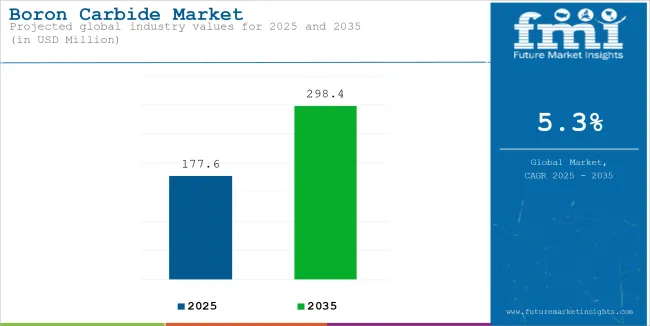

Global boron carbide market sale is estimated to be USD 177.6 million in 2025 and expected to reach a valuation of USD 298.4 million by 2035. The market is projected to grow at a rapid growth rate of 5.3% over the forecast period between 2025 and 2035. The revenue generated by Boron Carbide in 2024 was USD 169.9 million. The industry is predicted to exhibit a Y-o-Y growth of 4.6% in 2025.

The boron carbide market is expected to grow steadily from 2025 to 2035, as it is increasingly used in key industries such as defense, nuclear energy, aerospace, and electronics. Its unique features, such as high hardness, lightweight nature, and heat resistance, make it essential for various applications.

Much of this growth will be driven by the defense industry, as countries invest more in advanced body armor, vehicle protection, and helmets. Absorption of harmful radiation in nuclear reactors is also set to expand as a use of boron carbide, especially in Asia-Pacific and Europe as these regions expand their nuclear energy capacity.

Renewable energy and electronics will also make a great contribution to the industry growth. In renewable energy, boron carbide is used in solar power systems and for enhancing energy storage in advanced batteries. Its application is expected to surge in electronics.

This includes not only polishing silicon wafers, but also using it in a variety of devices for thermoelectric applications. With the new investments in technological and energy sectors in China, South Korea, and the USA, the market for boron carbide should remain high here.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 177.6 million |

| Projected Size (2035) | USD 298.4 million |

| Value-based CAGR (2025 to 2035) | 5.3% |

The sector will benefit from improvements in manufacturing and sustainability practices. Eco-friendly production methods that minimize waste are being adopted to meet global environmental standards. Production processes are now faster and less expensive with the use of automation and digital tools.

Research in new uses, like medicine and nanotechnology, opens new avenues for boron carbide in specialized applications. These will be the things that will push the market into growth to address growing demand and increase its scope.

The global boron carbide sector is expected to grow significantly by 2035, driven by emerging regions in Asia-Pacific, the Middle East, and Africa due to industrialization and infrastructure development.

Developed regions will be more focused on producing high-purity boron carbide for advanced applications. This growth prospect underlines the significance of boron carbide as an essential material across industries, thus making it relevant in the future.

The table below presents the annual growth rates of the global boron carbide industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 2.9% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 2.9% |

| H2(2024 to 2034) | 3.4% |

| H1(2025 to 2035) | 3.0% |

| H2(2025 to 2035) | 3.5% |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 3.0% in the first half and relatively increase to 3.5% in the second half. In the first half (H1), the sector saw an increase of 10 BPS while in the second half (H2), there was a slight increase of 10 BPS.

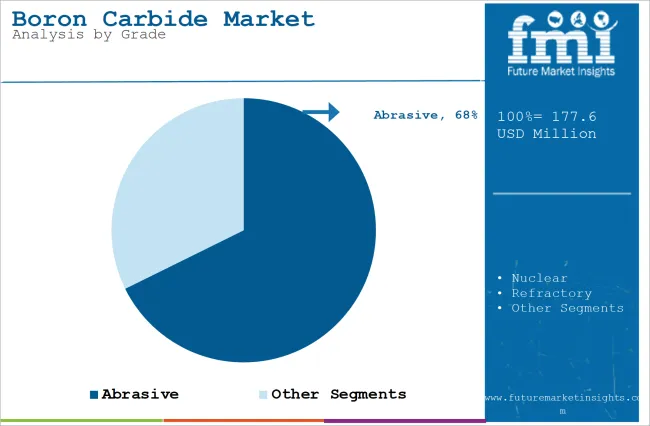

The section explains the growth trajectories of the leading segments in the industry. In terms of grade, natural will likely dominate and generate a share of around 67.7% in 2024.

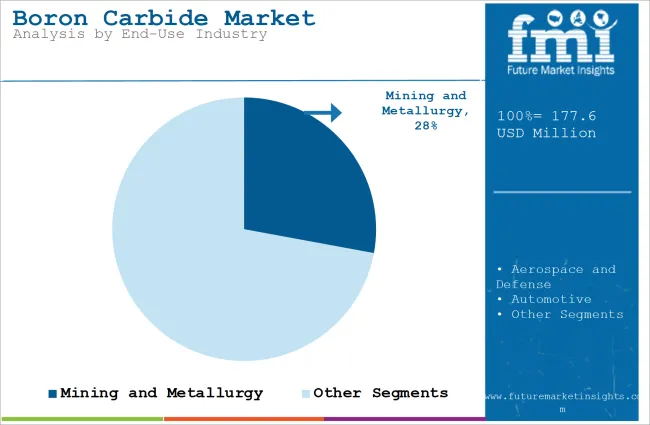

Based on the end use, the Mining and Metallurgy industry is projected to hold a major share of 27.9% in 2024. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Abrasive (Grade) |

|---|---|

| Value Share (2024) | 67.7% |

Abrasive grade is the largest in terms of market share, accounting for 67.6% of the total demand. The product has exceptional hardness, making it suitable for use in abrasives and cutting tools. The wear resistance of boron carbide ensures long-term performance in industrial applications, hence its wide application in grinding, polishing, and surface preparation.

Boron carbide abrasive grade is utilized in industrial processes for sandblasting, water jet cutting, and surface finishing. Its hardness is only inferior to diamond and thus is one of the most potent materials for machining and smoothing the toughest materials. Its dominance has been fueled mainly by the ever-increasing need for precision manufacturing and high-efficiency machining.

This type of boron carbide has been in growing demand due to the continuous industrialization, particularly in emerging economies. As these sectors expand and develop, more durable abrasives with high performance are required, such as automotive, aerospace, and construction sectors. The need for automation in manufacturing processes drives the market even further, assuring consistent demand for this grade of boron carbide.

| Segment | Mining and Metallurgy (By End-Use Industry) |

|---|---|

| Value Share (2024) | 27.9% |

The mining and metallurgy industry is the largest sector for boron carbide, accounting for 27.9% of the market. This is because the material is extremely hard and resistant to wear, which makes it indispensable for grinding, drilling, and cutting tools used in mining operations and metal processing.

Due to its resistance to extreme conditions and high abrasion resistance, boron carbide is the most suitable material for protective coatings on mining equipment. These coatings prolong the life of machinery and enhance performance, which in turn minimizes downtime and maintenance costs, hence increasing overall operational efficiency and productivity.

In metallurgy, it is used for refining and casting processes since boron carbide is chemically inert and has a very high melting point. It also has applications in producing high-quality alloys and superhard materials, essential in advanced manufacturing, which assures quality and performance in the products.

Increasing Use of Boron Carbide in Lightweight Composites for Aerospace and Automotive Applications

Lightweight composites are in ever-growing demand from the aerospace and automotive industries as a material of choice for making lighter vehicles and aircraft that save fuel and minimize emissions. Being one of the lightest yet strongest materials available, boron carbide is well suited to make parts such as aircraft panels, brake systems, and protective covers.

For instance, electric car companies use boron carbide in creating lightweight casings that would not break down from impact and would be viable for battery use. With these thrusts of efficiency and sustainability across industries, it will only follow that demand for lightweight materials having the unique properties of boron carbide will just increase.

Growing Demand for Boron Carbide in 3D Printing and Additive Manufacturing

Boron carbide is increasingly in demand for 3D printing and additive manufacturing due to its exceptional strength, lightweight properties, and resistance to wear. Additive manufacturing, or 3D printing, enables firms to produce precise, customizable parts with minimal waste. Boron carbide is ideally suited for this process.

For instance, defense companies are utilizing boron carbide to print lightweight armor plates for military vehicles. These plates provide solid protection while maintaining the mobility of the vehicle.

In medical science, boron carbide is being used to print medical implants, such as bone replacements. These implants are robust and biocompatible, making them safe for use in the body.

Industries are adopting 3D printing because it lowers production costs and improves quality. Boron carbide's role in this process is expanding as industries seek materials that offer both strength and precision in their products.

Rising Adoption of Boron Carbide Coatings for Industrial Equipment

An increasing demand for boron carbide coatings is observed in industrial equipment based upon outstanding hardness, wear resistance, and chemical stability. The durability of the protective layer offered by the coatings significantly extends the machinery's lifespan and reduces the maintenance costs.

In manufacturing, mining, and oil and gas sectors, boron carbide coatings are applied to components such as pumps, valves, and cutting tools to enhance their performance and durability.

For example, the oil and gas industry uses boron carbide coatings on equipment and pipeline parts to prevent wearing and corrosion arising from harsh environments. This way, the operation of the equipment is extended in addition to curtailing downtime as well as reduction in maintenance expenses, hence efficient operation.

The automotive industry also uses boron carbide coatings to enhance the efficiency and life of engine parts and other key components. Such coatings reduce friction and wear, which results in better fuel efficiency and lower emissions.

It will be interesting to see how industries continue to develop ways to increase the reliability and efficiency of equipment. The growth in demand for boron carbide coatings, a trend that follows the broader pattern of advanced materials that can work under harsh conditions and deliver performance, is going to be remarkable.

High Production Costs Due to Energy-Intensive Manufacturing and Limited Economies of Scale

The production of boron carbide is highly energy-intensive and, hence, expensive. Mainly, carbothermic reduction is the method used to manufacture the compound, which means an assortment of boron oxide and carbon is heated to extremely high temperatures. Therefore, a lot of energy is consumed, which increases the cost of production.

Energy costs tend to be higher in regions where electricity is expensive or where renewable sources of energy are scarce. Hence, the price of boron carbide is somewhat inhibitive, especially to industries that take concern over the constant fluctuations in the price.

Specialized applications such as defense, nuclear, and electronics are limited to boron carbide production. In other words, because of the relatively narrow application of boron carbide compared to more general industrial materials, economies of scale are difficult to obtain through large-scale production.

A small European manufacturer will be priced out of the market for example, when compared to a Chinese giant who produces in volumes with lower raw material and labor costs.

The high price of boron carbide also restrains its application in some fields. For instance, industries such as mining and automotive tend to use cheaper materials, even though the latter may not provide the same level of performance.

This price sensitivity makes it difficult for boron carbide to gain traction in mass-market applications, especially in emerging regions where cost is a critical factor.

From 2020 to 2024, the boron carbide market looked steady. This was primarily because of its use in defense, nuclear energy, and industrial applications.

Defense industries in North America and Europe have been driving demand for boron carbide in body armor, helmets, and vehicle protection because of its lightweight but high strength properties. The nuclear industry also became significant for this period, with boron carbide being used as a neutron absorber within control rods and reactor safety systems.

However, the market faced serious challenges, including high production costs and the COVID-19 pandemic-related supply chain disruptions. Even so, the Asia-Pacific region had shown great promise in increasing industrialization and defense modernization in countries like China and India in their demand for boron carbide in these applications.

The growth rate between 2025 and 2035 is supposed to be high for the market of boron carbide with emerging applications and demand. Opportunities are likely to be created with renewable energy systems, advanced electronics, and biomedical technologies.

Nuclear power, space exploration, and industrial development investment in Asia-Pacific will lead. The next-generation nuclear reactors, energy storage systems, and thermoelectric devices will increasingly demand high-purity boron carbide.

Sustainability will be critical as producers start adopting green methods of production due to tighter regulations, particularly in Europe and North America. The growth in this market will come from new applications and new technologies, but issues like supply chain risks and geopolitics might play a dampening role. This will be an era of further expansion for boron carbide in many sectors.

The Boron Carbide sector is moderately fragmented, where Tier-1 companies hold ~ 50-40% of the total share. The companies that dominate this segment include Saint-Gobain, S.A, Schunk Ingenieurkeramik GmbH, 3M Company, and others.

The annual revenues of such companies are more than USD 200 million. Their strategic focus on innovation, expansion, and automation technologies at advanced levels, the companies continue to lead the sector. Tier-1 companies always consider superior production and offer their products to diversified sectors including automobiles, electronics, and packaging.

Tier-2 companies control a huge amount that is ~35% - 40% the total share. This category Sigma-Aldrich Co. LLC. (Merck Group), UK Abrasives. with annual revenues between USD 50 to 100 million.

Tier-2 players have regional industry as their target, providing cost-effective, customized solutions to address regional needs. Their large size is indicative of the very fragmented nature of the market, where smaller firms take advantage of niche applications to compete effectively.

The section below covers the industry analysis for boron carbide demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe and Middle East and Africa is provided.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 8.6% |

| China | 7.5% |

| The USA | 4.7% |

| UK | 3.1% |

| Germany | 2.1% |

The United States is the largest consumer of boron carbide, and such factors as defense, nuclear energy, and aerospace significance drive it. It is used by the USA military for body armor, helmets, and vehicle protection.

These materials offer great protection yet are light in weight, which helps soldiers move around and keeps them safe. For example, boron carbide is a component in modern body armor used by USA Army. It also applies to the armoured vehicles protection mechanisms, reducing the weight of the vehicles, and enhancing its performance.

Nuclear energy industries in the United States apply the boron carbide. It is crucial to the safety reactor since it will capture the harmful radiations and maintain the neutron activity within control. Therefore, this material is crucial, and most the nuclear reactors which work in the United States is safe.

The USA aerospace also enjoys the applications of boron carbide, as NASA applies it within space components and commercial companies such as SpaceX. They are perfect, for example in extreme conditions due to its lighter properties and capabilities to withstand hot temperatures where in some instances spaceships will make a reentry into the atmospheric layer.

China is among the largest consumers of boron carbide, especially with the growing industries and modernization programs. Its manufacturing sector is the world's largest, and the industry uses boron carbide for cutting, polishing, and grinding tools.

Such tools are used in large numbers in industries such as automobiles, electronics, and construction. For instance, boron carbide abrasives are used to polish automobile parts and electronic devices, providing precision and quality.

China is also increasing its nuclear energy industry to serve the country's energy requirements. Boron carbide is an essential element in nuclear reactors; it provides radiation shielding as well as neutron absorption. This makes it an essential material for China's energy transition. Moreover, China's military modernization programs feature boron carbide in all the protective equipment.

The material is used in bulletproof vests and helmets in order to protect the soldier while the armor is kept light in weight. For example, boron carbide is applied in the newest protective equipment for the People's Liberation Army in order to enhance security and mobility. Thus, these industrial and defense applications make China the biggest consumer of boron carbide.

India is consuming more boron carbide because it is focused on defense modernization, nuclear energy, and industrial growth. Boron carbide is used by the Indian Army in bulletproof jackets for the soldiers operating in high-risk areas.

These jackets are lightweight and enable the soldier to move around while being protected. Boron carbide is also used in armored vehicles for reducing weight and enhancing durability, making it ideal for modern defense needs.

The increasing nuclear energy program in India is another reason for the growing demand for boron carbide. The material is crucial in nuclear reactors for neutron absorption and radiation shielding.

As India continues to build more nuclear reactors to meet its energy needs, boron carbide is an important component in reactor safety. The manufacturing sector in India is also a significant consumer.

Automotive and electronics are some of the industries where boron carbide is used in precision machining and polishing. For example, engine parts and fragile electronic components are polished using boron carbide. Such applications make India a significant market for boron carbide.

The Boron Carbide Market has a highly competitive landscape with global players and regional manufacturers. Top leaders are working towards increasing production, providing the best product formulation, and discovering new applications. In order to retain their position, strategic alliances in the defense and industrial sectors would be important to sustain their share in the market.

Innovation in this market is the rule of the day, and many companies invest in research and development of improving the efficiency, hardness, and durability of boron carbide products.

Innovations in this industry target high-demand sectors such as defense, abrasives, and nuclear power. Furthermore, companies are making use of advanced processes for manufacturing with the purpose of cutting down costs and meeting growing demands for high-performance materials.

Regional players also seem to gain traction, mainly in emerging markets, with rising industrialization and defense spending. Asia-Pacific companies, particularly in China and India, capitalize on the demand for local applications of boron carbide in industry and defense.

They will continue to seek ways to stay competitive with better established players in the market while competing on costs and expansion in capacity and product offerings.

Recent Industry Developments

The grade segment is divided into Abrasive, Nuclear and Refractory.

The physical form segment is categorized into Powder, Granular and Paste.

The end-use industry segment includes Aerospace and Defense, Automotive, Industrial Manufacturing, Nuclear Power, Mining and Metallurgy, Electronics and Semiconductors, Medical

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

Table 01: Global Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 02: Global Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 03: Global Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 04: Global Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 05: Global Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 06: Global Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 07: Global Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 08: Global Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 09: Global Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022and Forecast 2023 to 2033 By Region

Table 10: Global Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022and Forecast 2023 to 2033 By Region

Table 11: North America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 12: North America Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Country

Table 13: North America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 14: North America Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 15: North America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 16: North America Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 17: North America Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 18: North America Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 19: North America Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 20: North America Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 21: Latin America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 22: Latin America Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Country

Table 23: Latin America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 24: Latin America Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 25: Latin America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 26: Latin America Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 27: Latin America Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 28: Latin America Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 29: Latin America Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 30: Latin America Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 31: Western Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 32: Western Europe Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Country

Table 33: Western Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 34: Western Europe Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 35: Western Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 36: Western Europe Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 37: Western Europe Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 38: Western Europe Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 39: Western Europe Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 40: Western Europe Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 41: Eastern Europe Super Absorbent Polymers Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 42: Eastern Europe Super Absorbent Polymers Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Country

Table 43: Eastern Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 44: Eastern Europe Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 45: Eastern Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 46: Eastern Europe Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 47: Eastern Europe Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 48: Eastern Europe Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 49: Eastern Europe Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 50: Eastern Europe Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 51: East Asia Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 52: East Asia Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Country

Table 53: East Asia Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 54: East Asia Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 55: East Asia Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 56: East Asia Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 57: East Asia Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 58: East Asia Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 59: East Asia Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 60: East Asia Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 61: South Asia & Pacific Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 62: South Asia & Pacific Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Country

Table 63: South Asia Pacific Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 64: South Asia Pacific Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 65: South Asia Pacific Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 66: South Asia Pacific Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 67: South Asia Pacific Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 68: South Asia Pacific Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 69: South Asia Pacific Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 70: South Asia Pacific Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Table 71: Middle East Africa Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Country

Table 72: Middle East Africa Market Value (US$ million) and Volume (tons) Historical Data Forecast 2023 to 2033 By Country

Table 73: Middle East Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Grade

Table 74: Middle East Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Grade

Table 75: Middle East Africa Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 By Physical Form

Table 76: Middle East Africa Market Value (US$ million) and Volume (tons) Forecast 2023 to 2033 By Physical Form

Table 77: Middle East Africa Market Volume (tons) Historical Data 2018 to 2022 By End-Use

Table 78: Middle East Africa Market Volume (tons) Forecast 2023 to 2033 By End-Use

Table 79: Middle East Africa Market Value (US$ million) Historical Data 2018 to 2022 By End-Use

Table 80: Middle East Africa Market Value (US$ million) Forecast 2023 to 2033 By End-Use

Figure 01: Global Market Historical Volume (tons), 2018 to 2022

Figure 02: Global Market Current and Forecast Volume (tons), 2023 to 2033

Figure 03: Global Market Historical Value (US$ million), 2018 to 2022

Figure 04: Global Market Current and Forecast Value (US$ million), 2023 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ million), 2023 to 2033

Figure 06: Global Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 07: Global Market Y-o-Y Growth Projections by Grade, 2023 to 2033

Figure 08: Global Market Attractiveness by Grade, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Abrasive Segment

Figure 10: Global Market Absolute $ Opportunity by Nuclear Segment

Figure 11: Global Market Absolute $ Opportunity by Refractory Segment

Figure 12: Global Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 13: Global Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 14: Global Market Attractiveness by Physical Form, 2023 to 2033

Figure 15: Global Market Absolute $ Opportunity by Powder Segment

Figure 16: Global Market Absolute $ Opportunity by Granular Segment

Figure 17: Global Market Absolute $ Opportunity by Paste Segment

Figure 18: Global Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 19: Global Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 20: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 21: Global Market Absolute $ Opportunity by Armors and Ballistic Protection Segment

Figure 22: Global Market Absolute $ Opportunity by Industrial Abrasives Segment

Figure 23: Global Neutron Shielding Market Absolute $ Opportunity by Neutron Shielding Segment

Figure 24: Global Neutron Shielding Market Absolute $ Opportunity by Shields and Panels Segment

Figure 25: Global Market Absolute $ Opportunity by Refractory Materials Segment

Figure 26: Global Market Absolute $ Opportunity by Others Segment

Figure 27: Global Market Share and BPS Analysis By Region - 2023 to 2023

Figure 28: Global Market Y-o-Y Growth Projection By Region, 2023 to 2033

Figure 29: Global Market Attractiveness Index By Region, 2023 to 2033

Figure 30: Global Market Absolute $ Opportunity by North America Segment

Figure 31: Global Market Absolute $ Opportunity by Latin America Segment

Figure 32: Global Market Absolute $ Opportunity by Western Europe Segment

Figure 33: Global Market Absolute $ Opportunity by Eastern Europe Segment

Figure 34: Global Sheet Market Absolute $ Opportunity by East Asia Segment

Figure 35: Global Sheet Market Absolute $ Opportunity by South Asia Pacific Segment

Figure 36: Global Market Absolute $ Opportunity by Middle East Africa Segment

Figure 37: North America Market Share and BPS Analysis By Country - 2023 to 2023

Figure 38: North America Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 39: North America Market Attractiveness Index By Country, 2023 to 2033

Figure 40: North America Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 41: North America Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 42: North America Market Attractiveness by Grade, 2023 to 2033

Figure 43: North America Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 44: North America Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Physical Form, 2023 to 2033

Figure 46: North America Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 47: North America Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 48: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 49: Latin America Market Share and BPS Analysis By Country - 2023 to 2023

Figure 50: Latin America Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 51: Latin America Market Attractiveness Index By Country, 2023 to 2033

Figure 52: Latin America Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 53: Latin America Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 54: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 55: Latin America Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 56: Latin America Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Physical Form, 2023 to 2033

Figure 58: Latin America Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 59: Latin America Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 61: Western Europe Market Share and BPS Analysis By Country - 2023 to 2023

Figure 62: Western Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 63: Western Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 64: Western Europe Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 65: Western Europe Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 66: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 67: Western Europe Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 68: Western Europe Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 69: Western Europe Market Attractiveness by Physical Form, 2023 to 2033

Figure 70: Western Europe Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 71: Western Europe Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 73: Eastern Europe Super Absorbent Polymers Market Share and BPS Analysis By Country - 2023 to 2023

Figure 74: Eastern Europe Super Absorbent Polymers Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 75: Eastern Europe Super Absorbent Polymers Market Attractiveness Index By Country, 2023 to 2033

Figure 76: Eastern Europe Market Share and BPS Analysis by Grade- 2023 to 2023

Figure 77: Eastern Europe Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 78: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 79: Eastern Europe Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 80: Eastern Europe Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 81: Eastern Europe Market Attractiveness by Physical Form, 2023 to 2033

Figure 82: Eastern Europe Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 83: Eastern Europe Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 84: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 85: East Asia Market Share and BPS Analysis By Country - 2023 to 2023

Figure 86: East Asia Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 87: East Asia Market Attractiveness Index By Country, 2023 to 2033

Figure 88: East Asia Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 89: East Asia Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 90: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 91: East Asia Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 92: East Asia Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 93: East Asia Market Attractiveness by Physical Form, 2023 to 2033

Figure 94: East Asia Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 95: East Asia Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 96: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 97: South Asia & Pacific Market Share and BPS Analysis By Country - 2023 to 2023

Figure 98: South Asia & Pacific Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 99: South Asia & Pacific Market Attractiveness Index By Country, 2023 to 2033

Figure 100: South Asia Pacific Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 101: South Asia Pacific Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 102: South Asia Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 103: South Asia Pacific Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 104: South Asia Pacific Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 105: South Asia Pacific Market Attractiveness by Physical Form, 2023 to 2033

Figure 106: South Asia Pacific Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 107: South Asia Pacific Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 108: South Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 109: Middle East Africa Market Share and BPS Analysis By Country, 2023 & 2033

Figure 110: Middle East Africa Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 111: Middle East Africa Market Attractiveness Analysis By Country, 2023 to 2033

Figure 112: Middle East Africa Market Share and BPS Analysis by Grade - 2023 to 2023

Figure 113: Middle East Africa Market Y-o-Y Growth Projections by Grade, 2022 to 2033

Figure 114: Middle East Africa Market Attractiveness by Grade, 2023 to 2033

Figure 115: Middle East Africa Market Share and BPS Analysis by Physical Form - 2023 to 2023

Figure 116: Middle East Africa Market Y-o-Y Growth Projections by Physical Form, 2023 to 2033

Figure 117: Middle East Africa Market Attractiveness by Physical Form, 2023 to 2033

Figure 118: Middle East Africa Market Share and BPS Analysis by End-Use - 2023 to 2023

Figure 119: Middle East Africa Market Y-o-Y Growth Projections by End-Use, 2023 to 2033

Figure 120: Middle East Africa Market Attractiveness by End-Use, 2023 to 2033

The Boron Carbide used in automobiles were valued at USD 169.9 million in 2024.

The demand for Boron Carbide is set to reach USD 177.6 million in 2025.

The demand for Boron Carbide will be driven by increasing defense spending, growing industrial applications in abrasives and cutting tools, expansion of nuclear power projects, and advancements in manufacturing technologies.

The Boron Carbide demand is projected to reach USD 298.4 million by 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA