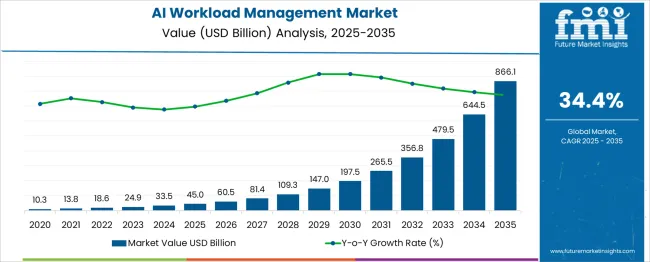

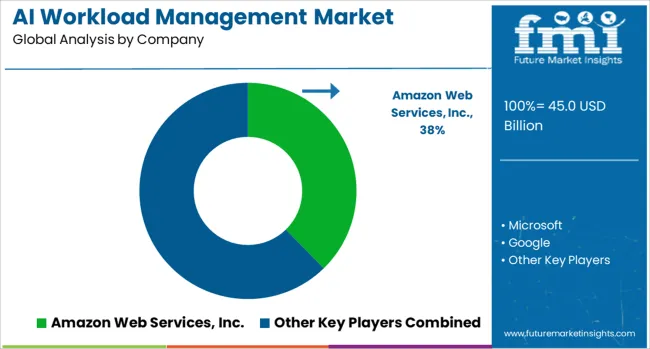

The AI workload management market was valued at USD 45 billion in 2025 and is projected to reach USD 866.1 billion by 2035, reflecting a remarkable CAGR of 34.4%. The absolute dollar opportunity, which represents a gain of over USD 821 billion, highlights the growing importance of managing AI-driven processes, tasks, and systems in an increasingly data-intensive environment. The rapid acceleration of this market reflects the rising dependency on AI for mission-critical applications across industries such as finance, healthcare, and manufacturing, where high-performance, scalable solutions are in demand.

The AI workload management market stood at USD 45 billion in 2025 and is expected to reach USD 866.1 billion by 2035, marking an impressive absolute dollar opportunity. This surge indicates that businesses are rapidly investing in AI workload solutions to support data-heavy environments and enhance the scalability of AI systems. Demand for AI workload management will be fueled by the need for seamless integration, intelligent load balancing, and optimized performance across diverse cloud infrastructures. The market’s meteoric growth suggests that the companies developing these AI-driven workload management tools will become indispensable partners for enterprises looking to improve their technological infrastructure and support complex, high-demand applications over the next decade.

| Item | Value |

|---|---|

| Market Value (2025) | USD 45 billion |

| Forecast Value (2035) | USD 866.1 billion |

| Forecast CAGR (2025–2035) | 34.4% |

The AI workload management market has seen significant growth as an integral part of the broader AI-driven technological ecosystem. Within the artificial intelligence market, AI workload management accounts for approximately 6.4%, as the increasing complexity of AI models and applications demands efficient orchestration, load balancing, and optimization of computing resources. In the cloud computing market, the share is estimated at 7.2%, driven by the rapid adoption of cloud platforms for deploying AI models that require dynamic resource allocation and management. The enterprise software market reflects a penetration of about 5.9%, as AI workload management tools are incorporated into business intelligence and enterprise resource planning (ERP) systems to ensure smooth operation and process automation. Within the IT infrastructure management market, the segment contributes roughly 6.1%, highlighting the critical need for managing infrastructure that can support AI-driven workloads across data centers and hybrid cloud environments. The data analytics market records a share of approximately 5.5%, driven by the increasing reliance on AI models to process, analyze, and interpret large volumes of structured and unstructured data in real-time. Collectively, these industries show that the AI workload management market represents around 31.1% across these parent markets, reinforcing its essential role in ensuring the smooth, efficient, and scalable operation of AI applications. Adoption has been driven by the need to optimize performance, reduce downtime, and ensure seamless integration across varied platforms, making AI workload management a key component for enterprises aiming to capitalize on AI's potential.

Market expansion is being supported by the exponential growth in AI model complexity and computational requirements that necessitate sophisticated workload management solutions. Organizations are deploying AI applications across multiple use cases simultaneously, creating complex resource allocation challenges that require intelligent orchestration and optimization. The increasing adoption of machine learning, deep learning, and generative AI models is driving demand for systems that can efficiently manage computational resources, optimize performance, and reduce operational costs.

The shift toward hybrid and multi-cloud architectures is creating opportunities for advanced workload management platforms that can optimize resource utilization across different computing environments. The growing emphasis on real-time AI applications and edge computing is requiring sophisticated workload distribution and management capabilities. Regulatory compliance requirements and the need for transparent AI operations are driving demand for comprehensive workload monitoring and governance solutions.

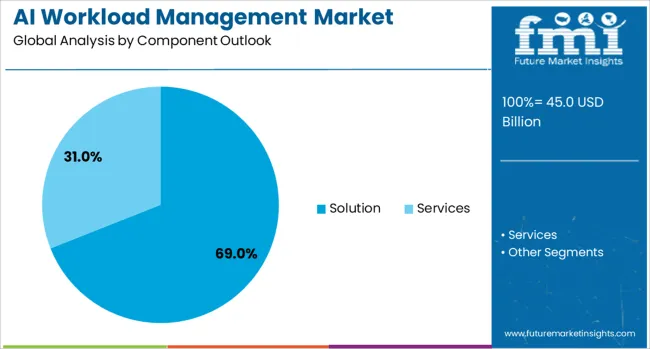

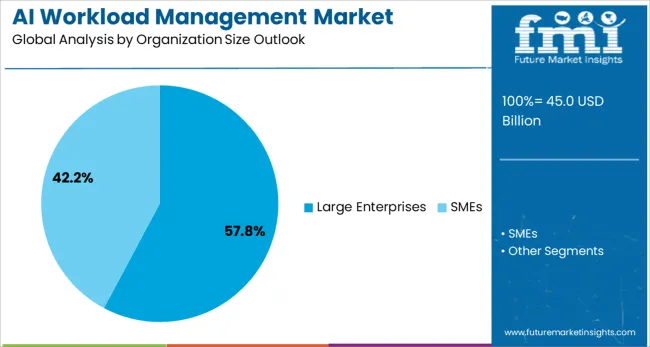

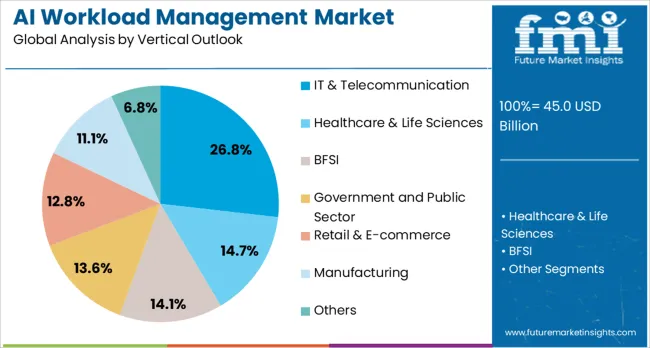

The market is segmented by component, organization size, deployment, vertical, and region. By component, the market is divided into solution and services. Based on organization size, the market is categorized into large enterprises and SMEs (Small and Medium Enterprises). In terms of deployment, the market is segmented into cloud and on-premises. By vertical, the market is classified into IT & telecommunication, healthcare & life sciences, BFSI (Banking, Financial Services, and Insurance), government and public sector, retail & e-commerce, manufacturing, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Solution segment is projected to account for 69% of the AI Workload Management market in 2025. This leading share is supported by the primary demand for comprehensive software platforms that provide workload orchestration, resource optimization, and automated scaling capabilities. The solution segment includes workload scheduling software, resource management platforms, performance optimization tools, and integrated AI operations management systems. Organizations prioritize investing in robust solution platforms that can handle complex AI workloads and provide comprehensive management capabilities across their technology infrastructure.

Large enterprises are expected to represent 58% of AI workload management spending in 2025. This dominant share reflects the substantial computational requirements and complex AI implementations typically found in large organizations. Large enterprises operate multiple AI initiatives simultaneously, require sophisticated resource optimization, and have the budget to invest in comprehensive workload management platforms. The segment benefits from having dedicated IT teams, complex infrastructure requirements, and the need for enterprise-grade solutions that can scale across global operations.

Cloud deployment is projected to contribute 79% of the market in 2025, representing the preferred deployment model for AI workload management solutions. This dominance reflects the scalability, flexibility, and cost-effectiveness advantages of cloud-based platforms for managing variable AI workloads. Cloud deployment enables organizations to access virtually unlimited computational resources, implement elastic scaling, and leverage managed services from cloud providers. The segment benefits from reduced infrastructure maintenance requirements and the ability to rapidly scale resources based on workload demands.

IT & telecommunication sector is estimated to hold 27% of the market share in 2025. This significant share reflects the technology sector's leadership in AI adoption and the complex workload management requirements of technology companies. IT organizations typically operate multiple AI development projects, require sophisticated resource optimization for software development and testing, and serve as early adopters of emerging workload management technologies. The segment includes cloud service providers, software companies, and telecommunications firms that require advanced workload orchestration capabilities.

The AI workload management market has been driven by the increasing need for businesses to optimize IT operations, enhance productivity, and manage complex workloads in dynamic environments. Demand has surged with the rise of cloud computing, multi-cloud strategies, and high-performance computing (HPC) applications. Opportunities are being unlocked in automation, data analytics, and performance optimization. Emerging trends include AI-driven resource allocation, real-time monitoring, and predictive scaling. However, challenges related to integration complexity, data security, and performance overhead continue to impede adoption, particularly in smaller enterprises and legacy systems.

The demand for AI-powered workload management solutions has been significantly shaped by businesses seeking to enhance operational efficiency, optimize resource allocation, and reduce costs. In opinion, enterprises are increasingly turning to AI to streamline complex workloads in data centers, cloud environments, and hybrid systems. The demand has been reinforced by the growing reliance on cloud services, where scaling resources automatically to meet fluctuating demand has become essential for cost-efficiency. AI-driven tools are enabling organizations to analyze, prioritize, and allocate computing resources dynamically across systems, thus improving productivity and reducing manual intervention. High-performance computing applications, which require efficient distribution of resources, have also contributed to this rising demand. Overall, the push for better workload optimization in increasingly complex IT environments is driving the growth of the AI workload management market.

Opportunities in the AI workload management market have been identified through automation, data analytics, and enhanced real-time management capabilities. Cloud service providers and large enterprises have been observed leveraging AI to automate resource provisioning, monitoring, and optimization tasks that were once performed manually. In opinion, automation has presented an opportunity to eliminate bottlenecks, reduce operational costs, and improve responsiveness. Data analytics further enhances decision-making by analyzing workload patterns and making proactive adjustments to improve resource utilization. Real-time monitoring of workloads enables dynamic scaling, ensuring systems can respond to demand fluctuations swiftly. These opportunities are further amplified by the increasing use of multi-cloud and hybrid cloud strategies, which require more sophisticated tools to manage diverse resources and workloads. Overall, these opportunities are expected to drive market growth and enhance competitiveness across industries.

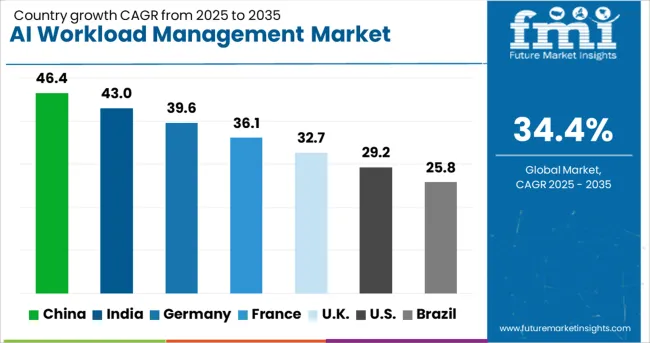

| Countries | CAGR (2025-2035) |

|---|---|

| China | 46.4 |

| India | 43 |

| Germany | 39.6 |

| France | 36.1 |

| UK | 32.7 |

| USA | 29.2 |

| Brazil | 25.8 |

The global AI workload management market is expected to grow robustly from 2025 to 2035, with countries showcasing varying growth rates. China leads with a staggering CAGR of 46.4%, followed by India at 43% and Germany at 39.6%. France records a growth rate of 36.1%, while the United Kingdom shows 32.7%. The United States grows at 29.2%, and Brazil registers 25.8%. Expansion is driven by the increasing need for efficient resource allocation, workload optimization, and scalable AI infrastructure in enterprises. Emerging markets like China and India are experiencing rapid adoption due to large-scale digital transformation and AI investment, while developed markets focus on enterprise-grade, multi-cloud, and hybrid infrastructure solutions for advanced workload management.

The report covers an in-depth analysis of 40+ countries; the top-performing countries are highlighted below.

The AI workload management market in China is expanding at an extraordinary CAGR of 46.4%, propelled by the country’s rapid digital transformation and massive investments in AI infrastructure. Chinese enterprises are increasingly deploying workload management solutions to optimize computing resources, streamline data processing, and enhance system performance across industries such as manufacturing, finance, and e-commerce. Government-backed AI research and development initiatives, combined with the country's growing emphasis on automation, further bolster market adoption. China’s burgeoning tech ecosystem, bolstered by AI research centers and local enterprises, positions it as a global leader in AI workload management solutions.

The AI workload management market in India is growing at a CAGR of 43%, driven by widespread digitalization and the need to manage complex workloads across rapidly evolving industries such as IT, telecom, and financial services. Indian enterprises are adopting AI workload management systems to enhance resource allocation, manage high volumes of data, and ensure efficient AI model training. Market growth is supported by the increasing push for cloud adoption, government-led AI initiatives, and the growth of AI-powered startups. As India continues to invest in building smart cities and digital economies, the need for advanced workload management technologies is expected to increase.

The AI workload management market in Germany is projected to grow at a CAGR of 39.6%, with industries such as automotive, manufacturing, and financial services leading adoption. German enterprises are implementing AI-driven solutions to manage workloads efficiently, optimize data pipelines, and ensure high computational performance in mission-critical applications. Growth is further fueled by strong investments in Industry 4.0, the rise of smart factories, and the country’s focus on integrating AI into both traditional and emerging industries. Regulatory frameworks ensuring the ethical use of AI also contribute to the safe and compliant deployment of workload management solutions.

The AI workload management market in France is expanding at a CAGR of 36.1%, fueled by the need for efficient management of AI workloads across industries such as healthcare, energy, and public services. French organizations are adopting advanced AI tools to balance computing resources, reduce latency, and improve efficiency in real-time data processing. Strong government support for digital infrastructure, AI research, and automation technologies further bolsters market growth. France’s emphasis on data privacy regulations and ethical AI adoption also drives the need for secure and efficient workload management solutions.

The AI workload management market in the United Kingdom is growing at a CAGR of 32.7%, driven by the need for effective resource management, especially in the financial services, retail, and telecom sectors. UK enterprises are increasingly adopting AI solutions to optimize workloads, improve real-time decision-making, and enhance system scalability. Growth is supported by the UK’s strong digital infrastructure, AI research initiatives, and its focus on providing secure, scalable cloud-based solutions. Additionally, the UK government’s emphasis on innovation in AI and machine learning applications for various industries further drives market demand.

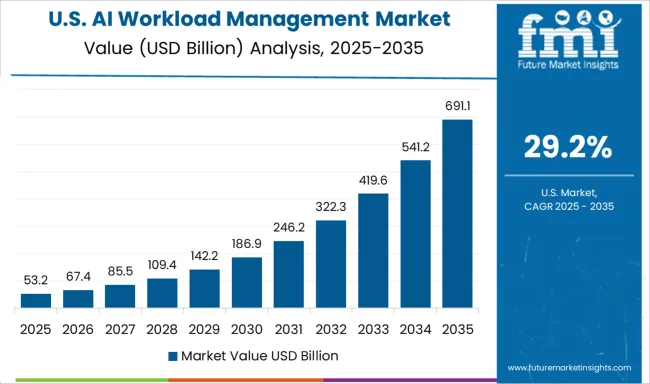

The AI workload management market in the United States is expanding at a CAGR of 29.2%, supported by increasing demand for AI-powered automation and workload optimization in cloud and data center environments. USA companies are leveraging advanced workload management systems to ensure efficient scaling of AI infrastructure, improve data processing speeds, and enhance AI model performance. The strong presence of tech giants, continuous advancements in AI research, and the rise of AI-as-a-service platforms contribute significantly to the market's growth. Furthermore, the USA government’s focus on fostering AI innovation through various funding programs accelerates AI workload management adoption.

The AI workload management market in Brazil is projected to grow at a CAGR of 25.8%, with industries like finance, retail, and telecom leading the charge in adopting AI-powered workload solutions. Brazilian enterprises are increasingly leveraging workload management systems to scale their AI infrastructure and optimize data flows for better performance and decision-making. Growth is reinforced by the country’s increasing focus on digitalization, expanding cloud infrastructure, and the rise of data-driven solutions. As Brazil continues to invest in AI, particularly in sectors like banking and e-commerce, the demand for advanced workload management systems is expected to accelerate.

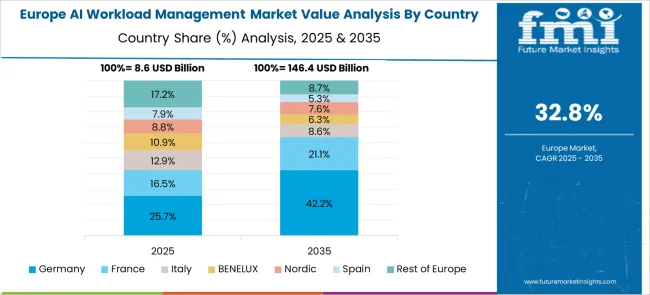

The AI workload management market in Europe is valued at approximately USD 5 billion in 2025, is projected to reach significantly higher valuations by 2035 with a strong CAGR of around 33.1% from 2025 to 2035 and sustained growth thereafter. Germany remains the dominant market due to its advanced industrial and IT infrastructure, prioritizing hybrid and multi-cloud AI solutions within a strict regulatory framework like GDPR. France continues to invest heavily in AI workload optimization, propelled by widespread digital transformation. The UK’s rapid expansion is driven by innovation hubs and cloud growth, while Southern, Eastern Europe, and the Nordics show rising adoption, focusing on sustainability and ethical AI practices through 2035.

The AI workload management market is being shaped by a mix of cloud service providers, hardware manufacturers, and AI processing innovators competing for efficient AI resource allocation and performance optimization. Amazon Web Services (AWS), Microsoft, and Google are being positioned as industry leaders through their vast cloud infrastructure and AI management platforms that optimize resource distribution, workload balancing, and automated scaling for AI-intensive applications. IBM Corporation and Hewlett Packard Enterprise are being recognized for their hybrid cloud solutions, combining on-premise data centers with cloud-native AI workloads, ensuring seamless integration for enterprises. NVIDIA Corporation and Advanced Micro Devices (AMD) are being directed toward AI-driven hardware acceleration, offering specialized GPUs and chipsets for workload processing that boost performance across deep learning, neural networks, and data analytics. Dell Inc., Lenovo, and Huawei Technologies are being noted for high-performance computing (HPC) systems and AI hardware that provide robust on-site infrastructure for data centers, focusing on energy efficiency and workload consolidation. Competition is being defined by platform scalability, hardware acceleration, and cloud-native flexibility, while leadership is being reinforced through resource optimization, processing speed, and integrated AI tools.

| Item | Value |

|---|---|

| Quantitative Units | USD 45 billion |

| Component Outlook | Solution, Services |

| Organization Size Outlook | Large Enterprises, SMEs |

| Deployment Outlook | Cloud, On-premises |

| Vertical Outlook | IT & Telecommunication, Healthcare & Life Sciences, BFSI, Government and Public Sector, Retail & E-commerce, Manufacturing, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Amazon Web Services Inc., Microsoft, Google, IBM Corporation, Dell Inc., Hewlett Packard Enterprise Development LP, Lenovo, Huawei Technologies Co. Ltd., NVIDIA Corporation, Advanced Micro Devices Inc. |

| Additional Attributes | Revenue analysis by component, organization size, deployment model, and vertical segments, regional demand patterns across major technology markets, competitive positioning with cloud service providers, infrastructure companies, and AI platform vendors, enterprise preferences for managed versus self-managed workload solutions, integration with advanced machine learning frameworks and automated optimization systems, innovations in edge computing orchestration and distributed AI management, and adoption of quantum computing integration with hybrid workload management capabilities. |

The global AI workload management market is estimated to be valued at USD 45.0 billion in 2025.

The market size for the AI workload management market is projected to reach USD 866.1 billion by 2035.

The AI workload management market is expected to grow at a 34.4% CAGR between 2025 and 2035.

The key product types in AI workload management market are solution and services.

In terms of organization size outlook, large enterprises segment to command 57.8% share in the ai workload management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Airway Management Devices Market Growth – Demand & Industry Forecast 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

Railways Management System Market Report – Trends & Forecast 2017-2022

Air Traffic Management Market Size and Share Forecast Outlook 2025 to 2035

AI in Fraud Management Market Size and Share Forecast Outlook 2025 to 2035

Dairy Herd Management Market Analysis – Size, Share & Forecast 2024-2034

Campaign Management Software Market

Airline Crisis Management Software Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Management Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Management BPO Market Analysis 2025 to 2035 by Outsourcing Model, Application, Service Type, Enterprise Size & Region

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Mobile Campaign Management Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Central Pain Syndrome Management Market – Size, Share & Growth 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA