The yerba mate market, being an ingredient market, is moderately fragmented. Multinational corporations such as Guayakí, focusing on organic and sustainable production, dominate approximately 28% of the market.

Regional leaders such as Taragüi, Rosamonte, and Pajarito hold a combined share of 40%, leveraging their strong cultural significance in key markets like Argentina, Brazil, and Paraguay.

Startups and niche brands like Meta Mate and Kraus are premium and organic, which takes 32%. Private labels are scarce or absent in this market because the production of yerba mate is specialized. The top five companies have around 50% of the global market, which is moderately concentrated.

The regional leaders' dominance and growing health-conscious niche brands indicate an inclusive competitive scenario whereby the global as well as local players exist as they service different bases of consumers and reach through their products.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share% |

|---|---|

| Top Multinationals (Guayakí, Mate Factor, Yaguar) | 28% |

| Regional Leaders (Taragüi, Rosamonte, Pajarito ,Canarias) | 40% |

| Startups & Niche Brands (Meta Mate, Kraus, La Merced) | 32% |

Moderate fragmentation characterizes the market. This is because there is a lot of share by leaders of the regional category and growing share of niche categories.

Powdered yerba mate was the most dominant category, accounting for 35% share volume, due mainly to traditional consumption behaviors in South America. Brands such as Taragüi and Rosamonte have long positioned themselves as strong leaders in this category, capitalizing on cultural depth and historical heritage.

Powdered yerba mate is popular because it is versatile enough for gourd preparation by bombilla. Liquid yerba mate is also a rapidly growing category, now representing 22%, with the increase in ready-to-drink products.

Guayakí has popularized innovative sparkling yerba mate beverages that are extending the reach of the category into North America and Europe. "Others" make up 13% of the share, consisting of yerba mate extracts and capsules that meet the demand for convenience by health-conscious consumers.

Beverages is the leading application for yerba mate, accounting for 60 percent of the market. This application is led by the traditional consumption in South America and increasing RTD yerba mate beverages worldwide. Leaders such as Guayakí and Canarias have developed their beverage offerings beyond the traditional taste and functional benefits, which appeal to younger generations.

The dietary supplements application accounts for 18% of the market, led by the natural energizing and antioxidant properties of yerba mate. Brands such as Meta Mate have established a market in this space with premium organic supplements. The personal care segment, accounting for 12%, includes yerba mate in skincare and haircare products because of its high antioxidant content, with growth coming from emerging natural cosmetics brands.

The yerba mate market saw great development in product innovation, sustainability, and market expansion in 2024. Multinational corporations and regional leaders are keen on reaching more people across the globe through innovative product launches and strategic partnerships.

Sustainability became a dominant theme, with brands adopting eco-friendly packaging and traceability initiatives. Additionally, the RTD yerba mate beverages have redefined consumer preferences in North America and Europe. Through the involvement of the HoReCa sector and targeted marketing campaigns, the brand managed to cover different consumer groups.

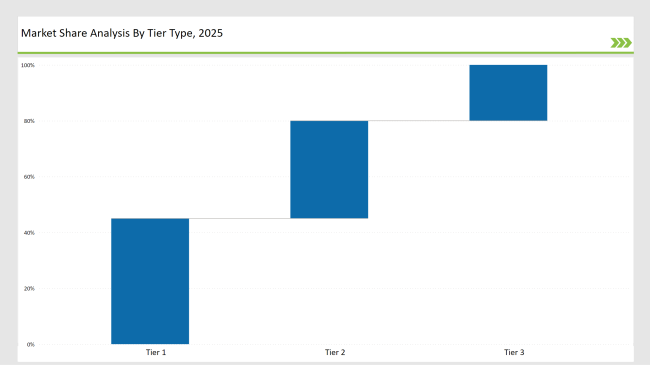

| By Tier Type | Tier 1 |

|---|---|

| Market Share% | 45% |

| Example of Key Players | Guayakí, Taragüi, Rosamonte |

| By Tier Type | Tier 2 |

|---|---|

| Market Share% | 35% |

| Example of Key Players | Pajarito, Canarias, Yaguar |

| By Tier Type | Tier 3 |

|---|---|

| Market Share% | 20% |

| Example of Key Players | Meta Mate, Kraus, La Merced |

| Brand | Key Focus |

|---|---|

| Guayakí | Implemented carbon-neutral supply chain initiatives to align with environmental goals. |

| Taragüi | Partnered with local schools in Argentina for yerba mate education programs. |

| Rosamonte | Launched direct-to-consumer subscription models in North America. |

| Meta Mate | Introduced blockchain for traceability in organic yerba mate production. |

| Kraus | Focused on regenerative agriculture practices to improve sustainability. |

| Canarias | Expanded product range to include yerba mate tea bags. |

| Pajarito | Developed partnerships with sports brands to promote yerba mate as an energy drink alternative. |

| Yaguar | Hosted virtual workshops on yerba mate preparation for global audiences |

| La Merced | Introduced customizable gift sets for corporate clients. |

| Selecta | Invested in digital marketing campaigns targeting millennial consumers. |

Market for RTD will grow significantly in the next ten years, especially in North America and Europe. Manufacturers can thus exploit this growing trend through the launch of innovative RTD yerba mate brands to tap into increasing consumer demand for convenient, healthy, and sustainable beverage options.

This may include developing unique flavor profiles, functional blends infused with complementary ingredients like adaptogens or probiotics, and implementing sustainable packaging solutions, such as recyclable or biodegradable containers.

As environmental consciousness remains on the upswing around the world, there will be much more of an emphasis on sustainable practices within the yerba mate industry itself and on the ecological friendliness of offered products. With carbon-neutral supply chains, renewable sources of energy applied in the manufacturer's production facilities, and biodegradable or recycled packaging solutions, manufacturers can begin to differentiate themselves.

The demand for yerba mate-based dietary supplements and functional foods is expected to grow, with its energy-boosting and antioxidant properties leading to increased consumption in developed markets. Manufacturers can take advantage of this trend by coming up with innovative supplement products that further benefit from the unique properties of yerba mate, including improved mental focus, enhanced athletic performance, and general immune system support.

The segmentation is into Loose Leaf, Powder, Extracts, and Concentrates.

The segmentation is into Business-to-Business (Beverage Processing, Dietary Supplement, Cosmetic, and Personal Care Pharmaceutical) and Business-to-Consumer (Hypermarkets/Supermarkets, Herbalist Shops, Health Food Stores, Online Retail).

The segmentation is into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

Leading companies like Guayakí, Taragüi, and Rosamonte dominate with a combined market share of approximately 50%, reflecting their strong global and regional presence.

Argentinian yerba mate leads with a 50% share, followed by Brazilian yerba mate at 30%, and Paraguayan yerba mate at 12%.

Asia and North America are key growth regions, with increasing demand for functional beverages and dietary supplements.

Partnerships with cafes and restaurants increase brand visibility and drive consumer trials, ultimately boosting retail demand.

Companies are launching infused yerba mate blends with exotic flavors and hosting online workshops to engage younger audiences.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yerba Mate Market Analysis by Form, Sales Channel, and Region Through 2035

UK Yerba Mate Market Analysis – Size, Share & Forecast 2025–2035

USA Yerba Mate Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Yerba Mate Market Analysis – Size, Share & Forecast 2025–2035

Europe Yerba Mate Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Latin America Yerba Mate Market Insights – Demand, Size & Industry Trends 2025–2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Maternity Products Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Material Tester Market Growth – Trends & Forecast 2025 to 2035

Maternity Innerwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Material Handling Monorails Market

Market Share Distribution Among Maternity Apparel Providers

Competitive Overview of Maternity Activewear Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA