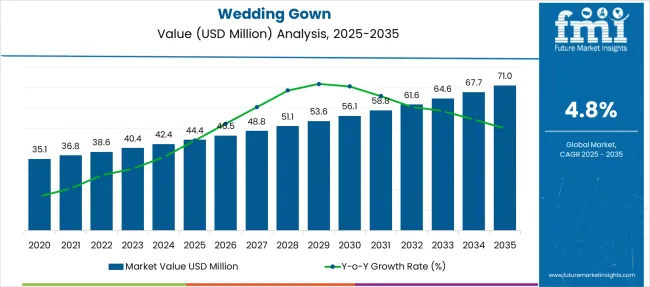

The Wedding Gown Market is estimated to be valued at USD 44.4 million in 2025 and is projected to reach USD 71.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Wedding Gown Market Estimated Value in (2025E) | USD 44.4 million |

| Wedding Gown Market Forecast Value in (2035F) | USD 71.0 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Wedding Gown Market is experiencing consistent growth supported by evolving consumer preferences, increased bridal customization, and the global rise in destination and themed weddings. Social media influence and celebrity fashion trends have elevated demand for distinctive and luxurious bridal attire.

Designers and bridal brands are increasingly offering diverse styles and materials that align with modern fashion sensibilities and cultural aesthetics. Additionally, the rise in dual ceremonies, second weddings, and pre-wedding events has created demand for multiple gowns, enhancing market depth.

Technological advancements in textile development and digital fitting tools have expanded accessibility while improving personalization and purchasing confidence. As the bridalwear industry becomes more inclusive and experience-driven, the market outlook for Wedding Gown Markets remains strong with opportunities for innovation in fit, fabric, and form.

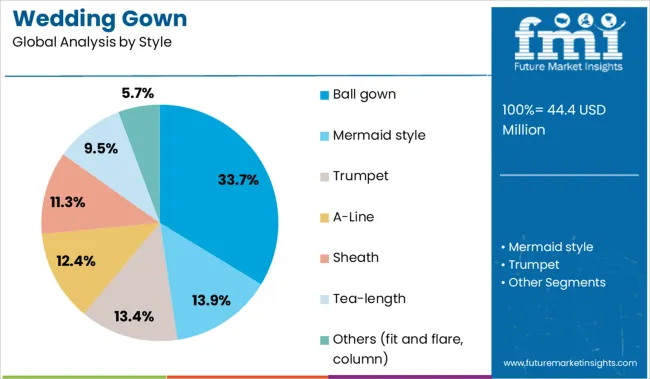

The market is segmented by Style, Material, Length, Sleeve Type, End Use, Distribution Channel, and region. By Style, the market is divided into Ball gown, Mermaid style, Trumpet, A-Line, Sheath, Tea-length, and Others (fit and flare, column).

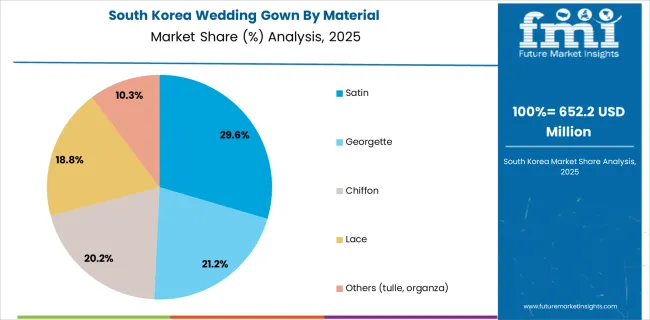

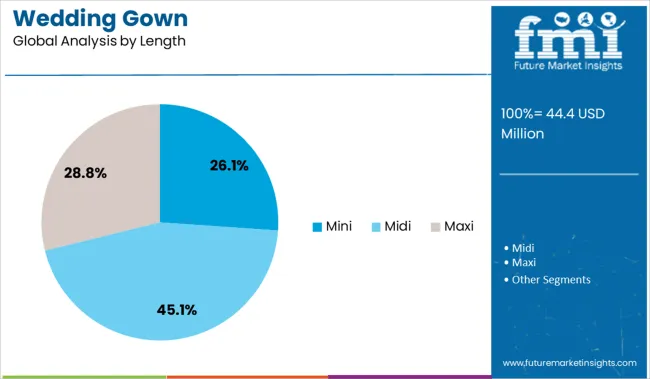

In terms of Material, the market is classified into Satin, Georgette, Chiffon, Lace, and Others (tulle, organza). Based on Length, the market is segmented into Mini, Midi, and Maxi. By Sleeve Type, the market is divided into Short sleeve, Long sleeve, and Sleeveless. By End Use, the market is segmented into Individuals, Commercial, Clothing rental services, Wedding consultants, Photographic studios, and Others (religious institutions, social institutions, etc).

By Distribution Channel, the market is segmented into Online channels, E-commerce, Company websites, Offline channels, Specialty stores, Mega retail stores, and Others (individual stores, departmental stores, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ball gown style segment is projected to contribute 33.70% of total market revenue by 2025 within the style category, making it the leading design choice. Its voluminous silhouette, structured bodice, and timeless elegance have made it a preferred option among brides seeking a traditional and dramatic bridal look.

The emotional and aspirational appeal of the ball gown has maintained its popularity across both luxury and mid-tier bridal markets. In addition, its suitability for formal and grand venues has reinforced its presence, especially in cultural settings where ceremonial opulence is valued.

As bridal preferences continue to balance classic charm with modern design elements, the ball gown remains a defining segment in the overall Wedding Gown Market.

The satin material segment is expected to hold 29.60% of market share by 2025 within the material category, establishing it as the most preferred fabric. Its smooth finish, natural sheen, and structured drape provide a luxurious look that complements a wide range of gown silhouettes.

Satin is favored for its versatility, allowing it to be used in both minimalist designs and intricate embellishments. Additionally, the fabric's ability to hold shape while offering comfort has contributed to its widespread use.

Its association with sophistication and premium aesthetics continues to drive preference among modern brides looking for both elegance and simplicity. As fabric selection becomes central to gown personalization, satin remains a dominant material choice in the bridal fashion landscape.

The mini length gown segment is projected to capture 26.10% of total market revenue by 2025 under the length category, positioning it as a prominent choice among contemporary brides. This trend is driven by the growing popularity of casual, destination, and pre wedding events where ease of movement and playful style are prioritized.

Mini gowns are increasingly chosen for receptions, elopements, and secondary looks that allow brides to express individuality while embracing comfort. The rise of fashion forward bridal collections has also contributed to the acceptance of shorter lengths, particularly among younger demographics.

With its modern aesthetic and functional advantages, the mini length segment continues to expand as brides seek versatile options that reflect personal style beyond traditional norms.

Online platforms now drive over 50% of gown orders in developed markets, while rental channels and resale platforms are reshaping pricing tiers. Modular designs, such as gowns with detachable overlays, are gaining share across mid-priced and premium labels. Asia-Pacific and North America lead in both unit volume and transaction size. Designers are shortening fulfillment windows through tech-enabled customization and offshore micro-factory setups, while physical retail continues to adapt to digital-first discovery paths.

Bridalwear firms have streamlined fulfillment through integrated e-commerce platforms and studio-appointment hybrids. Between Q2 2023 and Q1 2025, online-origin orders rose from 38% to 56% across the top five bridal markets. Mid-tier brands introduced algorithm-driven fit prediction and on-demand tailoring for gowns priced between USD 850–1,400. Storefronts in Canada and Japan reduced try-before-buy conversion times by 17% after deploying virtual fitting tools and 3D drape simulations. Custom orders with detachable sleeves, overlay skirts, and adjustable bustiers now account for 23% of unit sales. On the back end, micro-factory setups in Turkey and Vietnam shortened made-to-order lead times from 44 to 29 days. This hybrid model allowed firms to reduce unsold inventory by 12% and increase repeat traffic on bridal platforms by 19%.

Standalone boutiques and mid-range designers face volume pressures as brides opt for rental or resale over full-price purchases. Average spend on new gowns dropped from USD 1,672 in 2022 to USD 1,314 in 2024 across the US, UK, and Australia. Rental platforms logged a 26% YoY rise in volume during the wedding season peaks, drawing volume away from offline showrooms. Off-the-rack gowns purchased online showed a 21% return rate in Q1 2025, largely due to fit mismatches and fabric variance from digital previews. Inventory recovery and restocking added 4–6 weeks of delay for popular sizes (8–12). Some retailers shifted to capsule drops and limited sizing runs to manage warehousing costs. Others introduced alteration credits to keep post-purchase adjustments in-channel and preserve margins.

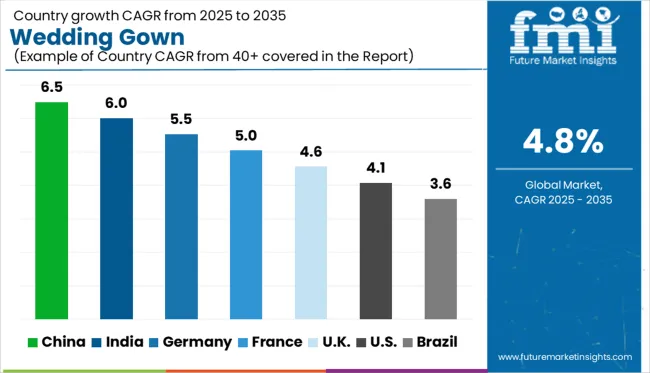

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

Allure Bridals leads the wedding gown market, offering a broad catalog across multiple price tiers and distribution through bridal boutiques and retail partners. David’s Bridal remains one of the largest mass-market suppliers, with in-house brands and exclusive collaborations. Designers such as Vera Wang, Monique Lhuillier, and Oscar de la Renta maintain a presence in the high-end segment through couture collections and limited releases. Labels like Maggie Sottero Designs, Sophia Tolli, and Pronovias serve the mid-range segment with consistent seasonal offerings. Amsale, Reem Acra, Marchesa, and Hayley Paige cater to personalized, made-to-order demand. Entry barriers include brand equity, production quality control, and access to established retail channels capable of sustaining year-round sales cycles.

On July 7, 2025, Dutch couturier Iris van Herpen showcased a Wedding Gown made from Brewed Protein™, a lab-grown protein fiber developed by Japanese biotech company Spiber.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.4 Million |

| Style | Ball gown, Mermaid style, Trumpet, A-Line, Sheath, Tea-length, and Others (fit and flare, column) |

| Material | Satin, Georgette, Chiffon, Lace, and Others (tulle, organza) |

| Length | Mini, Midi, and Maxi |

| Sleeve Type | Short sleeve, Long sleeve, and Sleeveless |

| End Use | Individuals, Commercial, Clothing rental services, Wedding consultant, Photographic studio, and Others (religious institutions, social institutions, etc) |

| Distribution Channel | Online channels, E-commerce, Company websites, Offline channels, Specialty stores, Mega retails stores, and Others (individual stores, departmental stores, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allure Bridals, Amsale, Carolina Herrera, David's Bridal, Hayley Paige, Jenny Packham, La Spose di Gio, Maggie Sottero Designs, Marchesa, Monique Lhuillier, Oscar de la Renta, Pronovias, Reem Acra, Sophia Tolli, and Vera Wang |

| Additional Attributes | Dollar sales by dress type and distribution channel, growing demand for customized and designer gowns in premium segments, stable sales in traditional retail and rental platforms, innovations in sustainable fabrics and 3D body scanning support personalization and fit precision |

The global wedding gown market is estimated to be valued at USD 44.4 million in 2025.

The market size for the wedding gown market is projected to reach USD 71.0 million by 2035.

The wedding gown market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in wedding gown market are ball gown, mermaid style, trumpet, a-line, sheath, tea-length and others (fit and flare, column).

In terms of material, satin segment to command 29.5% share in the wedding gown market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protective Gowns Market

Destination Wedding Industry Analysis in Hawaii Size and Share Forecast Outlook 2025 to 2035

Examination Gowns Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Destination Wedding Services

Destination Wedding Market Analysis by Wedding Type, Service Planning, Season, Organization of Stay, Guest Capacity - Forecast for 2025 to 2035

United Kingdom Destination Wedding Market Outlook – Trends & Forecast 2025–2035

United States Destination Wedding Market Insights – Growth & Trends 2025–2035

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Japan Destination Wedding Market Growth – Size, Share & Industry Trends 2025-2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Europe Destination Wedding market Analysis from 2025 to 2035

Germany Destination Wedding Market Insights – Trends, Size & Forecast 2025–2035

Thailand Destination Wedding market Analysis from 2025 to 2035

Maldives Destination Wedding Market Analysis 2025 to 2035

Caribbean Destination Wedding Market Trends - Growth & Forecast 2025 to 2035

GCC Countries Destination Wedding Market Insights – Demand, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA