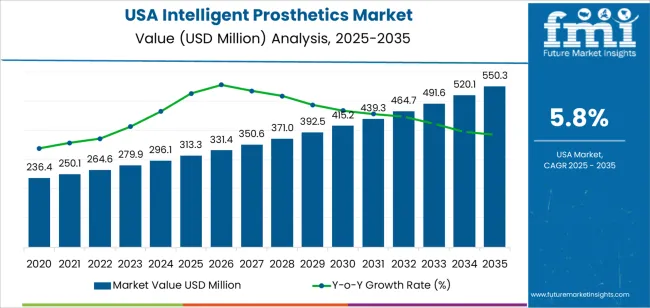

The USA intelligent prosthetics demand is valued at USD 313.3 million in 2025 and is forecasted to reach USD 550.3 million by 2035, recording a CAGR of 5.8%. Demand is supported by advances in sensor-driven control systems, rising adoption of myoelectric and microprocessor-enabled prosthetic devices, and broader clinical use of technologies designed to improve functional mobility. Intelligent prosthetics incorporate embedded electronics, adaptive grip control, and real-time feedback to enhance user comfort and precision in daily movements. Growth is further influenced by expanding rehabilitation programs and increased availability of customised prosthetic solutions through specialised clinics.

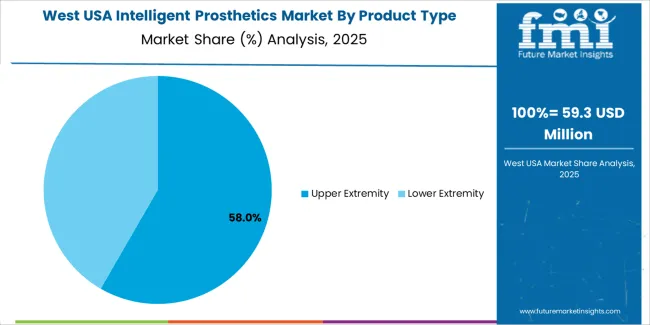

Upper extremity systems represent the leading product type, reflecting strong clinical demand for devices that support grasp, lift, rotation, and fine-motor tasks. These systems integrate pattern-recognition algorithms, multi-articulating hands, and pressure-sensitive interfaces that respond to user intent with greater accuracy than conventional prosthetic designs. Continued improvements in battery efficiency, lightweight materials, and soft-tissue interface comfort are contributing to wider adoption.

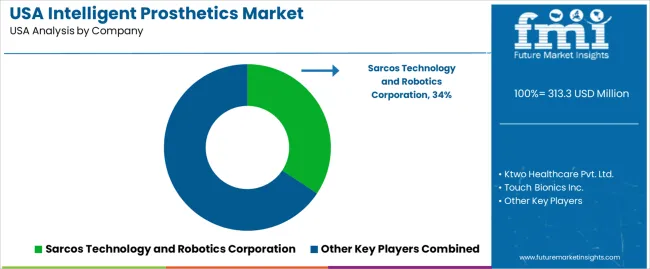

Demand is strongest in the West, South, and Northeast, where advanced rehabilitation centres, clinical research institutions, and specialised fitting facilities are concentrated. Key suppliers include Sarcos Technology and Robotics Corporation, Ktwo Healthcare Pvt. Ltd., Touch Bionics Inc., HDT Global, and Syn Touch, Inc., focusing on adaptive control features, biomechanical integration, and durable, user-oriented system design.

Peak-to-trough analysis shows a moderate cyclical pattern influenced by reimbursement cycles, technological-upgrade timelines, and procurement behavior across clinical settings. Between 2025 and 2028, the segment is expected to reach an early peak as clinics and rehabilitation centers adopt sensor-enabled, microprocessor-controlled prosthetic systems. Added demand will come from improved fitting workflows, expanded insurance coverage for advanced mobility devices, and wider patient access to intelligent limb solutions.

A mild trough is likely between 2029 and 2031, shaped by extended replacement intervals, budget adjustments among healthcare providers, and slower purchasing during periods of payer policy review. The trough remains limited because core demand for functional mobility, gait-stabilizing control units, and adaptive components remains steady across amputee populations. After 2031, the segment is expected to return to an upward trajectory as next-generation prosthetics with enhanced battery performance, multi-sensor integration, and improved joint-actuation technology enter routine clinical use. The peak-to-trough pattern reflects a resilient medical-device category shaped by technology refresh cycles, reimbursement timing, and consistent long-term rehabilitation needs.

| Metric | Value |

|---|---|

| USA Intelligent Prosthetics Sales Value (2025) | USD 313.3 million |

| USA Intelligent Prosthetics Forecast Value (2035) | USD 550.3 million |

| USA Intelligent Prosthetics Forecast CAGR (2025 to 2035) | 5.8% |

Demand for intelligent prosthetics in the USA is increasing because technological advancements enable prosthetic devices to offer greater functionality, finer control and enhanced comfort for users with limb loss. Intelligent prosthetics incorporate sensors, adaptive algorithms and connectivity features that allow more natural movements and better integration with the user’s residual anatomy. The prevalence of factors such as diabetes, vascular disease, traumatic injury and ageing contributes to a higher need for advanced prosthetic solutions.

Growing interest in rehabilitation outcomes, improved quality of life and personalised mobility supports adoption of smart prosthetic technologies. Healthcare providers and insurers increasingly recognise long-term benefits of functional prosthetic devices, which drives procurement and device upgrades. Constraints include high cost of intelligent prosthetic systems, complex regulatory and reimbursement landscapes and the need for specialist clinical fitting and training. Some users may still opt for conventional prosthetics due to budget or access limitations.

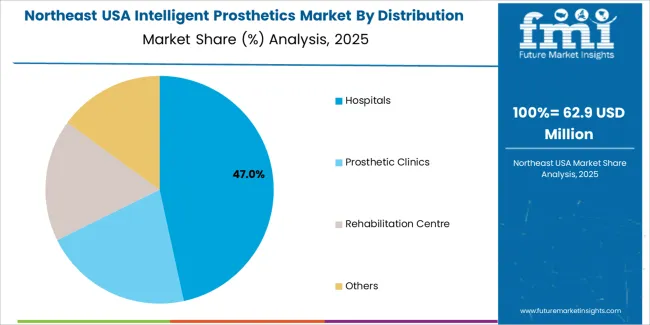

Demand for intelligent prosthetics in the United States is shaped by advancements in sensor-based control, improved material engineering, and rising use of myoelectric and microprocessor-enabled systems. Distribution across product type and clinical-delivery channels reflects functional requirements, patient rehabilitation needs, and variations in clinical capability across hospitals and specialised prosthetic facilities.

Upper-extremity intelligent prosthetics hold 58.6% of USA demand and represent the leading segment. Users rely on myoelectric hands, wrists, and multi-articulating systems that provide responsive grip patterns, improved dexterity, and adaptable movement profiles. These devices are widely prescribed for patients requiring fine-motor control and functional restoration in daily tasks. Lower-extremity prosthetics account for 41.4%, serving individuals requiring microprocessor-controlled knees, powered ankles, and stabilised gait-assistance technologies. Lower-extremity systems are essential for mobility and safety, particularly for long-term rehabilitation. Product-type distribution reflects differences in functional demands, device complexity, and reimbursement structures.

Key drivers and attributes:

Hospitals hold 46.1% of USA demand and represent the primary distribution channel for intelligent prosthetics. Hospital settings manage acute injury cases, surgical follow-ups, and initial fitting assessments, supporting early rehabilitation and device selection. Prosthetic clinics account for 21.3%, providing custom fitting, fine-tuning, and long-term device adjustment. Rehabilitation centres represent 17.5%, supporting gait training, neuromuscular conditioning, and functional integration of intelligent prosthetic systems. The remaining 15.1% includes outpatient facilities and specialty units that manage ongoing device evaluation and follow-up.

Key drivers and attributes:

Increasing amputee population, advances in AI-enabled prosthetics and rising focus on rehabilitation outcomes are driving demand.

Demand for intelligent prosthetics in the USA is supported by rising numbers of limb loss cases linked to diabetes, vascular disease, trauma, and military service. Patients and clinicians increasingly favour prosthetic systems that incorporate sensors, machine learning and user-feedback loops to improve mobility, independence and comfort. The USA healthcare system with advanced rehabilitation infrastructure and reimbursement pathways enables faster adoption of sophisticated prosthetic devices. As manufacturers introduce solutions with myoelectric control, adaptive gait algorithms, and connected monitoring, more users and payers are drawn to devices offering functional gains over conventional prosthetics.

High device cost, reimbursement complexity and technical integration challenges restrain the industry.

Intelligent prosthetics typically command higher purchase and maintenance price points than standard limbs. Some insurers and payers may delay approval or limit coverage for advanced systems, which slows uptake among certain patient groups. Technical complexity, including integration of sensors, firmware updates and user training can extend fitting and follow-up timelines, which may deter both clinicians and users. Multi-component devices may also incur higher service and lifecycle costs, and some patients may opt for more affordable conventional solutions, limiting the large-scale expansion of high-end devices.

Shift toward modular smart prosthetics, growth in direct-to-consumer and outpatient fitting services and expansion of data-driven outcomes monitoring define industry trends.

Manufacturers are evolving intelligent prosthetic designs into modular systems that enable component upgrades rather than full device replacement, which supports longer product lifecycles and lower incremental cost. Increasing use of outpatient and home-based fitting services reduces clinic burden and accelerates adoption of advanced limbs. Remote monitoring platforms and usage-analytics tools are being integrated into prosthetic solutions, enabling clinicians to assess gait patterns, device usage and maintenance needs in real time. These trends strengthen demand for intelligent prosthetics in the USA as both users and providers seek enhanced functionality and data-driven outcomes.

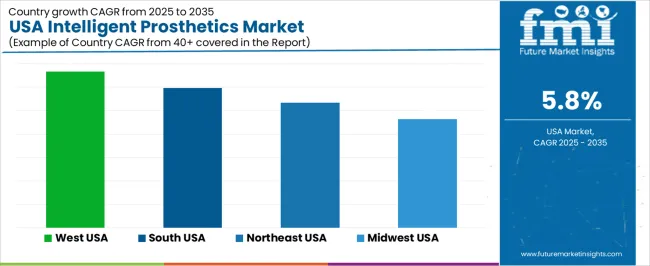

Demand for intelligent prosthetics in the United States is increasing through 2035 as healthcare systems expand access to advanced mobility solutions, rehabilitation programs adopt sensor-supported prosthetic technologies, and patient populations seek devices with improved comfort, adaptive movement, and integrated control capabilities. Intelligent prosthetics incorporate microprocessors, myoelectric systems, and multi-sensor feedback mechanisms that enhance gait stability and functional precision. Growth differs by region based on healthcare-infrastructure strength, rehabilitation-center density, veteran-care networks, and insurance-coverage patterns. The West leads with a 6.7% CAGR, followed by the South (6.0%), the Northeast (5.3%), and the Midwest (4.6%). Expansion is reinforced by rising clinical adoption, widening patient eligibility, and improvements in prosthetic-fitting and training services.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.7% |

| South | 6.0% |

| Northeast | 5.3% |

| Midwest | 4.6% |

The West grows at 6.7% CAGR, supported by large rehabilitation networks, strong adoption of advanced prosthetic technologies, and high patient access through academic medical centers in California, Washington, and Colorado. Clinics in the region use microprocessor-controlled knees, myoelectric arms, and adaptive ankle systems to support patients recovering from trauma, chronic illness, or congenital conditions. Technology-oriented healthcare facilities adopt sensors, motion-analysis tools, and fitting software to refine device calibration. Veterans’ medical centers maintain steady demand for intelligent prosthetics due to long-term mobility-restoration programs. High awareness of advanced prosthetic options across diverse patient groups reinforces procurement of next-generation devices.

The South grows at 6.0% CAGR, driven by extensive hospital networks, large veteran populations, and strong demand for next-generation prosthetic systems across trauma-care and rehabilitation facilities. States such as Texas, Florida, Georgia, and North Carolina maintain high clinical volumes for limb-loss patients, supporting broad use of intelligent prosthetics with sensor-guided motion control. Rehabilitation centers deploy adaptive wearable technologies to improve patient gait, stability, and functional mobility. Insurance coverage for advanced prosthetics continues to expand across major metropolitan areas, reinforcing steady procurement. Clinical programs focused on chronic disease, injury management, and long-term disability care contribute to consistent device utilization.

The Northeast grows at 5.3% CAGR, supported by strong academic-medical ecosystems, extensive rehabilitation services, and steady demand from aging populations and chronic-disease management programs. States including New York, New Jersey, Massachusetts, and Pennsylvania integrate microprocessor-based prosthetics for clinical mobility restoration, postoperative rehabilitation, and long-term patient support. Major hospitals employ gait-analysis labs and digital-fitting tools to optimize prosthetic alignment. Research institutions contribute to ongoing evaluation of intelligent prosthetic systems, reinforcing clinical acceptance. Regional health systems maintain stable adoption for upper- and lower-limb devices that improve user adaptability and safety.

The Midwest grows at 4.6% CAGR, supported by established rehabilitation centers, long-standing orthopedic networks, and consistent patient demand across manufacturing-driven states such as Illinois, Michigan, Ohio, and Wisconsin. Clinics use intelligent prosthetics for mobility restoration following work-related injuries, chronic illness, and surgical interventions. Rehabilitation programs incorporate microprocessor-controlled components to enhance user stability and walking efficiency. Although adoption rates are moderate due to a more mature healthcare infrastructure, ongoing demand for functional and durable prosthetic solutions supports steady procurement. Improved insurance pathways and expanding access in suburban and rural care settings contribute to long-term device utilization.

Demand for intelligent prosthetics in the USA is shaped by a concentrated group of developers supplying advanced upper- and lower-limb devices with sensory feedback, powered articulation, and multi-axis control. Sarcos Technology and Robotics Corporation holds the leading position with an estimated 34.3% share, supported by its engineering capability in robotic actuation, controlled motion algorithms, and consistent performance across powered prosthetic applications. Its position is reinforced by reliable joint mechanics, durable component design, and established collaboration with clinical partners.

Ktwo Healthcare Pvt. Ltd. and Touch Bionics Inc. follow as notable participants, offering myoelectric and microprocessor-driven prosthetic systems designed for daily use and fine-motor tasks. Their strengths include stable signal interpretation, adaptive grip patterns, and dependable compatibility with custom sockets fitted by certified prosthetists. HDT Global contributes capability in ruggedized prosthetic systems with enhanced load-handling and mechanical resilience, supporting users who require durable field-ready designs.

SynTouch, Inc. plays a specialized role by supplying tactile-sensing technologies that enhance grip feedback and improve functional realism in advanced prosthetic hands. Its contributions support broader adoption of sensory-enriched systems within the clinical rehabilitation environment. Competition across this segment centers on sensor accuracy, actuator reliability, battery performance, ergonomic fit, and consistency of myoelectric signal processing. Demand continues to grow as rehabilitation centres, veterans’ programmes, and clinical providers adopt powered, sensor-integrated prosthetics that offer greater functional range and improved user comfort in everyday activities.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Upper Extremity, Lower Extremity |

| Distribution Channel | Hospitals, Prosthetic Clinics, Rehabilitation Centre, Others |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Sarcos Technology and Robotics Corporation, Ktwo Healthcare Pvt. Ltd., Touch Bionics Inc., HDT Global, SynTouch, Inc. |

| Additional Attributes | Dollar sales by product type and distribution channel categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of intelligent and robotic prosthetic manufacturers; advancements in sensor-integrated prosthetics, myoelectric control systems, and AI-assisted limb movement; integration with hospital rehabilitation programs, prosthetic clinics, and patient mobility support services in the USA. |

The global demand for intelligent prosthetics in USA is estimated to be valued at USD 313.3 million in 2025.

The market size for the demand for intelligent prosthetics in USA is projected to reach USD 550.3 million by 2035.

The demand for intelligent prosthetics in USA is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in demand for intelligent prosthetics in USA are upper extremity and lower extremity.

In terms of distribution channel, hospitals segment to command 46.1% share in the demand for intelligent prosthetics in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Completion Market Size and Share Market Forecast and Outlook 2025 to 2035

Intelligent Rubber Tracks Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Cervical Massager Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Garment Hanging Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Rotary Kiln Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Multifunctional Laser Bird Repeller Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Platform Management Interface (IPMI) Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Lighting Control Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Intelligent Vending Machine Market Insights – Demand, Size & Industry Trends 2025–2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market Size, Growth, and Forecast 2025 to 2035

Intelligent Fencing Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market in Korea – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA