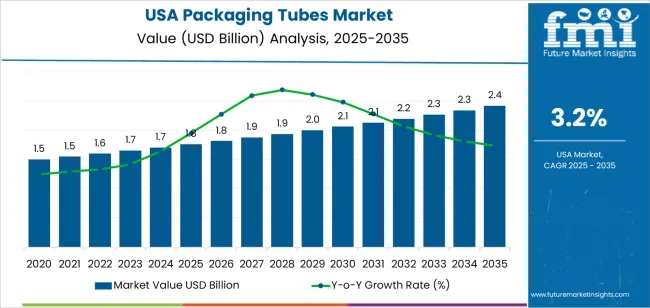

The demand for packaging tubes in the USA is expected to grow from USD 1.8 billion in 2025 to USD 2.4 billion by 2035, reflecting a CAGR of 3.2%. Packaging tubes are widely used in various industries, including cosmetics, pharmaceuticals, food, and personal care, primarily for products such as creams, gels, toothpaste, and lotions. The increasing preference for convenient and hygienic packaging, especially in the cosmetic and healthcare sectors, will drive the market for packaging tubes. Additionally, sustainability concerns are encouraging the adoption of eco-friendly packaging materials, such as recyclable or biodegradable tubes, which will further support the growth of this market.

As consumer demand for clean-label and eco-conscious products continues to rise, packaging tube manufacturers are increasingly focusing on innovations in material types, such as post-consumer recycled content and plant-based resins. Moreover, advancements in tube design and tamper-proof packaging are driving the adoption of packaging tubes. The rise of online shopping and the growing trend of personalized products in the beauty and healthcare industries will further fuel demand for packaging solutions that offer ease of use, flexibility, and customization.

From 2025 to 2030, the demand for packaging tubes in the USA will grow from USD 1.8 billion to USD 2.1 billion, contributing USD 0.3 billion in value. This phase will see a gain in market share, driven by innovations in packaging design and the increasing adoption of eco-friendly materials. As sustainability becomes a major focus in the consumer goods sector, biodegradable and recyclable packaging tubes will gain significant market share. Furthermore, packaging tubes in sectors such as cosmetics, pharmaceuticals, and personal care will continue to experience steady growth due to their ability to offer convenience, product protection, and hygiene. During this period, the adoption of environmentally sustainable tubes will provide a competitive edge for companies, allowing them to capture growing demand from eco-conscious consumers and industries.

From 2030 to 2035, the market will grow from USD 2.1 billion to USD 2.4 billion, adding USD 0.3 billion in value. The market share gain will continue in this phase, but at a slower pace, as the industry reaches greater maturity. The growth rate will be moderate, reflecting the increased competition and the standardization of packaging tube solutions across the market. While demand for sustainable and innovative packaging will persist, the focus will shift towards incremental improvements in product features and cost-efficiency. Although the pace of growth slows, the market will still experience steady demand for personal care and pharmaceutical packaging tubes, contributing to sustained market share gains in the latter years.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.8 billion |

| Industry Forecast Value (2035) | USD 2.4 billion |

| Industry Forecast CAGR (2025-2035) | 3.2% |

Demand for packaging tubes in the USA is rising as consumers and manufacturers increasingly prioritize convenience, functionality and premium presentation in categories such as personal care, cosmetics, pharmaceuticals and food. Tubes are preferred for products like creams, gels, ointments and condiments because they offer precise dispensing, product protection and compact formats suited to retail shelves and e commerce. According to recent estimates, the U.S. tube packaging market was valued at around USD 3.01 billion in 2023 and is projected to grow to about USD 5.98 billion by 2034, representing a compound annual growth rate (CAGR) of approximately 6.4%. The strong presence of personal care and health‐related applications underlies much of this demand.

Another key driver is the shift toward sustainable packaging solutions and format innovation. Brands in the USA are moving away from traditional rigid containers toward tubes made from laminated materials, recyclable plastics or bio based substrates to meet environmental goals and regulatory pressures. The rise of e commerce amplifies the need for packaging that protects the product in transit yet remains lightweight and shelf friendly. At the same time, challenges include raw material price volatility, competition from alternate packaging formats such as pouches or rigid bottles, and the complexity of recycling multi layer tubes. Despite these constraints, the alignment of consumer trends, packaging innovation and channel evolution suggests that demand for packaging tubes in the USA will continue to expand.

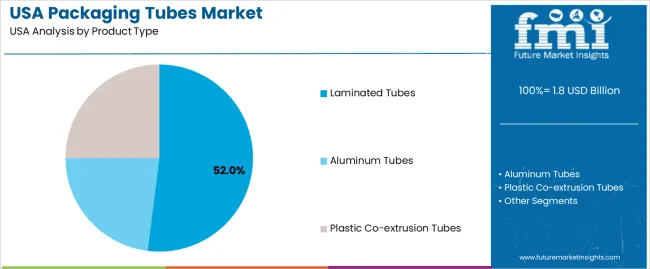

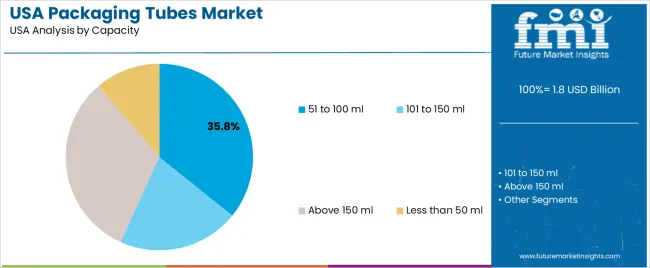

The demand for packaging tubes in the USA is driven by product type and capacity. The leading product type is laminated tubes, capturing 52% of the market share, while the most popular capacity range is 51 to 100 ml, accounting for 35.8% of the demand. Packaging tubes are widely used in a variety of industries, including personal care, pharmaceuticals, food, and cosmetics. As consumers increasingly seek convenient, portable, and sustainable packaging solutions, the demand for packaging tubes continues to grow.

Laminated tubes lead the market for packaging tubes in the USA, accounting for 52% of the demand. Laminated tubes are made from multiple layers of different materials, typically including aluminum, plastic, and sometimes paper, which offer a combination of strength, flexibility, and protection. These tubes are particularly popular in industries such as cosmetics, pharmaceuticals, and food packaging, as they provide an effective barrier against light, moisture, and air, which helps to preserve the integrity of the product inside.

The demand for laminated tubes is driven by their superior ability to protect sensitive products, their durability, and their ability to be molded into various shapes and sizes for different uses. Furthermore, laminated tubes offer excellent printing surfaces for branding and product information. As sustainability and product protection remain key concerns for consumers and businesses alike, laminated tubes are expected to maintain their dominance in the packaging tube market in the USA.

The 51 to 100 ml capacity range is the leading size for packaging tubes in the USA, capturing 35.8% of the demand. This capacity range is ideal for a variety of consumer products, including cosmetics, personal care items (like toothpaste and lotions), pharmaceuticals, and food products. The 51 to 100 ml size offers a balance between portability and functionality, making it perfect for both single-use and travel-sized products.

The demand for this capacity is driven by the growing popularity of small-sized, on-the-go products in sectors such as cosmetics and pharmaceuticals. These products cater to consumers looking for convenience and the ability to try new products without committing to larger quantities. As the trend for smaller, portable, and travel-friendly products continues to rise, packaging tubes in the 51 to 100 ml range will remain a dominant choice for both consumers and manufacturers.

What Are the Primary Growth Drivers for Packaging Tube Demand in the United States? The growing preference for convenient, user friendly packaging in industries like personal care and pharmaceuticals drives demand for packaging tubes. Increased consumer focus on sustainability is also pushing brands to adopt eco-friendly materials such as recycled and biodegradable options. The food and beverage sector’s demand for hygienic, tamper evident, and easy to store packaging is further supporting packaging tube usage. Additionally, advancements in tube manufacturing, such as innovation in multi layer structures and easy squeeze designs, provide greater customization options and contribute to market growth.

What Are the Key Restraints Affecting Packaging Tube Demand in the United States? Despite the increasing demand, challenges remain. Packaging tubes, particularly those made from plastic, face scrutiny due to sustainability concerns, particularly with single use plastic waste. The cost of producing eco friendly packaging tubes can also be higher, limiting their adoption in price sensitive markets. Material sourcing challenges, especially for bio based or recyclable alternatives, can create supply chain disruptions. Additionally, competition from rigid packaging solutions like glass and plastic bottles, which offer a longer shelf life, may restrict the penetration of packaging tubes in certain product categories.

What Are the Key Trends Shaping Packaging Tube Demand in the United States? Key trends include the rising adoption of sustainable materials, with a focus on recyclable and biodegradable tubes driven by consumer demand for eco friendly products. There is also growing interest in innovations such as airless packaging tubes, which enhance product preservation and reduce waste. Customization in design, including colorful, visually appealing packaging for cosmetics and pharmaceuticals, is gaining traction. Additionally, the rise of online shopping is influencing packaging design to accommodate better transportation and convenience, with packaging tubes gaining popularity due to their portability and ease of use.

The demand for packaging tubes in the USA is driven by their widespread use across various industries, including cosmetics, pharmaceuticals, food, and personal care products. Packaging tubes are an efficient, convenient, and cost-effective solution for containing and dispensing liquids, creams, gels, and other semi-solid products.

They offer advantages such as ease of use, portability, and product protection, which are crucial for industries requiring precise and controlled dispensing. The growing consumer preference for aesthetically appealing packaging and the increasing trend toward sustainable packaging are further contributing to the rise in demand for packaging tubes.

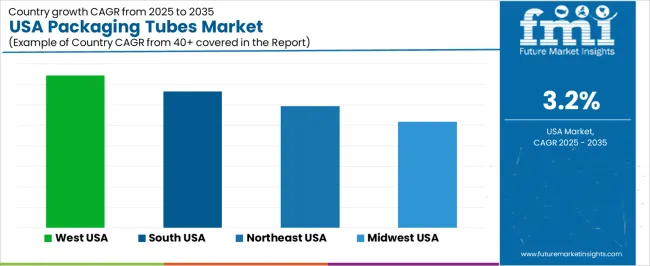

Additionally, the booming cosmetic and personal care sector, alongside a growing focus on eco-friendly materials and design innovations, is fueling this market. Regional variations in demand are influenced by factors such as industry concentration, consumer trends, and local production capabilities. Below is an analysis of the demand for packaging tubes across different regions in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 3.7% |

| South | 3.3% |

| Northeast | 3% |

| Midwest | 2.6% |

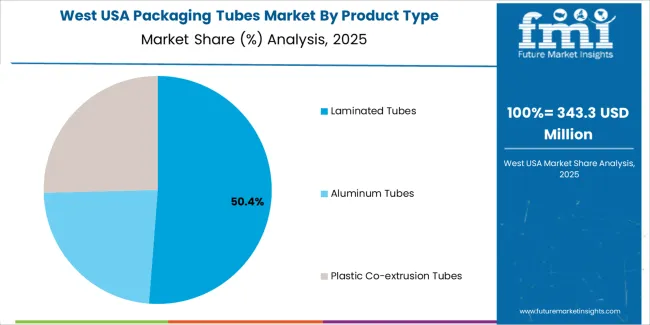

The West leads the demand for packaging tubes in the USA with a CAGR of 3.7%. This can be attributed to the region's robust consumer goods and manufacturing sectors, particularly in industries such as cosmetics, personal care, and pharmaceuticals. The West, including states like California, has a large presence of cosmetic and personal care companies that rely heavily on packaging tubes to deliver their products to consumers. Additionally, the region's focus on innovative and sustainable packaging solutions is driving the demand for eco-friendly tube packaging made from recyclable or biodegradable materials.

The West's strong emphasis on aesthetics and design innovation in packaging further fuels the demand for high-quality, visually appealing packaging tubes. With a high concentration of industries focused on beauty, skincare, and health products, the West is expected to continue driving growth in the packaging tube market.

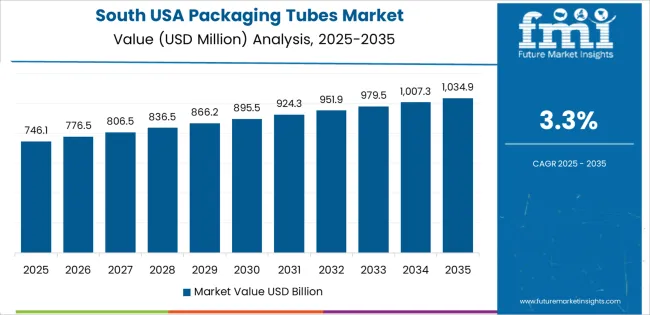

The South shows strong demand for packaging tubes with a CAGR of 3.3%. The region’s growing presence in the cosmetics, food, and pharmaceutical industries contributes to the increasing use of packaging tubes. States like Texas, Florida, and Georgia have significant manufacturing capabilities and are key players in the production of personal care products, pharmaceuticals, and food items that require effective and convenient packaging.

The demand in the South is also supported by the region's increasing emphasis on product safety, convenience, and consumer satisfaction, all of which are driving packaging innovations. As businesses in the South adopt more sustainable and consumer-friendly packaging solutions, the demand for packaging tubes is expected to remain strong, particularly in the personal care and pharmaceutical sectors.

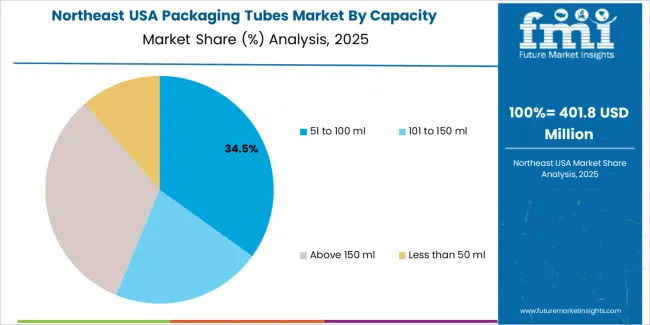

The Northeast shows steady demand for packaging tubes with a CAGR of 3.0%. The region has a well-established base in industries such as pharmaceuticals, cosmetics, and food, where packaging tubes are a widely used form of packaging for liquids, creams, and gels. Major cities like New York and Boston host a high concentration of cosmetic, pharmaceutical, and food manufacturers, all of whom require packaging solutions like tubes for their products.

Despite steady demand, the growth rate in the Northeast is slightly slower compared to the West and South, likely due to the more mature market and the region's focus on well-established packaging technologies. However, the continued focus on sustainable packaging, combined with the increasing trend of personalized products, ensures that the demand for packaging tubes remains robust in the region.

The Midwest shows moderate growth in the demand for packaging tubes with a CAGR of 2.6%. The region has a diverse industrial base, with significant sectors in food and beverage, pharmaceuticals, and personal care. However, the demand for packaging tubes is slower compared to other regions due to a more traditional reliance on other forms of packaging in certain industries.

Nevertheless, the demand for packaging tubes in the Midwest is growing steadily as businesses in the region recognize the benefits of packaging tubes, such as improved product protection, ease of use, and consumer appeal. As more companies adopt innovative packaging solutions and focus on sustainability, the market for packaging tubes in the Midwest is expected to grow at a moderate pace.

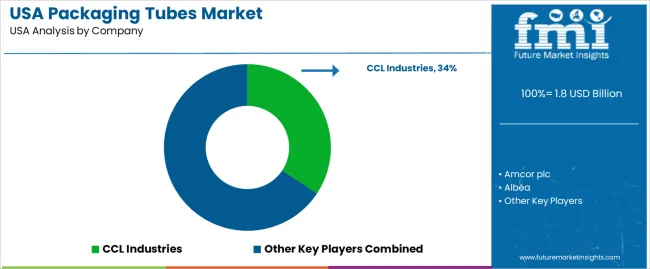

The demand for packaging tubes in the United States is rising, driven by the need for efficient, sustainable, and visually appealing packaging solutions across a variety of industries, including personal care, pharmaceuticals, food, and cosmetics. Companies like CCL Industries (holding approximately 34.3% market share), Amcor plc, Albéa, Berry Global Group, Inc., Huhtamaki Oyj, and EPL Limited are key players in this market. Packaging tubes are favored for their ability to provide a secure, convenient, and cost-effective way to package products like creams, gels, pastes, and lotions, ensuring product integrity and ease of use.

Competition in the packaging tube industry is focused on innovation, sustainability, and customization. Companies are investing in new materials, such as recyclable and biodegradable options, to meet the growing consumer demand for eco-friendly packaging. Another area of competition is the design and functionality of the tubes, with brands looking for unique shapes, sizes, and features (like airless pumps or easy-squeeze technology) to differentiate themselves in the market. Additionally, companies are working to improve manufacturing processes to reduce costs and improve efficiency while maintaining high-quality standards. Marketing materials often highlight features such as durability, product protection, sustainability, and customizable design options. By aligning their products with the growing demand for sustainable, functional, and aesthetically pleasing packaging solutions, these companies aim to strengthen their position in the U.S. packaging tube market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Laminated Tubes, Aluminum Tubes, Plastic Co-extrusion Tubes |

| Capacity | 51 to 100 ml, 101 to 150 ml, Above 150 ml, Less than 50 ml |

| End Use | Cosmetics, Oral Care, Commercial & Industrial, Pharmaceuticals, Home & Other Personal Care, Food, Others |

| Key Companies Profiled | CCL Industries, Amcor plc, Albéa, Berry Global Group, Inc., Huhtamaki Oyj, EPL Limited |

| Additional Attributes | The market analysis includes dollar sales by product type, capacity, and end-use categories. It also covers regional demand trends in the USA, particularly driven by the growing use of packaging tubes in industries such as cosmetics, oral care, and food. The competitive landscape highlights key manufacturers focusing on innovations in tube materials, designs, and functionality. Trends in the increasing demand for sustainable packaging solutions and eco-friendly materials, along with advancements in tube manufacturing technologies, are explored. |

The global demand for packaging tubes in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the demand for packaging tubes in USA is projected to reach USD 2.4 billion by 2035.

The demand for packaging tubes in USA is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for packaging tubes in USA are laminated tubes, aluminum tubes and plastic co-extrusion tubes.

In terms of capacity, 51 to 100 ml segment to command 35.8% share in the demand for packaging tubes in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

Market Share Insights of Leading Packaging Tube Providers

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Reusable Consumer Packaging Market

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Demand for Packaging Tubes in Japan Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Demand for Boxboard Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bag-In-Box Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Tracheal Tubes and Airway Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Moisture-resistant Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA