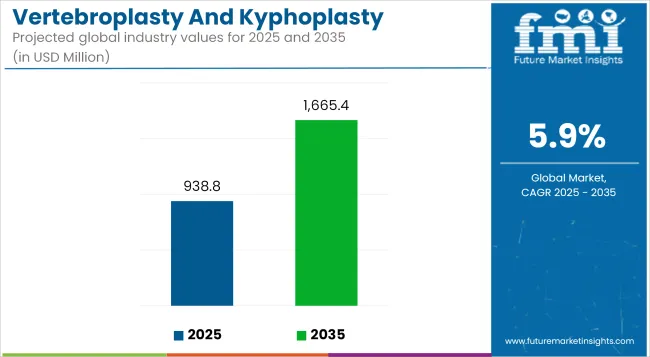

The global Vertebroplasty and Kyphoplasty Devices Market is estimated to be valued USD 938.8 million in 2025 and is projected to reach USD 1,665.4 million by 2035, registering a compound annual growth rate of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 938.8 million |

| Industry Value (2035F) | USD 1,665.4 million |

| CAGR (2025 to 2035) | 5.9% |

The vertebroplasty and kyphoplasty devices market is experiencing steady growth, driven by the increasing prevalence of spinal disorders, particularly among the aging population. These minimally invasive procedures have become preferred options for treating vertebral compression fractures, offering benefits such as reduced recovery times and improved patient outcomes.

Spinal surgeons are increasingly adopting these procedures due to their efficacy and cost-effectiveness, leading to a rise in demand for associated devices. Additionally, the growing awareness among patients and healthcare professionals about the advantages of vertebroplasty and kyphoplasty is contributing to market growth.

Vertebroplasty devices are expected to maintain a dominant position in 2025, capturing nearly 85.26% of the revenue share. This leadership is being attributed to the high clinical adoption of vertebroplasty as a first-line treatment for osteoporotic vertebral compression fractures. This procedure is often preferred owing to its shorter procedural duration and reduced cost burden.

A higher procedural throughput has been enabled due to fewer surgical complexities, which has strengthened its use in both hospital and ambulatory surgical center settings. Additionally, Vertebroplasty has been favored in clinical guidelines due to its proven efficacy in rapid pain relief and stabilization, especially in elderly populations. As more aging-related fractures are being diagnosed early, vertebroplasty remains a standard, cost-effective and time-efficient alternative.

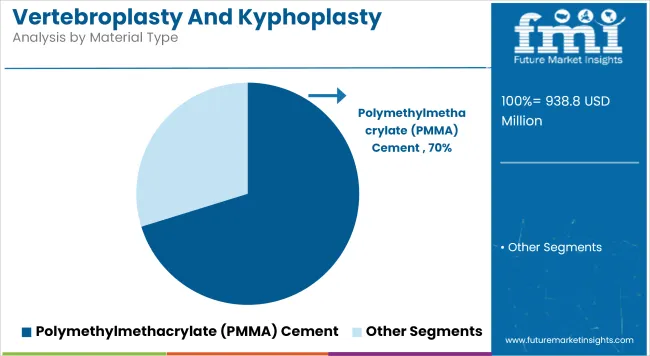

Polymethylmethacrylate (PMMA) cement is projected to hold 70.21% revenue share by 2025, establishing it as the preferred material in vertebral augmentation procedures. Its dominance can be linked to its high compressive strength, predictable setting behavior, and long-standing clinical track record.

The material has been widely utilized in both vertebroplasty and kyphoplasty due to its capacity to provide immediate mechanical stabilization, which is crucial in elderly osteoporotic patients. PMMA cement is also recognized for its cost-efficiency and wide availability, making it highly accessible in both developed and emerging healthcare markets.

Regulatory familiarity and established safety profiles have contributed to its strong market penetration. The segment continues to benefit from integration into turnkey vertebral augmentation kits, ensuring streamlined hospital procurement and ease of use in various care settings.

Reimbursement Uncertainty and Procedural Risks

Both vertebroplasty and kyphoplasty devices market have encountered challenges with reimbursement policies and procedural risk concerns. Although these minimally invasive techniques represent effective treatment options for vertebral compression fractures, both inconsistent insurance coverage across regions, particularly for vertebroplasty, limits procedural volumes. Additionally, concerns about cement extravasation, adjacent vertebral body fractures, and postoperative pain have fostered scepticism by some physicians.

The requirement for specialized imaging functions and surgical experience in addition to elevate operational costs and lessen the wide dissemination to smaller care settings. These issues lead to clinical hesitancy and inconsistent worldwide adoption, despite increasing interest in no/low pain relief in OPO.

Aging Population, Minimally Invasive Preference, and Technological Advancements

the demand for vertebroplasty and kyphoplasty devices is fueled mainly by the increasing elderly population and the growing incidence of spine cancer that require this type of surgical treatments, in spite of regulatory and clinical challenges. Patients and doctors are increasingly choosing minimally invasive procedures rather than open surgery for shorter recovery times and fewer complications.

The safety and precision of the technique is increasing due to technological advancements in the control of bone cement viscosity, balloon-assisted vertebral height restoration, and image-guided navigation systems. With hospital systems increasingly focused on outpatient care and early mobility, these devices will be key to both pain management and structural restoration of the spinal column through aging and trauma states of care.

North America dominates the vertebroplasty and kyphoplasty device market share in terms of the highest procedure volume, mature reimbursement policies, and a large pool of aging population. The population's increasing life expectancy has led to an increase in osteoporotic fractures and end-stage chronic back pain which has caused a rise in the demand for minimally invasive spinal procedures.

Balloon kyphoplasty systems and targeted cement delivery devices that provide more control and improved vertebral height restoration are being increasingly introduced in USA hospitals and outpatient centers. Procedural accuracy is also being supported by innovation in radiopaque bone cements and steerable cannulas.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

In the UK, the market continues to grow steadily as the NHS strives to reduce hospital stay and enhance outcomes for vertebral compression fractures. Vertebroplasty and kyphoplasty are increasingly done in the office, particularly for older patients with decreased bone density.

Clinicians in the UK prefer systems that balance rapid cement delivery with low-radiation exposure. Market acceptance is further increased by the growing usage of image guided systems and advances in biocompatible materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

Countries such as Germany, France, and Italy remain good markets in the European Union for vertebroplasty and kyphoplasty devices. The increasing procedural volumes can be attributed to high awareness regarding the osteoporotic fracture treatment followed by the well-established healthcare infrastructure.

Low-viscosity fast-setting bone cements and advanced balloon technologies are proliferating in the hands of device manufacturers in the EU to augment vertebral stabilization. Clinical data supporting early intervention to prevent spinal deformity and functional decline is also driving the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

Japan’s marketis increasing with the country’s aging populace and growing identification of vertebral contractions in elderly patients. Japanese hospitals are implementing image-guided, minimally invasive systems that minimize recovery and hinder the dependence on opioid-based anaesthesia.

Local medical device manufacturers are engaged in compact, precision-controlled injection systems and cement formulations that are appropriate for the smaller bone structures that are more prevalent in the region’s patient population.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea has also shown an impressive increase in vertebroplasty and kyphoplasty devices with the incrementing accessibility to the health care services, along with the increasing awareness of Osteoporosis and meager in elective spine procedures help boost growth in this region.

Integrated imaging and navigation systems being adopted at South Korean hospitals are generating benefits in accuracy and reduced complications. Local companies are also emerging with affordable options and customizable kits, improving accessibility for public and private care facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

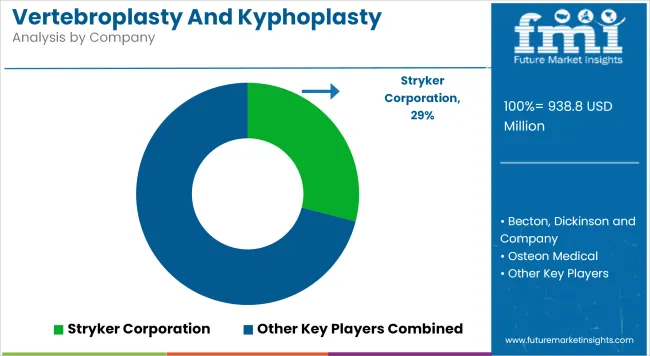

The vertebroplasty and kyphoplasty devices market is characterized by intensifying competition, as leading manufacturers continue to prioritize technological advancements, product diversification, and procedural integration. A strong emphasis is being placed on minimally invasive solutions that enhance precision, reduce surgical time, and improve patient outcomes.

Companies are increasingly investing in next-generation bone cements, balloon inflation systems, and integrated delivery kits to streamline workflows and expand procedural use across hospital and outpatient settings. Strategic activities such as mergers, global distribution partnerships, and portfolio consolidation are accelerating, particularly in emerging markets with growing spinal care infrastructure.

Key Development

The overall market size for the vertebroplasty and kyphoplasty devices market was USD 938.8 million in 2025.

The vertebroplasty and kyphoplasty devices market is expected to reach USD 1,665.4 million in 2035.

The increasing incidence of vertebral compression fractures, rising aging population, and growing adoption of minimally invasive spine procedures using kyphoplasty devices fuel the vertebroplasty and kyphoplasty devices market during the forecast period.

The top 5 countries driving the development of the vertebroplasty and kyphoplasty devices market are the USA, UK, European Union, Japan, and South Korea.

Kyphoplasty devices lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vertebroplasty Needles Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA