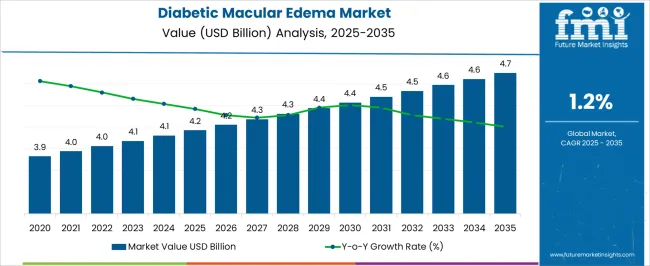

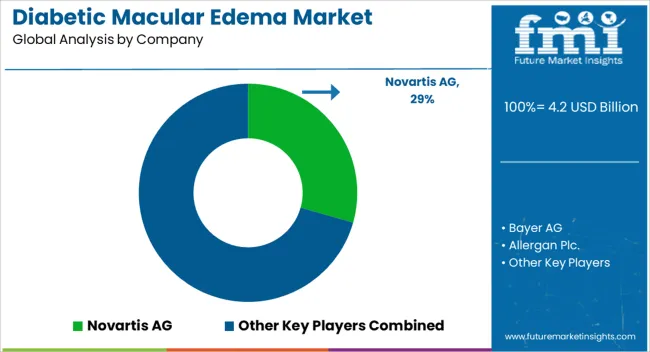

The Diabetic Macular Edema Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 1.2% over the forecast period.

The Diabetic Macular Edema market is experiencing consistent growth driven by the rising prevalence of diabetes and the associated risk of vision impairment among the global population. Increasing awareness of diabetic eye complications, coupled with early diagnosis initiatives, is fueling demand for effective treatment options. The market outlook is influenced by advancements in ophthalmology therapies, particularly targeted drug interventions that address retinal swelling and vascular leakage.

Continuous improvements in drug efficacy, safety profiles, and administration methods are enhancing patient compliance and treatment outcomes. Additionally, growing investments in healthcare infrastructure, particularly in hospitals and specialized eye care centers, support broader access to therapy.

The integration of intravitreal injections as a preferred treatment route, combined with the expansion of hospital networks, has further strengthened the market As healthcare providers and patients prioritize long-term vision preservation and quality of life, the market for Diabetic Macular Edema therapies is expected to maintain sustained growth, particularly in regions with rising diabetes prevalence and expanding medical services.

| Metric | Value |

|---|---|

| Diabetic Macular Edema Market Estimated Value in (2025 E) | USD 4.2 billion |

| Diabetic Macular Edema Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 1.2% |

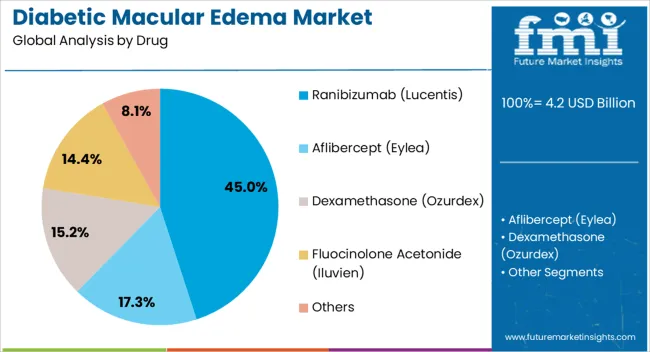

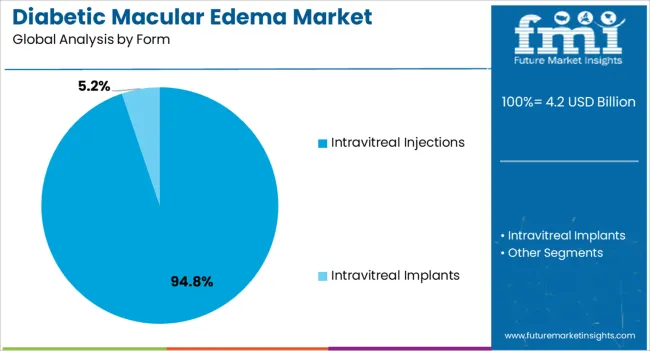

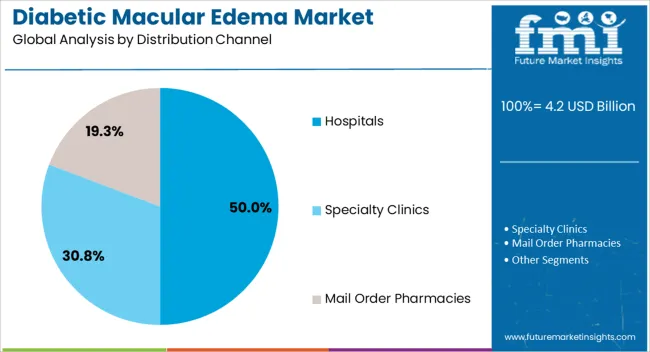

The market is segmented by Drug, Form, and Distribution Channel and region. By Drug, the market is divided into Ranibizumab (Lucentis), Aflibercept (Eylea), Dexamethasone (Ozurdex), Fluocinolone Acetonide (Iluvien), and Others. In terms of Form, the market is classified into Intravitreal Injections and Intravitreal Implants. Based on Distribution Channel, the market is segmented into Hospitals, Specialty Clinics, and Mail Order Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ranibizumab (Lucentis) drug segment is projected to hold 45.0% of the Diabetic Macular Edema market revenue share in 2025, positioning it as the leading therapeutic option. This dominance is primarily driven by the drug’s proven efficacy in reducing retinal swelling and improving visual acuity in patients with diabetic macular edema.

The high adoption of Ranibizumab is supported by its established safety profile, strong clinical validation, and widespread recognition among ophthalmologists. Its effectiveness in both monotherapy and combination therapy regimens has further reinforced its position as the preferred treatment.

Additionally, consistent patient outcomes and the availability of treatment protocols in hospitals have contributed to its market leadership, making Ranibizumab a central choice for managing diabetic eye complications.

Intravitreal injections are expected to account for 94.8% of the Diabetic Macular Edema market revenue share in 2025, reflecting their dominance as the preferred administration method. The growth of this segment has been driven by the direct delivery of therapeutic agents to the retina, enabling faster and more targeted treatment outcomes.

Intravitreal injections provide high bioavailability and reduce systemic exposure, enhancing both safety and efficacy. The established clinical practices for intravitreal administration, coupled with growing expertise among ophthalmologists, have increased patient acceptance.

Additionally, the method’s compatibility with advanced anti-VEGF therapies has solidified its central role in diabetic macular edema management, ensuring precise and consistent treatment outcomes.

Hospitals are anticipated to hold 50.0% of the Diabetic Macular Edema market revenue share in 2025, making them the leading distribution channel. This segment’s growth is driven by the increasing preference for hospital-based treatments due to the availability of trained specialists, advanced diagnostic tools, and comprehensive care services.

The controlled clinical environment ensures accurate administration of intravitreal injections and close monitoring of patient response. Hospitals also provide integrated services, including follow-up care, which enhances patient adherence and treatment outcomes.

The rising focus on ophthalmology care infrastructure and the growing number of hospital facilities in urban and semi-urban areas have further strengthened their role as the primary distribution channel for diabetic macular edema therapies.

Gene Therapy Can Bring a Life-long Cure for Diabetic Macular Edema

The field of treatment for diabetic macular edema is alive with the pursuit of gene therapy. Breakthrough research has been looking into the possibility of a single shot in gene therapy that would be administered once and cure diabetic macular edema forever. This will be a landmark diversion from current treatment paradigms that require control.

How Artificial Intelligence is Revolutionizing DME Diagnostics

The field of diagnosis in diabetic edema is expected to change due to the foray of AI algorithms. The new, advanced algorithms show great capabilities in the early detection of diabetic edema. It also involves the use of AI in the interpretation of data on patients in developing a personalized treatment plan for better management of the condition.

Patients with Diabetic Macular Edema: Home Monitoring Kits

The diabetic macular edema space is getting reformed rapidly with the coming in of home monitoring kits. An example of this has become part of a growing trend—home monitoring is being made simpler so that patients can proactively track changes in their vision between clinic visits. Intervention, which may prevent vision loss from occurring with diabetic macular edema, could thus be possible with this early change.

Drug Delivery Implants Improve Efficacy in the Treatment of Diabetic Macular Edema

Another promising trend for diabetic macular edema management is in the development of sustained-release drug delivery implants. These implants have a characteristic of continuous drug release over an extended period, thus offering the potential benefit of minimal injections and less burden to the patient over time.

Multifaceted Combination Therapies of DME

A greater understanding is emerging of the multifaceted nature of diabetic macular edema. With this, another major emerging trend is that of combination therapies. The combination of drugs that target different pathways of diabetic edema pathogenesis would provide an all-inclusive approach in managing the condition.

Telemedicine Now Expands Access to DME Care

Telemedicine is rapidly changing the face of accessibility to care for those patients who need diabetic macular edema. It reaches out to patients in far-off regions or with mobility limitations for consultations and follow-ups with specialists. Telemedicine has great potential to reduce this gap in DME care delivery.

Precautionary Measures are taking on a Significant Role in the Fight against DME

A significant shift in the focus of diabetic macular edema treatment is underway. Much of it is being turned from established cases toward preventive measures, which come in the shape of stiffer management protocols for diabetes and earlier intervention strategies to avoid the occurrence of DME completely.

Regenerative Medicine Turning Out to be an Option for the Reversal of DME

The future of diabetic macular edema treatment lies probably in the field of vision restoration. Studies are being carried out on the potential of regenerative medicine, including the use of stem cell therapies, to reverse DME damage and restore lost vision. This work is at a very early phase but does provide a flicker of hope to patients with diabetic edema.

Global diabetic macular edema sales have been on a rollercoaster over the period 2020 to 2025, with a CAGR of 18.40%. This remarkable growth was mainly attributed to the increase in diabetes incidence globally, the growing understanding of diabetic eye diseases and the screening that followed, and the introduction of new drugs that greatly improved patient outcomes. The sector also witnessed a hike in healthcare expenditure and a passage of reimbursement policies, which made advanced DME treatments more accessible to a wider range of patients.

The forecasted CAGR for 2025 to 2035 is catching up at a very sluggish CAGR of 1.20%. This slowdown is due to the saturation of the market, the high cost of treatment which cuts down affordability, and the possibility of technology stagnation in treatment options. When the market advances, the marginal improvements of existing treatments may not be as revolutionary as in previous years, thereby resulting in a natural slowing of growth rates.

Though the lower CAGR, the global DME market still has untapped potential for expansion. The current research on less invasive and cheaper treatments could help to lift the market. Moreover, the expanding utilization of telemedicine and AI for early diagnosis and management of DME is expected to spur the demand for patient monitoring and adherence, which could lead to a constant demand.

The United States is forecast to see a stable expansion in the diabetic macular edema industry. Following the path to market saturation, the United Kingdom and India foresees moderate yet steady momentum through 2035. China and Germany are likely to witness a steady momentum in the diabetic lar edema sector.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 5.8% |

| United Kingdom | 1.1% |

| Germany | 3.2% |

| India | 1.4% |

| China | 4.3% |

The United States is expected to register a CAGR of 5.8% in the forecast period. The country boasts a well-established healthcare infrastructure with relatively high access to advanced diagnostic tools and treatments for DME.

These include advanced imaging technologies for early detection, along with a number of treatment options, from anti-VEGF injections to laser therapy; however, there are still challenges such as the high cost of treatment and barriers to healthcare access for some specific demographic classes that limit optimization of management for DME. Going forward, the USA market may focus on future advances such as gene therapy and sustained-release drug delivery implants that could advance both treatment efficacy and accessibility.

Germany projects a CAGR of 3.2% from the year 2025 to 2035, displaying a tempered growth curve of the DME market. Germany is supported by a very good healthcare system that has a widespread focus on preventive care. This means early diagnoses and a more managed phase of diabetes, possibly reducing the chances of diabetic macular edema development.

Overall, access to some of the new treatments available for DME might be less than in countries like the USA However, Germany is accepting technological advances in diabetic macular edema care. Some of the evolving trends shaping the DME market in Germany are the incorporation of artificial intelligence in early detection and research in gene therapy for possible reversal of DME.

China is expected to register a CAGR of 4.3% from 2025 to 2035. China is a country with a high growth rate of diabetes, which concomitantly raises the number of cases of diabetic macular edema. Another is the increased awareness of DME and its related complications that compel the patients to be in continuous medical care. However, there are some challenges. Infrastructure for healthcare is being developed in some pockets, with China being one of them.

This is another reason advanced diabetic macular edema treatment facilities might not have penetrated certain parts. Yet, China is ready for an active investment in healthcare infrastructure and the adoption of new technologies, as it will cope with the rising diabetes. This, in addition to growing prevalence, makes China one of the main drivers of the global DME market.

Based on drug type, the anti-VEGF segment accounts for a prominent share in 2025. Also, by form, intravitreal injections have come out as the leading segment during the same period.

| Segment | Anti-VEGF (Drug Type) |

|---|---|

| Value Share (2035) | 95.5% |

Anti-VEGF drugs command a share of 95.5% in 2025. The widespread adoption of these drugs is because they work by the selective inhibition of vascular endothelial growth factor (VEGF), which is an active protein in the abnormal growth of blood vessels seen with DME.

In their effective targeting of VEGF, these anti-VEGF drugs reduce leakage from these blood vessels and reduce fluid accumulation in the most important part of the retina, the macula, at the center. This selective reduction ultimately leads to improved vision outcomes for diabetic macular edema patients. Furthermore, the latest anti-VEGF drug formulations have provided improved efficacy and treatment intervals.

The better efficacy in treatment becomes not only better for the patient in terms of compliance and convenience but also reduces pain during intravitreal injections because of their less frequent application.

| Segment | Intravitreal Injections (Form) |

|---|---|

| Value Share (2035) | 94.8% |

Intravitreal injections are currently the leading treatment for DME and have captured 94.8% of the share in 2025. In contrast to drugs given through the oral route, which affects the whole body, the intravitreal route of drug administration allows for a more localized approach.

Intravitreal injections deliver the medication straight into the vitreous cavity of the eye, maximizing the concentration of the drug at the site of action within the macula. Such site-specific drug delivery not only increases drug bioavailability at the target site but also minimizes systemic side effects, usually seen with oral medications, and enhances better tolerability to the patient.

Furthermore, safety and tolerability of intravitreal injections have been improved for patients with DME due to the recent advances in injection techniques and needle designs. Implants and various routes for the delivery of the drug are being researched, but the intravitreal route is still preferred the most since it is the most effective and safe and provides precise therapy at the site of the problem.

Some established players like Roche and Novartis are likely to hold dominance in the industry. Biosimilars-structural copies of biologic medications such as anti-VEGFs- are increasingly being seen as a more economical alternative. This might slowly eat into the market share that existing brands enjoy. A one-time treatment that might change the paradigm of DME management is promised by gene therapy, which is on the horizon. In the race to develop active gene therapy candidates, companies like Allergan and Roche could potentially threaten dominance.

To keep a competitive edge, startups must stress on constant development. The established players need to make the already existing formulations of drugs more refined so that the therapy has to be given less frequently, reducing the burden on the patient. They can also think of combination therapies by adding anti-VEGF drugs with other mechanisms that could possibly lead to good outcomes and differentiate them from the rest. Also, one important aspect is likely to be collaboration with research institutions in developing solutions for gene therapy.

Industry Updates

Novartis AG, headquartered in Switzerland, makes strides in diabetic macular edema (DME) treatment as the FDA and EMA accept filings for BEOVU (brolucizumab-dbll), with positive Phase III KESTREL study results.

Bayer AG, based in Germany, receives FDA approval for Eylea, an aflibercept solution for DME treatment, bolstering its portfolio for ocular health.

Allergan Plc., headquartered in Ireland, joins forces with the International Diabetes Federation to forge a global strategy for DME screening, diagnosis, and management.

F. Hoffmann-La Roche Ltd., based in Switzerland, earns FDA approval for Vabysmo (faricimab-svoa) in DME treatment, with promising data from phase III studies on Vabysmo for retinal vein occlusion.

Alimera Sciences Inc., headquartered in the United States, embarks on the NEW DAY clinical trial, evaluating ILUVIEN as a baseline therapy for DME patients.

Segmentation by drug includes anti-VEGF medications such as Ranibizumab (Lucentis) and Aflibercept (Eylea), as well as corticosteroid therapies like Dexamethasone (Ozurdex) and Fluocinolone Acetonide (Iluvien), alongside other off-label drugs.

Classification by form distinguishes between intravitreal injections and intravitreal implants.

Regarding distribution channels, patients may access treatments through hospitals, specialty clinics, or mail order pharmacies.

Geographical segmentation spans across regions including North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa (MEA).

The global diabetic macular edema market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the diabetic macular edema market is projected to reach USD 4.7 billion by 2035.

The diabetic macular edema market is expected to grow at a 1.2% CAGR between 2025 and 2035.

The key product types in diabetic macular edema market are ranibizumab (lucentis), aflibercept (eylea), dexamethasone (ozurdex), fluocinolone acetonide (iluvien) and others.

In terms of form, intravitreal injections segment to command 94.8% share in the diabetic macular edema market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diabetic Nephropathy Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Markers Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Retinopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Ketoacidosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Diabetic Retinopathy Market Analysis - Size, Share & Forecast 2025 to 2035

Diabetic Food Market Report – Trends & Innovations 2025-2035

Diabetic Assays Market

Diabetic Pen Cap Market

Antidiabetics Market Overview - Growth, Demand & Forecast 2024 to 2034

Angioedema Treatment Market Size and Share Forecast Outlook 2025 to 2035

Corneal Edema Treatment Market

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Necrobiosis Lipoidica Diabeticorum Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA