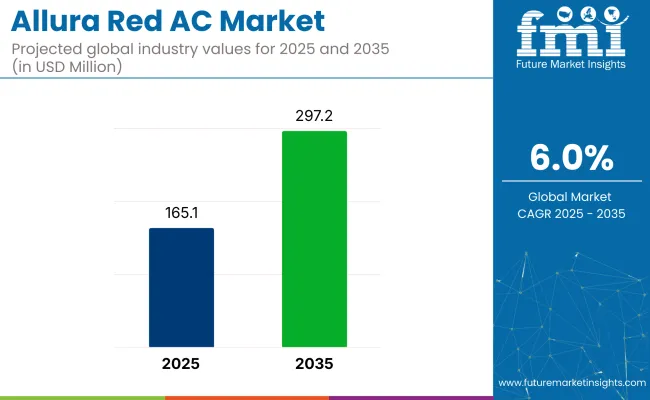

The global allura red ac market was valued at USD 140.0 million in 2022, growing at 5.2% in 2024 and expected to reach USD 165.1 million by 2025. The industry is projected to expand at a 6.0% CAGR during 2025 to 2035, totaling USD 297.2 million by 2035.

Used extensively in food and beverage industries, allura red ac adds vibrant red hues to products like confectionery, soft drinks, pastries, and processed snacks, especially appealing to children and young adults. Companies like Sensient Technologies and Dynemic Products focus on enhancing production efficiency while meeting regulatory standards to ensure product consistency and safety.

The allura red ac industry is heavily concentrated in the food and beverage sector, which accounts for approximately 65-70% of total demand. This includes its use in confectionery, soft drinks, flavored dairy, and bakery products. The cosmetics and personal care segment indicate about 10% of the market, where the dye is used in lipsticks, creams, and shampoos.

Pharmaceuticals contribute another 8-10%, mainly in tablet coatings and syrups. The animal feed sector holds a modest 5-7% share, while industrial applications, such as textiles and inks, account for the remaining 5-8%. This distribution reflects the strong regulatory acceptance of allura red ac in consumables and its limited, but strategic, presence in non-food sectors.

Ramon Laguarta, CEO of PepsiCo, confirmed the company’s ongoing efforts to remove artificial colors from its products. “As we continue to evolve our product portfolio, over 60% of our USA food lineup is now free from artificial colors. Brands like Lay’s and Tostitos will complete the phase-out by the end of this year, reflecting our commitment to aligning with consumer demand for cleaner, more natural ingredients,” Laguarta stated.

The shift toward specialty formulations to meet industry-specific demands, such as improved solubility in beverages and stability in bakery products, is driving growth in the allura red ac segment. To combat increasing regulatory scrutiny and consumer pushback against artificial coloring, companies are focusing on transparency in labeling and adherence to regulated usage levels.

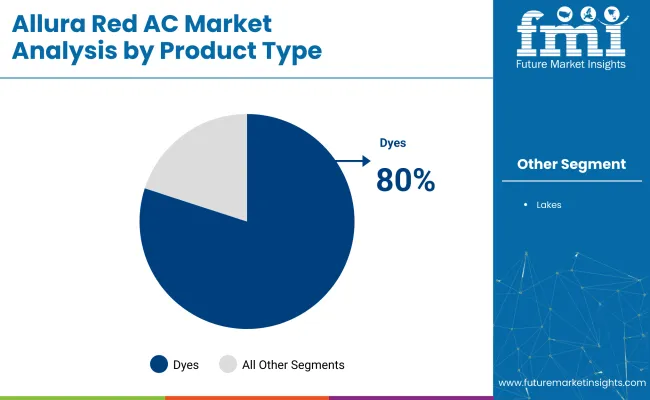

The industry in 2025 will be driven by dyes holding 80% share and food-grade formulations accounting for 50%. Beverage applications will lead usage, while cans dominate packaging with a 55% share. Hypermarkets and supermarkets signify 60% of distribution. Growth is supported by regulatory approvals and steady demand in processed food and drink sectors.

Dyes are projected to account for nearly 80% of the allura red ac product segment in 2025, supported by steady consumption in soft drinks, fruit syrups, and flavored dairy. FMCG producers in the United States, Germany, and India continue to standardize synthetic dyes due to cost-efficiency and regulatory allowances.

The food grade allura red ac is expected to hold 50% of the industry share in 2025, driven by its use in packaged foods, bakery coatings, jellies, and dessert toppings. Products compliant with FDA, EFSA, and FSSAI approvals have lower entry barriers and broader distribution opportunities.

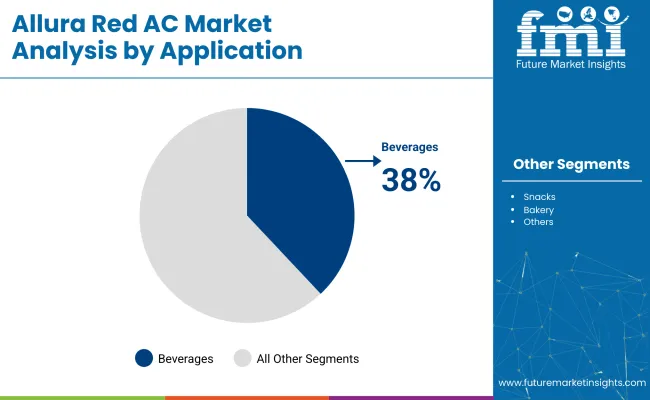

The beverage segment is anticipated to generate 38% of allura red ac’s demand in 2025. This segment comprises carbonated soft drinks, flavored waters, energy drinks, and sports beverages. The United States beverage sector alone accounts for 42% of synthetic colorant imports, led by demand for visual branding and flavor alignment.

Cans are projected to secure 55% of allura red ac packaging demand in 2025, due to their compatibility with carbonated beverage formats. Lightweight aluminum offers a low-reactivity surface that reduces pigment degradation, extending shelf life in tropical regions.

Hypermarkets and supermarkets are expected to capture the 60% of allura red ac’s distribution share in 2025. Retail chains such as Walmart, Carrefour, and Big Bazaar prioritize visual merchandising, which boosts off-the-shelf movement of color-enhanced products.

Allura Red AC experiences growth due to expanding food and beverage applications, increased regulatory scrutiny on additives, and innovation by key manufacturers. Rising consumer preference challenges purity standards, while industry leaders introduce cleaner, high performance formulations.

Recent Industry trends and innovations by key players

Frictions Slowing Allura Red AC’s Commercial Momentum

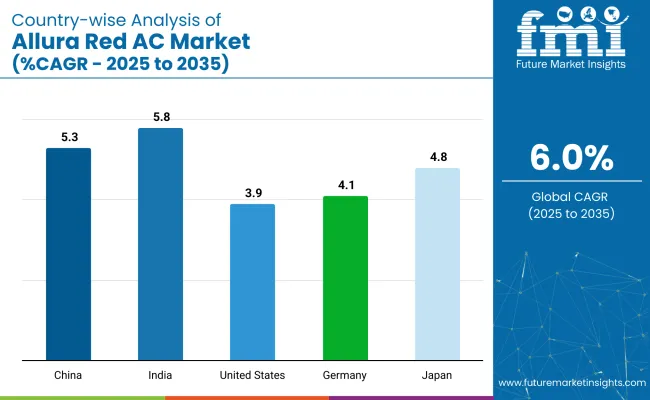

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| China | 5.3% |

| India | 5.8% |

| Germany | 4.1% |

| Japan | 4.8% |

India’s momentum is driven by the expanding processed food and beverage industries, alongside rising demand for vibrant food products. China follows closely, with a projected 5.3% CAGR, supported by its growing food production sector and increasing demand for food additives. In contrast, developed economies such as Japan (4.8%), Germany (4.1%), and the United States (3.9%) are expanding at a steady 0.95-1.03x rate.

The United States leads the demand for allura red ac, driven by the growing popularity of artificial food coloring in the food and beverage sectors. Japan focuses on high-quality additives for vibrant food products, while Germany and the United States benefit from steady demand in both the food and beverage industries. The industry adds significant value by 2035, both high-growth regions like India and China, and stable demand from OECD countries will shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The allura red ac industry in the United States is expected to grow at a CAGR of 3.9% between 2025 and 2035. While consumer preference increasingly shifts toward natural food colors, synthetic dyes such as allura red ac remain widely used due to their cost-efficiency and color stability. The USA Food and Drug Administration (FDA) enforces strict controls, especially in beverages, confectionery, and over-the-counter pharmaceuticals.

The industry in China is forecast to expand at a CAGR of 5.3% from 2025 to 2035, driven by demand from domestic processed food sectors. With fewer regulatory hurdles compared to OECD nations, synthetic dyes are used extensively in beverage concentrates, packaged snacks, and dairy-based products.

The industry in India is set to grow at a CAGR of 5.8% from 2025 to 2035, the highest among the analyzed countries. Broad consumption across traditional sweets, instant foods, and street beverages continues to support volume expansion. The Food Safety and Standards Authority of India (FSSAI) regulates permitted limits, but synthetic dye penetration remains high in cost-sensitive regions.

Germany’s allura red ac industry is projected to grow at a CAGR of 4.1% through 2035. The European Union’s tight food additive regulations restrict synthetic dye use, but budget-tier applications persist. Demand is concentrated in discount private-label products, flavored processed meats, and imported confectionery.

The red40 industry in Japan is forecast to expand at a CAGR of 4.8% from 2025 to 2035. Although consumer sentiment in Japan leans toward natural food colors, synthetic dyes remain permitted in approved food categories under guidelines from Japan’s Ministry of Health, Labour and Welfare.

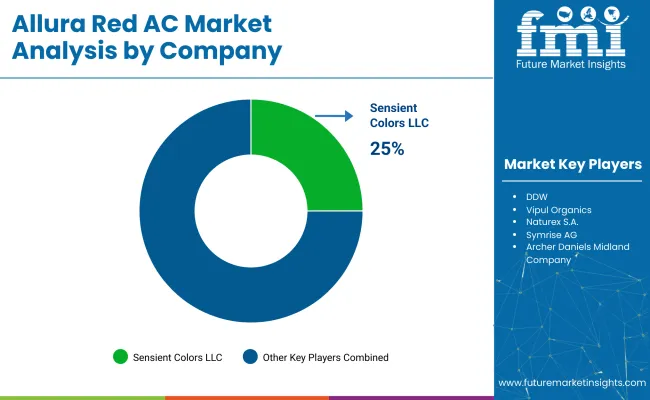

Leading Player -Sensient Colors LLC. Holding 20-25% Industry Share

The industry is shaped by both well-established players and new entrants, with key industry leaders such as Archer Daniels Midland, Sensient Colors, and Symrise driving growth through continuous innovation and diverse product portfolios. R&D investments are a primary focus, as seen in Symrise’s launch of new natural colorants aimed at meeting the increasing demand for clean-label products.

Companies like DIC Corporation and Chr. Hansen have expanded their global presence, with DIC’s acquisition of BASF’s colorants division further consolidating its standing. Despite the dominance of major players, the sector remains fragmented, with numerous smaller companies competing for market share.

High capital investment, complex regulatory requirements, and the demand for consistent innovation create significant entry barriers within the red 40 sector. Companies face ongoing pressure to meet stringent food safety standards while addressing evolving consumer preferences for natural and plant-based products. The competitive environment demands that both established companies and emerging players prioritize continuous product development and strategic partnerships to maintain the industry position.

Recent Allura Red AC Industry news

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 165.1 million |

| Projected Market Size (2035) | USD 297.2 million |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Types Analyzed | Dyes, Lakes |

| Grades Analyzed | Food Grade, Pharmaceutical Grade, Feed Grade, Industrial Grade |

| Applications Analyzed | Beverage, Bakery, Snacks and Cereals, Candy/Confectionery, Dairy, Fruit Preparations/Fillings, Meat, Poultry, Fish, and Eggs, Potatoes, Pasta and Rice, Sauces, Soups, and Dressings, Seasonings, Pet Food, Others |

| Packaging Types Analyzed | Cans, Glass Bottles, Others |

| Distribution Channels Analyzed | HoReCa (Hotels, Restaurants, Cafés), Cafés, Bakeries & Patisseries, Hypermarkets / Supermarkets, Convenience Stores, Wholesale Stores, Online Retail |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players | Archer Daniels Midland Company, Allied Biotech Corporation, Sensient Colors LLC, Symrise AG, Chr. Hansen Holding A/S, DIC Corporation (BASF SE), BioconColors, DSM, DDW, Vipul Organics, Naturex S.A., San- Ei Gen F.F.I., Inc., Others |

| Additional Attributes | Dollar sales growth by application (beverages, confectionery), regional demand trends, competitive landscape, pricing strategies, distribution channel insights, product innovation, regulatory landscape, and application-specific growth drivers. |

DyesandLakes.

Food Grade, Pharmaceutical Grade, Feed Grade, and Industrial Grade.

Beverage, Bakery, Snacks, and Cereals, Candy/Confectionery, Dairy, Fruit Preparations/Fillings, Meat, Poultry, Fish, and Eggs, Potatoes, Pasta, and Rice, Sauces, Soups, and Dressings, Seasonings, Pet Food, and Others.

Cans, Glass Bottles, andOthers.

HoReCa (Hotels, Restaurants, and Cafés), Cafés, Bakeries & Patisseries, Hypermarkets / Supermarkets, Convenience Stores, Wholesale Stores, and Online Retail.

North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and theMiddle East & Africa.

The industry size is projected to be USD 165.1 million in 2025 and USD 297.2 million by 2035.

The expected CAGR is 6.0% from 2025 to 2035.

Dyes hold the largest industry share at 80% in 2025.

Sensient Colors LLC is the leading company in the industry, holding 20-25% industry share.

India is the fastest-growing industry with a projected CAGR of 5.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Redness-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Butter Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Cheese Market Size, Growth, and Forecast for 2025 to 2035

Reduced Fat Dairy Market Analysis by Ice cream, Yogurt, Skim milk and Others through 2035

Reduced Iron Powder Market Analysis by Product, Application and Distribution Channel Through 2035

Redox Meter Market

Reduced Fat Cheeses Market

Red Berries Market Trends – Growth, Demand & Health Benefits

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Red Clover Extracts for Hormonal Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Red Vine Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Dredging Market Size and Share Forecast Outlook 2025 to 2035

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Quality Assurance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Predictive Touch Market Size and Share Forecast Outlook 2025 to 2035

Dredging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Predictive Analytics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA