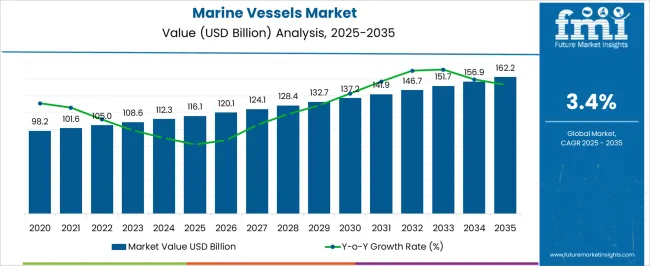

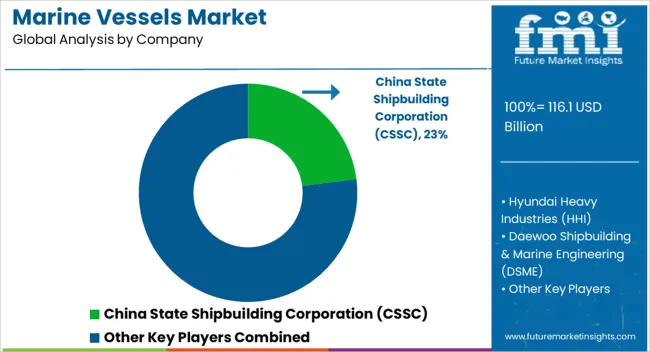

The marine vessels market is estimated to be valued at USD 116.1 billion in 2025 and is projected to reach USD 162.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

In the early years from 2021 to 2025, the market grows from USD 98.2 billion to USD 116.1 billion, showing a modest but consistent incline on the curve as demand is supported by rising global trade, modernization of naval fleets, and growing requirements for energy-efficient shipping solutions. Between 2026 and 2030, the market advances from USD 120.1 billion to USD 137.2 billion, contributing about 38% of the total projected increase, and the curve maintains a smooth, upward trajectory reflecting moderate acceleration. This phase is influenced by increased adoption of smart navigation systems, expansion of autonomous shipping technologies, and sustained investments in port infrastructure and logistics capacity.

From 2031 to 2035, the market rises from USD 141.9 billion to USD 162.2 billion, contributing nearly 39% of the overall gains. The curve in this phase flattens slightly, highlighting a mature stage where fleet renewals, regulatory compliance for emissions, and specialized vessel segments such as LNG carriers and offshore service vessels drive steady but less aggressive growth. Overall, the marine vessels market demonstrates a sigmoid-shaped growth curve—stable in the early years, modestly steeper in the middle, and flattening toward consolidation—signaling resilience and sustained momentum through 2035.

| Metric | Value |

|---|---|

| Marine Vessels Market Estimated Value in (2025 E) | USD 116.1 billion |

| Marine Vessels Market Forecast Value in (2035 F) | USD 162.2 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The marine vessels market holds a strong position within the global transportation and shipping sector, accounting for approximately 36–38% share of the overall maritime industry, underscoring its critical role in global trade and logistics. Within the commercial shipping segment, marine vessels contribute nearly 28–30%, supported by bulk carriers, container ships, and oil tankers that move essential goods, energy resources, and raw materials across regions. In the defense and naval applications segment, the share stands at about 18–20%, driven by the procurement of advanced submarines, aircraft carriers, and destroyers to strengthen maritime security and defense strategies. The offshore oil and gas support vessels category contributes close to 12–14%, reflecting their importance in exploration and production operations.

In the passenger transport segment, including ferries and cruise liners, marine vessels account for around 10–12%, fueled by rising tourism and regional connectivity needs. Growth is influenced by rising global seaborne trade, modernization of naval fleets, and increased investment in offshore exploration projects. Manufacturers are prioritizing fuel-efficient designs, lightweight construction, and hybrid propulsion systems to comply with emission regulations and operational cost pressures. With expanding international trade flows, increasing naval budgets, and higher reliance on maritime transport, marine vessels remain an indispensable component of the global shipping and defense ecosystem.

The marine vessels market is experiencing sustained expansion, driven by increasing global trade, advancements in shipbuilding technologies, and the rising demand for specialized vessels across multiple sectors. Significant investments in port infrastructure and shipping routes are enhancing maritime connectivity, creating favorable conditions for fleet modernization and capacity expansion.

Growing emphasis on fuel efficiency and compliance with stringent environmental regulations is prompting shipowners to adopt new designs and advanced propulsion systems. The integration of digital navigation systems, remote monitoring, and predictive maintenance solutions is improving operational safety and efficiency.

Furthermore, geopolitical factors and global supply chain diversification strategies are supporting the demand for a broad range of marine vessels in both commercial and defense applications As emerging economies continue to expand their import-export activities, and as the push for sustainable maritime operations gains momentum, the market is expected to benefit from ongoing innovations and capital investments, ensuring steady growth over the coming years.

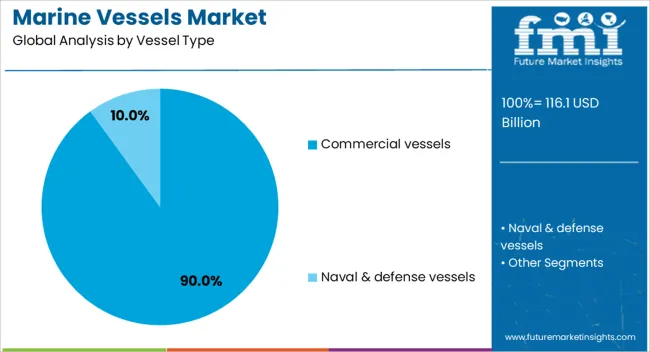

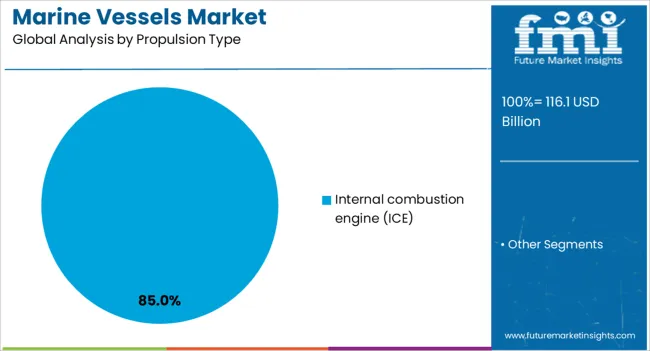

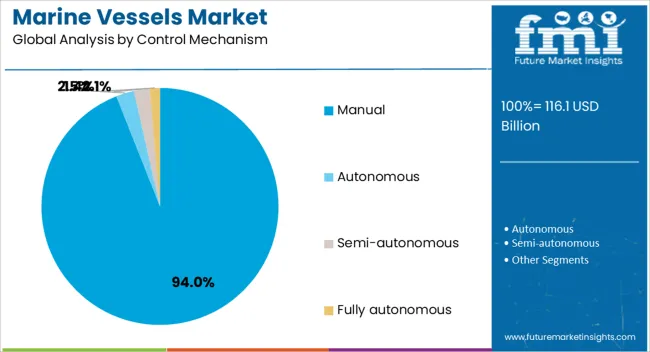

The marine vessels market is segmented by vessel type, propulsion type, control mechanism, and geographic regions. By vessel type, marine vessels market is divided into commercial vessels and naval & defense vessels. In terms of propulsion type, marine vessels market is classified into internal combustion engine (ICE). Based on control mechanism, marine vessels market is segmented into manual, autonomous, semi-autonomous, and Fully autonomous. Regionally, the marine vessels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial vessels segment is projected to hold 90% of the marine vessels market revenue share in 2025, making it the most dominant vessel type. This leadership position has been supported by the extensive use of commercial vessels for transporting goods, passengers, and resources across international and domestic waters.

The growth of this segment has been reinforced by the expansion of global trade routes, increased container traffic, and rising demand for specialized cargo handling. Shipowners have invested heavily in fleet expansion and modernization to meet evolving market demands, with a focus on enhancing fuel efficiency and operational reliability.

Commercial vessels have also benefitted from advancements in navigational technology and automation, which have improved safety and reduced operating costs The versatility of commercial vessels in handling diverse cargo types and operating under varying maritime conditions has further strengthened their position in the market, ensuring continued dominance in the foreseeable future.

The internal combustion engine (ICE) propulsion type segment is anticipated to account for 85% of the marine vessels market revenue share in 2025, establishing itself as the leading propulsion technology. The segment’s prominence has been maintained due to the widespread availability of ICE technology, its proven performance in various marine conditions, and its compatibility with a range of vessel sizes.

ICE systems have been preferred for their reliability, ease of maintenance, and established fueling infrastructure, which supports long-haul operations. Continuous advancements in engine efficiency, emission control technologies, and alternative fuel compatibility have enabled ICE-powered vessels to meet increasingly stringent environmental regulations.

Additionally, the cost-effectiveness of ICE systems compared to emerging propulsion alternatives has encouraged their sustained use As the maritime sector balances the need for operational reliability with the transition toward greener propulsion, ICE technology remains a primary choice for the majority of commercial and industrial marine operations.

The manual control mechanism segment is expected to secure 94% of the marine vessels market revenue share in 2025, representing the dominant control mechanism across the industry. This preference has been attributed to the reliability, simplicity, and lower cost of manual control systems in maritime operations.

Manual controls allow for direct human oversight, which is critical in navigating complex maritime environments, responding to emergencies, and managing unpredictable sea conditions. The segment has benefitted from its widespread adoption in small to mid-sized vessels, as well as in commercial and fishing fleets, where operational flexibility and hands-on control are highly valued.

Manual systems require less training in advanced automation technologies, making them more accessible to crews in developing maritime markets Furthermore, the durability and low maintenance needs of manual control systems have reinforced their popularity, ensuring their continued dominance even as automation technologies gradually gain traction in specific vessel categories.

Marine vessels are crucial to global trade, defense, offshore energy, and passenger transport. With rising demand across these sectors, the market continues to grow, driven by investments and expanding operations.

The marine vessels market is significantly driven by increasing global trade, which demands efficient and reliable shipping solutions for transporting goods, raw materials, and energy resources. Container ships, bulk carriers, and tankers are at the core of this demand, ensuring timely delivery of products worldwide. The rise in e-commerce and the expansion of supply chains further fuel the need for advanced marine vessels capable of handling larger cargo volumes. This demand has led to substantial investments in new vessel construction and fleet upgrades, ensuring that the industry keeps up with rising trade volumes. Additionally, shipping companies are focusing on expanding fleet capacities and improving operational efficiency to capture a larger share of global trade.

The defense sector plays a critical role in driving demand for marine vessels, particularly in military and strategic applications. Countries are investing heavily in modern naval fleets, including aircraft carriers, submarines, and destroyers, to maintain maritime security and global influence. Strategic defense investments also include upgrading existing fleets and increasing the procurement of specialized vessels, such as amphibious assault ships and offshore patrol vessels. As geopolitical tensions rise, nations are prioritizing strengthening their maritime defense capabilities, leading to continued growth in the demand for high-tech military marine vessels. This defense-driven expansion is a key factor in shaping the overall marine vessel market.

The marine vessel market also benefits from the growing offshore oil and gas sector, where support vessels are essential for exploration, production, and logistics in challenging marine environments. These vessels are crucial for offshore drilling operations, oil platform supply, and subsea construction, all of which are vital to meeting global energy needs. As energy demand rises and exploration activities extend to more remote areas, the need for specialized support vessels increases. Companies are focusing on upgrading vessel fleets to enhance safety, reliability, and operational efficiency in harsh marine environments. This sector’s expansion is driving innovations in vessel designs tailored for offshore operations, further strengthening the market.

The passenger transport sector, including ferries, cruise liners, and luxury vessels, is a growing contributor to the marine vessels market. The global tourism boom has increased the demand for luxury cruise ships, which offer unparalleled travel experiences across oceans. Similarly, regional ferries continue to play a critical role in connecting islands and coastal areas, facilitating both tourism and commerce. As consumer preferences shift toward unique travel experiences, investments in passenger marine vessels are growing. To meet this demand, companies are focusing on improving passenger comfort, enhancing onboard services, and ensuring eco-friendly designs for long-term operational sustainability in the tourism sector.

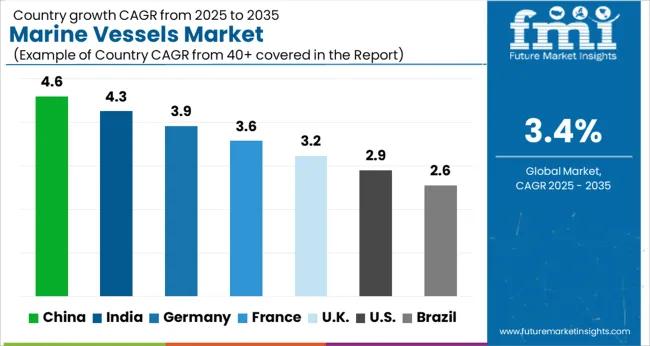

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The marine vessel market is projected to expand globally at a CAGR of 3.4% from 2025 to 2035, driven by increasing global trade, defense procurements, and offshore energy exploration. China leads with a CAGR of 4.6%, supported by large-scale port expansions, rising demand for cargo transport, and military vessel procurement. India follows at 4.3%, fueled by growing industrial and defense sectors, expanding maritime trade, and government initiatives to modernize ports and shipbuilding capabilities. France records a CAGR of 3.6%, with strong demand for naval vessels, offshore exploration, and luxury cruise liners. The United Kingdom grows at 3.2%, driven by rising defense spending, shipbuilding programs, and marine tourism. The United States posts 2.9%, influenced by continued investments in military vessels, the expansion of renewable offshore energy projects, and the modernization of commercial fleets. The study covers over 40 regions, with these countries serving as key benchmarks for naval capabilities, commercial shipping demand, and marine infrastructure growth worldwide.

China is expected to grow at a CAGR of 4.6% during 2025–2035, surpassing the global benchmark of 3.4%, driven by ongoing infrastructure projects and increasing maritime trade. During the 2020–2024 period, the growth rate was 3.9%, supported by expanding shipbuilding capabilities and domestic demand for commercial and military vessels. The increase in CAGR moving forward is driven by government-backed expansion of maritime infrastructure, increasing production of advanced naval and cargo vessels, and the growing demand for offshore energy exploration support vessels. China’s focus on becoming a global leader in maritime defense and shipping logistics, coupled with substantial investments in new ports and vessel fleets, underpins this rise.

India is projected to achieve a CAGR of 4.3% between 2025 and 2035, slightly outperforming the global average of 3.4%. During 2020–2024, India recorded a CAGR of 3.8%, driven by growth in cargo shipping, port modernization, and the government’s push to strengthen naval defense capabilities. Moving into the next few years, the rise in growth is attributed to the continued expansion of maritime trade, increasing naval procurements, and offshore energy projects. The Indian government’s initiatives, such as the "Sagarmala" project aimed at port infrastructure development and the focus on defense sector upgrades, are key drivers. The increased demand for commercial and defense vessels is driving the expansion of India’s maritime sector.

France is expected to grow at a CAGR of 3.6% from 2025 to 2035, driven by strong demand in naval defense, cruise ships, and offshore exploration vessels. The earlier period from 2020–2024 recorded a CAGR of 3.2%, reflecting stable demand driven by defense contracts, and expanding cruise tourism. The increase from 2020–2024 to 2025–2035 is fueled by heightened naval defense budgets, growing offshore renewable energy projects, and an expanding global cruise industry. French naval upgrades and the strengthening of maritime security also contribute to increased vessel procurements. With rising global energy demand, France’s offshore oil and gas sector is further propelling the demand for specialized vessels.

The United Kingdom is projected to grow at a CAGR of 3.2% for 2025–2035, improving from 2.7% during 2020–2024. The early growth was driven by steady demand for commercial vessels, and military shipbuilding projects under defense budgets. The increase in CAGR from 2020–2024 to 2025–2035 reflects growth in both the naval defense sector and the cruise and ferry segments, with investments in fleet modernization and offshore wind projects. The UK government’s focus on enhancing maritime defense capabilities and fostering green energy initiatives has led to a rise in demand for renewable energy support vessels. The ongoing projects aimed at reducing ship emissions and improving fuel efficiency will continue to boost the market.

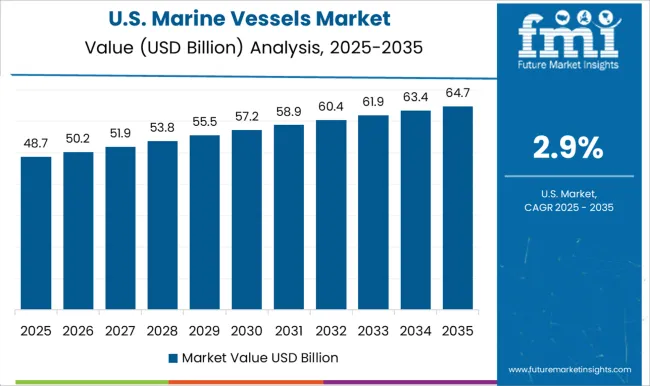

The United States is expected to grow at a CAGR of 2.9% during 2025–2035, lower than the global rate of 3.4%. The earlier CAGR for 2020–2024 was 2.5%, with growth largely driven by maintenance of existing fleets, demand for commercial shipping vessels, and military procurement. The rise in CAGR from 2020–2024 to 2025–2035 is attributed to increased investments in naval defense, offshore exploration, and environmentally friendly vessels. The USA government’s increasing focus on modernizing the military fleet, as well as expanding offshore renewable energy programs, contributes to this growth. As the demand for hybrid and eco-friendly vessels increases, the market for marine vessels in the USA is expected to benefit from technological advancements in fuel efficiency and reduced emissions.

The marine vessel market is shaped by fierce competition among leading global shipbuilding companies, focusing on advanced, fuel-efficient, and durable vessel designs. China State Shipbuilding Corporation (CSSC) is a dominant player, leveraging its extensive capabilities in naval and commercial vessel production, maintaining a stronghold in both domestic and international markets. Hyundai Heavy Industries (HHI) leads with cutting-edge shipbuilding technology, offering a wide range of vessel types, including LNG carriers, container ships, and specialized vessels. Daewoo Shipbuilding & Marine Engineering (DSME) excels in high-tech naval and offshore exploration vessels, with a strong presence in the defense sector.

Samsung Heavy Industries stands out for its focus on environmentally friendly ships and innovations in LNG and green technology. Fincantieri is recognized for producing luxury cruise ships, combining engineering expertise with high-end design for commercial passenger transport. Meyer Werft is known for its strong position in cruise vessel construction, offering tailored solutions for large-scale luxury liners. These companies continue to compete on efficiency, sustainability, and technological advancements, particularly with a focus on meeting new environmental regulations and integrating renewable energy sources into vessels. Strategic partnerships with government entities and energy companies, coupled with extensive R&D investments, are key to maintaining leadership in the highly competitive marine vessel manufacturing industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 116.1 Billion |

| Vessel Type | Commercial vessels and Naval & defense vessels |

| Propulsion Type | Internal combustion engine (ICE) |

| Control Mechanism | Manual, Autonomous, Semi-autonomous, and Fully autonomous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China State Shipbuilding Corporation (CSSC), Hyundai Heavy Industries (HHI), Daewoo Shipbuilding & Marine Engineering (DSME), Samsung Heavy Industries, Fincantieri, and Meyer Werf |

| Additional Attributes | Dollar sales, share, demand in commercial, defense, and passenger segments, production capacity, fleet modernization trends, regulatory compliance, environmental standards, fuel efficiency innovations, and competitive positioning. |

The global marine vessels market is estimated to be valued at USD 116.1 billion in 2025.

The market size for the marine vessels market is projected to reach USD 162.2 billion by 2035.

The marine vessels market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in marine vessels market are commercial vessels, _containerships, _tankers, _bulk carriers, _cruise ships, _others and naval & defense vessels.

In terms of propulsion type, internal combustion engine (ice) segment to command 85.0% share in the marine vessels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA