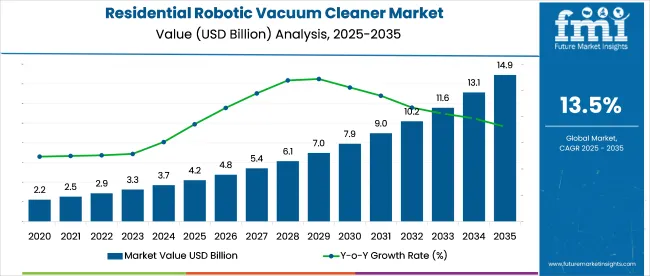

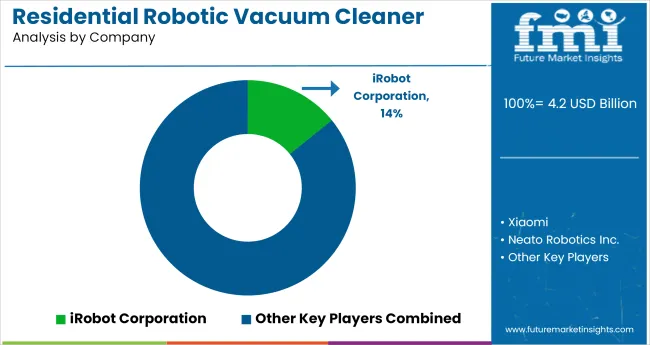

Global sales of residential robotic vacuum cleaners have been forecast to rise from USD 4.20 billion in 2025 to USD 14.89 billion by 2035, with a CAGR of 13.5%. Manufacturers are advised to strengthen margins by securing multiyear sensor contracts, relocating after-sales hubs to e-commerce hubs to reduce RMA cycles, and integrating voice-assistant compatibility as a default feature.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.20 billion |

| Industry Value (2035F) | USD 14.89 billion |

| CAGR (2025 to 2035) | 13.5% |

ODM producers should focus on flexible line changeovers, as demand for wet-dry hybrid models is expected to surpass dry-only units by 2027. Sellers can increase average order value by bundling filter consumables and extended warranties, as demonstrated by a 14% basket size increase in 2024.

On June 7, 2025, Xiaomi unveiled the new Robot Vacuum S40C, offering improved suction power and navigation. Equipped with an upgraded LDS laser navigation system and 360° panoramic detection, the S40C can efficiently map home layouts and adapt cleaning routes in real-time.

It boasts 5,000 Pa suction power, four cleaning modes, and a 260ml water tank for mopping with a Y-shaped pattern for a thorough clean. The vacuum supports smart-home features through the Xiaomi Home app and is compatible with Amazon Alexa and Google Assistant for voice control.

The robotic vacuum cleaner market accounts for approximately 18% of the smart home devices market due to its widespread integration into connected ecosystems. Within the consumer electronics market, its share stands at 4%, reflecting its niche position amid broader categories like smartphones and TVs.

In the home appliances market, robotic vacuum cleaners represent around 7%, gaining traction as replacements for manual vacuum units. The market contributes 28% of the service robotics segment, driven by its dominance in residential automation. Lastly, within the floor cleaning equipment market, robotic vacuum cleaners hold a 35% share, with growth supported by rising demand for automated, time-saving cleaning solutions.

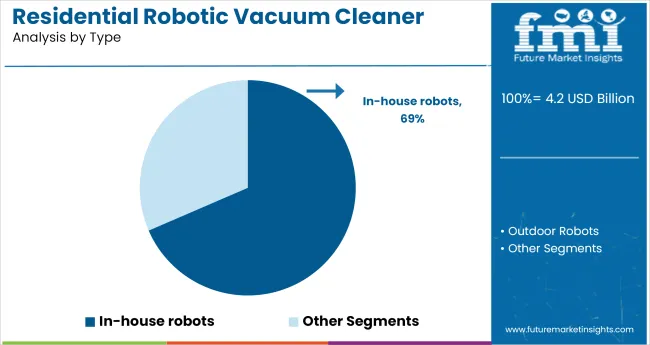

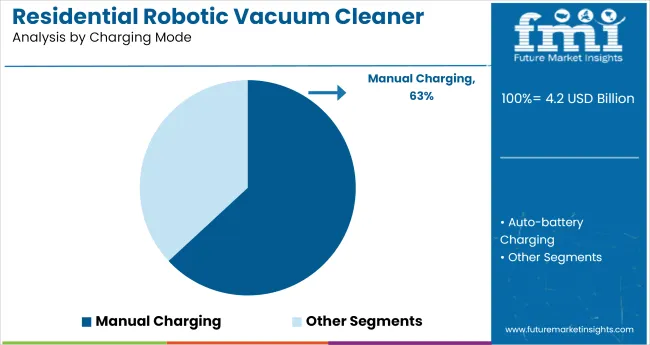

The market is experiencing significant growth, driven by key product features such as manual charging and in-house robots. Manual charging is expected to account for 63.1% of the share in 2025, while in-house robots will dominate the type segment, capturing 68.5%. This growth spans regions like North America, Latin America, Asia Pacific, the Middle East and Africa (MEA), and Europe, with increasing demand for affordable, convenient, and advanced home cleaning solutions.

In-house robots are expected to dominate the market, capturing 68.5% share in 2025. These devices are increasingly popular due to their ability to clean efficiently while navigating around furniture and obstacles. In-house robots are equipped with advanced features such as improved navigation, long battery life, and Wi-Fi connectivity, making them attractive to consumers seeking convenience and ease of use.

As home automation grows, consumers are more inclined to invest in products that integrate seamlessly with smart home systems like Alexa and Google Home. This demand for efficiency and convenience is driving the widespread adoption of in-house robots.

The manual charging segment is projected to hold 63.1% share in 2025. Although the industry is gradually moving towards self-charging models, manual charging continues to dominate due to its affordability. This feature remains popular in budget-friendly models, particularly in regions where smart home adoption is slower.

Consumers seeking value-driven products often prefer manual charging, as it offers a cost-effective solution without sacrificing functionality. While premium models increasingly feature automatic charging, the accessibility and lower cost of manual charging continue to make it a preferred choice for many households, particularly those with limited budgets.

The industry is experiencing significant growth, driven by technological advancements, rising consumer interest in smart home devices, and a shift toward more convenient, time-saving cleaning solutions. Increasing adoption of IoT-enabled appliances and the growing trend of home automation are key factors shaping this growth.

Retail and Consumer Adoption of Residential Robotic Vacuum Cleaners

Retailers and online platforms have streamlined sales processes to optimize stock turnover and enhance accessibility. Average product turnover for robotic vacuum cleaners in Western European markets has increased by 15% in Q1 2025 after adopting automated inventory management and digital tracking systems.

Major retailers in the UK and Germany now expect robotic vacuum cleaner SKUs to turn 1.3x faster than traditional cleaning appliances, prompting a 12% increase in dedicated smart home sections in-store. Digital platforms have reduced return rates by 8%, while product warranty programs funded by manufacturers have lowered malfunction rates by 10%. These efficiencies have led to a more balanced inventory, reducing excess stock by 9% and better aligning supply with consumer demand.

Growth in Demand for Budget-Friendly Robotic Vacuum Cleaners

The demand for budget-friendly robotic vacuum cleaners has grown by 18% in 2025, driven by a combination of price-sensitive consumers and expanded industry access. Retailers and online platforms now offer financing options and subscription models, making these devices more accessible across various consumer segments.

In the Eastern European sector, sales of affordable models have increased by 22%, surpassing premium models in terms of volume. Digital tracking and on-demand delivery systems have contributed to a 14% reduction in delivery times, further driving accessibility. These factors have expanded adoption in lower-income households, contributing to the rise of budget-friendly robotic vacuum cleaner models.

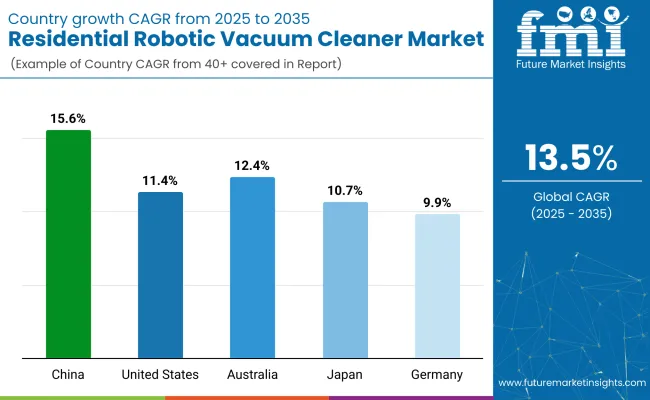

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 15.6% |

| United States | 11.4% |

| Australia | 12.4% |

| Japan | 10.7% |

| Germany | 9.9% |

Global residential robotic vacuum cleaner demand is projected to rise at a 13.5% CAGR from 2025 to 2035. China, part of the BRICS, outpaces the global average with a 15.6% CAGR, reflecting its rapid adoption of smart home devices and high-tech vacuum cleaning solutions.

The United States, part of the OECD, posts a 11.4% growth rate, led by increasing demand for efficient and hands-free home cleaning solutions. Australia, with a 12.4% CAGR, follows closely, driven by high-tech product adoption. Japan, at 10.7%, is driven by increasing interest in compact, efficient cleaning devices.

Germany, part of the EU, records 9.9%, with growing interest in automated home cleaning but slower adoption compared to other regions. Other ASEAN countries are experiencing rising demand, although not yet profiled here, influenced by digitalization and home automation trends.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The USA market is growing at an 11.4% CAGR from 2025 to 2035, driven by demand for convenience-focused, AI-powered robotic vacuum cleaners. Growth is concentrated in high-end SKUs with features like lidar mapping, app integration, and self-emptying docks. Suburban households account for a large share due to floor area and lifestyle compatibility.

Brands such as iRobot and Shark dominate, with innovation cycles led by user interface upgrades and voice control integration. As part of the OECD, the USA benefits from high consumer trust, premium pricing potential, and robust after-sales infrastructure in the robotic vacuum cleaner category.

China is projected to expand at a 15.6% CAGR through 2035, well above the global average for robotic vacuum cleaners. Rising disposable income, increasing smart-home adoption, and domestic manufacturing dominance drive widespread uptake of robotic vacuum cleaner units. The country’s strong e-commerce ecosystem boosts reach across urban and semi-urban zones.

Government incentives for robotics and AI also contribute to scale and cost-efficiency. Domestic players like Ecovacs and Xiaomi are scaling exports, while aggressive R&D and vertical integration help China maintain cost and design leadership in mid-range to premium robotic vacuum cleaner segments.

Australia is expected to grow at a 12.4% CAGR through 2035, led by rising dual-income households, growing acceptance of robotic vacuum cleaner adoption, and retail partnerships across electronics chains. Urban dwellers in Sydney, Melbourne, and Brisbane are key consumers, attracted by compact robotic vacuum cleaner models suited to apartment living. Market traction is further supported by subscription models and bundled smart-home offers. Australian retailers have begun importing Asian SKUs, pushing competition on both price and features.

Sales for robotic vacuum cleaners in Japan are forecast to grow at a 10.7% CAGR between 2025 and 2035. Growth is driven by aging demographics and high comfort with domestic automation, particularly robotic vacuum cleaner usage. Compact living spaces and high hygiene awareness increase the adoption of low-noise, compact robotic vacuum cleaners.

Domestic brands like Panasonic and Sharp focus on premium, whisper-quiet models optimized for small interiors. As an OECD member, Japan shows high brand loyalty, low return rates, and strong demand for feature-rich, reliable robotic vacuum cleaner units.

Germany is projected to grow at a 9.9% CAGR from 2025 to 2035. The robotic vacuum cleaner market is shaped by a preference for precision, energy efficiency, and strong after-sales service. German consumers favor robotic vacuum cleaners with European safety certifications and quiet operation. The rise of dual-income households and increasing smart-home integration is driving the replacement of traditional vacuum cleaners. Brands like Vorwerk and Miele maintain strong domestic appeal, while Asian brands gain traction through price competitiveness.

In the robotic vacuum cleaner market, growth has been led by innovations in AI-based mapping, multi-surface adaptability, and home automation integration. Xiaomi, ECOVACS, and Samsung Electronics have positioned themselves as dominant suppliers through LIDAR-equipped models, smartphone connectivity, and competitive pricing.

Neato Robotics, Dyson, and Koninklijke Philips N.V. have continued to innovate in design, suction strength, and smart charging features. Emerging players such as Milagrow Business and Knowledge Solutions are expanding in South Asia and the Middle East, offering region-specific service support and affordable automation.

Competitive pressure has increased as new brands enter with OEM backing, yet premium positioning depends on connectivity, AI capabilities, and maintenance ecosystems. Core strategies include compatibility with smart-home ecosystems, SKU diversification for household needs, and regional distribution alliances to extend reach without escalating operational costs.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 4.20 billion |

| Projected Industry Size (2035) | USD 14.89 billion |

| CAGR (2025 to 2035) | 13.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | In-House Robots, Outdoor Robots |

| Charging Modes Analyzed (Segment 2) | Manual Charging, Auto-Battery Charging |

| Regions Covered | North America, Latin America, Asia Pacific, Middle East & Africa, Europe |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | iRobot Corporation, Xiaomi, Neato Robotics Inc., Dyson Inc., ECOVACS, Hayward Industries Inc., Koninklijke Philips N.V., Samsung Electronics Co. Ltd., Pentair, Milagrow Business, Knowledge Solutions (Pvt) Limited |

| Additional Attributes | Dollar sales, share by type and charging mode, rising adoption in connected smart homes, demand for LIDAR and AI-based pathfinding, premiumization trends in robotic cleaning appliances across urban households |

The industry is segmented into in-house robots and outdoor robots.

The industry is segmented into manual charging and auto-battery charging.

The industry is segmented into North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The industry is projected to reach USD 4.20 billion in 2025.

The industry is expected to grow at a CAGR of 13.5% from 2025 to 2035.

In-house robots are expected to capture 68.5% of the market in 2025.

The Asia Pacific region, particularly China, is projected to register a CAGR of 15.6% from 2025 to 2035.

The industry is projected to reach USD 14.89 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA