The ornithology tourism market is experiencing notable growth driven by rising interest in wildlife observation, eco-friendly travel, and biodiversity conservation. Increasing global awareness about bird habitats and migratory patterns has encouraged both domestic and international travel focused on avian exploration. The market is being strengthened by the expansion of sustainable tourism infrastructure, supportive government initiatives, and growing participation from conservation organizations.

Technological integration, such as digital bird identification tools and guided virtual experiences, is enhancing engagement and accessibility for enthusiasts. Future growth is expected to be supported by the inclusion of birdwatching packages within broader ecotourism programs and the development of niche travel itineraries targeting nature-based tourists.

The rising inclination toward responsible travel and community-based conservation is further enhancing market credibility and long-term sustainability The overall outlook remains positive, with steady demand from environmentally conscious travelers and continued diversification of destinations, experiences, and organized tour offerings across both developing and developed regions.

| Metric | Value |

|---|---|

| Ornithology Tourism Market Estimated Value in (2025 E) | USD 0.7 trillion |

| Ornithology Tourism Market Forecast Value in (2035 F) | USD 1.2 trillion |

| Forecast CAGR (2025 to 2035) | 5.3% |

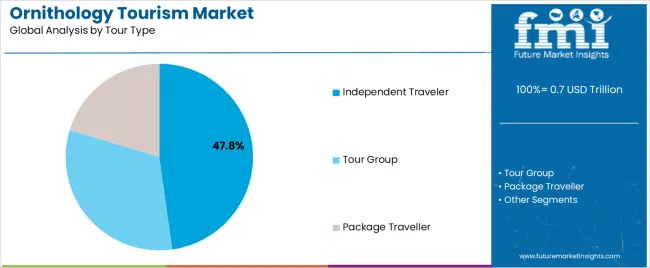

The market is segmented by Tourist Type, Tour Type, Age Group, and Booking Channel and region. By Tourist Type, the market is divided into Domestic Tourist and International Tourist. In terms of Tour Type, the market is classified into Independent Traveler, Tour Group, and Package Traveller. Based on Age Group, the market is segmented into 26 to 35 Years, 15 to 25 Years, 36 to 45 Years, 46 to 55 Years, 56 to 65 Years, 66 to 75 Years, and More Than 75 Years. By Booking Channel, the market is divided into Online Booking, Phone Booking, and In Person Booking. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The domestic tourist segment, holding 61.40% of the tourist type category, has emerged as the leading contributor due to increasing accessibility of local birdwatching destinations and the growing culture of short-haul nature trips. Regional governments and tourism boards are promoting ornithological hotspots through awareness campaigns and eco-tour circuits, stimulating domestic participation.

The affordability of domestic travel compared to international trips has encouraged broader engagement among middle-income groups. In addition, improvements in local transportation and accommodation infrastructure have enabled seamless travel experiences.

Conservation programs and local community involvement have enhanced destination authenticity, driving repeat visits The segment’s dominance is expected to persist as environmental awareness rises and regional ecosystems continue to attract eco-tourists seeking sustainable and educational travel experiences.

The independent traveler segment, accounting for 47.80% of the tour type category, has been leading the market owing to the increasing preference for flexible, self-guided experiences among modern travelers. Easy access to digital mapping, booking platforms, and wildlife tracking applications has empowered tourists to plan personalized birdwatching itineraries.

This autonomy allows travelers to explore at their own pace while minimizing organized tour costs. The segment benefits from strong engagement among adventure and photography enthusiasts seeking authentic, low-impact encounters with wildlife.

Social media sharing and community-driven birdwatching networks have further expanded participation Continued digitalization of tourism services and enhanced safety in remote destinations are expected to sustain the appeal of independent travel, ensuring consistent growth and diversification within the ornithology tourism industry.

The 26 to 35 years age group, representing 29.60% of the age group category, has emerged as the most active participant segment, driven by rising disposable incomes, interest in sustainable travel, and a preference for immersive outdoor experiences. This demographic is increasingly prioritizing wellness, exploration, and environmental consciousness in travel choices.

The ability to balance professional flexibility with adventure-driven lifestyles has encouraged frequent participation in short and long-duration ornithology trips. Online platforms, eco-travel communities, and experiential marketing have been effective in engaging this segment.

Demand from this age group is expected to grow further as more travelers seek meaningful connections with nature and adopt eco-tourism as a lifestyle preference, reinforcing its role as a key driver of growth in the ornithology tourism market.

From 2020 to 2025, the ornithology tourism market experienced a CAGR of 4.6%. Ornithology tourism emerges as a niche within ecotourism, attracting enthusiasts keen on observing and learning about various avian species in their natural habitats.

This specialized form of travel entails embarking on bird-watching expeditions across diverse locations boasting rich bird populations.

By traversing different habitats, enthusiasts maximize their opportunities to observe and comprehend the intricacies of numerous bird species, fostering a deeper appreciation for avian biodiversity.

Birdwatching stands out as a sustainable tourism activity that aligns with the principles of economic, social, and environmental sustainability. This leisure pursuit thrives in close association with protected natural areas, showcasing a harmonious bond between tourism and conservation efforts.

With a growing and enthusiastic following, birdwatching represents a burgeoning demand category among tourists, presenting significant opportunities for expansion and development in the tourism industry. Projections indicate that the global ornithology tourism market is expected to experience a CAGR of 7.6% from 2025 to 2035.

| Historical CAGR 2020 to 2025 | 4.6% |

|---|---|

| Forecast CAGR 2025 to 2035 | 7.6% |

The provided table highlights the top five countries in terms of revenue, with Japan and India leading the list. Increasing environmental awareness and a desire for sustainable travel experiences have led to a surge in interest in nature-based tourism activities like birdwatching in India.

Japan is experiencing a rise in interest in nature-based tourism activities, driven by increasing environmental awareness and a desire to connect with the natural world.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 6.1% |

| Australia | 5.7% |

| China | 6.4% |

| Japan | 6.9% |

| India | 8.8% |

The ornithology tourism market in the United States is expected to expand with a CAGR of 6.1% from 2025 to 2035. The United States is home to numerous national parks, wildlife refuges, and other protected areas that serve as important habitats for birds. These areas offer prime birdwatching opportunities and are often well-maintained and accessible to tourists.

There is a growing interest among Americans in nature-based activities and ecotourism, including birdwatching. As people become more environmentally conscious and seek meaningful outdoor experiences, birdwatching has emerged as a popular leisure activity.

The ornithology tourism market in India is expected to expand with a CAGR of 8.8% from 2025 to 2035. India's vast and varied geography, coupled with its favorable climate, establishes it as a significant stopover for a diverse array of migrating birds.

During winter, when these birds seek warmer climes, India becomes a hub for avian activity, hosting migratory species from Europe, Africa, and its northern regions.

This seasonal influx has sparked a surge in tourist interest in birdwatching, prompting numerous tour operators to craft curated experiences along migration routes. India emerges as a burgeoning hotspot for migratory bird tourism, offering enthusiasts unparalleled opportunities to witness this natural spectacle up close.

India's diverse landscapes, including tropical forests, grasslands, wetlands, and high-altitude regions, provide varied habitats for birds. Popular birdwatching destinations such as Bharatpur Bird Sanctuary, Corbett National Park, and Western Ghats offer enthusiasts the opportunity to explore a wide range of ecosystems and bird species.

The ornithology tourism market in China is expected to expand with a CAGR of 6.4% from 2025 to 2035. With growing environmental consciousness in China, there has been a heightened interest in nature-based tourism activities, including birdwatching. Many Chinese citizens are eager to explore and appreciate the country's rich biodiversity, including its diverse bird species.

As incomes rise and lifestyles become more affluent, an increasing number of Chinese people have the means and leisure time to pursue recreational activities such as birdwatching. This has led to a growing demand for nature tourism experiences, including birdwatching tours and excursions.

The ornithology tourism market in Japan is expected to expand with a CAGR of 6.9% from 2025 to 2035. Japan has developed a well-established tourism infrastructure, including national parks, wildlife reserves, and birdwatching facilities, to cater to the needs of birdwatchers.

Many regions offer guided birdwatching tours, birding trails, and birdwatching events to attract visitors interested in avian biodiversity.

Japan's diverse landscapes, ranging from coastal areas to mountains and forests, provide habitats for a wide variety of bird species. This abundance of birdlife attracts both domestic and international birdwatchers keen to observe and photograph rare and endemic species.

Japan's population is increasingly drawn to nature-based activities, including birdwatching, as a means of relaxation and recreation. This interest has spurred the development of ornithology tourism as a niche within the broader ecotourism sector.

Australia is renowned for its incredibly diverse range of bird species, including unique and endemic birds found nowhere else in the world. This rich avian biodiversity attracts birdwatchers from around the globe who come to observe and photograph a wide variety of species in their natural habitats.

Advances in technology, such as digital cameras, binoculars, and bird identification apps, have made birdwatching more accessible and enjoyable for enthusiasts in Australia. These tools allow birdwatchers to capture high-quality images, identify bird species with ease, and share their observations with others online.

The Australian government and conservation organizations actively promote ecotourism initiatives, including birdwatching, as a sustainable way to appreciate and conserve the country's natural resources.

This support for ecotourism helps to raise awareness about the importance of bird conservation and attract visitors to birdwatching destinations. The ornithology tourism market in Australia is expected to expand with a CAGR of 5.7% from 2025 to 2035.

The below section shows the leading segment. The online booking segment is to account for a market share of 44% in 2025. Based on the age group, the (35-55 year) segment is expected to have a share of 28%.

| Category | Market Share |

|---|---|

| Online booking | 44% |

| 36-55 years | 28% |

Based on the booking channel, the online booking segment is expected to account for market share of 44% in 2025. With the exponential growth of internet usage in recent years, the online booking channel has become the preferred choice for the majority of tourists, offering unparalleled convenience and accessibility. This trend is particularly pronounced in ornithology tourism, where destinations are often situated away from urban centers.

Online booking provides travelers with the flexibility to select and schedule specific tours while accessing comprehensive information about their chosen destinations. This seamless digital interface simplifies the planning process, allowing tourists to efficiently organize their journeys from the comfort of their own homes.

Based on age group, the 36-45 year segment is expected to account for 28% of the market share in 2025. The ornithology tourism market predominantly attracts travelers aged 35 to 55, with the average age of tourists being 50 years.

Middle-aged individuals and seniors comprise the majority of birdwatching enthusiasts due to their availability and inclination to spend time exploring bird habitats. However, there is a notable shift occurring as more millennials show interest in birdwatching tourism.

This trend is driven by a growing awareness of sustainability issues, particularly the significance of biodiversity conservation, which resonates across generations. While older birdwatchers remain the primary target demographic, the evolving landscape suggests a broader appeal among younger generations.

Key players in the market are actively devising innovative strategies to enhance the ornithology tourism sector. This includes an upsurge in the number of tour operators specializing in birdwatching, offering tailored experiences for enthusiasts.

These providers are diligently expanding their presence globally, aiming to cater to birdwatchers in every corner of the world. Notably, birdwatching tours are now being extended to remote regions such as Antarctica and Africa, renowned for their rich avifauna, demonstrating the sector's commitment to offering immersive experiences in diverse habitats.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 0.7 trillion |

| Projected Market Valuation in 2035 | USD 1.2 trillion |

| Value-based CAGR 2025 to 2035 | 5.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Tourist type, Tour Type, Age Group, Booking Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | India Bird Watching; Junglelore Pvt Ltd; Rockjumper Birding Tours; National Geographic Partners; Travel Tour World; Shikhar Travels; Victor Emanuel Nature Tours; Toehold Travel; Himalaya Birding; Nature trip; Tropical Birding |

The global ornithology tourism market is estimated to be valued at USD 0.7 trillion in 2025.

The market size for the ornithology tourism market is projected to reach USD 1.2 trillion by 2035.

The ornithology tourism market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in ornithology tourism market are domestic tourist and international tourist.

In terms of tour type, independent traveler segment to command 47.8% share in the ornithology tourism market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

War Tourism Market Insights - Size, Trends & Forecast 2025 to 2035

Dark Tourism Market Forecast and Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Market Share Breakdown of Wine Tourism Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA