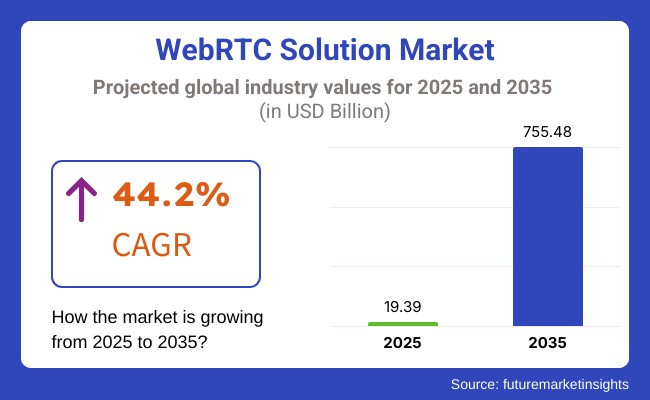

The web real-time communication (WebRTC) solution market is expected to expand rapidly from 2025 to 2035, driven by the growing adoption of AI-based communication solutions, increasing demand for seamless video calling, and the expansion of cloud-based collaboration software. The market is expected to reach USD 19.39 billion in 2025 and grow to USD 755.48 billion by 2035, at a compound annual growth rate (CAGR) of 44.2% for the forecast period.

As work-from-home, telemedicine, online learning, and virtual team collaboration gain traction, these solutions are gaining ground for browser-based, low-latency communication. With the integration of 5G connectivity, voice assistants powered by AI, and blockchain-protected real-time messaging, industry adoption is increasingly finding support. Furthermore, technological advancements in end-to-end encryption, cloud-native WebRTC platforms, and API-based real-time communication services are driving growth.

In addition, the advent of edge computing, adaptive bitrate streaming, and AI-driven noise cancellation is transforming the ecosystem by enhancing the quality of real-time video and audio. The players are investing in scalable cross-platform communication frameworks to enable immersive AR/VR conferencing, real-time language interpretation, and IoT-driven smart communication solutions.

In 2025, the overall market share is anticipated to be led by the Large Enterprises Segment, accounting for approximately 63-67% of the market. This dominance is driven by the growing need for enterprise-grade WebRTC solutions to facilitate secure, high-quality communications for customer engagements, internal collaboration, and remote working.

Enterprises with broader coverage in IT and telecom, BFSI, and healthcare are adopting WebRTC for omnichannel and AI-enhanced customer communication. Pioneering companies like Cisco, Google, and Twilio are headlining in this front by offering a scalable WebRTC platform that delivers enterprise-grade security, analytics, and DevOps with API integrations to step up business functionality.

The trend of enhanced affordability and accessibility of cloud-based communication solutions will drive the SME segment to capture 33-37% of the WebRTC Market by 2025. SMEs widely adopt WebRTC technology to enable remote work, support, and collaboration. If this is the case, then services like Vonage, Agora Zoom Video Communications, and other video conferencing, messaging, and voice application services are providing budget-friendly options, reducing the need for SMEs to have a detailed infrastructure.

For example, flexible pay-as-you-go pricing structures and AI-assisted automation have been key enablers that have powered WebRTC’s rise within customer service in the small and medium-sized enterprises (SME) segment, which we have identified as a marquee vertical in this fast-growing market.

IT & Telecom Segment to Account More than 29-33% of WebRTC Market Share in 2025. The rising penetration of VoIP services and cloud-based and 5G-enabled real-time services are driving demand. Telecom companies like AT&T, Verizon, and Vodafone are also adopting web-based real-time communication (WebRTC) as they will combine with WebRTC protocols to offer more consistent customer service and video calling, as well as less dependency on legacy telecom equipment.

The emergence of AI-integrated voice assistants and online collaboration tools is driving the growth of WebRTC in the IT and telecom industries. Twilio’s solutions, based on WebRTC, for instance, enable quicker and more seamless video interactions in the cloud contact center, resulting in faster response times and an improved user experience.

The BFSI segment is projected to account for approximately 21-25% of the WebRTC market by 2025, driven by increased demand for secure, real-time customer interactions and solutions to prevent fraud. High-end banking institutions, including JPMorgan Chase, Bank of America, and HSBC, are adopting WebRTC for video banking, digital ID verification, and secure communication channels.

AI chatbots and KYC (Know Your Customer) verification tools driven by WebRTC enhance both customer interactions and operational efficiency. Deutsche Bank leveraged the technology as a platform to offer secure video conferencing via WebRTC for its remote financial advisory services, reducing the need to visit its physical branches. Digital-only banks are also driving the growth of the segment.

The Web Real-Time Communication Solution Market is riding a significant wave of development growth, driven by accelerating demand for rapid browser communication and the rise of remote work. Communication of enterprise as a role model focuses on low latency, high-quality calls, security, and seamless integration with CRM and collaboration tools.

Telehealth & telemedicine providers' main concern is that power requires encs for detailed patient-physician discussions, a sign of their commitment to health-related laws like HIPAA. Customer support and contact centers are seeking a platform that offers scalability, multi-user support, and automation with AI for chatbot integration and real-time video channel assistance.

Media and entertainment businesses utilize WebRTC interactivity for live streaming, online gaming, and audience engagement, which are the primary business requirements for cross-platform compatibility and scalability. The industry is expected to continue its upward trajectory with innovations such as 5G, AI-driven functionalities, and the expanding range of cloud applications.

| Company | Contract Value (USD Million) |

|---|---|

| Twilio | Approximately USD 70 - 80 |

| Agora | Approximately USD 60 - 70 |

| Cisco | Approximately USD 80 - 90 |

| Vonage | Approximately USD 50 - 60 |

| Microsoft | Approximately USD 90 - 100 |

In 2024 and early 2025, the Web Real-Time Communication Solution Market experienced significant momentum driven by increasing demand for seamless, integrated communication tools across various industries.

Leading companies, including Twilio, Agora, Cisco, Vonage, and Microsoft, have secured substantial contracts and strategic partnerships, underscoring the industry’s commitment to enhancing digital collaboration, customer engagement, and operational efficiency. These developments highlight the pivotal role of real-time communication technologies in transforming digital interactions and driving innovation in a rapidly evolving global landscape.

Between 2020 and 2024, the Web Real-Time Communication (WebRTC) solution market experienced rapid growth as remote work, digital collaboration, and real-time customer interactions became increasingly essential across various industries. Video conferencing platforms like Zoom, Microsoft Teams, and Google Meet have integrated this technology to provide seamless, low-latency communication. Meanwhile, telehealth and e-learning platforms have leveraged it for secure virtual consultations and interactive online education.

The retail and customer service sectors have adopted WebRTC-powered chatbots and video call widgets to enhance digital customer engagement. However, challenges such as browser compatibility, network instability, and security vulnerabilities prompted advancements in AI-driven network optimization, adaptive bitrate streaming, and encrypted WebRTC protocols.

Between 2025 and 2035, this technology is expected to evolve with the integration of AI-driven automation, edge computing, and quantum-secure communication. AI-powered analytics will enhance real-time interactions with auto-translation, sentiment detection, and adaptive streaming quality.

The rise of 5G and metaverse applications will enable ultra-low latency video conferencing, immersive XR collaboration, and avatar-based virtual shopping experiences. Businesses will adopt blockchain-backed security and quantum-resistant encryption to protect sensitive communications in finance and healthcare. Additionally, edge computing will revolutionize performance, enabling real-time IoT monitoring, autonomous vehicle connectivity, and the management of smart city infrastructure.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter global regulations (GDPR, CCPA) required WebRTC solutions to implement end-to-end encryption, consent-based data sharing, and secure communication protocols. | AI-driven, blockchain-backed frameworks ensure real-time compliance, quantum-resistant encryption, and decentralized identity authentication for ultra-secure peer-to-peer communications. |

| AI-enhanced WebRTC improved noise cancellation, real-time translation, and automated video/audio quality optimization. | AI-native, self-learning platforms autonomously enhance voice and video clarity, enable real-time sentiment analysis, and provide adaptive AI-driven conversational experiences. |

| Healthcare providers and businesses adopted WebRTC-based video conferencing for secure, real-time consultations and virtual meetings. | AI-powered, immersive solutions integrate holographic communication, biometric authentication, and AI-driven diagnostics for hyper-realistic telehealth and enterprise collaboration. |

| Enterprises shifted to cloud-based platforms to enhance scalability, reliability, and seamless cross-platform communication. | AI-enhanced, edge-native architectures provide ultra-low latency, real-time adaptive streaming, and AI-driven congestion management for high-performance remote communications. |

| WebRTC enables real-time, low-latency video streaming for gaming, online education, and live sports broadcasting. | AI-powered, decentralized streaming platforms utilize predictive content delivery, real-time audience engagement analytics, and immersive AR/VR streaming to deliver next-generation digital experiences. |

| 5 G-enabled solutions reduced latency in real-time communication, improving video conferencing, gaming, and live broadcasting. | AI-driven, 6G-powered networks enable ultra-high-definition video calls, AI-assisted speech processing, and real-time AI-powered interaction across smart cities and enterprise applications. |

| Rising cyber threats led to the adoption of AI-based fraud detection, anti-phishing measures, and zero-trust security frameworks in WebRTC platforms. | AI-native, quantum-secure protocols autonomously detect cyber threats, implement real-time threat prevention, and ensure tamper-proof peer-to-peer communication security. |

| WebRTC platforms are integrated with AI chatbots and virtual assistants for automated, real-time customer engagement. | AI-enhanced, emotion-aware conversational solutions offer predictive AI-driven interactions, real-time voice modulation, and adaptive natural language processing, enabling seamless communication. |

| Companies optimize data transmission to reduce bandwidth usage and minimize energy consumption. | AI-driven, carbon-conscious solutions dynamically optimize energy efficiency, leverage green data centers, and enable eco-friendly, real-time digital interactions. |

| Enterprises explored decentralized models for improved security, transparent peer-to-peer interactions, and reduced reliance on centralized servers. | AI-integrated, blockchain-secured ecosystems enable real-time trustless communication, decentralized content ownership, and secure, permissionless peer-to-peer collaboration. |

The primary threat in the field of WebRTC solutions is the issue of data security and privacy. The real-time communication systems are under the threat of different types of cyber attacks that may lead to data breaches, unauthorized access of data and denial of service (DDoS) attacks. Organizations must adhere to international laws, such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Health Insurance Portability and Accountability Act (HIPAA), to secure customer data and establish a trustworthy partnership.

Another crucial risk is network reliability and latency. This platform relies heavily on a stable internet connection. Thus, any interruption may cause a poor experience, such as call dropouts or disconnections. Enterprises have to bolster their networks with strong infrastructures and adaptive bitrate techniques to make sure that communication runs smoothly during different networks and also enhance the user experience.

Technological obsolescence is another significant issue. The WebRTC segment is evolving rapidly due to the increasing demand for AI-powered streaming, 5G connectivity, and low-latency data transmission, which are among the latest technologies. Failing to adopt innovations places the company at risk of losing its competitive edge. Innovation, driven by constant research and development, enables them to stay relevant in the market.

Lastly, the financial risk related to market competition and pricing pressure is a critical aspect. In the presence of several service providers offering the same set of products, price competition may lead to a loss of profit. To ensure long-term effectiveness in business, innovation through unique features, security superiority, and adaptable solutions is the key.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| UK | 7.0% |

| European Union | 7.1% |

| Japan | 7.1% |

| South Korea | 7.3% |

The Web Real-Time Communication Solution Market in the United States is expanding rapidly, driven by rising demand for real-time digital communication, increasing remote work adoption, and advancements in cloud-based solutions. Businesses and consumers alike are leveraging video conferencing, voice-over-IP (VoIP), and AI-powered chatbots to enhance engagement and streamline collaboration.

The Federal Communications Commission (FCC) and major cloud service providers are supporting initiatives for seamless browser-based communication, AI-driven real-time transcription, and end-to-end encrypted platforms to ensure secure and efficient communication.

Leading companies, such as Google, Cisco, and Twilio, are investing in real-time collaboration tools, AI-powered noise cancellation, and WebRTC-enabled omnichannel communication to drive business agility and enhance customer experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.2% |

The WebRTC Solution Market in the United Kingdom is witnessing significant growth, driven by the increasing reliance on cloud-based collaboration tools, the expansion of 5G networks, and the demand for real-time communication in the telehealth and fintech sectors. Businesses are adopting secure, low-latency WebRTC solutions to improve user engagement and operational efficiency.

The UK’s Department for Digital, Culture, Media & Sport (DCMS) is promoting secure VoIP communication, AI-driven real-time analytics, and WebRTC-integrated customer support platforms to enhance business communication strategies. Additionally, the rise of remote work and hybrid business models is accelerating the adoption of WebRTC.

Key players, including BT Group, Voxbone, and RingCentral, are leading advancements in cloud-powered WebRTC APIs, AI-enhanced virtual meetings, and browser-based real-time collaboration, transforming digital interactions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.9% |

The WebRTC Solution Market in the European Union is expanding significantly, driven by EU-wide digital transformation policies, growing demand for secure enterprise communication, and increased use of WebRTC in financial services and online education. The EU’s General Data Protection Regulation (GDPR) is driving the need for secure, encrypted WebRTC solutions to comply with privacy laws.

Countries such as Germany, France, and the Netherlands are leading in real-time cloud collaboration, AI-driven video communication, and secure browser-based teleconferencing. The rise of omnichannel customer engagement and IoT-powered real-time data exchange is further accelerating market adoption.

Top technology providers such as Vonage, Ericsson, and Orange are investing in AI-assisted real-time analytics, WebRTC-powered telehealth, and blockchain-secured video communication to enable seamless digital interactions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.0% |

The WebRTC Solution Market in Japan is evolving rapidly, driven by government-led digital initiatives, the increased adoption of AI-driven business communication tools, and the demand for real-time interaction in e-commerce and telemedicine. Japan’s focus on 5 G-powered WebRTC solutions is driving innovation in ultra-low-latency video streaming and AI-enhanced call centers.

The Ministry of Internal Affairs and Communications (MIC) is promoting cloud-based telepresence solutions, AI-assisted remote collaboration, and next-generation WebRTC APIs to modernize Japan’s digital communication ecosystem. Additionally, advancements in smart cities and AI-powered chat support systems are fostering WebRTC innovation.

Japanese tech firms such as NTT Communications, Rakuten, and SoftBank are leading developments in cloud-native WebRTC platforms, 5 G-integrated video calling, and AI-powered voice recognition tools to enhance business communication strategies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.8% |

The WebRTC Solution Market in South Korea is witnessing strong growth, driven by nationwide 5G coverage, increasing demand for real-time virtual events, and AI-driven WebRTC solutions for enterprises. The South Korean government’s Smart Digital Infrastructure Plan is accelerating cloud-based communication technology adoption.

The Ministry of Science and ICT (MSIT) is promoting secure, AI-enhanced WebRTC applications, blockchain-based video conferencing, and automated real-time language translation to enhance digital interactions across various sectors, including finance, healthcare, and online education.

Leading South Korean companies such as Samsung, KT Corporation, and LG Uplus are investing in WebRTC-powered smart collaboration tools, AI-assisted virtual consultations, and cloud-based real-time communication APIs to drive business transformation and enhance global connectivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.5% |

The Web Real-Time Communication (WebRTC) solution market is evolving rapidly as businesses and developers adopt real-time voice, video, and messaging capabilities to enhance digital communication. The demand for seamless, low-latency peer-to-peer interactions is driving widespread adoption across various industries, including customer service, online collaboration, and enterprise communication. Companies are leveraging AI-powered call analytics, end-to-end encryption, and cloud-based WebRTC solutions to improve performance, security, and scalability.

Tech giants like Google LLC, Cisco Systems Inc., and Twilio Inc. lead the market with API-driven platforms, enterprise-grade video conferencing solutions, and WebRTC integration into browsers and cloud services. These companies invest heavily in network infrastructure, AI-driven engagement tools, and interoperability with existing communication ecosystems. Microsoft Corporation and Vonage (Ericsson) strengthen the competitive landscape with WebRTC-powered customer engagement and cloud collaboration offerings.

Smaller players and emerging startups focus on niche applications, including ultra-low-latency streaming, AI-enhanced call routing, and privacy-focused WebRTC encryption. As real-time communication becomes an integral part of digital transformation, competition will be driven by advancements in AI, cloud scalability, and seamless cross-platform integration.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google LLC | 25-30% |

| Cisco Systems Inc. | 15-20% |

| Twilio Inc. | 12-16% |

| Microsoft Corporation | 10-14% |

| Vonage (Ericsson) | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google LLC | Provides WebRTC technology for Chrome and cloud-based real-time communication services. |

| Cisco Systems Inc. | Innovates in WebRTC-powered video conferencing and enterprise communication solutions. |

| Twilio Inc. | Specializes in API-driven WebRTC solutions for voice, video, and chat applications. |

| Microsoft Corporation | Integrates WebRTC into Teams, Azure Communication Services, and cloud-based collaboration. |

| Vonage (Ericsson) | Focuses on AI-powered real-time customer engagement and VoIP solutions. |

Key Company Insights

Google LLC (25-30%)

Google leads the WebRTC market by integrating real-time communication technology into its Chrome browser and Google Meet, enabling secure, low-latency communication experiences.

Cisco Systems Inc. (15-20%)

Cisco is at the forefront of enterprise communication, leveraging WebRTC for seamless video conferencing, remote collaboration, and AI-powered virtual meeting solutions.

Twilio Inc. (12-16%)

Twilio is revolutionizing WebRTC with its API-driven solutions, providing businesses with cloud-based voice, video, and chat capabilities for customer engagement.

Microsoft Corporation (10-14%)

Microsoft integrates WebRTC into its cloud-based communication platforms, including Microsoft Teams and Azure Communication Services, ensuring secure and scalable collaboration.

Vonage (Ericsson) (6-10%)

Vonage enhances real-time customer interactions with AI-driven WebRTC solutions, enabling businesses to provide high-quality voice and video experiences.

Other Key Players (20-30% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 19.39 billion |

| Projected Market Size (2035) | USD 755.48 billion |

| CAGR (2025 to 2035) | 44.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million deployments for volume |

| Components Analyzed (Segment 1) | WebRTC Solutions (Cloud-based, On-premises), Services (Consulting, Integration, Development, Support & Maintenance) |

| Enterprise Sizes Analyzed (Segment 2) | Small & Medium Enterprises (SMEs), Large Enterprises |

| Industries Analyzed (Segment 3) | IT & Telecom, BFSI, Media & Entertainment, Healthcare, Government, Manufacturing, Others |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Spain, China, Japan, India, South Korea, Australia, New Zealand, UAE, South Africa |

| Key Players influencing the WebRTC Solution Market | Google LLC, Cisco Systems Inc., Twilio Inc., Microsoft Corporation, Vonage (Ericsson), Other Companies |

| Additional Attributes | Dollar sales acceleration driven by demand for cloud-native communication, AI-powered WebRTC enhancing enterprise collaboration, SMEs embracing cost-effective APIs, IT & telecom industry leading protocol integration, BFSI securing digital ID and video banking, direct online booking tools and real-time infrastructure scaling rapidly. |

| Customization and Pricing | Customization and Pricing Available on Request |

By component, the market is segmented into WebRTC solutions (cloud-based and on-premises) and services (consulting services, integration and services, design and development services, and support & maintenance).

By enterprise size, the market is categorized into small & medium enterprises (SMEs) and large enterprises.

By industry, the market is divided into IT & Telecom, BFSI, Media & Entertainment, Healthcare, Government, Manufacturing, and Others.

By region, the market spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 19: Global Market Attractiveness by Industry, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 39: North America Market Attractiveness by Industry, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 79: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 157: MEA Market Attractiveness by Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 159: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

The industry is slated to reach USD 19.39 billion in 2025.

The industry is predicted to reach a size of USD 755.48 billion by 2035.

Key companies include Google LLC, Cisco Systems Inc., Twilio Inc., Microsoft Corporation, Vonage (Ericsson), Zoom Video Communications, Amazon Web Services (AWS), Chime, Agora Inc., Tencent Cloud, and Ribbon Communications.

South Korea, driven by increasing demand for real-time communication solutions and cloud-based services, is expected to record the highest CAGR of 11.5% during the forecast period.

WebRTC solutions, including cloud-based and on-premises solutions, are widely adopted due to their scalability, security, and real-time communication capabilities.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.