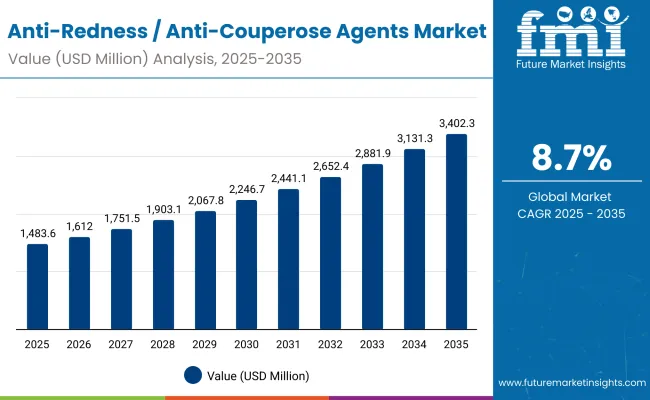

A valuation of USD 1,483.6 Million is anticipated for the Anti-Redness / Anti-Couperose Agents Market in 2025, with the size projected to reach USD 3,402.3 Million by 2035. This reflects an increase of nearly USD 1,918.7 Million over the decade, equating to an overall growth of 193%. The expansion corresponds to a CAGR of 8.7%, indicating a sustained rise in demand for redness-reducing actives across global formulation pipelines.

Anti-Redness / Anti-Couperose Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Redness / Anti-Couperose Agents Market Estimated Value in (2025E) | USD 1,483.6 Million |

| Anti-Redness / Anti-Couperose Agents Market Forecast Value in (2035F) | USD 3,402.3 Million |

| Forecast CAGR (2025 to 2035) | 8.70% |

The market trajectory signals a doubling of size within ten years, reinforcing its position as a high-growth segment within the broader skin care ingredients space.

During the initial phase from 2025 to 2030, the market value is set to expand from USD 1,483.6 Million to USD 2,246.7 Million, adding USD 763.1 Million. This period will contribute 40% of the total decade growth, underpinned by steady adoption of capillary and vasoprotective ingredients and the early shift toward encapsulated delivery systems. The emphasis by formulators on proven efficacy in sensitive and rosacea-prone care is expected to consolidate demand during this period.

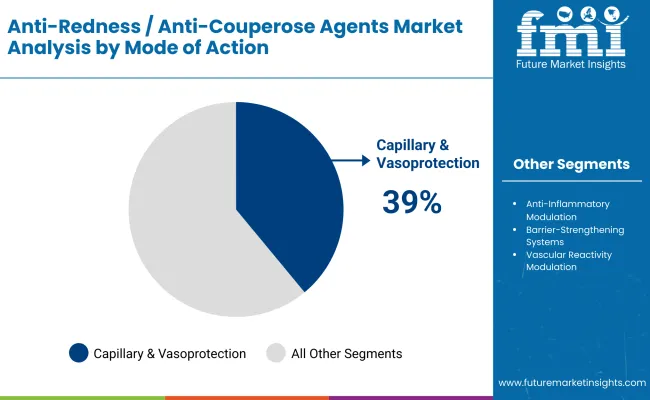

The second half from 2030 to 2035 is forecast to deliver USD 1,155.6 Million, accounting for 60% of the total decade growth. Market size is projected to advance from USD 2,246.7 Million in 2030 to USD 3,402.3 Million in 2035. This acceleration will be powered by strong penetration of encapsulated and polymer-complexed raw materials, together with intensified use of botanical actives supported by traceability and clean-label positioning. Capillary & vasoprotection will remain dominant with 39.0% share, while encapsulated delivery systems are expected to lead with 46.0% share in 2025.

From 2020 to 2024, the Anti-Redness / Anti-Couperose Agents Market progressed steadily as dermocosmetic adoption increased and demand for sensitive-skin formulations intensified. By 2025, valuation is expected at USD 1,483.6 Million, with accelerated growth projected as encapsulated and botanical actives gain stronger penetration. Competitive dynamics are expected to remain fragmented, although leading suppliers are likely to secure advantage through standardized efficacy data, advanced delivery technologies, and sustainable sourcing models.

Regional growth is anticipated to be highest in Asia-Pacific, supported by expanding consumer awareness and evolving cosmetic regulatory frameworks, while North America and Europe are expected to retain dominance through high-value formulations. By 2035, the market size is forecast to more than double, with differentiation projected to rely less on single-molecule innovation and more on ecosystem capabilities such as supply resilience, green chemistry, and clinically validated claims.

Growth in the Anti-Redness / Anti-Couperose Agents Market is being fueled by rising demand for clinically validated solutions addressing sensitive and rosacea-prone skin conditions. Increasing prevalence of skin barrier concerns, combined with heightened consumer awareness of redness triggers such as pollution, stress, and climate fluctuations, has been driving consistent adoption by formulators.

Strong emphasis is being placed on actives that provide capillary and vasoprotection, with encapsulated systems enabling greater stability, controlled release, and reduced irritation risks. Botanical and biotechnology-derived inputs are being prioritized due to clean-label alignment and regulatory acceptance, strengthening their role in ingredient innovation.

Expanding dermocosmetic channels and the integration of these actives into serums, lotions, and gels have reinforced their position within skin care formulations. Competitive differentiation is expected to be achieved through sustainable sourcing, traceability, and proof-backed claims, ensuring that long-term growth is supported by both technological innovation and evolving consumer trust in sensitive-skin solutions.

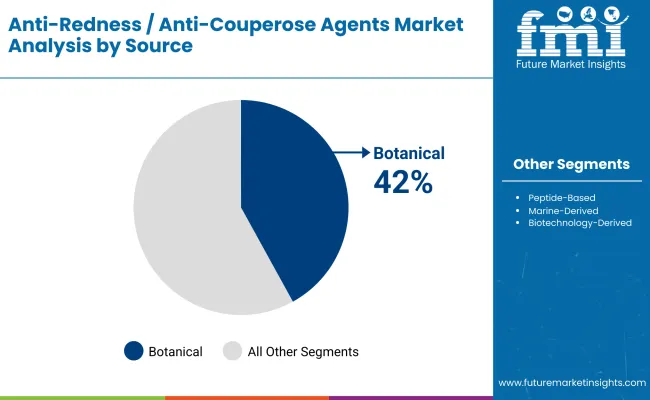

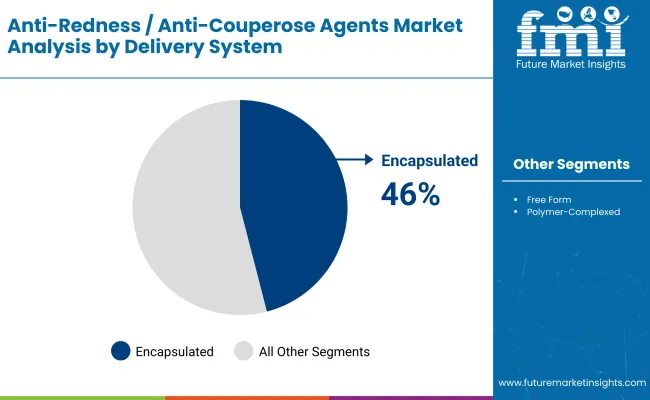

The Anti-Redness / Anti-Couperose Agents Market has been segmented based on mode of action, source, and delivery system to capture the underlying drivers of demand across the ingredient landscape. Each segment highlights the raw material strategies being prioritized by formulators and ingredient suppliers to address sensitive-skin and redness-prone concerns.

While mode of action determines the biological pathway targeted, the source of actives defines alignment with clean-label expectations and efficacy, and the delivery system dictates performance, stability, and consumer tolerance. Together, these segments shape competitive positioning, guide innovation priorities, and reveal where future value creation is most likely to occur within the formulation space.

| Market Value Share, 2025 | Mode of Action |

|---|---|

| Capillary & vasoprotection | 39% |

| Others | 61.0% |

Capillary & vasoprotection held 39.0% share in 2025, valued at USD 588.9 Million, while others accounted for 61.0% at USD 905.0 Million. Mode of action is expected to remain a crucial determinant of demand in the Anti-Redness / Anti-Couperose Agents Market. Growth in vasoprotective actives is anticipated as formulators prioritize improved circulation, visible redness reduction, and barrier resilience in sensitive-skin applications.

Regulatory scrutiny of efficacy claims is expected to accelerate investment in clinical testing, strengthening the segment’s credibility. Broader adoption in leave-on creams, serums, and dermocosmetic platforms is likely to reinforce demand. The segment outlook suggests that vasoprotective actives will remain a strategic priority, supported by their clear link to consumer-perceived results.

| Source | Market Value Share, 2025 |

|---|---|

| Botanical | 42% |

| Others | 58.0% |

Botanical actives commanded 42.0% share in 2025 at USD 369 Million, compared to others with 58.0% share valued at USD 860.49 Million. Source-based segmentation highlights the growing influence of natural actives in driving formulation strategies. Botanical dominance is anticipated to continue due to consumer trust in plant-based actives and alignment with clean-label expectations.

Challenges around supply variability and extraction efficiency are expected to be mitigated through advances in cultivation partnerships and green chemistry. Increased demand for standardized potency and allergen-free profiles is projected to strengthen the role of botanical actives. Other sources are forecast to grow through innovation in peptides and biotech inputs, ensuring a balanced competitive environment.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 46% |

| Others | 54.0% |

Encapsulated delivery systems held 46.0% share in 2025 at USD 533.3 Million, while others accounted for 54.0% at USD 801.14 Million. Delivery systems are projected to play a central role in shaping adoption patterns across the Anti-Redness / Anti-Couperose Agents Market. Encapsulation is expected to gain traction due to its ability to protect actives, enable controlled release, and minimize irritation risks, which are critical in sensitive-skin applications. Advancements in lipid carriers and polymer-complexed systems are projected to further elevate performance, allowing higher stability and improved bioavailability.

The preference of formulators for encapsulated actives is anticipated to intensify as premium dermocosmetic products expand globally. Other delivery formats will remain relevant for cost-sensitive formulations, but premium growth is projected to be centered on encapsulated solutions.

Complexity in ingredient validation and raw material sustainability is reshaping the Anti-Redness / Anti-Couperose Agents Market, even as demand strengthens for clinically proven, skin-friendly actives designed to deliver measurable redness reduction and enhanced dermocosmetic performance across global formulations.

Clinical Validation as a Commercial Imperative

Scientific substantiation is being positioned as a core growth driver within the Anti-Redness / Anti-Couperose Agents Market. Regulatory bodies, dermatologists, and consumers increasingly demand proof of efficacy, compelling ingredient suppliers to invest heavily in standardized trials, in vivo studies, and bioassays. This shift elevates barriers to entry, but it simultaneously strengthens trust in suppliers able to demonstrate measurable outcomes in redness reduction, barrier reinforcement, and skin-calming activity.

Future adoption is expected to be concentrated on actives backed by verifiable data rather than marketing narratives. This dynamic is projected to elevate the value of partnerships between ingredient innovators, clinical testing labs, and dermocosmetic brands, while also embedding efficacy metrics into procurement decisions.

Encapsulation as a Differentiation Strategy

Encapsulation is being redefined as more than a delivery tool; it is now emerging as a platform for market differentiation. Controlled release, reduced irritation, and bioavailability enhancement are enabling formulators to meet both performance and safety expectations in sensitive-skin care. Suppliers with proprietary encapsulation technologies are expected to capture premium margins, as encapsulated actives provide not only improved functional performance but also intellectual property advantages that protect innovation.

The trend signals a transition from commoditized botanical extracts to technologically advanced systems, where value is created through integration of chemistry, material science, and dermatological validation. This is likely to shift competitive advantage toward suppliers with R&D depth and scalable encapsulation capabilities.

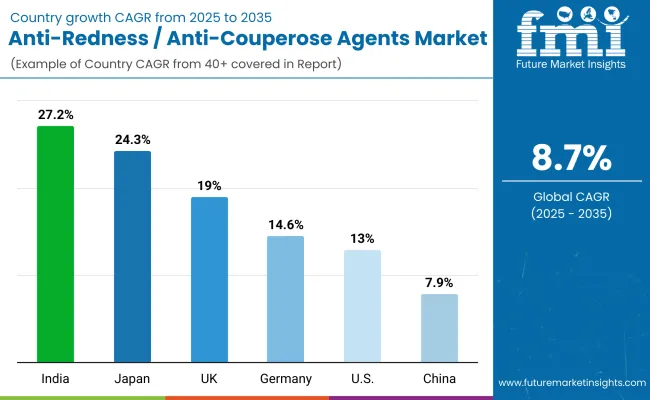

| Country | CAGR |

|---|---|

| China | 7.9% |

| USA | 13.0% |

| India | 27.2% |

| UK | 19.0% |

| Germany | 14.6% |

| Japan | 24.3% |

The Anti-Redness / Anti-Couperose Agents Market displays notable differences in growth trajectories across key countries, shaped by consumer sensitivity awareness, regulatory scrutiny, and the pace of dermocosmetic adoption. India is projected to emerge as the fastest-growing country with a CAGR of 27.2% between 2025 and 2035, reflecting rapid expansion of sensitive-skin care portfolios and heightened interest from global formulators in sourcing botanical actives.

Japan follows closely with a CAGR of 24.3%, supported by advanced cosmetic science, premium product positioning, and high dermatologist engagement. The UK is expected to sustain strong growth at 19.0%, where innovation in clinical-grade formulations aligns with consumer demand for performance-backed dermocosmetics.

Germany is projected at a CAGR of 14.6%, reinforced by strict efficacy and safety standards that elevate demand for clinically validated actives. The USA is expected to grow at 13.0%, reflecting significant opportunities in encapsulation and polymer-complexed systems that address consumer intolerance concerns.

Europe collectively is projected at 12.6% CAGR, with emphasis on sustainability, traceability, and green chemistry supporting demand for raw materials. China is anticipated to grow steadily at 7.9%, with regulatory frameworks focusing on compliance and safety influencing adoption speed. Overall, regional diversification underscores the global potential, with Asia expected to anchor future market acceleration.

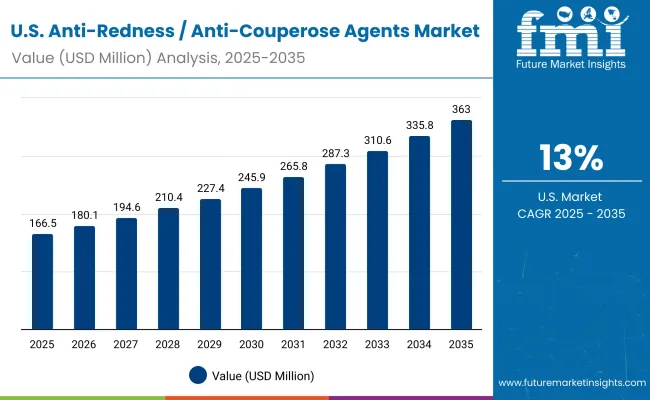

| Year | USA Anti-Redness / Anti-Couperose Agents Market (USD Million) |

|---|---|

| 2025 | 166.59 |

| 2026 | 180.08 |

| 2027 | 194.67 |

| 2028 | 210.44 |

| 2029 | 227.49 |

| 2030 | 245.92 |

| 2031 | 265.84 |

| 2032 | 287.38 |

| 2033 | 310.66 |

| 2034 | 335.83 |

| 2035 | 363.04 |

A CAGR of 8.3% is projected for the Anti-Redness / Anti-Couperose Agents Market in the United States between 2025 and 2035, with market size expected to rise from USD 166.59 Million to USD 363.04 Million. Growth is anticipated to be driven by the integration of clinically validated redness-reducing actives in premium formulations, reinforced by dermatologist endorsements and expanding dermocosmetic channels.

Encapsulation and polymer-complexed delivery systems are being adopted to enhance stability, ensure controlled release, and reduce irritation risks, making them vital for sensitive-skin care innovation. Botanical actives with traceable sourcing are also being prioritized to align with clean-label positioning and evolving transparency requirements.

A CAGR of 19.0% is projected for the Anti-Redness / Anti-Couperose Agents Market in the United Kingdom from 2025 to 2035. Market expansion is expected to be supported by strong adoption of dermocosmetic actives, shaped by clinical validation requirements and consumer preference for science-backed skin care.

Regulatory frameworks that emphasize product safety and allergen transparency are anticipated to strengthen demand for advanced redness-reducing ingredients. Encapsulation is projected to remain pivotal in enabling reduced irritation risk, while botanical actives are forecast to gain further momentum under clean-label and sustainability narratives.

A CAGR of 27.2% is forecast for the Anti-Redness / Anti-Couperose Agents Market in India between 2025 and 2035, marking it as the fastest-growing country in this sector. Rapid expansion is expected as rising consumer awareness of skin sensitivity intersects with increased urban exposure to pollution and stress triggers. Ingredient suppliers are anticipated to benefit from a growing preference for botanically derived actives, supported by India’s strong heritage in plant-based wellness. Global formulators are projected to target India as a sourcing and consumption hub, reinforcing investments in standardized cultivation and local partnerships.

A CAGR of 7.9% is anticipated for the Anti-Redness / Anti-Couperose Agents Market in China over the period 2025 to 2035. Market growth is expected to be driven by the rising prevalence of sensitive skin conditions and increased regulatory focus on safety and compliance in cosmetic ingredients. Local brands are forecast to prioritize redness-reducing actives that combine efficacy with consumer trust in traditional botanical formulations. International suppliers are projected to strengthen collaborations with Chinese formulators, enabling localized innovation and faster regulatory alignment.

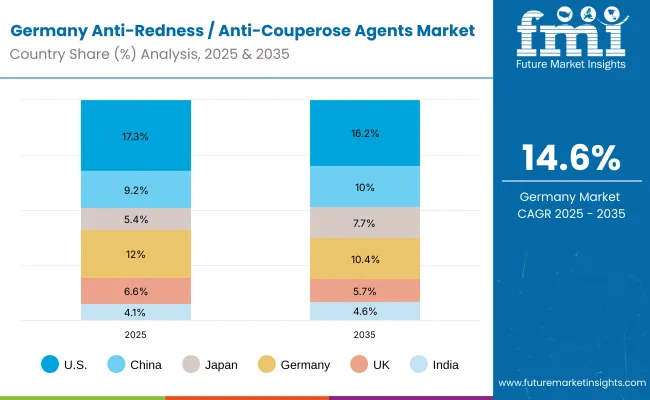

| Country | 2025 |

|---|---|

| USA | 17.3% |

| China | 9.2% |

| Japan | 5.4% |

| Germany | 12.0% |

| UK | 6.6% |

| India | 4.1% |

| Country | 2035 |

|---|---|

| USA | 16.2% |

| China | 10.0% |

| Japan | 7.7% |

| Germany | 10.4% |

| UK | 5.7% |

| India | 4.6% |

A CAGR of 14.6% is projected for the Anti-Redness / Anti-Couperose Agents Market in Germany from 2025 to 2035. Market expansion is expected to be strongly influenced by stringent regulatory frameworks that emphasize product safety, traceability, and proven efficacy. Demand is anticipated to be concentrated on actives backed by robust dermatological data, ensuring alignment with Germany’s clinically driven consumer base. Encapsulation and polymer-complexed delivery systems are projected to capture strong adoption in dermocosmetic applications. Sustainability expectations are also forecast to increase demand for green chemistry and traceable botanical sourcing.

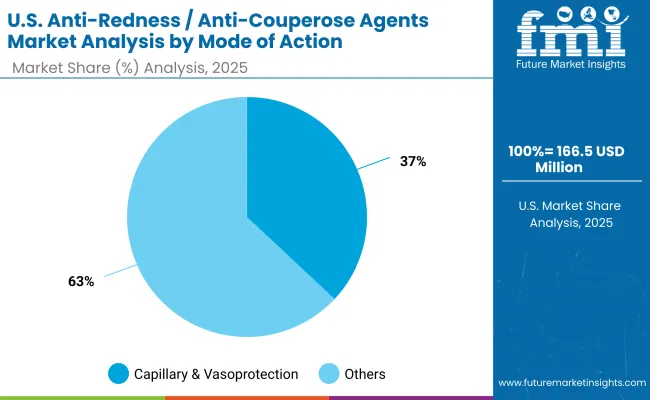

| USA by Mode of Action | Market Value Share, 2025 |

|---|---|

| Capillary & vasoprotection | 37% |

| Others | 63.0% |

The Anti-Redness / Anti-Couperose Agents Market in the United States is projected at USD 166.59 Million in 2025. Capillary & vasoprotection contributes 37% (USD 61.6 Million), while other mechanisms hold 63% (USD 104.95 Million), reflecting stronger adoption of multi-pathway redness control strategies.

This dominance of broader mechanisms stems from the complexity of sensitive-skin conditions, where anti-inflammatory, barrier-strengthening, and vascular modulation are often combined to achieve reliable outcomes.

Formulators are increasingly incorporating blended actives to deliver multi-functional performance, while vasoprotective agents are expected to retain importance due to their visible results on capillary resilience and flushing reduction. Competitive advantage is anticipated to be shaped by the ability of suppliers to integrate vasoprotective ingredients within encapsulated or polymer-complexed systems, ensuring higher tolerability in premium formulations.

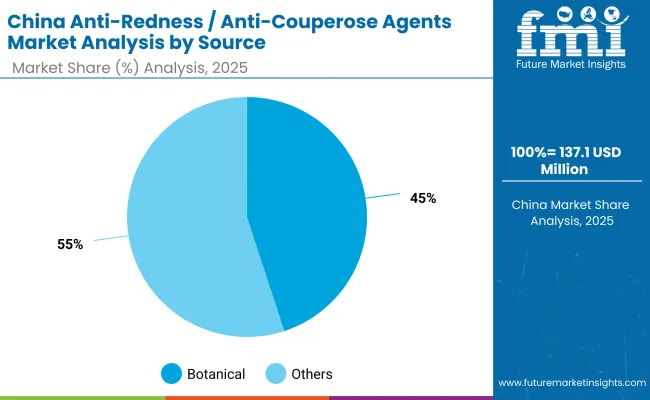

| China by source | Market Value Share, 2025 |

|---|---|

| Botanical | 45% |

| Others | 55.0% |

The Anti-Redness / Anti-Couperose Agents Market in China is projected at USD 137.12 Million in 2025. Botanical actives contribute 45% (USD 61.7 Million), while other sources account for 55% (USD 75.42 Million), reflecting a balanced reliance on natural and synthetic raw materials. Botanical dominance is being reinforced by strong consumer trust in plant-based remedies and alignment with China’s heritage of traditional medicine, which resonates with sensitive-skin care.

At the same time, reliance on peptides, biotech-derived, and marine-sourced actives is being expanded to deliver stability, potency, and standardized efficacy. Formulators are expected to prioritize suppliers that ensure traceability, allergen-free profiles, and sustainable extraction. The competitive landscape is likely to shift toward ingredient providers capable of merging botanical familiarity with advanced delivery systems, enabling premium performance and regulatory compliance.

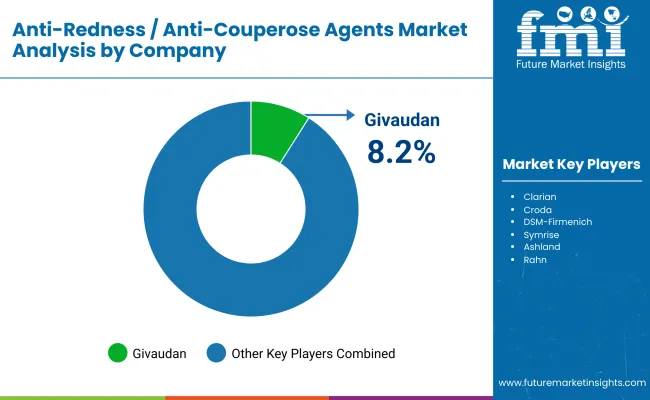

| Company | Global Value Share 2025 |

|---|---|

| Givaudan | 8.2% |

| Others | 91.8% |

The Anti-Redness / Anti-Couperose Agents Market is moderately fragmented, with global leaders, mid-sized innovators, and specialized suppliers competing for share across formulation-driven applications. Global ingredient majors such as Givaudan, Symrise, Croda, and DSM-Firmenich hold notable positions, supported by expansive R&D resources, robust botanical sourcing, and advanced encapsulation technologies. Their strategies are increasingly centered on clinical substantiation, transparent traceability, and sustainability commitments, which are being prioritized by dermocosmetic brands worldwide.

Established mid-sized players, including Ashland, Seppic, Clariant, Lucas Meyer, and Rahn, are focused on niche innovation by delivering multifunctional actives, polymer-complexed delivery systems, and region-specific formulations. These companies are leveraging expertise in sensitive-skin applications and strong regional networks to gain relevance in premium care formulations.

Specialized providers such as Greentech and other botanical-focused suppliers are emphasizing traceability, eco-friendly extraction, and biodiversity partnerships, ensuring alignment with clean-label consumer demand. Their strength lies in agility, customization, and responsiveness to evolving regional regulatory requirements.

Competitive differentiation is shifting from single-ingredient dominance toward integrated ingredient ecosystems that combine efficacy validation, green sourcing, and advanced delivery platforms. Future leadership is expected to favor suppliers capable of aligning innovation with transparent sustainability and clinically validated performance.

Key Developments in Anti-Redness / Anti-Couperose Agents Market

| Item | Value |

|---|---|

| Market Size (2025) | USD 1,483.6 Million |

| Market Forecast (2035) | USD 3,402.3 Million |

| Growth Rate (2025 to 2035) | CAGR 8.7% |

| Mode of Action | Capillary & vasoprotection, Anti-inflammatory modulation, Barrier-strengthening systems, Vascular reactivity modulation |

| Source | Botanical, Peptide-based, Biotechnology-derived, Marine-derived |

| Delivery System | Free form, Encapsulated, Polymer-complexed |

| Physical Form | Solution/concentrate, Powder, Dispersion |

| Application | Leave-on creams & lotions, Serums & ampoules, Gels & essences |

| End-use Industry | Sensitive skin care, Rosacea-prone care, Dermocosmetic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Germany, United Kingdom, Japan |

| Key Companies Profiled | Givaudan, Symrise, Croda, DSM-Firmenich, Ashland, Seppic, Clariant, Lucas Meyer, Rahn, Greentech |

| Additional Attributes | Dollar sales by mode of action, source, and delivery system; adoption trends in dermocosmetics and sensitive-skin care; rising demand for encapsulated delivery; clean-label and traceability focus; segment-specific growth in serums and leave-on creams; sustainability and green chemistry initiatives; regulatory-driven efficacy validation; regional expansion in Asia and North America |

The global Anti-Redness / Anti-Couperose Agents Market is estimated to be valued at USD 1,483.6 Million in 2025.

The market size for the Anti-Redness / Anti-Couperose Agents Market is projected to reach USD 3,402.3 Million by 2035.

The Anti-Redness / Anti-Couperose Agents Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The key product types in the Anti-Redness / Anti-Couperose Agents Market are capillary & vasoprotective actives, anti-inflammatory modulators, barrier-strengthening systems, and vascular reactivity modulators.

In terms of delivery systems, encapsulated actives are expected to command 46% share in the Anti-Redness / Anti-Couperose Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

I/O-Link Market Analysis - Size, Share, and Forecast 2025 to 2035

Breaking Down Market Share in the I/O-Link Industry

CMO/CDMO Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

CMO/CDMO Market Analysis - Size, Share, and Forecast 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

IaaS/Hosting Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

PD-1/PD-L1 Inhibitors Market – Trends, Growth & Forecast 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Stoma/Ostomy Care Market Growth - Trends & Forecast 2025 to 2035

Vacuum/Gas Flushing And Sealing Machine Market

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

802.15.4/ZigBee Market Size and Share Forecast Outlook 2025 to 2035

Starches/Glucose Market

EDM Oils/Fluids Market

Shotcrete/Sprayed Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA