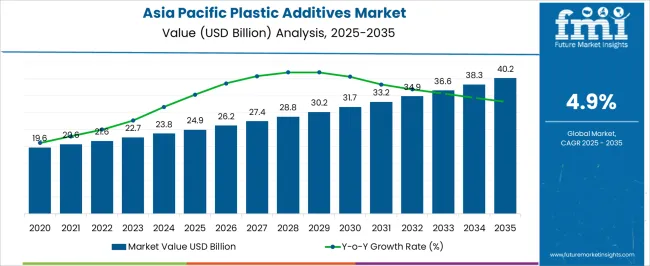

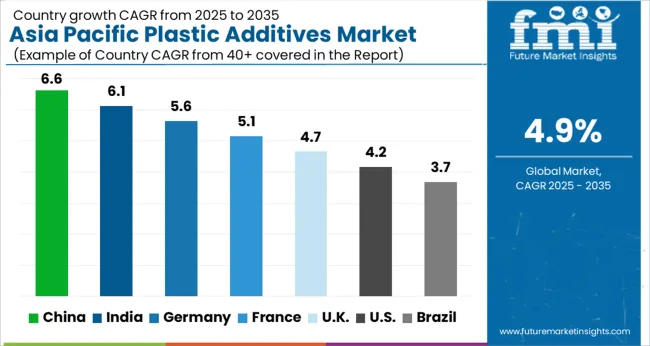

The Asia Pacific Plastic Additives Market is estimated to be valued at USD 24.9 billion in 2025 and is projected to reach USD 40.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Asia Pacific Plastic Additives Market Estimated Value in (2025 E) | USD 24.9 billion |

| Asia Pacific Plastic Additives Market Forecast Value in (2035 F) | USD 40.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

As reported in Future Market Insights (FMI)’s authoritative research on specialty and bulk chemicals, the Asia Pacific plastic additives market is experiencing substantial growth due to the increasing demand for plastics in the automotive, construction, electronics, and, particularly, the packaging industries. The demand for performance enhancement in polymers, coupled with strict environmental regulations and durability requirements, is encouraging manufacturers to adopt additive-based formulations for product differentiation and compliance.

Technological innovations in additive chemistry and the development of multifunctional additives are supporting the creation of lightweight, flexible, and high-strength plastic materials suited to the region's growing infrastructure and export-oriented manufacturing. Furthermore, rising demand for consumer electronics, fast-moving consumer goods, and flexible food packaging solutions is contributing to increased usage of advanced additives.

National policies across countries like China, India, and Southeast Asia are also incentivizing sustainable plastic production, encouraging additive deployment that enhances recyclability, thermal resistance, and biodegradability In the coming years, collaborative developments between petrochemical players and additive formulators are expected to strengthen supply chains and support the rapid evolution of functional plastic solutions.

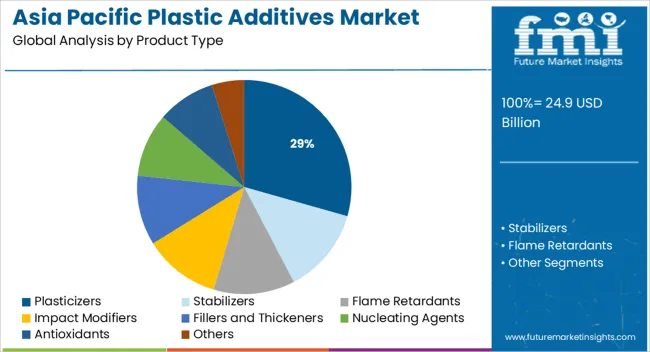

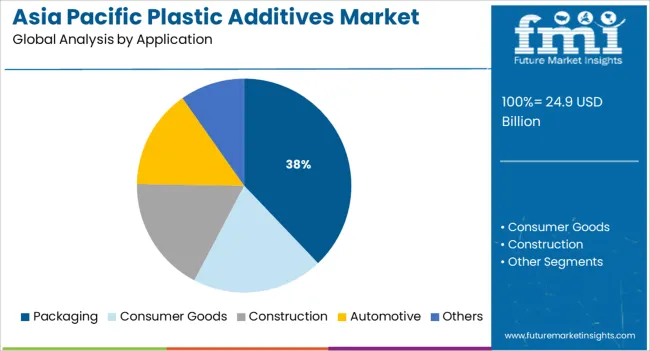

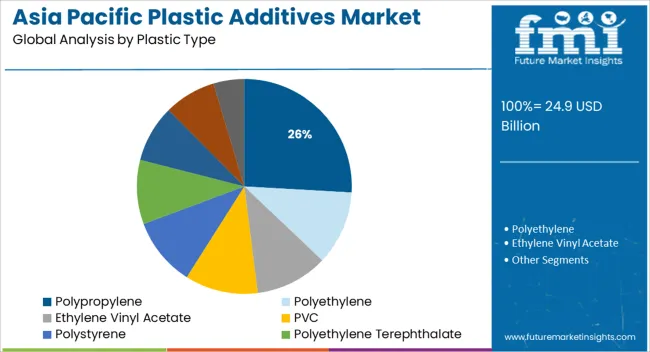

The market is segmented by Product Type, Application, and Plastic Type and region. By Product Type, the market is divided into Plasticizers, Stabilizers, Flame Retardants, Impact Modifiers, Fillers and Thickeners, Nucleating Agents, Antioxidants, and Others. In terms of Application, the market is classified into Packaging, Consumer Goods, Construction, Automotive, and Others. Based on Plastic Type, the market is segmented into Polypropylene, Polyethylene, Ethylene Vinyl Acetate, PVC, Polystyrene, Polyethylene Terephthalate, Engineering Plastic, Thermosets, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plasticizers are projected to hold 29.4% of the Asia Pacific plastic additives market revenue share in 2025, marking their position as the leading product type. This dominance is being attributed to their critical role in enhancing the flexibility, elongation, and processability of plastics used in consumer goods, construction materials, and electrical insulation.

The widespread application of plasticizers in flexible PVC products such as cables, hoses, flooring, and wall coverings has underpinned consistent demand across developing economies. The segment’s growth is being further supported by urban infrastructure development and housing expansion programs which have increased the consumption of vinyl-based construction materials.

Additionally, advancements in phthalate-free and bio-based plasticizer formulations are aligning with regional sustainability goals, contributing to continued adoption in regulated markets The capacity to improve the life span and mechanical strength of plastic products while meeting safety and environmental standards has ensured plasticizers remain an integral part of polymer processing throughout the region.

The packaging application segment is anticipated to account for 37.9% of the total revenue share in the Asia Pacific plastic additives market by 2025, emerging as the most dominant end-use sector. This growth is being driven by the escalating demand for flexible, durable, and lightweight packaging solutions across the food and beverage, personal care, pharmaceutical, and e-commerce industries.

The segment has benefited from the increased use of additives that offer UV resistance, oxygen barrier properties, and antimicrobial functionality, all of which extend the shelf life of packaged products. Rising urbanization and the growth of organized retail in countries such as China, India, and Indonesia have amplified the consumption of plastics in both primary and secondary packaging formats.

The proliferation of single-use and multilayered plastic applications has reinforced the need for performance-enhancing additives, which support efficiency in production and recyclability Furthermore, the rapid evolution of eco-friendly and intelligent packaging technologies is reinforcing additive innovation across the regional packaging value chain.

Polypropylene is expected to represent 25.9% of the total revenue share in the Asia Pacific plastic additives market in 2025, maintaining its position as a leading plastic type. This prominence is being driven by polypropylene’s widespread use in packaging, automotive components, household goods, textiles, and medical devices.

The integration of additives in polypropylene formulations has enabled improvements in stiffness, impact resistance, thermal stability, and UV protection, making it suitable for high-performance applications. Its cost-effectiveness, recyclability, and lightweight nature have made it a preferred choice in fast-growing industries seeking sustainable yet durable plastic materials.

Additive-enhanced polypropylene has seen strong uptake in the production of films, caps, containers, and industrial parts, especially where regulatory standards demand superior material properties The segment’s sustained growth is being further supported by technological developments in high-crystallinity and nucleated polypropylene grades, which rely heavily on advanced additive systems to meet evolving market performance requirements.

The analysis of Plastic Additives Market demand from 2020 to 2024 showed a historical growth rate of less than 4.3% CAGR, with the general expansion of the e-commerce, mobile, automotive, plastic industry due to an increase in consumer income, urbanization as well a growing population.

However, since infection curves have flattened from 2025, industrial production activity in important markets has restarted. As a result, FMI’s Asia Pacific Plastic Additives Market demand projection predicts a CAGR of 4.9% by 2035. Additionally, it is employed in many different fields, including packaging, construction, automotive, consumer goods industries, and utilized in several other industries across the Asia Pacific.

Due to the large number of manufacturers in the area, Asia Pacific is expected to account for a significant portion of the market share. With approximately 30% of the world's production, China is one of the biggest manufacturers of plastics and polymers. The nation is a global leader in the production of affordable, lightweight consumer products. Currently, plastic is one of the main materials used for packaging, and the packaging industry is expanding throughout Asia-Pacific.

The online economy is rapidly expanding, which is contributing to the enlargement of the local packaging industry, which in turn is being a catalyst for the expansion in the local economy. Also, when customer demands increase, they dramatically increase their spending on household furniture, home accessories, and more luxurious goods. Thus, leading to increased demand for plastics and plastic additives.

Among the most commonly used plasticizers, phthalates increase the transparency, flexibility, and durability of materials. They are largely used to melt PVC and as additives because of lower costs. However, phthalates may have various negative impacts on human health and the environment. From July 2025, all of India will be prohibited from manufacturing, importing, stocking, distributing, selling, and using certain single-use plastic goods that have been classified as having a high potential for littering and poor utility.

Increased research and development activities by market players aiming to develop advanced and diversified product portfolios may provide new opportunities for the growth of the Plastic Additives market.

Over the past few decades, there has been growing consumer demand for packaging that can only meet the highest food quality standards. This is driving market demand and contributing to higher market growth for packaging items such as food-grade plastic. Another influential factor contributing to market growth is the growth of the e-commerce industry worldwide.

As plastic production techniques become more advanced, automobile parts and other products and materials are created with increasingly less weight and at lower cost. The increasing demand for automotive products, packaging and building industries, as well as consumers' growing interest in commodities of lasting value will boost the usage of plastic additives.

The Asia pacific region anticipated with 51% of global plastic market. China will dominant the overall Asia pacific region with more than 31% of value share from the Asia Pacific region. Japan is anticipated with 11% of value share from Asia pacific region.

Moreover, Implementation of government regulations that limit use of plastics is expected to act as one of the major restraints of plastic demand in the Asia Pacific region. Increased investments in manufacturing activities in developing countries like India are expected to boost the demand for plastic additives in the upcoming forecast period. Also, increasing consumption of packaged items, light weight products is expected to boost market growth in the region.

Key players operating in the Asia Pacific Plastic Additives Market include

The plastics additives market is highly concentrated, with only a few large companies being responsible for market leadership. The primary business strategies employed by the market leaders in the retail, automotive, packaging and plastic additives industries include product development and mergers and acquisitions.

They also engage in partnerships and collaborations while obtaining regulatory permissions. Some instances of such developments are cited below

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Tons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Product Type, Application, Plastic Type, Country |

| Regions Covered |

Asia & Pacific |

| Key Countries Covered |

China, India, Japan, ASEAN, Oceania |

| Key Companies Profiled |

BASF SE; Mitsui Chemicals; Clariant AG; Albemarle Corporation; Songwon Industrial Co., Ltd; Nouryon; LANXESS AG; Evonik Industries AG; Kaneka Corporation; Dow; SABIC; Exxonmobil; Badische Anilin- und SodaFabrik SE; Others |

| Customization & Pricing | Available upon Request |

The global asia pacific plastic additives market is estimated to be valued at USD 24.9 billion in 2025.

The market size for the asia pacific plastic additives market is projected to reach USD 40.2 billion by 2035.

The asia pacific plastic additives market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in asia pacific plastic additives market are plasticizers, stabilizers, flame retardants, impact modifiers, fillers and thickeners, nucleating agents, antioxidants and others.

In terms of application, packaging segment to command 37.9% share in the asia pacific plastic additives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA