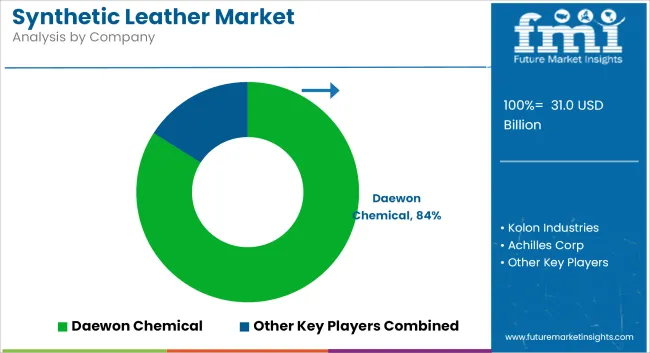

The global synthetic leather market is estimated to reach USD 31.0 billion in 2025 and expand to USD 54.9 billion by 2035, reflecting a CAGR of 5.9% over the forecast period. Growth is being driven by increasing consumer preference for animal-free materials, regulatory support for sustainable manufacturing, and continuous advancements in synthetic leather technologies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 31.0 billion |

| Industry Value (2035F) | USD 54.9 billion |

| CAGR (2025 to 2035) | 5.9% |

Synthetic leather is being adopted as an alternative to natural leather across industries such as automotive, footwear, fashion, and upholstery. Cost-effectiveness, durability, and reduced environmental impact are supporting widespread replacement of traditional animal-based leather with polyurethane (PU) and polyvinyl chloride (PVC) alternatives. As environmental concerns escalate, manufacturers are transitioning toward water-based and solvent-free PU formulations, which emit fewer pollutants and align with evolving emissions regulations.

The global movement toward vegan and cruelty-free consumer products is contributing significantly to synthetic leather adoption. In fashion, synthetic leather is being integrated into mainstream apparel and accessories, while in the automotive sector, it is being applied to vehicle interiors for its ease of cleaning, wear resistance, and cost efficiency. This trend is being reinforced by auto manufacturers seeking to improve sustainability credentials and meet shifting consumer values.

Technological innovation is expanding the market further. Bio-based synthetic leathers, derived from sources such as pineapple leaves, mushrooms, and recycled plastics, are being developed to meet demand for biodegradable and plant-based materials. These innovations are being supported by both public policy and corporate sustainability mandates, particularly in Europe and North America.

Production processes are being upgraded with precision coating and lamination technologies to enhance product aesthetics and tactile properties while minimizing solvent usage. The implementation of green chemistry in PU processing is enabling manufacturers to meet stricter environmental standards without compromising performance.

Regulatory restrictions on animal-hide leather production and growing interest in vegan-certified products are reinforcing long-term demand. The synthetic leather market is expected to remain on a steady growth path through 2035, driven by sustainability-led innovation, material versatility, and the rising consumer shift toward ethical and environmentally responsible alternatives.

Polyurethane (PU) synthetic leather is estimated to account for approximately 52% of the global synthetic leather market share in 2025 and is projected to grow at a CAGR of 6.1% through 2035. PU-based leather is widely used in footwear, apparel, automotive interiors, and lifestyle accessories, offering a closer aesthetic and tactile resemblance to natural leather.

Compared to polyvinyl chloride (PVC), PU exhibits better UV resistance, lower VOC emissions, and enhanced comfort in high-contact applications. Brands across the fashion and automotive industries are increasingly shifting to PU to meet regulatory demands and consumer preferences for cruelty-free and sustainable materials. Manufacturers are also investing in solvent-free, water-based, and partially bio-based PU variants to align with evolving ESG targets.

Synthetic leather for footwear is projected to hold approximately 34% of the global market share in 2025 and is expected to grow at a CAGR of 6.0% through 2035. The segment benefits from high-volume manufacturing in Asia-Pacific, supported by favorable economics, aesthetic versatility, and customization options.

PU and PVC synthetic leather are widely used for uppers, linings, and soles, providing water resistance, durability, and design flexibility. As global shoe production scales to meet demand from expanding middle-class populations and fast fashion cycles, synthetic alternatives offer reliable performance with significantly lower cost and environmental impact than genuine leather. Footwear brands are also launching vegan and eco-labeled lines that increasingly incorporate recycled and bio-based synthetic leather, further reinforcing this segment’s leadership in market share and innovation.

Environmental Concerns Over PVC-Based Leather

The biggest problem of the synthetic leather market is the environmental impact of PVC-based leather, in comparison to the synthetic leather that is made from it. PVC, which is often used for the sake of being cheaper and more durable, contains some harmful plasticizers and chlorine-based compounds that can lead to the generation of toxic emissions in the production and disposal processes.

The absence of biodegradable materials also means that the generation of waste is extended over a long period of time and this has become a major ecological threat. Policy-makers, especially in Europe and North America, have imposed stricter environmental norms and are encouraging manufacturers to substitute these problematic materials with environmentally friendly ones like water-based polyurethane (PU) and bio-based leather. Moving toward the sustainable materials adds production costs which can prevent the mass acceptance of products in price-sensitive markets.

Fluctuating Raw Material Prices and Production Costs

The synthetic leather market is very sensitive to raw material prices since it is heavily dependent on them. Particularly, polyurethane, PVC, and bio-polymer are highly volatile in prices owing to supply chain disruptions and oil price swings. The increasing cost of alternatives like the bio-based PU leather strain manufacturers further, making it difficult to balance profitable and environmentally friendly manufacturing operations.

Also, the need for high initial investment in green production technologies, and conformance to environmental regulations is another reason why the manufacturers incur additional operational costs. Moreover, more significant manufactures have the means to spend on resource development which smaller ones thus cannot afford, hence their competition suffers, and eventually, this may delay the introduction of sustainable synthetic leather.

Growth of Bio-Based and Sustainable Synthetic Leather

The increasing demand for eco-friendly and biodegradable materials represents a significant opportunity for the synthetic leather market. The trend of bio-sourced leather that has mushrooms, pineapple leaves, apple peels, and cork as inputs is catching on as being sustainable instead of traditional PU and PVC leather.

Companies are focusing on water-based PU leather and through a solvent-free method will cut carbon emissions. The preference of the consumers has been the driver for the brands to go vegan and apply these materials in fashion, the automotive sector, and sports apparel. The joint forces of the government propaganda and the law that encourages the sustainable manufacture postulate that the bio-based synthetic leather is bound to disrupt the whole industry.

Rising Demand in Automotive and Luxury Fashion Sectors

The market for synthetic leather is getting a boost from the growing use of synthetic leather in car interiors and style cloths because it is expanding. The interest from pre-eminent car brands is also driving the decision to install PU and bio-based the leather in vehicles as they stand for durability, cost-effectiveness, and simplicity in maintenance.

To complement that, the shift of many of the most luxurious brands to vegan leather has been partly caused by the pressure of consumers for going ethical and buying sustainable products. For instance, new trendy artificial leather textures that flourish and breathe not just like but leathers are also being invented. With the advancements in veganism and sustainability being so vivid, synthetic leather has already become the foremost choice in high-end applications.

The synthetic leather industry in the USA is gaining traction due to heightened demand in the automotive upholstery, footwear, and furniture industries. As consumers are increasingly opting for cruelty-free and sustainable choices over genuine leather, this trend is triggering the positive results. The rules and regulations under which eco-friendly materials are able to get ahead in the market are on the agenda of lawgivers. Major players in the market have started focusing on biosources and recyclable options.

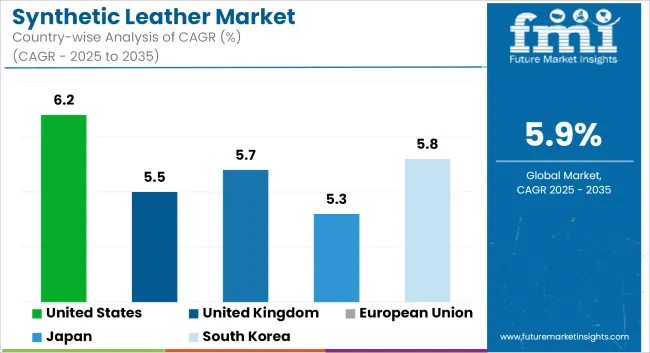

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

The demand for synthetic leather in the UK is mainly due to sustainability-driven projects and the advancement of the vegan fashion industry. The footwear and luxury sectors are the leading figures, as brands turn toward ethical sourcing more and more. The condition is further improved by government policies that advocate for eco-conscious materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

Strengthened regulations on animal products in the EU coupled with the rise in sustainability goals makes the market of synthetic leather bloom. The automotive sector, especially in Germany and France, is the major source, however, the fashion industry is flourishing too. The advancement of bio sourced and plant-derived leather is on the rise.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

The synthetic leather market in Japan is mostly concerned with the high-quality materials needed in the automotive and electronics sectors. The weight is taken off the environment with the invention of ultra-lightweight synthetics that are not chemical-based.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Korea's market sees significant growth in synthetic leather production, especially in the areas of fashion, automotive, and electronics. The market is based on green initiatives and the increasing norm of trendsetters such as K-fashion and K-beauty that focus on sustainability. K-Lifts the Weight of Fashion: The desire for Korean fashion brands increases the use of synthetic materials in apparel and accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The synthetic leather market is increasingly driven by demand for sustainable alternatives to traditional leather, with competition centered on developing eco-friendly and high-performance materials. Companies are focusing on innovations in polyurethane (PU) and polyvinyl chloride (PVC) synthetic leathers, as well as bio-based options that cater to industries such as fashion, automotive, and upholstery.

While large players dominate the market, regional manufacturers are carving out niche segments by offering cost-effective solutions and products with specialized features, such as enhanced durability or specific textures. With environmental regulations becoming stricter, manufacturers are investing in cleaner production processes and developing recyclable synthetic leather options.

In terms of Material Type, the industry is divided into Polyvinyl Chloride, Polyurethane, Bio Based

In terms of Application, the industry is divided into Synthetic Leather for Footwear, Synthetic Leather for Furnishing, Synthetic Leather for Automotive, Synthetic Leather for Clothing, Synthetic Leather for Bags, Synthetic Leather for Sports, Synthetic Leather for Electronics

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Synthetic Leather market is projected to reach USD 31.0 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.9% over the forecast period.

By 2035, the Synthetic Leather market is expected to reach USD 54.9 billion.

The Polyurethane segment is expected to dominate the market, due to superior heat dissipation, consistent performance, lower fade risk, better stopping power, reduced maintenance, and increasing adoption in passenger and commercial vehicles for safety.

Key players in the Synthetic Leather market include Kuraray Co., Ltd., Teijin Limited, Mayur Uniquoters, Nan Ya Plastics, Alfatex.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Microfiber Synthetic Leather Market is segmented by material, application, and end-use from 2025 to 2035

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA