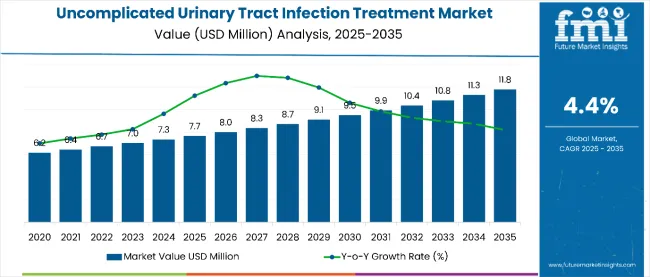

The global uncomplicated urinary tract infection treatment market is valued at USD 7.7 billion in 2025 and is set to reach USD 11.8 billion by 2035, which shows 4.4% CAGR.

An uncomplicated UTI is an acute minor infection of the urinary system, commonly including the bladder and the urethra. It affects healthy persons apparently free from structural and functional anomalies within the urinary system and most preponderantly female, for anatomical reasons. In this type of infection, bacteria penetrate through the female's urethra, which happens to be shorter than in that of the male.

These infections are primarily symptomatic, thereby causing irritation and pain to urinate plus an ache within the lower tummy. However, the massive increases in these cases across UTI worldwide pose as the leading reason for increasing demand in the market.

Strong growth in a disease with higher rates of diagnosis and incidence rate mainly in the women and currently growing among more senior populations still sustain steady antibiotics demand and discovery of new medications that prevent infection or treat an established infection more effectively.

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 7.7 billion |

| Industry Value (2035F) | USD 11.8 billion |

| CAGR (2025 to 2035) | 4.40% |

Increased Antibiotic awareness and availability drives the Global Uncomplicated UTI Treatment market. Improved access to healthcare globally, especially to developing regions around the world increases the availability of antibiotics.

Subsequently, greater ability to recognize and treat these infections before reaching complications such as kidney infections and recurrent infections arise. Various campaigns and awareness drives by governments and health care setups to educate people on the early signs of UTI, to consult a physician in time, and the possible consequences of neglected infection.

These initiatives have significantly improved health-seeking behavior, where more people visit healthcare providers once symptoms arise. Moreover, the availability of over-the-counter antibiotics in some areas, though controversial, has expedited treatment access. Controlled prescription practices, however, in most countries, seek to balance accessibility with the need to avoid antibiotic misuse.

Telemedicine platforms and e-prescription services, most importantly, increase access to antibiotics, especially in rural and otherwise underserved areas, so one can treat in a timely manner without having to visit a physical clinic. Among these factors, demand has been driven for the UTI treatment market, driving growth in developed and emerging economies.

The uncomplicated urinary tract infection treatment market is undergoing a pivotal shift due to rising antimicrobial resistance, which is reducing the effectiveness of conventional antibiotics like nitrofurantoin and trimethoprim. In response, healthcare systems are embracing next-generation, non-antibiotic strategies to manage and prevent UTIs more effectively.

The uncomplicated urinary tract infection treatment market often underrepresents immunocompromised patients who are highly vulnerable to severe complications. Individuals undergoing chemotherapy for cancers like leukemia, organ transplant recipients on anti-rejection drugs, or patients with autoimmune diseases such as lupus face elevated risks. In these populations, even a simple UTI can escalate rapidly, requiring more intensive interventions.

The uncomplicated urinary tract infection treatment market's compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis offers informative insights on the performance of the industry that has reflected changes and trends in revenue generation.

H1 represents the first half of the year, which runs from January to June, while H2 runs from July to December. For the first half of the decade 2024-2034, the business will have a CAGR of 4.3%, and in the second half of the same decade, the growth rate will be slightly higher at 4.8%.

| Particular | Value CAGR |

|---|---|

| H1 | 4.3% (2024 to 2034) |

| H2 | 4.8% (2024 to 2034) |

| H1 | 4.4% (2025 to 2035) |

| H2 | 5.0% (2025 to 2035) |

CAGR for the period ahead, which is H1 2025-H2 2035 is going to be marginally low at 4.4% for the first half and relatively more moderate at 5.0% for the second half. It increased 10 BPS for the first half, and it saw an increase of 19 BPS for the second halfss.

The prime mover behind the global market is the rising case of UTIs worldwide. UTIs are among the most common bacterial infections in the world and have its victims to cause over 150 million patients yearly. It largely affects women because nearly 50–60% of women obtain at least once in their lifetime due to anatomical reasons, such as having a shorter urethra which favors entry to bacteria. The prevalence is also high in the elderly, patients with diabetes, and patients on catheter, thus expanding the population.

This global burden of UTIs, thus, has always kept up with a consistent demand for treatment options such as antibiotics, pain relievers, and preventive therapies. Lifestyle changes, poor hygiene, and the ever-increasing geriatric population increase the rates of infection. In addition, the recurrent infections in women that may affect up to 30% of women within six months of an initial infection keep on demanding further treatment and management strategies.

This widespread prevalence not only drives pharmaceutical sales but also encourages continuous R&D efforts to develop advanced therapies, rapid diagnostics, and non-antibiotic treatments, contributing significantly to the uncomplicated urinary tract infection treatment market's growth trajectory.

A major driver for the Global Uncomplicated Urinary Tract Infection (UTI) Treatment Market is the increasing adoption of self-care and OTC products. Due to increasing health awareness and the trend of self-care, most people want to manage mild UTI symptoms independently, especially in the early stages. This has created an increasing demand for over-the-counter products, including urinary pain relief medications (e.g., phenazopyridine), cranberry supplements, D-mannose, probiotics, and herbal remedies believed to support urinary tract health.

The ease and accessibility of these products through self-care sources, that is, the pharmacies as well as online portals, have helped more consumers opt for it. The continuing growth in e-commerce has been adding to this by giving people ways to purchase discreetly and availability easily. Moreover, because of proper campaigns about UTI symptoms and prevention, consumers are able to take on proactive steps themselves toward their health.

With growing adoption of self-care and over-the-counter remedies, it relieves healthcare systems of this pressure and widens the scope of non-prescription UTI drugs in the global market, adding to its overall growth.

Development of Non-Antibiotic Therapies is one major opportunity in the Global Uncomplicated Urinary Tract Infection (UTI) Treatment Market. In response to mounting concerns over the development of AMR, development of alternative solutions that minimize traditional antibiotics is quickening. As such, novel non-antibiotic therapeutics, probiotics, vaccines, and others derived from plant-based sources represent promising solutions.

Probiotics support a normal gut and urinary tract microbiome, thereby theoretically lowering the UTI recurrence rates. Moreover, plant-based therapeutic interventions, including cranberry extracts, D-mannose, and herbal combinations, have demonstrated effectiveness in the prevention of adhesion of uropathogens to the urothelium. Recent advances have included vaccines designed against uropathogenic E. coli, which cause the vast majority of UTIs, potentially providing long-term immunity and reduced incidence.

These novel strategies not only provide an effective treatment option but also help reduce the overall usage of antibiotics and, thereby, AMR. Going forward, investment in R&D of non-antibiotic treatments is expected to be increased with the rising interest of consumers in such organic and preventive healthcare solutions. This leads to significant growth opportunities in the market for UTI treatment.

The increasing emergence of multidrug-resistant (MDR) bacteria, specifically E. coli with extended spectrum beta-lactamase produced enzymes. Such strains acquire cross-resistance to trimethoprim/sulfamethoxazole and fluoroquinolones along with the beta-lactams and become less reliable.

It makes them have to resort to antibiotics that are either broad-spectrum or more powerful. These usually come at a cost and, by extension, with a potential increased risk of side effects. The culture and sensitivity tests used to determine appropriate antibiotics may even cause treatment delay and expose them to the danger of complications like pyelonephritis and recurrent infections.

Furthermore, the spreading issues of AMR also surface as a colossal public health concern. AMR has been listed in the list of the World Health Organization most significant global health challenges. New antibiotics development is controlled by few commercial incentives, regulatory hurdles, and the fast pace of evolving resistant pathogens; therefore, this restrains growth in the UTI treatment market.

The global uncomplicated urinary tract infection treatment industry recorded a CAGR of 3.7% during the historical period between 2020 and 2024. The growth of uncomplicated urinary tract infection treatment industry was positive as it reached a value of USD 7.3 billion in 2024 from USD 6.3 billion in 2020.

Traditionally, the management of UTI involved natural remedies and an increased fluid intake, which were supplemented by herbal treatments, including cranberry juice, that prevented bacterial adhesion. Treatment before antibiotics was focused on bladder irrigations with antiseptic solutions and alkalinizing agents to achieve symptomatic relief. Diagnosis followed essentially on the basis of clinical symptoms without laboratory confirmation.

UTI management in the present era is more advanced than previously, with more precise diagnostic tools such as urine cultures and rapid point-of-care tests for an accurate diagnosis. As a rule, treatment is targeted through antibiotics, tested through antimicrobial susceptibility testing, and therefore sensitive to resistance. Newer non-antibiotic options available include probiotics, D-mannose, and vaccines. Of course, this means that telemedicine and e-prescriptions improve accessibility and indicate an evidence-based move towards individualized care.

Advances in Diagnostic Technologies are the most significant growth drivers for the Global Uncomplicated Urinary Tract Infection (UTI) Treatment Market. High Speed point-of-care (POC) systems allow for early, precise diagnosis of UTIs, significantly improving patient outcome. Other diagnostic technologies include rapid diagnostic tests and sometimes provide minute-long results, whereas the traditional urine culture takes much more time. Early diagnosis, followed by prompt appropriate target treatment, ensures a low probability of complications and recurrence.

Advanced diagnostics also lower the risk of misdiagnosis and unnecessary prescriptions of antibiotics, addressing AMR concerns. Molecular diagnostics and biosensors improve the identification of pathogens and antibiotic susceptibility tests, thus evidence-based treatment decisions. Improvements in rapid diagnostics indirectly fuel growth in effective UTI therapies.

Tier 1 companies are the industry leaders with 49.9% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Pfizer Inc., Merck & Co., Inc. and AbbVie Inc.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 34.0% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include F. Hoffmann-La Roche Ltd., Johnson & Johnson, GlaxoSmithKline Plc. and Bayer AG

Compared to Tiers 1 and 2, Tier 3 companies offer uncomplicated urinary tract infection treatment, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Validus Pharmaceuticals LLC, Lupin and Others, and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

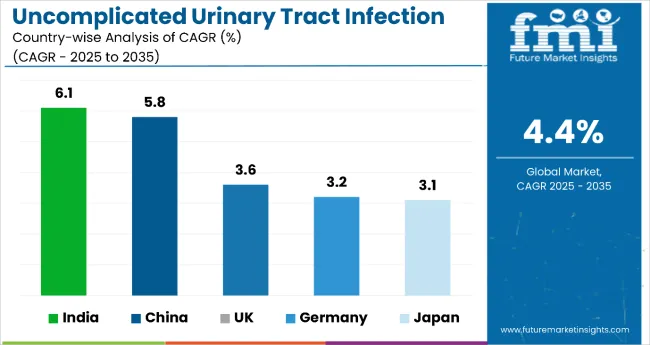

The market analysis for the treatment of uncomplicated urinary tract infection in different countries is given below. Analysis of Major Countries North America Latin America Western Europe Eastern Europe East Asia, South Asia & Pacific Middle East & Africa It can be found here. The United States is expected to lead North America by 2035, which is likely to hold an estimated 84.9% value share. In the Asia-Pacific region, by 2035, China would have reached a CAGR of 5.8%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Germany | 3.2% |

| UK | 3.6% |

| China | 5.8% |

| Japan | 3.2% |

| India | 6.1% |

The Germany will show CAGR of 3.2% between 2025 and 2035.

The awareness regarding AMR is the prime growth factor of the Global Uncomplicated UTI Treatment Market in Germany. The country, on the one hand, is proactive and active in handling the rising concern about AMR and has proposed national and regional antimicrobial stewardship programs to ensure responsible use of antibiotics and prevent the prescription of broad-spectrum antibiotics, hence overuse.

As more people become aware of AMR, the use of alternative and innovative treatment options is being pursued, including non-antibiotic therapies like probiotics, cranberry extracts, and vaccines, which would prevent or minimize recurrence of UTI without adding to resistance. Targeted antibiotics that specifically address resistant pathogens are also being pursued, thereby increasing the accuracy and effectiveness of the treatment.

Germany's strong healthcare system ensures that these services are made readily available for the introduction of new therapies, diagnostic tools, and stewardship programs, making the environment friendly for the use of advanced UTI treatment options. This is due to increasing concerns over AMR, leading to the need for more effective and sustainable treatments.

United States will show a CAGR of 2.9% between 2025 and 2035.

High Prevalence of UTIs among Women: According to the Center for Disease Control and Prevention, there are approximately 50-60% chances that women will face at least one episode of UTI in her lifetime. That is why the number of female cases is extremely high, hence considered as the main driving factor in the case of the US market for global uncomplicated UTI treatment. This means that women's anatomical structure, for example, the fact that their urethra is shorter, exposes them to UTIs. Relapse of the infections makes continuous treatment a must, which often involves antibiotics, pain relievers, and other OTC medicines.

This high incidence directly drives the market demand for UTI treatments across both prescription and OTC segments. With women increasingly demanding convenient and fast-acting solutions, OTC product sales for urinary pain relief medications and cranberry-based products have seen immense growth. This widespread prevalence among women creates a consistent need for effective, accessible treatment options and further boosts the market's growth trajectory in the USA

China is anticipated to show a CAGR of 5.8% between 2025 and 2035.

Rising awareness of women's health is a critical driver for the treatment market of uncomplicated urinary tract infection in the global China market. Over the last couple of years, the country has shown a huge improvement in handling women's health issues with different national campaigns and educational programs. These initiatives encompassed various health issues among women, most of which included UTIs as women are usually predisposed to anatomical factors and poor hygiene practices.

More Chinese women are being educated on UTI symptoms, risks, and preventive measures, as awareness spreads. This makes them detect early, consult physicians faster, and seek effective treatments. Thus, healthcare professionals and policymakers further push the market, stressing the importance of periodic screenings and early treatment.

Better education among the Chinese ladies will enhance their willingness to get treated early once they contract UTI, whether it is prescription medication, available over-the-counter solutions, or life-style change. Increased awareness is building the demand for UTI treatments in China, thus providing an expansion boost for the treatment market in China.

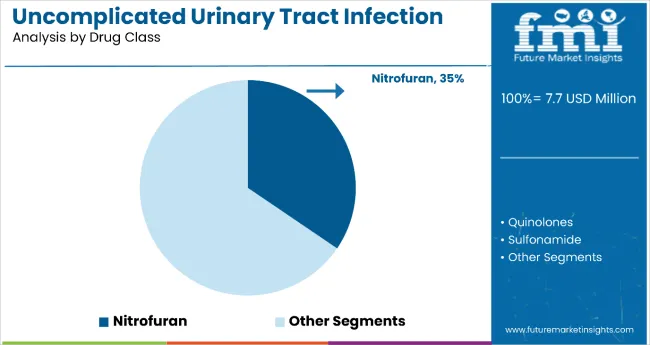

The section contains information about the leading segments in the industry. Based on drug class, the nitrofuran (nitrofurantoin) segment is expected to account for 35% of the global share in 2023.

| By Drug Class | Value Share (2025) |

|---|---|

| Nitrofuran (Nitrofurantoin) | 35% |

The Nitrofuran (Nitrofurantoin) segment will dominate the market in 2025 with a share of more than 35% of overall revenue. It is widely prescribed by doctors, since it remains one of the first-line, well-trusted antibiotics for treatment of uncomplicated UTIs caused by E. coli and other pathogens.

In its proper application, it demonstrates an excellent proven track record against antimicrobial resistance. With its long history of use and popularity, nitrofurantoin has not lost priority among healthcare providers and patients. Moreover, Nitrofurantoin possesses an excellent safety profile, particularly in nonpregnant women without renal impairment.

It is orally convenient for patients because it is offered in various ways. The overall cost-effectiveness also improves upon its access via the healthcare sectors. As shown to be beneficial for the purpose of uncomplicated UTIs treatments, with research now emphasizing AMR and unneeded antibiotic application, Nitrofurantoin will remain first choice.

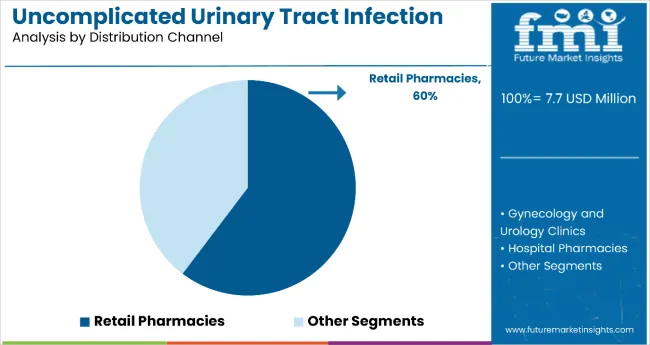

| By Distribution Channel | Value Share (2025) |

|---|---|

| Retail Pharmacies | 60% |

Retail pharmacies will be the market leader, taking in about 60% of revenues by 2025. This is because more people consider them convenient for easy access to these areas for the treatment of UTI. One-stop options on retail pharmacy shelves include prescription antibiotic drugs and over-the-counter pain relief products, as well as preventive measures, such as cranberry supplements.

With self-care becoming the norm, many people prefer to collect their remedies when they begin to feel symptoms of a UTI rather than waiting till they can see the doctor. This trend keeps retail pharmacies at the center of UTI treatment and prevention.

Moreover, retail pharmacies have faster accessibility to treatment in comparison to healthcare facilities. A faster turnaround ensures reduced waiting periods, and since both prescription and non-prescription treatments are possible, consumer confidence is increased with the sales volume. The trend of online pharmacy platforms and e-commerce has seen an increase with the convenience of purchasing UTI treatments without stepping into a healthcare facility, hence the growth in this segment within the market.

Main players of the market are adopting various growth strategies to enhance their market penetration. These include the launch of newer products, including non-antibiotic therapies and better formulations to overcome AMR.

Other major strategies pursued by companies in enhancing R&D capabilities and also expanding access to new geographies through strategic partnerships and collaborations also encompasses expansion into geographies, particularly Asia-Pacific and Latin America. Awareness programs, education of the consumers and health-care providers also result in generating demand for products of the companies and e-commerce channels enhance accessibilities.

Recent Industry Developments in Uncomplicated Urinary Tract Infection Treatment Market

In terms of drug class, the industry is divided into penicillin, quinolones, sulfonamide, tetracycline, nitrofuran, and others.

In terms of distribution channel, the industry is segregated into hospital pharmacies, gynecology and urology clinics, retail pharmacies, and online drug stores

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global uncomplicated urinary tract infection treatment industry is projected to witness CAGR of 4.4% between 2025 and 2035.

The global uncomplicated urinary tract infection treatment industry stood at USD 7.3 billion in 2024.

The global uncomplicated urinary tract infection treatment industry is anticipated to reach USD 11.8 billion by 2035 end.

China is expected to show a CAGR of 5.8% in the assessment period.

The key players operating in the global uncomplicated urinary tract infection treatment industry Pfizer Inc., Merck & Co., Inc., AbbVie Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson, GlaxoSmithKline Plc., Bayer AG, Validus Pharmaceuticals LLC, Lupin Ltd. and Others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 13: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 14: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 29: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 58: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 59: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 118: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 119: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Uncomplicated Urinary Tract Infection Treatment

Urinary Collection Device Market Size and Share Forecast Outlook 2025 to 2035

Urinary Bag Market - Trends & Forecast 2025 to 2035

Urinary Antibacterial & Antiseptic Pharmaceuticals Market Analysis – Forecast 2025 to 2035

Urinary Retention Therapeutics Market Growth - Demand & Forecast 2025 to 2035

Urinary Protein Reagents Market

Urinary Tract Infection Testing Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Urinary Tract Infection (UTI) Treatment Market (UTI) Analysis - Size, Share, and Forecast 2025 to 2035

Self-urinary Infection Testing Market Size and Share Forecast Outlook 2025 to 2035

Genitourinary Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Complicated Urinary Tract Infections Treatment Market - Trends & Outlook 2025 to 2035

Female Stress Urinary Incontinence Treatment Device Market Size and Share Forecast Outlook 2025 to 2035

Catheter Associated Urinary Tract Infections (UTI) Treatment Market - Demand & Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA