The Europe Yerba Mate market is set to grow from an estimated USD 712.4 million in 2025 to USD 1,201.7 million by 2035, with a compound annual growth rate (CAGR) of 5.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 712.4 million |

| Projected Europe Value (2035F) | USD 1,201.7 million |

| Value-based CAGR (2025 to 2035) | 5.4% |

The European yerba mate market is expected to increase significantly on account of the high demand for plant-based and functional beverages by consumers, alongside the growing consciousness about the benefits of yerba mate for human health.

Yerba mate originates from the Ilex paraguariensis leaves and is used because of their richness in antioxidants, caffeine level, and vast usage. This is another traditional, refreshing South American drink that has flowed into Europe due to its natural, energy-boosting properties and association with fitness and wellness trends.

It also pertains to innovation in the production formulation and packaging that would fit many diverse consumer needs within European regions. As more firms expand to launch yerba mate through forms of powdered and liquid consumable and blended special application variants within the beverage and supplement-based use in personal care.

Further, the region's preference for sustainable and responsibly sourced products has motivated European manufacturers to collaborate with South American producers to provide a consistent supply of high-quality yerba mate.

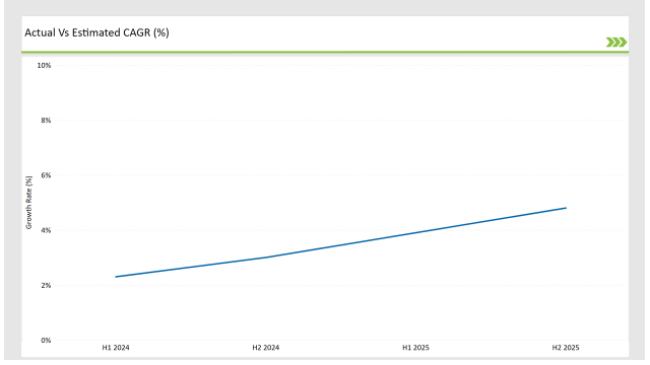

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Yerba Mate market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.3% |

| H2 (2024 to 2034) | 3.0% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 4.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Yerba Mate market, the sector is predicted to grow at a CAGR of 2.3% during the first half of 2023, with an increase to 3.0% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.9% in H1 but is expected to rise to 4.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Sustainability Initiatives- Mate Revolution launched a fair-trade-certified Argentinian yerba mate line, emphasizing eco-friendly packaging. |

| March-24 | Product La unches- Guayakí introduced an organic ready-to-drink yerba mate beverage line in Europe, featuring innovative flavors like hibiscus and elderberry. |

| February-24 | E xpansion of Retail Distribution- CBSe expanded its presence in Europe by collaborating with health food stores and e-commerce platforms, focusing on flavored yerba mate blends. |

| January- 24 | Strategic Partnerships - A major European beverage brand partnered with a Paraguayan yerba mate producer to develop premium loose-leaf and RTD products. |

Acceleration of Yerba Mate Consumption Due to Higher Demand for Functional Beverages

A significant reason that the yerba mate market is doing well is the changing mind-set of consumers in Europe who prefer functional beverages. The popularity of yerba mate is progressing by leaps and bounds due to its incorporation in energy drinks, iced teas, and herbal infusions as an ingredient containing natural caffeine and health-promoting properties.

In contrast to harmful energy drinks, yerba mate promotes a long-lasting energy effect without jitters, making it the most chosen product among those who care for their health.

For example, Guayakí and Mate Revolution are riding this wave of success and launching new yerba mate-based drinks, adding natural flavouring. Acceptance of yerba mate in Europe is also influenced by the increasing urge of consumers for plant-based and clean-label beverages.

Companies stress transparency and sustainability; therefore, they use organic and Fair-Trade ingredients. Among the most popular ready-to-drink product types, yerba mate is quick and easy to consume. This is a big advantage for busy, on-the-go consumers.

Sustainable Sourcing and Innovative Formulations

Product innovation, as well as the ethical practice of recycling, have become the major forces that propel the European yerba mate market. Some of the companies are also bringing yerba mate in new forms such as powder to make your own drinks, liquid concentrate for fast and easy recipes, and combinations that include herbs and fruits.

CBSe, for example, has diversified its flavoured yerba mate range, thus catering to consumers who look for a new taste experience with no health risks. Alongside such sustainable measures, the emphasis has been placed on fair trading and the use of eco-friendly packaging.

The alliance between beverage brands in Europe and yerba mate farmers in South America is a move that confirms the business ethics of fair trade as well as the assurance of quality. Mate Revolution's launch of Fairtrade-certified yerba mate is an example that supports the growing cause of sustainability in the market.

Through these product innovations, not only do they attain customer satisfaction, but also urge more partnerships with the European laws and the ethical beliefs of their users.

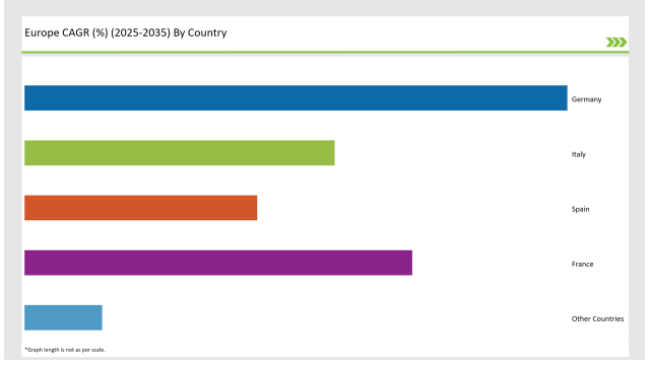

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 35% |

| Italy | 20% |

| Spain | 15% |

| France | 25% |

| Other Countries | 5% |

Germany is the only place that stands out as a major market for yerba mate in Europe due to the strong consumption of functional and organic beverages. The health-conscious individuals present in this country have become more and more fans of yerba mate-based drinks that are made of energy and these drinks are herbal infusions that are made of cannabis, along with other herbs instead of the traditional coffee and synthetic energy drinks.

Guayakí is the latest company that has not been left behind by the increasing trend of drinking yerba mate that is only packaged in an organic way, and as a result, they introduced a new range of products that are made from yerba mate with many different flavours that are exclusively made for the German market and which come in eco-friendly packaging.

Moreover, the distribution of yerba mate products has been largely facilitated by Germany’s long health food retail network. The retailers, Alnatura and Bio Company, for example, are organizing a campaign to sell both loose-leaf and flavoured yerba mate blends as tea for both tea lovers and new customers. The main focus on sustainability and organic certifications makes Germany the leading player in the yerba mate sector.

France is one of the places that has turned out to be wealthy in yerba mate with a special emphasis on gourmet and wellness applications. The state´s growing interest in the plant-based diet and herbal medicine has contributed to the growth of yerba mate among other things, as a truly versatile and healthy ingredient. French brands include yerba mate in innovative drinks, like sparkling teas and functional blends, to meet the demand for premium and health-oriented products.

Likewise, the cosmetic department in France is now observable by using yerba mate in making cream cosmetics. The health benefits of yerba mate make it a great ingredient for anti-aging creams, detoxifying masks, and energizing serums. With such innovations, France can be seen as a country that can utilize yerba mate, a product, in all sorts of various sectors thus it is considered to be a hub for product development and market expansion.

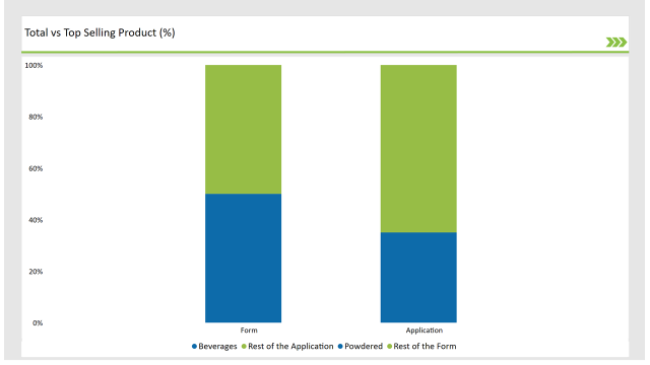

% share of Individual Categories Form and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Powdered) | 50% |

| Remaining segments | 50% |

The European market is mostly composed of the powdered yerba mate, thanks to its traditional yet versatile product. Loose-leaf and powdered are the most common alternatives used for the brewing of mate tea, which is considered one of the most popular rituals by health-conscious consumers.

Along with CBSe and others, flavoured powdered yerba mate blends are available, which not only promote the essence of the individual but also offer a broader selection for the customer. The powdered form is mainly preferred due to its versatility in different applications such as dietary supplements and functional beverages.

The surge in the trend of do-it-yourself brewing kits has also contributed to the growth in the market for powdered yerba mate. These kits give the chance for consumers to create their own yerba mate, mixing different herbs and spices to increase flavours and health benefits.

| Main Segment | Market Share (%) |

|---|---|

| Application (Beverages) | 65% |

| Remaining segments | 35% |

The beverage industry is an elevated application segment for yerba mate in Europe, taking a significant portion of the market share. The consumption of yerba mate products is boosted by its property of providing energy and the unique flavor that has made it a raw ingredient in energy drinks, herbal infusions, and iced teas.

The Guayakí iced tea beverage is a great representation of how the market is acknowledging the growing demand for functional and on-the-go drinks through the introduction of the product available.

OMR statistics also prove that the dietary supplements segment is growing in popularity as yerba mate is used in formulations introduced for weight management and energy-boosting. The fact that it is rich in antioxidant properties and also helps with metabolism, makes it a strong component in health-focused products.

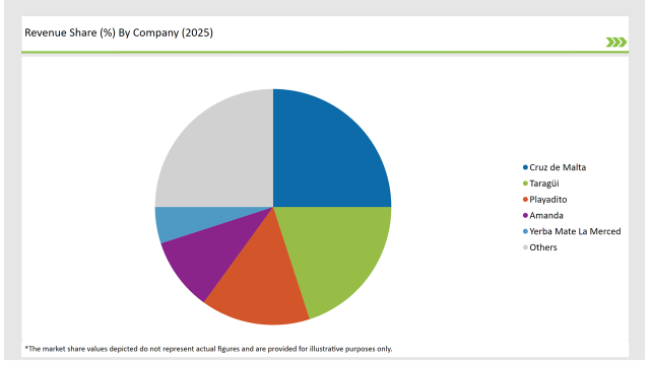

2025 Market share of Europe Yerba Mate manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cruz de Malta | 25% |

| Taragüi | 20% |

| Playadito | 15% |

| Amanda | 10% |

| Yerba Mate La Merced | 5% |

| Others | 25% |

The European yerba mate market is relatively fragmented, with the following key players being able to continue leading the industry: Guayakí, CBSe, Mate Revolution, and Canarias. These companies have focused on their capability in sourcing, innovation in products, and adhering to sustainability standards for market share capture and growth promotion.

Guayakí has focused more on increasing its presence in Europe, partnering with local distributors as well as local health food stores, offering several varieties of yerba mate beverages in ready-to-drink. CBSe's strength lies in its innovative offerings of flavored mixes that are appreciated by the tastes of the people in Europe.

Mate Revolution emphasized conducting fair-trade, and eco-friendly packaging, leading to a leading position in products of yerba mate based on sustainability. Regional players have their options in niche markets such as dietary supplements and personal care applications.

Innovation, strategic partnerships with suppliers, and ethical sourcing describe the competitive landscape. Innovation, strategic partnership with suppliers, and ethics in sourcing are set to keep the Europe yerba mate market on an upward growth trajectory.

As per Form Type, the industry has been categorized into Powder, Liquid, and Others.

As per Application, the industry has been categorized into Beverages, Dietary Supplements, Personal Care, and Others.

As per Type, the industry has been categorized into Argentinian Yerba Mate, Brazilian Yerba Mate, Paraguayan Yerba Mate, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Yerba Mate market is projected to grow at a CAGR of 5.4 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,201.7 million.

Key factors driving the Europe yerba mate market include the growing consumer interest in health and wellness beverages, as well as the increasing popularity of herbal teas and natural energy drinks among younger demographics. Additionally, the rise of social media and cultural trends promoting yerba mate consumption contribute to its market growth.

Germany, and France, are the key countries with high consumption rates in the Europe Yerba Mate market.

Leading manufacturers include Cruz de Malta, Taragüi, Playadito, Amanda, and Yerba Mate La Merced known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA