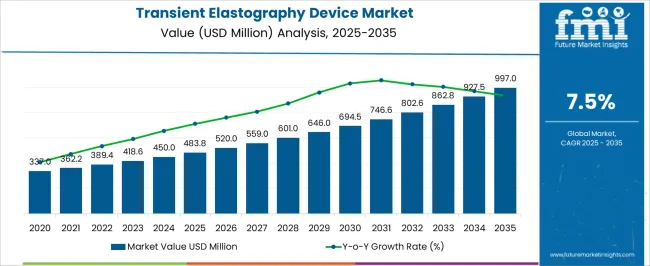

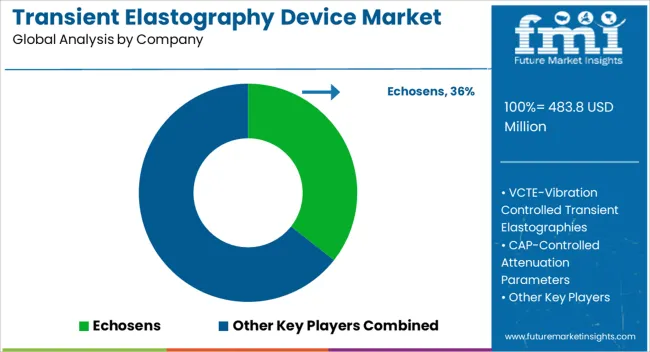

The Transient Elastography Device Market is estimated to be valued at USD 483.8 million in 2025 and is projected to reach USD 997.0 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Transient Elastography Device Market Estimated Value in (2025 E) | USD 483.8 million |

| Transient Elastography Device Market Forecast Value in (2035 F) | USD 997.0 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Transient Elastography Device market is experiencing significant growth, driven by the increasing prevalence of liver diseases, including fibrosis, cirrhosis, and non-alcoholic fatty liver disease, which require non-invasive diagnostic solutions. Adoption is being accelerated by the advantages of transient elastography, including rapid assessment, patient comfort, and high diagnostic accuracy compared with traditional biopsy methods. Technological advancements, such as vibration-controlled elastography, are improving measurement precision and expanding clinical applicability.

Rising investments in healthcare infrastructure, particularly in emerging markets, and increasing demand for early diagnosis and continuous monitoring of liver conditions are further supporting market expansion. Hospitals, diagnostic centers, and specialty clinics are actively integrating transient elastography devices into routine workflows to enhance patient outcomes and operational efficiency.

Regulatory support for non-invasive diagnostic tools and growing awareness among healthcare providers regarding disease monitoring protocols are also contributing to adoption As liver disease incidence rises globally and clinicians prioritize efficient, accurate, and patient-friendly diagnostic solutions, the market is expected to witness sustained growth, with innovation in device technology and software analytics driving continued expansion.

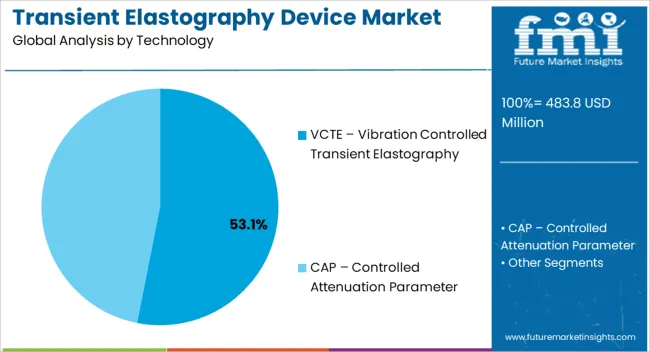

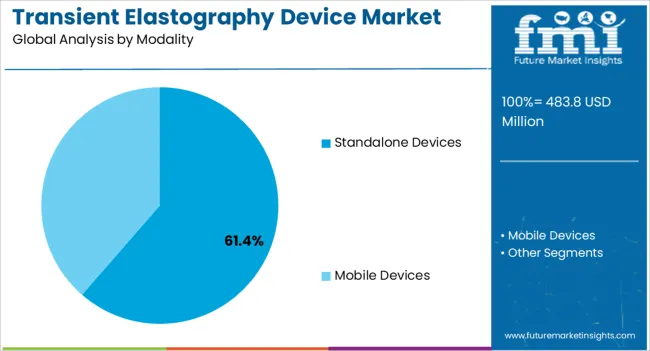

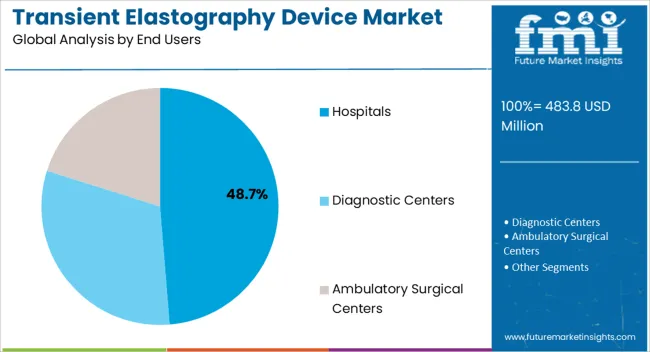

The transient elastography device market is segmented by technology, modality, end users, and geographic regions. By technology, transient elastography device market is divided into VCTE – Vibration Controlled Transient Elastography and CAP – Controlled Attenuation Parameter. In terms of modality, transient elastography device market is classified into Standalone Devices and Mobile Devices. Based on end users, transient elastography device market is segmented into Hospitals, Diagnostic Centers, and Ambulatory Surgical Centers. Regionally, the transient elastography device industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The VCTE – vibration controlled transient elastography segment is projected to hold 53.1% of the market revenue in 2025, establishing it as the leading technology. Growth in this segment is being driven by its ability to provide highly accurate, reproducible liver stiffness measurements in a non-invasive and rapid manner. The vibration-controlled mechanism enhances the reliability of measurements across diverse patient populations, including those with obesity or comorbidities.

Integration of advanced software for data analysis and reporting further strengthens clinical decision-making capabilities. Adoption is being supported by hospitals and specialty clinics seeking efficient, patient-friendly diagnostic workflows that reduce reliance on invasive biopsy procedures. The ability to combine speed, precision, and ease of use has positioned VCTE as the preferred technology among clinicians.

Continuous improvements in device ergonomics, calibration, and software analytics are expected to reinforce its market leadership As healthcare providers increasingly prioritize early disease detection and monitoring, the VCTE segment is likely to maintain its leading share, driven by clinical efficacy, operational efficiency, and patient comfort.

The standalone devices segment is anticipated to account for 61.4% of the market revenue in 2025, making it the leading modality. Growth is being supported by the widespread adoption of compact, independent devices that offer flexibility in deployment across hospitals, clinics, and diagnostic centers. Standalone devices do not require integration with existing imaging systems, allowing for quick installation, portability, and operational efficiency.

These devices are being leveraged to enhance liver disease screening programs, monitor disease progression, and support clinical decision-making in real time. Clinicians benefit from the ease of use, rapid measurement turnaround, and consistent accuracy, which improves patient experience and reduces procedural bottlenecks.

Increasing hospital investments in non-invasive diagnostics, combined with the rising prevalence of chronic liver conditions, are reinforcing demand for standalone devices As healthcare providers prioritize patient-centric, efficient, and cost-effective diagnostic tools, the standalone modality is expected to remain the dominant choice, supported by technological advancements, reliability, and operational convenience.

The hospitals end users segment is expected to hold 48.7% of the market revenue in 2025, establishing it as the leading end-user category. Growth in this segment is being driven by the high patient volumes, multidisciplinary care requirements, and investment capacity of hospitals, which favor the deployment of advanced transient elastography devices. Hospitals are increasingly integrating these devices into routine hepatology and gastroenterology workflows to improve early detection of liver diseases and monitor treatment outcomes.

The ability to perform rapid, non-invasive diagnostics on multiple patients enhances operational efficiency and reduces reliance on invasive biopsy procedures. Hospitals also benefit from comprehensive data management and reporting capabilities, which support clinical research, patient record maintenance, and regulatory compliance.

Rising awareness among healthcare providers regarding the importance of early liver disease intervention, combined with increasing government and private healthcare investments, further reinforces adoption As hospitals continue to prioritize patient-centered care, scalability, and operational efficiency, this end-user segment is expected to maintain its leading position in the market, driving overall growth.

Elastography is a medical imaging technique, like ultrasound and MRI, which is used to detect whether the tissue is hard or soft, depending on which the part is affected or stage of any disease can be determined. Transient elastography is a non – invasive test usually done to detect liver fibrosis.

Liver fibrosis or stestosis is stiffening of liver which is an indication for condition such as cirrhosis and hepatitis. Transient elastography is a technique which works on the principle of measuring the shear wave velocity and provides one dimensional image of the tissue.

In this the wave passes through the tissue which creates a distortion in the tissue. An image is created due to motion of the tissues which determines the condition of the tissue. The transient elastography device uses ultrasound waves of 5 MHz and low frequency elastic waves of 50 Hz, whose velocity is directly related to elasticity.

Transient elastography measures the stiffness of liver in volume which is approximately like a cylinder, 1 cm wide and 4 cm long, 25 – 65 mm just below the skin. The volume measured by transient elastography technique is 100 times bigger than a biopsy sample and is more accurate.

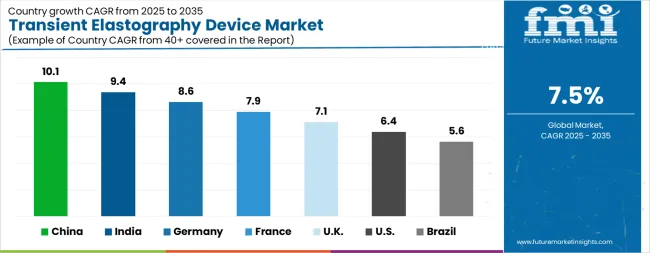

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The Transient Elastography Device Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Transient Elastography Device Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Transient Elastography Device Market is estimated to be valued at USD 166.1 million in 2025 and is anticipated to reach a valuation of USD 308.2 million by 2035. Sales are projected to rise at a CAGR of 6.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 22.7 million and USD 12.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 483.8 Million |

| Technology | VCTE – Vibration Controlled Transient Elastography and CAP – Controlled Attenuation Parameter |

| Modality | Standalone Devices and Mobile Devices |

| End Users | Hospitals, Diagnostic Centers, and Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Echosens, VCTE-Vibration Controlled Transient Elastographies, CAP-Controlled Attenuation Parameters, and Sandhill Scientific |

The global transient elastography device market is estimated to be valued at USD 483.8 million in 2025.

The market size for the transient elastography device market is projected to reach USD 997.0 million by 2035.

The transient elastography device market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in transient elastography device market are vcte – vibration controlled transient elastography and cap – controlled attenuation parameter.

In terms of modality, standalone devices segment to command 61.4% share in the transient elastography device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Elastography Imaging Market Growth – Trends & Forecast 2024-2034

Transient Protein Expression Market

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA