The demand for packaging tubes in Japan is valued at USD 260.1 million in 2025 and is projected to reach USD 334.6 million by 2035, reflecting a compound annual growth rate of 2.6%. Growth is shaped by steady use of tubes across personal care, cosmetics, pharmaceuticals and household products, where durability, portability and controlled dispensing remain essential. Packaging tubes continue to gain traction due to their compatibility with a wide range of formulations, including creams, gels and ointments. As manufacturers refine barrier properties and improve design efficiency, tubes maintain relevance in both premium and mass-market applications. Expanding product varieties and greater emphasis on convenient packaging formats support consistent demand across distribution channels.

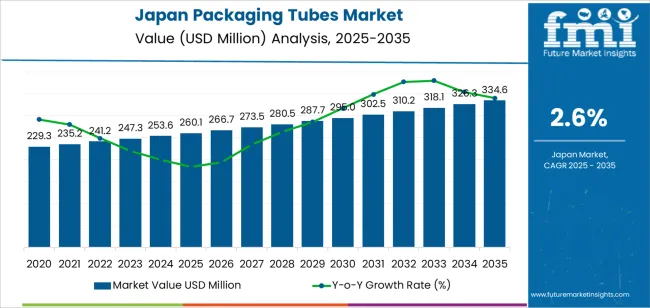

The growth pattern shows gradual year-on-year expansion, beginning at USD 229.3 million in earlier years and rising to USD 260.1 million in 2025 before reaching USD 334.6 million by 2035. Annual increments remain modest yet stable, with demand progressing from USD 266.7 million in 2026 to USD 273.5 million in 2027 and continuing through the forecast horizon. This steady trajectory reflects persistent reliance on tube packaging across industries that require controlled application and product protection. As companies broaden product lines and adapt packaging to evolving consumer preferences, demand for packaging tubes continues to build, supported by incremental advances in materials, shapes and closure systems that enhance functionality within Japan’s established packaging landscape.

Demand in Japan for packaging tubes is projected to grow steadily from USD 260.1 million in 2025 to USD 334.6 million by 2035, representing a compound annual growth rate (CAGR) of approximately 2.6%. Starting from USD 229.3 million in 2020, the value rises through USD 253.6 million in 2024 and reaches USD 260.1 million in 2025. Between 2025 and 2030 the demand will increase to roughly USD 295.0 million, and thereafter advance toward USD 334.6 million by 2035. Growth is underpinned by the continued use of tube packaging across personal care, food, pharmaceutical and household consumer goods applications, coupled with incremental upgrades in tube materials, barrier performance and design.

Despite the moderate growth rate, the longer term value uplift of USD 74.5 million over the decade (from USD 260.1 million to USD 334.6 million) signifies meaningful opportunity for tube packaging suppliers. Early in the period the increase is more gradual reflecting baseline adoption and replacement cycles while later years are driven by higher specification formats, premiumisation of tube materials (such as laminated, aluminium and paper based alternatives) and design innovations that command higher unit value. As sustainability mandates and consumer preferences shift toward enhanced packaging performance and eco credentials, the per tube value rises. Stakeholders should focus on value added materials and innovation to capture the uplift toward USD 334.6 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 260.1 million |

| Forecast Value (2035) | USD 334.6 million |

| Forecast CAGR (2025 to 2035) | 2.6% |

The demand for packaging tubes in Japan is primarily driven by rising consumption in cosmetics, personal care and pharmaceutical segments. Consumers in Japan expect convenient, hygienic and well-designed packaging that enables precise dispensing and preserves product integrity. Tube formats such as squeeze tubes for creams and lotions, or laminated tubes for pharmaceutical gels meet these requirements by offering ease of use and reliable containment. The ability of tube packaging to support small volumes and travel-friendly formats also aligns with Japanese consumer habits, promoting growth in this segment.

Growing regulatory and consumer pressure for more sustainable packaging solutions is also influencing demand. Tube manufacturers in Japan are increasingly adopting materials like paper-based or lightweight composite tubes to reduce plastic waste and comply with recycling obligations. Brand owners respond by offering tubes that reflect environmental commitments to Japanese consumers. Additionally, the expansion of e-commerce and direct-to-consumer channels is increasing demand for packaging formats that maintain product quality during shipping and handling. While factors such as rising raw-material costs and technical requirements around barrier protection continue to present challenges, overall growth for packaging tubes in Japan can be expected to remain steady.

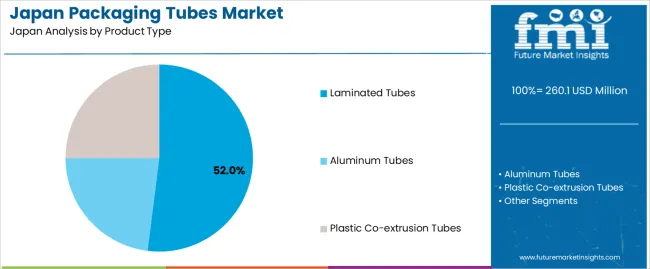

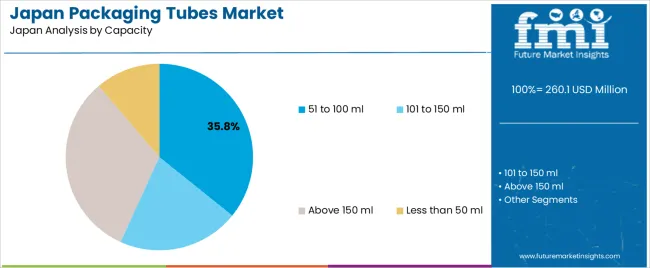

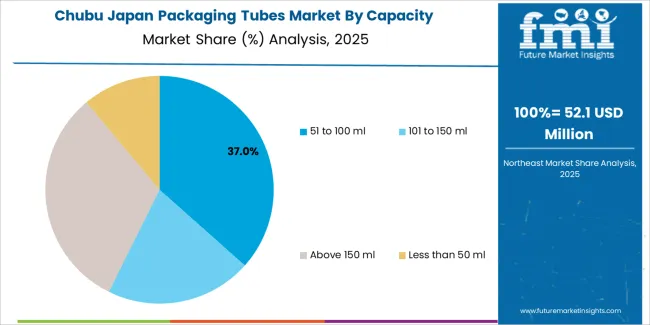

The demand for packaging tubes in Japan is shaped by product type variety and the range of available capacities. Laminated, aluminum and plastic co-extrusion tubes support different performance needs for industries such as personal care, pharmaceuticals and food products. Capacities including less than 50 ml, 51 to 100 ml, 101 to 150 ml and above 150 ml determine suitability for travel sizes, mid-range formats and larger volume applications. As brands focus on precise dosing, portability and product protection, the combination of material selection and capacity matching guides purchasing decisions across manufacturers seeking reliable and efficient packaging solutions.

Laminated tubes account for 52% of total demand for packaging tubes in Japan. Their strong position reflects the need for lightweight structures that offer effective barrier protection against oxygen, moisture and light. These tubes are widely used in oral care, skincare and pharmaceutical products where product stability is essential. The smooth surface and compatibility with high-quality printing support consistent branding across retail formats. Their adaptability for different filling lines makes laminated tubes suitable for large and small producers aiming for efficient packaging solutions.

Demand for laminated tubes is reinforced by their ability to combine durability with a premium appearance. They maintain shape under pressure, support controlled dispensing and reduce the risk of product contamination. Japanese manufacturers value their flexibility for both mass market and specialized items, as consistent quality helps maintain brand trust. As consumer expectations shift toward hygienic and dependable packaging, laminated tubes continue to hold a leading role across multiple applications that rely on strong barrier performance.

The 51 to 100 ml capacity segment represents 35.8% of total demand in Japan. This range is popular because it balances portability with sufficient volume for daily use items such as skincare creams, gels and pharmaceutical formulations. Consumers prefer this size for products that must last through regular application yet remain compact enough for travel or workplace use. Manufacturers choose this capacity due to its compatibility with standard retail shelving and its suitability for controlled dispensing without excessive product waste.

Demand for 51 to 100 ml tubes is also strengthened by their use in premium and mid-range personal care products that require secure and attractive packaging. Brands rely on this capacity to deliver a consistent user experience, as it provides ergonomic handling and supports clear labeling space. The size fits well within multipack strategies and gift sets, broadening its role across retail formats. As Japanese consumers favor practical and portable solutions, this capacity range remains a key choice among packaging tube formats.

Demand for packaging tubes in Japan is being shaped by growth in personal care, cosmetics, healthcare and pharmaceuticals sectors. Brands favour convenient, premium and visually appealing tube formats for creams, ointments and paste-based products. Material and sustainability pressures such as lighter weight, recyclable and paper-based tubes are increasingly influencing tube design and choice. Nonetheless, higher production costs for specialised tube materials, tooling investments, and competition from alternative formats like pouches or rigid containers remain barriers to faster adoption.

How Are Consumer Preferences and Sustainability Requirements Influencing Packaging Tube Demand in Japan?

Japanese consumers place strong emphasis on premium appearance, convenience, portability and environmental-friendliness. Packaging tubes appeal by offering sleek design, ease of use (squeeze/dispenser format) and suitability for on-the-go lifestyles. Concurrently, regulatory and brand pressures for cleaner, more recyclable packaging accelerate the shift from conventional plastic tubes to aluminium, paper-based or laminated alternatives in Japan. These evolving preferences prompt manufacturers and converters to invest in tube formats that meet both aesthetic and sustainable material criteria, thereby driving tube demand.

Where Are Growth Opportunities Emerging for Packaging Tubes in Japan’s Market?

Significant opportunities in Japan lie in niche and premium applications such as skincare, high-end cosmetics, functional foods, pharmaceuticals (topical gels/creams) and online-direct brands. These segments often require customised tube formats, high-quality printing/decoration and smaller batch runs all favourable for tube adoption. Growth of e-commerce and subscription-based personal care also increases demand for compact, protective tube packaging suited for shipping. Suppliers who can provide high-barrier materials, custom designs and environmentally responsive formats are well positioned in Japan’s tube-packaging sector.

What Challenges Are Restricting Broader Adoption of Packaging Tubes in Japan?

Despite favourable demand conditions, several challenges hamper broader tube adoption in Japan. Advanced tube formats using multiple layers, special barriers or premium materials require high tooling and manufacturing investment, which may deter smaller brands. Recycling systems for certain tube types remain underdeveloped, which creates uncertainty for environmentally-conscious companies. Also, alternative packaging formats such as pouches, dispensers or rigid containers may offer cost advantages in some applications, meaning tube packaging must continually justify its value proposition. These factors temper growth in some segments of the Japanese tube packaging market.

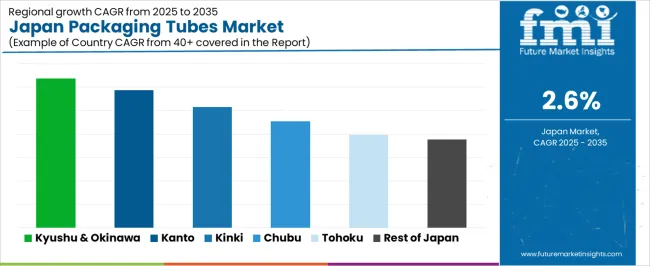

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.2% |

| Kanto | 2.9% |

| Kinki | 2.6% |

| Chubu | 2.3% |

| Tohoku | 2.0% |

| Rest of Japan | 1.9% |

Demand for packaging tubes in Japan is rising at a steady pace across all regions. Kyushu and Okinawa lead at 3.2%, supported by regional manufacturing activity and consistent use of tube packaging in personal care and household products. Kanto follows at 2.9%, driven by dense consumer markets and a strong presence of cosmetics, pharmaceutical, and food producers that rely on tube formats. Kinki records 2.6%, shaped by urban demand and stable output from regional industries. Chubu grows at 2.3%, reflecting steady adoption among mid-sized manufacturers. Tohoku reaches 2.0% as retail and healthcare applications expand. The rest of Japan shows 1.9%, indicating gradual penetration in smaller commercial areas.

Kyushu & Okinawa is projected to grow at a CAGR of 3.2% through 2035 in demand for packaging tubes. The region’s cosmetics, personal care, and pharmaceutical sectors increasingly use packaging tubes for product containment and distribution. Rising demand for convenience, portability, and hygienic packaging drives adoption. Urban centers like Fukuoka are investing in modern packaging solutions to meet consumer preferences. The growing focus on lightweight, durable, and recyclable materials further supports the use of packaging tubes. Manufacturers in Kyushu & Okinawa are adopting innovative tube designs to improve brand differentiation and consumer appeal.

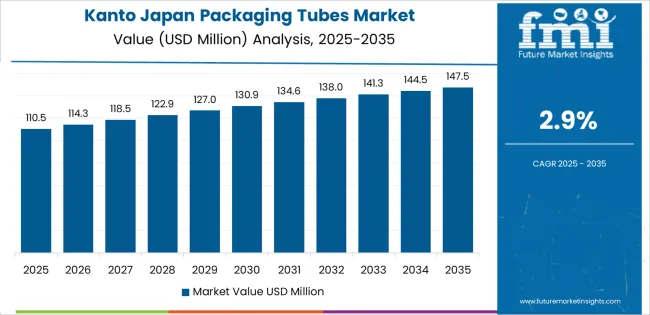

Kanto is projected to grow at a CAGR of 2.9% through 2035 in demand for packaging tubes. As Japan’s industrial and commercial hub, including Tokyo, Kanto leads in the production and use of packaging tubes for pharmaceuticals, cosmetics, and food products. The demand is fueled by consumer expectations for hygienic, convenient, and visually appealing packaging. Manufacturers in Kanto are increasingly adopting lightweight and durable tubes to improve distribution efficiency and reduce waste. The focus on innovative packaging solutions and quality standards further supports the growth of packaging tube demand in the region’s diverse industries.

Kinki is projected to grow at a CAGR of 2.6% through 2035 in demand for packaging tubes. The region’s industrial centers, particularly Osaka and Kyoto, are increasingly producing and using tubes for cosmetics, food, and pharmaceutical products. Rising consumer preference for convenient and portable packaging encourages adoption. Manufacturers in Kinki are exploring new materials and designs to improve shelf life and appeal. The integration of sustainable practices, such as recyclable and lightweight tubes, supports growth. Overall, the combination of industrial production, consumer expectations, and innovative design drives steady demand for packaging tubes in the Kinki region.

Chubu is projected to grow at a CAGR of 2.3% through 2035 in demand for packaging tubes. The region’s manufacturing and food processing sectors, including cities like Nagoya, are adopting tubes for hygiene, convenience, and durability. Rising consumer demand for packaged food, cosmetics, and healthcare products drives adoption. Manufacturers focus on lightweight and safe packaging solutions to improve product handling and shelf presentation. The region’s emphasis on quality standards, efficient production processes, and innovative tube designs contributes to steady growth. Chubu continues to integrate packaging tubes in industrial and consumer-oriented applications.

Tohoku is projected to grow at a CAGR of 2.0% through 2035 in demand for packaging tubes. The region’s smaller manufacturing and food processing facilities are increasingly incorporating packaging tubes to improve hygiene, portability, and product protection. Rising consumer awareness of packaging convenience and product safety drives adoption. Local manufacturers are using lightweight, durable, and visually appealing tubes to meet market expectations. Although Tohoku is less urbanized, the growing use of tubes in cosmetics, pharmaceuticals, and food products contributes to steady regional growth in demand for packaging solutions.

The Rest of Japan is projected to grow at a CAGR of 1.9% through 2035 in demand for packaging tubes. Regions outside major urban centers are gradually adopting tubes in food, pharmaceutical, and personal care sectors to enhance hygiene and convenience. The demand is driven by the need for lightweight, durable, and visually appealing packaging for consumer products. Local manufacturers are increasingly integrating tubes into small-scale production lines, while the growing awareness of packaged product safety further supports adoption. The steady expansion of packaging infrastructure across less urbanized regions continues to drive market growth.

The demand for packaging tubes in Japan is driven by consumer preferences for convenience, premium aesthetics, and increasingly the need for sustainable materials. Tube formats used across cosmetics, personal care, pharmaceuticals and food applications remain popular because they facilitate dispensing and support flexible branding. In Japan, there is strong emphasis on packaging that meets high hygiene standards, reflects minimalist design appeal and aligns with circular economy expectations. As packaging regulations tighten and brands seek differentiation, tubes made of laminated, paper-based or lightweight materials gain traction. The ongoing growth of e-commerce and premium product segments also fuels demand for high-quality tube packaging solutions.

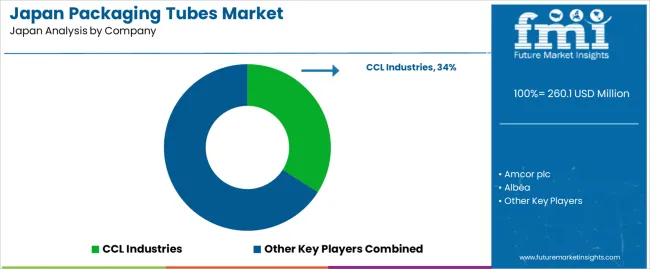

Major companies operating in Japan’s packaging tube sector include CCL Industries, Amcor plc, Albéa, Berry Global Group Inc., Huhtamaki Oyj and EPL Limited. These firms supply a broad range of tube solutions such as plastic, aluminum and paperboard tubes with customization capabilities for design, barrier properties and sustainable credentials. They collaborate with Japanese brand owners and packagers to tailor products according to local market needs, regulatory requirements and consumer expectations. Their global scale, innovation capacity and service networks position them to influence how packaging tubes evolve in Japan’s increasingly premium and environmentally conscious packaging environment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Users | Cosmetics, Oral Care, Commercial & Industrial, Pharmaceuticals, Home & Other Personal Care, Food, Others |

| Product Types | Laminated Tubes, Aluminum Tubes, Plastic Co-extrusion Tubes |

| Applications | Controlled dispensing, portability, hygiene maintenance, barrier protection, premium/eco-friendly packaging |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | CCL Industries, Amcor plc, Albéa, Berry Global Group Inc., Huhtamaki Oyj, EPL Limited |

| Additional Attributes | Dollar by sales across tube types, capacities, and end uses; regional adoption patterns; premiumization and sustainable material adoption; influence of e-commerce on packaging demand; regulatory and hygiene compliance; material innovation and barrier property upgrades. |

The demand for packaging tubes in Japan is estimated to be valued at USD 260.1 million in 2025.

The market size for the packaging tubes in Japan is projected to reach USD 334.6 million by 2035.

The demand for packaging tubes in Japan is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in packaging tubes in Japan are laminated tubes, aluminum tubes and plastic co-extrusion tubes.

In terms of capacity, 51 to 100 ml segment is expected to command 35.8% share in the packaging tubes in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA