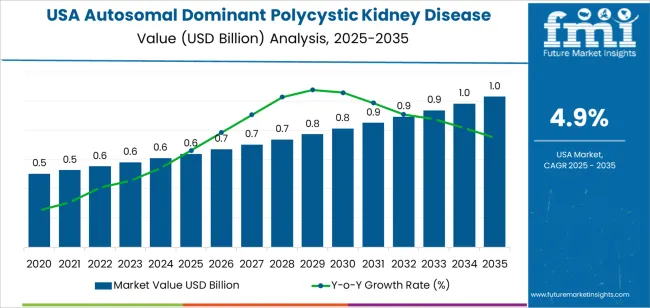

The demand for autosomal dominant polycystic kidney disease (ADPKD) treatment in the USA is expected to grow from USD 0.6 billion in 2025 to USD 1.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.9%. ADPKD, a genetic disorder characterized by the growth of cysts in the kidneys, often leads to kidney failure. Treatment options for ADPKD are evolving, with new therapies and management approaches improving the prognosis for affected individuals. The increasing prevalence of the disease, along with advancements in treatment options, will continue to drive market growth over the forecast period.

The market will experience steady growth, starting at USD 0.6 billion in 2025 and rising to USD 0.7 billion in 2026, and USD 0.7 billion in 2027. By 2028, the demand for ADPKD treatment will increase to USD 0.8 billion, continuing to rise each year. By 2035, the market is projected to reach USD 1.0 billion, driven by the development of new drugs, increasing awareness, and more effective treatments for managing the progression of the disease.

The market share erosion or gain analysis for ADPKD treatment reveals a steady expansion of market share as new therapies and drugs are introduced. In the early years (2025-2029), the market will experience a consistent increase in demand, with incremental annual growth. This steady increase is driven by ongoing advancements in the understanding of the disease and improvements in treatment options. As new treatments become available, they are expected to capture an increasing share of the market, contributing to market share gain.

However, the market share gain is not expected to be uniform across all existing therapies, as some treatments may face competition from newer, more effective drugs. Older treatments that lack innovation may experience market share erosion as they are gradually replaced by more effective alternatives. The late years of the forecast period (2029-2035) will see a continuation of this trend, with new drugs for ADPKD continuing to gain market share, leading to gradual erosion of market share for less effective therapies.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 0.6 billion |

| Industry Forecast Value (2035) | USD 1 billion |

| Industry Forecast CAGR (2025-2035) | 4.9% |

Demand for ADPKD treatment in the USA is rising because diagnosed prevalence continues to increase as clinical data and screening improve. ADPKD remains the most common inherited kidney disorder, and more individuals are being diagnosed with the condition earlier. As early detection becomes more common, the focus is shifting toward disease management and slowing progression, rather than just treating complications at later stages. The increasing awareness of the disease, along with better diagnostic capabilities, supports the rising demand for treatments.

At the same time, the therapeutic landscape for ADPKD is evolving, with new treatments becoming available. A drug that helps slow the growth of cysts and preserve kidney function is now being used to manage the disease in patients at risk of rapid progression. As research advances, new treatments and alternative therapies are being explored, raising hope for improved long term outcomes. Growing emphasis on early intervention, regular monitoring, and lifestyle changes as part of comprehensive care also expands the market for ADPKD treatment. The combination of rising diagnosed prevalence, expanding treatment options, and a focus on preventing disease progression suggests that demand for ADPKD treatment in the USA will continue to grow in the coming years.

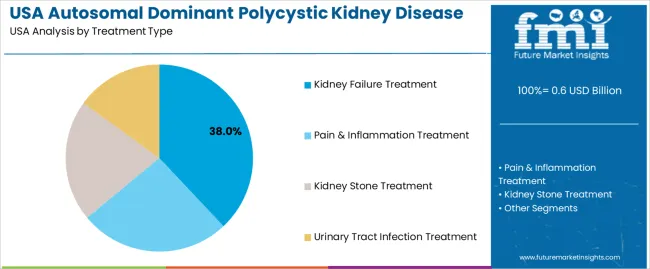

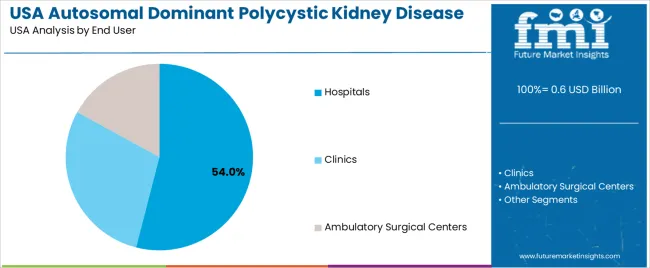

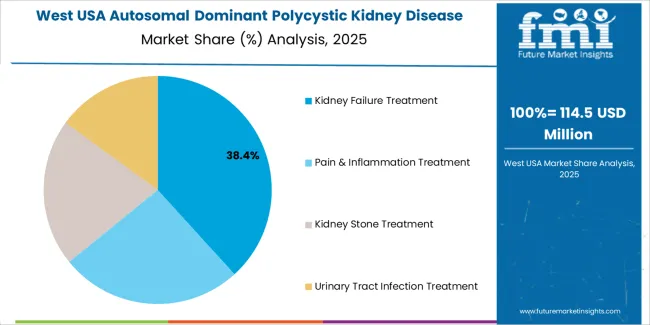

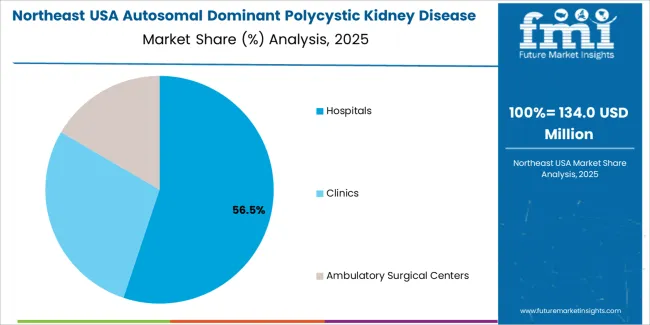

The demand for autosomal dominant polycystic kidney disease (ADPKD) treatment in the USA is driven by treatment type and end user. The leading treatment type is kidney failure treatment, accounting for 38% of the market share, while hospitals dominate the end-user segment, capturing 54% of the demand. ADPKD is a genetic disorder that leads to the formation of cysts in the kidneys, which can eventually result in kidney failure. The treatment landscape for ADPKD focuses on managing symptoms, preventing kidney failure, and improving the quality of life for affected individuals. As the prevalence of ADPKD continues to rise, so does the demand for specialized treatments, particularly in hospital settings.

Kidney failure treatment leads the demand for ADPKD treatment in the USA, holding 38% of the market share. Kidney failure is the most severe complication of ADPKD, and as the disease progresses, patients may require dialysis or a kidney transplant to manage the loss of kidney function. The demand for kidney failure treatments is driven by the need for life-saving interventions for patients with end-stage renal disease (ESRD), a common outcome of ADPKD. Kidney failure treatments focus on managing fluid balance, removing waste products from the blood, and alleviating symptoms associated with kidney dysfunction.

The increasing prevalence of kidney failure due to ADPKD, coupled with advancements in dialysis and kidney transplant options, continues to drive the demand for kidney failure treatment. Hospitals and healthcare providers are focused on offering patients comprehensive care for managing kidney failure, which includes not only dialysis but also pre-transplantation care and post-transplant monitoring. As the number of ADPKD patients requiring kidney failure treatment grows, the demand for effective and timely kidney failure treatments will continue to lead the ADPKD treatment market in the USA.

Hospitals lead the end-user demand for ADPKD treatment in the USA, capturing 54% of the market share. Hospitals are critical in managing the complex care required by ADPKD patients, especially those with advanced stages of kidney disease. Hospitals provide a range of services, from routine monitoring and management of kidney function to dialysis and kidney transplants, making them the central healthcare provider for individuals with ADPKD. In these settings, patients can access specialized nephrology care, diagnostic tests, and emergency treatments that are essential for managing the progression of the disease.

The demand for ADPKD treatment in hospitals is driven by the need for acute care, particularly for patients who develop complications like kidney failure, infections, and hypertension. Hospitals offer the necessary infrastructure, specialized medical professionals, and advanced treatments required for managing severe cases of ADPKD. As the burden of kidney disease continues to grow in the USA, hospitals will remain the leading end-user segment for ADPKD treatments, providing essential care for patients at various stages of the disease.

Demand for treatment of Autosomal Dominant Polycystic Kidney Disease (ADPKD) in the USA is increasing as awareness of the disease and diagnostic capabilities improve. ADPKD is a hereditary condition that can lead to kidney failure. As more people are diagnosed and the prevalence of chronic kidney disease rises, there is a growing need for effective treatment options. Advances in targeted therapies and a focus on early detection are contributing to the expansion of the treatment market, with increasing demand for therapies that slow disease progression and manage symptoms.

What are the Drivers of Demand for ADPKD Treatment in the USA?

Demand for ADPKD treatment is driven by several factors. The increasing prevalence of kidney disease and the growing number of diagnoses, particularly with early detection through genetic screening, contribute significantly. As more patients are identified, there is a greater need for treatments to manage disease progression. Additionally, the availability of new therapies that target the underlying mechanisms of the disease has expanded treatment options, encouraging more people to seek care. The rise in patient awareness and improved healthcare access, combined with a focus on maintaining kidney function and preventing end-stage renal disease, further drives demand.

What are the Restraints on Demand for ADPKD Treatment in the USA?

Despite growth, there are some restraints on ADPKD treatment. The limited availability of approved treatment options means that many patients still face limited choices, which can hinder treatment adoption. Cost is also a major factor, as therapies can be expensive, limiting access for those without sufficient insurance coverage. Furthermore, the slow progression of the disease in many patients means that treatment may not be sought until later stages, leading to under-treatment. The safety concerns associated with some therapies and potential side effects also deter both patients and healthcare providers from pursuing aggressive treatment options.

What are the Key Trends Influencing Demand for ADPKD Treatment in the USA?

Key trends influencing demand for ADPKD treatment include a growing focus on early detection through genetic screening, which helps identify patients before symptoms become severe. The development of new treatments targeting disease progression is expected to increase demand, as these therapies offer more effective management of the condition. Additionally, there is a rising emphasis on managing ADPKD over the long term, which includes both medical treatments and lifestyle adjustments. Improved access to healthcare, increasing patient advocacy, and the expanding recognition of ADPKD as a significant health concern will continue to drive demand for treatment.

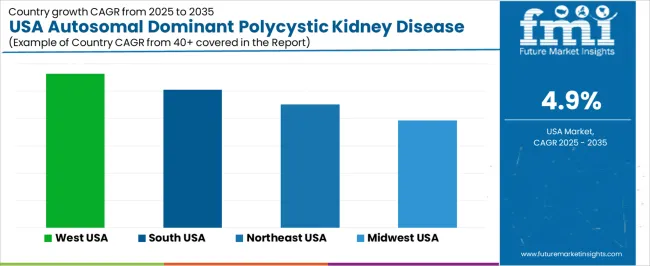

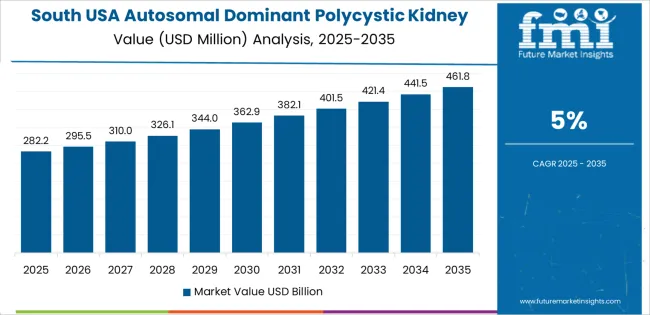

The demand for treatment of ADPKD in the USA is expected to rise across all regions, with the West USA showing the highest projected CAGR at 5.6%. The South USA follows with a 5.0% CAGR, the Northeast USA at 4.5%, and the Midwest USA at 3.9%. These regional differences reflect variations in diagnosed patient populations, healthcare infrastructure, access to nephrology services, and adoption of emerging therapies and monitoring for kidney disease.

| Region | CAGR (%) |

|---|---|

| West USA | 5.6 |

| South USA | 5.0 |

| Northeast USA | 4.5 |

| Midwest USA | 3.9 |

In the West USA, the projected 5.6% CAGR for ADPKD treatment may be driven by several factors. The region has growing healthcare infrastructure and increasing awareness of kidney diseases among patients and clinicians. As genetic testing and diagnostic imaging become more accessible, more cases of ADPKD are identified before advanced kidney failure. Early diagnosis enables the use of therapies aimed at slowing cyst growth, managing hypertension, and preserving kidney function. Additionally, demographic shifts and migration might increase the number of patients requiring care. As individuals diagnosed earlier enter long term care, demand for chronic management including medications, monitoring, and supportive treatment rises. This supports a relatively high rate of growth in treatment demand in the West USA.

In the South USA the forecast 5.0% CAGR reflects a gradually growing diagnosed population and increased adoption of disease management protocols. The South has a mix of urban and rural areas where access to nephrology care is expanding. As physicians become more aware of ADPKD’s progressive nature and as new therapies and guidelines gain acceptance, more patients begin long term treatment and monitoring. Moreover, health care payers and systems may increasingly support early intervention, which helps reduce downstream costs related to end stage renal disease. Growing patient awareness, screening, and diagnostic improvements contribute to consistent growth in treatment demand in the South.

In the Northeast USA, the estimated 4.5% CAGR reflects continued demand from a population with historically higher rates of diagnosed ADPKD. Many patients in this region present during middle age with hypertension, kidney function decline, or cyst complications. As research advances and newer therapies emerge (e.g. drugs that slow cyst growth), more patients opt for long-term management rather than waiting for advanced kidney failure. Healthcare networks and specialists in urban centers provide access to such treatments and regular monitoring. In addition, as standard of care evolves to include early detection and intervention, demand for ADPKD treatment and follow up services grows steadily.

In the Midwest USA, the projected 3.9% CAGR indicates a more gradual increase in treatment demand. Prevalence of diagnosed ADPKD is lower compared to some other regions, and rural areas may have limited access to specialists. As a result, diagnosis may occur later, which delays entry into treatment pathways. Still, as awareness of the disease increases and as healthcare providers screen at-risk individuals (e.g. family members of known patients), more cases are being identified. Use of existing therapies and supportive care for kidney function, blood pressure control, and monitoring is growing. The need for long term treatment and management supports a steady but slower increase in demand for ADPKD treatment across the Midwest.

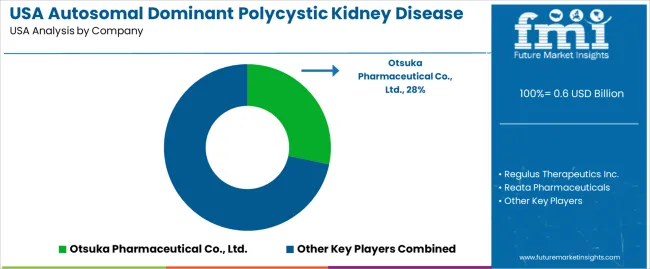

The ADPKD treatment market in the USA remains centred on a few established medicines and a growing pipeline of novel therapies. Otsuka Pharmaceutical Co., Ltd. holds a substantial portion of the market, with about 28.2% share, thanks to its drug Tolvaptan, which remains the only broadly approved therapy that slows cyst growth and kidney function decline in ADPKD patients. Other companies - Regulus Therapeutics Inc., Reata Pharmaceuticals, Sanofi, and Galapagos NV - are involved in research to expand treatment options beyond vasopressin antagonist therapy, though their approved therapies remain limited.

Competition among these firms increasingly hinges on innovation, mechanism of action, tolerability, and potential to modify underlying disease progression rather than only disease symptoms. Regulus is developing an investigational oligonucleotide therapy designed to inhibit microRNA 17, aiming to reduce cyst formation and kidney enlargement. Reata is advancing a small molecule therapy targeting oxidative stress pathways, and Galapagos is exploring alternative molecular targets to slow cyst growth. Sanofi has explored kinase inhibitors in ADPKD through prior collaborations, though clinical outcomes remain uncertain. Firms emphasise potential benefits such as reduced kidney volume, slower functional decline, improved safety profile compared to Tolvaptan, and broader eligibility among patients. The market remains dynamic as pipeline candidates advance, regulatory frameworks evolve, and patient demand grows for safer, more effective long term treatments.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Treatment Type | Kidney Failure Treatment, Pain & Inflammation Treatment, Kidney Stone Treatment, Urinary Tract Infection Treatment |

| End-User | Hospitals, Clinics, Ambulatory Surgical Centers |

| Key Companies Profiled | Otsuka Pharmaceutical Co., Ltd., Regulus Therapeutics Inc., Reata Pharmaceuticals, Sanofi, Galapagos NV |

| Additional Attributes | Dollar sales by treatment type and end-user highlight strong demand for kidney failure and pain/inflammation treatments in the management of Autosomal Dominant Polycystic Kidney Disease. Hospitals and clinics are the primary end-users, with increasing adoption of specialized therapies in ambulatory surgical centers. Leading companies like Otsuka Pharmaceutical, Sanofi, and Reata Pharmaceuticals are pivotal in providing advanced treatments. The market is expected to grow as more targeted therapies for the condition are developed, with a focus on improving patient outcomes. |

The demand for autosomal dominant polycystic kidney disease treatment in USA is estimated to be valued at USD 0.6 billion in 2025.

The market size for the autosomal dominant polycystic kidney disease treatment in USA is projected to reach USD 1.0 billion by 2035.

The demand for autosomal dominant polycystic kidney disease treatment in USA is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in autosomal dominant polycystic kidney disease treatment in USA are kidney failure treatment, pain & inflammation treatment, kidney stone treatment and urinary tract infection treatment.

In terms of end user, hospitals segment is expected to command 54.0% share in the autosomal dominant polycystic kidney disease treatment in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autosomal Dominant Polycystic Kidney Disease Treatment Market Overview - Growth & Forecast 2025 to 2035

USA Microbial Seed Treatment Market Analysis – Trends, Growth & Forecast 2025-2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Acute Kidney Injury Treatment Market Growth - Trends & Forecast 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Th17 Driven Disease Treatment Market

Hirschsprung Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Communicable Diseases Treatment Market

Meningococcal Disease Treatment Market

APOL1 Mediated Kidney Disease Market - Demand, Growth & Forecast 2025 to 2035

Global Postmenopausal Osteoporosis Treatment Market Insights – Size, Trends & Forecast 2024-2034

Rare Neurological Disease Treatment Market Report – Demand, Growth & Industry Outlook 2025-2035

Rare Inflammatory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Rare Neurological Disease Treatment Providers

Interstitial Lung Disease Treatment Market

Inherited Retinal Diseases Treatment Market Size and Share Forecast Outlook 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Swine Respiratory Diseases Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

ICU-acquired Acute Kidney Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA