The United States Scroll Compressor Market is set to expand moderately in the assessment period 2025 to 2035, contributing to the growing applications in heat pumps, refrigeration, HVAC systems, and electric vehicles.

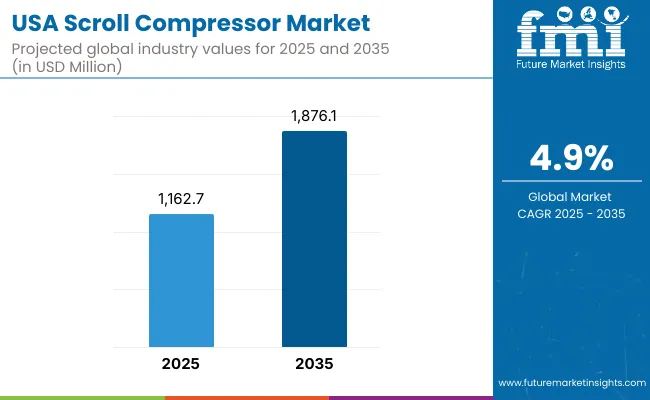

Scroll compressors are becoming more and more popular due to their energy-saving discipline, quiet operation, smaller footprint and minimum maintenance properties that are highly recognized by both commercial and household applications. The USA scroll compressor market was USD 1,162.7 million in 2025 and expected to reach USD 1,876.1 million by 2035, developing at a CAGR of 4.9% during the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,162.7 Million |

| Projected Market Size in 2035 | USD 1,876.1 Million |

| CAGR (2025 to 2035) | 4.9% |

Scroll compressors are now increasingly the center of the universe for new-build and retrofit applications, with decarburization of heating and cooling across the USA and available federal incentives for energy-efficient infrastructure and clean energy adoption. Also, robust growth is taking place in the electric vehicle thermal management segment, where scroll compressors enable battery cooling as well as cabin comfort.

But considering technological progress, this field is still being reshaped with smart scroll compressors now including variable-speed drives, Internet-of-Things-informed diagnostics and environmentally friendly low Global Warming Potential (GWP) refrigerants. Its integration into heat pump systems is one bright spot in the trend data, especially with USA residential homebuyers and commercial business executives setting their sights on electric, sustainable climate tech.

With high population density in cities like New York, Boston and Philadelphia and older building stock, the Northeast has high retrofitting activity. Increasing energy standards and winter heating loads have resulted in widespread use of scroll compressors in HVAC and heat pump replacement. The aggressive decarburization strategies of the region are also leading to the transition from conventional systems to scroll-based, highly efficient systems.

In warm-weather states such as Arizona, New Mexico and parts of Texas, the top priority is cooling efficiency. This has positioned scroll compressor technology as the dominant force in the residential HVAC market, where their dependable and zero-leakage operation is advantageous in high thermal loads. Solar in the Region as the use of solar energy is becoming common within the region, scroll compressors are becoming more and more widely integrated with air conditioners based on off-grid and hybrid systems to improve power consumption and system stability.

California, Oregon and Washington are frontrunners in energy-efficient building and climate policy and dominate scroll compressor adoption for HVAC and renewable-included heat pumps. Phasing out high-GWP refrigerants and electrifying heat systems will push legacy piston systems out of the market as states and provinces around the world regulate them. Consumer demographics that are aware of technology also drive demand for both variable-speed and smart-capable scroll units.

Southeasthave high year-round cooling loads. Scroll compressors abound in air conditioning equipment, where they far outperform conventional compressors in energy efficiency and durability. Demand for open-compression, scroll technology for high-volume, reliable cooling is hitting this often sought-after market, where real estate is expanding rapidly.

The Midwest, with a combination of urban and rural demand, sees scroll compressors in residential heating, commercial cooling and farm refrigeration. Illinois, Ohio, and Michigan are all pushing for gas heating replacements with heat pump installation; all before the push for scroll compressors. Product and supply chain innovation is also being driven by local manufacturers.

Overall high Front-End expense and Technology installation lag

Some of the major challenges faced in the USA Scroll Compressor Market are high initial cost of scroll compressor systems (for small- to medium-sized HVAC and refrigeration companies), and others. Compared to the traditional reciprocating compressors, scroll compressors need to invest more in machining processes, electronic control systems, and maintenance experience.

A sluggish adoption of conventional industrial installations and rural HVAC markets hinders ease of responsiveness for mass penetration of compact scroll systems. In the commercial market, existing systems with scroll compressors are being retrofitted as it becomes challenging to work with the existing systems. issue is sensitivity to fluctuations in the cost of raw materials (e.g., aluminum and copper) that have a bearing on total system pricing and margins.

Energy Efficiency Standards and Trends in Electrification

The USA scroll compressor market presents significant growth opportunities, driven mostly by rigid federal energy efficiency standards like SEER2/ EER ratings and the general trend toward low GWP refrigerants and decarbonized heating or cooling solutions. Due to their lower noise, efficiency, and smaller on-site footprint, scroll compressors are gaining traction in residential, commercial, and light industrial applications.

Residential demand for scroll compressors, especially in new builds and retrofits with IRA incentives, is fueling the heat pump boom. Scroll compressors used in thermal management, climate control and refrigeration supporting EV, data center, and modular cold chain logistics also creates new markets.

Between 2020 and 2024, scroll compressors saw greater use as older, energy-wasting HVAC and refrigeration systems were phased out. The market grew in multi-family residential buildings, supermarkets, and commercial rooftops, with scroll technology being optimized by manufacturers for low-noise and variable-speed applications. Supply chains were first disrupted by the COVID-19 pandemic but went on to increase demand for indoor clean air solutions, favoring scroll-based HVAC systems.

Looking ahead to 2025 to 2035, the scroll compressor industry is expected to transform into a smart, refrigerant-agnostic, and IoT-enabled ecosystem. Variable-speed scrolls, natural refrigerant compatibility (such as R-290 and CO₂), and AI-based HVAC control system integration will become the norm. As the USA continues to intensify its electrification and building decarburization initiatives, scroll compressors will become the backbone of energy-efficient climate technologies, especially in the Northeast, Midwest, and Western states.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with SEER2, EER, and HFC phasedown rules under AIM Act |

| Market Penetration | Growth in commercial rooftops, cold storage, and split HVAC systems |

| Technology Evolution | Adoption of two-stage and variable-speed scroll compressors |

| Material Innovation | Use of aluminum and traditional copper components |

| Market Competition | Dominated by Emerson, Copeland, Danfoss , Mitsubishi Electric |

| Customer Preferences | Focus on energy efficiency, compact design, and lower operating noise |

| Integration with Other Sectors | Used in HVAC-R systems for residential and retail refrigeration |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Mandates for low-GWP refrigerants, net-zero-ready HVAC systems, and building electrification |

| Market Penetration | Expansion into all-electric homes, EV battery cooling, smart buildings, and micro data centers |

| Technology Evolution | Rise of inverter-driven smart scrolls with cloud-based diagnostics and adaptive control |

| Material Innovation | Shift toward lightweight alloys, magnetically suspended rotors, and low-friction coatings |

| Market Competition | Entrance of AI-integrated HVAC firms, EV thermal management suppliers, and modular cooling solution providers |

| Customer Preferences | Preference for predictive maintenance, refrigerant flexibility, and smart system integration |

| Integration with Other Sectors | Integrated into EV thermal systems, containerized cold storage, and zero-emission buildings |

California is leading in the USA scroll compressor market based on its emphasis on energy-efficient HVAC appliance use, green building standards, and high levels of cooling technology adoption. California also dominates the use of green building techniques like LEED (Leadership in Energy and Environmental Design), which is fueling low-emission, ecologically friendly HVAC product demand.

Apart from this, the increasing renewable energy and electrification industries in California are contributing further to support the use of scroll compressors in other industrial procedures even more.

| State | CAGR (2025 to 2035) |

|---|---|

| California | 5.1% |

The scroll compressor market for New York is increasing at a steady rate due to the increasing use of domestic and commercial HVAC systems in the highly populated metropolitan urban cities.

The green city initiative and the renewable energy-based approach of the state are driving energy-efficient scroll compressor demand for commercial air conditioners and refrigeration equipment. Other than this, the increased deployment of smart technology by New York and higher energy-efficient building norms are stimulating new constructions and retrofits' demand for low-energy, high-performance compressors.

| State | CAGR (2025 to 2035) |

|---|---|

| New York | 4.7% |

Texas is witnessing strong growth in the scroll compressor market driven by its massive commercial, industrial, and residential cooling requirements. The hot climate of the state and fast-growing construction industry, particularly in Houston and Dallas, are fueling the demand for energy-efficient, high-performance HVAC equipment. The increasing emphasis of the state on energy efficiency and sustainability of cooling systems is driving the use of scroll compressors in Greenfield buildings and retrofitting.

| State | CAGR (2025 to 2035) |

|---|---|

| Texas | 5.0% |

Florida's market for scroll compressors is growing steadily because of its tropical location and the tremendous demand for air conditioning units used commercially and for homes. Thanks to the surge in demand for energy-efficient cooling systems and implementation of green building codes by the state, Florida is increasingly taking up green scroll compressors across commercial office complexes, industrial manufacturing facilities, and domestic houses.

Florida's tourism and marine industries are also fueling growing demand for effective cooling and refrigeration systems, which is further boosting the market growth.

| State | CAGR (2025 to 2035) |

|---|---|

| Florida | 4.8% |

By application, USA scroll compressor market is dominated by air conditioning application due to increased demand for smaller and efficient HVAC products in residential and commercial usage. Scroll compressors are more common in air conditioning applications due to smoother performance, quieter, and energy-saving nature compared to conventional reciprocating compressors.

Within the United States, the Department of Energy (DOE) strict energy standards and broad adoption of ENERGY STAR-certified products have led HVAC manufacturers to use high-efficiency components, and scroll compressors are among the most popular. Unitary products ranging from 1HP to 6HP are especially favored in new residential construction and retrofits that focus on green, quiet cooling systems.

Correspondingly, commercial market (7.5 HP to 30 HP) is also on the rise with investments by companies in office, retail, and institutional air conditioning and heating equipment. Along with these, building electrification and green tax credits for air conditioning retrofits also drive the use of scroll compressors on air conditioners. Condensing Units Dominate Refrigeration Industry Due to Retail and Food Service Fueling Growth.

Scroll compressors in condensing units have been shown to offer reliable performance, efficiency, and low maintenance issues of prime concern for businesses handling perishable goods. e-grocery, fresh food delivery, and rapid growth in quick-service restaurants demand silent, compact, and efficient refrigeration units.

The USA legislation to move away from high-GWP refrigerants and adopt low-GWP substitutes (e.g., R-290 and R-744) has compelled OEMs to employ scroll compressor-based equipment with environmentally friendly refrigerants. The benefits of scroll compressors over meeting temperature-critical needs and technological advancements in variable-speed scroll systems guarantee that condensing units will remain the prevailing application for the USA refrigeration scroll compressor market.

The USA Scroll Compressor Market is growing robustly with increasing energy-efficient air conditioning, ventilation, and heating system, green refrigeration, and electrification demand in the residential, commercial, and industrial sectors. Scroll compressors, with their low noise level operation, compact nature, and high efficiency, have emerged as an important component of new air conditioner and heat pump applications.

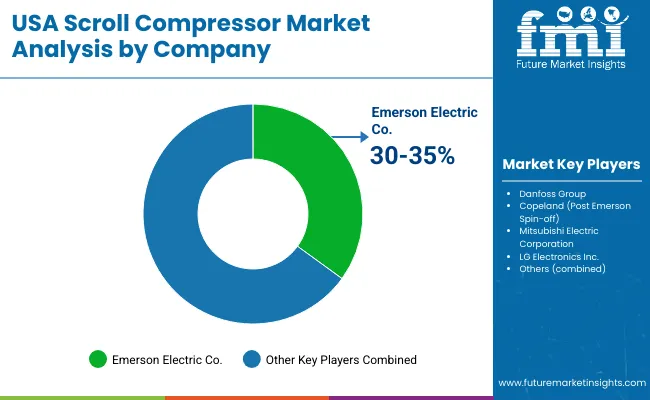

What's driving the pace even stronger? More stringent green policies, rising power costs, and state decarbonization policy. Opposition is at the doorstep of low-GWP refrigerant substitutes, variable speed compressors, and Internet-of-Things-based technology. The big boys dominate the market but also locally guarded by indigenous system integrators and OEMs.

Recent Developments

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Emerson Electric Co. | 30 - 35% |

| Danfoss Group | 18 - 22% |

| Copeland (Post Emerson Spin-off) | 12 - 16% |

| Mitsubishi Electric Corporation | 8 - 12% |

| LG Electronics Inc. | 6 - 9% |

| Other Players | 15 - 20% |

| Company Name | Key Offerings |

|---|---|

| Emerson Electric Co. | Industry leader with scroll compressors designed for HVAC and refrigeration systems; features include variable speed models and compatibility with low-GWP refrigerants. |

| Danfoss Group | Offers advanced scroll compressors for both commercial and residential buildings with enhanced energy efficiency, including inverter and tandem scroll technology. |

| Copeland (Post Spin-off) | A legacy scroll brand now operating independently, focused on accelerating innovations in decarbonized heating and modular HVAC design. |

| Mitsubishi Electric | Known for residential and light commercial scroll compressors in VRF systems and inverter-driven solutions optimized for USA climate zones. |

| LG Electronics Inc. | Focuses on high-efficiency residential and commercial HVAC systems, with smart control integration and compact scroll design. |

Other Key Players

On the basis of type, the USA Scroll Compressor Market is categorized into Air Conditioning (Residential (1HP to 6HP), Commercial (7.5 HP to 30 HP)) and Refrigeration (Condensing units (1 HP to 10HP), Industrial (10HP to 30 HP))

The overall market size for USA scroll compressor market was USD 1,162.7 Million in 2025.

The USA scroll compressor market is expected to reach USD 1,876.1 Million in 2035.

The increasing energy-saving discipline, quiet operation, smaller footprint and minimum maintenance properties will drive the demand for USA scroll compressor market.

The top states which drive the development of USA scroll compressor market are California, New York, Texas, and Florida.

Air Conditioning and Compact compressors (1 HP to 10 HP) are leading segment in the USA scroll compressor market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA