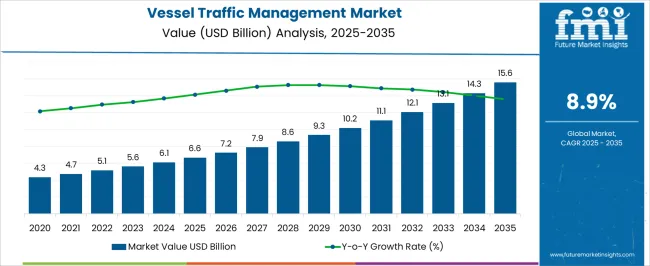

The vessel traffic management market is valued at USD 6.6 billion in 2025 and is expected to reach USD 15.6 billion by 2035, growing at a CAGR of 8.9%. Long-term value accumulation curve analysis shows how incremental market value develops over the forecast period, reflecting the combined impact of fleet expansion, port upgrades, and adoption of advanced monitoring systems.

In the early years, from 2025 to 2028, value accumulation is gradual as ports in developed regions implement radar systems, automatic identification systems (AIS), and integrated communication platforms, establishing a foundation for safer and more efficient vessel operations. Between 2028 and 2032, the curve steepens as adoption expands in emerging regions due to growing maritime trade, new port infrastructure, and stricter navigation safety regulations. Advanced technologies, including predictive analytics, real-time vessel tracking, and AI-assisted traffic coordination, drive a substantial portion of value creation during this phase.

From 2032 to 2035, accumulation continues steadily as existing systems are upgraded and integrated with smart port and digital twin frameworks. The long-term value accumulation curve indicates that market growth is dynamic; early infrastructure development enables faster value addition in subsequent years, while strategic technology deployment supports consistent expansion and improved operational efficiency in vessel traffic management worldwide.

| Metric | Value |

|---|---|

| Vessel Traffic Management Market Estimated Value in (2025 E) | USD 6.6 billion |

| Vessel Traffic Management Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The vessel traffic management market is supported by several upstream sectors. Port authorities and maritime regulators account for approximately 36%, overseeing vessel movements, safety compliance, and operational efficiency. Shipping companies and fleet operators contribute around 28%, relying on VTMS to optimize navigation, prevent collisions, and manage schedules. Technology and software providers represent roughly 17%, supplying radar, AIS systems, and integrated traffic management platforms.

Maritime communication and navigation equipment manufacturers hold close to 12%, delivering hardware such as sensors, transmitters, and monitoring devices. Consultancy and system integrators make up the remaining 7%, offering design, implementation, and maintenance services for VTMS deployments. The market is evolving with digitalization and automation of vessel traffic systems.

AI-based predictive analytics are now being applied to forecast congestion and optimize routing, improving port throughput by 10–12%. Integration of satellite AIS data with coastal radar has increased coverage reliability by 15%, supporting safer navigation in high-traffic regions. Adoption of cloud-based VTMS platforms is rising, enabling remote monitoring and decision-making, with deployment growth of ~20% year-on-year. Ports are increasingly investing in cyber-secure traffic management systems and automated alert mechanisms to reduce human error and improve maritime safety compliance.

The vessel traffic management market is experiencing steady expansion, supported by the global rise in maritime trade volumes and heightened emphasis on navigational safety. Industry publications and port authority updates have noted increasing investments in advanced monitoring and communication systems to manage congested waterways and complex port operations.

Regulatory frameworks from international maritime organizations are driving adoption of standardized traffic management protocols, ensuring safer and more efficient vessel movement. Technological advancements, including integration of AI-based analytics, satellite communication, and radar systems, are enhancing the precision and reliability of vessel tracking.

Growing demand for coastal surveillance and environmental protection measures has further strengthened the role of vessel traffic management systems in strategic maritime operations. Future growth is expected to be propelled by port modernization projects, expansion of smart port infrastructure, and collaborative efforts between public and private stakeholders to improve maritime situational awareness. Leading growth segments include vessel traffic services (VTS), hardware solutions, and applications managed by marine authorities.

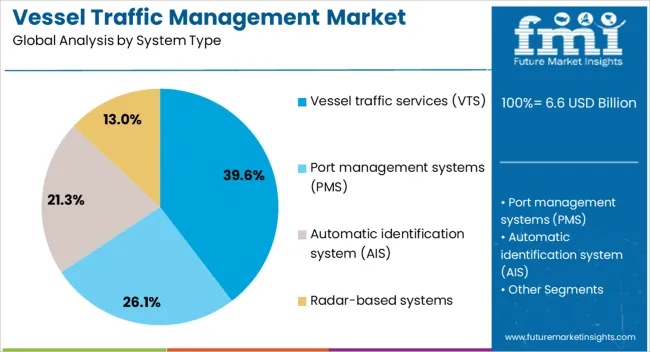

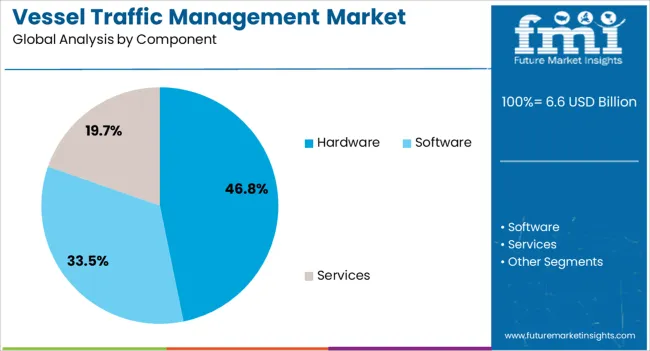

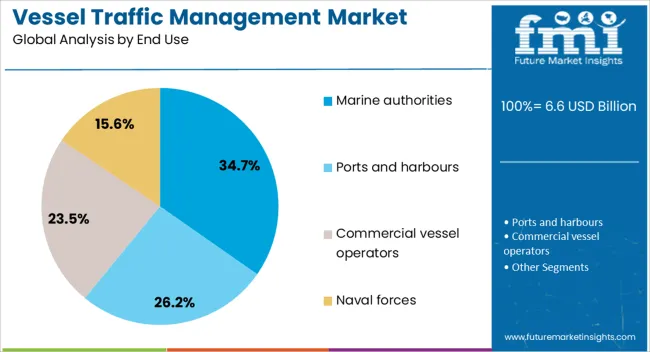

The vessel traffic management market is segmented by system type, component, end use, and geographic regions. By system type, vessel traffic management market is divided into Vessel traffic services (VTS), Port management systems (PMS), Automatic identification system (AIS), and Radar-based systems. In terms of component, vessel traffic management market is classified into Hardware, Software, and Services.

Based on end use, vessel traffic management market is segmented into Marine authorities, Ports and harbours, Commercial vessel operators, and Naval forces. Regionally, the vessel traffic management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vessel traffic services (VTS) segment is projected to account for 39.6% of the vessel traffic management market revenue in 2025, maintaining its leading position due to its critical role in ensuring maritime safety and operational efficiency. VTS solutions have been widely adopted by ports and coastal administrations to monitor, coordinate, and guide vessel movement in congested or sensitive waters.

Maritime safety reports have highlighted that VTS systems significantly reduce the risk of collisions, groundings, and environmental incidents. The integration of modern radar, AIS (Automatic Identification System), and real-time communication tools into VTS operations has improved decision-making and responsiveness.

Additionally, compliance with International Maritime Organization (IMO) guidelines has accelerated the global deployment of VTS infrastructure. As maritime trade continues to expand, demand for VTS systems is expected to remain high, driven by their proven ability to enhance safety and streamline traffic flow in increasingly busy shipping routes.

The hardware segment is projected to contribute 46.8% of the vessel traffic management market revenue in 2025, leading the component category due to its essential role in establishing and maintaining operational capabilities. This segment’s dominance is supported by continuous demand for radar systems, communication equipment, sensors, and display consoles that form the backbone of vessel traffic monitoring.

Port authorities and maritime agencies have prioritized investment in high-performance hardware to ensure accuracy, durability, and resilience in challenging marine environments. Technological upgrades, such as solid-state radar and integrated multi-sensor platforms, have improved detection range and operational efficiency.

Additionally, the replacement cycle for outdated or degraded hardware components sustains consistent market demand. As ports modernize and expand their capacity, the hardware segment is expected to retain its leadership, supported by both infrastructure expansion projects and the integration of advanced maritime monitoring technologies.

The marine authorities segment is projected to hold 34.7% of the vessel traffic management market revenue in 2025, remaining the primary end-user category due to their regulatory and operational control over maritime traffic. Marine authorities are tasked with enforcing safety regulations, coordinating vessel movements, and responding to emergencies, making them key adopters of advanced traffic management systems.

Reports from maritime administrations indicate that these entities are increasingly investing in integrated control centers and real-time data sharing platforms to enhance situational awareness. The need to manage international shipping lanes, monitor fishing activities, and protect environmentally sensitive marine areas has further driven adoption.

Collaboration between marine authorities and naval forces for coastal security has also increased the scope of vessel traffic management systems. With rising global maritime activity and the strategic importance of secure shipping routes, the marine authorities segment is expected to maintain strong demand for comprehensive traffic management solutions.

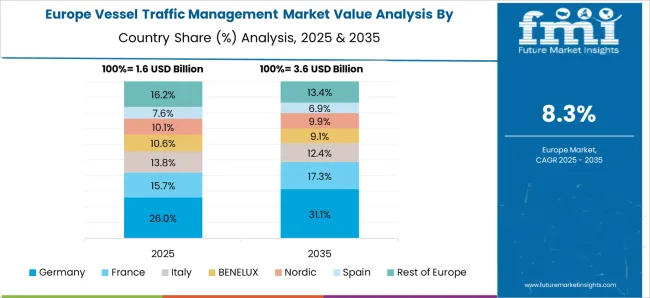

The vessel traffic management market is expanding as global maritime traffic increases and ports require precise monitoring to ensure navigational safety and operational efficiency. Systems provide real-time tracking of vessel movements to prevent collisions, reduce congestion, and optimize port scheduling. Europe and North America are leading adopters due to high maritime activity and regulatory compliance requirements, while Asia Pacific is growing rapidly with port expansions and increased shipping operations.

Growing port infrastructure and increasing global shipping volumes are major factors driving vessel traffic management adoption. Advanced monitoring allows port authorities to optimize berthing schedules, manage vessel flow, and reduce waiting times. Commercial shipping operators rely on these systems to enhance navigation efficiency and reduce fuel consumption, while defense agencies use them for coordinated maritime operations in strategic waterways. Integration with predictive analytics and digital modeling improves operational decision-making and safety. The need for precise vessel coordination, combined with rising maritime trade, continues to support investments in vessel traffic management technologies globally.

Automation and real-time data analytics are creating growth opportunities in the vessel traffic management market. Predictive modeling, automated alerts, and route optimization enhance operational efficiency and reduce the risk of collisions. Integrated monitoring platforms allow port authorities and shipping operators to manage vessel movements with minimal manual oversight. Systems that incorporate environmental monitoring and emissions tracking are gaining preference. Companies providing scalable, interoperable, and data-driven solutions are expected to capture long-term market opportunities by supporting safer, faster, and more efficient maritime operations across commercial and defense applications.

Defense and research organizations are increasingly using vessel traffic management systems for coastal surveillance, maritime monitoring, and navigation safety. Precise vessel tracking, coordination, and emergency response capabilities are critical for long-duration missions and strategic operations. Research vessels utilize integrated platforms for offshore studies and environmental monitoring. The adoption of satellite-based tracking, IoT-enabled sensors, and interoperable data-sharing systems enhances situational awareness. Growing interest in autonomous shipping and advanced port security further supports deployment. These trends indicate a shift toward broader utilization of vessel traffic management systems beyond commercial applications, enabling improved safety and operational efficiency across multiple maritime sectors.

High capital costs for installation and integration with existing port infrastructure pose challenges for adoption. Compliance with international maritime safety and communication standards adds operational and administrative expenses. Smaller ports and operators face limitations in technical expertise and funding for deployment. System maintenance, upgrades, and personnel training further increase costs. Companies offering modular, scalable solutions and support services are better positioned to overcome these barriers. Efficient implementation, standardization, and technological adaptability are critical for expanding adoption and maintaining competitiveness in the vessel traffic management market.

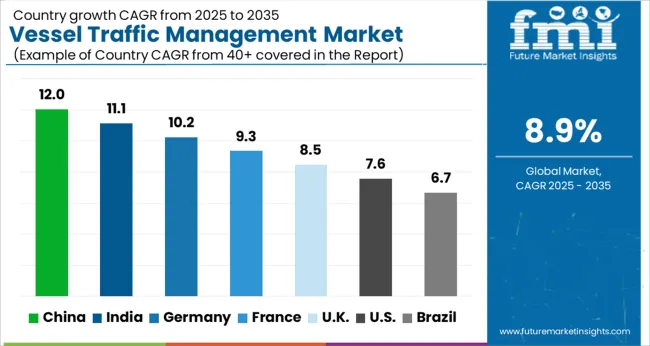

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The vessel traffic management market is growing at a global CAGR of 8.9% from 2025 to 2035, driven by rising maritime trade, port modernization, and the adoption of advanced navigation technologies. China leads with a CAGR of 12.0%, +35% above the global average, supported by BRICS-driven expansion of ports, shipping lanes, and investment in automated traffic monitoring systems. India follows at 11.1%, +25% over the global benchmark, reflecting growing domestic shipping volumes, infrastructure development, and adoption of integrated vessel monitoring solutions. Germany records 10.2%, +15% above the global CAGR, shaped by OECD-supported innovation in maritime safety systems and automation. The United Kingdom posts 8.5%, slightly below the global rate, influenced by moderate adoption in existing ports and selective technology upgrades. The United States stands at 7.6%, −15% under the global benchmark, constrained by mature port networks but benefiting from precision-driven monitoring and regulatory compliance. BRICS countries are driving scale, while OECD nations focus on technological sophistication and safety.

China is leading the vessel traffic management market with a CAGR of 12.0%, which is 3.1% higher than the global CAGR of 8.9%. This above-average growth is driven by rapid expansion of port infrastructure, rising maritime traffic, and adoption of advanced radar and automatic identification systems. Coastal cities and major ports are implementing smart port solutions and integrated navigation platforms to improve safety and efficiency. Partnerships between technology providers and port authorities are accelerating adoption. The focus on smart port initiatives, increased shipbuilding activities, and growing export trade further strengthen China’s position in the global market.

India is recording a CAGR of 11.1%, which is 2.2% higher than the global CAGR, reflecting stronger growth compared to the global average. This growth is fueled by commercial port expansion, inland waterways, and increased adoption of digital vessel tracking systems. Investments in port modernization, including initiatives like Sagarmala, are enhancing operational efficiency and safety. Integration with maritime communication systems and surveillance platforms is further boosting adoption. Rising cargo traffic and increasing naval operations provide steady demand for vessel traffic management solutions across India.

Germany is advancing at a CAGR of 10.2%, which is 1.3% above the global CAGR of 8.9%, reflecting strong but moderately higher-than-average growth. The country benefits from high traffic in major ports like Hamburg and Bremen, as well as automated navigation and radar adoption for safer operations. Digital twin simulations and predictive monitoring of shipping lanes are increasingly used to optimize traffic flow. Inland waterways and industrial logistics are also contributing to steady demand. Germany’s technological expertise and export orientation enhance market growth relative to the global benchmark.

The United Kingdom is growing at a CAGR of 8.5%, which is slightly below the global CAGR of 8.9% by 0.4%. Growth is supported by major ports, offshore installations, and naval operations, although adoption rates are more moderate. Imports of advanced radar and AIS systems from Europe and Asia remain important. Focus on port digitization, real-time tracking, and professional training is improving efficiency. Collaborations between technology providers and port authorities are helping implement integrated monitoring solutions. Overall, the UK shows stable growth, but slightly slower than the global average.

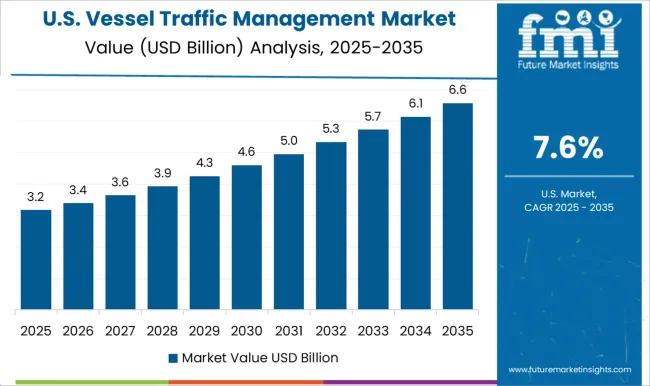

The United States is progressing at a CAGR of 7.6%, which is 1.3% below the global CAGR of 8.9%, reflecting slower growth relative to the global average. Growth is driven by major port operations, inland waterways, and coastal shipping, with increasing adoption of radar, AIS, and integrated monitoring platforms. Commercial and naval applications contribute equally to market demand. Investment in port modernization and offshore logistics is supporting steady adoption. Mature infrastructure and relatively slower implementation of cutting-edge systems compared to emerging markets like China and India explain the below-average growth rate.

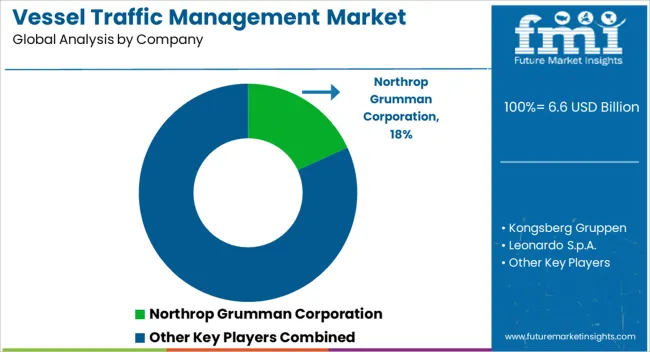

The vessel traffic management market is led by companies providing monitoring, navigation, and safety solutions for ports, harbors, and coastal waterways. Kongsberg Gruppen is assumed to be the leading player, supported by integrated radar systems, automatic identification systems, and digital traffic management platforms that enhance maritime safety, situational awareness, and operational efficiency.

Northrop Grumman Corporation and Leonardo S.p.A. maintain strong positions with advanced vessel tracking, port management software, and surveillance systems suitable for civilian and defense operations. ST Engineering delivers radar and sensor integration, communication systems, and automated control platforms to optimize vessel navigation and reduce collision risks. Saab AB contributes through specialized command and monitoring systems that enable real-time decision-making, ensuring smooth traffic flow and compliance with international maritime standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| System Type | Vessel traffic services (VTS), Port management systems (PMS), Automatic identification system (AIS), and Radar-based systems |

| Component | Hardware, Software, and Services |

| End Use | Marine authorities, Ports and harbours, Commercial vessel operators, and Naval forces |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Northrop Grumman Corporation, Kongsberg Gruppen, Leonardo S.p.A., ST Engineering, and Saab AB |

| Additional Attributes | Dollar sales by system type and vessel category, demand dynamics across cargo ships, tankers, and passenger vessels, regional trends across North America, Europe, and Asia-Pacific, innovation in radar integration, AIS tracking, and AI-based traffic prediction, environmental impact of optimized routing and reduced fuel consumption, and emerging use cases in smart ports, autonomous shipping, and maritime safety systems. |

The global vessel traffic management market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the vessel traffic management market is projected to reach USD 15.6 billion by 2035.

The vessel traffic management market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in vessel traffic management market are vessel traffic services (vts), port management systems (pms), automatic identification system (ais) and radar-based systems.

In terms of component, hardware segment to command 46.8% share in the vessel traffic management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Vessel-sealing Devices Market Trends - Growth & Forecast 2025 to 2035

Vessel Retrofit Market Growth – Trends & Forecast 2024-2034

Marine Vessels Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Umbilical Vessel Catheters Market

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Vessel Harvesting System Market Size, Share, and Forecast 2025 to 2035

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Maritime Patrol Naval Vessels Market Growth - Trends & Forecast 2025 to 2035

Coastal Patrol Military Vessels Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Powered Merchant Vessel Market Size and Share Forecast Outlook 2025 to 2035

Crew boats (Standby Crew Vessels) Market

Emergency Response and Rescue Vessels Market

Traffic Sign Recognition System Market Size and Share Forecast Outlook 2025 to 2035

Traffic Road Marking Coatings Market Size and Share Forecast Outlook 2025 to 2035

Traffic Control Device Tape Market Size and Share Forecast Outlook 2025 to 2035

Traffic Sensors Market Growth – Trends & Forecast through 2034

Traffic Signal Controller Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA