The vision screener market is advancing steadily, propelled by a rising focus on early detection of visual impairments and increasing demand for preventive ophthalmic care. Industry publications and clinical data reports have highlighted the growing burden of refractive errors, amblyopia, and other eye conditions across both pediatric and geriatric populations.

Healthcare institutions and school health programs are integrating vision screening into routine checkups, creating broader access to diagnostic tools. In response, manufacturers have intensified product development efforts around accuracy, portability, and automation, particularly in digital platforms.

Government-supported vision screening campaigns and partnerships with non-profit organizations have also expanded screening infrastructure in underdiagnosed regions. Technological enhancements in screening software, touch-screen interfaces, and wireless data integration are further streamlining workflows for clinicians and technicians. Looking ahead, market expansion is expected to be LED by rising adoption of digital and table-top devices for efficient screening, increased funding for vision care programs, and a growing emphasis on reducing undiagnosed visual disorders globally.

| Metric | Value |

|---|---|

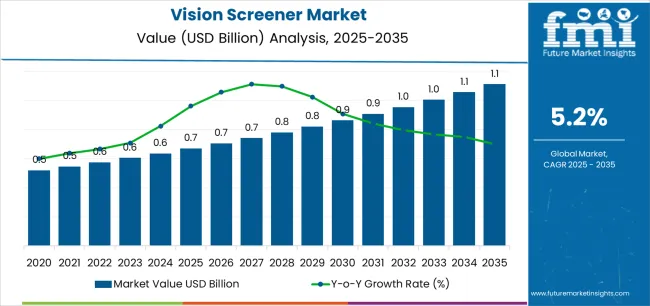

| Vision Screener Market Estimated Value in (2025 E) | USD 0.7 billion |

| Vision Screener Market Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

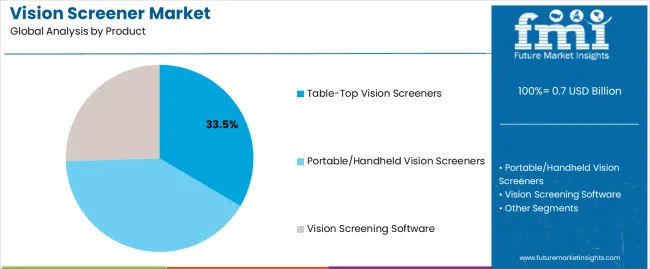

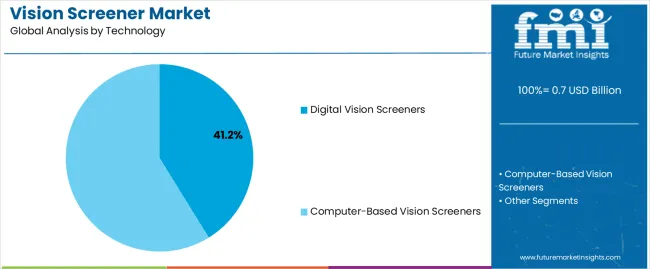

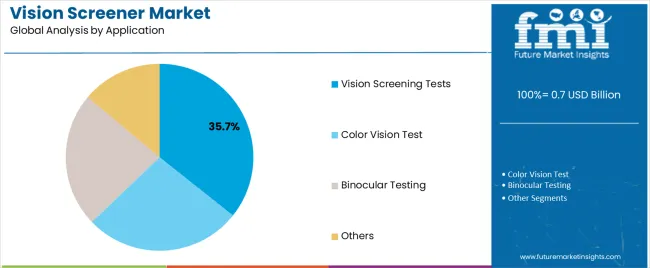

The market is segmented by Product, Technology, Application, and End-Users and region. By Product, the market is divided into Table-Top Vision Screeners, Portable/Handheld Vision Screeners, and Vision Screening Software. In terms of Technology, the market is classified into Digital Vision Screeners and Computer-Based Vision Screeners. Based on Application, the market is segmented into Vision Screening Tests, Color Vision Test, Binocular Testing, and Others.

By End-Users, the market is divided into Hospitals, Homecare Settings, Specialized Clinics, Rehabilitation Centers, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Table-Top Vision Screeners segment is projected to hold 33.5% of the market revenue in 2025, reinforcing its importance in primary care and specialized vision testing environments. This segment’s growth has been influenced by the high reliability and consistency offered by fixed-base screening devices.

Clinics, hospitals, and optometric practices have adopted table-top screeners for their ergonomic designs, comprehensive test menus, and ability to integrate with electronic health records. Product innovation in terms of compact footprints and user-friendly controls has made table-top devices more accessible for medium-sized practices and community health centers.

Moreover, their superior measurement accuracy and patient throughput capabilities have reinforced their value in mass screening initiatives. As vision care professionals continue to prioritize precision and workflow efficiency, table-top screeners are expected to maintain strong relevance in the diagnostic landscape.

The Digital Vision Screeners segment is projected to account for 41.2% of the market revenue in 2025, making it the leading technology category. Growth of this segment has been driven by increasing adoption of fully automated, touch-enabled screening systems capable of delivering rapid and objective assessments.

Digital screeners have replaced manual testing procedures in many settings due to their ability to minimize operator dependency and standardize outcomes. Portable digital devices have gained popularity among pediatricians, mobile screening units, and school-based health programs, where convenience and speed are critical.

Technology advancements such as wireless connectivity, cloud integration, and AI-based result interpretation have enhanced usability and data management. These features have made digital screeners indispensable for large-scale vision health programs and tele-optometry services. As digital health continues to reshape clinical workflows, the digital vision screeners segment is expected to lead the technological transformation in the market.

The Vision Screening Tests segment is projected to contribute 35.7% of the market revenue in 2025, sustaining its dominance among application areas. This growth has been supported by the increased use of screening tests for early identification of refractive errors, visual acuity deficiencies, and binocular vision problems.

Public health initiatives, school-based programs, and pediatric wellness guidelines have promoted vision screening as a standard protocol, especially in populations at risk for developmental or learning issues. Clinics and screening service providers have prioritized efficient, standardized vision tests to improve diagnostic accuracy and treatment planning.

Furthermore, innovations in test algorithms and adaptive testing interfaces have expanded the scope and sensitivity of vision screening procedures. With growing clinical emphasis on proactive visual health and broader integration into community and occupational health settings, the Vision Screening Tests segment is expected to retain its leading role in driving market demand.

The above table presents the expected CAGR for the global vision screener market over numerous semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the industry is predicted to surge at a CAGR of 5.8%, followed by a slightly lower growth rate of 5.7% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.8% (2025 to 2035) |

| H2 | 5.6% (2025 to 2035) |

| H1 | 5.4% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.4% in the first half and remain relatively moderate at 5.1% in the second half.

Growing Demand for Vision Screener Market Owing to Government Initiatives

Lack of proper nutrition in new borns, especially in under developed economies, has resulted in numerous medical conditions. Increasing prevalence of vision problems in children is aiding the demand for treatments related to eye disorders.

Vision impairment is one of the most common medical conditions that young children are facing due to several reasons. Irregular eye checkups, inconsistent care, increased screen time, is some of the key factors resulting in vision impairment, sometimes blindness.

Around 6.8% of children under the age of 18 are diagnosed with vision and eye condition in the United States as per the Centers for Disease Control and Prevention. Over 3% of children under the age of 18 are visually impaired or have some eye related disorders.

Governments across the globe are undertaking several initiatives in collaboration with leading companies to spread awareness regarding treatment. Key players in the industry are developing innovative products to curb the prevalence of such disorders among children.

Governments worldwide are initiating several preschool programs, which enable preschool children to undergo vision screening tests. The initiatives are expected to increase the demand for the market.

High Cost of Advanced Screening Methods is Expected to Stifle Vision Screener Industry Growth

The high cost of improved screening methods is a significant barrier to growth in the industry. Numerous recent technologies with artificial and advanced imaging capabilities need substantial investment, making them less accessible to smaller clinics, rural healthcare professionals, and developing nations.

This costly barrier may impede the broad use and integration of sophisticated screeners, thus impeding overall sector growth. The cost element might have an impact on patient affordability, particularly in places without adequate healthcare funding or insurance coverage, limiting access to comprehensive eye care.

The global vision screener market recorded a CAGR of 4% during the historical period between 2020 and 2025. The growth of the sector was positive as this reached a value of USD 0.7 billion in 2025 from USD 0.5 billion in 2020.

Rapid developments in the healthcare and advancements in technology are augmenting the growth in the sector. Growing prevalence of vision impairment, especially among children, is propelling the demand.

Lack of proper nutrition, irregular eye checkups, and extensive usage of smartphones is resulting in vision impairment. To reduce the global burden, especially across underdeveloped regions, governments worldwide are undertaking several initiatives to create awareness.

Surging demand for early and accurate detection of medical conditions such as vision impairment, spot vision, and others has created lucrative prospects for players operating in the , especially across Asia Pacific excluding Japan.

As per the National Blindness & Visual Impairment Survey, prevalence of vision impairment and number of blind individuals in India surpassed 0.6 million by the end of 2025. The government anticipates, with the initiatives and improvement in healthcare infrastructure, 15.6 million persons can be saved from permanent blindness.

In response to such developments in emerging economies, key players operating in the sector are eyeing the regions to improve sales. Following the outbreak of COVID 19, awareness regarding health among people has surged significantly.

Demand for portable/handheld vision screeners, especially for patients in home care settings is expected to increase. Backed by the aforementioned factors, the global vision screener market is expected to witness robust growth over the forecast period.

The market is organized and concentrated, with Tier 1, Tier 2, and Tier 3 firms. This segmentation depicts the competitive landscape and industry share distribution among several types of enterprises involved in the manufacture and distribution of vision screening equipment.

In 2025, Tier 1 firms are estimated to create USD 601.9 million in market concentration revenue, accounting for 55% of the overall industry share. Tier 1 organizations are often huge, well established businesses with vast research and development skills, strong distribution networks, and enormous industry impact.

Their overwhelming industry share demonstrates their leadership in driving innovation, creating industry standards, and offering a diverse variety of sophisticated vision screening products.

Tier 2 industry players, on the other hand, are expected to occupy 27% of the industry share by 2025. Tier 2 industry players are smaller than Tier 1 competitors, continue to play an important role in the industry.

Tier 2 firms frequently specialize on certain niches or areas, offering competitive goods that address unique demands in the vision screening industry. Tier 2 firms contribute to the industry by increasing product diversity, providing creative solutions, and promoting improved accessibility and affordability.

The market concentration reveals a competitive yet organized ecosystem in which Tier 1 and Tier 2 businesses are critical.

The dominance of Tier 1 industry players, along with a significant presence of Tier 2 competitors, guarantees a balanced industry dynamic, stimulating innovation and guaranteeing a diversified variety of high quality vision screening products are accessible to suit consumer demands. As the market evolves, the interaction between the levels will determine the future path of the.

The section below covers the industry analysis for the vision screener market for different countries. demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. Canada is anticipated to remain at the forefront in North America, with a value share of 5.1% through 2035. In Asia Pacific, China is projected to witness a CAGR of 7.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

| Canada | 5.1% |

| The United States | 4.3% |

| The United Kingdom | 4.1% |

China is expected ascend at a CAGR of 7.5% during the forecast period. The combination of artificial intelligence and big data analytics is considerably boosting the sector, improving diagnosis accuracy and efficiency.

Artificial intelligence systems examine massive volumes of data from vision tests to detect trends and forecast probable visual issues with high accuracy. This skill enables early identification and appropriate intervention, which are critical for avoiding serious visual deficits.

Big data analytics, on the other hand, allows for the consolidation and analysis of massive datasets, resulting in insights into trends and outcomes that help clinicians make better decisions. This connection also allows for individualized eye care, since artificial intelligence may adapt suggestions based on specific patient data, enhancing therapy efficacy.

Artificial intelligence powered vision screener may continuously learn and improve, guaranteeing that diagnostic tools grow more effective over time.

By simplifying the screening process and decreasing the strain on healthcare practitioners, the combination of artificial intelligence and big data analytics is driving innovation and sector growth, eventually leading to better patient outcomes.

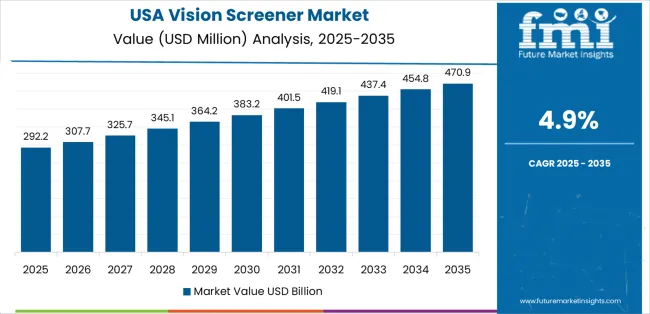

The United States market is expected ascend at a CAGR of 4.3% during forecast period. Growing prevalence of vision impairment, improved healthcare infrastructure, and cost effective prices of vision screener devices and treatment are key factors supporting the sector growth in the United States.

With the presence of leading companies in the United States, coupled with increasing development and innovation of the devices, demand in the United States is expected to propel.

The United Kingdom is expected to garner a CAGR of 4.1% during forecast period. In the United Kingdom, there are nearly 2 million people suffering from vision loss and around 360,000 diagnosed a visually impaired or partially blind, according to the United Kingdom National Health Statistics. The United Kingdom is expected to be among the most lucrative pockets in Europe for market players.

Growth in the country is attributable to the growing prevalence of vision impairment among the children and the geriatric population. Improved healthcare infrastructure and technological advancements in the digital vision screener devices will aid the growth in the sector.

The presence of leading companies and innovation in portable vision screener for the patients in home care setting in the United Kingdom is expected to favor the growth in the sector.

The section contains information about the leading segments in the sector. By product, the handheld vision screener segment held an industry share of 56.1% in 2025. Vision screening tests segment held an industry share of 32% in 2025.

| Product | Handheld Vision Screeners |

|---|---|

| Value Share (2025) | 56.1% |

The handheld vision screener segment dominates the sector, accounting for an industry share of 56.1% in 2025. The rising emphasis on early detection and preventative eye health, along with technical advances in mobile devices, has increased their popularity. The segment is dominating the sector, increasing global access to essential vision screening services.

| Application | Vision Screening Tests |

|---|---|

| Value Share (2035) | 32% |

The vision screening tests segment is forecast to account for a market share of 32% in 2025. Growing prevalence of vision impairment and eye related disorders is burgeoning the need for vision screening tests.

Governments and private healthcare organizations in emerging economies are organizing free vision screening tests to curb the burden of blindness and vision impairment. Increasing number of ophthalmic eye centers and multispecialty clinics worldwide are expected to aid the adoption of vision screening tests on the back growing prevalence of eye related disorders.

The global vision screener market is expected to be consolidated in nature. Tier-1 companies actively operating in the global sector. Some of the leading players are focusing on developing digital vision screener to capitalize on the surging trend, especially in the United States and Germany, to expand their global presence. Other key players are investing extensively in research & development activities for innovation for paediatric vision screener.

Recent Industry Developments in Vision Screener Market

In terms of product, the sector is divided into table-top vision screeners, portable/handheld vision screener and vision screening software.

By technology, the sector is divided into digital vision Screener and computer-based vision screeners.

By application, the sector is divided into vision screening tests, color vision test, binocular testing and others.

The sector is classified by end user as hospitals, homecare settings, specialized clinics, rehabilitation centers and ambulatory surgical centers.

Key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe and Middle East & Africa have been covered in the report.

The global vision screener market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the vision screener market is projected to reach USD 1.1 billion by 2035.

The vision screener market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in vision screener market are table-top vision screeners, portable/handheld vision screeners and vision screening software.

In terms of technology, digital vision screeners segment to command 41.2% share in the vision screener market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vision Care Market Size and Share Forecast Outlook 2025 to 2035

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Vision Sensor Market by Type, Application, End user and Region through 2035

Revision Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

Television Broadcasting Services Market Insights – Growth & Forecast 2023-2033

Television Services Market

Smart Vision Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision System Market Growth - Trends & Forecast 2024 to 2034

Night Vision Device Market

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Market Insights – Growth & Forecast 2024-2034

Digital Vision Lenses Market

Computer Vision in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Computer Vision Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA