The world carbon nanotube (CNT) market will expand significantly between 2025 and 2035 with the help of growing applications in electronics, automotive, aerospace, energy storage, and medicine. CNTs have excellent mechanical, electrical, and thermal properties that make them very promising material candidates. They possess high strength-to-weight ratio, conductivity, and elasticity that make it possible for industries to design lightweight yet high-performance material for a wide range of applications.

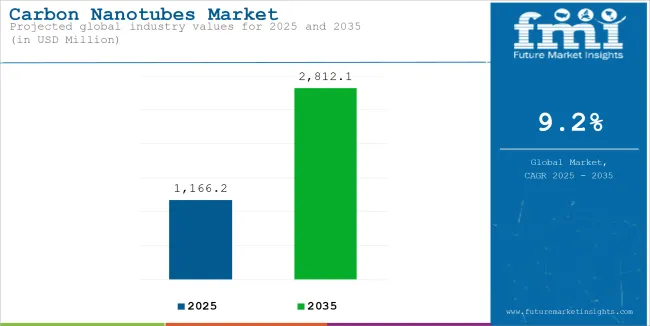

The market size of the global carbon nanotube in 2025 will be USD 1,166.2 million and the projection will escalate to an astronomical USD 2,812.1 million by the year 2035 with a 9.2% compound annual growth rate (CAGR) in the study duration. Use of CNTs in energy storage devices such as lithium-ion batteries and super capacitors will be one of the factor drivers for such a growth pattern.

Besides that, CNTs are also used in the electronics industry to make transistors, conducting films, and flexible display screens, whereas the automotive and aerospace industries use CNTs to make lightweight composite materials in an attempt to improve mileage and cut emissions.

With increasing investment in nanotechnology R&D, applications of CNTs are being researched in next-generation healthcare diagnostics, water filtration systems, and sensors. Nevertheless, exorbitant costs of production, environmental issues, and regulatory caps on nanomaterials pose major impediments to market penetration.

Improved low-cost and scalable processes for producing CNTs and improved regulations are likely to improve market access and accelerate more widespread adoption by industries.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,166.2 million |

| Projected Market Size in 2035 | USD 2,812.1 million |

| CAGR (2025 to 2035) | 9.2% |

The 9.2% Compound Annual Growth Rate (CAGR) indicates strong industrial demand, especially in automotive, energy storage, and electronic industries. Higher emphasis on material science efficiency and sustainability is creating pressure on the industries to explore CNT enriched composites to be used as structural reinforcement agents, thermal solutions, and ultra-high-performance conductivity agents. A growth in EV manufacturing and micro-miniaturization of electronic products are likely to continue fueling CNT's adoption in coming years.

On-going development of CNT synthesis methods, including chemical vapour deposition (CVD), arc discharge, and laser ablation, are becoming more cost-effective for large-scale production, thus stimulating commercialization. The market would see substantial investment from government, private organizations, and nanotech research centers, and thus the situation would turn competitive for upcoming CNT applications.

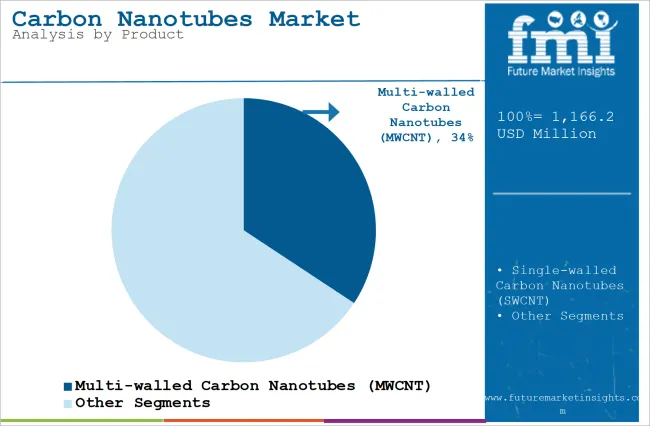

Carbon nanotube industry has seen exponential growth as a result of advancements in material science and nanotechnology. Single-walled carbon nanotube and multi-walled carbon nanotube are dominating the market through outstanding mechanical, electrical, and thermal properties.

The chemicals have a wide range of applications in diversified sectors such as aerospace, automobile, energy storage, electronics, and biomedical application that bring about innovative product performance and technology innovation.

Multi-Walled Carbon Nanotubes (MWCNT) Find Favor with the Market Due to Conductivity and Strength. MWCNT find widespread usage in various industries due to multi-layered configuration, which renders them strength, resistance, as well as conductivity. MWCNT consist of numerous concentric layers of graphene, which provides them with an ability to bear more mechanical strain and chemical contact than single-walled carbon nanotubes.

MWCNTs find far-reaching applications in the automotive and aerospace industries due to their improved strength and lesser weight. Composites of MWCNTs are employed by the manufacturers to reinforce the structures of car components, bumpers, and panels to reduce the weight of the automobile and boost fuel efficiency.. In aerospace too, MWCNT material ensures thermal stability and mechanical strength with performance under extreme conditions.

Apart from this, MWCNTs are not separable nowadays in the field of electronics, i.e., electromagnetic interference shielding. In light of fulfilling the need for miniaturized high-performance electronic devices, MWCNT conductive coatings and composites have been increasingly used for protecting sensitive electronics from electromagnetic radiation.

In energy storage devices, MWCNTs increase conductivity and efficiency of lithium-ion battery (LIB), fuel cells, and supercapacitors. Scientists have used MWCNTs in anode and cathode materials for improving battery life, charge retention, and energy density considerably. Growing market demand for electric vehicles (EVs) and renewable energy systems has also encouraged interest in using enhanced battery technology using MWCNTs.

In spite of their vast uses, high production costs and environmental issues pose a challenge to development in the MWCNT market. But improved cost-efficient manufacturing methods and eco-friendly synthesis technologies will spearhead further development in the market.

Single-walled carbon nanotubes (SWCNT) have also been preferred in precise applications with better electrical conductivity, flexibility, and strength. Though MWCNTs consist of many layers of graphene, SWCNT contain one cylindrical sheet of graphene and hence are slender and more conductive than multi-walled carbon nanotubes.

SWCNTs are utilized by the electronics and semiconductor industries in next-generation transistor form, nanoelectronics, and flexible display. Due to their superior electronic nature, SWCNTs can act as a potential substitute for silicon-based semiconductors and offer faster and efficient computing.

In addition, SWCNTs have contributed significantly to biomedical and drug applications. SWCNTs have found applications in entering drug delivery systems, biosensors, and medical imaging devices due to biocompatibility and penetration of the membrane. Targeted therapy and cancer treatment as well as disease diagnosis make SWCNTs a groundbreaking material in the field of medicine.

But SWCNTs also have production issues with scalability and cost. Low yields of traditional production techniques, including arc discharge and laser ablation, restrict scalability to industrial production. But improvements in chemical vapor deposition (CVD) technology and purification processes should make SWCNTs more generally available and cheaper in the future.

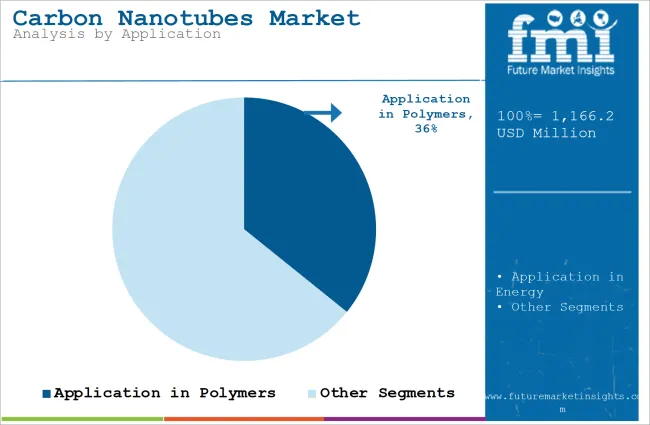

Polymers market is the largest application market for carbon nanotubes, and the company employs CNT additives in polymer matrices to attain improved mechanical properties, electrical conductivity, and thermal stability. Thermoplastics, elastomers, and resins reinforced with CNTs are providing high-performance composite materials to the automotive, aerospace, and industrial markets.

CNT-polymer reinforced polymers in vehicles are improving structure hardness, wear and tear resistance, and weight, resulting in more gas mileage and a decrease in emissions. Bumpers, dashboards, and other components under the hood CNT strengthening enhance impact tolerance and reduce wear and tear.

In the same way, building construction industry employs CNT-polymer composites in building materials with high strength, adhesives, and surface finishes. The flame retardancy, corrosion resistance, and weather resistance are enhanced by CNT-based materials, which are applied in structural reinforcement, protective coatings, and infrastructure buildings.

CNT-reinforced conducting polymers are also discovered to be used in wearable technology, smart wear, and stretchable electronics. They give conventional polymers the electric conduction ability to facilitate the build-up of flexible sensors, healable materials, and new-generation electronics.

One of the most applicable applications of carbon nanotubes is in energy, and this encompasses applications for utilization in the development of next-generation batteries, supercapacitors, and fuel cells. In energy storage devices, CNTs improve charge transfer, boost energy density, and prolong battery life.

CNT-reinforced lithium-ion batteries exhibit enhanced electrical conductivity, enhanced charge-discharge cycles, and enhanced thermal control. These are significant attributes in the electric vehicle (EV) market, where customers need to maximize driving range and optimize battery performance.

Supercapacitors, requiring efficient energy transfer with the requirement for fast transfer of energy and large power density, also benefit through CNT applications. CNT's high conductivity and surface area support good storage capacity and electrochemical stability to utilize them as advantageous materials in industrial energy storage, regenerative brakes, and electronic devices of small portable scale.

CNTs enhance the efficiency of the catalyst in fuel cell technology, resulting in hydrogen storage and long electrode life. With the globe transitioning towards cleaner energy sources, CNT-based fuel cell technology presents a cost-friendly solution for renewable power generation, grid storage, and hydrogen fuel vehicles.

While promising, carbon nanotubes are confronted with issues such as high production cost, environmental friendliness, and dispersion issues. Researchers are focusing on synthesizing low-cost methods and environmentally friendly manufacturing techniques to eliminate these issues as well as provide wider applications of CNT in industries.

As nanotechnology advances and the large-scale production of CNTs becomes more feasible, businesses will be incorporating CNTs into more and more types of consumer and industrial products, fueling market growth. Green materials and energy efficiency government regulations will also drive CNT adoption in automotive, building construction, and energy storage applictions.

North America is likely to continue being a major driving force in the CNT market, since the United States and Canada are the global leaders in nanotechnology research, advanced high-tech manufacturing, and sophisticated material engineering.

North America's robust automotive and aerospace sectors are heavily invested in light-weight CNT-composite materials for better fuel efficiency and structural integrity. The electronics sector, with semiconductor makers as a prime target, is moving in a big way to study CNTs for new-generation transistors and conductive coatings.

Increased usage of CNTs in energy storage is also seen in the interest of North America in developing battery technology. Various initiatives to fund advanced battery technology have been presented by the USA government, involving the use of CNT-based anodes for the improvement of lithium-ion battery and super capacitor charge retention and cycling endurance.

Regulating worries over CNT safety, possible environmental effects, and toxicity of the material remain a challenge that can influence market growth.

In spite of such challenges, the strong emphasis placed by North America on innovation and sustainability is set to propel gradual CNT market growth, especially with the greater use of cost-effective production technology.

Europe is an advanced carbon nanotubes market, joined by the UK, France, and Germany, which are forefront in R&D expenditure, application of composite materials, and sustainability programs. EU leadership in the suppression of carbon emissions has inspired the application of lightweight CNT-reinforced material applied in motor vehicle and aeronautical production to promote innovation in energy-efficient transport systems.

The EU's stringent environmental and safety standards have seen businesses come up with environmentally friendly, nontoxic methods for producing CNTs, and this has accelerated impressive innovation in recyclable and biodegradable CNT-based products. The emphasis in Europe on green energy has also spurred studies of solar cells and hydrogen fuel cells integrated with CNTs, which have expanded new clean energy uses.

Though production cost and regulatory hurdles remain challenges, aggressive investments in nanotechnology infrastructure by Europe will remain to propel market growth. Expansion of electric vehicle manufacturing and advanced materials engineering will be pivotal in defining the future of CNT business in the region.

Asia-Pacific is projected to dominate CNT market expansion worldwide, based on fast-growing industrialization, rising R&D investments, and robust demand in electronics and automobile sectors. Japan, China, and South Korea are the top producers of CNT and the leaders in application research, exploiting low-cost production and a competent labor force for the creation of high-performance nanomaterials.

China, especially, is heavily investing in battery technologies with CNT enhancements in a bid to support indigenous electric vehicle manufacturing and renewable energy storage options. China's strong government support for nanotechnology research and building its base of high-tech manufacturing placed it well to lead the growth of CNT markets.

South Korea and Japan, the world leaders in semiconductor and consumer electronics production, are applying CNTs to next-generation microprocessors, flexible circuits, and OLED displays. As these two countries continue to invest in performance efficiency and miniaturization, demand for CNTs in future electronic products is anticipated to boom.

Although Asia-Pacific has robust growth prospects, the region is also confronted with environmental policy issues, purification methods of CNTs, and issues with respect to production-related emissions. Yet, continuous R&D activities that seek to improve CNT synthesis methods are likely to overcome these challenges and increase commercial feasibility.

The CNT market is subjected to several challenges such as elevated costs of production, health risks, and environmental concerns, in addition to regulation obstacles. High-energy inputs and apparatus are demanded in existing synthesis methods like chemical vapour deposition and arc discharge. Large-scale manufacturing is thereby made costly. Reducing production cost without jeopardizing product performance and quality poses a key challenge for industry operators.

Focus on the toxicity of CNTs and their possible environmental consequences has incurred regulatory concern, especially in North America and Europe. Certain research indicates that exposure to CNTs can represent respiratory risks when inhaled, and so scientists are working towards creating safer production processes and biodegradable types of CNTs.

Also, limited standardization in CNT use holds back extensive commercialization. Industries need precise guidelines on CNT use, treatment, and integration, which calls for international regulatory frameworks to enable safe expansion of the market.

In spite of challenges, the CNT market offers great growth prospects, especially in energy storage, electronics, and Nano medicine. The high-speed take-up of CNT-enhanced lithium-ion batteries and super capacitors for electric cars and grid storage is propelling high-value investments in CNT research.

The new trend of miniaturization in consumer electronics is a benefit field for CNT-based sensors, transistors, and flexible display. With 5G technology and quantum computing evolving, CNTs will be crucial to making electronic circuit efficiency better.

In addition, CNT medical applications such as drug delivery systems and biosensors are also emerging. Researchers are investigating biocompatible CNT-based materials for cancer treatment, regenerative medicine, and drug targeting. The growth of Nano medicine can lead to new income streams for manufacturers of CNTs.

The carbon nanotubes market grew during the period 2020-2024 in the conductive, light, and high-performance materials market. The heightened technological innovations of nanotechnology and materials science found extensive applications in electronics, energy storage, automobiles, aero, and bio-medicals. Increasing adoption of electric vehicle (EVs), high-performance battery, and reinforcing material drove market growth.

Increasing demands for miniaturized electronics and power-conserving devices also stimulated integration of CNTs into many fields. Enhanced synthesis techniques of CNTs, i.e., CVD and arc discharge, enhanced scalability and quality of production at scales, which enabled applications of CNTs.

Improved electrical, thermal, and mechanical properties of single-walled and multi-walled CNTs were produced by entrepreneurs to meet the business requirement of a harder, conductive, and lighter material. CNTs have also found applications in the electronics industry in enhancing semiconductor conductivity, flexible screens, and sensors.

The energy industry utilized CNTs for supercapacitors, fuel cells, and lithium-ion batteries to enhance the efficiency of charging as well as energy density. Growing need for energy storage devices in alternative energy systems such as solar power and wind power networks also stimulated applications of CNTs in battery technology and high-capacity capacitors.

The automotive industry applied CNT-strengthened composites to produce lighter, more efficient, and stronger cars. The aerospace industry used lighter but stronger materials to enhance the performance and fuel efficiency of airplanes. The medical field also applied CNTs in drug delivery devices, biosensors, and medical imaging to create new fields of medical applications.

Scientists fabricated biocompatible CNTs that allowed for enhanced targeted drug delivery and real-time monitoring, thereby making therapeutic therapies safer and more efficient the functionalization capability of the CNTs for targeted biomedical applications led to next-generation tissue engineering devices, prosthetics, and implants.

Even with the fast increase in the market, limitations including high production cost, scale-up, and environmental issues dissuaded its mass uptake. The process of manufacturing CNT was elaborate, thereby pushing up the cost of production. The sector also feared toxicity and damage to the environment, which prompted researchers to look for cleaner and greener processes of CNT manufacture.

This also caused insufficient standard protocols for recycling and disposing of the CNTs, which became concerns of environmental sustainability, prompting governments and manufacturers to seek closed-loop production processes in order to mitigate wastes.

Governments and research centres invested in R&D and regulatory policies to make CNTs safe and increase their applications in industries. More applications of CNTs in high-technology industries made the market appropriate for long-term development, paving the way for great breakthroughs from 2025 to 2035. Demand for nanogreen material and breakthrough in mass-produced CNTs will fuel future growth in the market.

The coming decades of 2025-2035 will see the industry of carbon nanotubes revolutionized with developments in technology, reduced costs, and practices in sustainability. The synthesis process of CNT will be improved at a reduced cost by the producers to facilitate large-scale production.

With better nanotechnology research, uses of CNT will become more common in next-generation electronics, quantum computers, space missions, and medical nanotechnology. The development of multifunctional CNTs with improved self-assembly will reveal new applications in nanoelectromechanical systems (NEMS) and bioelectronics.

Demand for sophisticated composite materials will increase as business requires lighter, stronger, and more durable materials. CNT-polymer composites will drive innovation in construction, defense, and high-speed transport, where mechanical stability and electrical conductivity are critical Self-healing technology in CNT-based composites will also increase structural strength, impact resistance, and adaptive properties in aerospace and automotive applications.

Manufacturing of biodegradable CNT-based materials will also gain momentum, reducing the ecological footprint of nanotechnology-based products.

Researchers will create CNT-based logic circuits and transistors to improve nano-electronics and neuromorphic computing. The shift towards AI-driven automation and ultra-efficient data processing will increase CNT usage in microchips, high-speed processors, and flexible electronic displays. Advances in supercapacitor technology and high-capacity energy storage systems will optimize CNT integration in electric grids, autonomous transport, and off-grid renewable power.

The medical sector will witness revolutionary applications, such as real-time biosensing, improved wearable health sensors based on CNTs, and bioengineered tissue scaffolds made of CNTs to grow tissues. The union of gene editing technologies and biocompatible CNTs will also transform personal medicine and regenerative therapy of complex diseases at the molecular level.

The carbon nanotube industry will transition towards effective mass production, taking advantage of AI-aided optimization, modular synthesis, and localized industrial clusters to propel mounting industrial needs. Governments and private enterprises will spend more on CNT recycling and sustainability programs to make CNTs power a circular economy model.

As the carbon nanotubes market expands, innovation materials, green manufacturing, and AI-driven innovations will reshape industry capabilities. Manufacturers will propel CNT applications into new technologies, fueling long-term growth and market expansion while remaining committed to environmental stewardship and ethical material sourcing.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments enforced basic nanomaterial safety standards. |

| Technological Advancements | Companies developed CNT-based composites for electronics, aerospace, and energy storage. |

| Industry Applications | CNTs enhanced batteries, semiconductors, and structural reinforcements. |

| Environmental Sustainability | Manufacturers explored low-emission CNT production methods. |

| Market Growth Drivers | Demand for stronger, lighter, and conductive materials increased CNT usage. |

| Production & Supply Chain Dynamics | High CNT costs and limited production scalability slowed market penetration. |

| End-User Trends | Industries focused on performance enhancement using CNT composites. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Authorities will mandate CNT toxicity studies, recycling programs, and eco-certifications. |

| Technological Advancements | Innovations will introduce CNTs for quantum computing, self-healing materials, and medical nanotechnology. |

| Industry Applications | Expansion into wearable electronics, space exploration, and smart biomaterials will drive adoption. |

| Environmental Sustainability | The industry will embrace green CNT synthesis, carbon-negative production, and waste-free manufacturing. |

| Market Growth Drivers | Growth in renewable energy, AI-driven electronics, and sustainable automotive manufacturing will drive mass adoption. |

| Production & Supply Chain Dynamics | Automated, AI-enhanced manufacturing and regionalized production hubs will ensure widespread accessibility. |

| End-User Trends | Consumers will demand next-gen CNT-enabled products with superior conductivity, durability, and sustainability. |

United States carbon nanotubes market is experiencing strong growth due to growing investment in nanotechnology, demand for high-performance materials from automotive and electronic markets, and growing demand for energy storage applications.

The United States has the world-class nanomaterial producers and research institutions, which promote innovation of high-performance CNTs across a range of applications such as composites, coatings, and conductive films.

Sales expansion of the electric vehicle segment is one of the key drivers since CNTs are employed throughout in lithium-ion battery electrodes for increased energy density and conductivity. With the USA government encouraging the creation of alternative sources of energy, CNTs are at the center of next-generation solar cells and super capacitors.

CNT-based composites are also being adopted by the defense and aerospace sectors for the manufacturing of lightweight but significantly strength-conveying material for aircraft manufacturing and space exploration.

The biomedical and pharmaceutical sector is also investigating biocompatible CNTs to be applied in drug delivery, biosensing, and anticancer therapy to create new markets. Nevertheless, regulatory issues arising from CNT toxicity and environment are still hindering market development. To respond to this, firms are highlighting functionalized and green CNTs to resonate with sustainability policies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

The UK carbon nanotubes market is rising steadily backed by robust academia research, increased industrial uptake, and growing needs for lightweight applications in aerospace and vehicle industries. There is also a well-established nanotechnology ecosystem in the UK with nanotechnology institutes of research and universities together with industries, aiming to offer high-performance applications of CNT.

The drive for electric cars and green energy has created interest in CNT-enriched materials for fuel cells and battery technology. The UK government's interest in decarbonisation and going net-zero in 2050 is fueling investment in CNTs for hydrogen storage, wind turbine blade reinforcement, and carbon capture technologies.

The CNT composites are being incorporated into next-generation aircraft by companies that dominate the aerospace industry, such as Rolls-Royce and BAE Systems, in order to lower the weight of the aircraft but enhance fuel efficiency. The healthcare and medical sector is also fostering CNT drug delivery and biosensors, and the market is still growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The carbon nanotubes market for the European Union is expanding with a high rate fueled by eco-friendly policy shifts, strong industrial demand, and increasing R&D investments in nanomaterials. The EU Green Deal as well as harsh environmental regulations are driving the rise of eco-friendly CNT production processes to reduce environmental impacts.

Germany, Italy, and France are the early adopters of CNT, especially in top-end manufacturing, the automobile industry, and electronics. Volkswagen, BMW, and Renault, among other German automakers, utilize CNTs to make EV batteries, lightweight auto components, and fuel cells.

The aviation industry in Europe also has a stake in CNT-enhanced composites for aircraft performance upgrade. Whereas the EU is busy with energy storage and sustainability, CNTs find applications in solar cells, windmills, and hydrogen storage. In the healthcare sector, CNTs are applied across a number of uses in biosensors, Nano-drug carriers, and biomedical imaging, also fueling the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

The Japanese carbon nanotube industry is thriving with the latest technology, sound industrial applications, and government sponsorship of research into high-end materials. Japan has led the development of nanotechnology, specifically the production and marketing of CNTs, under the guidance of industry leaders such as NEC, Sumitomo, and Toray Industries.

Semiconductor and electronics are some of the key drivers, for which CNTs are being employed in transistors, flexible electronics, and transparent conductive films. The Japanese hybrid automobile and electric car markets, pioneered by Toyota and Honda, also drive CNT usage in weight-reduced parts and enhanced battery efficiency.

Furthermore, Japan's focus on renewable energy is increasing CNT application in solar power and hydrogen fuel cells. The healthcare and medical industries are also using CNT-based Nano medicine for biosensors and cancer therapy, contributing to the market potential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The South Korean carbon nanotube market is expanding with rising semiconductor manufacturing, electric vehicles, and nanotechnology research. With Samsung, LG, and SK Innovation investing in CNT-based batteries and flexible electronics, demand is rising at a rapid rate.

South Korea's push for hydrogen economy development is driving CNT application in fuel cells and hydrogen storage. The government's Green Growth Strategy is further encouraging CNT-based energy-saving materials.

With top battery makers investing in CNTs for lithium-ion and solid-state batteries, South Korea will dominate worldwide CNT adoption in future-generation energy storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

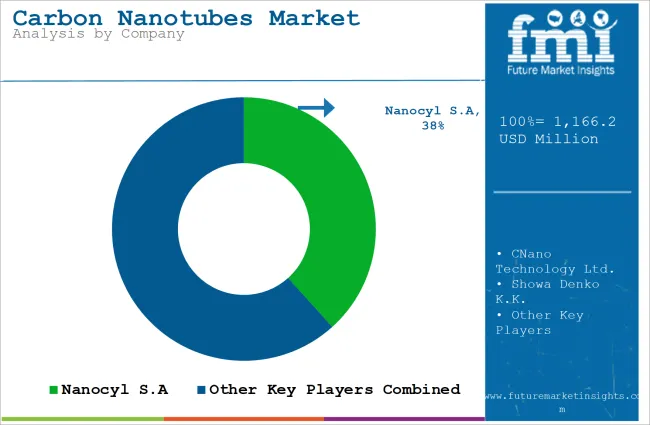

The carbon nanotube (CNT) market is competitive with massive-scale global players and new companies that lead the development of nanomaterials. Companies focus on improving CNT synthesis methods, product purity improvement, and expansion of applications in electronics, energy storage, aerospace, automotive, and medical care. The market is driven by rising demand for light, high-strength materials and expanding uses of CNTs in conductive polymers and high-performance composites.

Other Key Players

Several other companies contribute significantly to the CNT market, fostering innovation and cost efficiency. These include:

The overall market size for Carbon Nanotubes Market was USD 1166.2 million in 2025.

The Carbon Nanotubes Market is expected to reach USD 2812.1 million in 2035.

Growing demand for lightweight and high-strength materials in aerospace, automotive, and electronics will drive the carbon nanotubes market. Expanding applications in energy storage, medical devices, and conductive coatings further boost growth. Additionally, advancements in nanotechnology and increasing investments in R&D will accelerate market expansion.

The top 5 countries which drives the development of Carbon Nanotubes Market are U.S., U.K., Europe Union, Japan and South Korea.

Multi-Walled Carbon Nanotubes to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Wraps Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Boat Hulls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA