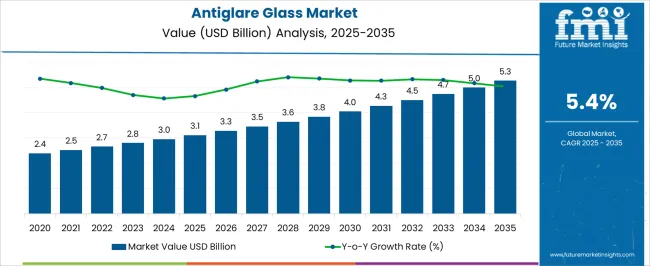

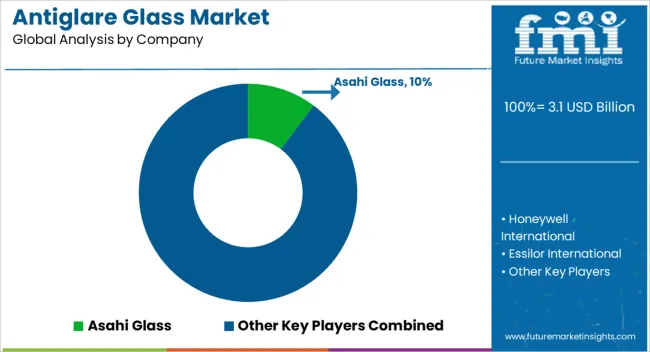

The antiglare glass market is valued at USD 3.1 billion in 2025 and is anticipated to reach USD 5.3 billion by 2035, registering a CAGR of 5.4%. A detailed analysis of the contribution of volume versus price growth highlights the relative impact of sales expansion and pricing trends on overall market value. From 2021 to 2025, the market grows from USD 2.4 billion to 3.1 billion, with intermediate values of USD 2.5 billion, 2.7 billion, 2.8 billion, and 3.0 billion. During this early phase, growth is largely volume-driven, supported by rising demand from automotive, consumer electronics, and architectural sectors. Increasing production capacity, enhanced distribution channels, and expanding application in display technologies contribute to steady unit sales.

Between 2026 and 2030, values rise from USD 3.1 billion to 4.0 billion, passing through USD 3.3 billion, 3.5 billion, 3.6 billion, and 3.8 billion. In this mid-phase, both volume expansion and price adjustments influence market growth, with premium antiglare solutions, technological improvements, and higher specification requirements driving price contributions. From 2031 to 2035, the market progresses from USD 4.3 billion to 5.3 billion, with intermediate values of USD 4.3 billion, 4.5 billion, 4.7 billion, and 5.0 billion. In the latter period, price growth will play a more pronounced role as innovations, high-performance coatings, and specialty glass products allow suppliers to command higher margins, while volume growth continues steadily.

| Metric | Value |

|---|---|

| Antiglare Glass Market Estimated Value in (2025 E) | USD 3.1 billion |

| Antiglare Glass Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The antiglare glass market is expanding at a steady pace, supported by rising demand across electronics, automotive, and architectural applications. Increasing consumer awareness of visual comfort, alongside the need to reduce reflections and glare in high-light environments, has accelerated product adoption.

Technological developments in surface treatments and coating methods have enabled improved optical clarity without compromising durability, expanding usage across diverse end-user industries. Consumer electronics manufacturers are integrating antiglare glass into display panels and touchscreens to enhance user experience, while automotive applications are benefiting from enhanced driver visibility under varying light conditions.

Sustainability considerations are also influencing material selection, with eco-friendly manufacturing gaining traction. Looking forward, advancements in nanocoating technologies and the integration of multifunctional properties such as scratch resistance and anti-fingerprint features are expected to drive further market growth.

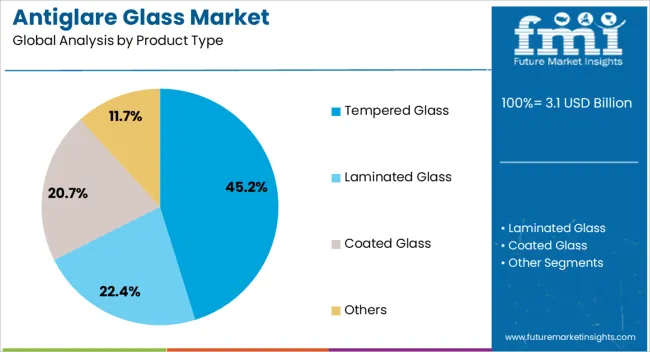

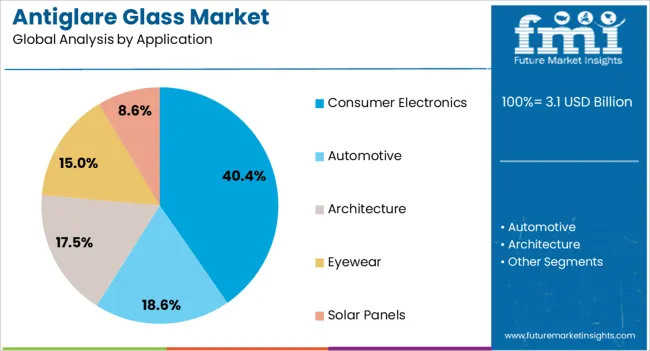

The antiglare glass market is segmented by product type, application, technology, end-use industry, coating feature, distribution channel, and geographic regions. By product type, antiglare glass market is divided into Tempered Glass, Laminated Glass, Coated Glass, and Others. In terms of application, antiglare glass market is classified into Consumer Electronics, Automotive, Architecture, Eyewear, and Solar Panels.

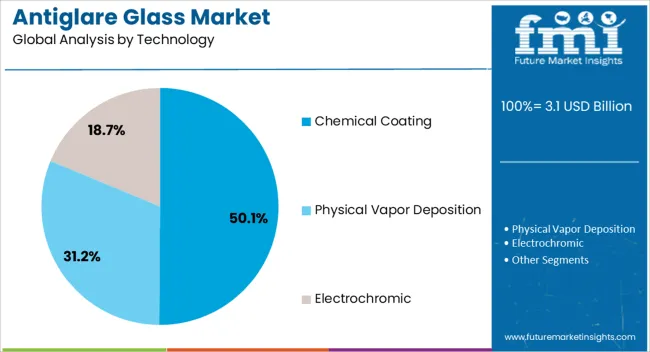

Based on technology, antiglare glass market is segmented into Chemical Coating, Physical Vapor Deposition, and Electrochromic. By end-use industry, antiglare glass market is segmented into Electronics, Automotive, Construction, Healthcare, and Aerospace. By coating feature, antiglare glass market is segmented into Anti-Fingerprint, Anti-Reflection, Anti-Glare, and Scratch-Resistant.

By distribution channel, antiglare glass market is segmented into Online, Retail, B2B Contracts, and OEM Supply. Regionally, the antiglare glass industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tempered glass segment is projected to account for 45.2% of the antiglare glass market revenue in 2025, making it the leading product type. This growth is being driven by the segment’s superior strength, impact resistance, and safety properties compared to standard glass.

Tempered glass offers enhanced durability, making it suitable for high-use applications in consumer electronics, automotive windows, and public infrastructure. The ability to integrate advanced antiglare coatings during manufacturing has further increased its appeal for display screens and architectural glass panels.

Its heat resistance and shatterproof qualities have positioned it as a preferred material in safety-critical and performance-driven applications. With consumer and industrial markets demanding products that balance optical performance and mechanical strength, tempered glass continues to dominate the product mix.

The consumer electronics segment is anticipated to hold 40.4% of the antiglare glass market revenue in 2025, reinforcing its leadership in application share. Growth in this segment is being propelled by the proliferation of smartphones, tablets, laptops, and high-resolution monitors, where visual clarity is a critical factor for user satisfaction.

Antiglare glass has become an essential component for minimizing reflection in varying ambient light conditions, improving both aesthetic appeal and functional performance. Manufacturers are increasingly embedding advanced coatings that offer glare reduction without sacrificing touch sensitivity or color accuracy.

The surge in remote working, gaming, and multimedia consumption has amplified demand for display technologies that reduce eye strain. As electronic device designs evolve toward sleeker, high-performance screens, the consumer electronics segment is expected to maintain its position as a primary growth driver.

The chemical coating segment is forecast to represent 50.1% of the antiglare glass market revenue in 2025, holding the top position among technology types. This segment’s prominence stems from its ability to deliver uniform glare reduction while maintaining optical transparency and durability.

Chemical coating processes enable fine control over surface texture and light diffusion, resulting in superior performance for high-end displays and architectural glass. Compared to mechanical methods, chemical coatings provide greater design flexibility and can be customized for different light transmission and reflection levels.

Additionally, chemical coatings offer long-term resistance to wear, moisture, and UV exposure, enhancing product lifespan. The technology’s adaptability across mass production for electronics, automotive, and building applications has reinforced its market share. As demand for multifunctional glass surfaces continues to grow, chemical coating technology is set to remain at the forefront of innovation in the antiglare glass market.

The antiglare glass market is growing due to rising demand from consumer electronics, automotive, and commercial display sectors for glare reduction, improved visibility, and scratch resistance. Products are widely used in smartphones, tablets, laptops, infotainment systems, and outdoor displays. Challenges include high production costs, coating complexity, and integration with advanced display technologies. Opportunities exist in automotive dashboards, high-brightness screens, and customized coating solutions. Manufacturers providing high-performance, certified, and technically supported antiglare glass are best positioned to capture global growth.

The antiglare glass market is expanding as manufacturers of smartphones, tablets, laptops, automotive displays, and televisions increasingly adopt glare-reducing glass solutions. Growth is driven by rising consumer preference for improved screen visibility under bright lighting, enhanced user experience, and scratch-resistant surfaces. Automotive applications in dashboards, infotainment systems, and instrument panels further support adoption.

Companies such as Corning, AGC Inc., SCHOTT AG, and Nippon Electric Glass are offering advanced anti-reflective coatings and chemically strengthened glass. Increasing demand for high-performance displays, outdoor visibility, and reduced eye strain contributes to market expansion. Suppliers providing customized thickness, coating options, and high-durability glass for consumer electronics, automotive, and commercial applications are well-positioned to capture global market growth.

Despite rising adoption, the antiglare glass market faces challenges from high production costs, coating complexity, and integration with touch-sensitive or OLED displays. Achieving uniform antireflective properties and durability requires precision manufacturing and advanced coating technologies, increasing capital and operational expenses. Variability in glass quality, substrate material, and environmental conditions can affect optical performance. Compliance with safety standards, automotive regulations, and electronic device certifications adds operational complexity for manufacturers. Buyers increasingly demand certified, high-durability, scratch-resistant, and visually consistent glass products. Companies investing in process optimization, quality control, and advanced coating solutions can mitigate technical and operational challenges while meeting stringent industry requirements across consumer electronics, automotive, and commercial applications globally.

Opportunities in the antiglare glass market are driven by increasing adoption in smartphones, tablets, laptops, automotive displays, digital signage, and commercial monitors. Outdoor and high-brightness display applications, such as kiosks and stadium screens, further expand demand. Asia-Pacific, North America, and Europe are key growth regions due to high consumer electronics penetration, urbanization, and automotive production. Manufacturers offering customizable coatings, enhanced scratch resistance, and high optical clarity gain a competitive advantage. Collaborations with electronics and automotive OEMs enable integration into high-end devices and vehicle interiors. Expanding applications in commercial, transportation, and industrial displays provide long-term growth potential, positioning antiglare glass as a critical material for high-visibility applications globally.

Technological trends in the antiglare glass market include advanced anti-reflective coatings, oleophobic layers, and chemically strengthened substrates. Integration with touch-sensitive, OLED, and flexible displays ensures performance without compromising screen clarity. Manufacturers are developing durable, high-transmittance glass with improved scratch resistance and reduced glare for outdoor and automotive applications. Digital fabrication, automated coating processes, and precision polishing enhance uniformity and quality. Companies are also focusing on custom thicknesses, multi-layer coatings, and low-reflection solutions for specialized applications.

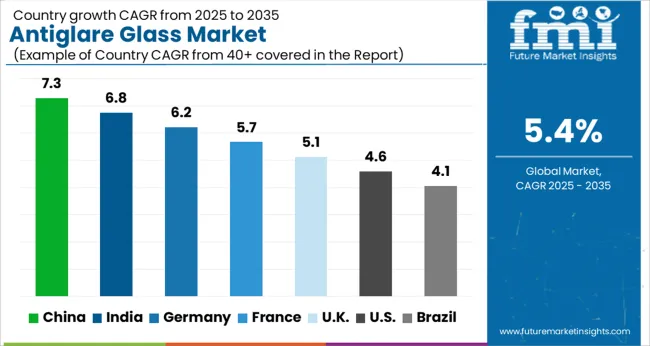

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| U.K. | 5.1% |

| U.S. | 4.6% |

| Brazil | 4.1% |

Expansion Pathways of Antiglare Glass Market in China

The antiglare glass market in China is projected to grow at a CAGR of 7.3% from 2025 to 2035, driven by rapid urbanization, construction of commercial and residential buildings, and increasing adoption in consumer electronics. The expanding automotive sector is also contributing to the demand for antiglare automotive glass used in windshields, infotainment displays, and dashboard systems. Manufacturers are introducing high-transparency, low-reflective, and scratch-resistant coatings to enhance product performance. The rise of smart devices and LCD/LED display panels with antiglare requirements is further boosting market growth. Local production capabilities, combined with government incentives for technology upgrades in construction and electronics, support market expansion. Strong e-commerce channels and partnerships with construction, electronics, and automotive OEMs are facilitating wider adoption.

The antiglare glass market in India is expected to expand at a CAGR of 6.8% from 2025 to 2035. Rising construction of commercial and residential complexes is a major driver, with architects specifying antiglare glass for improved lighting and reduced eye strain. Increasing adoption in automotive applications, particularly in premium vehicles, is accelerating demand.

Consumer electronics, including smartphones, laptops, and display panels, are also driving market growth. Manufacturers are offering chemically strengthened, coated, and laminated antiglare glass products to meet diverse requirements. Expansion of organized retail and e-commerce distribution channels ensures wider availability. Government initiatives supporting smart city projects, renewable energy, and urban infrastructure development are indirectly contributing to market growth.

The antiglare glass market in Germany is projected to grow at a CAGR of 6.2% from 2025 to 2035. Strong automotive manufacturing and consumer electronics industries are the primary demand drivers. Automotive OEMs increasingly use antiglare windshields, infotainment displays, and dashboard panels to improve safety and visibility. Commercial construction projects are specifying antiglare glass for office spaces, hospitals, and educational facilities. Manufacturers are innovating with anti-reflective coatings, chemically strengthened glass, and multi-layer lamination to meet stringent quality and durability requirements. Integration with energy-efficient and low-emission glass products is helping commercial projects meet building standards.

The U.K. market is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by modern architectural trends and the need for glare reduction in residential, commercial, and public buildings. Office spaces, airports, hospitals, and educational institutions are increasingly specifying antiglare glass to enhance visual comfort and reduce light reflection. Automotive applications in premium vehicles are contributing to steady market growth. Display panels and smart device screens also drive demand. Manufacturers are focusing on high-transparency, low-reflective coatings, scratch-resistant treatments, and laminated glass solutions. Growth in the construction and electronics sectors, coupled with increasing imports of advanced antiglare glass technologies, supports market expansion.

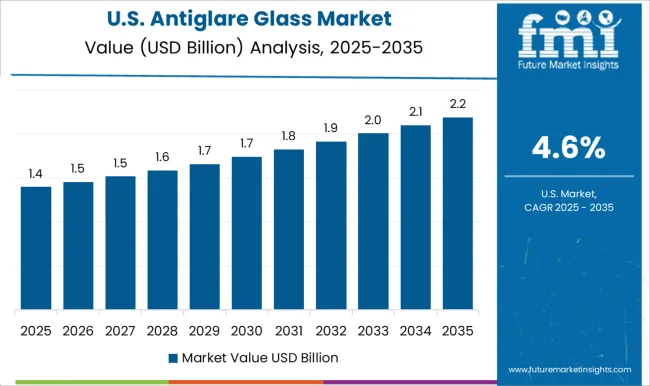

The U.S. antiglare glass market is projected to grow at a CAGR of 4.6% from 2025 to 2035. Market growth is supported by adoption in the automotive, construction, and consumer electronics sectors. Automotive manufacturers increasingly specify antiglare windshields, dashboards, and infotainment displays for safety and visibility enhancement. Commercial and residential construction projects are integrating antiglare glass to improve visual comfort and reduce indoor light reflection.

Consumer electronics, including tablets, laptops, and television screens, drive demand for anti-reflective solutions. Manufacturers focus on coating technologies, chemically strengthened glass, and laminated solutions to meet durability and safety standards. Expansion of distribution channels and partnerships with construction, automotive, and electronics OEMs further strengthen adoption.

The antiglare glass market is characterized by strong competition and rapid technological advancement. Leading players include Asahi Glass, Honeywell International, Essilor International, Carl Zeiss AG, PPG Industries Inc., Hoya Corporation, Schott AG, Guardian Industries, and iCoat Company LLC. Asahi Glass focuses on high-performance coatings for display screens, automotive, and architectural applications. Products highlight clarity, durability, and resistance to scratches. Honeywell International offers specialty films and treated glass solutions designed to reduce glare and improve safety in industrial and automotive environments. Essilor International and Carl Zeiss AG specialize in precision optics. Their antiglare lenses serve eyewear, medical devices, and optical instruments. Emphasis is placed on optical accuracy, visual comfort, and long-term durability. PPG Industries Inc. and Hoya Corporation differentiate through advanced coating technologies for electronics, consumer devices, and automotive applications.

Product brochures detail features such as anti-reflective thin films, customized performance, and enhanced viewing quality. Schott AG and Guardian Industries target architectural and display-grade applications. Products focus on energy efficiency, optical performance, and scratch resistance. iCoat Company LLC addresses niche industrial and consumer electronics markets with ultra-thin antiglare films. Innovation, optical clarity, and product durability define competitive strategies. Market rivalry is influenced by the ability to serve multiple applications, from automotive glass and architectural panels to electronic displays and precision optical devices. Product brochures serve as a key marketing tool, showcasing technical specifications, performance metrics, and differentiation factors. Companies highlight technological expertise, application versatility, and coating innovations that improve user experience.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Product Type | Tempered Glass, Laminated Glass, Coated Glass, and Others |

| Application | Consumer Electronics, Automotive, Architecture, Eyewear, and Solar Panels |

| Technology | Chemical Coating, Physical Vapor Deposition, and Electrochromic |

| End-Use Industry | Electronics, Automotive, Construction, Healthcare, and Aerospace |

| Coating Feature | Anti-Fingerprint, Anti-Reflection, Anti-Glare, and Scratch-Resistant |

| Distribution Channel | Online, Retail, B2B Contracts, and OEM Supply |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Asahi Glass, Honeywell International, Essilor International, Carl Zeiss AG, PPG Industries Inc., Hoya Corporation, Schott AG, Guardian Industries, and iCoat Company LLC |

| Additional Attributes | Dollar sales by product type (coated glass, laminated glass, tempered glass), application (automotive, consumer electronics, architectural, medical devices), and coating technology (chemical etching, nano-coatings, thin-film deposition). Demand is driven by the rising adoption of display devices, automotive glazing, and energy-efficient building designs. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, supported by increasing consumer electronics penetration, automotive production, and smart infrastructure development. |

The global antiglare glass market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the antiglare glass market is projected to reach USD 5.3 billion by 2035.

The antiglare glass market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in antiglare glass market are tempered glass, laminated glass, coated glass and others.

In terms of application, consumer electronics segment to command 40.4% share in the antiglare glass market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA