well for the regional market.

The rapid expansion of the logistics and transportation sectors in this region is another vital factor that is anticipated to push the market.

Moreover, stringent norms associated with the improvement of road safety by government bodies are anticipated to propel the demand for traffic control device tapes in North America in the assessment period.

In addition, increasing awareness about accident prevention, as well as driver safety is likely to aid growth in the regional market.

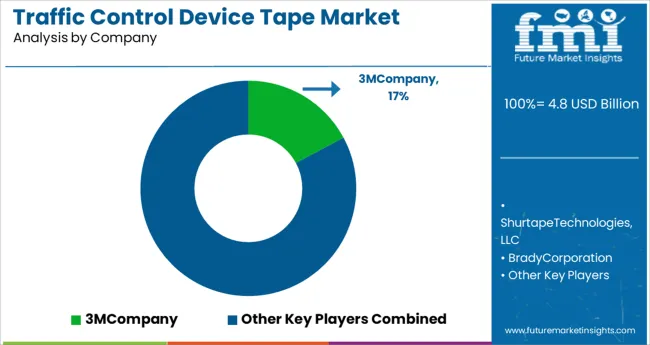

Some of the prominent companies present in the global traffic control device tape market include Vibac, 3M Company, Advance Tapes International Ltd., Kruse Adhesive Tape, Inc., Scapa, Surface Shields, and Nitto Denko Corp. among others.

Leading companies operating in the global market are increasingly focusing on introducing new products to fulfill the high unmet demand from end-user industries. Meanwhile, a few other companies are aiming to strengthen their positions in the global market by collaborating with renowned players and acquiring small-scale enterprises.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Product Type, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | 3M Company; Kruse Adhesive Tape, Inc.; Nitto Denko Corp.; Surface Shields; Scapa; Vibac; Advance Tapes International Ltd. |

| Customization | Available Upon Request |

The global traffic control device tape market is estimated to be valued at USD 4.8 billion in 2025.

It is projected to reach USD 7.9 billion by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are plastic, paper and metal.

adhesive tape segment is expected to dominate with a 64.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Traffic Sign Recognition System Market Size and Share Forecast Outlook 2025 to 2035

Traffic Road Marking Coatings Market Size and Share Forecast Outlook 2025 to 2035

Traffic Management System Market Analysis – Demand, Growth & Forecast 2025–2035

Traffic Sensors Market Growth – Trends & Forecast through 2034

Traffic Signal Controller Market

Air Traffic Management Market Size and Share Forecast Outlook 2025 to 2035

Air Traffic Industry Analysis in the Kingdom of Saudi Arabia 2025 to 2035

Air Traffic Control Equipment Market

Vessel Traffic Management Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Traffic Management Market Trends – Growth & Forecast 2024 to 2034

Automotive Rear Cross Traffic Alert Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA