The demand for tracheal tubes and airway products in the USA is projected to grow from USD 887.8 million in 2025 to USD 1,464.1 million by 2035, reflecting a CAGR of 5.1%. These products, which include endotracheal tubes, laryngoscopes, and airway management devices, are essential in critical care, emergency medical services, and surgical procedures. The market growth is driven by the increasing number of respiratory diseases, chronic conditions, and trauma cases requiring airway management. The aging population and the rise of chronic obstructive pulmonary diseases (COPD) and respiratory infections will contribute significantly to the demand for these products.

Technological advancements in airway management devices, such as improved tube materials, smarter intubation systems, and non-invasive ventilation techniques, will further fuel the growth of this market. As healthcare systems focus on improving patient outcomes and reducing intubation-related complications, the need for high-quality and innovative airway products will continue to rise. The growing emphasis on preventive care, critical care management, and surgical safety will also support sustained growth in the demand for tracheal tubes and airway products in the USA.

Between 2025 and 2030, the demand for tracheal tubes and airway products in the USA will grow from USD 887.8 million to USD 1,140.1 million, contributing USD 252.3 million in value. This phase represents an important growth block, driven by the increasing prevalence of respiratory diseases and aging populations, which significantly increase the demand for airway management solutions. In particular, the rise of emergency care cases, surgical procedures, and critical care admissions will lead to increased use of tracheal tubes and ventilation products. During this period, advancements in device technology, such as smarter, more flexible tubes and improved laryngoscopes, will also contribute to the demand, providing healthcare providers with better tools for airway management and patient safety.

The second part of this growth block, from 2027 to 2030, will experience an acceleration as hospital settings and ambulatory services increasingly adopt advanced airway management systems to handle rising numbers of respiratory emergencies. With a growing focus on minimizing complications and improving intubation accuracy, new innovations in non-invasive airway management will further push market expansion. In addition, training and education initiatives in healthcare settings will enhance the adoption of more sophisticated airway products, as the emphasis shifts towards reducing intubation risks and improving overall care delivery. The 5-year growth block analysis suggests strong and consistent growth, driven by the increasing demand for advanced, safe, and efficient airway products in the healthcare system.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 887.8 million |

| Industry Forecast Value (2035) | USD 1,464.1 million |

| Industry Forecast CAGR (2025 to 2035) | 5.1% |

The demand for tracheal tubes and airway products in the USA is increasing due to the growing volume of surgical procedures, rising prevalence of respiratory illnesses, and expansion of intensive care services. As hospitals and healthcare facilities perform more complex surgeries and treat a larger number of patients requiring mechanical ventilation or advanced airway management, products such as tracheal tubes, laryngeal masks, and airway adjuncts become essential. The ageing population and heightened incidence of conditions like chronic obstructive pulmonary disease (COPD), sleep apnea, and acute respiratory distress syndrome (ARDS) further amplify the need for reliable airway devices.

Another key driver is the advancement in device design and material technology, which is enhancing safety, ease of use, and patient comfort. Innovations such as video laryngoscopy compatible tubes, low trauma cuff materials, antimicrobial coatings, and single use airway systems appeal to hospitals focused on infection control and operational efficiency. The shift toward outpatient surgical centres and the emphasis on reducing hospital stay lengths also support devices that facilitate quicker recovery. Challenges remain including procurement cost pressures, regulatory scrutiny of device performance, and competition from reusable airway systems. Despite these constraints, the combination of increasing respiratory care demand and surgical volume suggests steady growth in the market for tracheal tubes and airway products in the USA.

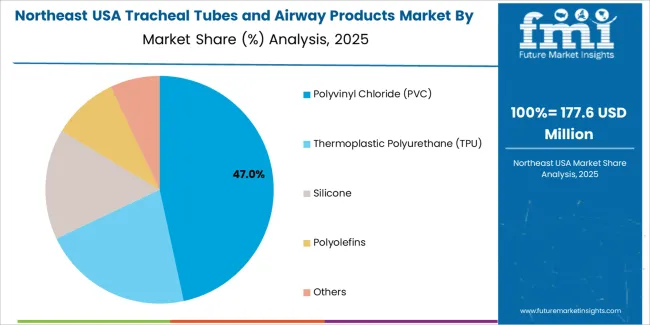

The demand for tracheal tubes and airway products in the USA is primarily driven by product type and material. The leading product type is products, which hold 89% of the market share, while polyvinyl chloride (PVC) is the dominant material, accounting for 46.2% of the demand. Tracheal tubes and airway products are critical for airway management, particularly in medical settings such as hospitals, emergency care units, and intensive care units. The increasing prevalence of respiratory diseases, surgeries, and trauma cases is driving the demand for these products, along with advancements in materials that improve comfort, safety, and performance.

Products lead the demand for tracheal tubes and airway products in the USA, accounting for 89% of the market share. These products, which include tracheal tubes, endotracheal tubes, and laryngeal masks, are essential for managing airways in patients undergoing surgery, experiencing respiratory failure, or requiring mechanical ventilation. They provide a direct airway to the lungs, ensuring that oxygen reaches the patient's lungs during critical medical procedures or emergencies.m

The demand for tracheal tubes and other airway products is driven by the increasing number of surgeries, the aging population, and the rising incidence of respiratory diseases such as COPD, asthma, and pneumonia. As more patients require advanced respiratory support in medical settings, the need for high-quality airway products continues to grow. Additionally, as healthcare systems focus on improving patient outcomes and minimizing complications during surgeries and critical care, the demand for effective and reliable airway management products remains robust.

Polyvinyl chloride (PVC) is the dominant material in the tracheal tube and airway products market, capturing 46.2% of the demand. PVC is widely used in medical devices due to its versatility, durability, and ease of use. In the case of tracheal tubes and airway products, PVC is valued for its strength, flexibility, and ability to be easily molded into various shapes, which is essential for ensuring secure and comfortable placement of the tube in the patient’s airway.

The popularity of PVC in tracheal tube and airway product manufacturing is also attributed to its cost-effectiveness, ability to be sterilized, and low risk of triggering adverse reactions in patients. PVC is also used in conjunction with other materials to enhance performance, such as in tubes that are flexible yet strong enough to maintain an open airway under various conditions. As healthcare continues to prioritize both patient safety and cost management, PVC is expected to remain the material of choice for many tracheal tubes and airway products in the USA.

Demand for tracheal tubes and airway products in the U.S. is reinforced by the rising incidence of chronic respiratory disorders such as COPD and obstructive sleep apnea, increased use of prolonged mechanical ventilation, and the trend toward home based respiratory care. The mature healthcare infrastructure, advanced critical care services, and strong device development ecosystem further support adoption. At the same time, high costs, regulatory complexity, and stiff competition from alternative airway management technologies moderate the pace of growth. These forces together shape the overall demand environment.

What Are the Primary Growth Drivers for Tracheal Tubes and Airway Product Demand in the United States?

Several drivers underpin market expansion. First, an ageing population with a higher prevalence of respiratory insufficiency and comorbidities increases demand for airway devices and tracheal tubes in critical care and home care settings. Second, growth in surgical procedures involving airway access, such as head and neck surgeries, trauma care, and long term ventilation support, strengthens device uptake. Third, technological innovation such as low profile tracheostomy tubes, improved cuff systems, and devices designed for easier patient management enhances clinical acceptance. Fourth, the shift toward outpatient and home based respiratory management supports demand for airway products compatible with non hospital environments.

What Are the Key Restraints Affecting Tracheal Tubes and Airway Product Demand in the United States?

Despite favorable drivers, several constraints exist. High device and procedure costs, especially for advanced airway products, can limit access or slow purchase decisions in cost constrained settings. Reimbursement variability and complex regulatory approvals can delay product launches and slow adoption of newer devices. Integration of new airway technologies into existing hospital workflows, staff training, and clinician preference for conventional equipment may pose barriers. Furthermore, alternative airway management methods and less invasive ventilation strategies reduce the volume of traditional tracheal tube usage in some care pathways.

What Are the Key Trends Shaping Tracheal Tubes and Airway Product Demand in the United States?

Key trends include increasing development of airway devices engineered for home care and portable use, reflecting the shift toward long term ventilation outside intensive care units. There is growing integration of smart features and sensor enabled airway devices that monitor tube placement, cuff pressure, and patient status. Manufacturers are also offering modular and patient customized airway systems to improve comfort, reduce complications, and simplify care transitions. Another trend is the rising focus on minimally invasive tracheostomy techniques and airway access technologies that shorten length of stay and support faster recovery.

The demand for tracheal tubes and airway products in the USA is driven by factors such as an aging population, increasing incidence of respiratory diseases, and the growing number of surgical procedures requiring airway management. Tracheal tubes and airway products, including endotracheal tubes, laryngeal masks, and other intubation devices, are essential in emergency care, critical care, and during surgeries.

The rise in chronic respiratory conditions like COPD and asthma, along with the prevalence of conditions that require surgical intervention, is fueling demand. Additionally, advancements in airway management technology, including more efficient, safer, and easier-to-use products, contribute to the market’s growth. Regional variations in demand are influenced by healthcare infrastructure, population health, and the prevalence of respiratory diseases in each region. Below is an analysis of the demand for tracheal tubes and airway products across different regions of the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.9% |

| South | 5.3% |

| Northeast | 4.7% |

| Midwest | 4.1% |

The West leads the demand for tracheal tubes and airway products in the USA with a CAGR of 5.9%. The region has a large and diverse population with a high prevalence of chronic respiratory conditions such as asthma, COPD, and other diseases requiring airway management. States like California, Washington, and Oregon have well-established healthcare systems and significant numbers of healthcare facilities, which provide advanced treatment and care for respiratory patients.

Additionally, the West's focus on healthcare innovation and cutting-edge medical technology ensures that healthcare providers have access to the latest airway products, driving the demand for tracheal tubes. The region’s strong emphasis on critical care services, as well as high levels of emergency and surgical procedures, further fuels the demand for reliable airway management solutions. As the population continues to age, the need for effective airway products in surgeries and emergency care will continue to increase.

The South shows strong demand for tracheal tubes and airway products with a CAGR of 5.3%. The region has a large population with a high prevalence of respiratory diseases, particularly COPD and asthma. States like Texas, Florida, and Georgia have well-developed healthcare infrastructure, with many hospitals and critical care units where airway products are essential for patient management.

In addition to respiratory diseases, the South has a significant number of surgical procedures that require airway management, including both elective and emergency surgeries. The region's growing healthcare facilities and advancements in medical technology also support the increasing adoption of tracheal tubes and airway products. As more people in the South seek treatment for respiratory conditions and undergo surgical interventions, demand for these essential airway management tools will continue to rise.

The Northeast demonstrates steady demand for tracheal tubes and airway products with a CAGR of 4.7%. The region’s large population centers, including New York, Boston, and Philadelphia, have a high concentration of healthcare providers offering both emergency and elective surgeries, which require effective airway management. As the region's healthcare infrastructure continues to expand, the demand for tracheal tubes and other airway products grows.

The aging population in the Northeast is another contributing factor, as older individuals are more likely to require surgical interventions or develop respiratory conditions that necessitate the use of airway products. While the growth rate is slightly lower than in the West and South, the steady demand for these products is driven by both the region’s healthcare capacity and the ongoing need for airway management in emergency and critical care settings.

The Midwest shows moderate growth in the demand for tracheal tubes and airway products, with a CAGR of 4.1%. The region has a large population with a steady incidence of respiratory diseases, which drives the need for airway management in both surgical and emergency care situations. However, compared to the West and South, the Midwest has a lower growth rate, which can be attributed to fewer large metropolitan areas and hospitals with specialized services.

Despite this, healthcare providers in the Midwest continue to adopt advanced airway management products as awareness grows about their benefits in critical care. The region’s aging population, particularly in cities like Chicago, Detroit, and Minneapolis, also contributes to increased demand for airway products, as older adults are more likely to require surgeries and experience respiratory difficulties. As healthcare access improves and medical technologies evolve, demand for tracheal tubes and airway products will continue to rise in the Midwest, though at a slower pace than other regions.

The demand for tracheal tubes and airway products in the United States is increasing due to the growing number of patients requiring respiratory support, particularly in critical care, anesthesia, and emergency medicine. Companies like Medtronic plc (holding approximately 28.2% market share), Smith’s Medical (ICU Medical, Inc.), Teleflex Incorporated, Ambu A/S, and Vyaire Medical, Inc. are key players in this market. The rising incidence of respiratory diseases, surgical procedures, and critical care admissions is driving the demand for high-quality, reliable airway management products.

Competition in the tracheal tubes and airway products industry is primarily driven by product innovation, safety features, and ease of use. Companies focus on developing tracheal tubes and related devices that minimize the risk of complications, such as tube dislodgement or airway obstruction, and improve patient comfort. Another competitive factor is the integration of advanced materials and technologies, such as cuff pressure monitoring, radiopaque markings, and antimicrobial coatings, to enhance safety and performance. Companies are also investing in products that facilitate easier insertion, optimal positioning, and secure fixation, as well as devices that reduce the risk of infection. Marketing materials often emphasize features such as biocompatibility, ease of intubation, patient comfort, and safety. By aligning their products with the growing demand for effective, safe, and easy-to-use airway management solutions, these companies aim to strengthen their position in the U.S. tracheal tubes and airway products industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Product Type | Products, Accessories, Vacuums |

| Material | Polyvinyl Chloride (PVC), Thermoplastic Polyurethane (TPU), Silicone, Polyolefins, Others |

| End User | Hospitals, Surgical / Ambulatory Surgical Centers, Homecare Settings |

| Key Companies Profiled | Medtronic plc, Smith’s Medical (ICU Medical, Inc.), Teleflex Incorporated, Ambu A/S, Vyaire Medical, Inc. |

| Additional Attributes | The market analysis includes dollar sales by product type, material, and end-user categories. It also covers regional demand trends in the USA, driven by the increasing need for respiratory care and airway management in hospitals, surgical centers, and homecare settings. The competitive landscape highlights major players focusing on innovations in tracheal tubes, airway products, and associated accessories. Trends in the growing demand for high-quality, biocompatible materials such as silicone and TPU are explored, along with advancements in patient safety, comfort, and ease of use. |

The global demand for tracheal tubes and airway products in USA is estimated to be valued at USD 887.8 million in 2025.

The market size for the demand for tracheal tubes and airway products in USA is projected to reach USD 1,464.1 million by 2035.

The demand for tracheal tubes and airway products in USA is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in demand for tracheal tubes and airway products in USA are products, accessories and vacuums.

In terms of material, polyvinyl chloride (pvc) segment to command 46.2% share in the demand for tracheal tubes and airway products in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tracheal Tubes and Airway Products Market Analysis - Growth & Forecast 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Endotracheal Tube Cuffs Market

Demand for Tracheal Tubes and Airway Products in Japan Size and Share Forecast Outlook 2025 to 2035

Veterinary Endotracheal Tubes Market Size and Share Forecast Outlook 2025 to 2035

Tubes, Bottles and Tottles Market

Cryotubes Market

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Key Companies & Market Share in Paper Tubes Industry

Paper Tubes Market Growth & Industry Insights 2021-2031

Lotion Tubes Market Size and Share Forecast Outlook 2025 to 2035

Bubble Tubes Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bubble Tubes Suppliers

Postal Tubes Market

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Market Share Insights of Cosmetic Tubes Product Providers

Aluminum Tubes Market from 2023 to 2033

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA