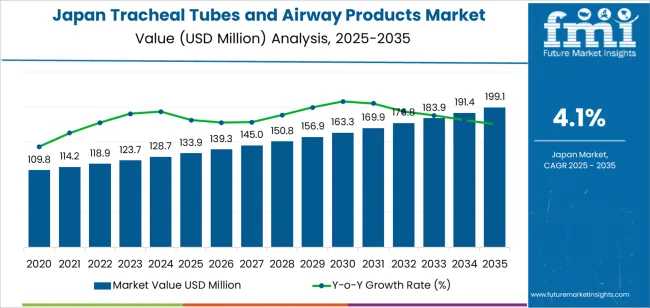

The Japan tracheal tubes and airway products demand is valued at USD 133.9 million in 2025 and is forecasted to reach USD 199.1 million by 2035, recording a CAGR of 4.1%. Demand is shaped by the continued utilisation of airway management devices across emergency medicine, anaesthesia, intensive care, and perioperative settings. Wider use of tracheal intubation in surgical procedures, stable case volumes in critical-care units, and structured airway-management protocols support consistent procurement. Japan’s ageing population also influences growth, increased incidence of respiratory compromise, and expanded capacity within acute-care hospitals.

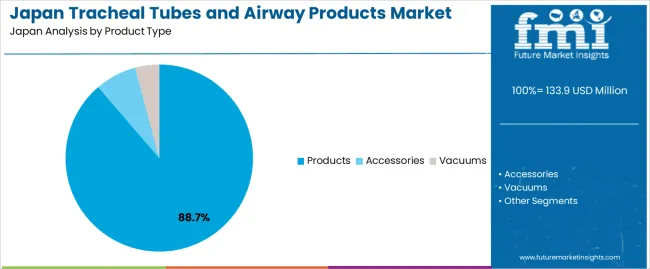

Primary airway products represent the leading product type. This category includes tracheal tubes, laryngeal masks, oropharyngeal airways, nasopharyngeal airways, and related accessories used for airway stabilisation and ventilation. These devices are selected for predictable performance, compatibility with standard ventilators, and established clinical workflow integration. Advancements in material flexibility, cuff pressure control, and single-use sterility features continue to support adoption in operating rooms and emergency response settings.

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kinki, where regional medical centres, university hospitals, and emergency-care networks drive usage. Key suppliers include Medtronic, Smith’s Medical (ICU Medical), Teleflex, Ambu, and Vyaire Medical. These companies provide airway-management portfolios used across anaesthesia departments, ICUs, and pre-hospital environments.

The growth contribution index shows that hospitals and acute-care centres will account for the largest share of incremental expansion during the early period from 2025 to 2029. Demand will be driven by stable surgical volumes, routine airway-management requirements in intensive-care units, and continued use of endotracheal tubes, laryngeal masks, and airway adjuncts in emergency settings. Expanded adoption of reinforced, cuff-pressure-regulated, and single-use sterile products will strengthen early contributions.

Between 2030 and 2035, contributions broaden across ambulatory surgical centres, long-term care facilities, and home-ventilation programs. Growth during this phase will be shaped by lifecycle replacements, infection-control updates, and incremental shifts toward improved materials with enhanced biocompatibility and reduced airway trauma. Procurement becomes more predictable as product categories mature, with contributions tied to steady utilisation rather than rapid technology turnover. The contribution pattern reflects a clinically stable segment in which expansion is driven first by high-acuity hospital environments and later by wider, maintenance-oriented adoption across Japan’s broader respiratory-care and perioperative-care infrastructure.

| Metric | Value |

|---|---|

| Japan Tracheal Tubes and Airway Products Sales Value (2025) | USD 133.9 million |

| Japan Tracheal Tubes and Airway Products Forecast Value (2035) | USD 199.1 million |

| Japan Tracheal Tubes and Airway Products Forecast CAGR (2025-2035) | 4.1% |

Demand for tracheal tubes and airway products in Japan is growing because the ageing population and increasing prevalence of respiratory conditions such as COPD and pneumonia raise the need for advanced airway management in hospitals and clinics. Surgical volumes and emergency medicine cases increase demand for reliable endotracheal and tracheostomy tubes in anaesthesia and critical-care settings. Technological improvements in materials (such as silicone or thermoplastic elastomers), single-use disposables and enhanced safety features like antimicrobial cuffs support industry growth.

Home-ventilation and outpatient respiratory-care trends motivate increased demand for airway accessories outside traditional hospital settings. The trend toward minimally invasive procedures and outpatient surgical centres also boosts usage of modern airway-management devices. Constraints include high device cost relative to simpler alternatives, strict regulatory and quality-assurance requirements in the Japanese medical-device industry and competition from legacy products that may slow transitions. Some smaller hospitals or clinics may delay upgrading equipment until budgets allow.

Demand for tracheal tubes and airway products in Japan reflects clinical practices across emergency care, surgical procedures, intensive care, and long-term respiratory support. Product-type distribution is shaped by the frequency of intubation, airway stabilisation needs, and procedural guidelines followed in hospitals and surgical centres. Material preferences reflect biocompatibility, flexibility, and performance characteristics required for safe airway management. End-user patterns indicate where airway devices are primarily used, from emergency interventions to home-based respiratory support.

Primary airway products hold 88.7% of national demand and form the dominant product-type category. This group includes standard tracheal tubes, reinforced tubes, cuffed and uncuffed variants, and specialty airway devices used during surgery, emergency response, and critical-care management. These devices support ventilation, airway protection, and anaesthesia delivery, making them central to routine hospital procedures. Accessories and vacuums comprise the remaining share, serving supportive functions such as suctioning, tube securement, and maintenance tasks. Their adoption is tied to procedural demand and frequency of airway management in high-acuity settings. Product-type distribution reflects the clinical importance of intubation devices and their continuous use in operating rooms, intensive-care units, and emergency departments.

Key drivers and attributes:

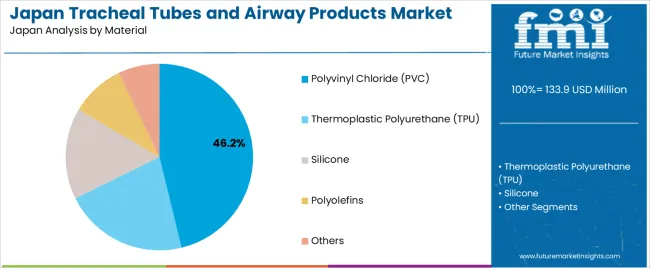

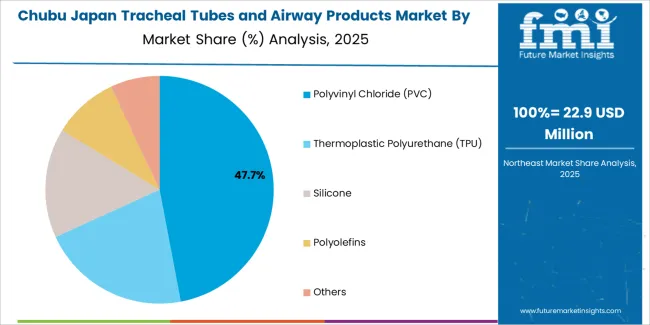

PVC represents 46.2% of national demand and is the leading material used for tracheal tubes in Japan. PVC’s flexibility, transparency, and low cost support widespread adoption across routine intubations and surgical procedures. Thermoplastic polyurethane (TPU) accounts for 21.5%, offering improved elasticity and patient comfort during extended airway management. Silicone represents 15.8%, valued for biocompatibility and long-term indwelling applications, particularly in reconstructive or chronic airway conditions. Polyolefins hold 9.4%, while the remaining 7.1% includes specialty materials used for reinforcement or specific performance needs. Material distribution reflects balancing cost, comfort, durability, and safety across varied clinical situations requiring temporary or prolonged airway access.

Key drivers and attributes:

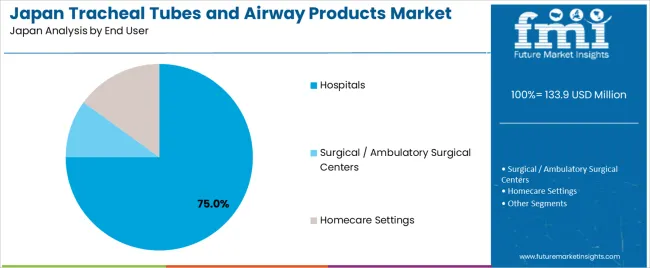

Hospitals hold 75.0% of Japan’s demand and represent the primary end-user group for tracheal tubes and airway products. Emergency departments, operating theatres, and intensive-care units rely heavily on airway devices for acute respiratory management, trauma care, and anaesthesia procedures. Homecare settings represent 15.0%, supporting long-term tracheostomy care and chronic respiratory conditions requiring stable airway access outside hospital environments. Surgical and ambulatory surgical centres account for 10.0%, performing elective procedures that require short-duration airway control. End-user distribution reflects the higher concentration of airway interventions within hospitals, where complex cases and continuous monitoring are performed.

Key drivers and attributes:

Growing surgical volumes, ageing population with respiratory conditions, and heightened focus on airway management safety drive demand.

In Japan, demand for airway products such as tracheal tubes are supported by an increase in surgical procedures requiring general anaesthesia, higher rates of intensive-care hospitalisation in older adults, and rising prevalence of chronic respiratory disorders. Hospitals prioritise airway safety and infection control, which leads to adoption of advanced endotracheal and tracheostomy tubes. The large elderly population increases incidences of respiratory failure, aspiration risk, and extended ventilation support, which bolsters demand for high-quality airway management devices.

Budget constraints, established equipment retention and procedural training requirements restrain further uptake.

Airway products like tracheal tubes, especially advanced or disposable versions, often cost more than standard models, which may delay replacement in hospitals with tight capital budgets or where existing inventory is adequate. Many facilities retain devices for extended periods because they meet current clinical needs, which slows industry refresh cycles. Advanced airway techniques and devices also require specific training for safe use; this requirement may limit rapid introduction in smaller clinics or rural settings.

Shift toward single-use and antimicrobial-coated tracheal tubes, increased use of airway products in home and long-term-care settings, and integration with digital monitoring systems define key industry trends.

Manufacturers are offering single-use endotracheal tubes and tracheostomy products to reduce infection risk and improve workflow efficiency in Japanese hospitals. The long-term care and home-ventilation segments are expanding, with devices tailored for outpatient or home use of airway tubes gaining traction. Smart airway products incorporating pressure monitoring, cuff-inflation feedback and connectivity to ventilation systems are emerging to enhance patient safety and clinician oversight. These trends support moderate but steady growth in this industry in Japan.

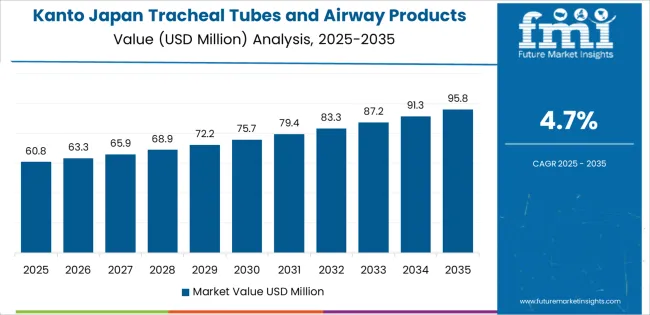

Demand for tracheal tubes and airway products in Japan is growing through 2035 as hospitals, emergency departments, and surgical centers expand the use of intubation devices, laryngeal masks, supraglottic airways, and airway-management consumables. Growth is driven by rising surgical volumes, aging populations with respiratory disorders, expansion of critical-care services, and improved prehospital emergency response capacity. Airway products support anesthesia procedures, ICU ventilation, emergency intubation, and postoperative respiratory management. Adoption varies by regional hospital density, advanced-care capacity, and availability of anesthesiology and emergency-medicine specialists. Kyushu & Okinawa leads with a 5.1% CAGR, followed by Kanto (4.7%), Kinki (4.1%), Chubu (3.6%), Tohoku (3.2%), and the Rest of Japan (3.0%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.1% |

| Kanto | 4.7% |

| Kinki | 4.1% |

| Chubu | 3.6% |

| Tohoku | 3.2% |

| Rest of Japan | 3.0% |

Kyushu & Okinawa grows at 5.1% CAGR, supported by active surgical workloads, established ICU capacity, and strong emergency-care networks across Fukuoka, Kumamoto, Kagoshima, and Okinawa. Hospitals use tracheal tubes for anesthesia support in general and orthopedic surgeries and rely on reinforced tubes, dual-lumen designs, and cuffed systems for complex airway cases. Emergency departments frequently manage respiratory-distress cases requiring rapid sequence intubation. Clinics and hospitals adopt supraglottic devices for routine airway maintenance during short procedures. Postoperative care units use airway adjuncts to stabilize patients with compromised breathing. The region’s aging population increases the demand for airway interventions linked to chronic respiratory decline.

Kanto grows at 4.7% CAGR, driven by Japan’s largest concentration of tertiary hospitals, emergency centers, and surgical facilities across Tokyo, Kanagawa, Chiba, and Saitama. Operating theaters use a wide range of cuffed, reinforced, and pediatric tracheal tubes for high surgical throughput. ICUs rely on advanced airway systems for ventilation management and acute respiratory failure. Emergency centers and ambulance networks use rapid-deployment airway devices for prehospital stabilization. Teaching hospitals integrate airway-simulation training that increases usage of training-grade consumables. Large patient volumes with chronic respiratory diseases support recurring clinical demand.

Kinki grows at 4.1% CAGR, supported by consistent surgical activity and emergency-care capacity across Osaka, Kyoto, and Hyogo. Hospitals use cuffed tracheal tubes, reinforced tubes, and supraglottic devices during anesthesia procedures and respiratory support. ICUs handle chronic respiratory failure and postoperative ventilation needs among elderly patients. Emergency facilities treat respiratory distress and trauma cases requiring secure airway placement. Specialty clinics performing ENT and thoracic procedures maintain regular use of airway consumables. Although hospital density is lower than Kanto, stable multi-specialty care ensures recurring demand.

Chubu grows at 3.6% CAGR, supported by balanced surgical workloads and respiratory-care needs across Aichi, Shizuoka, and Mie. Hospitals use tracheal tubes for anesthesia in general surgery, orthopedics, and cardiovascular procedures. ICUs adopt airway products for ventilation management in chronic respiratory failure and postoperative recovery. Emergency units rely on rapid-deployment airway devices for acute respiratory compromise. Clinics and day-surgery centers use supraglottic devices for short procedures. Industrial regions report higher incidence of chronic respiratory conditions, contributing to sustained clinical usage.

Tohoku grows at 3.2% CAGR, supported by regional hospital networks across Miyagi, Fukushima, and Iwate treating chronic respiratory cases and surgical workloads. Hospitals use tracheal tubes for anesthesia support and ICU ventilation. Emergency departments frequently manage winter-related respiratory exacerbations requiring airway stabilization. Clinic-based surgery units rely on supraglottic devices for shorter procedures. Geographic dispersion increases reliance on essential airway consumables maintained in smaller facilities. While procedure volumes are lower than in metropolitan regions, consistent chronic-care needs steady demand.

The Rest of Japan grows at 3.0% CAGR, supported by distributed hospitals, community emergency units, and small surgical centers in rural prefectures. Facilities maintain stocks of tracheal tubes for routine surgery and acute respiratory emergencies. Clinics use supraglottic devices in smaller operating suites. Although specialist density is limited, essential airway care for elderly patients with chronic respiratory disorders sustains ongoing usage. Emergency teams rely on basic and intermediate airway devices for prehospital stabilization. Lower population density reduces total procedure volumes, but essential respiratory care ensures stable demand.

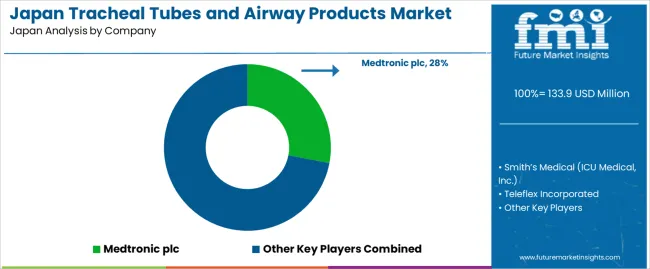

Demand for tracheal tubes and airway products in Japan is shaped by a concentrated group of medical-device manufacturers supplying equipment for anesthesia, emergency airway management, and intensive-care ventilation. Medtronic plc holds the leading position with an estimated 28% share, supported by controlled manufacturing standards, consistent cuff-performance reliability, and long-term use of its endotracheal and subglottic-suction systems across Japanese hospitals. Its position is reinforced by predictable product quality and broad availability through established distribution channels.

Smith’s Medical (ICU Medical, Inc.) and Teleflex Incorporated follow as major participants, offering a wide range of tracheal tubes, laryngectomy tubes, and advanced airway devices used in operating rooms, emergency departments, and ICUs. Their strengths include stable tube geometry, dependable material integrity, and well-documented performance in both routine and difficult-airway scenarios. Ambu A/S maintains a notable role through single-use airway devices that support infection-control priorities and predictable intubation performance. Vyaire Medical, Inc. contributes additional capability with airway consumables designed for mechanical ventilation and long-term respiratory care, emphasizing consistent airflow characteristics and reliable tube–ventilator compatibility.

Competition across this segment centers on cuff-seal stability, material biocompatibility, ease of insertion, ventilator compatibility, and consistency of performance during prolonged use. Demand remains steady due to Japan’s aging population, high surgical volumes, and continued reliance on standardized, clinically proven airway products across perioperative, emergency, and critical-care environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Products, Accessories, Vacuums |

| Material | Polyvinyl Chloride (PVC), Thermoplastic Polyurethane (TPU), Silicone, Polyolefins, Others |

| End User | Hospitals, Surgical / Ambulatory Surgical Centers, Homecare Settings |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Medtronic plc, Smith’s Medical (ICU Medical, Inc.), Teleflex Incorporated, Ambu A/S, Vyaire Medical, Inc. |

| Additional Attributes | Dollar sales by product type, material category, and end-user groups; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of airway management device manufacturers; advancements in kink-resistant materials, reinforced endotracheal tubes, and suction-enabled airway systems; integration with hospital critical care units, emergency medicine, surgical anesthesiology, and home respiratory support across Japan. |

The global demand for tracheal tubes and airway products in Japan is estimated to be valued at USD 133.9 million in 2025.

The demand for tracheal tubes and airway products in Japan is projected to reach USD 199.1 million by 2035.

The demand for tracheal tubes and airway products in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types are products, accessories and vacuums.

In terms of material, the polyvinyl chloride (PVC) segment is expected to account for 46.2% of the market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA